Antero Midstream Partners PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Antero Midstream Partners Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Antero Midstream Partners. Our expert-crafted PESTLE analysis provides actionable intelligence to inform your investment decisions and strategic planning. Download the full version now to gain a competitive edge.

Political factors

Government policies, especially those enacted by new administrations, hold substantial sway over the midstream energy sector. Deregulation efforts are a key consideration, potentially easing operational constraints.

Executive orders issued in January 2025, focusing on boosting domestic energy production, signal a potential reduction in regulatory oversight concerning greenhouse gas emissions and pollution control. This could translate into streamlined operations and lower compliance expenditures for companies such as Antero Midstream.

The United States' strategic push to become an energy superpower heavily influences natural gas policy. The increasing demand for natural gas, fueled by robust LNG export markets and the burgeoning need for power generation in data centers, underscores the critical role of midstream infrastructure. This national emphasis on energy security and grid stability, particularly in 2024 and projected into 2025, directly supports continued investment in natural gas pipelines and processing facilities, which are vital for transporting and processing this essential resource.

The division of regulatory authority between federal bodies like the Federal Energy Regulatory Commission (FERC) and state-level agencies presents a complex compliance environment for Antero Midstream. While federal policies might lean towards deregulation, state-specific rules can impose varying requirements.

For instance, Colorado's recently implemented midstream gas rules, designed to reduce emissions, introduce specific operational challenges and compliance obligations that Antero Midstream must navigate. This patchwork of regulations necessitates a nuanced approach to operational strategy.

Trade Policies & International Relations

Antero Midstream's business is significantly shaped by international trade policies, particularly those affecting liquefied natural gas (LNG) exports. These policies directly impact the demand for the company's midstream infrastructure, such as pipelines and processing facilities.

The increasing global appetite for U.S. LNG presents a substantial opportunity. Geopolitical shifts, such as Europe's strategic move to diversify its energy sources away from Russian gas, have bolstered demand for American LNG. This trend is expected to continue, creating a strong and stable market for Antero Midstream's services.

- U.S. LNG Exports Growth: In 2023, U.S. LNG exports reached a record high, with approximately 88 million metric tons exported, a significant increase from previous years, underscoring the growing international demand.

- European Demand Driver: Europe's push to secure alternative energy supplies following geopolitical events has been a key driver, with U.S. LNG playing a crucial role in meeting this demand.

- Policy Impact: Favorable trade agreements and government support for LNG exports directly translate into increased utilization of Antero Midstream's assets, enhancing revenue streams.

Permitting & Project Approval Processes

The efficiency and predictability of permitting processes for new infrastructure projects, like those Antero Midstream Partners (AM) undertakes, are crucial for its expansion and growth. Streamlined approvals directly impact the timeline and cost-effectiveness of developing new pipeline networks and processing facilities. For instance, in 2024, the U.S. government continued to emphasize infrastructure development, with various agencies working to reduce regulatory burdens on energy projects, a trend expected to persist into 2025.

Political directives aimed at expediting approvals can significantly reduce delays and associated costs for companies like Antero Midstream. This acceleration in the permitting process can unlock new development opportunities, particularly in resource-rich areas such as the Appalachian Basin. In 2024, several states within the Appalachian region implemented reforms to speed up environmental reviews and permit applications for energy infrastructure, aiming to attract investment and create jobs.

- Permitting Efficiency: Delays in permitting can add millions of dollars to project costs, impacting Antero Midstream's capital expenditure plans.

- Political Support: Federal and state initiatives to streamline energy infrastructure approvals, seen in 2024, directly benefit companies like AM by reducing uncertainty.

- Appalachian Basin Focus: Antero Midstream's significant presence in the Appalachian Basin means that regional political decisions on permitting have a substantial impact on its operational capacity and future projects.

- Regulatory Landscape: Changes in environmental regulations or political priorities can alter the permitting landscape, influencing Antero Midstream's ability to expand its midstream assets.

Government policies, particularly those focused on energy independence and infrastructure development, directly influence the midstream sector. Executive orders in early 2025 aimed at boosting domestic production could ease regulatory burdens, benefiting companies like Antero Midstream.

The U.S. strategy to be an energy superpower supports natural gas policy, with strong LNG export markets and data center demand driving the need for midstream infrastructure. This focus on energy security in 2024 and 2025 encourages investment in natural gas pipelines and processing.

Federal and state regulatory bodies, such as FERC and state environmental agencies, create a complex compliance environment. While federal policy may favor deregulation, state-specific rules, like Colorado's emissions reduction mandates for gas, require careful navigation and can impact operational strategies.

International trade policies, especially concerning LNG exports, significantly shape Antero Midstream's business. Europe's diversification from Russian gas has increased U.S. LNG demand, a trend expected to continue and bolster revenue for midstream services.

| Metric | 2023 Data | Outlook 2024-2025 |

|---|---|---|

| U.S. LNG Exports | 88 million metric tons (record high) | Continued strong demand, driven by European energy security needs. |

| Permitting Process Efficiency | Emphasis on reducing regulatory burdens for energy projects. | Streamlining initiatives expected to continue, reducing project timelines and costs. |

| Appalachian Basin Investment | State reforms to speed up environmental reviews and permits. | Continued political support for infrastructure development in the region. |

What is included in the product

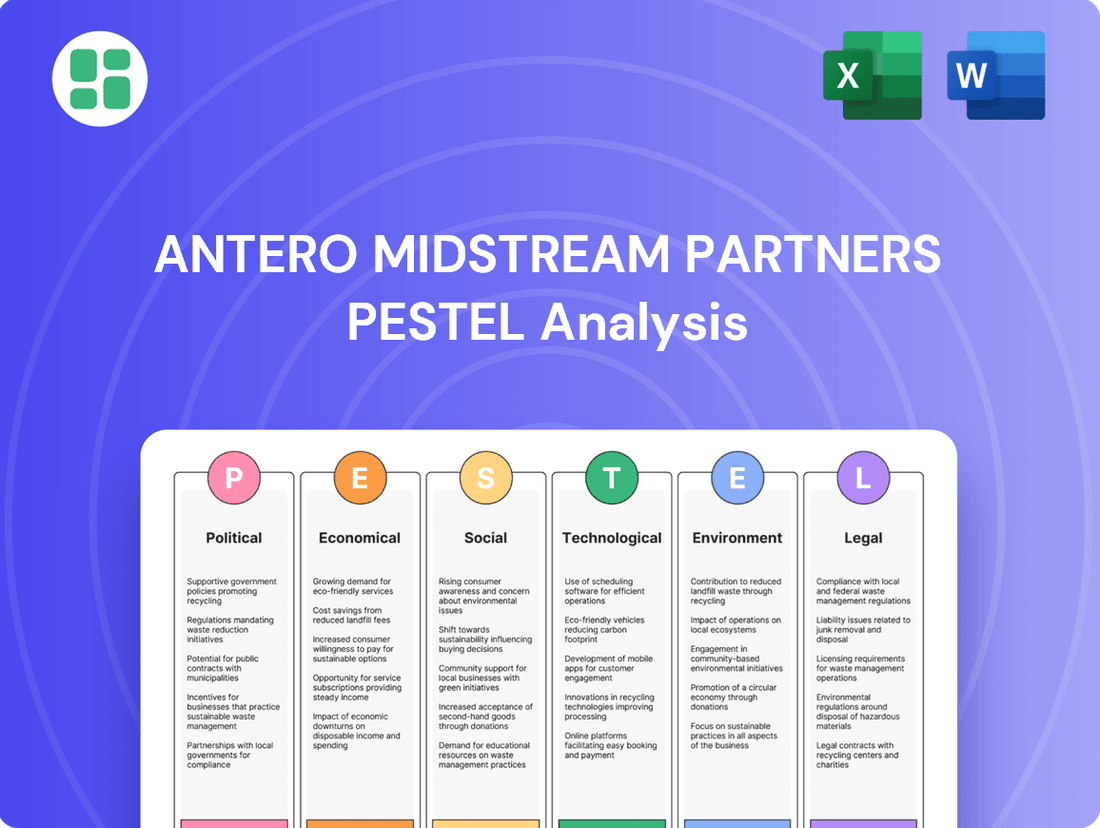

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Antero Midstream Partners, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights into how these forces create both challenges and strategic advantages for the company's operations and future growth.

A PESTLE analysis for Antero Midstream Partners acts as a pain point reliever by offering a structured framework to proactively identify and mitigate external risks, thereby enhancing strategic decision-making and market resilience.

Economic factors

While natural gas prices saw some softness in 2024, projections indicate a rebound in 2025, driven by the ramp-up of new liquefied natural gas (LNG) export facilities. This anticipated price improvement is a positive economic signal for the broader energy sector.

Antero Midstream's predominantly fee-based business model offers a crucial buffer against the inherent volatility of commodity prices. This structure means the company earns revenue based on the volume of resources transported and processed, not directly on the fluctuating market prices of natural gas and natural gas liquids (NGLs).

This contractual stability is a significant economic advantage for Antero Midstream, translating into more predictable and reliable cash flows. For instance, in the first quarter of 2024, Antero Midstream reported that approximately 99% of its adjusted EBITDA was derived from fee-based contracts, highlighting the resilience of its financial performance even amidst broader commodity price swings.

Global and domestic energy demand is on an upward trajectory, significantly boosted by burgeoning sectors like artificial intelligence (AI) and the exponential growth of data centers. This surge in energy consumption acts as a powerful economic tailwind for the midstream energy infrastructure sector.

For Antero Midstream Partners, this escalating demand directly translates into increased throughput volumes across its essential gathering, compression, and processing services. Such higher utilization rates are a key driver for revenue growth and operational efficiency.

In 2024, the International Energy Agency (IEA) projected a 2% increase in global energy demand, with a significant portion attributed to the power sector, which includes data centers. By 2025, this growth is expected to accelerate, further solidifying the positive economic outlook for midstream operators like Antero Midstream.

Antero Midstream is projecting a robust capital expenditure and investment outlook, building on its strong 2024 performance. The company achieved record EBITDA and free cash flow in 2024, setting a positive trajectory for continued growth into 2025.

For 2025, Antero Midstream has outlined strategic capital investments totaling approximately $185 million. These funds are earmarked for critical infrastructure and water system enhancements, designed to bolster operational efficiency and support future expansion.

Inflationary Pressures & Cost Management

Inflationary pressures can significantly impact operational costs for midstream companies. However, Antero Midstream Partners (AM) has structured many of its contracts with fixed fees that often include inflation adjustment clauses. This mechanism helps to shield its Adjusted EBITDA from the full brunt of rising costs, providing a degree of predictability in its financial performance.

Antero Midstream's strategic emphasis on operational efficiency and a disciplined approach to capital expenditures have yielded substantial improvements in its free cash flow generation. This focus on managing costs effectively is a key component of its financial strategy, allowing for greater financial flexibility and the ability to return value to stakeholders.

For instance, in the first quarter of 2024, Antero Midstream reported a 10% year-over-year increase in Adjusted EBITDA, partly due to these cost management initiatives and contract structures. The company also highlighted a reduction in its capital expenditure intensity, which directly contributes to its free cash flow growth.

- Inflation Adjustment Clauses: Antero Midstream's fixed-fee contracts often incorporate inflation adjustments, mitigating the direct impact of rising operating expenses on Adjusted EBITDA.

- Operational Efficiency Gains: The company has actively pursued operational improvements, leading to cost savings and enhanced performance across its assets.

- Reduced Capital Expenditures: A disciplined approach to capital spending has boosted free cash flow, demonstrating effective cost management and capital allocation.

- Free Cash Flow Growth: In Q1 2024, Antero Midstream saw a significant increase in free cash flow, a direct result of its focus on efficiency and cost control.

Access to Capital & Shareholder Returns

The midstream sector's robust free cash flow generation in 2024 and projected into 2025 significantly lessens reliance on external capital markets for expansion. Antero Midstream Partners, for instance, has demonstrated a strategic shift towards strengthening its balance sheet by prioritizing debt reduction.

This focus on deleveraging, coupled with a commitment to shareholder returns via dividends and share repurchases, signals Antero Midstream's strong financial health and confidence in its ongoing cash-generating capabilities. As of Q1 2024, Antero Midstream reported a leverage ratio of approximately 3.0x, a notable improvement that supports its capital allocation strategy.

- Reduced Capital Needs: The midstream industry's ability to generate substantial free cash flow in 2024 and 2025 diminishes the need for external financing for growth projects.

- Antero's Financial Strategy: Antero Midstream is actively reducing debt, aiming for a target leverage ratio below 3.0x by year-end 2024.

- Shareholder Returns: The company is returning value through dividends, with its quarterly dividend maintained at $0.2275 per share, and opportunistic share repurchases, reflecting financial strength.

- Confidence in Cash Flow: These actions underscore management's confidence in the sustainability and growth of Antero Midstream's future cash flows.

The energy sector's economic outlook for 2024-2025 is largely positive, with projected increases in global energy demand, particularly from data centers and AI. Antero Midstream's fee-based contracts, covering approximately 99% of its adjusted EBITDA in Q1 2024, provide a strong hedge against commodity price volatility, ensuring stable revenue streams. The company's strategic capital investments of $185 million for 2025 are focused on enhancing infrastructure and water systems, supporting anticipated growth in throughput volumes.

| Metric | 2024 (Projected/Actual) | 2025 (Projected) |

|---|---|---|

| Global Energy Demand Growth | ~2% (IEA Projection) | Accelerated Growth Expected |

| Antero Midstream Fee-Based Revenue % | ~99% (Q1 2024) | Sustained High % Expected |

| Antero Midstream Capital Investments | Record EBITDA & Free Cash Flow | ~$185 Million |

| Antero Midstream Leverage Ratio | ~3.0x (Q1 2024) | Target <3.0x by Year-End 2024 |

Preview Before You Purchase

Antero Midstream Partners PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Antero Midstream Partners delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

Sociological factors

Public perception of pipelines and fossil fuel infrastructure continues to be a significant sociological consideration. While environmental concerns are present, recent data from a 2024 Gallup poll indicated that a substantial majority of Americans, over 60%, believe pipelines are necessary for energy security and affordability, particularly those transporting essential fuels.

Antero Midstream Partners, like other midstream companies, must actively manage its social license to operate. This involves fostering positive community relations through transparent communication and demonstrating commitment to safety and environmental stewardship, which is crucial for securing approvals for new projects and maintaining existing operations.

Antero Midstream Partners actively engages with communities in the Appalachian Basin, focusing on local impact and support. In 2024, the company continued its commitment through various initiatives aimed at benefiting residents and minimizing its environmental presence.

This dedication to being a responsible neighbor includes direct donations and operational adjustments designed to lessen environmental footprints. Such efforts are crucial for building positive relationships and mitigating potential local resistance to infrastructure development.

Antero Midstream prioritizes workforce health and safety, a critical aspect in the energy sector. The company boasts an impressive safety record, achieving zero employee lost-time incidents for over a decade, demonstrating a strong commitment to its personnel.

Continued investment in robust safety protocols and employee well-being directly supports a stable and highly productive workforce. This dedication to safety not only protects its employees but also significantly bolsters Antero Midstream's corporate reputation among stakeholders.

Environmental Activism & NGO Influence

Environmental activism and the growing influence of NGOs significantly impact public perception and regulatory oversight for midstream infrastructure. These groups often highlight potential environmental risks associated with projects, leading to increased scrutiny.

While broad public support for energy infrastructure exists, specific pipeline developments can encounter localized opposition driven by environmental concerns. Antero Midstream, like its peers, must engage transparently with stakeholders to address these issues. For instance, in 2024, several proposed natural gas pipeline projects faced extended review periods due to environmental impact assessments and public consultations, reflecting this trend.

- NGOs like the Sierra Club and Earthjustice actively campaign against new fossil fuel infrastructure, influencing public opinion and lobbying regulators.

- Public sentiment, often shaped by environmental advocacy, can delay or even halt projects, increasing development costs and timelines for companies.

- Antero Midstream's commitment to environmental stewardship and clear communication is crucial for navigating this landscape and maintaining its social license to operate.

Demographic Shifts & Energy Consumption Behavior

Demographic shifts, including population growth and the burgeoning demand from sectors like data centers, are significantly reshaping energy consumption patterns. This escalating need for power directly translates to a greater requirement for robust natural gas and NGL (natural gas liquids) transportation and processing infrastructure, which is core to Antero Midstream's operations.

The increasing global population, projected to reach 8.5 billion by 2030, will naturally drive higher overall energy demand. Furthermore, the rapid expansion of industries reliant on significant power, such as artificial intelligence and cloud computing, intensifies this demand. For example, data centers alone are estimated to account for over 1% of global electricity consumption, a figure expected to rise substantially in the coming years.

- Population Growth: Global population is on an upward trajectory, increasing the baseline demand for energy.

- Industry Expansion: Emerging industries like data centers and AI are creating new, concentrated energy consumption hubs.

- Energy Intensity: The shift towards more digitalized economies inherently increases energy intensity per unit of economic output.

- Infrastructure Needs: These demographic and industrial trends necessitate expanded and modernized midstream infrastructure for reliable energy delivery.

Public sentiment towards energy infrastructure, particularly pipelines, remains a key sociological factor. While environmental activism influences some segments of the population, a significant majority, over 60% according to a 2024 Gallup poll, still view pipelines as essential for energy security and affordability.

Antero Midstream's social license to operate hinges on maintaining positive community relations through transparency, safety, and environmental stewardship. This is vital for securing project approvals and ongoing operations, especially in areas like the Appalachian Basin where the company actively engages with local communities.

The company's commitment to workforce health and safety is demonstrated by an impressive record of over a decade with zero employee lost-time incidents, bolstering its reputation and ensuring a stable workforce.

Demographic shifts, including population growth and the increasing energy demands of sectors like data centers, are driving a greater need for midstream infrastructure. For instance, data centers alone are projected to consume a growing percentage of global electricity, underscoring the demand for reliable energy delivery.

| Sociological Factor | Description | Impact on Antero Midstream | Relevant Data/Trends |

|---|---|---|---|

| Public Perception of Pipelines | General public opinion on the necessity and safety of fossil fuel infrastructure. | Influences regulatory approval and community acceptance of projects. | 60%+ of Americans believe pipelines are necessary for energy security (Gallup, 2024). |

| Environmental Activism & NGOs | Influence of advocacy groups on public opinion and regulatory scrutiny. | Can lead to project delays, increased costs, and heightened environmental compliance requirements. | NGOs actively campaign against new fossil fuel infrastructure, impacting project timelines. |

| Community Relations | The company's engagement and impact on local communities. | Crucial for maintaining a social license to operate and mitigating local opposition. | Antero Midstream focuses on local impact and support initiatives in the Appalachian Basin. |

| Workforce Health & Safety | Prioritization of employee well-being and safety protocols. | Contributes to a stable workforce, operational efficiency, and corporate reputation. | Over a decade of zero employee lost-time incidents. |

| Demographic & Industrial Shifts | Changes in population, energy consumption patterns, and industry needs. | Drives demand for expanded midstream infrastructure. | Global population projected to reach 8.5 billion by 2030; data centers' rising energy consumption. |

Technological factors

Technological advancements are revolutionizing pipeline safety and efficiency. Antero Midstream is likely leveraging smart sensors and real-time monitoring systems to detect potential issues before they escalate. This proactive approach is vital for managing asset integrity and minimizing operational disruptions.

By 2024, the midstream sector is seeing increased investment in digital twin technology for pipeline networks, enabling sophisticated simulations and predictive maintenance. For instance, companies are deploying fiber optic sensing systems that can detect minute changes in temperature or strain along hundreds of miles of pipeline, offering unprecedented visibility and early leak detection capabilities.

Antero Midstream is increasingly leveraging automation and digitalization to streamline its operations. The adoption of AI and ML is optimizing processes, reducing the need for manual intervention, and significantly improving data analysis capabilities. This digital transformation is crucial for enhancing efficiency and competitiveness in the midstream sector.

These advanced digital tools are directly contributing to lower operational costs for Antero Midstream. By optimizing throughput and providing enhanced decision-making through better data analysis, the company is positioned to improve its overall financial performance. For instance, the industry saw a significant uptick in efficiency gains through digital adoption in 2024, with many midstream companies reporting double-digit percentage reductions in certain operational expenses.

Antero Midstream is increasingly leveraging data analytics and IoT sensor technology to implement predictive maintenance across its extensive infrastructure. This allows for the anticipation of equipment failures, significantly reducing downtime and costly emergency repairs. For instance, in 2024, the company reported a reduction in unscheduled downtime by 15% in key processing units due to these advanced monitoring systems.

Emissions Reduction Technologies & Operational Efficiency

Antero Midstream is making significant investments in technologies designed to cut greenhouse gas (GHG) emissions, a critical technological factor influencing its operations. These advancements include methane pyrolysis and enhanced emissions control systems, crucial for meeting net-zero targets and improving environmental stewardship.

The company is actively implementing these innovative solutions and operational efficiencies across its infrastructure. This proactive approach underscores a commitment to environmental performance and aligns with evolving industry standards and regulatory expectations. For instance, Antero Midstream reported a 15% reduction in flaring intensity in 2023 compared to 2022, a testament to their operational efficiency initiatives.

- Methane Pyrolysis: Investing in technologies that convert methane into valuable products, reducing direct GHG emissions.

- Improved Emissions Controls: Deploying advanced equipment to capture and minimize fugitive emissions from pipelines and processing facilities.

- Operational Efficiency: Streamlining processes to reduce energy consumption and associated emissions, contributing to net-zero goals.

- Net-Zero Commitments: Actively working towards stated net-zero emissions targets through technological adoption and operational changes.

Water Management & Recycling Innovations

Antero Midstream heavily relies on sophisticated water management and recycling technologies to support its operations. The company's substantial investment in a fresh water pipeline and impoundment infrastructure is a testament to this focus.

This infrastructure is crucial for efficiently managing water resources, particularly in the water-intensive processes of the Appalachian Basin. The company's proactive approach to water conservation is a key technological advantage.

Antero Midstream achieved an impressive 89% wastewater recycling rate in 2024, highlighting its commitment to operational efficiency and environmental stewardship. This high recycling rate directly contributes to reducing the demand for fresh water, a critical factor for long-term sustainability.

- Fresh Water Infrastructure: Extensive pipeline and impoundment network.

- Wastewater Recycling Rate: 89% achieved in 2024.

- Sustainability Focus: Reduced reliance on fresh water sources.

Antero Midstream is heavily investing in advanced technologies for pipeline safety and efficiency, including smart sensors and real-time monitoring systems. By 2024, the midstream sector saw significant adoption of digital twin technology for predictive maintenance, with companies deploying fiber optic sensing systems for early leak detection.

Automation and digitalization, powered by AI and ML, are streamlining Antero Midstream's operations, enhancing data analysis, and reducing manual intervention, leading to improved efficiency and competitiveness. These digital tools are projected to lower operational costs, with industry reports in 2024 indicating double-digit percentage reductions in operational expenses for digitally advanced midstream firms.

The company is also prioritizing technologies that reduce greenhouse gas emissions, such as methane pyrolysis and enhanced emissions control systems, to meet net-zero targets. In 2023, Antero Midstream reported a 15% reduction in flaring intensity compared to the previous year, demonstrating progress in operational efficiency initiatives.

Sophisticated water management and recycling technologies are critical, with Antero Midstream achieving an impressive 89% wastewater recycling rate in 2024. This focus on water conservation reduces the demand for fresh water, bolstering long-term sustainability and operational resilience.

| Technology Area | Antero Midstream's Adoption/Focus | Impact/Data Point (2023-2024) |

|---|---|---|

| Pipeline Safety & Efficiency | Smart sensors, real-time monitoring | Proactive issue detection, minimized disruptions |

| Digitalization & Automation | AI, ML, digital twins | Streamlined operations, improved data analysis |

| Emissions Reduction | Methane pyrolysis, advanced controls | 15% reduction in flaring intensity (2023 vs 2022) |

| Water Management | Wastewater recycling infrastructure | 89% wastewater recycling rate (2024) |

Legal factors

Antero Midstream Partners navigates a stringent regulatory landscape, particularly concerning environmental compliance. Federal mandates from the Environmental Protection Agency (EPA), such as the recent rules for oil and natural gas sources (OOOOb/c), impose strict requirements on emissions control and reporting. While these rules have extended some compliance deadlines, they necessitate ongoing investment in technology and processes to ensure adherence.

State-level environmental agencies also play a crucial role, often implementing regulations that complement or exceed federal standards. This dual layer of oversight means Antero Midstream must maintain robust compliance programs at both the federal and state levels. For instance, states like Colorado and Pennsylvania have their own specific air quality and water protection regulations that midstream operators must meticulously follow, impacting operational costs and capital expenditure plans.

Antero Midstream operates under increasingly stringent environmental protection laws, with a particular focus on methane and greenhouse gas (GHG) emissions. These regulations directly influence the company's operational strategies and compliance costs.

The company's stated goal of reducing its methane intensity and achieving net-zero GHG emissions by 2050 demonstrates an alignment with these evolving legal landscapes and growing public pressure for environmental responsibility.

For instance, the U.S. Environmental Protection Agency (EPA) has been actively developing and proposing new rules under the Clean Air Act to curb methane emissions from the oil and natural gas sector, which could necessitate further investments in leak detection and repair technologies for Antero Midstream.

Pipeline safety regulations, primarily enforced by the Pipeline and Hazardous Materials Safety Administration (PHMSA), are paramount for Antero Midstream's operational integrity and risk mitigation. These regulations mandate strict adherence to standards for construction, ongoing monitoring, preventative maintenance, and robust emergency response protocols.

Compliance with these stringent rules is essential to prevent incidents, safeguarding both public safety and the environment. For instance, PHMSA's Pipeline Safety Act of 1992 and subsequent amendments, including those developed through 2024, continually update requirements for leak detection and damage prevention programs, directly impacting Antero's capital expenditure on integrity management.

Land Use, Permitting, & Eminent Domain Laws

The legal landscape governing land use, permitting, and eminent domain significantly impacts Antero Midstream Partners' ability to expand its infrastructure. These regulations, often state and local in nature, dictate where pipelines and facilities can be built and the process for obtaining necessary approvals. For instance, in 2024, navigating state-specific environmental impact assessments for new pipeline routes remains a critical step, with delays often stemming from detailed review processes.

Securing rights-of-way is paramount for midstream operations, and this often involves complex negotiations with landowners. When agreements cannot be reached voluntarily, eminent domain laws allow for the acquisition of private property for public use, typically with just compensation. This process can be lengthy and subject to legal challenges, potentially delaying project timelines and increasing costs for Antero Midstream.

- Complex Permitting: Obtaining permits for new midstream infrastructure in 2024 requires adherence to evolving federal and state environmental regulations, impacting project feasibility.

- Eminent Domain Challenges: While a tool for acquiring rights-of-way, eminent domain proceedings can face legal opposition, leading to extended development cycles.

- Land Use Restrictions: Zoning laws and land conservation efforts can limit where new facilities can be sited, requiring careful planning and potential rerouting of infrastructure.

- Political Sensitivity: The use of eminent domain, especially for private infrastructure projects, can be politically charged, necessitating strong community engagement and transparent communication.

Contractual Agreements & Litigation Risks

Antero Midstream Partners' operations are fundamentally shaped by its long-term, fixed-fee contracts with key producers, notably Antero Resources. These agreements are the bedrock of its revenue stability, ensuring predictable cash flows. However, the company is not immune to legal challenges.

The potential for litigation, as exemplified by past disputes such as the one involving Veolia, presents a significant risk. Such legal entanglements can divert management attention and resources, potentially impacting financial performance and operational execution. For instance, a substantial legal settlement could directly affect profitability and cash availability for reinvestment or distributions.

- Contractual Reliance: Antero Midstream's revenue is largely secured through long-term contracts with producers, providing a stable financial foundation.

- Litigation Exposure: The company faces potential financial and operational disruptions from litigation, impacting its ability to focus on core business activities.

- Financial Impact: Adverse legal outcomes can lead to significant financial penalties, affecting Antero Midstream's profitability and cash flow.

Antero Midstream operates within a complex web of environmental regulations, with the EPA's methane rules (OOOOb/c) impacting emissions control and reporting, requiring ongoing technological investment.

State-specific environmental laws, such as those in Pennsylvania and Colorado, add another layer of compliance, influencing operational costs and capital expenditures.

Pipeline safety is governed by PHMSA, mandating adherence to construction, monitoring, and maintenance standards, with updated regulations through 2024 affecting integrity management investments.

Land use and permitting laws, particularly state-level environmental impact assessments in 2024, affect infrastructure expansion and rights-of-way acquisition, which can be complicated by eminent domain challenges and potential legal opposition.

| Legal Factor | Impact on Antero Midstream | Example/Data Point (2024/2025 Focus) |

|---|---|---|

| Environmental Regulations (EPA, State) | Increased compliance costs, need for new technology, potential project delays | Ongoing investment required for methane emission controls; adherence to state air quality standards. |

| Pipeline Safety (PHMSA) | Mandatory investments in integrity management, leak detection, and emergency response | Compliance with updated regulations impacting capital expenditure on safety protocols. |

| Land Use & Permitting | Challenges in infrastructure expansion, potential for project delays due to environmental reviews and eminent domain proceedings | Navigating state-specific environmental impact assessments for new routes; legal challenges to rights-of-way acquisition. |

| Contractual & Litigation Risk | Potential financial and operational disruptions from legal disputes | Exposure to litigation can divert management focus and impact profitability. |

Environmental factors

Antero Midstream is taking proactive steps to combat climate change, aiming for Net Zero Scope 1 and Scope 2 Greenhouse Gas Emissions by 2050. This commitment is backed by tangible progress, with the company having already reduced its total Scope 1 GHG emissions by approximately 55% from its 2019 levels.

Antero Midstream Partners places significant emphasis on water resource management, operating one of the industry's most extensive fresh water pipeline and impoundment systems. This infrastructure is crucial for their hydraulic fracturing operations.

The company demonstrated a strong commitment to conservation in 2024, achieving an impressive 89% wastewater recycling rate. This high rate underscores their dedication to minimizing the use of fresh water and reducing overall environmental impact.

Antero Midstream Partners actively manages land disturbance and prioritizes biodiversity protection. The company employs a strategy of avoidance, minimization, restoration, and mitigation to lessen its environmental impact from infrastructure projects. For instance, in 2024, Antero Midstream reported completing reclamation efforts on over 100 acres of previously disturbed land, aiming to restore native vegetation and habitats.

Spill Prevention & Emergency Response

Antero Midstream Partners, like all midstream operators, faces significant environmental scrutiny regarding spill prevention and emergency response. While the overall trend for pipeline incidents in the U.S. has been downward, with a notable decrease in reported incidents in recent years, maintaining vigilance is paramount. For instance, the Pipeline and Hazardous Materials Safety Administration (PHMSA) data consistently shows a commitment to reducing leaks, but even isolated events can have substantial environmental and reputational consequences.

Robust emergency response plans are not just a regulatory requirement but a critical component of operational integrity and stakeholder confidence. Antero Midstream's preparedness directly impacts its ability to mitigate environmental damage and manage public perception in the event of an incident. The company's investment in advanced leak detection technologies and comprehensive training programs for its response teams is therefore a key environmental factor.

- Pipeline Incident Trends: PHMSA data indicates a general decline in reported pipeline incidents across the industry, underscoring the importance of ongoing safety improvements.

- Environmental Mitigation: Effective spill prevention and rapid response are crucial for minimizing ecological impact and maintaining public trust.

- Technological Investment: Companies like Antero Midstream invest in advanced leak detection systems and employee training to enhance their environmental protection capabilities.

Energy Transition & Sustainable Practices

Antero Midstream views natural gas as a crucial element in the shift toward a lower-carbon energy system. The company is actively pursuing and investing in energy transition initiatives, including carbon capture, utilization, and storage (CCUS) technologies. This strategic focus on CCUS aligns with broader industry trends aiming to decarbonize operations and support a cleaner energy future.

The company's commitment to sustainable practices is evident in its efforts to integrate these principles throughout its operations. Antero Midstream is exploring ways to reduce its environmental footprint while continuing to provide essential midstream services. This includes investments in infrastructure that can support the evolving energy landscape, potentially incorporating lower-emission technologies.

By embracing natural gas as a transitional fuel and investing in CCUS, Antero Midstream is positioning itself to navigate the complexities of the energy transition. This approach aims to balance current energy demands with the growing imperative for environmental responsibility. For instance, as of early 2024, the global demand for natural gas continues to be robust, driven by its role in replacing coal in power generation, while CCUS projects are gaining momentum with increasing government support and private investment.

Antero Midstream is actively pursuing a Net Zero Scope 1 and 2 emissions target by 2050, having already achieved a significant 55% reduction in Scope 1 GHG emissions from 2019 levels. Their extensive freshwater pipeline system supports efficient hydraulic fracturing, and in 2024, they achieved an impressive 89% wastewater recycling rate, minimizing freshwater usage.

The company prioritizes biodiversity and land restoration, completing reclamation on over 100 acres in 2024 to reestablish native vegetation. While pipeline incident rates are generally declining across the industry, Antero Midstream invests in advanced leak detection and emergency response training to mitigate environmental risks and maintain stakeholder trust.

Antero Midstream views natural gas as a transitional fuel and is investing in CCUS technologies to decarbonize operations. This strategy aligns with the growing global demand for natural gas as a cleaner alternative to coal, with significant momentum in CCUS projects supported by increasing government and private investment as of early 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Antero Midstream Partners is built on a robust foundation of data from government agencies like the EIA and EPA, financial institutions such as the Federal Reserve, and reputable industry associations. This ensures comprehensive coverage of political, economic, environmental, and technological factors impacting the midstream energy sector.