Apellis Pharmaceuticals Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apellis Pharmaceuticals Bundle

Apellis Pharmaceuticals operates in a dynamic biopharmaceutical landscape, facing moderate threats from new entrants and the bargaining power of buyers, particularly with its innovative complement cascade inhibitors. The intensity of rivalry is significant, driven by the need for continuous R&D and market differentiation.

The complete report reveals the real forces shaping Apellis Pharmaceuticals’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Apellis Pharmaceuticals, like many in its sector, depends on highly specialized raw materials and active pharmaceutical ingredients (APIs) for its unique therapies. The suppliers of these critical, often proprietary, inputs wield considerable influence because there are few qualified alternatives. This scarcity is a key driver of their bargaining power.

The biopharmaceutical industry's supply chain faced significant disruptions in 2024 and into 2025, a trend that has only intensified the bargaining power of these specialized suppliers. Companies like Apellis must ensure reliable sourcing, making them more amenable to supplier-driven terms, especially for novel components essential to their drug development pipeline.

The development and manufacturing of complex biologic drugs, such as Apellis Pharmaceuticals' complement-targeting therapies, frequently require collaboration with specialized Contract Manufacturing Organizations (CMOs). These CMOs can wield significant bargaining power, particularly when they possess unique expertise, advanced facilities, or proprietary intellectual property crucial for the intricate production processes involved.

The global biopharmaceutical contract development and manufacturing organization (CDMO) market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of approximately 10-12% through 2027. This increasing demand for specialized CDMO services can translate into higher pricing power for these organizations and influence their negotiation leverage with pharmaceutical companies like Apellis.

Suppliers of patented technologies or specialized research tools vital for drug development can wield significant power. For Apellis, whose work centers on the complement system, reliance on specific licensed intellectual property or unique research platforms means these licensors hold considerable sway.

For instance, companies providing advanced gene sequencing or specialized protein analysis platforms, if critical to Apellis's research pipeline, could negotiate favorable terms. The cost of licensing such essential technologies can be substantial, impacting Apellis's R&D expenses and potentially its profit margins.

Quality and Regulatory Compliance

Suppliers who consistently meet stringent pharmaceutical quality standards and regulatory compliance, such as those mandated by the FDA and EMA, hold significant leverage. The substantial investment and complexity involved in maintaining these standards mean that Apellis Pharmaceuticals faces considerable risk and cost when considering a switch to unproven suppliers. This reliance on established, compliant suppliers strengthens their bargaining power.

The high cost and complexity of ensuring regulatory adherence create a substantial barrier to entry for new suppliers. This situation naturally favors established suppliers who have already navigated these intricate requirements, thereby enhancing their negotiating position with companies like Apellis.

- Supplier Dependence: Pharmaceutical companies often rely on a limited number of suppliers for critical raw materials and components that meet rigorous quality and regulatory specifications.

- Switching Costs: The expense and time required to qualify new suppliers, revalidate processes, and ensure continued regulatory compliance are significant deterrents to changing suppliers.

- Regulatory Scrutiny: Suppliers who can consistently demonstrate adherence to evolving pharmaceutical regulations (e.g., Good Manufacturing Practices) are indispensable, giving them greater leverage.

Geopolitical and Economic Factors

Geopolitical instability and persistent inflation are creating significant headwinds for biopharmaceutical supply chains. These factors directly influence the cost and consistent availability of critical raw materials and specialized manufacturing services. For instance, the global inflation rate averaged 5.9% in 2023, impacting input costs across industries, including pharmaceuticals.

In response, companies like Apellis Pharmaceuticals are prioritizing supply chain resilience. This often involves exploring more diversified or localized sourcing strategies. Such shifts can fundamentally alter supplier bargaining power, potentially granting greater leverage to suppliers situated in strategically favored or newly developed regional hubs.

- Supply Chain Diversification: Companies are actively seeking to reduce reliance on single-source suppliers, particularly those located in politically volatile regions.

- Inflationary Pressures: Rising costs for energy, labor, and transportation directly translate to higher prices for pharmaceutical raw materials and contract manufacturing.

- Geopolitical Risk: Trade disputes, sanctions, and regional conflicts can disrupt the flow of essential components, forcing companies to seek alternative, often more expensive, suppliers.

- Regional Sourcing Advantages: Suppliers in regions offering greater political stability and favorable trade agreements may see an increase in their bargaining power.

Suppliers of specialized APIs and critical raw materials for Apellis Pharmaceuticals hold significant bargaining power due to the limited availability of qualified alternatives and the high switching costs involved in qualifying new vendors. The biopharmaceutical industry's inherent reliance on proprietary inputs and advanced manufacturing processes further solidifies this leverage. This dynamic was particularly evident in 2024, with ongoing supply chain disruptions and inflationary pressures increasing the cost and reducing the availability of essential components.

The increasing demand for specialized contract manufacturing services, with the global CDMO market projected to grow at a CAGR of 10-12% through 2027, empowers these organizations. Their unique expertise and advanced facilities, crucial for complex drug production, allow them to negotiate favorable terms. Furthermore, suppliers who consistently meet stringent regulatory standards, a complex and costly endeavor, become indispensable, strengthening their negotiating position.

| Factor | Impact on Apellis | Supplier Leverage |

|---|---|---|

| Limited Qualified Suppliers | High reliance on existing partners | Strong |

| Switching Costs (Qualification, Validation) | Significant financial and time investment to change | Strong |

| Regulatory Compliance Expertise | Essential for market access and product integrity | Strong |

| Supply Chain Disruptions (2024-2025) | Increased risk of shortages and price volatility | Strong |

| CDMO Market Growth (10-12% CAGR) | Higher demand for specialized manufacturing services | Moderate to Strong |

What is included in the product

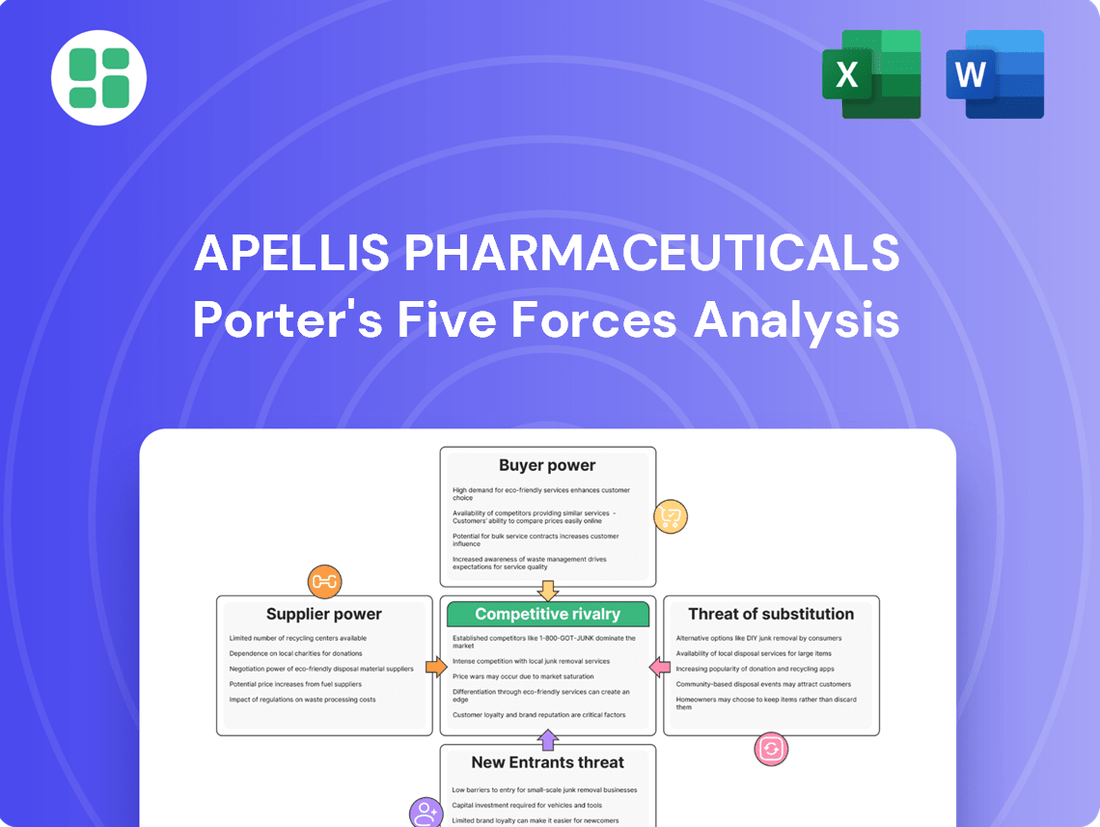

This analysis tailors Porter's Five Forces to Apellis Pharmaceuticals, examining the intensity of rivalry, threat of new entrants, buyer and supplier power, and the threat of substitutes within the rare disease therapeutic market.

Apellis Pharmaceuticals' Porter's Five Forces analysis provides a clear, one-sheet summary of competitive pressures, simplifying strategic decision-making for pain point relief.

Customers Bargaining Power

Healthcare payers, particularly government programs like Medicare and major private insurers, form a concentrated customer base that wields significant bargaining power over pharmaceutical companies. This influence is amplified by legislative actions such as the Inflation Reduction Act (IRA) in the United States, which grants Medicare the authority to negotiate drug prices starting in 2026. For companies like Apellis Pharmaceuticals, this means a direct impact on their revenue streams and necessitates a strategic reevaluation of pricing and market access approaches.

Physicians and specialists, such as ophthalmologists and nephrologists, are the primary decision-makers for Apellis's treatments. Their choices are driven by a balance of patient outcomes, drug effectiveness, safety, and ease of use. For instance, in 2024, the market for treatments impacting conditions like geographic atrophy saw continued innovation, offering prescribers a wider array of choices.

Patient advocacy groups and individual patients are increasingly vocal about the need for affordable access to critical medications, including those for rare diseases. This pressure can significantly impact pricing strategies and market penetration for companies like Apellis. For instance, in 2024, ongoing discussions around drug pricing reform in the U.S. continued to highlight patient affordability as a major concern for pharmaceutical manufacturers.

When high drug costs become a barrier, patients may struggle with adherence or seek out less expensive alternatives, directly affecting sales volumes. Apellis has encountered this challenge, with reports indicating funding shortages in co-pay assistance programs for its products. This situation can dampen revenue, even when there is clear demand for therapies like SYFOVRE, which treats geographic atrophy.

Hospital and Integrated Delivery Networks

Large hospital systems and integrated delivery networks (IDNs) wield significant bargaining power over pharmaceutical companies like Apellis Pharmaceuticals. By consolidating their purchasing, these entities can negotiate better prices and terms for drug acquisition. For instance, in 2024, the top 10 largest US hospital systems accounted for a substantial portion of national healthcare spending, increasing their leverage.

These consolidated entities maintain powerful formularies and preferred drug lists, which directly influence physician prescribing habits and, consequently, the market access for specific medications. The ongoing trend of consolidation within the healthcare industry, with fewer, larger players emerging, further amplifies their negotiating strength against drug manufacturers.

- Consolidated Purchasing Power: Major hospital systems and IDNs aggregate demand, enabling them to secure more favorable pricing.

- Formulary Control: Inclusion on preferred drug lists is critical for market penetration and directly impacts sales.

- Industry Consolidation: The trend towards fewer, larger healthcare providers enhances their collective bargaining clout.

- Negotiating Leverage: Increased market share for these systems translates into greater influence over drug procurement decisions.

Availability of Generics/Biosimilars (Long-term)

The long-term availability of generics and biosimilars poses a significant threat to Apellis Pharmaceuticals by increasing customer bargaining power. As patent protections for Apellis's innovative biologics eventually expire, the market entry of biosimilar competitors will become a reality.

The biosimilar market is experiencing substantial growth, with projections indicating a compound annual growth rate (CAGR) that will lead to increased price competition for therapies that are equivalent to Apellis's current offerings. For instance, the global biosimilars market was valued at approximately $20.6 billion in 2023 and is forecast to reach $115.8 billion by 2030, growing at a CAGR of 27.8% during this period. This anticipated price erosion directly impacts the revenue potential of Apellis's products post-patent expiry.

- Increased Price Pressure: The entry of biosimilars will force Apellis to lower prices for its treatments to remain competitive.

- Reduced Profit Margins: Lower prices directly translate to reduced profit margins on products that were once protected by exclusivity.

- Strategic Considerations: This future dynamic necessitates careful consideration in current pricing strategies and ongoing research and development investments to maintain a competitive edge.

The bargaining power of customers for Apellis Pharmaceuticals is substantial, driven by concentrated payers like government programs and private insurers, who are increasingly empowered by legislation like the Inflation Reduction Act. Physicians, as key prescribers, wield influence through their treatment choices, balancing efficacy with cost, especially as more treatment options emerged in 2024. Patient advocacy groups and patients themselves are also exerting pressure for affordability, a trend highlighted in ongoing drug pricing discussions throughout 2024.

Consolidated entities like large hospital systems and integrated delivery networks (IDNs) significantly amplify customer bargaining power. These organizations, which represented a considerable portion of healthcare spending in 2024, use their aggregated demand to negotiate favorable pricing and control formularies, directly impacting market access for Apellis's therapies.

| Customer Segment | Bargaining Power Drivers | Impact on Apellis |

|---|---|---|

| Payers (Government/Private Insurers) | Price negotiation (IRA), formulary control | Revenue pressure, market access challenges |

| Physicians/Specialists | Treatment choice, efficacy/cost balance | Prescribing patterns, adoption rates |

| Patient Advocacy Groups/Patients | Affordability demands, access advocacy | Pricing strategy influence, public perception |

| Hospital Systems/IDNs | Consolidated purchasing, formulary power | Volume discounts, preferred drug status |

Preview Before You Purchase

Apellis Pharmaceuticals Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Apellis Pharmaceuticals, detailing the competitive landscape impacting its operations. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry.

Rivalry Among Competitors

Apellis Pharmaceuticals operates in intensely competitive therapeutic areas, especially for complement-driven diseases like geographic atrophy (GA) and paroxysmal nocturnal hemoglobinuria (PNH). In GA, Apellis's SYFOVRE faces direct rivalry from Astellas's Izervay, though Apellis currently holds a dominant market position.

The PNH market presents even more robust competition for Apellis's Empaveli. It contends with long-standing C5 inhibitors such as Alexion's Soliris and Ultomiris, alongside emerging treatments like Novartis's Fabhalta and Roche's crovalimab, indicating a crowded and dynamic competitive landscape.

The diseases Apellis targets, like geographic atrophy (GA) and paroxysmal nocturnal hemoglobinuria (PNH), are serious conditions with a clear demand for better treatments. This naturally draws in many pharmaceutical companies, all pouring resources into research and development for new therapies. For instance, in 2024, the global market for rare diseases was projected to reach over $250 billion, highlighting the immense financial incentive.

This intense R&D activity means there's a crowded field of companies developing treatments for the same conditions, creating a highly competitive environment. Companies are vying to be the first or best to market, especially in areas with significant unmet medical needs like complement-mediated diseases. The potential for substantial returns in these therapeutic areas fuels this fierce competition.

Apellis Pharmaceuticals distinguishes its products through robust clinical efficacy and safety profiles. SYFOVRE, for instance, has demonstrated significant benefits in slowing geographic atrophy (GA) progression, a key factor in its market adoption. The drug's administration convenience also plays a role in its competitive standing.

For paroxysmal nocturnal hemoglobinuria (PNH), Apellis's Empaveli offers a unique C3-targeting mechanism. This approach directly addresses extravascular hemolysis, a component of PNH that C5 inhibitors may not fully manage, providing a distinct clinical advantage for patients.

R&D Pipeline and Innovation Race

The biopharmaceutical sector thrives on a relentless pursuit of innovation, where companies like Apellis Pharmaceuticals are deeply invested in research and development. This commitment fuels the creation of novel therapies and the expansion of existing drug applications, directly impacting competitive intensity.

Apellis is actively progressing its pipeline, notably with APL-3007 targeting geographic atrophy (GA), and is seeking to broaden the use of its drug Empaveli into new kidney disease indications such as focal segmental glomerulosclerosis (FSGS) and delayed graft function (DGF). These strategic moves are designed to capture new market segments and solidify its competitive position.

- R&D Investment: Apellis reported approximately $380 million in R&D expenses for the fiscal year 2023, underscoring its dedication to pipeline advancement.

- Pipeline Expansion: The company's focus on APL-3007 for GA and exploring Empaveli for FSGS and DGF signifies a strategy to diversify its therapeutic offerings and address unmet medical needs.

- Competitive Landscape: These developments place Apellis in direct competition with other biopharma firms also targeting rare diseases and kidney disorders, intensifying the race for market share and scientific breakthroughs.

Marketing and Commercialization Strength

Apellis Pharmaceuticals faces intense competitive rivalry in its key therapeutic areas, particularly in the treatment of geographic atrophy (GA) and paroxysmal nocturnal hemoglobinuria (PNH). Effective marketing, a robust sales force, and strategic market access are critical differentiators in this highly regulated and competitive landscape.

While Apellis demonstrated strong commercialization for SYFOVRE, evidenced by its dominant market share in GA, it's navigating revenue complexities stemming from factors like free goods utilization. This highlights the ongoing challenge of translating market presence into consistent financial performance against established players.

The PNH market, in particular, presents a formidable competitive challenge. Larger pharmaceutical companies with substantial resources and deeply entrenched sales networks and physician relationships pose a significant hurdle for Apellis to overcome. For instance, in 2024, the PNH market is dominated by established therapies with significant market penetration.

- Marketing and Sales Force Reach: The ability to effectively reach and educate physicians and patients about new treatments is paramount. Apellis's success with SYFOVRE shows a strong initial marketing push.

- Market Access and Reimbursement: Securing favorable reimbursement and formulary placement is crucial for patient access and commercial viability.

- Competitive Landscape in GA: While Apellis leads in GA, other companies are actively developing and launching competing therapies, intensifying rivalry.

- PNH Market Dynamics: Established players in the PNH space possess significant advantages due to long-standing market presence and patient relationships.

Apellis Pharmaceuticals faces significant competitive rivalry, especially in the geographic atrophy (GA) and paroxysmal nocturnal hemoglobinuria (PNH) markets. The company's SYFOVRE for GA competes directly with Astellas's Izervay, though Apellis currently holds a leading position. However, the PNH market is more crowded, with Apellis's Empaveli challenged by established C5 inhibitors and newer entrants, indicating a dynamic and competitive environment.

The intense R&D investment in rare and complement-driven diseases fuels this rivalry, as companies vie for market share in areas with high unmet needs. For instance, in 2024, the global rare disease market is projected to exceed $250 billion, attracting substantial investment and competition. Apellis's strategy of differentiating through clinical efficacy, safety, and unique mechanisms of action, like Empaveli's C3 targeting, is crucial for navigating this landscape.

Apellis reported approximately $380 million in R&D expenses for 2023, reflecting its commitment to innovation and pipeline expansion, including APL-3007 for GA and exploring Empaveli for new kidney disease indications. This proactive pipeline development is essential to maintain its competitive edge against well-resourced competitors with established market presence and physician relationships, particularly in the PNH sector.

| Therapeutic Area | Apellis Product | Key Competitors | Competitive Factors |

| Geographic Atrophy (GA) | SYFOVRE | Astellas (Izervay) | Clinical efficacy, administration convenience, market access |

| Paroxysmal Nocturnal Hemoglobinuria (PNH) | Empaveli | Alexion (Soliris, Ultomiris), Novartis (Fabhalta), Roche (crovalimab) | Mechanism of action (C3 vs. C5 inhibition), established market presence, physician relationships |

SSubstitutes Threaten

For conditions like paroxysmal nocturnal hemoglobinuria (PNH), conventional supportive care, including blood transfusions and iron supplementation, presents a substitute threat. These methods can manage symptoms for patients with less severe cases or those who cannot tolerate or access more advanced treatments, even though they don't address the underlying disease mechanism. In 2023, Apellis' Empaveli (pegcetacoplan) generated $713 million in revenue, indicating a significant market for targeted therapies that these supportive measures aim to compete with.

While Apellis Pharmaceuticals' treatments are specifically approved for certain conditions, the threat of substitutes can emerge from the off-label use of other complement inhibitors. This is a less common but still present risk, particularly if patients face access issues or cannot tolerate the prescribed therapy. For example, if a complement inhibitor approved for a rare autoimmune disease shows even marginal efficacy in a condition Apellis targets, it could be explored off-label. This represents a subtle, yet potential, substitution dynamic.

For certain chronic conditions, lifestyle changes and preventative actions can slow disease progression, lessening the immediate need for advanced drug treatments. For instance, in 2024, the CDC reported that approximately 80% of heart disease and stroke cases could be prevented through healthy lifestyle choices, including diet and exercise. This broad approach to health management can act as a general alternative to relying solely on pharmaceuticals.

Surgical Interventions and Procedures

Surgical interventions can pose a threat to pharmaceutical treatments by offering alternative solutions for specific medical conditions. For example, while Apellis Pharmaceuticals' treatments address paroxysmal nocturnal hemoglobinuria (PNH), bone marrow transplantation remains the sole potential cure for severe PNH cases. However, this procedure is high-risk and not universally applicable, limiting its direct substitution impact.

The threat of substitutes is also evident in the development of gene therapies for conditions like geographic atrophy (GA). These therapies, often delivered through a single surgical intervention, are being explored as long-term alternatives to the repeated injections currently offered by pharmaceuticals. While still under development, the potential for a one-time curative treatment could significantly disrupt the market for ongoing pharmaceutical management.

- Bone Marrow Transplant for PNH: While a cure, it's high-risk and not for all PNH patients.

- Gene Therapy for GA: Future single-intervention gene therapies could replace repeated injections.

- Limited Applicability: The effectiveness and suitability of these surgical alternatives vary greatly by condition and patient.

Emerging Non-Pharmacological Treatments

Beyond traditional drug therapies, the threat of substitutes for Apellis Pharmaceuticals' treatments, particularly for complement-driven diseases like geographic atrophy (GA), is evolving. Emerging non-pharmacological interventions and medical devices that target the underlying disease mechanisms pose a long-term risk.

While currently in early stages, advancements in areas such as photobiomodulation therapy are being investigated as non-invasive alternatives for GA. For instance, research into light-based therapies aims to stimulate cellular repair and reduce inflammation, potentially offering a different approach to disease management.

- Emerging Non-Pharmacological Treatments: The development of non-drug therapies or medical devices that address the root causes of complement-mediated diseases presents a significant substitute threat.

- Photobiomodulation Therapy for GA: This therapy, utilizing specific wavelengths of light, is being explored for its potential to promote healing and reduce inflammation in GA, offering a non-invasive alternative to intravitreal injections.

- Early Stage Research: While promising, these non-pharmacological approaches are still in nascent stages of development and clinical validation, meaning their widespread adoption and efficacy compared to current treatments are yet to be fully established.

The threat of substitutes for Apellis Pharmaceuticals' treatments is multifaceted, encompassing both established and emerging alternatives. While Apellis' Empaveli achieved $713 million in revenue in 2023, indicating strong market acceptance, other approaches can still impact its market share. These range from conventional supportive care for conditions like PNH to potentially curative gene therapies in development for geographic atrophy (GA).

| Substitute Type | Condition Addressed | Potential Impact | Notes |

|---|---|---|---|

| Supportive Care | PNH | Moderate | Manages symptoms for less severe cases or when advanced treatments are inaccessible. |

| Off-label Use | Complement-driven diseases | Low to Moderate | Risk if patients face access issues or intolerance to prescribed therapies. |

| Lifestyle Changes | Chronic diseases | Indirect | Can slow disease progression, reducing reliance on pharmaceuticals. |

| Bone Marrow Transplant | PNH | Moderate | Potential cure, but high-risk and not universally applicable. |

| Gene Therapy | GA | High (potential) | Emerging single-intervention curative treatments could disrupt ongoing management. |

| Photobiomodulation Therapy | GA | Low (currently) | Early-stage non-invasive research for cellular repair and inflammation reduction. |

Entrants Threaten

Developing novel biopharmaceutical therapies, particularly for intricate complement-driven diseases, demands substantial capital for research, preclinical work, and extensive clinical trials. Apellis Pharmaceuticals' significant R&D expenditures, which contributed to a net loss of $536.1 million in 2023, highlight this substantial barrier to entry for aspiring companies.

Stringent regulatory hurdles significantly deter new entrants in the biopharmaceutical sector. Agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose lengthy and rigorous approval processes for new drugs.

For instance, the average time for FDA approval of a new molecular entity (NME) has seen fluctuations, but the process consistently requires substantial investment in clinical trials and data submission. In 2023, the FDA approved 55 novel drugs, a number that underscores the high bar for market entry.

Achieving market authorization for novel therapies, especially first-in-class treatments like those Apellis Pharmaceuticals develops, necessitates comprehensive clinical data, adherence to strict manufacturing standards, and thorough safety evaluations. These requirements create a formidable barrier, demanding considerable capital and expertise that new companies may struggle to muster.

Intellectual property and patent protection are significant barriers for new entrants. Apellis Pharmaceuticals, for instance, benefits from patent protection on its key drugs like SYFOVRE and EMPAVELI, ensuring market exclusivity. This exclusivity period, typically 20 years from filing but with effective market exclusivity often shorter due to regulatory review, means new companies must invest heavily in developing truly novel compounds or navigate complex, non-infringing pathways to enter the market.

Need for Specialized Expertise and Infrastructure

The threat of new entrants for Apellis Pharmaceuticals is somewhat limited by the substantial need for specialized expertise and infrastructure. Developing and bringing to market treatments for rare and complex diseases demands deep knowledge in specific fields such as immunology, ophthalmology, nephrology, and hematology. This isn't something easily replicated by a new player.

Furthermore, any new company would have to invest heavily in building or acquiring the necessary infrastructure. This includes state-of-the-art R&D laboratories, advanced manufacturing facilities capable of producing complex biologics, and a highly specialized sales force trained to engage with physicians and patient advocacy groups in niche therapeutic areas. For instance, the cost of establishing a cGMP-compliant manufacturing facility can easily run into hundreds of millions of dollars, a significant barrier to entry.

- High R&D Investment: Pharmaceutical R&D spending is notoriously high, with estimates suggesting it costs over $2 billion to bring a new drug to market.

- Specialized Talent Acquisition: Recruiting and retaining top-tier scientists and clinicians in rare disease fields is competitive and expensive.

- Regulatory Hurdles: Navigating complex regulatory pathways for novel therapies requires significant expertise and resources.

- Capital Intensive Infrastructure: Building and maintaining specialized manufacturing and distribution networks demands substantial upfront capital.

Established Market Leaders and Brand Loyalty

Established market leaders, like Apellis Pharmaceuticals with its drug SYFOVRE for geographic atrophy (GA), possess significant advantages. Apellis has cultivated strong relationships with healthcare providers who prescribe these treatments and has built substantial brand recognition. Furthermore, the company has invested in patient support programs, creating a sticky ecosystem that new entrants must contend with.

New companies entering the GA market would face the considerable hurdle of displacing these entrenched positions. Significant investment in marketing and prescriber education would be essential to even begin gaining traction. This is particularly true in specialized therapeutic areas like GA, where physician trust and established treatment pathways are critical for adoption.

Consider the competitive landscape in ophthalmology. For instance, in 2024, the market for GA treatments is still developing, but existing players have already captured mindshare. Apellis reported $100 million in SYFOVRE sales in its first year on the market, demonstrating early success and brand establishment that new entrants will need to overcome.

- Established prescriber relationships: Apellis has built trust and familiarity with ophthalmologists.

- Strong brand recognition: SYFOVRE is becoming a known entity in the GA treatment space.

- Patient support infrastructure: Programs designed to help patients access and adhere to treatment create loyalty.

- High barrier to entry: New entrants require substantial capital for marketing and education to compete effectively.

The threat of new entrants for Apellis Pharmaceuticals is considerably low due to the immense capital required for research, development, and navigating stringent regulatory pathways. The company's 2023 net loss of $536.1 million underscores the significant financial commitment necessary, a barrier that deters many potential competitors.

Intellectual property protection, such as Apellis' patents on SYFOVRE and EMPAVELI, further solidifies this low threat by granting market exclusivity. New entrants must either develop entirely novel compounds or find non-infringing pathways, which demands substantial investment and innovation.

The need for specialized expertise in areas like immunology and ophthalmology, coupled with the infrastructure costs for manufacturing biologics, creates a high barrier. For example, building a cGMP-compliant facility can cost hundreds of millions of dollars, making it difficult for new players to compete effectively.

Established market presence and strong prescriber relationships, exemplified by SYFOVRE's $100 million in first-year sales in 2024, also make it challenging for newcomers to gain traction. New entrants would need significant marketing and educational investment to displace Apellis' entrenched position.

| Barrier Type | Description | Impact on New Entrants | Example for Apellis |

|---|---|---|---|

| Capital Requirements | High R&D and infrastructure costs | Significant deterrent | $536.1M net loss in 2023 |

| Intellectual Property | Patent protection | Limits market access for competitors | Patents on SYFOVRE and EMPAVELI |

| Specialized Expertise | Knowledge in niche therapeutic areas | Requires deep scientific and clinical talent | Immunology, ophthalmology expertise |

| Regulatory Hurdles | FDA/EMA approval processes | Lengthy and costly market entry | Rigorous clinical trial data submission |

| Established Market Position | Brand recognition and prescriber relationships | Difficult to displace incumbents | SYFOVRE's $100M sales in first year (2024) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Apellis Pharmaceuticals leverages data from SEC filings, investor relations reports, and industry-specific market research databases to assess competitive dynamics.

We incorporate insights from pharmaceutical trade journals, competitor press releases, and financial analyst reports to gain a comprehensive understanding of the forces shaping the industry.