Apellis Pharmaceuticals PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apellis Pharmaceuticals Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Apellis Pharmaceuticals. Discover how political, economic, social, technological, environmental, and legal forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Government healthcare policies, especially those concerning drug pricing and reimbursement, are critical for Apellis Pharmaceuticals. For instance, the Inflation Reduction Act's Medicare drug price negotiation provisions, which began impacting a select group of high-cost drugs in 2024, could potentially influence the long-term profitability of Apellis's therapies like SYFOVRE and EMPAVELI if they are selected for negotiation in future rounds.

Changes in national healthcare budgets and the formulary decisions made by both public and private payers directly shape patient access and the overall uptake of Apellis's products. In 2024, for example, many health systems continued to refine their drug formularies, balancing innovation with cost-effectiveness, which directly impacts how readily patients can access Apellis's treatments.

The effectiveness and speed of regulatory agencies like the FDA and EMA are vital for Apellis's drug development and market access. Recent FDA approvals for EMPAVELI in C3G and primary IC-MPGN highlight Apellis's ability to successfully navigate these complex processes.

However, challenges remain, as evidenced by a prior negative CHMP opinion for pegcetacoplan in geographic atrophy (GA), which could impede European market expansion. The timelines for current regulatory reviews directly influence when Apellis can bring its new therapies to market.

Global trade policies and international agreements significantly influence Apellis Pharmaceuticals' operations, affecting everything from clinical trial conduct to worldwide product commercialization. Changes in tariffs or import/export regulations can directly impact the cost and availability of raw materials and finished goods, as well as Apellis's ability to access key markets.

Collaborations, like the one with Sobi for Aspaveli outside the U.S., are inherently tied to the political and economic stability of partner regions and their existing trade frameworks. For instance, in 2024, ongoing trade discussions between major economic blocs could introduce new complexities or opportunities for pharmaceutical companies seeking to expand their global reach.

Positive international relations foster smoother global market penetration and enhance supply chain efficiencies for companies like Apellis. Conversely, geopolitical tensions or trade disputes can create significant hurdles, potentially delaying product launches or disrupting the delivery of critical medicines to patients in affected countries.

Government Support for Rare Diseases

Government support for rare diseases significantly benefits companies like Apellis Pharmaceuticals. Initiatives such as expedited review pathways and tax credits, common in the US and EU, can substantially reduce the time and cost associated with bringing orphan drugs to market. For instance, the Orphan Drug Act in the United States provides a seven-year market exclusivity period for approved orphan drugs, a crucial advantage for Apellis's therapies targeting conditions like paroxysmal nocturnal hemoglobinuria (PNH) and geographic atrophy (GA) associated with age-related macular degeneration.

Apellis's strategic focus on complement-driven rare diseases aligns perfectly with ongoing government efforts to address unmet medical needs in these areas. The continued recognition of rare diseases as a public health priority by regulatory bodies worldwide, including the FDA and EMA, translates into a more favorable environment for research and development investment. This governmental backing helps de-risk the substantial capital required for clinical trials and drug development.

- Expedited Review Pathways: Regulatory agencies often prioritize rare disease treatments, shortening approval timelines.

- Market Exclusivity: Extended periods of market exclusivity, like the seven years in the US for orphan drugs, protect revenue streams.

- Tax Credits: Financial incentives, such as tax credits for research and development, lower the cost of innovation.

- Government Funding: Direct or indirect government funding for rare disease research can accelerate scientific discovery and drug development.

Political Stability and Geopolitical Risks

Political stability within Apellis's key operational markets, including the United States and Europe, is a crucial factor. For instance, the U.S. government's approach to pharmaceutical pricing and reimbursement, as seen in ongoing debates and potential legislative changes in 2024 and 2025, directly impacts revenue potential for drugs like Syfovre and Empaveli. Geopolitical tensions, such as those in Eastern Europe or the Middle East, could disrupt global supply chains or affect international trade agreements, potentially increasing the cost of raw materials or impacting distribution networks. A predictable political landscape generally supports sustained investment and operational planning for companies like Apellis.

Shifts in governmental priorities, particularly concerning healthcare innovation and access, can significantly influence Apellis's growth trajectory. For example, a renewed focus on rare diseases or specific therapeutic areas by regulatory bodies in 2024 could create new opportunities or necessitate adjustments in R&D investment. Conversely, a contraction in healthcare budgets due to economic pressures or changing political mandates could limit market access or reimbursement levels for Apellis's products. The company actively monitors these evolving political landscapes to mitigate risks and capitalize on favorable policy shifts.

The stability of political systems in regions where Apellis seeks to expand its market presence is also paramount. Uncertainty in emerging markets, for example, can deter investment and complicate the establishment of robust commercial operations. Apellis's strategic decisions regarding international expansion are therefore heavily influenced by assessments of political risk and the long-term stability of governance in target countries. A stable environment fosters predictable regulatory frameworks and consistent market access, which are essential for sustainable global growth.

Government policies directly impact Apellis's market access and pricing strategies. For instance, the Inflation Reduction Act's drug price negotiation, potentially affecting drugs like SYFOVRE and EMPAVELI from 2024 onwards, highlights the influence of legislative action on profitability. Furthermore, the ongoing debate around healthcare spending and reimbursement in major markets like the US and EU in 2024-2025 will shape patient access and Apellis's revenue potential.

Regulatory environments are crucial for Apellis's product pipeline. The FDA's recent approvals for EMPAVELI in C3G and primary IC-MPGN demonstrate successful navigation of regulatory pathways. However, prior setbacks, such as the CHMP's initial negative opinion on pegcetacoplan for geographic atrophy in Europe, underscore the critical nature of regulatory timelines and decisions for market expansion.

Government support for rare diseases provides a significant advantage for Apellis. Initiatives like the Orphan Drug Act in the US, offering seven-year market exclusivity, are vital for companies developing treatments for conditions such as paroxysmal nocturnal hemoglobinuria (PNH) and geographic atrophy (GA). This governmental backing helps de-risk the substantial investment required for rare disease drug development.

What is included in the product

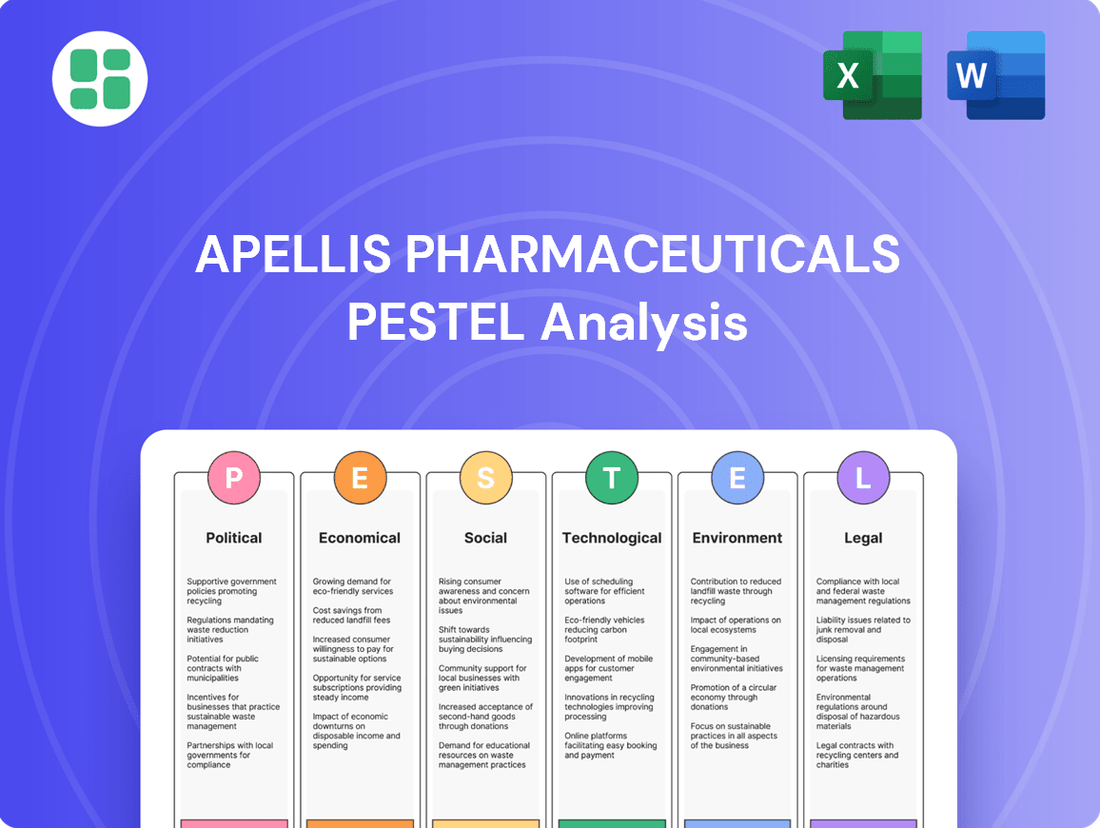

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Apellis Pharmaceuticals, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers a strategic overview for identifying potential threats and opportunities within the pharmaceutical landscape, informing decision-making and future planning.

A concise PESTLE analysis for Apellis Pharmaceuticals, highlighting key external factors impacting their business, serves as a pain point reliever by providing clarity and focus for strategic decision-making.

This analysis offers a streamlined view of the political, economic, social, technological, environmental, and legal landscape, enabling Apellis to proactively address challenges and capitalize on opportunities.

Economic factors

Global economic growth significantly impacts healthcare spending. In 2024, the IMF projected global growth at 3.2%, a steady rate that generally supports sustained healthcare investment. However, regional variations exist, with emerging markets often showing higher growth. This overall stability is positive for companies like Apellis, but economic slowdowns can quickly tighten healthcare budgets, affecting drug pricing and patient access to expensive treatments.

The financial health of national healthcare systems is paramount. Many developed nations, key markets for Apellis, are grappling with rising healthcare costs and aging populations. For instance, in 2023, healthcare spending in OECD countries continued its upward trend, often exceeding GDP growth. This puts pressure on reimbursement policies and can limit market penetration for novel therapies, even those with strong clinical data.

Economic downturns directly threaten Apellis's revenue streams. A slowdown in major economies could lead to increased scrutiny of pharmaceutical expenditures, potentially impacting Apellis's ability to secure favorable pricing and reimbursement for its products. For example, if a recession leads to widespread job losses, commercial insurance coverage for patients may decline, further hindering affordability for high-cost therapies.

Apellis Pharmaceuticals navigates substantial economic headwinds stemming from drug pricing and reimbursement challenges, especially for its advanced treatments like SYFOVRE and EMPAVELI. These high-cost therapies are particularly sensitive to market access and affordability dynamics.

Recent financial reports indicate that funding constraints within third-party co-pay assistance programs have directly affected SYFOVRE's net product revenue, necessitating a greater reliance on providing free samples to patients. This highlights the fragility of patient access when external financial support falters.

Securing advantageous reimbursement agreements from payers and effectively managing patient out-of-pocket costs are paramount for Apellis's long-term commercial viability. The company's ability to demonstrate value and negotiate favorable terms will be a key determinant of its growth trajectory in the coming years.

The substantial economic burden of pharmaceutical research and development (R&D) directly impacts Apellis Pharmaceuticals, contributing to its net losses. These significant investments are vital for creating innovative treatments and building a robust product pipeline.

For instance, Apellis reported R&D expenses of $308.5 million in the first nine months of 2023, underscoring the financial commitment required. The company's capacity to finance critical clinical trials, including those for APL-3007 and emerging gene-edited therapies, is intrinsically linked to its available cash and revenue streams.

Market Competition and Product Mix

The competitive environment significantly shapes Apellis Pharmaceuticals' market performance. In geographic atrophy (GA), SYFOVRE holds a strong position, but the broader landscape of paroxysmal nocturnal hemoglobinuria (PNH) and rare kidney diseases presents ongoing challenges. This competition directly impacts Apellis's ability to command pricing and secure market share.

While SYFOVRE has seen success, the market for EMPAVELI has faced headwinds. Payer pushback and increasing competition have tempered revenue growth for this key therapy. This highlights the delicate balance between innovation and market access in the pharmaceutical sector.

Apellis is actively pursuing strategies to navigate these competitive pressures. Diversifying its product pipeline and seeking expanded indications for its existing treatments are crucial for long-term revenue stability. For instance, ongoing clinical trials for EMPAVELI in new indications aim to broaden its patient base and offset competitive pressures.

- Geographic Atrophy (GA) Market: SYFOVRE is a leading therapy, but the emergence of new competitors and evolving treatment guidelines will continue to influence its market share.

- Paroxysmal Nocturnal Hemoglobinuria (PNH) & Rare Kidney Diseases: EMPAVELI faces competition from established and emerging therapies, impacting its pricing power and revenue trajectory.

- Revenue Impact: Payer negotiations and reimbursement challenges, particularly for EMPAVELI, have affected its financial performance, underscoring the importance of market access strategies.

- Strategic Outlook: Apellis's focus on portfolio diversification and indication expansion is designed to mitigate competitive risks and create sustainable revenue streams.

Capital Structure and Profitability Outlook

Apellis Pharmaceuticals' economic health hinges on its cash reserves, revenue growth, and the management of its net losses. As of Q1 2024, the company reported a cash and cash equivalents balance of $1.2 billion, aiming to fuel operations towards profitability.

The company continues to navigate net losses, with a reported net loss of $153 million for Q1 2024. However, Apellis projects that its current cash position, bolstered by anticipated product sales and strategic financial maneuvers like the Sobi royalty transaction, will provide adequate runway to achieve profitability.

- Cash Position: $1.2 billion (as of Q1 2024)

- Net Loss: $153 million (as of Q1 2024)

- Key Objective: Achieve sustainable profitability by managing operational expenses and increasing revenue.

Global economic stability, projected at 3.2% growth for 2024 by the IMF, generally supports healthcare investment. However, Apellis's high-cost therapies like SYFOVRE and EMPAVELI are sensitive to economic downturns, which can tighten healthcare budgets and impact patient affordability. The company's net losses, with R&D expenses at $308.5 million for the first nine months of 2023, highlight the significant financial commitment required for innovation, a commitment that relies on sustained economic conditions and favorable reimbursement policies.

| Financial Metric | Value | Period |

| Global Economic Growth Projection | 3.2% | 2024 (IMF) |

| Apellis R&D Expenses | $308.5 million | First nine months of 2023 |

| Apellis Cash and Cash Equivalents | $1.2 billion | Q1 2024 |

| Apellis Net Loss | $153 million | Q1 2024 |

What You See Is What You Get

Apellis Pharmaceuticals PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive PESTLE analysis of Apellis Pharmaceuticals.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the political, economic, social, technological, legal, and environmental factors impacting Apellis.

The content and structure shown in the preview is the same document you’ll download after payment, offering critical insights into Apellis Pharmaceuticals' strategic landscape.

Sociological factors

The prevalence of conditions like geographic atrophy (GA), paroxysmal nocturnal hemoglobinuria (PNH), and rare kidney diseases such as C3 glomerulonephritis (C3G) and immune complex-mediated membranoproliferative glomerulonephritis (IC-MPGN) directly shapes the market size for Apellis Pharmaceuticals. For example, an aging global population is a key driver for GA treatments, with the World Health Organization projecting that the number of people aged 60 and over will more than double by 2050, reaching 2.1 billion.

Understanding the specific epidemiology and how these diseases progress within different age groups and demographic segments is vital for accurate market sizing and effective patient outreach strategies. For instance, the incidence of PNH is estimated to be between 1 to 1.5 per million people annually in Western countries, highlighting the need for precise targeting.

Societal expectations regarding healthcare access and the burden of chronic or rare diseases create significant challenges for patients seeking specialized treatments. High-priced medications like SYFOVRE, approved in 2023 for geographic atrophy, can be a major hurdle.

Affordability issues, including co-pay assistance program limitations and the drug's overall cost, mean many patients may rely on free samples, which can disrupt consistent treatment and long-term adherence. This reliance can impact market penetration for innovative therapies.

Apellis Pharmaceuticals is actively addressing these access barriers through dedicated patient advocacy and support initiatives. These programs are designed to bridge the gap between the cost of treatment and patient ability to pay, fostering greater equity in healthcare access.

Patient advocacy groups are increasingly influential, driving awareness and support for rare diseases like those targeted by Apellis. For instance, the National Organization for Rare Disorders (NORD) reported in 2024 that patient advocacy organizations raised over $500 million for rare disease research and patient support services in the past five years, highlighting their significant impact.

Apellis Pharmaceuticals actively partners with these groups, recognizing their importance in understanding patient needs and improving treatment access. This collaboration is crucial for integrating real-world patient experiences into drug development, as seen in their engagement with groups focused on paroxysmal nocturnal hemoglobinuria (PNH) and geographic atrophy (GA).

The growing strength of patient advocacy can directly accelerate diagnosis rates and foster robust community support networks. Furthermore, these organizations are instrumental in shaping healthcare policy, influencing reimbursement decisions and market access for innovative therapies, a trend expected to continue through 2025.

Public Perception of Pharmaceutical Companies

Public perception of pharmaceutical companies significantly impacts Apellis Pharmaceuticals. Societal scrutiny over drug pricing, ethical conduct, and corporate responsibility can shape public trust and brand image. For instance, in 2023, a Gallup poll indicated that 60% of Americans believed prescription drug costs were too high, a sentiment that can extend to all pharmaceutical firms, including Apellis.

Maintaining transparency and high ethical standards are crucial for Apellis to foster positive public perception and societal acceptance of its therapies. Demonstrating a genuine commitment to patient well-being through responsible marketing and pricing strategies is paramount. This includes clear communication about drug benefits and risks, as well as efforts to ensure affordability and access.

- Public Trust: A significant portion of the public, around 60% in 2023 according to Gallup, views prescription drug prices as excessive, creating a challenging environment for all pharmaceutical companies.

- Ethical Scrutiny: Pharmaceutical firms face ongoing public and regulatory examination regarding their research practices, marketing tactics, and pricing models.

- Brand Reputation: Apellis's ability to build and maintain a positive brand image hinges on its perceived commitment to patient welfare and ethical operations.

- Societal Acceptance: Public acceptance of Apellis's innovative therapies is directly linked to trust in the company's practices and its perceived contribution to public health.

Healthcare Infrastructure and Specialization

The availability of specialized healthcare professionals and diagnostic capabilities is crucial for Apellis Pharmaceuticals, particularly for conditions like geographic atrophy (GA) and rare kidney disorders. The capacity of healthcare systems to accurately diagnose these complex diseases and administer specialized treatments, such as intravitreal injections, directly impacts the adoption of Apellis's therapies. For instance, the number of retina specialists equipped to handle GA treatments and nephrologists experienced with rare kidney diseases forms a key segment of the market. As of 2024, the global shortage of highly specialized medical professionals, particularly in ophthalmology and nephrology in emerging markets, presents a potential bottleneck for widespread treatment rollout.

Investments in medical education and healthcare infrastructure indirectly support Apellis's growth by expanding the pool of qualified practitioners and enhancing the overall patient management pathway. A robust healthcare infrastructure ensures that patients can access necessary diagnostic tools and receive ongoing care, which is vital for the long-term success of treatments for chronic and complex conditions. For example, increased funding for post-graduate medical training programs in 2024 across several key European markets aims to address these specialist shortages, potentially benefiting companies like Apellis.

- Specialist Availability: The number of ophthalmologists and nephrologists trained in administering advanced therapies for GA and rare kidney diseases directly influences market penetration.

- Diagnostic Capacity: Access to advanced imaging and diagnostic technologies for early and accurate disease identification is essential for patient identification and treatment initiation.

- Healthcare System Investment: Government and private sector investments in medical education and specialized clinic development in 2024-2025 are critical for building a sustainable treatment ecosystem.

- Patient Management Infrastructure: The ability of clinics to manage complex treatment regimens, including patient monitoring and follow-up care, is paramount for therapeutic efficacy and patient retention.

Societal attitudes towards healthcare costs and access significantly impact Apellis Pharmaceuticals. The high price of treatments like SYFOVRE, approved in 2023, presents a substantial barrier for many patients, often necessitating reliance on limited co-pay assistance or free samples, which can hinder consistent treatment adherence.

Patient advocacy groups are increasingly influential, driving awareness and support for rare diseases, with organizations like NORD raising over $500 million for rare disease initiatives in the past five years, as reported in 2024. Apellis actively collaborates with these groups to understand patient needs and improve treatment accessibility.

Public perception of pharmaceutical companies, particularly regarding drug pricing and ethical conduct, directly affects Apellis's brand image. A 2023 Gallup poll indicated that 60% of Americans found prescription drug costs too high, underscoring the need for transparency and a commitment to patient welfare.

The availability of specialized healthcare professionals and diagnostic capabilities is crucial for Apellis's therapies. However, global shortages of ophthalmologists and nephrologists, particularly in emerging markets, pose a challenge to widespread treatment adoption as of 2024, though investments in medical education are beginning to address this.

Technological factors

Apellis Pharmaceuticals is at the forefront of complement science, with its core business centered on pioneering targeted C3 therapies. This specialization represents a significant leap forward in understanding and treating diseases driven by the complement system. The company's commitment to this field is crucial for its ongoing innovation.

Continued breakthroughs in deciphering the complex complement system and its intricate role in various pathologies are directly fueling the development of novel and more potent therapeutic interventions. This scientific progress is the bedrock upon which Apellis builds its future treatments.

Investing heavily in cutting-edge research within complement science is not merely an option but a fundamental necessity for Apellis to sustain its leadership position and to effectively expand its diverse therapeutic pipeline. This strategic focus ensures their competitive edge.

The swift advancement of biotechnology, especially gene-editing tools like CRISPR, offers significant avenues for innovation in drug development, potentially disrupting existing treatment paradigms. Apellis Pharmaceuticals is actively engaging with these technologies, exploring gene-edited FcRn and complement therapies through strategic partnerships, signaling a proactive stance on next-generation treatments.

These cutting-edge biotechnologies hold the promise of developing one-time curative therapies for chronic diseases, a stark contrast to current management approaches. For instance, gene therapy approvals in the US reached 10 in 2023, up from 3 in 2022, demonstrating the accelerating market adoption and potential for transformative treatments.

Advancements in drug delivery are crucial for therapies like Apellis' SYFOVRE, which treats geographic atrophy (GA). Innovations that make injections more convenient and less frequent can significantly boost patient compliance and treatment success. For instance, the development of sustained-release formulations or less invasive delivery methods could transform the patient experience.

Apellis is actively exploring next-generation treatments, such as APL-3007, which is designed to work alongside SYFOVRE. The success of such programs often hinges on integrating these new therapies with cutting-edge delivery technologies. This focus on innovation in delivery systems is a key factor in maintaining a competitive advantage in the pharmaceutical market.

Diagnostic Technologies and Early Detection

Advancements in diagnostic technologies are significantly enhancing the early and precise identification of complement-driven diseases. This improved diagnostic capability directly broadens the addressable patient population for therapies like Apellis Pharmaceuticals' EMPAVELI, particularly for conditions such as C3 Glomerulonephritis (C3G) and Immune Complex-Mediated Glomerulonephritis (IC-MPGN).

The increasing accuracy of diagnostic tools, especially in identifying specific biomarkers associated with these rare diseases, is a key technological driver. For example, the development of advanced genetic testing and sophisticated imaging techniques allows for earlier intervention, potentially improving patient outcomes and increasing the commercial viability of targeted treatments.

Technological progress in diagnostics is creating a positive feedback loop, driving demand for specialized therapies. As more patients are diagnosed earlier and with greater certainty, the market for treatments designed to target the underlying complement pathway, like EMPAVELI, is expected to grow substantially. This trend is underscored by the projected growth in the rare disease diagnostics market, which is anticipated to reach billions by 2028.

- Improved Diagnostic Accuracy: Technologies like advanced biomarker assays and genetic sequencing enable earlier and more precise identification of complement-mediated diseases.

- Expanded Patient Populations: More effective diagnostics lead to a larger pool of identifiable patients for targeted therapies such as EMPAVELI.

- Increased Demand for Therapies: Technological breakthroughs in diagnostics directly correlate with increased demand for specialized treatments.

- Market Growth: The global market for rare disease diagnostics is projected for significant expansion, creating substantial opportunities for companies with relevant therapies.

Data Analytics and Artificial Intelligence in R&D

The integration of data analytics and AI is revolutionizing R&D for companies like Apellis. These tools can dramatically speed up drug discovery and clinical trial design by identifying promising candidates and optimizing patient selection. For instance, AI algorithms are being used to analyze vast biological datasets, potentially uncovering novel therapeutic targets much faster than traditional methods. This technological leap is crucial for enhancing R&D efficiency and maintaining a competitive edge in the pharmaceutical sector.

Apellis can leverage these advancements to refine its clinical trial strategies and improve patient stratification. By analyzing real-world data and patient profiles, AI can help predict treatment responses and identify individuals most likely to benefit from specific therapies. This precision approach not only increases the likelihood of trial success but also contributes to more personalized medicine. In 2024, the global AI in drug discovery market was valued at approximately $2.5 billion, with projections indicating substantial growth, highlighting the increasing adoption and impact of these technologies.

- AI-driven drug discovery platforms can reduce the time and cost associated with identifying new drug candidates, potentially shaving years off the traditional development timeline.

- Data analytics enables more precise patient stratification in clinical trials, leading to higher success rates and faster regulatory approvals. For example, companies are using machine learning to analyze genomic data for better patient selection.

- Optimizing resource allocation through advanced analytics can lead to significant cost savings in R&D, allowing companies to invest more in promising pipeline assets.

- The personalized treatment landscape, powered by data analytics and AI, offers new avenues for therapeutic development, aligning with Apellis's focus on complement-mediated diseases.

Technological advancements in gene editing, such as CRISPR, offer Apellis opportunities to develop novel, potentially curative therapies for chronic diseases, moving beyond current management approaches. The company's strategic partnerships in this area underscore its commitment to next-generation treatments.

Innovations in drug delivery systems are critical for enhancing patient compliance and treatment success, particularly for therapies like SYFOVRE. Developments in sustained-release formulations or less invasive delivery methods could significantly improve the patient experience.

The increasing sophistication of diagnostic technologies, including advanced biomarker assays and genetic sequencing, is crucial for the early and precise identification of complement-mediated diseases. This improved diagnostic capability directly expands the potential patient populations for Apellis's therapies.

AI and data analytics are revolutionizing drug discovery and clinical trial design for Apellis by accelerating the identification of promising drug candidates and optimizing patient selection. The global AI in drug discovery market was valued at approximately $2.5 billion in 2024, highlighting the growing impact of these technologies.

Legal factors

Intellectual property rights, particularly patent protection, are critical for Apellis Pharmaceuticals. These patents safeguard substantial research and development expenditures, ensuring market exclusivity for novel treatments. For instance, the company's key therapies rely on patent protection to recoup investment and fund future innovation.

Enforcing these patent rights against potential infringers and defending against legal challenges are constant legal considerations. These actions directly influence Apellis's revenue streams and its ability to maintain a competitive edge in the pharmaceutical market. The strength and duration of patent protection significantly impact the company's long-term financial viability.

Apellis Pharmaceuticals must navigate complex drug approval pathways governed by agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). For instance, the FDA's rigorous review process for novel therapies, including those for rare diseases, demands extensive clinical data demonstrating both safety and efficacy. Failure to meet these stringent standards can lead to significant delays or outright rejection of product applications.

Post-market surveillance is equally vital, requiring ongoing monitoring of drug performance and safety once approved. Apellis's EMPAVELI, for example, operates under a Risk Evaluation and Mitigation Strategy (REMS) program, underscoring the regulatory emphasis on managing potential risks. Adherence to these post-approval requirements, including reporting adverse events and conducting further studies, is essential for maintaining market access and patient trust.

Clinical trials are the bedrock of pharmaceutical development, and their design, execution, and monitoring are strictly governed by a complex web of regulations aimed at safeguarding participants and ensuring the reliability of the data generated. For Apellis Pharmaceuticals, adherence to these global standards is paramount, especially as they advance pivotal studies for EMPAVELI in conditions like Focal Segmental Glomerulosclerosis (FSGS) and Delayed Graft Function (DGF).

Failure to navigate this regulatory landscape effectively can have significant consequences. Non-compliance can trigger severe outcomes, including regulatory scrutiny, costly trial interruptions, and substantial damage to the company's reputation. For instance, in 2024, several pharmaceutical companies faced delays and investigations due to protocol deviations in their Phase 3 trials, highlighting the critical importance of meticulous oversight.

Data Privacy and Security Laws

Apellis Pharmaceuticals must navigate a complex landscape of data privacy and security laws, with regulations like GDPR and HIPAA being paramount given the company's reliance on patient data for research, development, and commercialization. Ensuring robust data security measures and ethical handling of sensitive patient information is critical to avoid significant legal penalties and maintain vital patient trust, especially in areas like clinical trials and patient support programs.

The increasing volume of health data collected and analyzed by pharmaceutical companies like Apellis underscores the importance of compliance. For instance, the Health Insurance Portability and Accountability Act (HIPAA) in the United States mandates strict privacy and security standards for protected health information. In Europe, the General Data Protection Regulation (GDPR) imposes stringent rules on data processing and consent, with potential fines reaching up to 4% of global annual revenue for non-compliance, as seen in cases involving other industries in recent years.

- GDPR Fines: Non-compliance can result in penalties of up to 4% of global annual turnover or €20 million, whichever is higher.

- HIPAA Penalties: Violations can lead to fines ranging from $100 to $50,000 per violation, with annual limits up to $1.5 million for repeat offenses.

- Clinical Trial Data: Ensuring secure and compliant handling of patient data in clinical trials is essential for regulatory approval and scientific integrity.

Anti-Trust and Competition Laws

Apellis Pharmaceuticals operates within a highly regulated pharmaceutical sector where anti-trust and competition laws are paramount. These regulations aim to prevent monopolistic behavior and ensure a fair playing field for all market participants. For Apellis, this means careful consideration of pricing strategies, particularly for its novel therapies like Empaveli (pegcetacoplan), to avoid accusations of price gouging or anti-competitive practices. The company's market share growth and any potential mergers or acquisitions are also scrutinized to ensure they do not unduly stifle competition.

Adherence to these legal frameworks is critical for maintaining operational integrity and avoiding costly legal battles or regulatory sanctions. For instance, in 2024, the U.S. Federal Trade Commission (FTC) continued its focus on pharmaceutical mergers, reviewing numerous deals to assess their impact on competition. Apellis must ensure its business practices and strategic decisions align with these evolving enforcement priorities.

Key areas of focus for Apellis regarding anti-trust and competition laws include:

- Pricing Transparency and Justification: Ensuring drug pricing is defensible and not indicative of leveraging a dominant market position unfairly.

- Merger and Acquisition Scrutiny: Diligently assessing the competitive impact of any potential M&A activity to comply with antitrust regulations.

- Collaboration Agreements: Structuring partnerships and licensing deals to avoid exclusivity clauses that could restrict competition.

- Market Dominance Assessment: Proactively monitoring its own market position and that of competitors to preemptively address any potential antitrust concerns.

Apellis Pharmaceuticals navigates a stringent regulatory environment, with intellectual property protection being paramount. The company's key therapies, like Empaveli, depend on patent exclusivity to recoup R&D investments and maintain market advantage. For instance, patent expiry dates directly influence future revenue projections and competitive strategy, making robust patent defense a continuous legal imperative. Ensuring compliance with FDA and EMA approval processes, as well as post-market surveillance, is critical for sustained market access and patient safety.

Data privacy laws, including GDPR and HIPAA, significantly impact Apellis's operations, particularly concerning patient data in clinical trials and support programs. Non-compliance carries substantial financial risks, with GDPR fines potentially reaching up to 4% of global annual revenue. In 2024, the focus on data security intensified across the healthcare sector, underscoring the need for meticulous adherence to these regulations.

Antitrust and competition laws require Apellis to carefully manage drug pricing and market strategies. The company must ensure its practices, especially for novel therapies like pegcetacoplan, do not create anti-competitive conditions. The FTC's scrutiny of pharmaceutical mergers in 2024 highlights the importance of compliance with these regulations to avoid legal sanctions and maintain market integrity.

| Legal Factor | Impact on Apellis | 2024/2025 Relevance |

|---|---|---|

| Intellectual Property (Patents) | Secures market exclusivity, protects R&D investment, drives revenue. | Ongoing defense against infringement and challenges to key patents for Empaveli. |

| Regulatory Approvals (FDA/EMA) | Essential for market access; delays or rejections impact revenue. | Rigorous review of new indications and post-market surveillance requirements. |

| Data Privacy (GDPR/HIPAA) | Crucial for handling patient data; non-compliance incurs significant fines. | Increased enforcement and focus on secure, ethical data handling in clinical trials. |

| Antitrust & Competition Laws | Governs pricing, M&A, and market practices to prevent monopolies. | Scrutiny of pricing strategies and market dominance, especially with growing market share. |

Environmental factors

Apellis Pharmaceuticals, like its peers in the biopharmaceutical sector, faces mounting pressure regarding the environmental footprint of its supply chain. Stakeholders, including investors and regulators, are demanding greater transparency and action on sustainability, from the origin of raw materials to the final delivery of products. This scrutiny extends to minimizing waste and reducing greenhouse gas emissions throughout the entire value chain.

In 2024, the biopharmaceutical industry continued to focus on decarbonizing logistics. For instance, companies are exploring more efficient transportation methods and optimizing distribution networks to cut down on emissions. Apellis's commitment to these principles will be crucial as global supply chains become more interconnected and environmentally regulated.

Apellis Pharmaceuticals, like all drug manufacturers, faces significant environmental scrutiny regarding waste management. Pharmaceutical production can generate hazardous waste, requiring strict adherence to disposal regulations. For instance, the U.S. Environmental Protection Agency (EPA) mandates specific protocols for handling pharmaceutical waste, aiming to prevent contamination of water and soil.

Compliance with emissions standards and pollution control measures is crucial for Apellis to maintain its operating license and public trust. In 2023, the pharmaceutical industry globally saw increased investment in sustainable manufacturing, with companies allocating billions towards reducing their environmental impact. This trend is expected to continue through 2025, driven by both regulatory pressures and consumer demand for eco-friendly products.

Implementing advanced waste management systems and investing in greener chemistry and manufacturing processes are key strategies for Apellis. These initiatives not only mitigate environmental risks but can also lead to cost savings through resource efficiency. For example, adopting closed-loop manufacturing systems can significantly reduce water usage and chemical waste, contributing to a more sustainable operational model.

Apellis Pharmaceuticals must navigate a complex web of environmental regulations, from local emissions standards to international agreements on chemical management. Compliance isn't just a legal necessity; it's a core ethical responsibility, impacting everything from water quality standards to the protection of biodiversity in areas where Apellis operates or sources materials. Failure to adhere can result in significant penalties, legal battles, and severe reputational harm, underscoring the importance of robust environmental stewardship.

Climate Change Impact and Adaptation

While Apellis Pharmaceuticals, a biopharmaceutical company, might not face direct impacts from climate change on its core drug development, indirect effects are becoming increasingly significant. Extreme weather events, a consequence of climate change, can disrupt critical supply chains for raw materials or finished products. For instance, a severe hurricane or prolonged drought in a key agricultural region could impact the availability and cost of biological components used in research or manufacturing.

Furthermore, there's a growing regulatory and investor expectation for companies to quantify and disclose their climate-related risks and opportunities. This includes reporting on greenhouse gas (GHG) emissions. In 2023, the SEC proposed rules mandating climate-related disclosures, requiring companies to report Scope 1, 2, and potentially Scope 3 emissions, which can be challenging for complex global operations.

Apellis's long-term sustainability strategy will likely need to incorporate robust adaptation and mitigation measures. This could involve diversifying supply chain partners to reduce reliance on climate-vulnerable regions, investing in energy-efficient facilities, and setting ambitious targets for reducing their carbon footprint. For example, many pharmaceutical companies are aiming for net-zero emissions by 2040 or 2050, aligning with global climate goals.

Key considerations for Apellis include:

- Supply Chain Resilience: Assessing the vulnerability of key suppliers to climate-related disruptions and developing contingency plans.

- Greenhouse Gas Emissions: Measuring and reporting Scope 1, 2, and potentially Scope 3 emissions, and setting reduction targets.

- Operational Adaptation: Evaluating the impact of extreme weather on research facilities and manufacturing sites, and implementing protective measures.

- Investor and Regulatory Scrutiny: Proactively addressing climate-related disclosure requirements and demonstrating a commitment to sustainability.

Corporate Social Responsibility (CSR) and Environmental Stewardship

The increasing emphasis on Corporate Social Responsibility (CSR) pushes companies like Apellis Pharmaceuticals to go beyond basic environmental regulations. Investors and consumers now expect demonstrable commitment to sustainability. Apellis's public disclosures, including any sustainability reports or statements on their website, will detail their efforts to reduce their ecological footprint and engage in community betterment.

This proactive environmental stance is crucial for building brand reputation and attracting a growing segment of investors and employees who prioritize ethical and sustainable business practices. For instance, in 2023, the global ESG investment market was valued at over $37 trillion, highlighting the financial significance of environmental stewardship.

- Environmental Stewardship: Apellis's commitment to minimizing waste, reducing greenhouse gas emissions, and conserving resources in its operations.

- Community Engagement: Initiatives aimed at supporting local communities, potentially through environmental clean-ups or educational programs.

- Sustainable Supply Chains: Efforts to ensure that suppliers also adhere to environmental and social responsibility standards.

- Transparency and Reporting: Publicly communicating environmental performance and sustainability goals, often through annual CSR or sustainability reports.

Apellis Pharmaceuticals operates within an increasingly stringent environmental regulatory landscape. Compliance with emissions standards and pollution control is paramount, with significant investments being made across the pharmaceutical sector. For example, in 2023, global pharmaceutical companies directed billions towards reducing their environmental impact, a trend projected to intensify through 2025 due to regulatory pressures and consumer demand for eco-friendly practices.

The company must also manage pharmaceutical waste, which requires strict adherence to protocols like those mandated by the U.S. EPA to prevent soil and water contamination. Implementing advanced waste management systems and adopting greener manufacturing processes are key strategies for Apellis, potentially leading to cost savings through enhanced resource efficiency.

Climate change presents indirect risks to Apellis through supply chain disruptions from extreme weather, impacting raw material availability and cost. The company faces growing expectations for climate-related risk disclosure, including greenhouse gas (GHG) emissions reporting, a requirement highlighted by the SEC's proposed rules in 2023. Proactive measures, such as diversifying supply chains and investing in energy-efficient facilities, are crucial for long-term sustainability, with many companies targeting net-zero emissions by 2040 or 2050.

Investor and consumer demand for Corporate Social Responsibility (CSR) drives Apellis to demonstrate a commitment to sustainability beyond regulatory compliance. The global ESG investment market, valued at over $37 trillion in 2023, underscores the financial importance of environmental stewardship and ethical business practices.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Apellis Pharmaceuticals draws from a robust blend of public and proprietary data, including regulatory filings from bodies like the FDA and EMA, market research reports from leading healthcare analytics firms, and economic indicators from institutions such as the IMF and World Bank.