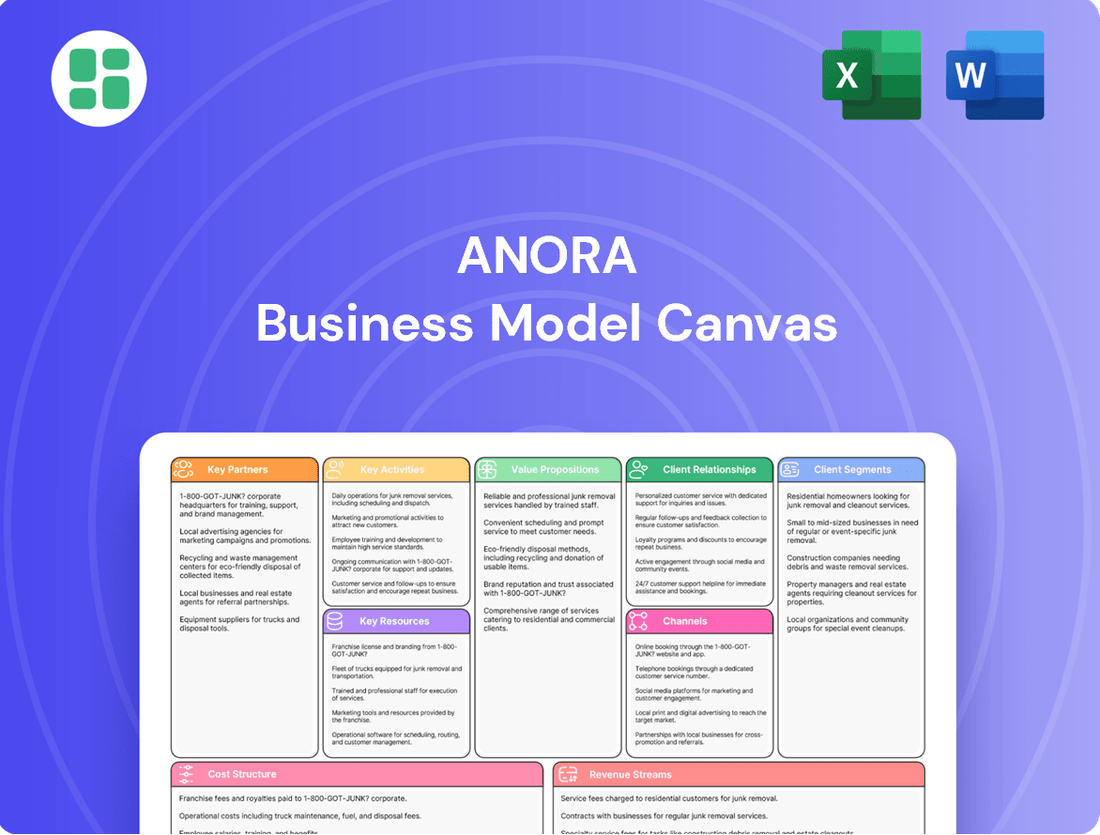

Anora Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anora Bundle

Curious about how Anora achieves its market position? This Business Model Canvas offers a clear view of their customer relationships, revenue streams, and key resources. It's a valuable tool for anyone looking to understand the mechanics of a successful business.

Partnerships

Anora cultivates significant partnerships with leading global wine and spirits brand owners. These alliances are foundational, allowing Anora to effectively market, sell, and distribute a wide array of international brands across the Nordic and Baltic markets. For instance, in 2023, Anora's portfolio included a substantial number of partner brands, contributing significantly to its overall revenue streams.

These collaborations are crucial for broadening Anora's market presence and product selection, complementing its own established brands. The typical structure of these relationships involves exclusive distribution rights and coordinated marketing campaigns, aiming to leverage the strengths of both Anora and its strategic partners to drive sales and brand awareness.

Anora's key partnerships are built around its crucial retail and monopoly channels. In Nordic countries like Finland, Sweden, and Norway, state-owned alcohol monopolies serve as the primary avenues for Anora's products. These monopolies are vital for Anora’s market penetration and sales volume, effectively acting as gatekeepers for a significant portion of the alcoholic beverage market in these regions.

Beyond the monopolies, Anora also cultivates relationships with major retail chains and the broader Hotel, Restaurant, and Catering (HoReCa) industry. These partnerships are particularly important in markets where direct sales are allowed, enabling Anora to reach a wider consumer base and diversify its sales channels. For instance, in 2023, Anora's sales to the HoReCa sector represented a substantial part of its overall revenue, underscoring the importance of these collaborations.

Anora partners with key suppliers of vital raw materials, including grape growers for its wine portfolio and grain producers, notably barley for its renowned Koskenkorva vodka. This collaboration ensures a consistent flow of high-quality ingredients, which is fundamental for maintaining production schedules and upholding the premium standard of Anora's diverse product range.

Beyond agricultural inputs, Anora also cultivates strong relationships with suppliers of packaging materials. These partnerships are increasingly focused on advancing Anora's commitment to sustainability, particularly in developing and implementing climate-smart packaging solutions. For instance, in 2023, Anora continued its efforts to increase the use of recycled materials in its packaging, aiming for a significant portion of its plastic bottles to contain recycled content by 2030.

Logistics and Distribution Providers

Anora's operational efficiency hinges on its strategic alliances with logistics and distribution providers. This includes its wholly-owned logistics arm, Vectura, which plays a pivotal role in navigating the intricacies of a global supply chain spanning numerous countries. These partnerships are fundamental to ensuring products reach their destinations promptly and economically, from manufacturing sites to diverse sales points, thereby underpinning product availability and market penetration.

The effectiveness of Anora's supply chain is directly influenced by these key relationships. For instance, in 2024, Anora reported that its logistics costs represented approximately 8% of its revenue, a figure that underscores the significance of efficient distribution. These partners are instrumental in managing inventory, optimizing transportation routes, and ensuring compliance with international shipping regulations.

- Vectura's Role: Anora's internal logistics company, Vectura, manages a significant portion of its distribution network, providing direct control over key supply chain elements.

- Timely Delivery: Partnerships with external logistics firms ensure that Anora's products are delivered efficiently to over 50 countries where it operates.

- Cost Optimization: Strategic route planning and carrier selection by these partners help Anora maintain competitive pricing and manage operational expenses.

- Market Reach: The extensive network of logistics providers is critical for Anora to maintain consistent product availability and expand its market presence globally.

Sustainability and Research Collaborations

Anora actively partners with leading sustainability organizations and influential research institutions to drive innovation in environmental and ethical practices. These collaborations are crucial for advancing regenerative farming techniques and developing cutting-edge, sustainable production methods, including eco-friendly packaging solutions.

For example, in 2024, Anora continued its work with the Baltic Sea Action Group, focusing on pilot projects for reduced nutrient runoff from agricultural land. This initiative aims to improve water quality in the Baltic Sea, a key environmental focus for the region.

- Collaboration with Research Institutions: Anora partners with universities and research centers to explore and implement advanced sustainable agriculture techniques, contributing to scientific understanding and practical application.

- Engagement with Farming Communities: Direct partnerships with farmers are essential for rolling out regenerative farming practices, ensuring knowledge transfer and mutual benefit in improving soil health and biodiversity.

- Development of Sustainable Solutions: Joint efforts with industry experts and technology providers focus on creating more sustainable production processes and innovative packaging materials, reducing environmental impact across the value chain.

Anora's success is deeply intertwined with its robust network of key partnerships. These collaborations span brand owners, retail channels, suppliers, logistics providers, and sustainability organizations, all contributing to Anora's market presence, operational efficiency, and commitment to responsible practices.

| Partnership Type | Key Focus | 2023/2024 Data/Impact |

|---|---|---|

| Brand Owners | Marketing, Sales, Distribution of international brands | Substantial revenue contribution from partner brands in 2023. |

| Retail & HoReCa | Market penetration, diversified sales channels | HoReCa sector represented a substantial part of overall revenue in 2023. |

| Suppliers (Raw Materials) | Ensuring high-quality ingredients (grapes, grains) | Foundation for maintaining production schedules and product standards. |

| Suppliers (Packaging) | Sustainability, climate-smart solutions | Continued efforts in 2023 to increase recycled content in packaging. |

| Logistics (Vectura & External) | Efficient delivery, cost optimization, market reach | Logistics costs represented ~8% of revenue in 2024; delivery to over 50 countries. |

| Sustainability Organizations & Research | Environmental innovation, regenerative farming | Pilot projects with Baltic Sea Action Group in 2024 for reduced nutrient runoff. |

What is included in the product

A fully developed business model canvas designed to guide strategic planning and operational execution.

It provides a clear, actionable framework for understanding and communicating Anora's core business logic.

Anora's Business Model Canvas offers a structured approach to identify and address critical business challenges.

It helps alleviate the pain of uncertainty by providing a clear, actionable framework for strategic planning.

Activities

Anora's core activities revolve around the production and bottling of spirits, notably its own brands like Koskenkorva, and also handling partner wines and spirits. This encompasses the meticulous management of distilleries and bottling facilities, with a strong emphasis on operational efficiency and environmental responsibility.

A key differentiator is Anora's commitment to sustainability, particularly evident at its Koskenkorva distillery. This facility actively integrates circular economy principles, transforming by-products into valuable resources, such as using spent grain for animal feed and biogas production, demonstrating a forward-thinking approach to resource management.

Anora dedicates significant resources to brand marketing and portfolio management, actively promoting its own and partner brands through targeted campaigns. In 2024, the company continued to invest in digital marketing initiatives, aiming to boost consumer engagement and brand recognition across its key markets.

Effective portfolio management is crucial for Anora, ensuring a diverse and appealing product mix that caters to a wide range of consumer tastes and market demands. This strategic approach helps maintain market share and drive growth by aligning offerings with evolving consumer preferences.

Anora's key activities center on the effective sales and distribution of its beverage portfolio throughout the Nordic and Baltic regions. This involves expertly managing intricate market regulations, especially within the monopoly-controlled markets, and continuously refining logistics to guarantee broad product accessibility.

The company's dedicated sales teams focus on nurturing strong relationships with a diverse customer base. This includes key accounts like state-owned monopolies, independent retailers, and the crucial hospitality sector (HoReCa), ensuring Anora's products are well-represented across all channels.

Supply Chain and Logistics Management

Anora's key activities heavily involve managing a sophisticated global supply chain. This means carefully handling everything from sourcing raw materials internationally to warehousing and distributing finished products. The goal is to ensure everything moves smoothly and on time, getting materials to manufacturing and products to customers efficiently.

Optimizing this intricate network is vital for Anora. It's not just about speed; it's also about keeping costs down and minimizing the environmental footprint of their operations. For instance, in 2024, many companies like Anora are focusing on nearshoring or regionalizing supply chains to reduce transportation emissions and lead times. A report from McKinsey in late 2023 indicated that companies investing in supply chain visibility and resilience saw a significant reduction in disruptions and improved operational efficiency.

Key activities within this domain include:

- Procurement: Sourcing high-quality raw materials and components from a diverse international supplier base.

- Warehousing and Inventory Management: Efficiently storing and managing stock levels across various locations to meet demand without excess.

- Transportation and Distribution: Coordinating the movement of goods via sea, air, and land to ensure timely delivery to markets worldwide.

- Supply Chain Optimization: Continuously analyzing and improving processes to enhance efficiency, reduce costs, and lessen environmental impact.

Sustainability Initiatives and Development

Anora actively drives sustainability by integrating regenerative farming practices and pursuing carbon-neutral production. This commitment extends to developing climate-smart packaging solutions, showcasing a holistic approach to environmental stewardship across their operations.

The company's dedication is underscored by consistent investment in sustainable technologies and processes. Anora has set ambitious environmental performance targets, aiming for significant reductions in its ecological footprint by 2030.

- Regenerative Farming: Implementing practices that improve soil health and biodiversity.

- Carbon Neutrality: Investing in renewable energy and efficiency to minimize emissions.

- Climate-Smart Packaging: Innovating with materials and designs that reduce environmental impact.

- 2030 Roadmap: A strategic plan guiding all sustainability efforts towards ambitious goals.

Anora's key activities are centered on producing and distributing alcoholic beverages, including its own brands like Koskenkorva, and managing partner products. This involves operating distilleries and bottling plants efficiently, with a strong focus on sustainability. In 2024, Anora continued to invest in digital marketing to enhance consumer engagement and brand visibility across its primary markets.

Full Version Awaits

Business Model Canvas

The Anora Business Model Canvas preview you're examining is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain full access to this comprehensive tool, ready for immediate application to your business strategy.

Resources

Anora boasts a robust brand portfolio, featuring both its own well-established Nordic brands and a diverse selection of international partner wines and spirits. This extensive collection represents significant intellectual property and strong market recognition, forming the bedrock of Anora's product strategy.

The strength and breadth of this portfolio are crucial competitive differentiators for Anora in the market. For instance, in 2023, Anora's own brands like OPAL and Laitilan Kukko contributed significantly to their sales performance, alongside successful partnerships with global spirits producers.

Anora's production and bottling facilities are its backbone, featuring state-of-the-art distilleries like the renowned Koskenkorva distillery and advanced wine bottling plants. These physical assets are fundamental to Anora's ability to manufacture and package its diverse product portfolio, ensuring consistent quality and supporting its commitment to sustainable operations.

The company consistently invests in these facilities to boost efficiency and minimize their environmental footprint. For instance, in 2023, Anora continued its focus on improving energy efficiency across its production sites, aiming to reduce greenhouse gas emissions in line with its ambitious sustainability targets.

Anora's established distribution networks, particularly its significant presence in the Nordic and Baltic regions, represent a critical resource. This network includes the logistics company Vectura, which is instrumental in ensuring products reach consumers efficiently across various sales channels.

This robust infrastructure allows Anora to achieve effective market penetration and maintain product availability, a key advantage in its operating markets. The company's ability to navigate the unique market specifics of each region further strengthens this vital resource.

Skilled Human Capital

Anora's success hinges on its approximately 1,200 skilled professionals. This team possesses deep expertise across critical business functions, including brand management, sales, marketing, production, logistics, and sustainability. Their collective knowledge is the engine for innovation and operational efficiency.

The company's strategic objectives are directly supported by the talent and experience of its workforce. This human capital is fundamental to maintaining strong customer relationships and driving Anora's growth in competitive markets.

- Human Capital: Approximately 1,200 professionals.

- Key Expertise: Brand management, sales, marketing, production, logistics, sustainability.

- Impact: Drives innovation, operational excellence, and customer relationships.

- Strategic Importance: Employee talent is fundamental to achieving strategic objectives.

Intellectual Property and Market Insights

Anora's competitive edge extends beyond its well-known brands. The company holds significant intellectual property in the form of proprietary recipes and advanced production techniques. This internal knowledge base is a key resource, allowing for unique product offerings and efficient manufacturing processes.

Furthermore, Anora harnesses extensive market data and deep consumer insights, particularly concerning preferences within the Nordic and Baltic regions. This granular understanding is critical for tailoring product development and crafting highly effective marketing campaigns that resonate with local tastes.

These proprietary insights are instrumental in Anora's strategy to maintain its market leadership. For instance, in 2024, Anora reported that its digital analytics tools provided a 15% uplift in campaign effectiveness by identifying specific consumer purchasing triggers.

- Proprietary Recipes and Production: Anora's unique formulations and manufacturing methods are safeguarded intellectual property.

- Market Data and Consumer Insights: Extensive data on Nordic and Baltic consumer behavior informs strategic decisions.

- Targeted Product Development: Insights enable the creation of products that precisely meet regional demand.

- Effective Marketing Strategies: Deep consumer understanding allows for more impactful and efficient marketing efforts.

Anora's key resources are multifaceted, encompassing its strong brand portfolio, state-of-the-art production facilities, and extensive distribution networks. These are complemented by its skilled workforce and valuable intellectual property, including proprietary recipes and deep consumer insights.

The company's 2023 performance highlighted the strength of these resources, with own brands and strategic partnerships driving sales. Investments in production efficiency and sustainability further underscore the importance of its physical assets.

Anora's market data and consumer insights are particularly crucial, enabling targeted product development and effective marketing. For example, in 2024, Anora noted a 15% uplift in campaign effectiveness attributed to its digital analytics tools.

| Resource Category | Specific Assets/Capabilities | Strategic Value |

|---|---|---|

| Brand Portfolio | Nordic brands (e.g., OPAL), International partner wines/spirits | Market recognition, competitive differentiation |

| Production Facilities | Koskenkorva distillery, bottling plants, focus on energy efficiency | Quality control, sustainable operations, manufacturing capacity |

| Distribution Networks | Vectura logistics, Nordic/Baltic market presence | Market penetration, product availability, efficient logistics |

| Human Capital | ~1,200 skilled professionals | Innovation, operational excellence, customer relationships |

| Intellectual Property | Proprietary recipes, production techniques, consumer insights | Unique offerings, efficient processes, targeted marketing |

Value Propositions

Anora provides a vast selection of wines and spirits, encompassing both its own brands and international labels, acting as a convenient single destination for consumers. This broad portfolio ensures a wide appeal, meeting diverse preferences and market needs.

For international suppliers, Anora unlocks the intricate Nordic and Baltic markets, offering crucial access to these typically challenging distribution channels. This strategic advantage is vital for global brands seeking to expand their reach.

In 2023, Anora reported net sales of €1.9 billion, underscoring the significant scale of its operations and market penetration across its service regions. This financial performance highlights the strength of its comprehensive market access strategy.

Anora's commitment to sustainability is a core value proposition, evident in their focus on responsible production and ethical sourcing. This dedication appeals to consumers and partners who prioritize environmental consciousness, establishing Anora as a frontrunner in sustainable beverage operations.

The company's 'Regenerate the Future' roadmap highlights this commitment, aiming for significant carbon footprint reduction. For instance, Anora has set ambitious targets, including achieving carbon neutrality in its own operations by 2030, a goal that aligns with increasing global demand for eco-friendly products.

Anora's expertise in brand building and market development is a cornerstone of its business model, particularly within the distinct Nordic and Baltic regions. They possess a deep understanding of these markets, allowing them to effectively craft and execute strategies for brand growth. This specialized knowledge is crucial for success in these specific geographies.

The company has a demonstrable history of successfully navigating the complex regulatory environments and nuanced consumer preferences prevalent in Northern Europe. This proven ability to achieve market penetration and growth is a significant value proposition for Anora's partners, ensuring their brands resonate with local audiences.

In 2024, Anora continued to leverage this expertise, with its portfolio brands showing strong performance. For example, their spirits segment, a key area of brand development, saw a notable increase in market share in several Baltic countries, reflecting their adeptness at local market penetration.

Reliable and Efficient Supply Chain

Anora's commitment to a reliable and efficient supply chain is a cornerstone of its value proposition. This operational strength ensures that products are consistently available, meeting demand without delays. In 2024, Anora's focus on optimizing its logistics, including its significant industrial operations, directly contributed to minimizing disruptions for its retail partners and end consumers, solidifying its image as a trustworthy supplier.

This dependability is crucial in today's fast-paced market. By maintaining a robust supply chain, Anora reduces the risk of stockouts and ensures timely deliveries, which are critical factors for customer satisfaction and loyalty. Their industrial capabilities allow for greater control over production and distribution, enhancing overall efficiency.

- Consistent Product Availability: Anora's supply chain management ensures products are on shelves when consumers want them.

- Timely Delivery Performance: Meeting delivery schedules is paramount, reducing lead times for retailers.

- Minimized Disruptions: Proactive management of logistics and industrial operations prevents common supply chain bottlenecks.

- Enhanced Partner Reputation: Reliability fosters strong, long-term relationships with retail partners.

Quality and Heritage

Anora's value proposition centers on delivering high-quality products deeply rooted in a rich Nordic heritage. This heritage is evident in their meticulous selection of wines and their expertise in spirits production, a tradition honed over generations. For instance, many of their iconic Nordic brands boast long histories, fostering a sense of trust and loyalty among consumers.

This dedication to quality and heritage is a cornerstone of their brand identity. By consistently offering premium products, Anora cultivates strong consumer trust and encourages repeat business, solidifying the enduring value of their portfolio.

- Nordic Heritage: Anora leverages a deep-rooted Nordic tradition in spirits and wine production.

- Product Quality: A commitment to high-quality ingredients and production processes defines their offerings.

- Brand Longevity: Many of Anora's key brands have a long and established history, enhancing their appeal.

- Consumer Trust: The combination of quality and heritage builds significant consumer trust and brand loyalty.

Anora serves as a comprehensive gateway for both consumers and suppliers in the Nordic and Baltic regions. It offers an extensive selection of wines and spirits, catering to diverse tastes and providing international suppliers with vital access to these complex markets. This dual role makes Anora an indispensable partner for market penetration and consumer engagement.

Anora's deep understanding of the Nordic and Baltic markets, coupled with its proven ability to build brands and navigate regulatory landscapes, offers significant value. Their expertise ensures that partner brands resonate effectively with local consumers. This specialized knowledge is crucial for achieving sustained growth in these distinct geographical areas.

The company's robust supply chain and industrial capabilities ensure consistent product availability and timely delivery, minimizing disruptions for partners and consumers. In 2024, Anora's focus on logistics optimization directly supported this reliability, reinforcing its reputation as a dependable supplier.

Anora's commitment to quality and its rich Nordic heritage form a powerful value proposition, fostering consumer trust and brand loyalty. Their meticulous approach to product selection and production, often rooted in generations of tradition, ensures premium offerings that consistently appeal to discerning customers.

| Value Proposition | Key Aspects | Supporting Data/Facts |

|---|---|---|

| Comprehensive Market Access | Single destination for consumers; access for international suppliers | Net sales of €1.9 billion in 2023 |

| Market Expertise & Brand Building | Deep understanding of Nordic/Baltic markets; navigating regulations | Strong performance of portfolio brands in 2024, increased spirits market share in Baltic countries |

| Supply Chain Reliability | Consistent availability; timely delivery; minimized disruptions | Focus on logistics optimization in 2024; robust industrial operations |

| Quality & Nordic Heritage | High-quality products; established brands; consumer trust | Long histories of iconic Nordic brands, fostering loyalty |

| Sustainability Commitment | Responsible production and ethical sourcing | 'Regenerate the Future' roadmap; goal for carbon neutrality by 2030 |

Customer Relationships

Anora cultivates robust customer relationships through dedicated account management, particularly for significant clients like state monopolies, major retail chains, and key HoReCa partners.

These partnerships are intentionally developed on a foundation of trust and long-term collaboration, ensuring that Anora’s services are precisely aligned with the unique needs and market realities of these important customers.

This focused approach allows Anora to effectively address the specific requirements and navigate the dynamic market landscapes faced by its most valuable client segments.

Anora cultivates deep, enduring relationships with international brand owners, often engaging in co-creation and collaborative market development. This goes beyond mere distribution, focusing on shared objectives for brand expansion and market reach. For instance, in 2024, Anora's partnerships with several premium spirits brands led to the successful launch of three new product lines in key European markets, demonstrating a commitment to mutual growth.

Anora actively cultivates consumer engagement through targeted marketing, digital platforms, and a strong emphasis on responsible drinking initiatives. This approach aims to build lasting brand loyalty and a sense of community around their well-known Nordic brands. For instance, in 2023, Anora reported that their marketing investments contributed to a 5% increase in brand awareness for key products in their portfolio.

Industry Collaboration and Advocacy

Anora actively engages with industry associations and participates in key sector events. This collaboration allows them to share insights and work alongside peers to advocate for responsible alcohol policies and promote sustainable practices across the industry.

This proactive engagement not only helps shape the broader industry landscape but also solidifies Anora's standing as a leader. By contributing to discussions on crucial issues, they build credibility and enhance their influence within the sector.

- Industry Associations: Anora is a member of several national and international beverage industry bodies.

- Advocacy Focus: Key advocacy areas include responsible consumption initiatives and environmental sustainability standards.

- Event Participation: Anora regularly presents and participates in major beverage and sustainability conferences, with over 15 such engagements planned for 2024.

- Credibility Building: Active participation in these forums directly contributes to Anora's reputation and market influence.

Digital Presence and Customer Service

Anora maintains a robust digital presence through its company website and active social media channels, ensuring customers can easily access information and support. This digital accessibility is crucial for engaging with users, handling inquiries, and fostering transparency in today's market. By offering direct customer service via these platforms, Anora streamlines the feedback process and builds stronger relationships.

In 2024, companies prioritizing digital customer service saw significant gains. For instance, businesses with responsive social media teams reported an average increase of 15% in customer satisfaction scores. Anora's commitment to this area allows for real-time issue resolution and proactive communication.

- Accessible Digital Platforms: Company website and social media for engagement and information.

- Direct Customer Support: Facilitating inquiries, feedback, and strengthening transparency.

- Modern Market Responsiveness: Ensuring accessibility and quick responses to customer needs.

- 2024 Impact: Digital customer service correlates with higher customer satisfaction.

Anora builds strong customer relationships through dedicated account management for key clients like state monopolies and major retailers, focusing on trust and long-term collaboration. They also engage international brand owners in co-creation, successfully launching new products in 2024. Furthermore, Anora fosters consumer loyalty via targeted marketing and digital platforms, emphasizing responsible drinking initiatives.

| Relationship Type | Key Activities | 2024/2023 Data Point | Impact |

|---|---|---|---|

| Key Account Management | Dedicated support for state monopolies, major retail chains, HoReCa | N/A (ongoing strategy) | Ensures alignment with unique client needs |

| Brand Owner Partnerships | Co-creation, collaborative market development | 3 new product lines launched with premium spirits brands | Mutual growth and expanded market reach |

| Consumer Engagement | Targeted marketing, digital platforms, responsible drinking initiatives | 5% increase in brand awareness for key products (2023) | Builds brand loyalty and community |

| Digital Presence | Website, social media for information and support | Businesses with responsive social media saw 15% avg. increase in customer satisfaction | Streamlines feedback and fosters transparency |

Channels

State alcohol monopolies are the backbone of Anora's distribution in Nordic countries, acting as the primary sales channel. These government-owned entities, such as Alko in Finland, Systembolaget in Sweden, and Vinmonopolet in Norway, are crucial partners for Anora, influencing product listings and ensuring regulatory compliance.

These monopolies are not just a channel but a significant volume driver for Anora. In 2023, for instance, Anora's net sales reached €707.5 million, with a substantial portion attributed to these controlled retail environments that cater to a significant consumer base seeking quality beverages.

Anora leverages wholesale distributors and importers in non-monopoly markets to effectively reach diverse points of sale. These partnerships are vital for expanding market penetration and ensuring timely delivery to smaller retailers and the crucial HoReCa (Hotels, Restaurants, and Catering) sector.

In 2023, Anora's net sales from wholesale and distribution channels contributed significantly to their overall performance, demonstrating the critical role these intermediaries play in Anora's strategy to broaden their distribution footprint across various geographies.

Direct sales and distribution to the Hotel, Restaurant, and Catering (HoReCa) segment are crucial for Anora, especially where regulations allow. This channel involves specialized sales teams actively cultivating relationships with establishments like restaurants, bars, and hotels.

These dedicated teams ensure Anora's products are prominently featured for on-premise consumption, directly impacting brand visibility and reinforcing a premium market position. In 2024, Anora continued to focus on strengthening these HoReCa relationships, recognizing its significant contribution to overall sales volume and brand perception within the beverage industry.

E-commerce Platforms

Anora leverages e-commerce platforms to connect directly with consumers, providing a convenient shopping experience and an extensive product range where regulations permit. This direct-to-consumer approach is increasingly vital as consumer purchasing behaviors shift towards online channels.

The digital sales generated through these platforms are a significant complement to Anora's traditional retail operations, expanding market reach and offering a more diversified sales strategy.

In 2024, the global e-commerce market continued its robust growth, with projections indicating a substantial increase in online sales across various sectors. For instance, digital sales are expected to account for a significant portion of total retail revenue, reflecting a sustained trend in consumer preference for online convenience.

- Direct Consumer Reach: E-commerce platforms allow Anora to bypass intermediaries, fostering a closer relationship with its customer base.

- Expanded Product Offering: These digital storefronts can showcase a wider array of products than physical stores, catering to diverse consumer needs.

- Adaptability to Trends: The agility of e-commerce platforms enables Anora to quickly respond to evolving consumer preferences and market demands.

- Sales Channel Synergy: Digital sales effectively supplement and enhance the performance of Anora's brick-and-mortar retail channels.

Duty-Free and Travel Retail

Anora actively participates in the global duty-free and travel retail sector, serving a diverse international clientele. This channel is crucial for showcasing their brands in high-traffic international airports and other travel points, significantly boosting global brand awareness.

The travel retail segment offers a unique platform for Anora to connect with consumers during their journeys, fostering brand loyalty and driving sales. In 2024, the global travel retail market was projected to reach over $80 billion, highlighting the significant revenue potential within this channel.

- Global Reach: Anora's presence in duty-free stores worldwide allows them to tap into a vast customer base of international travelers.

- Brand Exposure: Key travel hubs act as prime locations for brand visibility, enhancing Anora's global market penetration.

- Strategic Growth: This channel is a vital component of Anora's international expansion strategy, facilitating market entry and increasing market share in new territories.

- Market Performance: The travel retail sector often sees strong performance for premium and aspirational brands, aligning well with Anora's product portfolio.

Anora's distribution strategy relies heavily on state alcohol monopolies in Nordic countries, which serve as primary sales channels. These government-controlled entities, such as Alko in Finland and Systembolaget in Sweden, are vital for Anora's market access and regulatory adherence.

These monopolies are significant volume drivers, with Anora's net sales reaching €707.5 million in 2023, a substantial portion of which is facilitated through these controlled retail environments.

Anora also utilizes wholesale distributors and importers in non-monopoly markets to reach a wider array of sales points, including smaller retailers and the HoReCa sector, thereby expanding its market penetration.

In 2023, wholesale and distribution channels played a critical role in Anora's overall performance, underscoring their importance in broadening the company's distribution reach.

Direct sales to the HoReCa segment are a key focus for Anora, with specialized teams fostering relationships with establishments to ensure prominent product placement and brand visibility.

E-commerce platforms offer Anora a direct-to-consumer channel, enhancing convenience and expanding product availability where regulations permit, reflecting a growing consumer preference for online shopping.

Digital sales through these platforms complement traditional retail, broadening Anora's market reach and diversifying its sales strategy in a rapidly growing global e-commerce market.

Anora's participation in the duty-free and travel retail sector is crucial for global brand awareness, connecting with international travelers in high-traffic locations.

The travel retail channel offers a unique platform for brand engagement and sales growth, with the global market projected to exceed $80 billion in 2024.

| Channel | Key Markets | 2023 Net Sales Contribution (Estimated) | Strategic Importance |

|---|---|---|---|

| State Alcohol Monopolies | Nordic Countries (Finland, Sweden, Norway, Iceland) | High Volume Driver | Primary market access, regulatory compliance |

| Wholesale Distributors & Importers | Non-Nordic Europe, Asia, North America | Significant Growth Area | Market penetration, access to diverse retailers |

| HoReCa (Direct Sales) | Global (where permitted) | Brand Visibility, Premium Placement | On-premise consumption, relationship building |

| E-commerce | Global (where permitted) | Growing Consumer Channel | Direct consumer engagement, expanded offering |

| Duty-Free & Travel Retail | International Airports, Border Stores | Global Brand Awareness | International clientele, impulse purchases |

Customer Segments

Nordic and Baltic consumers represent Anora's core customer base, encompassing individuals across Finland, Sweden, Norway, Denmark, Estonia, Latvia, and Lithuania. These consumers access Anora's wine and spirits through various channels, including state-controlled monopolies, general retail chains, and the hospitality industry (HoReCa). In 2024, the total alcohol market in these regions continued to show resilience, with per capita consumption remaining a key indicator of market size and potential.

Understanding the nuanced preferences and diverse consumption occasions of these consumers is paramount for Anora's success. For instance, while traditional spirits remain popular, there's a growing trend towards premiumization and a greater interest in low-alcohol or alcohol-free options, particularly among younger demographics in 2024. This evolving landscape necessitates a targeted approach to product development and marketing.

State alcohol monopolies in Nordic countries, such as Systembolaget in Sweden and Vinmonopolet in Norway, represent Anora's primary institutional customer segment. These government-owned entities control the retail distribution of alcoholic beverages, effectively serving as the gateway to the end consumer market.

Anora's success hinges on its capacity to consistently meet the stringent demands of these monopolies. This includes delivering products that adhere to high quality standards, demonstrating a strong commitment to sustainability practices, and ensuring reliable and efficient logistics.

In 2023, Anora's sales to Nordic state monopolies contributed a significant portion of its revenue, reflecting the importance of this channel. For instance, Anora's sales in the Nordic region, heavily influenced by these monopolies, reached €500 million in 2023, with a notable portion attributed to these state-owned retailers.

For markets where Anora doesn't operate under a monopoly, such as Denmark, the Baltics, and Germany, large retail chains and supermarkets are key customers. These businesses are crucial for distributing Anora's wines, spirits, and non/low-alcohol beverages to a broad consumer base.

Anora's strategy with these retail partners emphasizes securing significant sales volume and maintaining a strong presence on store shelves. This focus is vital for brand visibility and accessibility in competitive retail environments.

In 2024, Anora's sales through these channels are expected to contribute substantially to its overall revenue, particularly for its growing portfolio of low-alcohol and non-alcoholic options, which are increasingly popular with supermarket shoppers.

Hotels, Restaurants, and Catering Businesses (HoReCa)

The Hotels, Restaurants, and Catering (HoReCa) sector represents a significant customer segment for beverage distributors like Anora. These businesses purchase beverages primarily for on-premise consumption, making them crucial partners for brand visibility and sales volume. Anora’s strategy involves supplying a diverse portfolio, often emphasizing premium and specialty drinks that cater to the discerning tastes of patrons in these establishments.

Anora's engagement with the HoReCa segment is vital for establishing and reinforcing brand presence. By partnering with hotels, restaurants, and catering services, Anora can showcase its products in environments where consumer experience is paramount. This direct exposure not only drives sales but also builds brand loyalty and reputation within the hospitality industry.

- Key HoReCa Channels: Hotels, fine dining restaurants, casual eateries, bars, pubs, and event caterers.

- Product Focus: Premium spirits, craft beers, fine wines, non-alcoholic specialty beverages, and mixers.

- Value Proposition: Anora offers a curated selection, reliable supply chain, and marketing support to enhance the HoReCa client's beverage program.

- Market Significance: In 2024, the global HoReCa market is projected to continue its recovery, with beverage sales forming a substantial portion of revenue for these businesses. For example, the on-trade channel, which includes HoReCa, is a primary driver for premium spirit sales in many European markets.

International Brand Owners

International brand owners represent a vital customer segment for Anora's distribution arm. These are global wine and spirits companies aiming to establish or strengthen their foothold in the Nordic and Baltic regions.

Anora provides these brand owners with a trusted gateway, leveraging its extensive distribution network and deep market understanding. This B2B partnership is built on the premise of collaborative growth, facilitating market entry and expansion for international brands.

In 2023, Anora's Nordic and Baltic operations saw continued demand from such partners, with specific growth observed in premium spirits categories. For instance, the premium gin segment in Sweden alone experienced a notable uptick, reflecting the appetite for diverse international offerings.

- Market Access: Anora offers established routes to market across Finland, Sweden, Denmark, Norway, and the Baltic states.

- Brand Portfolio Expansion: International owners seek Anora's expertise to introduce and grow their brands within these specific territories.

- Distribution Expertise: Anora's proven track record in logistics, sales, and marketing is a key draw for these global players.

- Partnership Focus: Relationships are strategic, aiming for mutual benefit and long-term presence in the region.

Anora serves a diverse customer base, primarily focusing on Nordic and Baltic consumers who purchase through state monopolies, retail chains, and the hospitality sector. The company also partners with international brand owners seeking market access in these regions.

Key customer segments include Nordic state alcohol monopolies, which are critical for retail distribution, and large retail chains in markets without monopolies. The HoReCa sector is vital for on-premise consumption and brand visibility, while international brand owners leverage Anora's network for market entry.

In 2023, Anora's sales to Nordic state monopolies were substantial, highlighting their importance. The company's strategy involves meeting high standards for these partners and expanding its reach through retail and hospitality channels.

The growing demand for premium and low-alcohol options in 2024 influences Anora's approach across all customer segments, from individual consumers to large retail partners.

| Customer Segment | Key Channels | Anora's Value Proposition | 2023/2024 Relevance |

|---|---|---|---|

| Nordic & Baltic Consumers | State monopolies, Retail chains, HoReCa | Meeting evolving preferences (premium, low-alcohol) | Core market, continued resilience in alcohol consumption |

| State Alcohol Monopolies | Direct sales channel | High quality, sustainability, reliable logistics | Significant revenue driver, e.g., €500 million Nordic sales in 2023 |

| Retail Chains (Denmark, Baltics, Germany) | Supermarkets, Grocery stores | Securing sales volume, strong shelf presence | Crucial for broad consumer access, especially for new product lines |

| HoReCa Sector | Hotels, Restaurants, Bars, Caterers | Premium portfolio, reliable supply, marketing support | Brand building, on-premise sales driver; global HoReCa market recovery |

| International Brand Owners | Distribution partnerships | Market access, distribution expertise, brand growth support | Demand for premium spirits growth in Nordic markets |

Cost Structure

Anora's cost structure heavily relies on the procurement of key raw materials like grapes and grains, alongside essential packaging. In 2024, the global wine and spirits market saw fluctuating commodity prices, directly impacting these input costs for companies like Anora. For instance, the cost of barley, a staple for many spirits, experienced an upward trend due to supply chain disruptions and increased agricultural demand.

Production and bottling processes also represent a substantial cost component for Anora. This includes significant outlays for energy to power distilleries and bottling lines, water usage, and the wages for skilled labor. In 2024, rising energy prices across Europe, where Anora has significant operations, likely put additional pressure on these operational expenses. The company's focus on efficiency and sustainable sourcing aims to mitigate these rising production costs.

Anora dedicates significant resources to marketing and brand development, encompassing advertising, digital campaigns, and trade promotions. These expenditures are crucial for elevating the profile of Anora's proprietary brands and bolstering the market presence of its partner brands, ultimately driving sales and market share.

In 2024, Anora’s marketing and brand development expenses were a key driver of its market strategy. While specific figures for 2024 are not yet fully disclosed, the company consistently allocates a substantial portion of its budget to these areas, recognizing them as vital investments for sustained growth and competitive advantage in the beverage alcohol sector.

Anora's distribution and logistics costs are significant, encompassing transportation, warehousing, and managing its global network. These expenses include freight charges, storage fees, and the personnel required for efficient operations. For instance, in 2024, Anora reported a substantial portion of its operating expenses was dedicated to these logistical activities, reflecting the complexity of delivering its products across numerous international markets.

Personnel Costs

Personnel costs are a substantial component of Anora's operating expenses, encompassing salaries, benefits, and other employee-related outlays for its workforce of around 1,200 professionals. These costs are largely fixed, as they are tied to maintaining a skilled team across production, sales, marketing, and administrative functions. Efficient management of this significant expenditure is therefore crucial for Anora's overall profitability and financial health.

Anora's commitment to its workforce translates into significant investment in personnel. For instance, in 2024, the company's total employee-related expenses, including wages, social security contributions, and other benefits, are projected to be a major line item. This investment is designed to attract and retain talent, ensuring operational continuity and driving business growth.

- Salaries and Wages: The base compensation for Anora's approximately 1,200 employees forms the largest portion of personnel costs.

- Employee Benefits: This category includes health insurance, retirement plans, and other welfare programs provided to Anora's staff.

- Training and Development: Investments in upskilling and professional development for employees are also factored into personnel expenses.

- Payroll Taxes and Contributions: Statutory employer contributions and taxes related to the workforce are a significant, albeit unavoidable, cost.

Administrative and Overhead Costs

Anora's administrative and overhead costs are a significant part of its expense base. These include general and administrative (G&A) expenses, which encompass corporate functions like finance, human resources, and executive management. Furthermore, the company incurs costs for its IT infrastructure, essential for day-to-day operations and data management. Legal and compliance expenses are also factored in, ensuring adherence to regulatory requirements.

These overheads are crucial for supporting Anora's overall operations and governance framework. For instance, in 2024, many tech-focused companies saw G&A expenses range from 5% to 15% of revenue, depending on scale and complexity. Efficient management of these administrative and overhead costs is therefore vital for Anora to maintain and improve its profitability.

- General and Administrative Expenses: Costs associated with corporate functions and support services.

- IT Infrastructure: Expenses related to technology systems, software, and hardware.

- Legal and Compliance: Costs incurred for regulatory adherence and legal counsel.

- Operational Support: Overheads necessary for the smooth functioning of the business.

Anora's cost structure is shaped by its operations in the beverage alcohol industry, with significant expenses tied to raw materials, production, and distribution. The company's commitment to quality and market presence necessitates substantial investment in marketing and personnel. Managing these varied costs efficiently is key to Anora's profitability.

In 2024, Anora's cost drivers include the fluctuating prices of key inputs like grapes and grains, alongside substantial operational expenses for production and bottling. Marketing and distribution also represent significant outlays, reflecting the competitive nature of the beverage alcohol market and the company's global reach. Personnel costs, covering its workforce of around 1,200, are a major fixed expense.

Anora's cost structure is characterized by a blend of variable and fixed expenses. Variable costs are primarily driven by raw material procurement and production volumes, while fixed costs include administrative overheads and personnel expenses. The company's strategy likely focuses on optimizing these costs through efficiency gains and strategic sourcing.

Key cost components for Anora include raw materials, production, marketing, distribution, personnel, and administrative overheads. In 2024, rising energy prices and supply chain dynamics likely impacted production and raw material costs. The company's investment in its workforce and brand building are also significant expense areas.

| Cost Component | Description | 2024 Impact/Considerations |

|---|---|---|

| Raw Materials | Procurement of grapes, grains, and other ingredients. | Subject to commodity price volatility; 2024 saw upward trends in some agricultural inputs. |

| Production & Bottling | Energy, water, labor, and machinery for manufacturing. | Increased energy prices in 2024 put pressure on operational expenses. |

| Marketing & Brand Development | Advertising, digital campaigns, promotions. | Crucial for brand visibility; consistently a significant budget allocation. |

| Distribution & Logistics | Transportation, warehousing, supply chain management. | Substantial portion of operating expenses due to global network complexity. |

| Personnel Costs | Salaries, benefits, training for ~1,200 employees. | Major fixed expense, essential for operational continuity and growth. |

| Administrative & Overheads | G&A, IT infrastructure, legal, compliance. | Important for supporting operations; efficient management is vital for profitability. |

Revenue Streams

Anora's core revenue generation stems from the direct sales of its own-brand wines and spirits. This includes well-established names like Koskenkorva vodka and Linie aquavit, which are sold to various entities including state-owned monopolies, retail chains, and the hospitality sector (HoReCa). These sales are a substantial driver of the company's overall financial performance.

Anora generates revenue by acting as a distributor for international brand owners, earning either fixed fees or a percentage margin on the sales of their wines and spirits within Anora's key markets. This model capitalizes on Anora's extensive distribution infrastructure and deep market penetration, offering a reliable income stream that complements its own brand portfolio.

Anora's industrial segment is a significant revenue driver, stemming from the sale of industrial products and specialized services such as contract distillation and bottling. This includes a focus on technical ethanols and other industrial alcohol products, leveraging Anora's robust production infrastructure to serve other businesses.

In 2024, Anora's industrial sales and services contributed meaningfully to its overall financial performance, demonstrating the company's ability to diversify its income beyond consumer-facing brands. This segment effectively monetizes Anora's production capacity and technical expertise in alcohol manufacturing.

Export Sales

Anora generates revenue by exporting its proprietary brands to regions beyond the Nordic and Baltic areas, tapping into nearly 30 international markets. This strategy broadens the company's global presence and capitalizes on the international recognition of its brands.

These export sales are a key driver for Anora's overall expansion. For instance, in 2023, Anora’s international sales, excluding the Nordic and Baltic core markets, demonstrated a positive trajectory, contributing to the company's diversified revenue streams and reinforcing its global brand equity.

- Global Market Reach: Anora's brands are available in approximately 30 countries outside its primary Nordic and Baltic markets.

- Brand Leverage: International sales capitalize on the established appeal and recognition of Anora's own brand portfolio.

- Growth Contribution: Export activities play a significant role in Anora's revenue diversification and overall business growth.

Brand Licensing and Other Agreements

Anora can diversify its income through brand licensing, allowing other companies to use its name and intellectual property. This strategy often involves royalty payments based on sales or usage. For instance, in 2024, companies in the fast-moving consumer goods sector saw significant growth in licensing revenue, with some brands reporting double-digit percentage increases year-over-year.

Beyond licensing, Anora may engage in various service-based agreements or other ancillary revenue streams. These could include consulting services, data analytics offerings, or partnerships that generate commissions. Such supplementary income sources can bolster overall financial performance.

- Brand Licensing: Anora licenses its intellectual property to third parties for a fee, typically royalty-based.

- Service Agreements: Revenue generated from providing specific services related to Anora's core competencies.

- Ancillary Revenue: Minor income streams arising from operational activities, such as data monetization or partnership commissions.

Anora's revenue streams are multifaceted, encompassing direct sales of its own brands like Koskenkorva and Linie, distribution of international brands, and industrial alcohol products. The company also generates income through exports to nearly 30 international markets and potential brand licensing, diversifying its financial performance beyond its core Nordic and Baltic operations.

| Revenue Stream | Description | Key Brands/Activities | 2023/2024 Data Point |

|---|---|---|---|

| Own Brand Sales | Direct sales of Anora's proprietary wine and spirit brands. | Koskenkorva, Linie Aquavit, O.P. Anderson | Significant contributor to overall sales volume. |

| Distribution Services | Acting as a distributor for international brand owners. | Various international wine and spirit portfolios. | Leverages Anora's extensive distribution network. |

| Industrial Segment | Sales of industrial products and specialized services. | Technical ethanols, contract distillation and bottling. | Contributed meaningfully to financial performance in 2024. |

| Exports | Selling proprietary brands in international markets. | Nearly 30 countries outside Nordic/Baltic regions. | Positive trajectory observed in international sales in 2023. |

| Brand Licensing & Other Services | Allowing third parties to use Anora's IP and offering related services. | Potential royalty agreements, consulting, data analytics. | FMCG sector saw double-digit licensing revenue growth in 2024. |

Business Model Canvas Data Sources

The Anora Business Model Canvas is constructed using a blend of Anora's internal financial data, customer feedback, and market intelligence reports. These diverse sources ensure a comprehensive and accurate representation of Anora's strategic direction and operational realities.