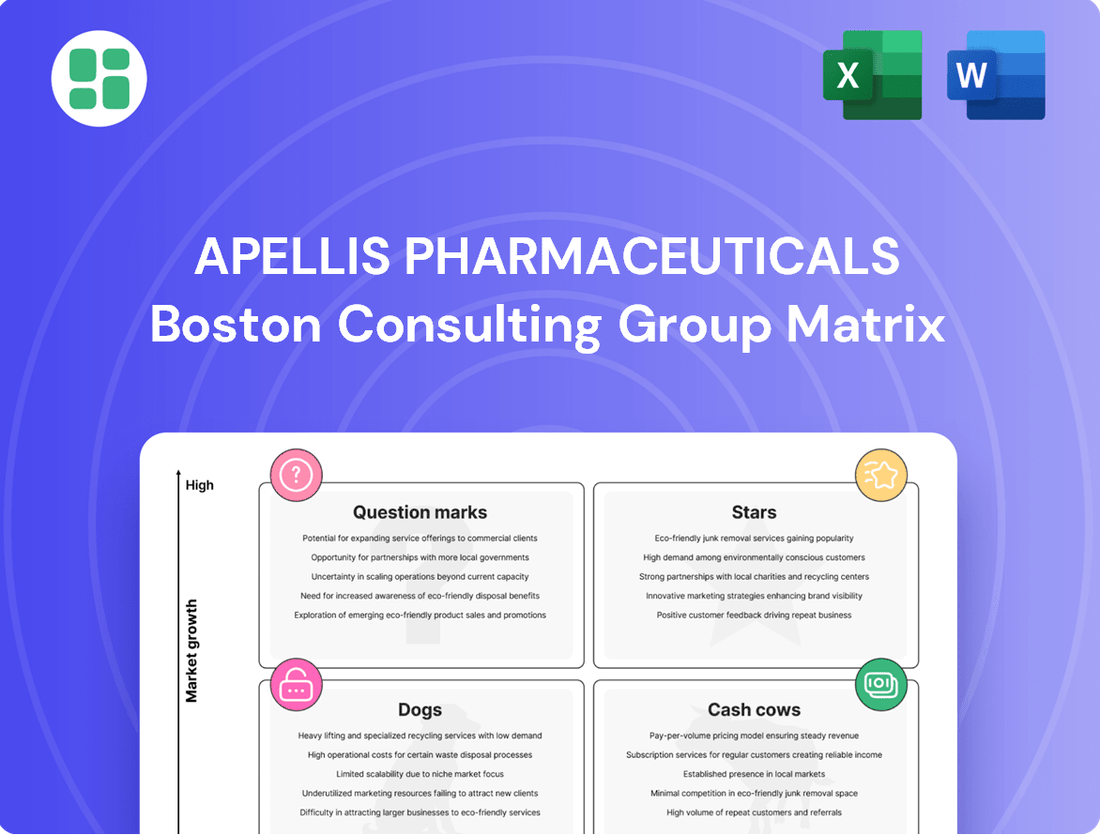

Apellis Pharmaceuticals Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apellis Pharmaceuticals Bundle

Curious about Apellis Pharmaceuticals' product portfolio and its market standing? This glimpse into their BCG Matrix reveals where their innovations are positioned as Stars, Cash Cows, Dogs, or Question Marks, offering a strategic overview of their growth potential and resource allocation.

To truly unlock the strategic advantage, dive into the full Apellis Pharmaceuticals BCG Matrix. Gain a comprehensive understanding of each product's quadrant, backed by data-driven insights and actionable recommendations to guide your investment and product development decisions with confidence.

Don't miss out on the complete picture. Purchase the full BCG Matrix report today for a detailed breakdown, expert commentary, and visual mapping that will equip you to navigate the competitive landscape and make informed strategic moves for Apellis Pharmaceuticals.

Stars

SYFOVRE has firmly established itself as the leader in the geographic atrophy (GA) market. By the second quarter of 2025, it commanded over 60% of the total market share and secured 55% of new patient initiations. This impressive performance highlights SYFOVRE's dominant position in a rapidly advancing therapeutic field.

SYFOVRE, approved by the FDA in early 2023, was the first treatment specifically designed for geographic atrophy (GA). This groundbreaking status gives Apellis a significant edge in the ophthalmology market, positioning them as a key innovator. The therapy's unique approach, targeting C3, offers a comprehensive way to manage the complement cascade, a critical factor in GA progression.

SYFOVRE is a star performer, bringing in $150.6 million in U.S. net product revenue during the second quarter of 2025. This robust sales figure highlights the drug's strong commercial traction and market acceptance.

Demand for SYFOVRE continues to climb, with a solid 6% increase in injections quarter-over-quarter in Q2 2025. This growth signals increasing physician confidence and patient uptake, even with some revenue moderation due to factors such as co-pay assistance programs.

Potential for Combination Therapy Expansion

Apellis Pharmaceuticals is exploring combination therapy as a key growth driver. Their next-generation siRNA therapy, APL-3007, is entering a Phase 2 study alongside SYFOVRE for geographic atrophy (GA). This move is designed to boost efficacy and potentially extend SYFOVRE's market presence.

This expansion into combination treatments could significantly enhance SYFOVRE's competitive edge. By offering a more robust therapeutic option, Apellis aims to capture a larger share of the GA market and secure sustained future revenue streams.

- Synergy in GA Treatment: APL-3007 in combination with SYFOVRE aims to provide a more potent treatment for geographic atrophy.

- Lifecycle Extension: This combination strategy could prolong SYFOVRE's commercial viability and market relevance.

- Competitive Advantage: A dual-action therapy offers a distinct advantage over single-agent treatments in the GA landscape.

- Market Penetration: Enhanced efficacy from combination therapy could lead to deeper penetration and increased adoption within the GA patient population.

Positive Long-Term Efficacy Data

Positive Long-Term Efficacy Data

Long-term data from studies, such as the GALE extension study presented in February 2025, indicate that early treatment with SYFOVRE results in significant preservation of retinal tissue. This sustained efficacy over time underscores the drug's clinical value and strengthens its market leadership position. The data encourages broader and earlier adoption among patients diagnosed with geographic atrophy (GA).

- Retinal Tissue Preservation: Studies show early SYFOVRE treatment leads to significant preservation of retinal tissue.

- Sustained Efficacy: Long-term data reinforces the drug's consistent clinical value over time.

- Market Leadership: Sustained efficacy supports SYFOVRE's position as a market leader in GA treatment.

- Adoption Encouragement: The positive long-term outlook encourages earlier patient adoption.

SYFOVRE is a clear Star in Apellis Pharmaceuticals' portfolio, dominating the geographic atrophy (GA) market. By Q2 2025, it held over 60% market share and secured 55% of new patient initiations, demonstrating exceptional commercial success. Its first-to-market advantage, combined with strong clinical data showing retinal tissue preservation, solidifies its position.

The drug generated $150.6 million in U.S. net product revenue in Q2 2025, with a consistent 6% quarter-over-quarter increase in injections. This growth trajectory, even with some revenue moderation from assistance programs, points to sustained demand and market leadership.

Apellis is further bolstering SYFOVRE's Star status by exploring combination therapies, including a Phase 2 study with APL-3007. This strategy aims to enhance efficacy, extend the drug's lifecycle, and create a significant competitive advantage in the evolving GA treatment landscape.

| Product | Market | Q2 2025 Market Share | Q2 2025 U.S. Net Revenue | Quarter-over-Quarter Injection Growth |

|---|---|---|---|---|

| SYFOVRE | Geographic Atrophy (GA) | >60% | $150.6 million | 6% |

What is included in the product

Apellis Pharmaceuticals' BCG Matrix analyzes its product portfolio across Stars, Cash Cows, Question Marks, and Dogs.

It highlights strategic recommendations for investment, divestment, or divestment based on market growth and share.

Apellis Pharmaceuticals' BCG Matrix visually clarifies portfolio strengths, easing strategic decisions for resource allocation.

Cash Cows

EMPAVELI, approved in May 2021 for paroxysmal nocturnal hemoglobinuria (PNH) in adults, represents a stable revenue generator for Apellis Pharmaceuticals. Its established presence in this chronic rare disease market ensures a consistent patient base, contributing significantly to the company's financial stability.

EMPAVELI demonstrates consistent revenue generation for Apellis Pharmaceuticals. In the second quarter of 2025, it brought in $20.8 million in U.S. net product revenue. This steady income stream, though perhaps not as explosive as newer offerings, provides a reliable cash foundation for the company.

This established market presence translates into dependable cash flow. Such stability is crucial, allowing Apellis to allocate these funds towards other strategic initiatives and the development of its pipeline.

Apellis Pharmaceuticals' therapy for paroxysmal nocturnal hemoglobinuria (PNH) stands out as a strong Cash Cow, largely due to exceptional patient compliance. In 2024, the therapy achieved a remarkable patient compliance rate of approximately 97% within the PNH indication. This high level of adherence underscores patient satisfaction and the therapy's effectiveness, solidifying its position as a reliable revenue generator.

This impressive retention rate directly translates into predictable, ongoing revenue streams for Apellis. By ensuring patients consistently use the treatment, the company benefits from a stable customer base, significantly reducing the financial and operational burden associated with acquiring new patients. This stability is a hallmark of a mature, successful product within the BCG matrix.

Differentiated Mechanism in PNH

Apellis Pharmaceuticals' EMPAVELI stands out in the PNH market due to its novel C3 inhibition mechanism, a distinct advantage over existing C5 inhibitors.

This differentiated approach tackles both intravascular and extravascular hemolysis, offering a more comprehensive treatment solution. For instance, in 2023, Apellis reported strong revenue growth for EMPAVELI, driven by its unique efficacy profile.

- Unique Mechanism: EMPAVELI targets C3, addressing a broader aspect of complement cascade activation than C5 inhibitors.

- Comprehensive Hemolysis Control: It effectively manages both intravascular and extravascular hemolysis, a key differentiator.

- Market Position: This distinct mechanism secures EMPAVELI's competitive edge, allowing it to capture and maintain market share in the PNH segment.

Leveraging Existing Infrastructure

Apellis Pharmaceuticals is strategically leveraging its existing commercial infrastructure, initially built for EMPAVELI in paroxysmal nocturnal hemoglobinuria (PNH), to support its expansion into new indications. This efficient use of established resources significantly reduces the cost of bringing new treatments to market. For instance, by utilizing the same sales force and distribution networks, Apellis can achieve greater economies of scale.

This synergy directly bolsters the profitability of EMPAVELI in its PNH indication, a hallmark of a cash cow. The ability to service multiple indications with a single, robust infrastructure allows for optimized operational costs and enhanced profit margins. This approach is crucial for maximizing returns from established, high-performing products.

- Infrastructure Leverage: Apellis's commercial infrastructure for EMPAVELI in PNH is being repurposed for new indications, reducing incremental costs.

- Cost Optimization: This synergy allows for more efficient operational spending, directly contributing to higher profit margins for EMPAVELI.

- Profitability Driver: The ability to service multiple indications with existing infrastructure makes EMPAVELI a strong cash cow, generating substantial profits.

EMPAVELI's position as a Cash Cow is solidified by its strong market performance and patient adherence. In the second quarter of 2025, it generated $20.8 million in U.S. net product revenue, demonstrating consistent financial contribution. The therapy's remarkable 97% patient compliance rate in 2024 within the PNH indication further underscores its reliability and patient satisfaction.

This high compliance directly translates into predictable, ongoing revenue streams, reducing the need for costly new patient acquisition. Apellis's strategic leveraging of its existing commercial infrastructure, initially built for EMPAVELI in PNH, for new indications also optimizes operational costs, boosting profitability.

The unique C3 inhibition mechanism, addressing both intravascular and extravascular hemolysis, provides EMPAVELI a distinct competitive edge in the PNH market, securing its market share and revenue generation capabilities.

| Product | Indication | Revenue (Q2 2025 US) | Patient Compliance (2024) | BCG Matrix Category |

|---|---|---|---|---|

| EMPAVELI | PNH | $20.8 million | ~97% | Cash Cow |

Delivered as Shown

Apellis Pharmaceuticals BCG Matrix

The Apellis Pharmaceuticals BCG Matrix preview you are viewing is the identical, fully comprehensive document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content—just the complete, professionally formatted strategic analysis ready for your immediate use. You can confidently use this preview as an accurate representation of the high-quality, actionable insights you'll obtain. The report has been meticulously prepared by industry experts to provide a clear and impactful overview of Apellis Pharmaceuticals' product portfolio within the BCG framework.

Dogs

In 2023, Apellis Pharmaceuticals made a significant strategic shift, discontinuing several preclinical programs focused on geographic atrophy. This move was part of a broader restructuring aimed at optimizing resource allocation.

These discontinued programs represent past research and development investments that did not progress to commercial viability. They are classified as Dogs in the BCG Matrix, as they consumed capital without generating future revenue streams, reflecting a clear instance of sunk costs with no anticipated returns.

Apellis Pharmaceuticals made a strategic decision in 2023 to discontinue its preclinical program targeting an unspecified brain disease. This move aligns with a broader strategic overhaul, signaling a divestment from an asset deemed non-performing.

The discontinuation reflects a program with limited market share potential, likely operating within a low-growth or uncertain market segment for Apellis. This strategic pivot allows the company to reallocate resources to more promising areas.

Apellis Pharmaceuticals strategically shelved the systemic development of pegcetacoplan for new indications in 2023. This decision means they are not pursuing broader systemic uses beyond existing trials, effectively placing these potential new areas in the 'question mark' category of the BCG matrix. This implies these ventures were considered low-priority or low-return at that stage.

Eliminated RNA-based Treatment Combination Plan

Apellis Pharmaceuticals discontinued a plan to investigate a combination therapy involving one of its marketed drugs with an RNA-based treatment. This decision stemmed from a 2023 restructuring, which involved a comprehensive review of the company's R&D pipeline. The program, likely in its nascent stages of development, was evaluated and deemed to lack the necessary potential to justify continued financial backing.

This strategic pivot means that resources previously earmarked for this project will be reallocated to more promising areas within Apellis's portfolio. The elimination of this RNA-based treatment combination plan positions it as a 'Dog' in the BCG matrix, signifying a low-growth, low-market-share product that is no longer a strategic priority. For instance, in 2023, Apellis reported a significant increase in R&D expenses, reaching $715.7 million, highlighting the company's commitment to optimizing its investment decisions.

The rationale behind classifying this initiative as a 'Dog' is its perceived inability to generate substantial future returns compared to other pipeline candidates. This move aligns with Apellis's objective to streamline its operations and focus on assets with a higher probability of commercial success. Such portfolio management is crucial for companies navigating the complex and capital-intensive biopharmaceutical landscape.

- Program Discontinuation: A combination study of a marketed medicine with an RNA-based treatment was halted.

- Strategic Rationale: Assessed as not having sufficient potential for further investment following a 2023 restructuring.

- BCG Matrix Classification: Categorized as a 'Dog' due to low growth and market potential.

- Resource Reallocation: Funds and resources will be redirected to more promising R&D initiatives.

Past Pipeline Rationalization

Apellis Pharmaceuticals underwent a significant pipeline rationalization in 2023, a strategic move that involved a substantial workforce reduction and a focused trimming of research initiatives. This restructuring aimed to concentrate resources on opportunities with the highest potential for market success.

This strategic pruning suggests that certain research programs or product candidates were identified as having low market share and limited growth prospects. Consequently, these were terminated to reallocate capital towards more promising ventures, aligning with the divestment strategy for "dogs" in a BCG matrix.

- Workforce Reduction: Apellis reported a workforce reduction impacting approximately 20% of its employees in late 2023, a move designed to streamline operations and reduce costs.

- R&D Focus: The company stated its intention to prioritize R&D efforts on its complement cascade inhibitors, particularly those with clear paths to market and significant commercial potential.

- Divestment Rationale: Projects deemed to have low probability of success or limited market differentiation were likely candidates for this rationalization, freeing up financial resources for core assets.

Apellis Pharmaceuticals' strategic pruning in 2023 led to the discontinuation of several preclinical programs and research initiatives. These "Dogs" in the BCG matrix represent investments that were not yielding expected returns or had limited future potential. For instance, the company halted the systemic development of pegcetacoplan for new indications and a combination therapy study with an RNA-based treatment. This allowed for resource reallocation to core assets.

These discontinued projects, such as the unspecified brain disease program and the RNA-based treatment combination, were evaluated and deemed to lack sufficient market share or growth prospects. By divesting from these "Dogs," Apellis aimed to optimize its R&D pipeline and focus capital on more promising opportunities, particularly its complement cascade inhibitors. This strategic move aligns with a broader effort to streamline operations, evidenced by a workforce reduction impacting approximately 20% of employees in late 2023.

The financial implications of such decisions are significant; in 2023, Apellis reported R&D expenses of $715.7 million. The discontinuation of "Dog" assets is a critical component of portfolio management, ensuring that financial resources are directed towards ventures with a higher probability of commercial success and market differentiation.

| Discontinued Program Area | BCG Classification | Rationale | Financial Impact (2023) |

| Geographic Atrophy (preclinical) | Dog | Resource optimization, low future revenue | Part of overall R&D spend |

| Unspecified brain disease (preclinical) | Dog | Non-performing asset, divestment | Part of overall R&D spend |

| Systemic pegcetacoplan (new indications) | Dog (potential) | Low priority/return at present | Reallocation of development funds |

| Marketed drug + RNA treatment combo | Dog | Insufficient potential, restructuring | Reallocation of development funds |

Question Marks

EMPAVELI is positioned as a potential disruptor in the Focal Segmental Glomerulosclerosis (FSGS) market. While FSGS is a rare kidney disease with a significant unmet medical need and no approved treatments, EMPAVELI has a zero market share in this segment currently. This presents a substantial growth opportunity for Apellis Pharmaceuticals.

The company is strategically advancing EMPAVELI towards pivotal Phase 3 studies in FSGS, with initiation planned for the second half of 2025. This timeline indicates a focused effort to address this high-growth, underserved market. The absence of existing therapies means EMPAVELI could capture a significant share if successful.

Apellis Pharmaceuticals is exploring EMPAVELI for Delayed Graft Function (DGF), a significant unmet need in kidney transplantation. Pivotal studies are slated to begin in the latter half of 2025, aiming to bring a much-needed treatment option to patients.

This move into DGF, another rare kidney disease with no current approved therapies, aligns with Apellis' strategy to target high-growth potential markets. The company's success with EMPAVELI in other indications positions it to potentially capture a substantial share in this underserved therapeutic area.

Apellis Pharmaceuticals initiated a Phase 2 study in Q2 2025 for APL-3007 combined with SYFOVRE, targeting a next-generation treatment for geographic atrophy (GA). This strategic move aims to build upon the established success of SYFOVRE, which received FDA approval in February 2023 and is projected to reach over $2 billion in sales by 2028, according to market analysts.

While the GA market is experiencing significant growth, with an estimated CAGR of 15% through 2030, this particular combination therapy is in its nascent clinical development stages. Consequently, it currently holds a low market share, awaiting further efficacy and safety data to demonstrate its potential superiority or complementary benefits over existing treatments.

Preclinical Gene-Edited Complement Therapies (Beam Collaboration)

Apellis Pharmaceuticals is collaborating with Beam Therapeutics on preclinical gene-edited therapies targeting the FcRn and complement systems. These represent early-stage, high-risk, high-reward ventures with the potential for significant future growth, though they currently hold no market share.

These programs are positioned as potential question marks within Apellis's portfolio, reflecting their significant future growth potential but also their inherent uncertainty and lack of current market penetration.

- Preclinical Stage: The therapies are in the earliest stages of development, meaning they have not yet undergone human testing.

- High Risk, High Reward: Success in these areas could lead to transformative treatments, but failure is also a distinct possibility.

- Undisclosed Indications: Specific diseases or conditions these therapies aim to treat have not been publicly disclosed by Apellis.

- Collaboration with Beam Therapeutics: This partnership leverages Beam's expertise in gene editing, specifically their base editing and prime editing technologies.

Oral Complement Inhibitor Program

Apellis Pharmaceuticals' oral complement inhibitor program is positioned as a 'Question Mark' within the BCG matrix. This preclinical initiative aims to develop a more convenient, orally administered complement inhibitor, a significant advantage over existing injectable therapies.

The market for complement-mediated diseases is substantial, with a clear demand for oral treatment options. While this program currently holds no market share, its potential for high future growth is evident, given the unmet need for improved patient convenience and adherence.

- Program Status: Preclinical, focusing on oral administration.

- Market Position: Question Mark (low market share, high growth potential).

- Market Opportunity: High demand for oral alternatives in complement-mediated diseases.

- Strategic Implication: Requires significant investment to advance through development and capture future market share.

Apellis Pharmaceuticals' gene-edited therapies, developed in partnership with Beam Therapeutics, represent early-stage ventures with significant future growth potential but currently no market share. These programs are categorized as Question Marks due to their high-risk, high-reward profile and the inherent uncertainty of preclinical development.

The oral complement inhibitor program is also a Question Mark, targeting a substantial market for complement-mediated diseases with a focus on improved patient convenience through oral administration. This initiative requires substantial investment to progress through clinical trials and secure future market share.

| Product/Program | BCG Category | Market Share | Market Growth Potential | Development Stage | Key Considerations |

|---|---|---|---|---|---|

| Gene-Edited Therapies (Beam Therapeutics Collaboration) | Question Mark | Negligible (Preclinical) | High | Preclinical | High risk, high reward; leverages Beam's gene editing expertise. |

| Oral Complement Inhibitor Program | Question Mark | Negligible (Preclinical) | High | Preclinical | Addresses unmet need for oral administration; requires significant investment. |

BCG Matrix Data Sources

Our Apellis Pharmaceuticals BCG Matrix leverages data from SEC filings, industry growth forecasts, and market share analyses to provide strategic insights into product portfolio performance.