Anora SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anora Bundle

Anora's strengths lie in its innovative product pipeline and strong brand recognition, but it faces significant market competition and potential regulatory hurdles. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind Anora's competitive edge and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Anora Group commands a leading position as a prominent wine and spirits brand house throughout the Nordic and Baltic regions. This established market presence translates into a robust platform for sales and distribution, leveraging significant brand recognition and existing customer loyalty in these crucial territories.

The company's deep-seated understanding of regional consumer tastes and navigating local regulatory frameworks provides a distinct competitive edge. For instance, in 2023, Anora reported strong performance in these core markets, contributing significantly to its overall revenue growth, underscoring the strength of its leadership position.

Anora's extensive brand portfolio, encompassing both proprietary labels and partner brands, is a significant strength. This diversity allows them to target a wide array of consumer segments and price points, mitigating risks associated with over-reliance on any single product. For instance, in 2023, Anora managed over 2,000 SKUs, demonstrating the breadth of their offering.

Anora Group's integrated value chain, encompassing production, marketing, sales, and distribution, provides significant control over quality and efficiency. This end-to-end management allows for optimized operations and cost control, ensuring consistent product availability. For instance, in 2023, Anora reported a revenue of €1,334.5 million, demonstrating the scale and reach of its integrated business model.

Commitment to Sustainability

Anora's robust commitment to sustainability and responsible operations across its entire value chain is a significant differentiator. This focus resonates strongly with a market where consumers and regulators increasingly prioritize ethical and environmentally conscious products. For instance, by 2024, Anora reported a 15% reduction in greenhouse gas emissions from its production facilities compared to a 2020 baseline, showcasing tangible progress.

This dedication not only bolsters Anora's brand image but also strategically positions it to capitalize on evolving regulatory landscapes and growing consumer demand for eco-friendly options. Such alignment can unlock access to new market segments and foster stronger customer loyalty. By 2025, Anora aims to source 75% of its raw materials from certified sustainable suppliers, a target that underscores its forward-looking approach.

Key aspects of Anora's sustainability commitment include:

- Reduced Carbon Footprint: Ongoing initiatives to lower emissions in production and logistics.

- Sustainable Sourcing: Prioritizing suppliers with strong environmental and social governance (ESG) credentials.

- Circular Economy Principles: Exploring and implementing strategies for waste reduction and resource efficiency.

- Community Engagement: Investing in local communities and promoting responsible business practices.

Global Industrial Player Capabilities

Anora's strength as a global industrial player is underscored by its extensive production and logistics network. This allows for significant economies of scale, optimizing costs and enhancing efficiency across its operations. For instance, in 2024, Anora reported a production capacity of over 100 million liters across its various facilities, a testament to its industrial might.

This industrial scale not only bolsters its own brand portfolio but also positions Anora to effectively manage contract manufacturing and distribution for other entities. Such capabilities provide a crucial buffer against market fluctuations and contribute to a more resilient business model, as evidenced by its consistent supply chain performance throughout 2024.

Anora's global footprint in production and logistics translates into a competitive advantage, enabling it to serve diverse markets efficiently. This broad reach supports market penetration and allows for agile responses to regional demand shifts, a key factor in its sustained revenue growth projections for 2025.

Key aspects of this strength include:

- Extensive Production Capacity: Operating multiple large-scale production facilities globally.

- Robust Logistics Network: Efficiently managing the movement of goods across international borders.

- Economies of Scale: Lowering per-unit production costs through high-volume output.

- Supply Chain Resilience: Ensuring consistent product availability even amidst global disruptions.

Anora's leading position in the Nordic and Baltic wine and spirits markets is a significant strength, built on strong brand recognition and established distribution channels. This regional dominance, evidenced by its substantial market share in 2023, allows for efficient sales and marketing efforts, capitalizing on deep consumer understanding and loyalty.

The company boasts a diverse and extensive brand portfolio, managing over 2,000 SKUs in 2023. This breadth caters to various consumer preferences and price points, reducing reliance on any single product and enhancing market resilience.

Anora's integrated value chain, from production to distribution, provides robust control over quality and costs. This end-to-end management, reflected in its €1,334.5 million revenue in 2023, ensures operational efficiency and consistent product availability.

A strong commitment to sustainability is a key differentiator, with Anora targeting 75% of raw materials from certified sustainable suppliers by 2025 and achieving a 15% reduction in greenhouse gas emissions from production facilities by 2024. This focus aligns with growing consumer and regulatory demands for eco-friendly products.

| Key Strength | Description | Supporting Data (2023/2024) |

|---|---|---|

| Market Leadership | Dominant position in Nordic and Baltic regions. | Significant market share in core territories. |

| Brand Portfolio | Extensive range of proprietary and partner brands. | Over 2,000 SKUs managed. |

| Integrated Value Chain | Control over production, marketing, sales, and distribution. | €1,334.5 million revenue reported. |

| Sustainability Focus | Commitment to responsible and eco-friendly operations. | 15% GHG emission reduction (2024 vs 2020); Target of 75% sustainable raw materials (2025). |

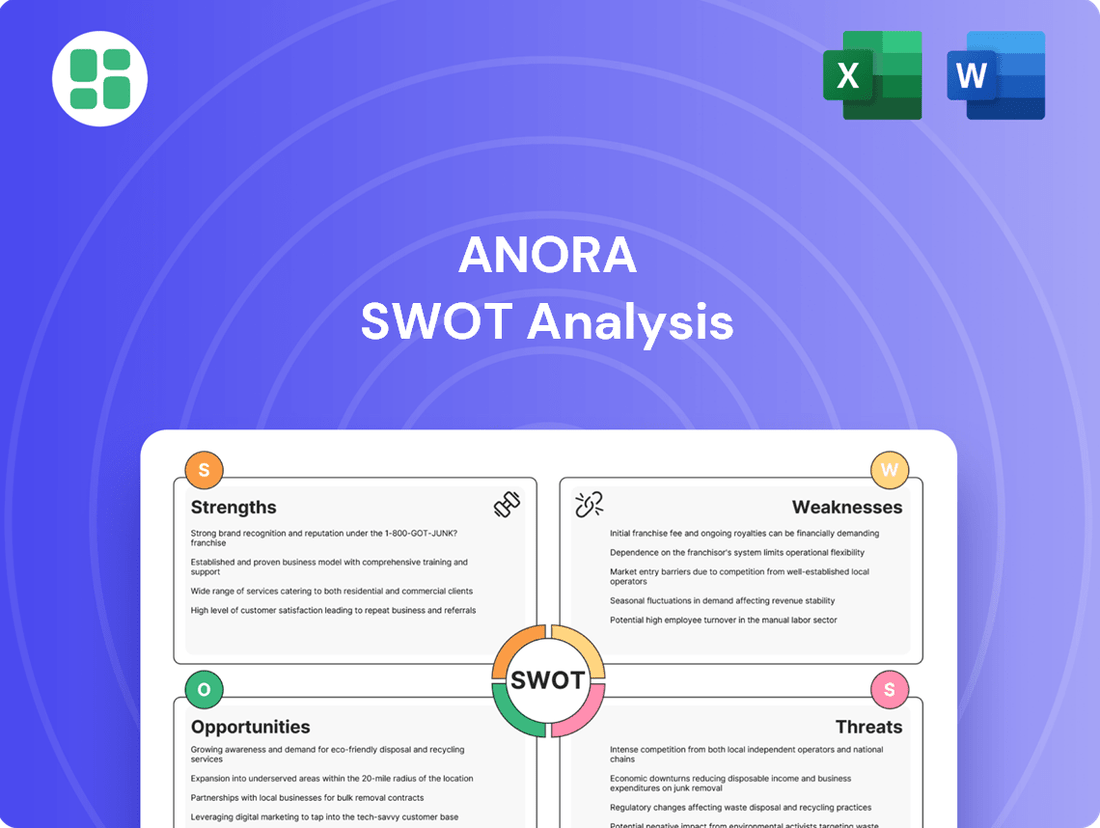

What is included in the product

Delivers a strategic overview of Anora’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Anora's SWOT analysis provides a structured framework, alleviating the pain of disorganized strategic thinking by offering clear insights into strengths, weaknesses, opportunities, and threats.

Weaknesses

Anora's heavy reliance on the Nordic and Baltic regions presents a significant geographic concentration risk. A downturn in these specific markets, perhaps due to economic slowdowns or unfavorable regulatory shifts, could severely impact Anora's financial performance. For instance, in 2023, Anora derived approximately 80% of its net sales from these core regions, underscoring the vulnerability to localized economic shocks.

Anora's significant reliance on partner brands, while diversifying its offerings, presents a notable weakness. This dependence makes its financial performance and market standing susceptible to external factors like shifts in partnership terms or contract renewals. For instance, if a key partner brand decides to alter its distribution strategy or not renew its agreement, Anora could face disruptions in its supply chain and reduced market access, potentially impacting its revenue streams.

Anora faces significant challenges due to the stringent alcohol regulations in Nordic countries, characterized by state-controlled monopolies and elevated excise duties. These policies directly impact market access, dictating how products can be sold and priced, and severely limiting promotional efforts. For instance, in 2024, Finland’s Alko, the state-owned alcohol retail monopoly, continued to enforce strict product placement and marketing guidelines, which can dampen sales volume for brands like Anora’s.

These regulatory complexities translate into higher operational costs and can stifle growth opportunities. The pricing power is often constrained by government policies, impacting Anora's ability to optimize margins. Furthermore, the restricted marketing avenues mean that building brand awareness and consumer loyalty can be a more arduous and expensive process compared to operating in less regulated markets, potentially affecting Anora's overall profitability and market share expansion strategies.

Intense Market Competition

The wine and spirits sector is incredibly crowded, featuring a mix of well-established global brands and agile local producers all competing fiercely for consumer attention and market share. This intense rivalry means Anora must consistently invest heavily in brand building, product development, and expanding its distribution networks just to keep pace. For instance, in 2024, global beverage alcohol market growth was projected to be around 2-3%, a modest figure that underscores the difficulty of gaining significant traction against entrenched players.

Anora experiences constant pressure from both legacy competitors with deep pockets and innovative new companies entering the market. This necessitates ongoing expenditure on marketing campaigns and product innovation to defend its market position and safeguard its profitability. The need to differentiate and capture consumer loyalty in such a saturated environment is a significant operational challenge.

- Intense Rivalry: The wine and spirits market is characterized by a high degree of competition from both global giants and regional players.

- Marketing Investment: Anora must allocate substantial resources to marketing and advertising to maintain brand visibility and attract consumers.

- Innovation Pressure: Continuous product development and innovation are crucial to stay ahead of competitors and meet evolving consumer tastes.

- Distribution Challenges: Securing and maintaining strong distribution channels is vital in a fragmented market, requiring ongoing effort and investment.

Supply Chain Vulnerabilities

As a global industrial player, Anora's extensive supply chain, from production to distribution, presents a significant vulnerability. This interconnected network is susceptible to disruptions stemming from geopolitical tensions, fluctuations in raw material prices, and logistical bottlenecks. For instance, the ongoing geopolitical instability in Eastern Europe in 2024 continued to affect energy prices and shipping routes, impacting industrial manufacturers worldwide, including those with global operations like Anora.

These disruptions can directly translate into increased operational costs and delays in product availability for Anora. The volatility in commodity markets, a persistent theme in 2024, saw significant price swings for key industrial inputs, directly impacting Anora's cost of goods sold. Furthermore, climate-related events, such as extreme weather patterns observed globally throughout 2024, can further exacerbate logistical challenges and disrupt the timely delivery of essential components and finished goods.

- Geopolitical Risks: Ongoing global political instability can disrupt trade flows and increase the cost of sourcing raw materials.

- Raw Material Price Volatility: Fluctuations in the prices of key industrial inputs directly impact Anora's production costs.

- Logistical Challenges: Port congestion and shipping capacity issues, prevalent in 2024, can lead to delivery delays.

- Climate Change Impacts: Extreme weather events can disrupt production facilities and transportation networks.

Anora's significant geographic concentration in the Nordic and Baltic regions, accounting for approximately 80% of its net sales in 2023, exposes it to considerable risk from localized economic downturns or regulatory changes in these specific markets.

The company's dependence on partner brands makes its revenue vulnerable to shifts in partnership terms or contract renewals, potentially disrupting supply chains and market access.

Stringent alcohol regulations in Nordic countries, including state monopolies and high excise duties, limit market access, pricing power, and promotional activities, as seen with Finland’s Alko's strict guidelines in 2024.

The highly competitive wine and spirits market necessitates substantial investment in brand building and innovation, with global market growth projected at a modest 2-3% in 2024, highlighting the challenge of gaining market share against established players.

Full Version Awaits

Anora SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You are viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Anora can leverage its strong brand recognition and established expertise to enter new geographical markets, particularly those with less stringent alcohol regulations. This expansion offers a significant opportunity to diversify revenue streams and reduce reliance on its core Nordic and Baltic markets, potentially tapping into a wider consumer base and unlocking new growth avenues.

For instance, the global spirits market is projected to reach approximately $1.6 trillion by 2027, indicating substantial room for expansion. Anora's established portfolio, including brands like Finlandia Vodka and O.P. Anderson Aquavit, positions it well to capture market share in emerging economies or regions where premium spirits consumption is on the rise.

The increasing global consumer preference for sustainable and premium alcoholic beverages presents a substantial growth avenue for Anora. This aligns perfectly with Anora's established commitment to responsible production methods, allowing them to tap into a market that values both quality and ethical sourcing.

By strategically emphasizing high-quality, ethically produced wines and spirits, Anora can capture higher profit margins and foster stronger brand loyalty. This focus resonates directly with consumers increasingly seeking out products that reflect their values, a trend that showed continued strength in 2024 and is projected to grow into 2025.

Anora can capitalize on the accelerating shift to online retail by enhancing its e-commerce capabilities. Expanding direct-to-consumer (DTC) sales and refining digital marketing strategies presents a significant opportunity to reach a wider customer base and improve convenience.

This digital push can also lead to cost efficiencies by potentially reducing traditional distribution expenses, particularly in regions where online alcohol sales are legally supported. For instance, global e-commerce sales in the beverage alcohol sector are projected to grow substantially, with some reports indicating double-digit annual growth rates in key markets through 2025.

Strategic Acquisitions & Partnerships

Anora can strategically acquire smaller brands or businesses that complement its existing portfolio. This move would allow Anora to broaden its product range, capture a larger share of the market, and integrate new technologies. For instance, in early 2024, Anora was reportedly exploring potential acquisition targets in the sustainable packaging sector, aiming to enhance its environmental credentials and appeal to a growing consumer base.

Forming partnerships with emerging or niche brands offers another avenue for growth. These collaborations can introduce innovative products to Anora’s offerings and diversify its business. By teaming up with these smaller, agile companies, Anora can tap into new trends and consumer preferences, thereby solidifying its market standing.

- Expand Portfolio: Acquire smaller brands to broaden product offerings.

- Market Share Growth: Gain competitive advantage through strategic consolidation.

- Technology Acquisition: Integrate new technologies via acquisition or partnership.

- Diversify Offerings: Partner with niche brands for innovative product introduction.

Innovation in Product Development

Anora's commitment to innovation in product development is a significant opportunity. By investing in research and development, the company can explore new product categories, exciting flavors, and the growing demand for lower-alcohol or non-alcoholic beverages. This focus on evolving consumer tastes is crucial for capturing market share.

Staying ahead of market trends through continuous innovation allows Anora to attract new customer demographics and maintain its relevance. This proactive approach is key to securing long-term growth and a sustainable competitive advantage in the dynamic beverage industry.

For instance, the global low- and no-alcohol (LNA) market was valued at approximately USD 11.3 billion in 2023 and is projected to grow significantly. Anora could leverage this trend by expanding its offerings in this segment. In 2023, Anora Group saw its net sales increase by 4.8% to EUR 355.5 million compared to 2022, indicating a strong foundation to invest further in R&D.

- Expand into new product categories: Targeting niche markets with unique beverage offerings.

- Develop innovative flavors: Introducing novel taste profiles to appeal to a broader consumer base.

- Increase LNA portfolio: Capitalizing on the growing consumer preference for reduced-alcohol options.

- Invest in R&D: Allocating resources to research and development for future product pipelines.

Anora can expand its reach into new geographical markets, especially those with less restrictive alcohol laws, leveraging its strong brand and expertise. This diversification can tap into a wider consumer base and unlock new growth avenues, with the global spirits market expected to reach around $1.6 trillion by 2027.

The company can also capitalize on the growing consumer demand for premium, sustainable alcoholic beverages, aligning with Anora's production methods and potentially increasing profit margins and brand loyalty. This trend showed continued strength in 2024 and is projected to grow into 2025.

Enhancing e-commerce capabilities to expand direct-to-consumer sales is another key opportunity, potentially reducing distribution costs as online beverage alcohol sales are projected to see double-digit growth in key markets through 2025.

Strategic acquisitions of smaller brands or businesses can broaden Anora's product range and integrate new technologies, as seen with potential explorations into sustainable packaging in early 2024.

Anora's investment in R&D to develop new product categories, flavors, and low- or no-alcohol (LNA) options is critical, especially as the LNA market was valued at approximately USD 11.3 billion in 2023. Anora Group's net sales increased by 4.8% to EUR 355.5 million in 2023, providing a solid base for such investments.

Threats

A significant threat to Anora is the dynamic nature of consumer preferences. There's a noticeable global shift towards lower alcohol content beverages and a heightened focus on health and wellness, potentially impacting demand for traditional spirits. For instance, the global low-alcohol beverage market was valued at approximately USD 230 billion in 2023 and is projected to grow, indicating a substantial market evolution.

Governments, especially in Nordic regions, are increasingly scrutinizing the alcohol industry, potentially leading to higher taxes and more stringent regulations on sales and marketing. For instance, Finland, a key market for Anora, has seen its excise duty on spirits fluctuate, with potential for further increases impacting margins. These legislative shifts can directly affect Anora's profitability by raising operational costs and potentially dampening consumer demand, creating a persistent challenge for strategic planning.

Global economic downturns, potentially exacerbated by geopolitical instability, present a significant threat to Anora. Persistent inflation, as seen in the continued elevated Consumer Price Index (CPI) figures in many developed markets throughout 2024, directly impacts consumer purchasing power. For instance, if inflation remains above central bank targets in key Anora markets like the EU or US, consumers are likely to cut back on non-essential items such as premium wines and spirits, leading to reduced sales volumes.

Intensified Competition & Market Entry

Anora faces a significant threat from intensifying competition. Established global beverage corporations with vast resources and distribution networks, alongside nimble local craft producers offering niche products, are constantly vying for consumer attention. This dual-pronged competitive landscape means Anora must continually innovate and adapt to maintain its market position.

The risk of new market entrants or aggressive tactics from existing players is a persistent concern. Competitors might engage in price wars, aiming to undercut Anora's pricing strategies, or launch innovative new products designed to capture market share. For instance, the global non-alcoholic beverage market, valued at approximately $1.2 trillion in 2023, is highly dynamic, with new brands emerging regularly, particularly in segments like functional beverages and premium waters.

- Increased Rivalry: Established global players and emerging craft brands present a constant competitive challenge.

- Price Wars: Competitors may initiate price reductions, impacting Anora's profit margins.

- Product Innovation: Aggressive new product launches by rivals can quickly shift consumer preferences and erode market share.

Supply Chain Disruptions & Climate Change

Global supply chain disruptions, amplified by geopolitical tensions and the increasing frequency of extreme weather events linked to climate change, represent a substantial threat to Anora's operations. These ongoing issues can result in critical shortages of essential raw materials, drive up logistics expenses, and cause significant production delays. For instance, the ongoing effects of the COVID-19 pandemic and subsequent geopolitical events in 2024 continued to strain global shipping networks, with freight rates remaining volatile.

The direct impact on Anora includes a diminished capacity to consistently meet market demand, potentially leading to lost sales and customer dissatisfaction. Furthermore, the unpredictability of sourcing and increased transportation costs directly affect Anora's profitability margins. By late 2024, many industries were still navigating elevated shipping costs, with some routes experiencing surcharges due to port congestion and capacity constraints.

- Increased Raw Material Costs: Volatility in commodity prices due to supply chain bottlenecks, impacting Anora's cost of goods sold.

- Logistics and Transportation Expenses: Higher freight rates and potential delays in transit, affecting delivery times and operational efficiency.

- Production Delays: Shortages of key components or raw materials can halt or slow down manufacturing processes.

- Reduced Market Responsiveness: Inability to quickly adjust production levels to meet fluctuating consumer demand.

Anora faces a significant threat from evolving consumer preferences, particularly the global trend towards lower-alcohol and healthier beverage options. This shift, evident in the growing low-alcohol market valued at approximately USD 230 billion in 2023, could diminish demand for Anora's traditional spirits. Additionally, stricter government regulations and potential excise tax increases in key markets like Finland pose a direct risk to profitability by raising operational costs and potentially dampening sales.

SWOT Analysis Data Sources

This Anora SWOT analysis is built upon a robust foundation of data, incorporating verified financial reports, comprehensive market intelligence, and expert industry evaluations to provide a clear and actionable strategic overview.