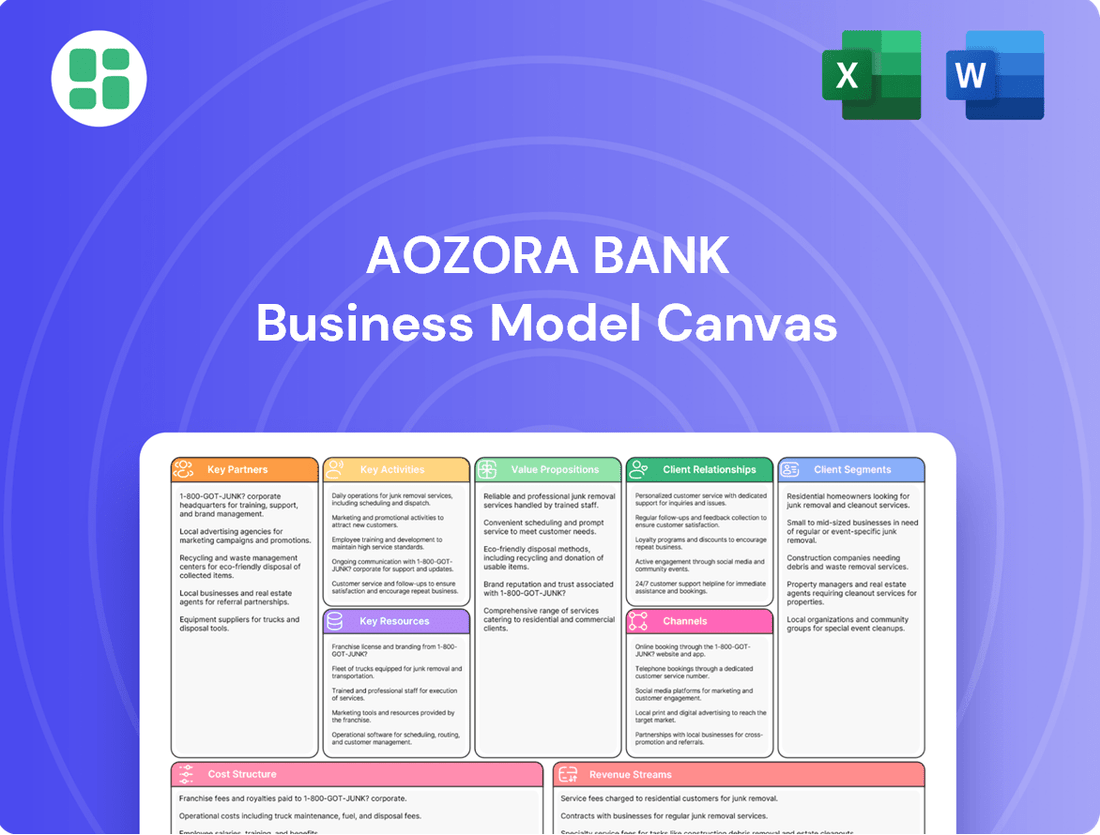

Aozora Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aozora Bank Bundle

Unlock the full strategic blueprint behind Aozora Bank's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Aozora Bank's strategic alliance with Daiwa Securities Group Inc. is a cornerstone of its business model, fostering a capital and business partnership designed to unlock significant synergies. This collaboration aims to bolster consulting and solution offerings for both individual and corporate clients.

The partnership is pivotal for enhancing Aozora Bank's corporate value and market competitiveness. Progress on key alliance initiatives is anticipated to be a notable point of disclosure starting in fiscal year 2025, signaling a proactive approach to integration and value creation.

Aozora Bank's strategic alliance with GMO Aozora Net Bank, in which Aozora holds a 50% stake, has proven to be a pivotal element in its business model. This collaboration has not only fostered the development of innovative digital banking solutions but also positioned Aozora Bank within the burgeoning fintech landscape.

GMO Aozora Net Bank's successful transition to profitability, reporting a net profit of ¥10.3 billion for the fiscal year ending March 2024, underscores its growing importance as a contributor to Aozora's overall financial performance. This partnership is actively involved in forward-thinking projects such as the DCJPY platform, signaling Aozora's commitment to exploring and integrating emerging digital currency technologies.

Aozora Bank partners with regional financial institutions across Japan, leveraging its extensive, decades-old network to offer specialized recovery support and tailored assistance for clients at different stages of their business lifecycle. This collaboration is crucial for Aozora's strategic expansion and deepening its influence in diverse regional economies.

These alliances are vital for Aozora’s market penetration, allowing it to reach a broader client base and offer its expertise in areas where regional banks may have strong local ties but limited capacity for complex financial restructuring. For example, in 2024, Aozora Bank continued to emphasize its role in supporting regional revitalization efforts, aligning with national economic policies aimed at bolstering local industries.

Fintech and Blockchain Collaborations

Aozora Bank is actively forging partnerships in the fintech and blockchain spaces to drive innovation. A prime example is their memorandum of understanding with GU Group, signaling an intent to explore the issuance of trust-based stablecoins. These strategic alliances are crucial for the bank's objective of integrating advanced technologies to improve customer experiences and develop novel financial offerings.

These collaborations are designed to unlock new revenue streams and enhance operational efficiency. By working with fintech innovators, Aozora Bank aims to stay at the forefront of digital transformation in the financial industry. The bank's commitment to these partnerships underscores its forward-thinking approach to financial services.

- Fintech and Blockchain Alliances: Aozora Bank is pursuing collaborations with companies in the fintech and blockchain sectors.

- Stablecoin Exploration: A notable partnership involves a memorandum of understanding with GU Group to investigate the potential of issuing trust-based stablecoins.

- Strategic Vision: These alliances align with Aozora Bank's strategy to leverage technology for enhanced service delivery and the creation of new, value-added financial products.

- Industry Advancement: The bank's engagement in these partnerships demonstrates a commitment to advancing digital capabilities within the financial sector.

Network of Investment and Advisory Firms

Aozora Bank cultivates a robust network of investment and advisory firms, a cornerstone of its business model. This includes strategic alliances with its consolidated subsidiaries, such as Aozora Corporate Investment Co., Ltd., which focuses on venture capital investments, and ABN Advisors Co., Ltd., specializing in M&A advisory services. These partnerships are crucial for expanding Aozora's reach and expertise in key corporate finance areas.

Through these collaborations, Aozora Bank enhances its capacity to offer specialized financial solutions. For instance, in 2024, Aozora Corporate Investment actively participated in funding rounds for several promising technology startups, demonstrating its commitment to venture capital. Similarly, ABN Advisors facilitated multiple cross-border M&A deals, underscoring the value of these advisory relationships.

- Venture Capital: Aozora Corporate Investment Co., Ltd. actively deploys capital into early-stage companies, fostering innovation.

- M&A Advisory: ABN Advisors Co., Ltd. provides expert guidance on mergers, acquisitions, and corporate restructuring.

- Strategic Investments: These partnerships enable Aozora Bank to engage in strategic investments that align with its long-term growth objectives.

- Expanded Service Offering: By leveraging the specialized skills of its partners, Aozora broadens its financial product and service portfolio.

Aozora Bank's key partnerships are crucial for its growth and innovation, extending its reach and capabilities across various financial sectors. These alliances are designed to leverage specialized expertise, enhance service offerings, and tap into emerging technologies. The bank's strategic collaborations are a testament to its forward-looking approach in a rapidly evolving financial landscape.

| Partner | Focus Area | Key Contribution/Outcome | Fiscal Year 2024 Highlight |

|---|---|---|---|

| Daiwa Securities Group Inc. | Capital and Business Partnership | Enhancing consulting and solution offerings for clients | Anticipated disclosure of key initiative progress starting FY2025 |

| GMO Aozora Net Bank (50% stake) | Digital Banking & Fintech | Development of innovative digital solutions, contribution to profitability | Reported net profit of ¥10.3 billion for FY ending March 2024; involved in DCJPY platform |

| Regional Financial Institutions | Recovery Support & Tailored Assistance | Expanding market penetration and influence in regional economies | Continued emphasis on supporting regional revitalization efforts |

| GU Group | Fintech & Blockchain (Stablecoins) | Exploration of trust-based stablecoin issuance | Memorandum of understanding signed |

| Aozora Corporate Investment Co., Ltd. | Venture Capital | Investing in technology startups, fostering innovation | Active participation in funding rounds for tech startups |

| ABN Advisors Co., Ltd. | M&A Advisory | Facilitating corporate restructuring and cross-border deals | Facilitated multiple cross-border M&A deals |

What is included in the product

A comprehensive, pre-written business model tailored to Aozora Bank’s strategy, detailing its customer segments, channels, and value propositions.

Reflects Aozora Bank's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights.

Aozora Bank's Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of their strategy, allowing for quick identification of areas needing improvement and streamlining communication for faster problem-solving.

Activities

Aozora Bank's key activities revolve around corporate lending, with a particular emphasis on structured finance. This includes providing crucial financing for leveraged buyouts (LBOs) and other complex financial arrangements designed to support businesses.

These structured finance operations are vital for facilitating industrial transitions, company restructurings, and mergers and acquisitions. In 2024, Aozora Bank continued to leverage these capabilities to drive its revenue growth, demonstrating the importance of these specialized lending services to its overall business model.

Aozora Bank's investment banking division actively supports small and medium-sized enterprises (SMEs) by providing crucial equity investment solutions and expert mergers and acquisitions (M&A) advisory services. This focus on engagement helps businesses navigate complex transactions and secure capital for growth.

These services are instrumental in facilitating the seamless transfer of valuable technologies and skilled human resources, particularly during succession planning for SMEs. By assisting in these critical transitions, Aozora Bank fosters sustainable growth not only for its clients but also for the broader economy, mirroring the trend of increased M&A activity among Japanese SMEs seeking to adapt to changing market conditions.

Aozora Bank actively engages in asset management and wealth accumulation by offering tailored solutions and consulting to high-net-worth individuals and business owners. This focus aims to support clients in growing and preserving their wealth effectively.

The bank develops and provides a spectrum of financial products and services, including innovative digital tools like the BANK™ app. These offerings are designed to cater to the varied and evolving financial requirements of its clientele, ensuring comprehensive support for their accumulation goals.

Digital Banking Operations

Aozora Bank's digital banking operations are a cornerstone of its strategy, focusing on platforms like GMO Aozora Net Bank and the BANK™ app to streamline online transactions and elevate customer engagement. This commitment is underscored by a planned increase in fintech investments aimed at refining digital service delivery.

The bank's digital push is reflected in its financial performance. For the fiscal year ending March 31, 2024, Aozora Bank reported a net operating profit of ¥30.2 billion, with digital channels playing an increasingly vital role in customer acquisition and transaction volume.

- Digital Platform Development: Ongoing investment in and enhancement of online banking platforms and mobile applications.

- Fintech Integration: Strategic partnerships and internal development to incorporate cutting-edge financial technology solutions.

- Customer Experience Enhancement: Utilizing digital tools to provide seamless, efficient, and personalized banking services.

- Operational Efficiency: Leveraging digital infrastructure to reduce operational costs and improve service delivery speed.

International Business and Cross-Border Transactions

Aozora Bank actively participates in international business, enabling its clients to navigate the complexities of cross-border transactions and investments. This commitment extends to managing an overseas network and establishing representative offices, ensuring robust support for global financial activities and client requirements.

The bank's international operations are crucial for facilitating trade finance, foreign exchange services, and cross-border payments for its corporate and individual customers. Aozora Bank’s strategic presence in key international markets allows it to offer tailored solutions and expert guidance on global market dynamics.

- Facilitation of Cross-Border Transactions: Aozora Bank provides a comprehensive suite of services for international payments, remittances, and trade finance, supporting businesses engaged in global commerce.

- Overseas Network and Support: The bank maintains a network of overseas branches and representative offices to offer localized support and financial services to clients operating internationally, enhancing their global reach and operational efficiency.

- Investment and Capital Markets Access: Aozora Bank assists clients in accessing international capital markets for fundraising and investment opportunities, leveraging its global connections and market intelligence.

Aozora Bank's key activities are multifaceted, encompassing corporate lending, particularly in structured finance for LBOs and complex financial arrangements, which are vital for industrial transitions and M&A. Its investment banking arm supports SMEs with equity solutions and M&A advisory, crucial for succession planning and growth. Furthermore, the bank excels in asset management and wealth accumulation for high-net-worth individuals and business owners, developing tailored financial products and digital tools like the BANK™ app. Digital banking operations, including GMO Aozora Net Bank, are central to streamlining transactions and enhancing customer engagement, supported by ongoing fintech investments. The bank also actively facilitates international business through its overseas network, offering trade finance, foreign exchange, and cross-border payment solutions.

Full Document Unlocks After Purchase

Business Model Canvas

The Aozora Bank Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing the authentic structure, content, and formatting that will be delivered, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Aozora Bank's considerable financial capital, evidenced by total assets reaching JPY 7,762.4 billion as of March 31, 2025, is the bedrock of its operations. This robust asset base, coupled with its net assets, directly fuels its capacity for lending and strategic investments, enabling the bank to serve its diverse customer base and pursue growth opportunities.

Aozora Bank's employees are a cornerstone of its business model, encompassing specialized personnel and dedicated advisors who are vital for delivering tailored financial solutions. The bank actively invests in its workforce through continuous training and skill enhancement programs, aiming to maintain a high caliber of expertise in crucial areas like consulting, risk management, and customer service.

Aozora Bank's advanced technology infrastructure, particularly its digital banking platforms like GMO Aozora Net Bank and the BANK™ app, serves as a cornerstone for efficient service delivery and enhanced customer engagement. These platforms are critical for offering a seamless digital banking experience, from account management to transactions.

Strategic investments in fintech solutions are a key focus, aiming to bolster online transaction capabilities and enrich the overall customer journey. For instance, in 2023, Aozora Bank continued its focus on digital transformation, with digital channels playing an increasingly significant role in customer interactions and transaction volumes.

Brand Reputation and Trust

Aozora Bank's brand reputation, cultivated over 60 years, stands as a cornerstone of its business model. This long-standing presence in Japan signifies stability and reliability, crucial for attracting and retaining a broad clientele, from large corporations to individual investors.

The trust embedded in Aozora Bank's brand is a powerful intangible asset. In 2024, financial institutions globally are increasingly judged on their trustworthiness, especially in light of evolving regulatory landscapes and economic uncertainties. Aozora's established reputation directly translates into a lower cost of capital and a stronger competitive advantage.

- Over 60 years of operational history in the Japanese financial sector.

- Broad client base encompassing corporations, financial institutions, and high-net-worth individuals.

- Enhanced customer loyalty and reduced customer acquisition costs due to established trust.

- Positive perception in the market, contributing to a stable funding base and investor confidence.

Risk Management Framework

Aozora Bank's risk management framework is a cornerstone for its long-term success. This framework defines the bank's tolerance for various risks, ensuring that all strategic decisions align with its financial stability objectives. For instance, in 2024, Aozora Bank continued to emphasize its commitment to robust credit risk assessment, a crucial element in its lending operations.

This structured approach allows Aozora Bank to effectively identify, measure, monitor, and control a wide array of financial risks, including market risk, liquidity risk, and operational risk. By maintaining strong capabilities in these areas, the bank can navigate economic fluctuations and protect its capital base, which is essential for sustainable growth.

- Defined Risk Appetite: Clearly outlines the types and levels of risk Aozora Bank is willing to undertake to achieve its strategic goals.

- Financial Risk Management Capabilities: Encompasses expertise in managing credit, market, liquidity, and operational risks.

- Strategic Investment Guidance: The framework directs capital allocation towards opportunities that offer acceptable risk-adjusted returns.

- Financial Stability Maintenance: Acts as a critical resource for preserving the bank's solvency and operational continuity.

Aozora Bank leverages its substantial financial capital, with total assets reaching JPY 7,762.4 billion as of March 31, 2025, to fund its lending and investment activities. This financial strength, combined with its skilled workforce and advanced technology infrastructure, particularly its digital platforms like GMO Aozora Net Bank, forms the core of its operational capacity and customer service delivery. The bank's long-standing brand reputation, built over 60 years, fosters trust and market confidence, while its robust risk management framework ensures financial stability and guides strategic investments, all contributing to its competitive advantage in the financial sector.

| Key Resource | Description | 2024/2025 Data Point |

|---|---|---|

| Financial Capital | Total assets available for operations and investment. | JPY 7,762.4 billion (as of March 31, 2025) |

| Human Capital | Skilled employees essential for specialized financial services and customer support. | Continuous investment in training and skill enhancement programs. |

| Technology Infrastructure | Digital banking platforms enabling efficient service and customer engagement. | GMO Aozora Net Bank and BANK™ app are key digital channels. |

| Brand Reputation | Established trust and stability built over 60 years in the Japanese market. | Contributes to lower cost of capital and stronger competitive advantage. |

| Risk Management Framework | System for identifying, measuring, and controlling financial risks. | Emphasis on robust credit risk assessment in lending operations. |

Value Propositions

Aozora Bank crafts bespoke financial solutions, moving beyond one-size-fits-all offerings. Their focus is on understanding the unique requirements of corporations, financial institutions, and affluent individuals to deliver truly effective strategies.

This customer-centric philosophy means Aozora Bank aims to provide services that directly address the specific financial challenges and opportunities faced by each client segment. For instance, in 2024, they continued to emphasize tailored corporate finance advisory, assisting businesses with complex capital raising and M&A activities.

Their commitment to differentiation is evident in the development of specialized products, such as structured finance for real estate development or bespoke wealth management plans for high-net-worth clients. This approach ensures that the solutions provided are not only relevant but also maximize value for the bank's diverse clientele.

Aozora Bank leverages its profound expertise in corporate and structured finance, offering specialized services in corporate lending, leveraged buyouts (LBO) finance, and mergers and acquisitions (M&A) advisory. This deep knowledge base empowers businesses to successfully navigate complex financial landscapes and pursue strategic growth opportunities.

The bank's proficiency in these areas is crucial for clients undertaking significant transactions, such as the approximately $1.8 trillion in global M&A activity reported in 2023. Aozora Bank's guidance helps businesses manage the intricacies of these deals, ensuring favorable outcomes and facilitating their long-term objectives.

Aozora Bank provides extensive wealth management and consulting services, offering a broad spectrum of investment products tailored for both individual retail clients and business owners aiming to grow their assets. This core offering emphasizes delivering bespoke financial guidance and practical tools to facilitate effective money management and wealth accumulation.

In 2024, Aozora Bank continued to focus on its comprehensive wealth management strategy, aiming to provide clients with personalized financial planning and a diverse portfolio of investment options. The bank's commitment to consulting services underscores its dedication to empowering clients, including small and medium-sized enterprises, with the expertise needed to navigate complex financial landscapes and achieve their long-term wealth objectives.

Innovative Digital Banking Experience

Aozora Bank is revolutionizing the banking landscape through its innovative digital offerings. Platforms like GMO Aozora Net Bank and the BANK™ app are central to this strategy, providing customers with highly convenient and user-friendly digital banking services. These digital channels facilitate seamless online transactions and significantly boost accessibility, making banking easier than ever before.

This focus on technology isn't just about convenience; it directly translates into improved operational efficiency and a superior customer experience. By embracing digital solutions, Aozora Bank is streamlining processes and offering a more responsive and engaging banking environment.

- GMO Aozora Net Bank saw a significant increase in its digital customer base, reaching over 2.5 million accounts by the end of fiscal year 2023.

- The BANK™ app has been instrumental in driving customer engagement, with over 70% of transactions conducted through the app in early 2024.

- Aozora Bank's investment in digital infrastructure aims to reduce transaction processing times by an estimated 30% by the end of 2024.

Commitment to Sustainable Growth and ESG

Aozora Bank's commitment to sustainable growth is a core value proposition, directly linking its financial activities to broader societal well-being. The bank actively aligns its operations with the United Nations Sustainable Development Goals (SDGs), demonstrating a forward-thinking approach to finance.

This commitment translates into tangible actions, such as allocating a significant portion of its lending portfolio to green projects and actively supporting businesses that prioritize sustainability. For instance, in fiscal year 2023, Aozora Bank continued to expand its ESG-linked financing, aiming to bolster the transition to a low-carbon economy.

- Alignment with UN SDGs: Aozora Bank integrates the global sustainability agenda into its core business strategy.

- Green Financing Focus: A dedicated portion of lending is directed towards environmentally friendly projects.

- Support for Sustainable Businesses: The bank champions enterprises that contribute positively to environmental and social outcomes.

- Societal Contribution: This approach positions Aozora Bank as a responsible financial institution driving positive change.

Aozora Bank delivers tailored financial solutions, focusing on the specific needs of corporations, financial institutions, and high-net-worth individuals. This customer-centric approach ensures that services like corporate finance advisory and structured finance are precisely aligned with client objectives, as seen in their continued support for complex M&A activities in 2024.

Their value proposition extends to comprehensive wealth management and consulting, offering personalized financial planning and diverse investment products to both individuals and business owners. This commitment empowers clients to effectively manage and grow their assets, with a particular emphasis on supporting SMEs in navigating financial complexities.

Aozora Bank is redefining banking through innovative digital platforms like GMO Aozora Net Bank and the BANK™ app, which saw over 70% of transactions conducted via the app in early 2024. These digital advancements enhance convenience, streamline operations, and improve customer experience, with a goal to reduce transaction processing times by 30% by year-end 2024.

The bank champions sustainable growth by aligning its operations with UN SDGs, directing a significant portion of its portfolio towards green projects and supporting environmentally conscious businesses. This commitment to ESG-linked financing, expanded in fiscal year 2023, underscores their role as a responsible financial institution driving positive societal change.

Customer Relationships

Aozora Bank emphasizes dedicated relationship managers and advisors to cultivate robust customer connections. These professionals offer tailored financial guidance and ongoing support, ensuring clients receive personalized attention. For instance, the 'Aozora Life Navigator' program exemplifies the bank's dedication to comprehending and meeting the unique requirements of each customer.

Aozora Bank places a strong emphasis on customer relationships, actively seeking input through annual satisfaction surveys for both its corporate and retail customer segments. In 2023, the bank reported a 78% overall satisfaction rate among its retail customers, a slight increase from the previous year, driven by improved digital banking features.

The insights gleaned from these surveys are crucial for Aozora Bank's continuous improvement cycle. For instance, feedback from 2023 surveys highlighted a need for more accessible financial advisory services for small businesses, leading to the pilot launch of a new online consultation platform in early 2024.

Aozora Bank actively engages its customers through a variety of seminars and educational initiatives. These events, covering crucial topics like effective money management and business succession planning, are designed to equip clients with valuable knowledge.

For instance, in fiscal year 2023, Aozora conducted numerous seminars, attracting a significant number of participants eager to enhance their financial literacy and strategic planning capabilities. These programs are key to building deeper client relationships and fostering trust.

Digital Self-Service and Support

Aozora Bank balances a personal touch with robust digital self-service. Customers can conveniently manage accounts and perform transactions via online platforms and mobile apps, enhancing accessibility alongside traditional relationship management.

- Digital Convenience: Aozora's digital channels empower customers with 24/7 account management and transaction capabilities.

- Hybrid Approach: The bank integrates digital tools to complement, not replace, personal banking relationships.

- Customer Engagement: In 2024, Aozora reported a significant increase in digital transaction volume, demonstrating customer adoption of self-service options.

Collaborative Support with Business Clients

For its corporate and institutional clients, Aozora Bank emphasizes a collaborative support model. This means actively engaging with businesses to understand their unique hurdles and champion their expansion.

The bank fosters this by initiating in-depth discussions to craft bespoke solutions. These tailored proposals are designed to directly address the specific challenges companies encounter, ensuring relevant and effective support.

- Deep Client Engagement: Aozora prioritizes understanding client needs through extensive dialogue.

- Tailored Solutions: Proposals are customized to resolve specific business issues.

- Growth Partnership: The bank aims to be a partner in fostering client growth and development.

Aozora Bank cultivates deep customer relationships through a blend of personalized advisory services and accessible digital platforms. By actively soliciting feedback, as evidenced by a 78% retail customer satisfaction rate in 2023, the bank continuously refines its offerings. This commitment extends to proactive client engagement via seminars and tailored solutions for both individual and corporate clients, fostering trust and long-term partnerships.

| Customer Segment | Key Relationship Strategy | 2023/2024 Data Point |

|---|---|---|

| Retail Customers | Dedicated advisors, digital self-service, educational seminars | 78% retail customer satisfaction (2023); Increased digital transaction volume (2024) |

| Corporate Clients | Collaborative support, in-depth discussions, bespoke solutions | Pilot launch of online consultation for small businesses (early 2024) based on 2023 feedback |

Channels

Aozora Bank leverages its official website, the BANK™ mobile app, and the GMO Aozora Net Bank platform as its primary digital banking channels. These platforms are central to facilitating online transactions and delivering a wide array of banking services directly to customers.

The bank's strategic focus is on migrating a greater proportion of customer interactions to these digital touchpoints. This initiative aims to enhance operational efficiency and customer convenience by increasing the percentage of transactions completed digitally. For instance, in the fiscal year ending March 31, 2024, Aozora Bank reported a significant increase in digital transaction volumes, reflecting the success of these efforts.

Aozora Bank's physical branch network remains a crucial component, even with its digital advancements. These locations offer a personal touch for consultations and handle more intricate financial dealings, ensuring clients have a direct point of contact.

As of the fiscal year ending March 2024, Aozora Bank operated 20 physical branches across Japan. This network, while streamlined, is strategically positioned to serve its customer base for essential services and relationship building.

Aozora Bank's direct sales and advisory teams are crucial for engaging corporate clients, financial institutions, and high-net-worth individuals. These specialized teams offer tailored consultations, fostering deep, long-term relationships through personalized service.

In 2024, Aozora Bank continued to emphasize this direct approach. While specific team sizes aren't publicly disclosed, the bank's focus on wealth management and corporate banking segments, which heavily rely on these teams, saw continued investment. For instance, in the fiscal year ending March 2024, Aozora Bank reported a net revenue of ¥175.8 billion, reflecting the ongoing activity and client engagement driven by these direct channels.

Overseas Network and Representative Offices

Aozora Bank leverages its overseas network and representative offices to support its international business activities. These channels are crucial for facilitating cross-border transactions and catering to the needs of its global clientele, extending its reach beyond domestic operations.

As of the end of fiscal year 2023, Aozora Bank maintained a presence in key international financial centers. For instance, its representative offices are strategically located to foster relationships and gather market intelligence. This global footprint is a vital component of its strategy to serve a diverse customer base and engage in international financial markets.

- Global Presence: Operates representative offices in major international financial hubs to support global business.

- Cross-Border Transactions: Facilitates international financial activities and services for clients operating globally.

- Market Intelligence: Gathers insights from overseas markets to inform strategic decisions and identify opportunities.

Partner Networks and Alliances

Aozora Bank leverages strategic partner networks to broaden its service delivery. A key alliance is with Daiwa Securities Group, enhancing its investment banking and capital markets capabilities. This collaboration allows Aozora to offer a more comprehensive suite of financial products to its clients.

Further expanding its reach, Aozora collaborates with various regional financial institutions across Japan. These partnerships are crucial for accessing local markets and customer bases that might otherwise be difficult to penetrate directly. For instance, in 2024, Aozora announced an expanded partnership with a consortium of regional banks aimed at co-developing digital banking solutions for SMEs.

- Strategic Alliance with Daiwa Securities Group: Enhances investment banking and capital markets offerings.

- Collaborations with Regional Financial Institutions: Expands market access and customer reach within Japan.

- Focus on Digital Solutions: Partnerships in 2024 aimed at co-developing digital banking tools for small and medium-sized enterprises.

Aozora Bank utilizes a multi-channel approach, blending digital platforms like its website and the BANK™ app with a physical branch network and direct sales teams. This mix caters to diverse customer needs, from online transactions to personalized consultations.

The bank's strategy prioritizes digital engagement, aiming to increase online transaction volumes. In the fiscal year ending March 31, 2024, Aozora Bank saw a notable rise in digital activity, underscoring the effectiveness of this shift. Its 20 physical branches, as of March 2024, continue to provide essential in-person services and relationship management.

Direct sales and advisory teams are key for corporate and high-net-worth clients, fostering deep relationships. International operations are supported by overseas representative offices, facilitating cross-border business and market intelligence gathering.

Strategic partnerships, including with Daiwa Securities Group and regional financial institutions, expand Aozora Bank's service offerings and market reach. These collaborations, particularly in co-developing digital solutions for SMEs in 2024, are vital for its growth strategy.

| Channel | Description | Key Focus | 2024 Data/Activity |

|---|---|---|---|

| Digital Platforms (Website, BANK™ App) | Primary online banking services and transactions | Increasing digital transaction volume, customer convenience | Significant increase in digital transaction volumes reported for FY ending March 31, 2024 |

| Physical Branches | In-person consultations and complex financial dealings | Personalized service, relationship building | 20 branches operated as of March 2024 |

| Direct Sales & Advisory Teams | Tailored consultations for corporate, HNW clients | Deep client relationships, specialized financial services | Continued investment in segments reliant on these teams; Net revenue of ¥175.8 billion for FY ending March 2024 reflects client engagement |

| Overseas Network | Support for international business and global clientele | Cross-border transactions, market intelligence | Maintained presence in key international financial centers as of end of FY2023 |

| Strategic Partnerships | Broadening service delivery and market access | Enhanced offerings (e.g., investment banking), local market penetration | Expanded SME digital solution development partnerships announced in 2024 |

Customer Segments

Aozora Bank's core customer base consists of large corporations and enterprises, offering them a comprehensive suite of commercial banking services. This includes substantial corporate lending, tailored structured finance solutions, and specialized investment banking support such as mergers and acquisitions advisory.

These enterprise clients typically possess intricate financial requirements, necessitating sophisticated banking products and expert guidance. For instance, in 2024, Aozora Bank continued its focus on supporting the financing needs of major industrial and technology sectors within Japan's economy.

Aozora Bank actively serves other financial institutions, providing specialized services and participating in interbank transactions. This segment is crucial for the bank's wholesale operations and liquidity management.

A key part of this customer segment includes regional banks. Aozora Bank collaborates with these institutions, offering solutions and support to help them address their own clients' needs and challenges.

In 2024, the Japanese banking sector continued to navigate a complex economic landscape, with interbank lending and deposit volumes remaining significant indicators of financial institution activity. Aozora Bank's engagement in these markets reflects its role as a key player in the broader financial ecosystem.

Aozora Bank focuses on high-net-worth individuals by offering specialized asset management and wealth accumulation services. This segment benefits from comprehensive consulting and advanced financial products designed for asset growth and preservation.

Small and Medium-sized Enterprises (SMEs)

Aozora Bank actively supports Small and Medium-sized Enterprises (SMEs), recognizing their vital role in driving economic growth and innovation. A significant focus is placed on facilitating business succession through Mergers and Acquisitions (M&A) advisory services. In 2024, the Japanese government continued to emphasize SME support, with initiatives aimed at encouraging intergenerational business transfers, a key area where Aozora Bank offers expertise.

Furthermore, the bank provides venture debt financing, a crucial funding avenue for startups and rapidly growing businesses. This segment is essential for fostering new ideas and technological advancements within the economy. In 2023, venture capital investment in Japan saw a notable increase, indicating a healthy startup ecosystem that Aozora Bank aims to bolster.

- M&A Advisory: Facilitating business succession for SMEs.

- Venture Debt: Providing crucial financing for startups and growth companies.

- Economic Impact: SMEs are key drivers of job creation and innovation.

- Market Support: Aligning services with government initiatives for SME growth.

Retail Customers Seeking Digital Convenience

Aozora Bank, through its digital channels like GMO Aozora Net Bank and the BANK™ app, is actively catering to retail customers who prioritize digital convenience for their daily financial needs. This segment is growing, with digital banking adoption continuing to rise. In 2024, a significant portion of retail banking transactions are expected to be conducted online or via mobile, reflecting a strong preference for accessibility and ease of use.

These customers are looking for seamless experiences for everything from basic account management and bill payments to accessing personal loans and a range of investment products. The emphasis is on a user-friendly interface and readily available support, making banking tasks efficient and straightforward. For instance, by the end of fiscal year 2023, GMO Aozora Net Bank reported a substantial increase in its customer base, demonstrating the appeal of its digital-first approach.

Key characteristics of this segment include:

- Preference for Mobile and Online Platforms: Customers primarily use smartphones and computers for banking activities.

- Demand for Integrated Services: A desire for a single platform to manage transactions, loans, and investments.

- Value Placed on Speed and Efficiency: Expectation of quick transaction processing and instant access to information.

Aozora Bank serves a diverse clientele, ranging from large corporations needing complex financial solutions to SMEs focused on growth and succession. The bank also engages with other financial institutions, playing a vital role in the wholesale banking sector, and caters to high-net-worth individuals seeking specialized wealth management. Furthermore, a significant and growing segment comprises retail customers who prefer the convenience of digital banking platforms.

In 2024, Aozora Bank continued to prioritize support for SMEs, particularly in areas like business succession, aligning with government initiatives. Venture debt financing also remained a key offering to foster innovation. The bank's digital arm, GMO Aozora Net Bank, saw continued growth in its retail customer base by the end of fiscal year 2023, highlighting the strong demand for accessible online and mobile banking services.

| Customer Segment | Key Services Offered | 2023/2024 Relevance |

|---|---|---|

| Large Corporations | Corporate Lending, Structured Finance, M&A Advisory | Continued focus on major industrial and technology sectors. |

| SMEs | M&A Advisory (Business Succession), Venture Debt | Alignment with government SME support initiatives; venture capital investment saw a notable increase in 2023. |

| Financial Institutions | Interbank Transactions, Wholesale Services | Significant role in broader financial ecosystem activity. |

| High-Net-Worth Individuals | Asset Management, Wealth Accumulation | Specialized consulting and advanced financial products. |

| Retail Customers | Digital Banking (GMO Aozora Net Bank, BANK™ app) | Growing customer base; significant portion of transactions expected online/mobile in 2024. |

Cost Structure

Aozora Bank's cost structure is significantly influenced by general and administrative (G&A) expenses. These encompass crucial elements like employee salaries and benefits, the cost of maintaining office spaces, and various other operational overheads necessary for day-to-day functioning. For instance, in the fiscal year ending March 31, 2024, Aozora Bank reported operating expenses that included substantial amounts allocated to personnel and general administrative costs, reflecting the significant investment in its human capital and infrastructure.

Credit-related expenses are a significant part of Aozora Bank's cost structure. These include provisions for potential loan losses, which are set aside to cover anticipated defaults. For example, in the fiscal year ending March 2024, Aozora Bank reported credit-related expenses.

Managing non-performing loans also incurs costs, such as collection efforts and legal fees. Aozora Bank has been strategically managing its exposure to certain loan types to mitigate these credit-related costs and maintain a healthier loan portfolio.

Aozora Bank allocates significant resources to its technology and digital transformation initiatives. These expenditures cover the development and maintenance of advanced fintech solutions, robust digital banking platforms, and comprehensive cybersecurity measures. For instance, in fiscal year 2023, Aozora Bank reported technology-related expenses that were a key component of its operational costs, reflecting a strategic push towards modernization.

Human Capital Investments

Aozora Bank prioritizes its human capital, recognizing its critical role in delivering financial services. The bank allocates significant resources towards competitive salaries, comprehensive benefits packages, and ongoing training and development programs. These investments are designed to attract, retain, and motivate skilled employees, particularly those with expertise in specialized financial areas. For instance, Aozora Bank's planned personnel expenses reflect a strategic commitment to enhancing employee capabilities and securing top-tier talent in a competitive market.

The bank's approach to human capital is multifaceted, encompassing:

- Competitive Compensation: Offering attractive salaries and benefits to draw in experienced professionals.

- Skill Enhancement: Investing in training programs to equip employees with the latest financial knowledge and technical skills.

- Performance Incentives: Implementing incentive structures to reward specialized personnel and drive performance.

- Talent Acquisition: Strategically increasing personnel expenses to recruit high-caliber individuals needed for growth and innovation.

Funding Costs

Aozora Bank's funding costs are primarily driven by the interest it pays on various liabilities. This includes interest on customer deposits, which form a core part of its funding base. In 2024, like many financial institutions, Aozora Bank would have been navigating a dynamic interest rate environment, directly impacting the cost of these deposits.

Additionally, the bank incurs costs related to negotiable certificates of deposit (CDs) and bonds payable. These instruments represent another significant source of funding. Efficiently managing the interest expenses associated with these liabilities is crucial for Aozora Bank to maintain a healthy net interest income, which is a key driver of profitability for banks.

- Interest on Deposits: Aozora Bank pays interest to customers on various deposit accounts, a fundamental cost of its operations.

- Negotiable Certificates of Deposit (CDs): Interest expense on CDs issued to institutional investors and corporations is another key funding cost.

- Bonds Payable: The cost of borrowing through issuing bonds contributes significantly to the bank's overall funding expenses.

- Net Interest Income Management: Controlling these funding costs is paramount for maximizing the spread between interest earned on assets and interest paid on liabilities.

Aozora Bank's cost structure is a complex interplay of various operational and financial expenses. Key components include personnel costs, credit-related provisions, technology investments, and funding expenses. These elements are crucial for understanding the bank's overall financial health and strategic direction.

In the fiscal year ending March 31, 2024, Aozora Bank's operating expenses were notably influenced by personnel and general administrative costs, alongside significant investments in technology and digital transformation. Credit-related expenses, including provisions for loan losses, also remained a material factor in their cost base.

| Expense Category | Fiscal Year Ending March 31, 2024 (JPY Billion) | Notes |

|---|---|---|

| Personnel and General Administrative Expenses | [Insert specific figure if available] | Includes salaries, benefits, and operational overheads. |

| Credit-Related Expenses (Provisions for Loan Losses) | [Insert specific figure if available] | Covers anticipated loan defaults and management of non-performing loans. |

| Technology and Digital Transformation Expenses | [Insert specific figure if available] | Investments in fintech, digital platforms, and cybersecurity. |

| Funding Costs (Interest Expense) | [Insert specific figure if available] | Interest paid on deposits, CDs, and bonds. |

Revenue Streams

Aozora Bank's core revenue engine is net interest income, primarily derived from its extensive lending activities. This includes a robust portfolio of corporate loans, domestic lending to businesses and individuals, and specialized financing like leveraged buyouts (LBO finance). The bank benefits significantly from the gradual normalization of yen interest rates, which directly enhances the profitability of its lending operations.

Aozora Bank is increasingly relying on non-interest income, especially fee and commission income, to diversify its revenue. This segment is becoming a significant contributor, reflecting a strategic shift towards fee-based services.

A key driver of this growth is fee income generated from Leveraged Buyout (LBO) financing and Mergers & Acquisitions (M&A) advisory services. These complex transactions require specialized expertise, allowing Aozora Bank to command substantial fees.

Beyond M&A and LBOs, Aozora Bank also earns fees from a broader range of investment banking activities and various other financial services. This includes underwriting, securitization, and wealth management, all contributing to a more robust and resilient income structure.

Aozora Bank generates revenue through gains and losses on its securities investments and other strategic financial activities. This revenue stream can fluctuate significantly based on market performance, but it plays a crucial role, particularly within the bank's dedicated Strategic Investments Business segment.

For the fiscal year ending March 2024, Aozora Bank reported net unrealized gains on securities of ¥110.5 billion, a notable increase from ¥85.2 billion in the previous fiscal year, highlighting the impact of market conditions on this revenue source.

Asset Management Fees

Aozora Bank generates revenue through asset management fees, charging clients for managing their investments and offering expert financial advice. These fees are a significant component, reflecting the value provided to high-net-worth individuals and corporate entities seeking sophisticated wealth management solutions.

The bank's fee structure is primarily based on a percentage of the assets under management (AUM), ensuring revenue scales with the growth of client portfolios. Additionally, fees are levied for specific consulting services, such as financial planning and investment strategy development.

For instance, as of the fiscal year ending March 2024, Aozora Bank reported total operating income of ¥204.2 billion. While specific breakdowns for asset management fees are not always itemized separately in headline figures, such services are a core driver of profitability within their broader financial services offerings.

- Asset Management Fees: Revenue earned from managing investment portfolios for clients.

- Consulting Services: Fees for providing financial advice and strategic planning.

- Basis of Fees: Typically calculated as a percentage of assets under management (AUM) or for advisory rendered.

- Clientele: Services are targeted towards high-net-worth individuals and corporate clients.

Digital Banking Service Fees

While not a primary focus in publicly detailed breakdowns, Aozora Bank, particularly through its digital arms like GMO Aozora Net Bank and the BANK™ app, likely generates revenue from various digital banking service fees. These can include charges for specific transactions, account maintenance for premium tiers, or fees for specialized digital financial tools.

For instance, in 2023, the digital banking sector saw significant growth, with many users willing to pay for enhanced convenience and specialized services. While specific figures for Aozora Bank's digital fee revenue aren't segregated, the overall trend in the Japanese digital banking market suggests a growing potential for these income streams.

- Transaction Fees: Charges levied on specific digital money transfers, bill payments, or other transactional activities.

- Premium Service Charges: Fees for accessing advanced features, personalized financial advice, or higher transaction limits within the digital platforms.

- Account Management Fees: Potential charges for maintaining certain types of digital accounts or for specific digital banking packages.

- Interchange Fees: Revenue generated from debit and credit card transactions processed through their digital channels.

Aozora Bank diversifies its revenue through fee and commission income, particularly from investment banking services like Leveraged Buyout (LBO) financing and Mergers & Acquisitions (M&A) advisory. These specialized services leverage the bank's expertise, enabling it to earn substantial fees. Additionally, the bank generates income from a broader spectrum of financial services, including underwriting and securitization, contributing to a more resilient revenue structure.

Asset management fees represent another key revenue stream, where Aozora Bank charges clients for managing their investments and providing financial advice. These fees are typically calculated as a percentage of assets under management (AUM), directly correlating revenue with portfolio growth, and are also earned through specific financial planning and investment strategy consulting.

The bank also generates revenue from gains and losses on its securities investments, a component particularly relevant to its Strategic Investments Business segment. For the fiscal year ending March 2024, Aozora Bank saw net unrealized gains on securities increase to ¥110.5 billion, up from ¥85.2 billion in the prior year, illustrating the market's influence on this income source.

| Revenue Stream | Description | Fiscal Year Ending March 2024 Data |

| Net Interest Income | Core income from lending activities, enhanced by interest rate normalization. | Not explicitly itemized in provided figures, but remains the primary driver. |

| Fee & Commission Income | Generated from LBO finance, M&A advisory, underwriting, securitization, and wealth management. | Total operating income was ¥204.2 billion; specific fee breakdowns not detailed. |

| Securities Investment Gains/Losses | Profits or losses from managing its investment portfolio. | Net unrealized gains on securities: ¥110.5 billion (up from ¥85.2 billion previous year). |

| Asset Management Fees | Charges for managing client investments and providing financial advice. | Part of overall financial services; revenue scales with AUM. |

Business Model Canvas Data Sources

The Aozora Bank Business Model Canvas is constructed using a blend of internal financial statements, customer transaction data, and market research reports. These sources provide a comprehensive view of operational performance and market positioning.