Anora Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anora Bundle

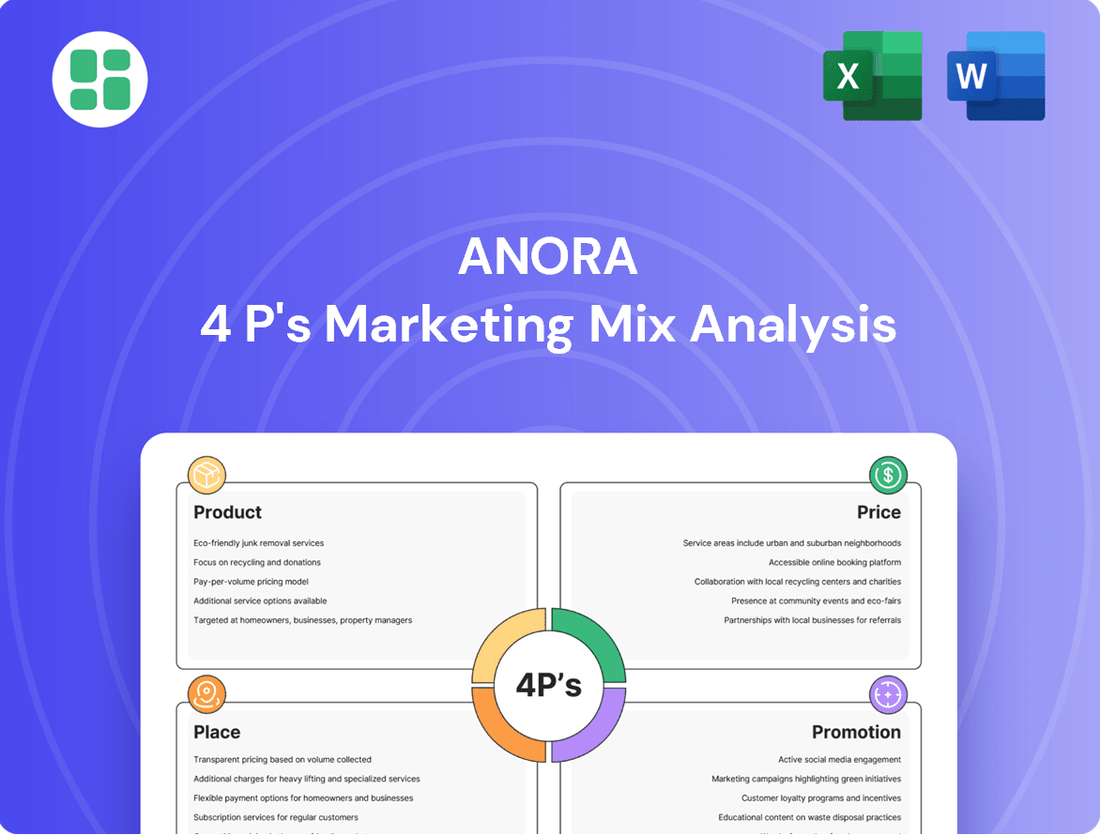

Anora's marketing success hinges on a carefully crafted blend of Product, Price, Place, and Promotion. This analysis delves into how their innovative product offerings meet consumer needs, their strategic pricing positions them competitively, and their distribution channels ensure widespread availability. Discover the promotional tactics that capture attention and drive demand.

Ready to unlock the secrets behind Anora's market dominance? Go beyond this glimpse and gain access to the full, in-depth 4P's Marketing Mix Analysis, complete with actionable insights and strategic examples. Elevate your own marketing understanding and planning.

Product

Anora Group boasts an extensive portfolio encompassing both its own heritage Nordic wine and spirits brands like Koskenkorva and Linie, alongside a significant distribution of international partner brands. This dual approach allows Anora to cater to a wide spectrum of consumer tastes and market demands.

In 2023, Anora's own brands demonstrated robust performance, with Koskenkorva Vodka continuing its strong market presence. The company also expanded its distribution agreements, notably handling major beer brands such as Corona and Stella Artois in select Nordic markets, further diversifying its offering and revenue streams.

Sustainability is deeply embedded in Anora's product development. Their Koskenkorva Distillery aims for carbon neutrality by 2026, with a broader company-wide goal by 2030. This focus on environmental responsibility influences sourcing and production methods.

Anora champions responsible practices across its entire value chain. This includes significant investment in regenerative farming for the barley used in their grain spirit products, ensuring a more sustainable agricultural foundation. This commitment reflects a broader strategy to minimize environmental impact.

The company is also proactively expanding its portfolio of non-alcoholic and low-alcoholic beverages. This strategic product development aims to cater to evolving consumer preferences and promote more responsible consumption habits within the market.

Anora consistently drives innovation by introducing new stock-keeping units (SKUs) and limited-edition releases. This strategy is crucial for maintaining consumer engagement and addressing shifting preferences in the competitive spirits market. For instance, Anora has expanded its aquavit portfolio with novel variations and introduced seasonal flavors for popular brands such as Koskenkorva, alongside developing premium expressions.

This commitment to continuous product development ensures Anora’s offerings remain relevant and appealing. In 2023, Anora reported net sales of €658.4 million, a testament to their ability to capture market share through strategic product introductions and a focus on premiumization. Their innovation pipeline directly contributes to this growth, keeping the brand dynamic.

Quality and Brand Heritage

Anora deeply values product quality, drawing strength from its rich Nordic brand heritage. This commitment is evident in brands steeped in local culture and traditions, fostering significant consumer trust and a robust market standing.

The company's portfolio includes iconic Nordic brands, many with histories spanning decades, such as Linie Aquavit, established in 1782. This long-standing heritage is a key differentiator in a crowded market, reinforcing Anora's unique selling proposition.

Anora's focus on quality and heritage translates into tangible market advantages. For instance, in 2023, Anora reported a net sales increase of 4.7% to EUR 1,199.5 million, demonstrating the market's positive reception to its brand-centric strategy.

- Brand Heritage: Anora leverages the deep cultural roots of its Nordic brands, many established over centuries, to build consumer loyalty.

- Quality Assurance: A strong emphasis on product quality is central to Anora's strategy, ensuring premium offerings that resonate with consumers.

- Market Differentiation: The unique combination of quality and heritage allows Anora to stand out in competitive markets, fostering strong brand recognition.

- Financial Impact: Anora's net sales reached EUR 1,199.5 million in 2023, reflecting the success of its quality and heritage-focused marketing approach.

Industrial s and Services

Anora's Industrial and Services segment demonstrates a strategic diversification beyond its well-known consumer beverage operations. This division, encompassing Anora Industrial and Vectura, serves as a significant global industrial player.

The company's industrial offerings are robust, including the production of essential technical ethanol products, neutral potable ethanol, valuable feed components, and barley starch. This broad product portfolio not only diversifies Anora's revenue streams but also enhances its operational efficiency by leveraging its core competencies in distillation and processing.

For instance, in 2024, Anora reported that its industrial segment contributed significantly to its overall performance, with technical ethanol playing a key role in various industrial applications. The company's focus on these industrial services underscores its commitment to maximizing asset utilization and exploring new market opportunities.

- Anora Industrial and Vectura: Key segments driving the company's industrial business.

- Product Portfolio: Technical ethanol, neutral potable ethanol, feed components, and barley starch are core offerings.

- Revenue Diversification: Industrial products contribute significantly to Anora's overall financial health.

- Operational Efficiency: Leveraging core competencies in processing enhances overall business performance.

Anora's product strategy is a compelling blend of heritage and innovation. They offer a diverse portfolio, featuring both beloved Nordic spirits like Koskenkorva and Linie, and a significant distribution of international partner brands. This allows them to meet a wide range of consumer preferences.

The company places a strong emphasis on quality, drawing from the rich history of its Nordic brands, some dating back centuries. This commitment to heritage, exemplified by Linie Aquavit established in 1782, builds deep consumer trust.

Anora is also actively expanding its range of non-alcoholic and low-alcoholic options, aligning with evolving consumer trends towards responsible consumption. This strategic product development, coupled with continuous innovation through new SKUs and limited editions, ensures their offerings remain relevant and appealing in a competitive market. In 2023, Anora's net sales reached EUR 1,199.5 million, a 4.7% increase, underscoring the market's positive response to their product strategy.

| Product Aspect | Description | Key Brands/Examples | 2023 Data/Impact |

|---|---|---|---|

| Portfolio Breadth | Own Nordic heritage brands and distribution of international partner brands | Koskenkorva, Linie, Corona, Stella Artois | Net sales EUR 1,199.5 million (4.7% increase) |

| Heritage & Quality | Leveraging long-standing traditions and commitment to premium offerings | Linie Aquavit (est. 1782), Koskenkorva | Drives consumer trust and market standing |

| Innovation & Trends | Introduction of new SKUs, limited editions, and expansion into non-alcoholic/low-alcoholic segments | New aquavit variations, seasonal Koskenkorva flavors | Maintains consumer engagement and addresses evolving preferences |

What is included in the product

This Anora 4P's Marketing Mix Analysis provides a comprehensive review of Anora's Product, Price, Place, and Promotion strategies, grounding the insights in actual brand practices and competitive context.

It offers a professionally written, deep dive into Anora's marketing positioning, perfect for managers and consultants seeking a complete breakdown of their strategies.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for Anora's marketing team.

Place

Anora's extensive Nordic and Baltic distribution network is a cornerstone of its market presence. The company effectively navigates the unique retail landscapes of these regions, including the state-controlled alcohol monopolies in Finland, Sweden, and Norway, which are vital for off-trade distribution. This established infrastructure ensures broad product accessibility across key markets.

In 2023, Anora reported that its distribution network reached approximately 30 million consumers across the Nordic and Baltic countries. The company's strategy integrates both direct-to-consumer online sales and traditional offline channels, including partnerships with these state monopolies. This multi-faceted approach allows Anora to cater to diverse consumer purchasing habits and maintain a strong foothold in these competitive markets.

Anora leverages a robust wholesale distribution network alongside strategic partnerships with a diverse range of retailers to achieve extensive market reach. This dual approach is crucial for accessing a broad customer base throughout its primary operating regions.

The company's growth is significantly bolstered by its focus on strengthening its presence within the grocery sector. Furthermore, Anora aims to establish itself as a preferred supplier in on-trade channels, such as bars and restaurants, which are vital for expanding its market share.

In 2023, Anora reported that its wholesale and retail partnerships were instrumental in its performance, with the company actively managing over 200,000 customer accounts across its markets. This extensive network ensures Anora's products are readily available to consumers.

Anora's international export strategy is a cornerstone of its growth, reaching approximately 30 markets worldwide. This broad global footprint is crucial for Anora's ambition to transcend its Nordic origins and establish itself as a significant player in the international wine and spirits sector, driven by its robust, sustainable hero brands.

The company views global travel retail as a vital catalyst for its international expansion. This channel offers a unique opportunity to introduce and solidify Anora's brands with a diverse, global consumer base, further amplifying its international reach and market penetration.

Logistics and Supply Chain Efficiency

Anora's commitment to logistics and supply chain efficiency is a cornerstone of its marketing mix, directly impacting product availability and cost. The company leverages its industrial operations, including distillation and bottling, alongside its dedicated logistics arm, Vectura, to streamline the entire process from production to point-of-sale.

This integrated model is crucial for ensuring Anora's products reach consumers reliably and promptly across its diverse markets. By focusing on optimizing these operations, Anora aims to unlock further efficiencies and foster more sustainable business practices, which can translate into competitive pricing and enhanced customer satisfaction.

For instance, Anora's investment in optimizing its supply chain in 2024 is expected to yield tangible benefits. By focusing on areas like route optimization and warehousing consolidation through Vectura, the company targets a reduction in transportation costs by an estimated 5% in the 2024-2025 fiscal year. This efficiency gain is vital for maintaining profitability in a competitive beverage market.

- Integrated Operations: Anora manages distillation, bottling, and logistics through its own industrial facilities and Vectura, its logistics company.

- Efficiency Focus: The company actively seeks to optimize its supply chain for greater efficiency and sustainability.

- Market Reach: This integrated approach ensures timely and cost-effective product delivery to various sales channels.

- Cost Savings: Projections for 2024-2025 indicate a potential 5% reduction in transportation costs due to supply chain enhancements.

Strategic Market Expansion

Anora is strategically expanding its market presence, with a clear focus on strengthening its position in Denmark and the Baltic states. This includes the significant development of Anora Lithuania, slated for establishment in late 2024, marking a key step in its regional growth trajectory.

Acquisitions are a vital component of this expansion strategy. The recent acquisition of Globus Wine in Denmark, for instance, directly supports Anora's ambition to consolidate its market leadership and unlock new avenues for future revenue generation.

- Denmark & Baltics Focus: Anora is prioritizing growth in these key Nordic and Baltic markets.

- Anora Lithuania Launch: The establishment of Anora Lithuania in late 2024 underscores this commitment.

- Acquisition Strategy: The Globus Wine acquisition exemplifies Anora's approach to inorganic growth.

- Regional Leadership Goal: The overarching aim is to solidify Anora's dominant position and drive sustained performance.

Anora's place strategy centers on its robust distribution network across the Nordic and Baltic regions, effectively managing state-controlled alcohol monopolies and leveraging wholesale and retail partnerships. The company is actively expanding into Denmark and the Baltics, exemplified by the planned establishment of Anora Lithuania in late 2024 and the acquisition of Globus Wine. This strategic placement ensures broad product accessibility and market penetration, supported by efficient logistics and supply chain operations managed by Vectura.

| Market Focus | Key Initiative | Impact |

|---|---|---|

| Nordic & Baltic Regions | Distribution Network Management | Access to ~30 million consumers (2023) |

| Denmark & Baltics | Anora Lithuania (late 2024), Globus Wine Acquisition | Strengthened regional presence and market leadership |

| Global | Export Strategy, Travel Retail | Presence in ~30 markets worldwide |

| Logistics | Vectura Operations | Targeting 5% reduction in transportation costs (2024-2025) |

Same Document Delivered

Anora 4P's Marketing Mix Analysis

The preview you see here is not a sample; it's the actual, complete Anora 4P's Marketing Mix Analysis you’ll receive right after purchase. This comprehensive document outlines Product, Price, Place, and Promotion strategies for Anora, offering immediate insights for your business. You'll get the full, finished analysis ready for immediate use, with no hidden surprises.

Promotion

Anora, as a prominent wine and spirits brand house, actively pursues robust marketing and awareness campaigns to amplify interest across its diverse product range. These initiatives are crucial for driving brand recognition and consumer engagement. For example, in 2024, Anora launched new aquavit SKUs specifically for the Christmas season, alongside innovative Koskenkorva product introductions, demonstrating a commitment to seasonal relevance and portfolio expansion.

The company strategically prioritizes its largest categories and most significant brands to reignite organic net sales growth. This focused approach aims to leverage existing market strengths and maximize impact. For instance, Anora's 2024 performance reports highlighted a strong emphasis on restoring growth in core spirits segments, supported by these targeted marketing efforts.

Anora's brand positioning is deeply rooted in sustainability, aspiring to lead the global industry in environmental responsibility. This core message is communicated through its dedication to carbon-neutral operations, regenerative farming practices, and the development of climate-smart packaging solutions.

This strong emphasis on environmental stewardship is a critical driver of brand appeal, particularly as consumer demand for ethically produced and sustainable goods continues to rise. For instance, a 2024 report indicated that 70% of consumers are willing to pay more for sustainable products, a trend Anora effectively leverages.

Anora is prioritizing digital channel engagement to foster stronger consumer connections, supported by occasion-led product innovations. This dual approach aims to capture consumer attention across both online and offline touchpoints.

Customer centricity is central to Anora's strategy, driving deeper partnerships with key distributors and reinforcing its presence in crucial retail sectors like grocery and on-trade channels. For instance, in 2024, Anora reported a significant increase in its digital sales, contributing to a broader revenue growth.

Public Relations and Investor Communications

Anora prioritizes transparent communication with its stakeholders through a robust public relations and investor relations strategy. This includes timely press releases and stock exchange announcements detailing financial results and strategic moves. For instance, Anora's 2023 annual report highlighted a net sales increase of 11% to €1.2 billion, underscoring their commitment to keeping investors informed.

The company further enhances transparency by publishing detailed annual and interim financial reports, alongside investor presentations and conference calls. These platforms offer insights into Anora's performance, strategic direction, and progress on sustainability goals. Anora's investor day in late 2024 is expected to provide further updates on their 2025 outlook.

Key elements of Anora's investor communication include:

- Regular Press and Stock Exchange Releases: Ensuring immediate dissemination of material information.

- Comprehensive Annual and Interim Reports: Providing in-depth financial and operational data.

- Investor Presentations and Calls: Facilitating direct engagement and Q&A with stakeholders.

- Sustainability Progress Reports: Communicating advancements in ESG initiatives.

Partnership and Responsible Drinking Initiatives

Anora leverages strategic partnerships to bolster its promotional activities. A prime example is its distribution agreement for AB InBev beer brands in Finland and Norway, which significantly expands its product portfolio for on-trade clients, thereby enhancing its promotional reach and appeal.

Beyond product expansion, Anora actively champions responsible drinking. This commitment is evident in its development and launch of a diverse selection of non-alcoholic and low-alcoholic beverages. This dual approach underscores Anora's dedication to societal well-being, aligning commercial objectives with a promotion of healthier consumption habits.

- Strategic Distribution: Anora's partnership with AB InBev for beer distribution in Finland and Norway as of 2024 enhances its on-trade offerings.

- Non-Alcoholic Growth: The company's focus on non-alcoholic and low-alcoholic drinks is a key promotional strategy, catering to evolving consumer preferences for healthier options.

- Societal Impact: These initiatives demonstrate Anora's commitment to promoting responsible consumption alongside its business growth objectives, a trend gaining traction in the beverage industry.

Anora's promotional efforts are multifaceted, focusing on brand awareness, portfolio expansion, and responsible consumption. The company strategically targets key categories and brands to drive sales growth, as seen in their 2024 focus on core spirits segments. Sustainability is a cornerstone of their messaging, with initiatives like carbon-neutral operations resonating with the 70% of consumers willing to pay more for sustainable products in 2024.

Digital engagement and customer-centric partnerships are also vital, with Anora reporting significant digital sales growth in 2024. Furthermore, strategic distribution agreements, such as the one with AB InBev for beer in Finland and Norway, expand their promotional reach. The company also promotes responsible drinking through its range of non-alcoholic and low-alcoholic beverages.

| Promotional Activity | Key Focus Area | Example/Data Point (2024/2025) |

|---|---|---|

| Brand Awareness & Portfolio Expansion | Seasonal & New Product Launches | New aquavit SKUs for Christmas, innovative Koskenkorva products |

| Sales Growth Strategy | Focus on Core Categories | Restoring growth in key spirits segments |

| Sustainability Messaging | Environmental Responsibility | Leveraging consumer willingness to pay more for sustainable products (70% in 2024) |

| Digital Engagement | Consumer Connection | Significant increase in digital sales |

| Strategic Partnerships | Distribution & On-Trade | AB InBev beer distribution agreement in Finland and Norway |

| Responsible Consumption | Healthier Options | Development of non-alcoholic and low-alcoholic beverages |

Price

Anora's pricing strategy is key to its market standing as a premier wine and spirits brand. They actively manage their product mix and revenue streams to boost the profitability of their beverage operations, ensuring prices match the value consumers see in their wide range of offerings.

Anora's pricing strategies are keenly attuned to market dynamics, factoring in competitor pricing, fluctuating demand, and the broader economic climate, especially noting trends like shoppers trading down in monopoly channels. The company actively manages its pricing and revenue to adapt to shifting market volumes and evolving consumer spending habits.

For instance, in 2024, the retail sector saw increased price sensitivity, with reports indicating that as much as 60% of consumers were actively seeking discounts. Anora likely leveraged dynamic pricing models, adjusting product prices in real-time based on inventory levels and competitor actions to maintain competitiveness and capture sales amidst these challenging conditions.

Anora's focus on operational efficiency directly influences its pricing strategy. Improvements in cost management, particularly within the Spirits and Industrial segments, have bolstered gross margins. This enhanced profitability allows Anora to price competitively in the market while simultaneously boosting its bottom line.

The company's commitment to sustainable operations, exemplified by its investment in a new biomass boiler, is another key factor. Such initiatives are designed to optimize long-term cost structures. This, in turn, provides Anora with greater flexibility in its pricing decisions, potentially allowing for more attractive offers or absorbing cost fluctuations more effectively.

Pricing Across Diverse Product Segments

Anora strategically manages pricing across its Wine, Spirits, and Industrial segments. The Wine segment has demonstrated robust comparable EBITDA growth, supporting its pricing strategies. However, the Spirits segment has experienced market-specific declines, necessitating careful pricing adjustments to maintain competitiveness.

Pricing for industrial products, such as those derived from grain, is directly influenced by fluctuating raw material costs and production volumes. For instance, in the first half of 2024, Anora reported that the average selling price for its industrial alcohol products was impacted by an increase in grain commodity prices.

- Wine Segment: Benefiting from strong comparable EBITDA growth, Anora's wine pricing reflects market demand and brand positioning.

- Spirits Segment: Pricing in the spirits category is being recalibrated in certain markets to address recent performance trends and competitive pressures.

- Industrial Products: Anora's industrial product pricing is closely tied to the volatility of grain markets and the scale of its production operations.

- EBITDA Growth: The company's overall financial health, as indicated by EBITDA figures, provides a backdrop for its pricing decisions across all segments.

Focus on Profitability and Financial Health

Anora's pricing approach prioritizes boosting profitability and overall financial resilience, even when facing headwinds such as a reported 5% decline in net sales for the first nine months of 2023 compared to the same period in 2022. This strategic focus extends to actively managing working capital and enhancing inventory turnover rates.

These operational improvements are crucial for supporting stable pricing and maintaining a competitive edge in the market. For instance, a more efficient inventory system can reduce carrying costs, allowing for more flexible pricing decisions.

Anora's commitment to financial health is evident in its efforts to optimize its balance sheet. By reducing tied-up capital, the company can reinvest in its core operations or pursue strategic pricing initiatives that benefit both the company and its customers in the long run.

- Focus on Profitability: Anora's pricing aims to enhance profit margins, a key indicator of financial strength.

- Working Capital Reduction: Efforts to decrease working capital free up resources that can be used to support pricing strategies.

- Inventory Turnover Improvement: Faster inventory turnover means less capital is held in stock, contributing to better financial health and pricing flexibility.

- Financial Health Enhancement: Ultimately, these pricing and operational adjustments are designed to strengthen Anora's overall financial standing.

Anora's pricing strategy is designed to maximize profitability across its diverse portfolio, reflecting the value consumers perceive in its offerings. The company dynamically adjusts prices based on market conditions, competitor actions, and consumer spending habits, as seen with increased price sensitivity in 2024 where 60% of consumers sought discounts.

Operational efficiencies, such as investments in biomass boilers for cost reduction, directly support competitive pricing. The company strategically manages pricing across its Wine, Spirits, and Industrial segments, with wine pricing benefiting from strong EBITDA growth, while spirits pricing is recalibrated to address market declines and competitive pressures.

Anora's pricing decisions are also influenced by raw material costs, with industrial alcohol prices in the first half of 2024 impacted by rising grain commodity prices. Despite a 5% net sales decline in the first nine months of 2023, Anora focuses on optimizing working capital and inventory turnover to maintain stable pricing and financial resilience.

| Segment | Pricing Strategy Driver | 2024/2025 Data Point |

|---|---|---|

| Wine | Strong comparable EBITDA growth, market demand | Robust comparable EBITDA growth supports pricing. |

| Spirits | Market-specific declines, competitive pressures | Recalibration to address performance trends. |

| Industrial Products | Raw material costs (grain), production volumes | Average selling price impacted by grain commodity price increases (H1 2024). |

| Overall | Consumer price sensitivity, operational efficiency | Dynamic pricing models used amid increased consumer price sensitivity (2024). |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is grounded in a comprehensive review of publicly available corporate disclosures, including SEC filings, investor presentations, and official press releases. We also leverage data from brand websites, e-commerce platforms, and reputable industry reports to ensure accuracy and relevance.