Aozora Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aozora Bank Bundle

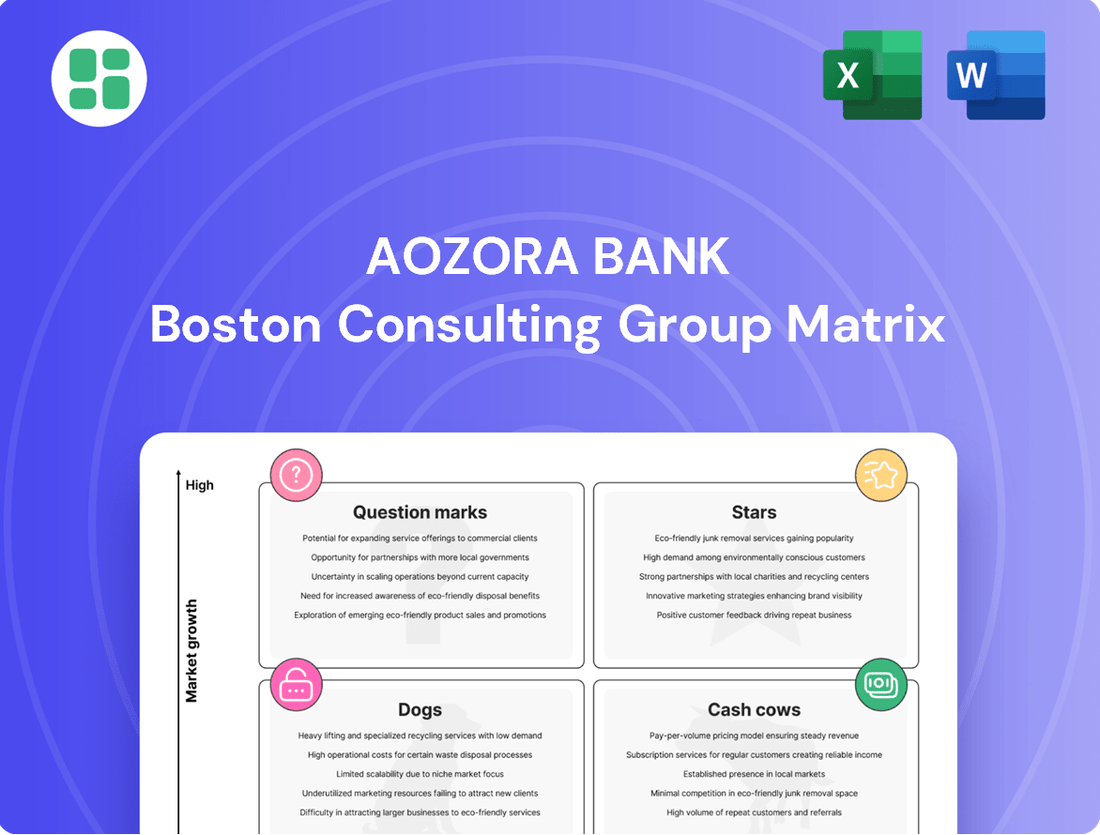

Curious about Aozora Bank's strategic positioning? Our BCG Matrix preview highlights key product areas, but the full report unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Dive deeper into their market share and growth potential.

Don't miss out on the actionable insights that can drive your own strategic decisions. Purchase the complete Aozora Bank BCG Matrix to gain a detailed breakdown of each quadrant, data-driven recommendations, and a clear roadmap for optimizing their product portfolio.

This is your opportunity to gain a competitive edge. Get the full BCG Matrix now and equip yourself with the knowledge to understand Aozora Bank's current market standing and identify future opportunities for growth and investment.

Stars

Aozora Bank's strategic investments business, especially its leveraged buyout (LBO) finance and other structured finance operations, is a key engine for growth. This segment has shown robust performance, contributing to increased non-interest income and expanding domestic earning assets for the bank.

This strategic focus aligns perfectly with the dynamic domestic M&A market, which is experiencing significant activity. For example, Japan's M&A deal volume reached a record high in 2023, with over 4,000 deals reported, indicating a fertile ground for Aozora Bank to further its expansion in this high-potential sector.

Aozora Bank has firmly embedded sustainability into its core strategy, evident in its expanding ESG Support Framework and Positive Impact Finance initiatives. This focus is not just aspirational; it's backed by concrete goals.

By 2025, Aozora Bank is targeting the allocation of 15% of its annual lending portfolio to green projects. This strategic move directly addresses the increasing investor demand for environmentally and socially conscious investments, a market experiencing significant growth.

GMO Aozora Net Bank (GANB) has transitioned into a profitable entity, becoming a significant contributor to Aozora Bank's overall earnings. This shift is a pivotal moment, reinforcing the bank's strategic focus on expanding its digital banking capabilities.

GANB has experienced substantial growth in corporate accounts and deposit balances, demonstrating its increasing traction within the dynamic digital banking and fintech sectors. This expansion underscores Aozora Bank's successful strategy of innovation and market penetration.

Digital Transformation Initiatives

Aozora Bank is making significant strides in its digital transformation, pouring resources into fintech and enhancing its digital banking infrastructure. The bank has set an ambitious goal: to have 50% of all transactions processed online by the close of the current fiscal year.

This focus on digital advancement, which includes upgrading its mobile banking platform and deploying AI-powered chatbots, is a direct response to the growing customer preference for convenient, digital financial interactions. This strategic push is designed to secure a stronger market position amidst intense competition in the digital financial services sector.

- Digital Transaction Target: Aiming for 50% of all transactions to be online by fiscal year-end.

- Key Initiatives: Investment in fintech solutions, mobile banking upgrades, and AI chatbots.

- Market Strategy: Capturing market share in the evolving digital financial landscape.

Niche Corporate Lending (High-Growth Segments)

Aozora Bank's strategic emphasis on niche corporate lending within high-growth sectors positions it as a Star in the BCG Matrix. This focus is particularly evident in areas benefiting from increased M&A activity and evolving corporate governance standards in Japan.

The bank's success is underscored by its revenue growth, driven by a combination of expanded domestic lending and the formation of strategic alliances. These initiatives demonstrate a keen ability to tap into dynamic segments of the corporate finance landscape.

- Revenue Growth: Aozora Bank reported a 5.2% year-on-year increase in net interest income for the fiscal year ended March 31, 2024, reflecting strong performance in its lending operations.

- Strategic Alliances: In 2023, Aozora Bank partnered with a leading fintech firm to enhance its digital lending platform for corporate clients, aiming to capture a larger share of the SME lending market.

- M&A Support: The bank provided significant financing for several mid-market M&A deals in the technology and healthcare sectors throughout 2024, highlighting its role in facilitating corporate expansion.

- Governance Focus: Aozora Bank has actively supported companies undergoing governance reforms, offering tailored financial solutions that contribute to their growth and stability.

Aozora Bank's strategic focus on niche corporate lending within high-growth sectors, particularly those benefiting from increased M&A activity and evolving governance standards, firmly places it in the Star category of the BCG Matrix. This segment is characterized by high growth and high market share, driven by the bank's ability to provide specialized financing solutions.

The bank's revenue growth, fueled by expanded domestic lending and strategic alliances, underscores its success in capturing these dynamic markets. For instance, Aozora Bank reported a 5.2% year-on-year increase in net interest income for the fiscal year ended March 31, 2024, demonstrating strong performance in its lending operations.

Aozora Bank's active participation in facilitating mid-market M&A deals throughout 2024, especially in technology and healthcare, further solidifies its Star status. These activities highlight its crucial role in supporting corporate expansion and its strong position in a growing market.

| Segment | Market Growth | Market Share | Aozora Bank's Position |

|---|---|---|---|

| Niche Corporate Lending (M&A Finance) | High | High | Star |

| Digital Banking (GANB) | High | Growing | Question Mark (potential Star) |

| ESG Support Framework | High | Growing | Question Mark (potential Star) |

What is included in the product

The Aozora Bank BCG Matrix offers a strategic overview of its business units, categorizing them by market share and growth potential.

Aozora Bank's BCG Matrix offers a clear, one-page overview, relieving the pain of complex strategic analysis by placing each business unit in a quadrant.

Cash Cows

Aozora Bank's established corporate loan services are a significant Cash Cow, generating substantial and consistent revenue. This strength stems from its deep-rooted presence and long-standing relationships within the mature Japanese corporate lending market.

These established relationships translate into a reliable stream of net interest income, a hallmark of a successful Cash Cow. The domestic loan market's continued smooth functioning, marked by active bank lending, further solidifies this dependable cash flow for Aozora Bank.

Aozora Bank's asset management for high-net-worth individuals (HNWIs) functions as a cash cow within its business portfolio. This segment benefits from inherently high profit margins and the loyalty of its affluent clientele.

The HNI market, while competitive, offers a stable, recurring revenue stream through fees, reducing the necessity for substantial reinvestment in growth. This mirrors the characteristics of a mature market where established players can consistently extract value.

In 2024, the global wealth management industry saw continued growth, with HNWIs increasingly seeking sophisticated investment strategies. Aozora Bank's established presence in this arena allows it to capitalize on this trend, generating consistent fee-based income.

Aozora Bank's stable deposit base is a significant asset, acting as a low-cost and dependable funding source. This stability is crucial in a mature banking sector, directly contributing to healthy profit margins and robust liquidity. For instance, as of the fiscal year ending March 2024, Aozora Bank reported total deposits of approximately ¥8.07 trillion, showcasing the sheer scale of this foundational element.

Traditional Investment Banking Advisory

Aozora Bank's traditional investment banking advisory services, encompassing corporate finance consulting and M&A advisory, are considered cash cows. These offerings consistently generate stable fee income by capitalizing on the bank's deep-seated expertise and extensive client relationships within a mature yet lucrative financial market segment.

These services are characterized by their predictable revenue streams, reflecting Aozora Bank's established presence and reputation. For instance, in the fiscal year ending March 2024, Japanese M&A deal volume remained robust, with over 3,000 transactions recorded, underscoring the ongoing demand for such advisory services.

- Consistent Fee Income: Traditional advisory services provide a reliable source of revenue for Aozora Bank.

- Leveraging Expertise: The bank's long-standing experience and established client network are key assets.

- Mature Market: Operating in a well-established financial sector ensures predictable demand.

- Profitability: Despite market maturity, these services remain highly profitable.

Securities Investment Portfolio

Aozora Bank's securities investment portfolio, a key component of its financial strategy, functions as a cash cow. This segment, focused on stable, established asset classes, is a significant contributor to the bank's revenue and net interest income.

The portfolio consistently delivers returns with low volatility, acting as a dependable cash flow generator within predictable market conditions. For instance, as of the first quarter of 2024, Aozora Bank reported a substantial portion of its income derived from its investment securities, reflecting the stability of these operations.

- Stable Revenue Generation: The securities portfolio provides a predictable and consistent income stream for Aozora Bank.

- Low Volatility: Investments are typically in well-established asset classes, minimizing risk and ensuring stable returns.

- Net Interest Income Contribution: This segment plays a crucial role in bolstering the bank's overall net interest income.

- Predictable Market Performance: The portfolio thrives in stable market environments, reinforcing its cash cow status.

Aozora Bank's established corporate loan services represent a significant Cash Cow, leveraging its deep roots in the mature Japanese corporate lending market for substantial and consistent revenue. This stability is further reinforced by the reliable net interest income generated from these operations, a direct benefit of the domestic loan market's ongoing smooth functioning and active bank lending, as observed through fiscal year data ending March 2024.

The bank's asset management for high-net-worth individuals (HNWIs) also acts as a cash cow, benefiting from high profit margins and client loyalty. This segment, while competitive, offers a stable, recurring fee-based revenue stream, minimizing the need for extensive reinvestment, a trend that continued into 2024 with global wealth management growth.

Aozora Bank's stable deposit base, totaling approximately ¥8.07 trillion as of the fiscal year ending March 2024, is a low-cost funding source that contributes to healthy profit margins and liquidity. Similarly, its traditional investment banking advisory services, including M&A, consistently generate stable fee income, capitalizing on expertise and client relationships within a lucrative financial market segment, with Japanese M&A deal volume remaining robust in 2024.

The bank's securities investment portfolio also functions as a cash cow, contributing significantly to revenue and net interest income through stable, established asset classes that deliver low volatility returns, as evidenced by its performance in the first quarter of 2024.

| Business Segment | BCG Category | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| Corporate Loans | Cash Cow | Consistent net interest income, deep market relationships | Mature Japanese market, active lending |

| HNWI Asset Management | Cash Cow | High profit margins, recurring fee income, client loyalty | Global wealth management growth in 2024 |

| Stable Deposit Base | Cash Cow | Low-cost funding, robust liquidity, profit margin support | ¥8.07 trillion total deposits (FY ending Mar 2024) |

| Investment Banking Advisory | Cash Cow | Stable fee income, expertise leverage, client relationships | Robust Japanese M&A deal volume in 2024 (>3,000 transactions) |

| Securities Investment Portfolio | Cash Cow | Stable returns, low volatility, net interest income contribution | Substantial income from investments (Q1 2024) |

Delivered as Shown

Aozora Bank BCG Matrix

The Aozora Bank BCG Matrix preview you are currently viewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, detailing Aozora Bank's strategic positioning, is ready for immediate application without any watermarks or sample content. Rest assured, what you see is precisely the professional-grade document that will be delivered to you, enabling swift and informed strategic decision-making.

Dogs

Aozora Bank has publicly stated its past involvement with non-recourse loans for U.S. office properties, a segment that has demonstrably hurt its financial performance. This exposure necessitated a deliberate strategy to decrease its holdings in this area.

The U.S. office real estate market is characterized by sluggish growth, and in many instances, contraction. Within this challenging environment, Aozora Bank's market share is minimal, reflecting its ongoing efforts to exit these positions.

Continuing to maintain these overseas real estate assets would be financially imprudent, as it would lock up valuable capital without generating meaningful, or potentially even positive, returns. As of the end of fiscal year 2023, Aozora Bank reported a significant reduction in its U.S. commercial real estate loan portfolio, though specific figures for the non-recourse office segment were not detailed separately.

Aozora Bank's focus on corporate, institutional, and high-net-worth clients means its undifferentiated retail banking services likely have a minimal market share. These mass-market offerings exist in Japan's fiercely competitive, low-margin retail banking sector, presenting restricted growth potential.

Legacy IT infrastructure at Aozora Bank, while not a traditional product, can be categorized as a 'Dog' in the BCG Matrix. These systems often incur substantial maintenance expenses and limit the bank's ability to adapt quickly to market changes, offering little in terms of market share growth or competitive advantage.

Aozora Bank's strategic focus on digital transformation, including significant investments in upgrading its core banking systems and enhancing digital customer interfaces, directly addresses the challenges posed by its legacy IT. For instance, in the fiscal year ending March 31, 2024, Aozora Bank reported IT-related expenses that reflect the ongoing costs associated with maintaining older systems alongside investments in modernization.

The bank's commitment to shedding these low-return, cash-consuming assets is evident in its ongoing efforts to streamline operations and adopt more agile, cloud-based solutions. This strategic shift aims to reduce the burden of legacy systems and unlock greater efficiency and innovation, thereby improving the bank's overall financial health and market responsiveness.

Underperforming International Branches/Operations

Aozora Bank's underperforming international branches or operations could be classified as Dogs in the BCG Matrix if they consistently fail to generate substantial cross-border transaction volume or attract significant investment opportunities, especially when weighed against their operational expenditures. These segments might represent a drain on resources without contributing meaningfully to the bank's overall growth or market presence.

For instance, if a specific overseas branch in a low-growth market incurs annual operating costs of ¥100 million but facilitates only ¥50 million in cross-border transactions, it would clearly fall into this category. Such units consume capital and management attention that could be better allocated to more promising areas.

- Low Transaction Volume: Branches facilitating minimal cross-border deals, such as a European office handling less than 0.5% of the bank's total international transaction value.

- High Operational Costs Relative to Revenue: Operations where costs exceed revenue by a significant margin, potentially a 2:1 cost-to-revenue ratio or worse.

- Lack of Strategic Importance: Units that do not align with Aozora Bank's core international expansion strategy or offer limited synergy with other business lines.

Outdated Traditional Financial Products

Outdated Traditional Financial Products are those that haven't kept pace with evolving client expectations and digital advancements. These offerings often struggle to attract new customers and see declining usage, marking them as potential Dogs in the BCG Matrix.

These products typically hold a small market share within a market that is either shrinking or showing no growth. For instance, many legacy savings accounts with low interest rates and limited online functionality fall into this category. By 2024, the average interest rate on traditional savings accounts in many developed markets hovered around 0.1% to 0.5%, significantly below inflation and the yields offered by modern digital alternatives.

- Low Market Share: Products with a minimal percentage of the total market.

- Stagnant/Declining Demand: Markets where customer interest and product usage are not growing or are actively decreasing.

- Lack of Digital Integration: Products that do not offer robust online or mobile banking features.

- Uncompetitive Returns: Interest rates or investment yields that are significantly lower than market averages or competitor offerings.

Aozora Bank's U.S. office property loans, characterized by low market share in a contracting sector, are prime examples of Dogs. These assets represent a significant drag on capital, with ongoing efforts to divest them. The bank's legacy IT infrastructure also falls into this category, incurring high maintenance costs and hindering innovation.

Underperforming international branches with minimal transaction volume and high operational costs, such as a European office costing ¥100 million annually but generating only ¥50 million in transactions, are also classified as Dogs. Similarly, outdated traditional financial products with low market share and stagnant demand, like savings accounts offering around 0.1% interest in 2024, fit this profile.

| Category | Description | Example for Aozora Bank | Market Share | Growth Rate |

|---|---|---|---|---|

| Dogs | Low market share, low growth | U.S. Office Property Loans | Minimal | Contracting |

| Dogs | Low market share, low growth | Legacy IT Infrastructure | N/A (Internal) | Stagnant/Declining Utility |

| Dogs | Low market share, low growth | Underperforming Overseas Branches | Low (e.g., <0.5% of total international transactions) | Low/Negative |

| Dogs | Low market share, low growth | Outdated Traditional Products | Low | Stagnant/Declining |

Question Marks

Aozora Bank's strategic focus extends beyond its established GMO Aozora Net Bank, actively pursuing and investing in emerging fintech solutions. These ventures are positioned within a rapidly expanding market, yet Aozora's current market share in these nascent areas remains small. This necessitates substantial investment to capture a leading position, with the potential to fall into the Dogs category if these efforts don't yield significant growth.

Aozora Bank's venture debt fund, a pioneering initiative in Japan, is positioned as a Question Mark within the BCG matrix. This signifies a new venture for the bank, entering a high-growth startup market where its current share is minimal, requiring substantial investment to foster growth and market penetration.

Aozora Bank's expansion into new niche international markets, particularly those in underserved emerging economies, would likely position it as a Question Mark in the BCG Matrix. These markets offer significant growth potential, but also carry inherent risks and require substantial upfront investment to establish a presence and build customer relationships.

For instance, focusing on specialized cross-border payment solutions for rapidly growing African economies, where traditional banking infrastructure may be less developed, represents a prime example of a niche international market. Such ventures demand considerable capital for technology development, regulatory compliance, and local partnership building, mirroring the characteristics of a Question Mark.

Targeted Digital Wealth Management Solutions for Emerging Affluent

Aozora Bank can target the burgeoning Japanese wealth management sector by focusing on digital solutions for the emerging affluent. This demographic, often younger and tech-savvy, is increasingly seeking personalized, accessible financial guidance. While the overall Japanese wealth market saw assets under management reach an estimated ¥1,600 trillion in 2023, capturing a significant share of this younger segment requires innovative digital offerings.

Developing and marketing highly tailored digital wealth management solutions for this emerging affluent group represents a significant growth avenue. For instance, a projected 15% year-over-year growth in digital financial advisory services in Japan by 2025 highlights the market's potential. However, Aozora's current market penetration within this specific demographic, especially when contrasted with established financial institutions and agile fintech competitors, may still be relatively modest.

- High-Growth Opportunity: The Japanese wealth management market is expanding, with a notable shift towards digital platforms, particularly among the emerging affluent.

- Digital Focus: Developing and marketing new, highly tailored digital wealth management solutions specifically for younger, emerging affluent segments presents a high-growth opportunity.

- Market Share Challenge: Aozora's market share in this specific demographic, compared to established players or new fintechs, might still be low, indicating a need for strategic focus.

- Market Data: Japanese wealth management assets under management were estimated at ¥1,600 trillion in 2023, with digital advisory services projected for 15% annual growth through 2025.

Advanced AI/Data Analytics-driven Financial Advisory

Investing in advanced AI and data analytics for financial advisory presents a significant growth opportunity. Aozora Bank can leverage these technologies to offer highly personalized and predictive financial guidance, setting itself apart in the market.

While Aozora has begun integrating AI through chatbots, the next frontier involves developing more sophisticated, data-driven advisory platforms. This evolution is crucial for staying competitive in a rapidly advancing financial landscape.

Currently, Aozora's market share in this advanced AI advisory segment is likely nascent. Capturing this market will necessitate considerable investment in research and development, alongside robust strategies for market adoption and customer engagement.

- Personalized Advice: AI can analyze vast datasets to tailor financial recommendations to individual client needs, risk appetites, and life goals.

- Predictive Analytics: Advanced algorithms can forecast market trends and potential investment outcomes, enabling more proactive and informed decision-making.

- Market Potential: The global AI in financial services market was valued at approximately $10.4 billion in 2023 and is projected to grow significantly, with some estimates reaching over $30 billion by 2028, indicating substantial room for new entrants.

- R&D Investment: To compete, Aozora would need to allocate resources to build or acquire sophisticated AI capabilities, focusing on areas like machine learning for portfolio optimization and natural language processing for client interaction.

Question Marks in Aozora Bank's BCG Matrix represent new ventures with high growth potential but currently low market share. These require significant investment to develop and capture market dominance. Without successful growth, they risk becoming Dogs. For example, Aozora's venture debt fund and expansion into niche international markets are prime examples of such strategic initiatives.

BCG Matrix Data Sources

Our Aozora Bank BCG Matrix leverages financial disclosures, market share data, and economic trend reports to provide strategic insights.