Andersen Corporation SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andersen Corporation Bundle

Andersen Corporation, a leader in the window and door industry, boasts strong brand recognition and a commitment to innovation as key strengths. However, potential threats from economic downturns and intense competition necessitate a deeper understanding of their market position. Want the full story behind Andersen's opportunities and weaknesses? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Andersen Corporation stands as America's most trusted name in windows and doors, a distinction earned through decades of reliable performance and customer satisfaction. This deeply ingrained trust acts as a powerful differentiator, resonating with homeowners, construction professionals, and architects alike, giving Andersen a significant edge over competitors.

The company's commitment to quality and integrity is consistently validated by industry recognition. Notably, Andersen was honored by Newsweek as one of America's Most Trustworthy Companies in both 2024 and 2023, underscoring its robust brand equity and the enduring faith consumers place in its products.

Andersen boasts an extensive product lineup, offering a wide variety of window and door styles, materials, and performance features. This diversity allows them to serve both new construction and the remodeling/replacement markets effectively.

Their dedication to innovation is a key strength, highlighted by proprietary materials like Fibrex. This composite material provides enhanced strength and superior thermal insulation compared to traditional options, contributing to energy efficiency in homes.

In 2024, Andersen continued to push product development, introducing advancements such as triple-pane glass options across multiple product series. This move directly addresses growing consumer and regulatory demand for improved energy performance in building envelopes.

Andersen Corporation demonstrates a significant commitment to environmental stewardship, actively pursuing initiatives to shrink its ecological impact. This includes robust recycling programs and a strong emphasis on energy conservation throughout its operations.

The company's dedication to sustainability was further validated by receiving the U.S. Environmental Protection Agency's 2024 ENERGY STAR Partner of the Year – Sustained Excellence Award. This prestigious recognition underscores Andersen's leadership in creating energy-efficient products and implementing sustainable manufacturing processes.

This strong focus on sustainability and energy efficiency appeals to a growing segment of environmentally aware consumers and positions Andersen favorably in light of increasing environmental regulations and market demands for greener products.

Robust Distribution Network

Andersen Corporation boasts a robust distribution network, reaching customers through a wide array of independent dealers, retailers, and home improvement centers. This expansive presence, spanning North America and international markets, ensures broad product availability and solidifies its market position.

The company's commitment extends to its supplier relationships, actively partnering with small businesses to fortify its supply chain. This approach not only enhances distribution capabilities but also champions community-driven business growth.

- Extensive Reach: Andersen products are available through thousands of independent dealers, retailers, and home improvement centers across North America and globally.

- Supplier Engagement: The company actively collaborates with its supplier network, including a significant number of small businesses, to build a resilient and community-focused supply chain.

- Market Penetration: This broad distribution infrastructure is a key driver of Andersen's strong market presence and customer accessibility in the building materials sector.

Strong Employee Relations and Corporate Philanthropy

Andersen Corporation excels in fostering strong employee relations, evidenced by its substantial profit-sharing initiatives. In 2024 alone, the company distributed over $50 million to its employees. This commitment to its workforce is further recognized by accolades such as being named a 'World's Best Employer' and one of 'America's Greatest Workplaces for Women', highlighting a dedication to an inclusive and supportive environment.

The company's positive impact extends beyond its employees through robust corporate philanthropy. Andersen actively contributes millions to various non-profit organizations. These donations support critical areas including affordable housing, vocational training in the trades, hunger relief, and healthcare initiatives, demonstrating a deep commitment to community well-being.

- Employee Profit Sharing: Distributed over $50 million in 2024.

- Workplace Recognition: Named a 'World's Best Employer' and 'America's Greatest Workplaces for Women'.

- Philanthropic Impact: Millions donated to non-profits supporting housing, trades education, hunger, and healthcare.

Andersen's brand recognition, consistently reinforced by accolades like Newsweek's America's Most Trustworthy Companies in 2023 and 2024, provides a significant competitive advantage. This trust translates into strong customer loyalty and a preference for Andersen products in both new construction and the replacement market.

The company's commitment to innovation is evident in proprietary materials like Fibrex, which offers superior thermal performance, and the expansion of triple-pane glass options in 2024, directly addressing market demand for energy efficiency.

Andersen's dedication to sustainability, recognized by the EPA's 2024 ENERGY STAR Partner of the Year award, aligns with growing consumer preferences and regulatory trends favoring eco-friendly building solutions.

Its extensive distribution network, reaching customers through thousands of dealers and retailers, ensures broad market accessibility and reinforces its leading market position.

Andersen's strong employee relations, highlighted by over $50 million in profit sharing in 2024 and recognition as a World's Best Employer, fosters a motivated and dedicated workforce.

What is included in the product

Delivers a strategic overview of Andersen Corporation’s internal and external business factors, highlighting its strong brand reputation and product innovation while acknowledging potential supply chain vulnerabilities and competitive pressures.

Identifies key competitive advantages and potential threats for proactive strategic adjustments.

Weaknesses

Andersen Corporation's significant reliance on the construction market presents a key weakness. As a primary manufacturer of windows and doors for both residential and commercial projects, the company's revenue is directly influenced by the ebb and flow of housing starts and renovation activity. This cyclical dependency means Andersen's financial performance can be quite volatile, mirroring broader economic trends in the construction sector.

For instance, Andersen's 2024 performance, while showing growth, occurred within a context of 'ongoing challenges in the housing market.' This highlights the company's susceptibility to fluctuations in housing demand, which are often driven by factors like interest rates and overall economic health. Such sensitivity can lead to unpredictable revenue streams and impact long-term strategic planning.

Manufacturing Andersen's extensive product line, which includes windows and doors made from various materials like wood, vinyl, and composite, naturally increases production complexity. This diversity, while catering to different customer needs and price points, can drive up manufacturing expenses due to specialized machinery and processes required for each material type.

The company's commitment to high-quality materials and innovative features, such as energy-efficient glass and advanced locking mechanisms, contributes to premium product positioning but also elevates production costs. Balancing these quality investments with the need for competitive pricing is a constant challenge, especially when faced with the industry-wide issue of fluctuating raw material prices, like lumber and aluminum, which directly impact Andersen's cost of goods sold and overall profitability.

Andersen Corporation's significant reliance on its independent dealer and retailer network presents a notable weakness. The company's market reach and sales volume are directly tied to the performance and effectiveness of these partners. For instance, in 2023, Andersen's revenue was influenced by the sales activities of thousands of independent dealers across North America and Europe, highlighting the critical nature of this distribution channel.

Challenges such as maintaining dealer loyalty, ensuring consistent sales training, and monitoring the financial health of these independent entities can directly impact Andersen's distribution efficiency and market penetration. The inherent lack of direct control over an independent network means that external factors affecting these partners, like economic downturns impacting local construction markets, can indirectly hinder Andersen's growth and sales targets.

Competition in a Fragmented Market

The windows and doors market is highly competitive, with Andersen facing rivals such as YKK Corporation, JELD-WEN, and Pella Corporation. This fragmentation, featuring many regional and specialized players, demands constant innovation from Andersen to preserve its leading position. The need to differentiate products and services in such a crowded space can be a significant drain on resources.

Andersen's market share, while substantial, is constantly challenged by this diverse competitive set. For instance, JELD-WEN reported revenues of approximately $4.7 billion for the fiscal year ending December 31, 2023, indicating the scale of competition Andersen navigates. This intense rivalry necessitates continuous investment in product development and marketing to maintain brand visibility and customer loyalty.

- Intense Competition: Andersen operates in a market with major global players and numerous smaller, agile regional competitors.

- Market Fragmentation: The presence of many specialized firms means market share can be eroded by niche product offerings.

- Resource Strain: Maintaining a leadership position requires significant and ongoing investment in innovation and marketing to stand out.

- Price Sensitivity: In a fragmented market, price can become a key differentiator, potentially impacting Andersen's margins.

Logistics and Supply Chain Vulnerabilities

Andersen Corporation’s extensive manufacturing and distribution network, while a strength, also presents a significant vulnerability to global supply chain disruptions. Events like the semiconductor shortages experienced in 2021-2022 highlighted how reliance on international suppliers can lead to production bottlenecks and increased costs for building materials. Despite ongoing efforts to diversify and onshore, the sheer scale of operations means that geopolitical tensions, natural disasters, or unexpected economic downturns can still impact the timely and cost-effective procurement of essential components and raw materials. For instance, fluctuations in lumber prices, a key input for Andersen's products, can be heavily influenced by factors far beyond the company's direct control.

The company's reliance on a complex, global supply chain exposes it to risks that can affect both the availability and the price of necessary inputs. For example, a disruption in the shipping industry, as seen with port congestion in 2023, can directly translate into delays for Andersen's finished goods reaching customers. While the U.S. government has initiatives aimed at bolstering domestic manufacturing and supply chain resilience, the interconnected nature of global trade means that vulnerabilities persist, potentially impacting Andersen's operational efficiency and profitability.

- Global Interdependence: Andersen's large-scale operations depend on a global network of suppliers, making it susceptible to international disruptions.

- Input Cost Volatility: Geopolitical events and economic shifts can cause unpredictable swings in the cost of raw materials like glass, aluminum, and wood.

- Logistical Challenges: Shipping delays and port congestion, as experienced in recent years, can impede the timely delivery of both components and finished products.

- Regulatory Impact: Changes in trade policies or tariffs can unexpectedly increase the cost of imported materials or components.

Andersen faces significant challenges due to its heavy reliance on the construction industry, making its revenue susceptible to housing market fluctuations. For example, while Andersen reported growth in 2024, this occurred amidst "ongoing challenges in the housing market," underscoring its vulnerability to economic downturns and interest rate changes impacting new builds and renovations.

The complexity of manufacturing a diverse product range, from wood to vinyl windows, increases operational costs. This is further compounded by investments in high-quality features and energy efficiency, which, while differentiating, also elevate production expenses and require careful balancing with competitive pricing, especially given fluctuating raw material costs.

Andersen's dependence on a vast network of independent dealers and retailers presents a weakness. The company's sales performance is directly tied to the effectiveness and financial health of these partners, as seen in 2023 where thousands of dealers influenced Andersen's revenue. Maintaining dealer loyalty and consistent sales standards across this decentralized network is a continuous challenge.

The company's extensive global supply chain, while enabling scale, also exposes it to significant risks. Disruptions from geopolitical events, natural disasters, or logistical bottlenecks, such as port congestion experienced in 2023, can impact the timely procurement of materials like lumber and glass, as well as the delivery of finished goods, directly affecting operational efficiency and profitability.

Same Document Delivered

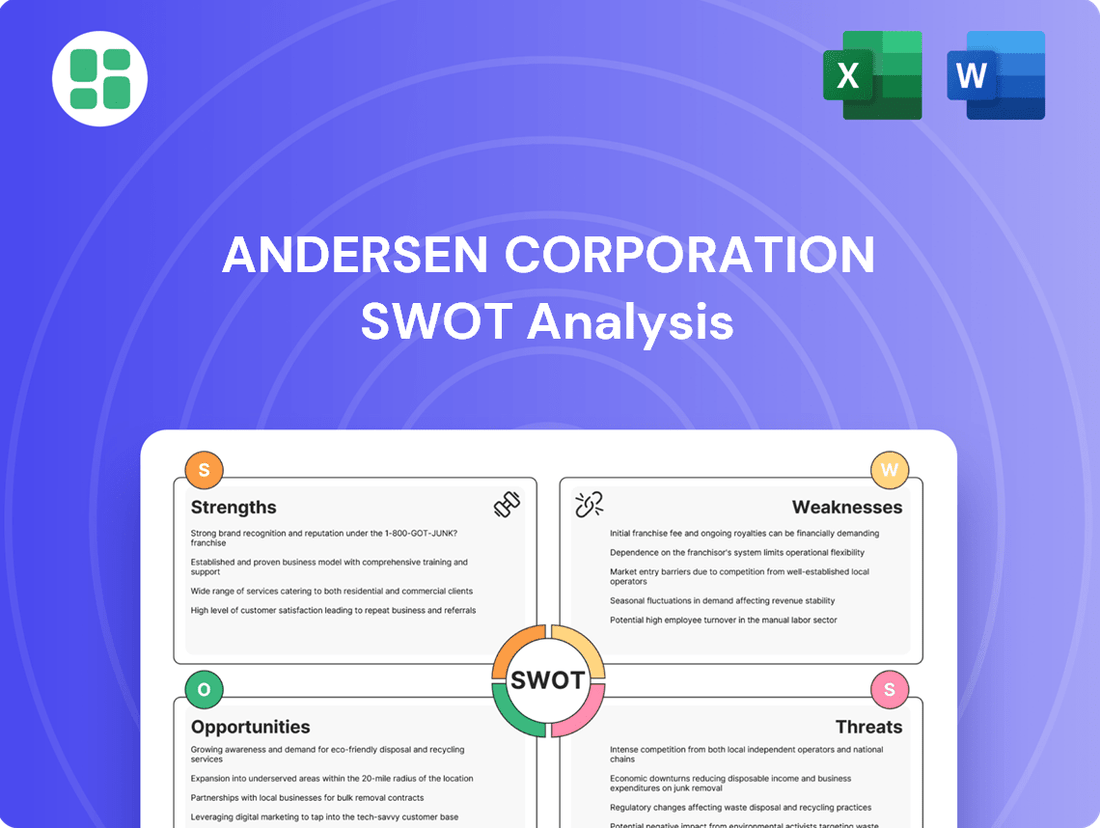

Andersen Corporation SWOT Analysis

This is the actual Andersen Corporation SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key factors influencing Andersen Corporation's market position and future growth potential.

Opportunities

The increasing consumer and regulatory focus on energy efficiency in buildings offers a substantial opportunity for Andersen Corporation. The company's strong portfolio of ENERGY STAR certified windows and doors, alongside its advanced triple-pane glass technology, directly addresses this growing market need. This trend is further bolstered by government incentives and a broader societal shift towards sustainable construction practices.

The real estate market's 'lock-in' effect, fueled by persistently high housing prices, is steering more homeowners towards renovation and remodeling instead of buying new homes. This shift is a significant tailwind for Andersen, as it directly translates to increased demand for replacement windows and doors. Andersen's established brands, such as Renewal by Andersen, are well-positioned to capitalize on this robust market, offering a stable growth avenue even when new construction activity slows.

The increasing demand for smart home technology presents a significant opportunity for Andersen. Consumers are actively seeking window and door systems that offer convenience, energy efficiency monitoring, and enhanced security through integration with smart home ecosystems. This trend is expected to continue growing, with the global smart home market projected to reach over $200 billion by 2025.

Andersen can capitalize on this by developing and promoting its product lines with advanced features like automated locking mechanisms, integrated sensors for climate control, and seamless connectivity to popular smart home platforms. This innovation not only caters to a growing segment of tech-oriented homeowners but also provides a clear point of differentiation against competitors still focused on traditional offerings, potentially capturing a larger share of the premium market.

Geographic Expansion and Emerging Markets

Andersen's established North American footprint presents a solid base for international growth. Emerging markets, especially in Asia and Latin America, are seeing robust construction activity driven by urbanization. For instance, the global construction market is projected to reach $17.5 trillion by 2030, with a significant portion of this growth originating from developing economies.

Expanding into these regions offers a chance to tap into new customer segments and diversify revenue streams. Andersen could leverage its brand reputation and product quality to gain traction.

- Increased Demand: Rapid urbanization in emerging markets fuels demand for housing and infrastructure, directly benefiting building material suppliers.

- Market Diversification: Entering new geographic territories reduces reliance on any single market, mitigating regional economic downturn risks.

- Strategic Entry: Partnerships or acquisitions in target countries can accelerate market penetration and provide local expertise.

- Economic Tailwinds: Many developing economies are experiencing strong GDP growth, supporting increased consumer spending on home improvement and new construction.

Strategic Partnerships and Acquisitions

Andersen Corporation can capitalize on the fragmented window and door market by pursuing strategic partnerships and acquisitions. This approach allows for expansion into new product lines, such as advanced smart home integrated windows, and strengthens market presence. For instance, acquiring a niche player specializing in sustainable building materials could bolster Andersen's ESG credentials, a key differentiator in the 2024-2025 market where consumer demand for eco-friendly products is projected to grow by an estimated 10-15% annually.

Targeted acquisitions can also enhance technological capabilities, particularly in areas like energy-efficient glazing or smart-tinting glass. By integrating innovative technologies through M&A, Andersen can differentiate its offerings and capture higher-margin segments. This strategy is particularly relevant given the ongoing advancements in building science and the increasing demand for high-performance building envelopes, with the smart windows market alone anticipated to reach over $10 billion globally by 2027.

- Market Consolidation: Acquire smaller competitors to increase market share in key regions.

- Technology Integration: Partner with or buy companies with expertise in smart home technology or advanced materials.

- Portfolio Expansion: Broaden product offerings into adjacent or emerging market segments.

- Synergy Realization: Leverage combined resources and expertise for operational efficiencies and innovation.

Andersen can expand its reach by leveraging the growing demand for sustainable and energy-efficient building solutions. The company's strong product portfolio, including ENERGY STAR certified windows and doors, aligns perfectly with increasing consumer and regulatory emphasis on green building practices. This trend is further supported by government incentives for energy-efficient upgrades, presenting a clear path for market share growth.

The persistent high cost of housing is driving more homeowners toward renovations rather than new purchases, creating a significant opportunity for Andersen's replacement window and door business. Brands like Renewal by Andersen are well-positioned to benefit from this trend, ensuring a steady demand for their products. This market dynamic is expected to continue through 2024 and 2025, offering a stable revenue stream.

The integration of smart home technology into residential buildings presents a lucrative avenue for Andersen. As consumers increasingly adopt smart home systems for convenience and efficiency, demand for connected windows and doors is rising. The global smart home market is projected to exceed $200 billion by 2025, and Andersen can capture a share of this by offering advanced features like automated climate control and security sensors.

Andersen's established presence in North America provides a strong foundation for international expansion, particularly in rapidly urbanizing emerging markets in Asia and Latin America. The global construction market is anticipated to reach $17.5 trillion by 2030, with developing economies driving a substantial portion of this growth. Andersen can tap into these new markets by leveraging its brand reputation and product quality.

The fragmented nature of the window and door industry allows Andersen to pursue strategic acquisitions and partnerships to expand its market share and product offerings. Acquiring companies with expertise in smart home integration or sustainable materials can enhance Andersen's competitive edge and appeal to environmentally conscious consumers. The market for smart windows alone is projected to reach over $10 billion globally by 2027.

| Opportunity Area | Market Trend/Driver | Andersen's Position/Action | Projected Market Growth (2024-2025) |

|---|---|---|---|

| Energy Efficiency | Increased consumer/regulatory focus on sustainable buildings | Strong portfolio of ENERGY STAR certified products, advanced glass technology | Estimated 10-15% annual growth in eco-friendly products |

| Home Renovation | High housing prices leading to remodeling over new purchases | Established Renewal by Andersen brand for replacement windows | Continued robust demand for replacement products |

| Smart Home Integration | Growing consumer adoption of smart home technology | Potential for advanced features in windows/doors (automation, sensors) | Global smart home market projected >$200 billion by 2025 |

| International Expansion | Urbanization and construction growth in emerging markets | Leverage North American footprint for global reach | Global construction market to reach $17.5 trillion by 2030 |

| Market Consolidation | Fragmented industry for strategic M&A | Acquire niche players for product/technology enhancement | Smart windows market projected >$10 billion by 2027 |

Threats

Andersen Corporation, like many in the windows and doors sector, faces significant risk from fluctuating raw material costs. Prices for essential inputs like lumber, vinyl, glass, and aluminum are inherently volatile, influenced by global supply chains and economic conditions. For instance, lumber prices saw considerable spikes in 2021 and early 2022, impacting construction materials across the board.

These cost surges can directly squeeze Andersen's profit margins. If the company cannot fully pass these increased expenses onto customers through higher product prices, its profitability will suffer. This pricing challenge is particularly acute during periods of high inflation, which has been a notable economic trend in 2022 and 2023, potentially continuing into 2024.

Geopolitical events also play a substantial role in raw material price volatility. Disruptions in mining, manufacturing, or transportation due to international conflicts or trade disputes can lead to sudden and significant price increases for metals like aluminum or even impact the availability of specialized glass. Such external factors create an unpredictable operating environment for Andersen.

Economic downturns and a slowdown in the housing market represent a significant threat to Andersen Corporation. A severe recession or prolonged housing slump, marked by less new building and fewer home improvement projects, directly reduces demand for Andersen's windows and doors. This can lead to lower sales volumes and overall revenue for the company.

For instance, Andersen's own commentary in early 2024 acknowledged navigating 'ongoing challenges in the housing market,' underscoring the sector's sensitivity. While the company demonstrated resilience, this highlights how a significant contraction in construction and renovation activity, potentially exacerbated by rising interest rates or job losses, could materially impact Andersen's financial performance in 2024 and beyond.

The home improvement market is fiercely competitive, with giants like Home Depot and Lowe's alongside a multitude of smaller, specialized players. This intense rivalry often translates into aggressive pricing tactics, squeezing profit margins for all involved. For instance, in the fiscal year ending January 2024, Andersen reported a net sales increase of 3.7%, but this growth was achieved while navigating a landscape where competitors frequently introduced similar products or undercut prices, necessitating a strong focus on Andersen's premium brand value.

Supply Chain Disruptions and Logistics Challenges

Despite Andersen's proactive steps to diversify and fortify its supply chain, the company still faces significant risks from global disruptions. These can manifest as transportation bottlenecks, labor scarcity, or unexpected events like extreme weather, all of which can impede production and delivery schedules. Such delays directly affect customer satisfaction and overall operational effectiveness.

The company's own 2021-2024 quadrennial supply chain review underscored these persistent vulnerabilities. For instance, a 2023 report indicated that global shipping costs saw a 15% increase year-over-year, impacting Andersen's logistics expenses. Labor shortages in the manufacturing sector, particularly in key component production, also presented challenges throughout 2024.

- Vulnerability to Global Supply Chain Shocks: Andersen remains susceptible to widespread disruptions affecting raw material availability and component sourcing.

- Logistical Hurdles: Transportation delays and rising freight costs, evidenced by a 15% increase in global shipping costs in 2023, continue to pose challenges.

- Labor Shortages Impact: Scarcity of skilled labor in manufacturing and logistics sectors can slow down production and distribution, as observed throughout 2024.

- Operational Inefficiencies: These disruptions can lead to increased lead times, impacting Andersen's ability to meet customer demand promptly and maintain smooth operations.

Regulatory Changes and Environmental Compliance Costs

Andersen Corporation, despite its strong sustainability initiatives, faces potential headwinds from evolving environmental regulations. Stricter standards for energy efficiency, material sourcing, and waste management, such as the increasingly rigorous ENERGY STAR requirements, could necessitate significant investments in manufacturing process adaptations and product redesign. For instance, meeting new energy performance benchmarks might involve upgrading window technologies, impacting production costs and potentially affecting profit margins if these costs cannot be passed on to consumers or offset by operational efficiencies.

These regulatory shifts can translate into tangible financial burdens. For example, if new regulations mandate the use of specific recycled or low-VOC (volatile organic compound) materials, Andersen would need to secure new supply chains and potentially retool its production lines. While the company’s commitment to sustainability is a strength, the pace and cost of compliance with new environmental mandates represent a notable threat, especially as governments globally aim to accelerate climate action and circular economy principles. The financial impact will depend on the specific nature of future regulations and Andersen's ability to innovate cost-effectively.

- Increased Capital Expenditures: Adapting to stricter ENERGY STAR certifications or new building codes could require substantial investment in research and development, manufacturing equipment upgrades, and material sourcing changes.

- Operational Cost Increases: Compliance with new regulations on waste management, emissions, or material sourcing may lead to higher operating expenses, affecting Andersen's cost structure.

- Potential for Supply Chain Disruptions: New material requirements or sourcing mandates could strain existing supply chains, potentially leading to temporary shortages or increased input costs.

Intensifying competition, particularly from large home improvement retailers and specialized manufacturers, poses a threat to Andersen's market share and pricing power. The company must continually innovate and emphasize its brand value to differentiate itself in a crowded marketplace. For instance, in fiscal year 2024, Andersen's net sales growth of 3.7% was achieved amidst aggressive competitor strategies, highlighting the ongoing challenge of maintaining premium positioning.

The housing market's cyclical nature and sensitivity to economic downturns present a significant risk, potentially reducing demand for Andersen's products. Factors like rising interest rates or job market instability can curb new construction and renovation activity, directly impacting Andersen's sales volumes. Andersen's own acknowledgment of navigating housing market challenges in early 2024 underscores this vulnerability.

Volatile raw material costs, including lumber, vinyl, and aluminum, can compress Andersen's profit margins if increases cannot be fully passed on to customers. Economic conditions and geopolitical events contribute to this price fluctuation, creating an unpredictable cost environment. Lumber prices, for example, saw significant spikes in 2021-2022, illustrating the impact of such volatility.

Evolving environmental regulations, such as stricter ENERGY STAR requirements, may necessitate costly investments in product redesign and manufacturing process adaptations. While Andersen is committed to sustainability, the financial burden of compliance with new mandates, potentially impacting operating expenses and capital expenditures, represents a notable threat.

SWOT Analysis Data Sources

This Andersen Corporation SWOT analysis draws from a robust blend of data, including their official financial statements, comprehensive market research reports, and insights from industry experts. This multi-faceted approach ensures a well-rounded and accurate understanding of the company's strategic position.