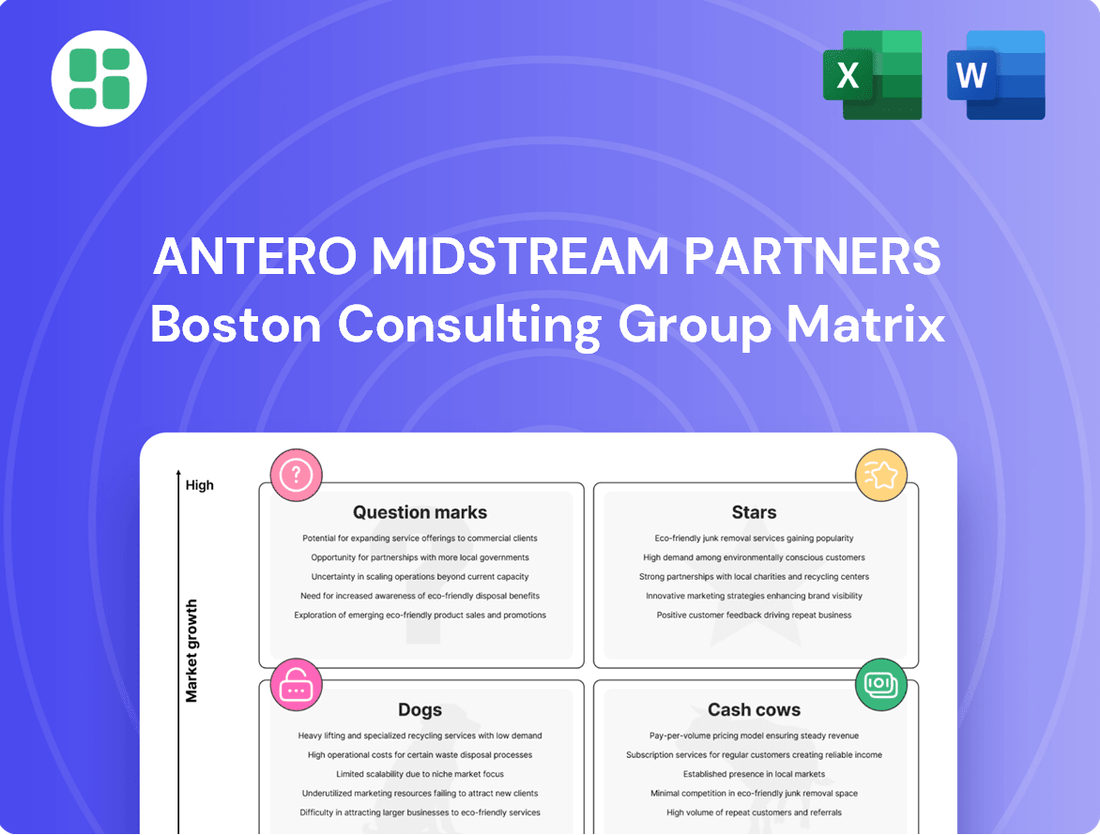

Antero Midstream Partners Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Antero Midstream Partners Bundle

Curious about Antero Midstream Partners' strategic positioning? Our BCG Matrix analysis reveals where their assets fall as Stars, Cash Cows, Dogs, or Question Marks, offering a crucial snapshot of their market performance. Don't miss out on understanding the full picture of their portfolio's potential and challenges.

Unlock the complete Antero Midstream Partners BCG Matrix to gain a comprehensive understanding of their business units and their growth prospects. This detailed report provides the actionable insights you need to make informed investment and strategic decisions.

Dive into the full Antero Midstream Partners BCG Matrix for a clear, data-driven breakdown of their product lines and services. Understand which assets are driving growth and which require a strategic rethink. Purchase the complete report to arm yourself with the knowledge to navigate their market landscape effectively.

Stars

Antero Midstream's infrastructure expansion to serve new data centers and power plants in Appalachia is a key growth driver. This surge in demand, exemplified by Amazon and Meta's significant data center investments in Ohio, falls directly within Antero's operational footprint. The company is well-positioned to capitalize on this high-growth market by leveraging its existing network and strategic advantage.

Antero Resources' production growth, fueled by enhanced well efficiency and a rise in liquids output, is elevating its associated gathering and compression assets within Antero Midstream Partners' portfolio to star status. This robust performance translates directly into increased throughput volumes, a key indicator of asset strength and market demand.

Antero Midstream's 2025 financial guidance anticipates low-single-digit throughput growth, underscoring the sustained operational tempo of its primary customer, Antero Resources. This projected expansion signifies continued investment in and reliance on Antero Midstream's infrastructure, reinforcing the star positioning of these critical midstream assets.

Strategic bolt-on acquisitions are crucial for Antero Midstream Partners' growth. For instance, their 2024 acquisition of Marcellus gathering and compression assets immediately boosted earnings and seamlessly integrated with their existing low-pressure gathering network. This move not only expanded their market share in critical regions but also increased the volume of product handled for their main client, Antero Resources, solidifying their leading position.

Critical Link to LNG Supply Infrastructure

Antero Midstream's infrastructure serves as a crucial initial connection to the burgeoning liquefied natural gas (LNG) supply chain. By transporting and processing natural gas and natural gas liquids (NGLs) destined for global markets, the company operates within a dynamic, high-growth sector.

The outlook for Antero's midstream assets is particularly strong, with substantial new LNG export capacity slated to become operational between 2025 and 2027. This expansion is projected to significantly boost demand for the firm's transportation and processing services.

- Antero Midstream's role as a first-mile connector for LNG exports positions its assets in a high-growth market.

- The company's infrastructure is vital for transporting and processing natural gas and NGLs for international consumption.

- Significant new LNG export capacity is expected to come online between 2025 and 2027, driving increased demand for Antero's services.

- Antero's established transportation and processing capabilities are well-positioned to capitalize on this anticipated demand surge.

High Utilization of Processing and Fractionation Capacity

Antero Midstream Partners is demonstrating exceptional performance with its processing and fractionation assets. In the second quarter of 2025, the company achieved a remarkable 100% utilization rate across this critical infrastructure. This peak operational efficiency highlights the strong demand for its services within a robust market environment.

This high utilization, alongside increased gathering and processing volumes, clearly signals robust market demand for Antero Midstream’s services, where it holds a significant market share. This operational success positions the company favorably within its strategic framework.

- 100% utilization of processing and fractionation capacity in Q2 2025.

- Indicates peak efficiency of core processing assets.

- Strong demand for high-market-share services.

- Increased gathering and processing volumes support high utilization.

Antero Midstream's processing and fractionation assets are clear stars, evidenced by their exceptional performance. In the second quarter of 2025, these assets achieved a perfect 100% utilization rate, showcasing peak operational efficiency. This high demand, coupled with increased gathering and processing volumes, underscores Antero Midstream's strong market position and the critical nature of these facilities.

| Metric | Q2 2025 Value | Significance |

|---|---|---|

| Processing & Fractionation Utilization | 100% | Indicates maximum operational efficiency and strong demand. |

| Gathering & Processing Volumes | Increased | Supports high utilization and reflects customer activity. |

| Market Share | Significant | Highlights competitive advantage and customer reliance. |

What is included in the product

Antero Midstream Partners' BCG Matrix analysis categorizes its assets into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each business segment.

The Antero Midstream Partners BCG Matrix offers a clear, one-page overview, simplifying complex portfolio analysis for executives.

Cash Cows

Antero Midstream Partners' long-term fixed-fee gathering and processing agreements with Antero Resources are the bedrock of its cash flow. These agreements are designed to provide stable, predictable revenue, essentially acting as a reliable income generator for the company.

These mature contracts are crucial because they ensure consistent cash flow, insulating Antero Midstream from the volatility of short-term commodity prices. This makes them a dependable source of funds for the business, allowing for consistent planning and investment.

In 2024, Antero Midstream's financial performance highlights the strength of these agreements. The company reported significant revenue from its gathering and processing segment, demonstrating the ongoing stability provided by these long-term commitments, even amidst fluctuating market conditions.

Antero Midstream Partners' established water handling and reuse systems function as a classic cash cow within the BCG matrix. These integrated, closed-loop operations, encompassing pipelines, pump stations, and storage, consistently generate revenue by facilitating Antero Resources' drilling and completion efforts.

Despite projections of stable water volumes for 2025, the existing, robust infrastructure guarantees sustained, high-margin business with minimal need for significant promotional investment. This stability allows Antero Midstream to leverage its established assets for reliable cash flow generation.

Antero Midstream Partners' mature low-pressure gathering networks are firmly established as cash cows. These extensive pipeline systems boast a high market share within a mature but stable segment of the midstream industry.

These networks consistently generate substantial volumes and contribute significantly to Antero Midstream's EBITDA, all while requiring minimal maintenance capital. For instance, in the first quarter of 2024, Antero Midstream reported gathering and processing volumes that underscore the reliability of these mature assets.

Joint Venture Processing Complex (Sherwood and Smithburg)

The Sherwood and Smithburg joint venture processing complex, a 50/50 partnership, stands as a titan in the natural gas sector, recognized as the largest of its kind in North America. This facility consistently operates at full capacity, a testament to its critical role and robust demand. Its established market position and high operational efficiency translate into significant and reliable cash flow generation for Antero Midstream Partners.

This processing complex is a prime example of a cash cow within Antero Midstream's portfolio. Its consistent 100% utilization rate underscores its importance and the steady demand for its services. The predictable revenue streams generated by Sherwood and Smithburg are crucial for funding other ventures and returning value to stakeholders.

- Largest Natural Gas Processing Complex in North America: Sherwood and Smithburg are significant assets in the midstream sector.

- Consistent 100% Utilization: This indicates strong, ongoing demand and operational success.

- Substantial and Predictable Cash Flow: The complex is a reliable generator of revenue due to its market dominance and efficiency.

- Established Market Position: Its size and operational capacity give it a competitive advantage.

Stable Adjusted EBITDA and Free Cash Flow Generation

Antero Midstream Partners demonstrates robust financial stability, consistently delivering strong Adjusted EBITDA and Free Cash Flow after dividend payments. For 2025, the company anticipates further growth in these key metrics, underscoring the enduring cash-generating power of its established assets.

This reliability is bolstered by CPI-based adjustments to its fixed fees, ensuring revenue streams keep pace with inflation. Furthermore, the company's operational efficiency contributes significantly to its ability to generate substantial free cash flow, even after distributing dividends to unitholders.

- Stable Financial Performance: Antero Midstream consistently generates strong Adjusted EBITDA and Free Cash Flow after dividends.

- Projected Growth: Projections for 2025 indicate continued increases in both Adjusted EBITDA and Free Cash Flow.

- CPI Adjustments: Fixed fees are adjusted based on the Consumer Price Index (CPI), enhancing revenue stability.

- Operational Efficiency: Efficient operations contribute to the company's strong cash-generating capabilities from its core assets.

Antero Midstream's established water handling and reuse systems are a prime example of a cash cow. These integrated operations consistently generate revenue by facilitating Antero Resources' drilling activities, with projections for stable water volumes in 2025 ensuring sustained, high-margin business.

The company's mature low-pressure gathering networks also function as cash cows, holding a high market share in a stable segment. These networks generate substantial volumes and contribute significantly to EBITDA with minimal maintenance capital, as evidenced by Q1 2024 gathering and processing volumes.

The Sherwood and Smithburg joint venture processing complex, operating at a consistent 100% utilization rate, is a major cash cow. This facility's established market position and efficiency translate into significant and reliable cash flow for Antero Midstream.

| Asset Segment | BCG Category | Key Financial Indicator (2024 Data) | Outlook (2025) |

|---|---|---|---|

| Water Handling & Reuse | Cash Cow | Consistent Revenue Generation | Stable Volumes, High Margins |

| Low-Pressure Gathering Networks | Cash Cow | Significant EBITDA Contribution | Minimal Maintenance Capital Required |

| Sherwood & Smithburg Processing Complex | Cash Cow | 100% Utilization Rate | Reliable Cash Flow Generation |

Preview = Final Product

Antero Midstream Partners BCG Matrix

The preview you see is the exact Antero Midstream Partners BCG Matrix report you will receive upon purchase, offering a comprehensive strategic overview without any alterations or watermarks. This document has been meticulously prepared to provide actionable insights into Antero Midstream's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide your investment and divestment decisions. You'll gain access to a fully formatted, analysis-ready file that can be immediately utilized for internal strategy sessions or client presentations. This is not a sample, but the complete, professionally designed report ready for your immediate download and application.

Dogs

Antero Midstream Partners' strategic relocation of compressor units from underutilized areas, while not explicitly termed 'dogs' in their BCG analysis, points to assets with low market share and low growth potential. This proactive management suggests these legacy assets were candidates for repurposing or divestment.

For instance, in 2024, Antero Midstream continued to optimize its asset base. While specific data on the 'dog' category isn't public, the company's capital allocation strategy often involves retiring or repurposing older, less efficient infrastructure to focus on more productive, higher-growth segments of its midstream network.

While Antero Midstream's core operations are in the thriving Marcellus and Utica shale plays, any smaller, isolated infrastructure segments situated in areas experiencing declining production from Antero Resources or other producers would fall into the 'dogs' category. These segments would likely yield very little cash flow, as the company's strategic focus remains on areas with robust growth potential. For instance, if a particular gathering system in a depleted section of the Utica shale only handles a few thousand barrels of oil equivalent per day (boepd) compared to the hundreds of thousands boepd in its core assets, it would represent a dog.

Antero Midstream Partners might classify small, non-strategic assets that drain resources disproportionately into the Dogs category of the BCG Matrix. These might be pipelines or facilities with low throughput and high maintenance expenses, negatively impacting overall profitability. For instance, if a particular gathering system segment incurred $5 million in annual operating costs for only $1 million in revenue, it would likely be considered a Dog.

Water Handling Assets with No Volume Growth

Antero Midstream's water handling assets, despite servicing an increasing number of wells, are projected to experience stagnant volume growth. For 2025, the company anticipates water volumes to remain largely unchanged year-over-year, signaling a low-growth segment.

- Stagnant Volume Growth: Antero Midstream expects no significant increase in water volumes in 2025, even with more wells being serviced.

- Low-Growth Segment: This lack of volume expansion indicates a market segment with limited growth potential.

- Limited Investment Appeal: Without new demand drivers, further substantial investments in this efficient but non-expanding water system are less appealing.

Assets with Limited Third-Party Diversification Potential

Infrastructure solely reliant on Antero Resources' production, especially if that production is declining or plateauing, presents a risk. If Antero Resources' activity in certain areas slows, these assets could become 'dogs' in the BCG matrix. This is particularly true if there's limited opportunity to bring in business from other companies.

Antero Midstream Partners is aware of this potential issue and is actively working to diversify its customer base. This strategy aims to reduce the dependency on a single producer. For instance, in 2024, the company continued to focus on securing third-party contracts to bolster volumes across its gathering and processing systems.

- Infrastructure Dependency: Assets tied exclusively to Antero Resources' output are vulnerable to production shifts.

- Diversification Efforts: Antero Midstream is pursuing third-party business to spread risk.

- Potential 'Dog' Status: A lack of external customer growth could relegate these assets to 'dog' status if Antero Resources' activity declines.

- Mitigation Strategy: Proactive third-party contract acquisition is key to preventing this outcome.

Assets classified as Dogs within Antero Midstream Partners' portfolio likely represent infrastructure with low utilization and minimal growth prospects, potentially leading to divestment or repurposing. These could be older gathering systems in declining production areas, such as a segment in the Utica shale handling only a few thousand boepd, compared to the hundreds of thousands boepd in core assets. Such segments would offer little cash flow and represent a strategic drain.

For example, if a specific pipeline segment incurred $5 million in annual operating costs while generating only $1 million in revenue, it would be a prime candidate for the Dog category due to its negative profitability. The company's 2024 capital allocation strategy, which often involves retiring or repurposing less efficient infrastructure, aligns with managing these low-performing assets.

Antero Midstream's water handling services, despite servicing more wells, are expected to see stagnant volume growth in 2025, with volumes remaining largely unchanged year-over-year. This lack of expansion signals a low-growth market segment, making further substantial investment in these efficient but non-expanding systems less appealing.

Infrastructure tied exclusively to Antero Resources' production, especially if that production is declining, risks becoming a Dog if third-party business cannot be secured. For instance, if Antero Resources' activity in a particular region slows, and no other producers can utilize that infrastructure, it could become a 'dog' with limited revenue potential.

| Asset Type | Market Share | Market Growth | BCG Category | Potential Strategy |

| Legacy Gathering Systems (Depleted Areas) | Low | Low | Dog | Repurpose or Divest |

| Water Handling (Stagnant Volumes) | Moderate | Low (projected 2025) | Dog | Optimize, Limit Investment |

| Producer-Specific Infrastructure (Declining Production) | Low | Low | Dog | Seek Third-Party Business, Divest |

Question Marks

Antero Midstream Partners is strategically investing in the Stonewall Joint Venture, allocating capital for increased capacity, which includes adding new compression units. This expansion is designed to boost throughput and attract a broader range of third-party customers.

This initiative positions Stonewall as a high-growth opportunity for Antero Midstream, as they actively work to capture a larger share of the market by offering enhanced services and expanded reach.

Antero Midstream Partners is strategically investing heavily in water infrastructure for 2025, targeting the southern Marcellus liquids-rich midstream corridor. This expansion is designed to create a unified water system, enabling more cost-effective development in a high-demand market.

This focus on integration aims to capture greater market share and capitalize on the rich resource potential within this region. The company's commitment underscores its belief in the long-term growth prospects of the southern Marcellus.

Antero Midstream Partners' existing infrastructure can accommodate some of the new demand from data centers and LNG exports. However, for larger-scale projects specifically targeting these burgeoning sectors, the company faces 'question mark' opportunities. These ventures promise substantial growth but necessitate considerable upfront capital investment before market share can be solidified.

The strategic positioning of these future infrastructure projects aligns with a 'question mark' status in the BCG Matrix. This is due to their high growth potential, evidenced by Antero's active engagement in discussions for new developments. Yet, the significant capital expenditure required before revenue generation classifies them as requiring careful evaluation and strategic decision-making regarding investment and market penetration.

Potential Strategic M&A Opportunities

Antero Midstream (AM) has a demonstrated capacity for strategic growth through bolt-on acquisitions, a key element of its financial flexibility. Looking ahead, any potential mergers or acquisitions targeting high-growth sectors would likely be classified as 'question marks' within a BCG framework. This classification stems from the inherent risk and unproven market share in new ventures, despite their promising growth trajectories. For instance, AM's 2023 capital expenditures were approximately $650 million, with a significant portion allocated to growth projects and infrastructure expansion, signaling a readiness to explore new opportunities.

These 'question mark' acquisitions would require substantial investment and careful execution to establish a solid market position. The company's history of successful integration of smaller, complementary assets provides a foundation for this approach. For example, AM's acquisition of the remaining stake in the Stonewall Gas Gathering System in 2022 for $221 million demonstrates its ability to execute and integrate bolt-on transactions effectively.

- New Market Entry: Acquisitions in nascent but rapidly expanding midstream sectors, such as those supporting emerging energy technologies, would initially represent question marks.

- Expansion into Adjacent Geographies: Entering new, high-growth basins where AM currently has minimal presence would also fall into this category.

- Technological Integration: Acquiring companies with advanced processing technologies or digital infrastructure could be a strategic question mark, offering high growth potential but requiring integration expertise.

- Diversification into New Services: Expanding into related midstream services not currently offered, like carbon capture and sequestration infrastructure, would be a strategic question mark with high future growth prospects.

Further Enhancements in Water Recycling Efficiency

Antero Midstream Partners is actively pursuing enhanced water recycling, projecting significant cost reductions. Their commitment to this area is underscored by an estimated $60 million in reuse savings over a five-year period, demonstrating a strong focus on operational efficiency and Environmental, Social, and Governance (ESG) principles. This ongoing effort in a high-growth sector highlights their strategic approach to sustainable operations.

Further advancements in water recycling technology could position Antero Midstream for even greater market penetration. While the company has established a solid foundation in this domain, exploring new applications or extending these capabilities to additional clients could represent a substantial opportunity for market adoption. Continued innovation here could unlock new revenue streams and solidify their leadership in water management.

- Projected Savings: Antero Midstream anticipates $60 million in water reuse savings over five years.

- ESG Focus: Water recycling aligns with Antero's commitment to operational efficiency and ESG initiatives.

- Growth Area: Water recycling represents a high-growth sector for operational improvements.

- Market Adoption Potential: Further innovations could expand the application of recycling technology to new clients and regions.

Antero Midstream's ventures into new, high-growth areas like supporting data centers or LNG exports represent significant 'question mark' opportunities. These require substantial upfront capital, and their market share is not yet established, demanding careful strategic evaluation.

The company's potential for bolt-on acquisitions in rapidly expanding midstream sectors also falls into the 'question mark' category. While promising, these ventures carry inherent risks and require significant investment for market penetration, though AM's past integration successes provide a strong foundation.

| Opportunity Type | Potential Growth | Capital Requirement | Market Share Uncertainty | BCG Classification |

|---|---|---|---|---|

| Data Center/LNG Infrastructure | High | Substantial | High | Question Mark |

| New Sector Acquisitions | High | Substantial | High | Question Mark |

| Expansion into New Basins | High | Significant | High | Question Mark |

| Advanced Tech Integration | High | Moderate to High | Moderate | Question Mark |

BCG Matrix Data Sources

Our Antero Midstream BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.