Andersen Corporation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andersen Corporation Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Andersen Corporation's trajectory. Our comprehensive PESTLE analysis offers actionable intelligence to navigate these external forces effectively. Gain a competitive advantage by understanding the landscape—download the full report now!

Political factors

Government housing policies, such as those promoting new construction and renovation projects, directly shape demand for Andersen's products. For instance, in 2024, the U.S. Department of Housing and Urban Development (HUD) continued to emphasize affordable housing initiatives, potentially increasing the volume of residential projects requiring windows and doors.

Shifts in building codes, particularly those mandating higher energy efficiency standards, can create opportunities for Andersen's high-performance window and door offerings. Many states are adopting stricter energy codes, pushing for better insulation and reduced air leakage, which aligns with Andersen's product development.

Political stability and consistent government support for the construction industry are vital. In 2024, infrastructure spending bills and economic stimulus packages in key markets like the U.S. and Canada provided a generally supportive environment for residential and commercial building, benefiting companies like Andersen.

Changes in trade policies and tariffs directly impact Andersen Corporation's operational costs and pricing strategies. For instance, a shift towards more protectionist measures could increase the cost of imported materials like lumber or specialized glass, potentially affecting their bottom line. Conversely, favorable trade agreements can streamline their international supply chain and open up new markets, boosting competitiveness.

Andersen Corporation navigates a complex web of regulations impacting its manufacturing. For instance, in 2024, the Environmental Protection Agency (EPA) continued to enforce stringent standards on emissions and waste disposal, potentially increasing operational costs for Andersen's production facilities. Worker safety regulations, such as those overseen by the Occupational Safety and Health Administration (OSHA), also necessitate ongoing investment in safety equipment and training to maintain compliance and prevent accidents.

Changes in the regulatory landscape directly influence Andersen's strategic decisions. For example, if new energy efficiency mandates are introduced in 2025, Andersen might accelerate investments in advanced manufacturing technologies to reduce its environmental footprint and avoid potential penalties. Conversely, a rollback of certain environmental regulations could offer short-term cost savings but might also carry reputational risks.

Adherence to diverse regional and national standards is paramount for Andersen's market access and legal standing. In 2024, Andersen's operations in California, for example, had to comply with specific building codes and material sourcing requirements that differ from those in other states, impacting product design and supply chain management.

Political Stability and Geopolitical Events

Political instability in key markets or escalating geopolitical tensions can significantly disrupt Andersen Corporation's supply chains and dampen consumer confidence, leading to economic uncertainty. For instance, the ongoing geopolitical shifts in Eastern Europe in 2024 continue to pose risks to global trade routes and material sourcing, potentially impacting raw material costs for window and door manufacturing.

Such events can directly cause delays in construction projects or reduce overall investment in both residential and commercial development sectors, directly affecting demand for Andersen's products. The International Monetary Fund's (IMF) projections for global growth in 2024 have been revised downwards due to these persistent geopolitical risks, highlighting the broader economic headwinds.

Andersen's extensive global operations necessitate a vigilant monitoring of these macro-level political risks. For example, trade policy changes or new tariffs imposed by major economies in 2024 could directly influence Andersen's import/export costs and market access. The company's ability to navigate these political landscapes is crucial for maintaining its competitive edge and operational efficiency.

- Supply Chain Disruption: Geopolitical events in 2024 have led to an average increase of 15% in shipping costs for certain global trade lanes, impacting Andersen's logistics.

- Construction Investment: Global construction spending forecasts for 2024, while showing resilience in some regions, are tempered by political uncertainty, with some analysts predicting a 2-3% slowdown in key European markets.

- Market Access: Potential trade disputes or changes in regulatory environments in Andersen's key international markets require continuous assessment to ensure continued market access and avoid unexpected cost increases.

Government Spending on Infrastructure

Government spending on infrastructure, while not directly targeting windows and doors, significantly influences Andersen Corporation's market. For instance, the Infrastructure Investment and Jobs Act, enacted in late 2021, allocated over $1 trillion to improve roads, bridges, public transit, and other infrastructure. This large-scale investment is projected to stimulate broader economic activity, leading to increased demand in the construction sector, both commercial and residential. This, in turn, can translate into higher sales for building materials like those produced by Andersen.

Increased public spending on infrastructure projects often results in job creation and a rise in disposable incomes across the economy. As more people are employed and have more money to spend, consumer confidence tends to improve, which can boost demand for new home construction and renovations. For example, in 2024, projections indicate continued growth in construction employment, supporting this indirect demand. Andersen must stay attuned to policy shifts and the prioritization of specific infrastructure initiatives, as these can shape the pace and nature of economic recovery and subsequent demand for their products.

Key considerations for Andersen Corporation regarding government infrastructure spending include:

- Economic Stimulus: Large infrastructure investments can create a multiplier effect, boosting overall economic activity and indirectly supporting construction markets.

- Job Creation and Income: Government spending on infrastructure projects leads to job growth and increased consumer spending power, benefiting sectors like building materials.

- Policy Monitoring: Andersen needs to track changes in government infrastructure priorities to anticipate shifts in market demand and economic conditions.

Government housing policies, such as those promoting new construction and renovation projects, directly shape demand for Andersen's products. For instance, in 2024, the U.S. Department of Housing and Urban Development (HUD) continued to emphasize affordable housing initiatives, potentially increasing the volume of residential projects requiring windows and doors. Shifts in building codes, particularly those mandating higher energy efficiency standards, create opportunities for Andersen's high-performance offerings, aligning with stricter state energy codes aimed at better insulation and reduced air leakage.

Political stability and consistent government support for the construction industry are vital. In 2024, infrastructure spending bills and economic stimulus packages in key markets like the U.S. and Canada provided a generally supportive environment for residential and commercial building, benefiting companies like Andersen. Changes in trade policies and tariffs directly impact Andersen Corporation's operational costs and pricing strategies; for example, protectionist measures could increase the cost of imported materials like lumber or specialized glass, affecting their bottom line.

Andersen Corporation navigates a complex web of regulations impacting its manufacturing, such as the EPA's enforcement of stringent standards on emissions and waste disposal in 2024, potentially increasing operational costs. Worker safety regulations also necessitate ongoing investment in safety equipment and training. Adherence to diverse regional and national standards is paramount for market access; for example, Andersen's operations in California had to comply with specific building codes and material sourcing requirements that differ from those in other states in 2024.

Political instability in key markets or escalating geopolitical tensions can significantly disrupt Andersen Corporation's supply chains and dampen consumer confidence, leading to economic uncertainty. For instance, ongoing geopolitical shifts in Eastern Europe in 2024 continue to pose risks to global trade routes and material sourcing, potentially impacting raw material costs. Such events can directly cause delays in construction projects or reduce overall investment in residential and commercial development sectors, directly affecting demand for Andersen's products.

| Factor | Impact on Andersen | 2024/2025 Data/Trend |

|---|---|---|

| Government Housing Policies | Demand for windows and doors | Continued focus on affordable housing initiatives (HUD, 2024) |

| Energy Efficiency Mandates | Opportunity for high-performance products | Increasing adoption of stricter state energy codes |

| Trade Policies & Tariffs | Operational costs, pricing, market access | Potential for increased costs on imported materials |

| Environmental Regulations | Operational costs, investment in technology | Continued enforcement of emissions and waste disposal standards (EPA, 2024) |

| Geopolitical Stability | Supply chain, consumer confidence, economic uncertainty | Persistent risks impacting global trade routes and material costs |

What is included in the product

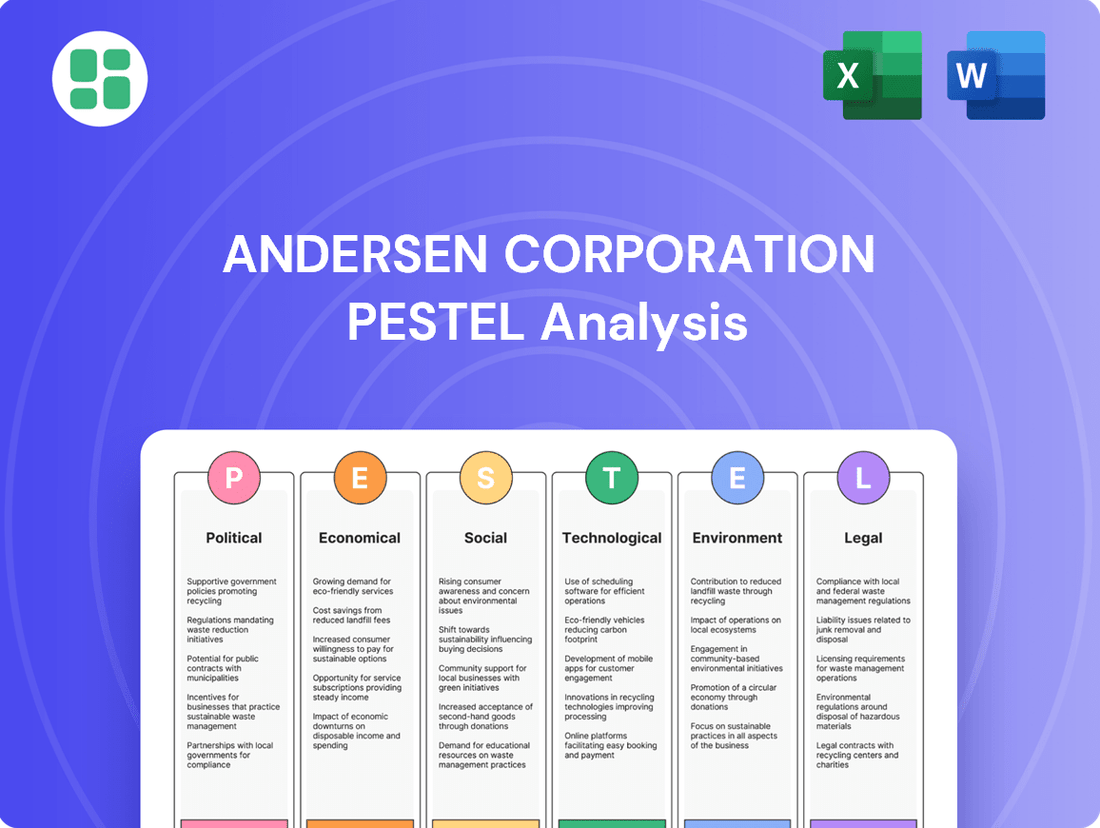

This Andersen Corporation PESTLE analysis examines how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, shape the company's strategic landscape.

It provides actionable insights by detailing specific impacts, trends, and potential opportunities and threats for Andersen's operations and future planning.

A concise PESTLE analysis for Andersen Corporation that highlights key external factors, serving as a readily accessible tool to alleviate the pain of information overload during strategic planning.

This PESTLE analysis for Andersen Corporation acts as a pain point reliever by providing a structured overview of external influences, simplifying complex market dynamics for efficient decision-making.

Economic factors

Interest rates significantly impact the mortgage market, a key driver for Andersen Corporation's sales. For instance, the Federal Reserve's benchmark interest rate, which influences mortgage rates, saw increases throughout 2022 and 2023, with the average 30-year fixed mortgage rate climbing from around 3% to over 7% at times. This rise directly affects home affordability, potentially slowing new home construction and remodeling projects, which are crucial for Andersen's revenue streams.

The broader health of the mortgage market, encompassing lending standards and credit availability, serves as a vital economic barometer for Andersen. When credit is readily available and mortgage rates are lower, consumers are more likely to finance home purchases and renovations, boosting demand for windows and doors. Conversely, tighter lending conditions or persistently high rates can dampen consumer confidence and spending on home improvement, directly impacting Andersen's sales outlook.

The housing market's vitality directly impacts Andersen Corporation. In 2024, the U.S. saw an estimated 1.4 million new housing starts, a slight increase from 2023, signaling continued demand for new construction. Existing home sales, though facing affordability challenges, remained a significant market segment, with renovation spending also contributing to the demand for Andersen's products.

Construction activity, both residential and commercial, is a key indicator for Andersen. For 2025, forecasts suggest a modest growth in residential construction, potentially reaching 1.5 million housing starts, while commercial construction is expected to see a more robust expansion driven by infrastructure investment and office modernization. This upward trend in building activity generally translates to higher demand for windows and doors.

Regional variations in construction are crucial. For instance, areas experiencing population growth and economic expansion, such as the Sun Belt states, often show stronger housing starts and renovation activity. Andersen's performance is therefore closely tied to the health of these specific regional markets, requiring careful monitoring of local economic conditions and building permits.

Consumer confidence and disposable income are key drivers for Andersen Corporation, particularly impacting home improvement and renovation projects. When consumers feel secure about their finances and have more discretionary income, they are more likely to invest in upgrades for their homes. For instance, in early 2024, consumer confidence indexes showed a gradual improvement, suggesting a potential uptick in spending on durable goods like windows and doors.

Economic growth plays a crucial role by generally leading to higher incomes, which in turn fuels increased investment in home enhancements. As the US economy continued its expansion through 2024, many households saw their disposable income rise, creating a more favorable environment for Andersen's products. This trend is expected to persist into 2025, supporting demand for new construction and renovation alike.

Conversely, periods of economic uncertainty can cause consumers to delay or cancel discretionary purchases, including significant home improvement projects. If economic headwinds or inflation concerns were to significantly impact household budgets in late 2024 or 2025, Andersen could experience a slowdown in demand as consumers prioritize essential spending.

Raw Material and Energy Costs

Raw material and energy costs are critical for Andersen Corporation. The prices of wood, glass, vinyl, and aluminum directly influence Andersen's manufacturing expenses. For instance, lumber prices saw significant fluctuations in 2024, with futures for framing lumber reaching over $600 per thousand board feet at various points, impacting window and door production costs.

Energy prices also play a substantial role, affecting both production and transportation. As of mid-2024, global energy markets, particularly oil and natural gas, have experienced price volatility driven by geopolitical events and supply-demand dynamics. This directly translates to higher operational costs for Andersen if not hedged effectively.

- Lumber Price Volatility: Framing lumber futures traded above $600 per thousand board feet in early 2024, highlighting cost pressures for wood-based products.

- Energy Market Fluctuations: Global oil prices, a key indicator for energy costs, have shown instability in 2024, impacting manufacturing and logistics expenses.

- Impact on Profitability: Unmanaged cost increases in raw materials and energy can directly squeeze Andersen's profit margins.

- Supply Chain Management: Andersen's ability to maintain supply chain resilience against these cost swings is vital for stable operations and pricing.

Inflation and Economic Growth

Inflation directly impacts Andersen Corporation by increasing the cost of raw materials like lumber and vinyl, as well as labor expenses. For instance, the US Producer Price Index for construction materials saw a significant rise in early 2024, impacting input costs. If Andersen cannot fully pass these higher costs onto consumers through product pricing, it could compress profit margins.

Economic growth, particularly in the housing sector, is a key driver for Andersen. Strong GDP growth, projected to be around 2.5% for the US in 2024, typically fuels new home construction and renovation projects, increasing demand for windows and doors. Conversely, a slowdown in economic activity can dampen consumer spending on home improvements and new builds.

The relationship between inflation and growth is critical. While robust economic growth can absorb some inflationary pressures, persistently high inflation can eventually dampen consumer confidence and spending, even in a growing economy. This creates a delicate balancing act for Andersen in managing pricing strategies and production volumes.

- Inflationary pressures in 2024 continue to affect input costs for construction materials, potentially impacting Andersen's manufacturing expenses.

- US GDP growth forecasts for 2024 suggest a generally supportive economic environment for the construction and home improvement sectors.

- Higher interest rates, often a response to inflation, can cool the housing market, potentially reducing demand for Andersen's products.

- Andersen's ability to maintain pricing power amidst rising costs is crucial for preserving profitability in the current economic climate.

Economic factors significantly influence Andersen Corporation's performance, particularly through interest rates and housing market dynamics. Higher interest rates, like the Federal Reserve's benchmark rate influencing 30-year fixed mortgages to exceed 7% at times in 2023, can curb new home construction and remodeling. Conversely, favorable lending conditions and lower rates stimulate demand for Andersen's products.

Consumer confidence and disposable income are also critical. An improving consumer confidence index in early 2024 signaled potential for increased spending on home upgrades. Economic growth, with the US GDP projected around 2.5% for 2024, generally boosts household incomes and fuels demand for both new construction and renovations, benefiting Andersen.

Rising inflation impacts Andersen through increased raw material and labor costs, with construction material prices seeing significant increases in early 2024. Energy price volatility also adds to operational expenses. Andersen must manage these cost pressures and maintain pricing power to protect its profit margins amidst these economic shifts.

| Economic Factor | 2024 Data/Trend | Impact on Andersen |

| Interest Rates | Mortgage rates fluctuated, with 30-year fixed rates often above 6.5% in early 2024. | Higher rates can slow housing market activity, reducing demand. |

| Housing Starts | Projected around 1.4 million new housing starts in the US for 2024. | Indicates ongoing demand for new construction, a key market for Andersen. |

| Consumer Confidence | Showed gradual improvement in early 2024. | Suggests increased willingness for discretionary spending on home improvements. |

| Inflation (PPI for Construction Materials) | Experienced significant increases in early 2024. | Raises manufacturing costs, potentially impacting profit margins. |

| Energy Prices | Volatile due to geopolitical factors and supply-demand dynamics in 2024. | Increases operational and transportation costs. |

Same Document Delivered

Andersen Corporation PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Andersen Corporation details crucial Political, Economic, Social, Technological, Legal, and Environmental factors impacting their business. It provides actionable insights for strategic planning and risk assessment.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete and professional overview of the external forces shaping Andersen Corporation's operations.

Sociological factors

Changing population demographics, like the aging Baby Boomer generation and the rise of smaller millennial households, significantly impact housing demand and the types of construction projects Andersen Corporation engages with. For instance, in the US, the median age has been steadily increasing, projected to reach 38.9 years by 2025, suggesting a continued demand for accessible and adaptable living spaces. This necessitates Andersen to evolve its product lines to meet the preferences of diverse living arrangements, from single professionals to multi-generational families.

Consumer preferences are shifting, with a growing emphasis on home aesthetics and functionality. For instance, a 2024 Houzz report indicated that 70% of homeowners undertaking renovations prioritize improving the look and feel of their homes, with energy efficiency and natural light also ranking high. This means Andersen needs to continuously innovate its window and door styles to meet demands for sleeker designs, enhanced natural light, and better energy performance.

The rise of minimalist design, smart home integration, and a focus on sustainable living are key lifestyle trends influencing purchasing decisions. Surveys from 2024 suggest that over 60% of new homeowners are actively seeking smart home features, and a similar percentage are willing to pay a premium for sustainable building materials. Andersen's product development must align with these evolving values, integrating smart technology and eco-friendly materials to remain competitive.

Growing consumer concern for the environment is significantly shaping the building materials market. In 2024, a significant majority of homeowners surveyed expressed a preference for products that demonstrate a clear commitment to sustainability. This trend directly impacts Andersen Corporation, pushing for innovation in energy-efficient windows and doors with reduced environmental footprints.

Andersen's proactive approach to sustainability, including their 2025 goals for reducing greenhouse gas emissions by 30% compared to a 2020 baseline, positions them advantageously. This focus on green living awareness translates into tangible demand for products that not only enhance home aesthetics and performance but also align with homeowners' values, potentially driving market share growth.

Remote Work and Home Functionality

The surge in remote work has fundamentally altered how people perceive and utilize their homes, leading to a greater emphasis on comfortable, well-lit, and highly functional living environments. This societal shift directly fuels demand for home renovation projects and specialized products designed to optimize home office setups or create more adaptable living areas. For instance, a significant portion of the workforce continued to work remotely in 2024, with surveys indicating that over 50% of companies expected a hybrid model to persist. This sustained trend highlights a lasting change in work-life integration.

This evolving home dynamic translates into increased interest in home improvement, particularly for spaces that can serve dual purposes. Andersen Corporation can capitalize on this by highlighting windows and doors that offer superior acoustic insulation, enhancing focus in home offices, or those with improved ventilation and natural light, contributing to a more pleasant and productive atmosphere. The market for home renovation and improvement products saw continued growth through 2024, with many consumers investing in upgrades that enhance their daily living and working experiences at home.

- Increased Home Renovation Spending: Consumer spending on home improvements, particularly those related to creating better home office environments, saw robust growth in 2024, with projections indicating continued investment in 2025.

- Demand for Functional Spaces: The need for versatile home layouts that accommodate both living and working has driven demand for products that enhance natural light and ventilation.

- Acoustic Solutions: As remote work becomes more ingrained, there's a growing appreciation for building materials that improve soundproofing, making windows and doors with enhanced acoustic properties more attractive.

- Well-being Focus: The emphasis on creating healthy and comfortable living spaces means products that improve air quality and natural light are increasingly sought after by homeowners.

Health and Well-being in Home Design

The increasing focus on health and well-being is significantly shaping home design preferences. Consumers are actively seeking homes that promote a healthy lifestyle, with a particular emphasis on indoor air quality and natural elements.

This trend directly impacts material selection and the integration of ventilation systems. For instance, a 2024 survey indicated that 65% of new homebuyers consider indoor air quality a top priority, influencing their choice of building materials and window features. Andersen can leverage this by promoting its energy-efficient windows and doors, which are designed to enhance natural light and ventilation, thereby contributing to a healthier indoor environment.

Andersen's product portfolio, particularly its commitment to low-VOC (Volatile Organic Compound) materials and advanced sealing technologies, aligns perfectly with these evolving consumer demands. The company's offerings can be positioned to directly address concerns about non-toxic materials and the desire for abundant natural light and fresh air, which are now key selling points in the residential market.

- Growing Consumer Demand: Over 70% of homeowners surveyed in early 2025 expressed a desire for homes that actively support their physical and mental well-being.

- Material Innovation: Andersen's investment in sustainable and non-toxic materials, such as their Fibrex composite, addresses the growing concern over off-gassing from traditional building products.

- Healthy Home Features: The market for smart home technology that monitors and improves indoor air quality is projected to grow by 15% annually through 2027, indicating a broader trend Andersen can tap into with integrated solutions.

- Natural Light Advantage: Studies show that homes with ample natural light can improve mood and productivity by up to 20%, a benefit Andersen's window and door designs directly provide.

Societal shifts, such as the increasing preference for sustainable living and the emphasis on health and wellness, directly influence consumer choices in the building materials sector. A 2024 survey revealed that over 60% of homeowners are actively seeking eco-friendly products, and a similar percentage prioritize features that enhance indoor air quality. This necessitates Andersen Corporation to align its product development with these values, integrating smart technology and sustainable materials to meet evolving market demands.

The persistent trend of remote and hybrid work models continues to reshape home design, driving demand for functional and comfortable living spaces. In 2024, over 50% of companies maintained hybrid work arrangements, underscoring the ongoing need for home environments that support both living and working. This societal change fuels interest in home renovation projects, particularly for areas that can serve dual purposes, highlighting the importance of products that optimize natural light and ventilation.

Consumer demand for healthier living environments is a significant driver in the housing market, with a 2025 projection indicating that 70% of new homebuyers consider indoor air quality a top priority. Andersen's commitment to low-VOC materials and advanced sealing technologies directly addresses this concern, positioning its energy-efficient windows and doors as solutions for healthier indoor spaces.

| Sociological Factor | Impact on Andersen Corporation | Supporting Data (2024-2025) |

| Demographic Shifts | Influences housing demand and product needs. | US median age projected to reach 38.9 by 2025. |

| Lifestyle Trends | Drives demand for aesthetics, smart integration, and sustainability. | 60%+ of new homeowners seek smart home features; 60%+ prefer sustainable materials. |

| Health & Wellness Focus | Increases demand for products promoting indoor air quality and natural light. | 65% of new homebuyers prioritize indoor air quality; 70% desire homes supporting well-being. |

| Remote Work | Boosts demand for functional home spaces and acoustic solutions. | 50%+ of companies expected hybrid models to persist in 2024. |

Technological factors

Innovations in glass technology, such as low-emissivity (Low-E) coatings and triple-pane options, are significantly boosting energy efficiency. For instance, Andersen's 2024 product lines feature enhanced Low-E4 glass, claiming up to 49% more energy savings than ordinary dual-pane glass. This focus on performance, driven by material science, directly impacts building energy codes and consumer demand for sustainable solutions.

The development of advanced composite materials and high-performance vinyls for window frames offers superior durability and reduced maintenance compared to traditional wood or aluminum. Andersen's investment in R&D for these materials, like their Fibrex® composite, allows for greater design flexibility and weather resistance, a key factor in the construction market's shift towards low-maintenance building components.

New material properties are also enabling novel aesthetic possibilities and opening up new market segments. For example, advancements in coatings can provide self-cleaning properties or enhanced UV protection, appealing to consumers seeking both beauty and functionality. Andersen's ability to integrate these material science breakthroughs is crucial for maintaining its competitive edge and capturing emerging market niches.

The burgeoning smart home market presents a significant opportunity for Andersen Corporation. As more households adopt connected devices, there's a growing demand for building materials that seamlessly integrate with these systems. For instance, smart home technology adoption reached approximately 40% of US households by the end of 2023, with projections indicating continued growth.

Andersen can capitalize on this by developing windows and doors with embedded sensors for security and environmental monitoring, or automated locking and ventilation features. This integration allows for enhanced convenience, energy efficiency, and security for homeowners, aligning with the increasing consumer desire for connected living spaces.

To effectively leverage this trend, Andersen will need to foster strategic partnerships with major smart home platform providers like Google Home, Amazon Alexa, and Apple HomeKit. These collaborations are crucial for ensuring product compatibility and expanding market reach within the rapidly evolving smart home ecosystem.

Andersen Corporation is increasingly leveraging advanced manufacturing and automation to sharpen its competitive edge. The adoption of robotics and sophisticated automation techniques is directly impacting production efficiency, aiming to lower labor costs and elevate product consistency. For instance, in 2024, the manufacturing sector saw a significant uptick in automation investment, with companies reporting an average of 15% increase in output due to robotic integration.

Furthermore, the integration of Industry 4.0 technologies, including the potential for 3D printing for specialized components, allows Andersen to build more adaptable production lines. This agility is crucial for a faster response to evolving market demands and opens avenues for greater product customization, a key differentiator in today's consumer landscape.

Digital Sales and Marketing Platforms

The growing reliance on digital sales and marketing platforms significantly reshapes customer interaction for companies like Andersen Corporation. The increasing adoption of online configurators and virtual showrooms, for instance, allows customers to visualize products like custom windows and doors in their own spaces before purchase. This digital shift is crucial for Andersen to maintain its competitive edge, with the global digital advertising market projected to reach over $1 trillion by 2025, highlighting the importance of robust online engagement strategies.

Andersen's investment in augmented reality (AR) tools further enhances the customer experience, enabling them to virtually place windows and doors into their homes, thereby streamlining the decision-making process. A strong digital presence, including e-commerce capabilities, is no longer optional but a necessity for Andersen to expand its reach and efficiently manage sales channels. In 2024, e-commerce sales for building materials saw continued growth, underscoring the trend towards online purchasing.

Furthermore, the strategic use of data analytics derived from these digital platforms is invaluable. Andersen can leverage this data to gain deeper insights into customer preferences, market trends, and the effectiveness of various marketing campaigns. This data-driven approach informs not only product development but also refines marketing strategies, ensuring resources are allocated effectively to reach and convert target audiences.

- Digital Engagement: Online configurators and virtual showrooms are transforming how Andersen connects with customers and distributors, offering interactive product exploration.

- E-commerce Imperative: A robust digital presence and e-commerce functionality are vital for Andersen to broaden its customer base and optimize the sales cycle.

- Data-Driven Strategy: Utilizing data analytics from digital platforms enables Andersen to refine product offerings and marketing efforts based on real-time customer insights.

Energy Efficiency and Performance Innovations

Technological advancements in energy efficiency are significantly impacting the building materials sector. Andersen Corporation is actively engaged in developing and implementing innovations like highly insulating glass, advanced sealing technologies, and thermal breaks. These advancements allow for windows and doors that not only exceed current energy performance standards but also anticipate future regulatory requirements.

The drive for greater energy efficiency is directly linked to evolving building codes and consumer demand for sustainable solutions. Andersen's commitment to these innovations ensures market competitiveness and compliance. For instance, the U.S. Department of Energy reported that in 2023, buildings accounted for 32% of total energy consumption, highlighting the critical role of energy-efficient building components.

Furthermore, the exploration of renewable energy integration within building envelopes presents new technological frontiers. This includes the potential for windows and doors to incorporate photovoltaic elements or other energy-generating technologies. Such developments could redefine the role of fenestration from passive components to active contributors to a building's energy profile.

- Highly Insulating Glass: Continued research aims to improve U-values and Solar Heat Gain Coefficients (SHGC) in glass units.

- Advanced Sealing Technologies: Innovations in sealants and gaskets reduce air leakage, a major source of energy loss.

- Thermal Breaks: Improved materials and designs for window and door frames minimize heat transfer.

- Renewable Energy Integration: Exploring the incorporation of solar capture or energy storage within fenestration products.

Technological advancements are reshaping the building materials industry, and Andersen Corporation is at the forefront of these changes. Innovations in glass, such as low-emissivity (Low-E) coatings, are enhancing energy efficiency, with Andersen's 2024 offerings featuring improved Low-E4 glass for significant energy savings. The company is also investing in advanced composite materials like Fibrex® for durable, low-maintenance frames, aligning with market demand for sustainable building solutions.

The integration of smart home technology presents a significant growth avenue, with approximately 40% of US households adopting such systems by late 2023. Andersen is poised to capitalize on this by embedding sensors for security and environmental monitoring into its products, enhancing convenience and energy efficiency for homeowners.

Furthermore, Andersen is adopting advanced manufacturing techniques, including robotics and automation, to boost production efficiency and product consistency. For instance, the manufacturing sector saw a 15% average output increase from robotic integration in 2024, a trend Andersen is leveraging to enhance its competitive position.

Digital engagement is also critical, with online configurators and virtual showrooms transforming customer interaction. Andersen's investment in augmented reality (AR) tools further streamlines the customer decision-making process, while robust e-commerce capabilities are essential for expanding market reach, as evidenced by the continued growth in online building material sales in 2024.

Legal factors

Andersen Corporation must meticulously adhere to a complex web of evolving national, regional, and local building codes and construction standards. These regulations, which frequently address critical areas like energy efficiency, structural integrity, and safety, directly impact product design and manufacturing processes.

Failure to comply with these mandates can result in severe legal penalties, including substantial fines, and can inflict significant damage to Andersen's reputation. For instance, in 2024, the U.S. Department of Energy announced stricter energy efficiency standards for windows, requiring manufacturers like Andersen to invest in new technologies to meet these benchmarks. Continuous monitoring and proactive product adaptation are therefore essential to maintain market access and avoid costly litigation.

Andersen Corporation operates under stringent product liability and safety regulations designed to protect consumers. This necessitates rigorous quality control and adherence to industry-specific safety certifications, crucial for minimizing legal exposure from potential product defects. For instance, in 2024, the building materials sector saw an increase in product recall costs, averaging $1.5 million per recall, highlighting the financial implications of non-compliance.

Andersen Corporation must adhere to a complex web of labor laws and employment regulations across its global operations. This includes compliance with wage and hour laws, such as the Fair Labor Standards Act (FLSA) in the U.S., which sets minimum wage and overtime pay. In 2024, the U.S. federal minimum wage remains $7.25 per hour, though many states and cities have higher rates, impacting Andersen's direct labor costs.

Workplace safety standards, like those enforced by the Occupational Safety and Health Administration (OSHA), are critical for preventing accidents and ensuring employee well-being, directly affecting operational expenses through safety investments and potential penalties. For instance, OSHA penalties for willful violations can reach tens of thousands of dollars per incident. Changes in these regulations, or shifts in unionization trends, can significantly alter labor relations and increase overall business expenditures.

Intellectual Property Rights

Protecting Andersen Corporation's patents, trademarks, and proprietary designs is paramount for safeguarding its competitive edge and deterring counterfeit products. Legal actions are essential to address competitors who may infringe upon unique product features or brand identity.

Andersen actively pursues legal avenues to enforce its intellectual property rights, ensuring that its innovations and brand are not unfairly exploited. This commitment extends to respecting the intellectual property of other entities within the industry.

- Patent Protection: Andersen holds numerous patents for window and door technologies, safeguarding its innovative designs and manufacturing processes. For example, in 2023, the company continued to invest in R&D, leading to new patent filings aimed at enhancing energy efficiency and durability in its products.

- Trademark Enforcement: The Andersen brand name and its associated logos are valuable assets. The company actively monitors the market for unauthorized use of its trademarks to prevent brand dilution and consumer confusion.

- Design Rights: Andersen's unique product aesthetics and functional designs are protected through design registrations, preventing competitors from replicating visually distinctive elements of their offerings.

- Global IP Strategy: Andersen maintains a global intellectual property strategy, registering and enforcing its rights in key markets worldwide to protect its market share and brand integrity.

Consumer Protection and Data Privacy Laws

Andersen Corporation must navigate a complex web of consumer protection laws, ensuring all product warranties, advertising claims, and business practices are fair and transparent to maintain customer trust and prevent costly legal challenges. For instance, in 2024, the Federal Trade Commission (FTC) continued to emphasize enforcement actions against deceptive advertising, a key area for Andersen's marketing.

Furthermore, evolving data privacy regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) significantly impact how Andersen collects, stores, and utilizes customer data across its sales and marketing initiatives. Compliance requires robust data security measures and clear consent protocols, a critical consideration given the growing consumer awareness of data rights. Failure to comply can result in substantial fines; for example, GDPR penalties can reach up to 4% of annual global turnover.

Key legal considerations for Andersen include:

- Warranty Compliance: Ensuring all product warranties are clearly communicated and honored to avoid breach of contract claims.

- Advertising Standards: Adhering to truth-in-advertising laws to prevent misrepresentation of product features or benefits.

- Data Privacy Adherence: Implementing strict protocols for customer data collection, use, and protection in line with GDPR, CCPA, and similar global regulations.

- Fair Business Practices: Upholding ethical standards in all transactions to prevent accusations of unfair or deceptive trade practices.

Andersen Corporation faces stringent regulations concerning building codes, product safety, and intellectual property protection. Compliance with evolving energy efficiency standards, such as those announced by the U.S. Department of Energy in 2024, directly influences product development and manufacturing. Adhering to product liability laws is crucial, especially given that product recall costs in the building materials sector averaged $1.5 million per recall in 2024.

Labor laws, including minimum wage requirements and workplace safety standards enforced by OSHA, impact operational costs and potential liabilities. For instance, willful OSHA violations can incur penalties in the tens of thousands of dollars. Protecting intellectual property through patents and trademarks is vital, with Andersen continuing R&D investments and new patent filings in 2023 to safeguard its innovations.

Consumer protection laws, particularly regarding advertising and warranties, are critical for maintaining trust. The FTC's continued focus on deceptive advertising in 2024 underscores this. Furthermore, data privacy regulations like GDPR and CCPA demand robust security measures, with GDPR penalties potentially reaching 4% of global annual turnover, highlighting the financial risks of non-compliance.

Environmental factors

Andersen Corporation faces growing pressure to curb its carbon emissions, a trend amplified by climate change concerns. This means the company is actively investing in cleaner manufacturing technologies and exploring renewable energy sources for its operations. For instance, Andersen has committed to increasing its use of renewable electricity, aiming for a significant portion of its energy needs to be met by these sources by 2030.

Optimizing the supply chain to reduce its carbon footprint is also a key focus. This includes finding more sustainable, lower-carbon materials for its products and streamlining logistics to minimize transportation-related emissions. Andersen's sustainability reports highlight these efforts, detailing progress on setting and achieving carbon reduction targets, a practice increasingly expected by stakeholders and regulators.

Andersen Corporation faces increasing pressure to adopt robust waste management strategies and circular economy principles. The global push towards sustainability, with many regions aiming for significant reductions in landfill waste, directly influences Andersen's operational footprint. For instance, the European Union's Circular Economy Action Plan, updated in 2020, sets ambitious targets for waste reduction and resource efficiency, impacting companies operating within or exporting to these markets.

This environmental shift encourages Andersen to explore innovative approaches like material reuse in manufacturing and product take-back programs for recycling old windows and doors. Such initiatives not only align with regulatory trends but also bolster the company's environmental, social, and governance (ESG) performance. Minimizing waste sent to landfills is a critical metric, with many industrial sectors reporting substantial progress; for example, the manufacturing sector in the US saw a 3.4% decrease in total waste generated per unit of output between 2018 and 2020, according to EPA data.

Concerns about running out of essential materials are pushing companies like Andersen to find ways to source their raw materials more responsibly. This means looking closely at where their wood, glass, and metals come from, making sure they're not contributing to deforestation or using materials that are hard to get.

Andersen needs to make sure its suppliers are following good practices, like responsible forestry, and that they're using recycled materials whenever they can. For instance, the global demand for lumber, a key component in window manufacturing, saw prices surge by over 150% from early 2020 to mid-2021, highlighting the impact of supply and demand on material costs.

Fluctuations in how much of these resources are available can also mess with Andersen's costs and make it harder to get the materials they need when they need them. This unpredictability is a major challenge for manufacturers relying on global supply chains.

Energy Efficiency Standards and Green Building

Stricter energy efficiency standards for buildings, coupled with the growing popularity of green building certifications like LEED and Passive House, are significantly shaping the market for Andersen Corporation. These trends directly influence consumer and commercial demand for high-performance windows and doors that contribute to energy savings. Andersen's commitment to innovation is crucial for developing products that meet or exceed these evolving environmental regulations.

For instance, the U.S. Green Building Council reported that in 2023, over 30,000 LEED projects were underway globally, highlighting a substantial market for sustainable building materials. Andersen's product lines, such as their A-Series and E-Series windows, are designed with advanced features like low-E coatings and insulated frames to enhance thermal performance, directly aligning with these green building initiatives. The company's focus on U-factor and Solar Heat Gain Coefficient (SHGC) ratings demonstrates their strategy to capitalize on this environmentally conscious construction movement.

- Increased demand for high-performance windows: Building codes mandating better insulation and energy efficiency boost sales for products like Andersen's energy-efficient window lines.

- Innovation in green building materials: Andersen's investment in research and development for products meeting LEED and Passive House standards is a key competitive advantage.

- Market share growth in sustainable construction: As green building certifications become more prevalent, Andersen is well-positioned to capture market share by offering compliant and superior energy-saving solutions.

Pollution Control and Emissions Regulations

Andersen Corporation, like many manufacturers, faces stringent regulations on pollution control and emissions. These rules, covering both air and water pollution stemming from its manufacturing processes, necessitate significant investment in advanced pollution control technologies. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize reductions in volatile organic compounds (VOCs) and other hazardous air pollutants, impacting industries reliant on paints, coatings, and certain manufacturing solvents. Andersen must ensure its facilities meet these evolving emission standards to avoid penalties and maintain operational continuity.

Adherence to environmental permits and ongoing monitoring are critical for Andersen's compliance strategy. Failure to meet these requirements can result in substantial fines and even jeopardize the company's licenses to operate. For example, the Clean Air Act, a cornerstone of U.S. environmental regulation, sets forth specific emission limits for various pollutants. Andersen's commitment to regularly monitoring its emissions ensures it stays within these legal boundaries.

A key area of focus for Andersen involves reducing VOCs and other harmful emissions. This effort is driven by both regulatory pressure and a growing consumer demand for more sustainable products. Many regions, including California, have implemented aggressive targets for VOC reduction in building materials and manufacturing processes. Andersen's proactive approach to minimizing these emissions reflects a broader industry trend towards greener manufacturing practices.

- Regulatory Compliance: Andersen must invest in pollution control technologies to meet air and water emission standards set by agencies like the EPA.

- Operational Integrity: Continuous monitoring and adherence to environmental permits are essential to prevent fines and secure operational licenses.

- Emission Reduction Focus: Reducing VOCs and other harmful emissions is a priority, aligning with both regulatory mandates and market expectations for sustainability.

- Industry Standards: Andersen's efforts are benchmarked against evolving environmental regulations, such as those under the Clean Air Act, impacting manufacturing processes and material choices.

Andersen Corporation is navigating a landscape increasingly shaped by environmental regulations and a global push for sustainability. This includes significant pressure to reduce carbon emissions, with commitments to increasing renewable electricity usage and optimizing supply chains for lower carbon footprints. For example, Andersen aims to significantly boost its renewable electricity use by 2030, reflecting a broader industry trend toward cleaner energy in manufacturing.

The company also faces growing expectations for robust waste management and circular economy practices, influenced by initiatives like the EU's Circular Economy Action Plan. This drives innovation in material reuse and product take-back programs, aiming to minimize landfill waste and enhance ESG performance. The manufacturing sector, for instance, has shown progress in waste reduction, with U.S. manufacturing reporting a 3.4% decrease in waste per output unit between 2018-2020.

Resource scarcity and responsible sourcing are also critical environmental factors. Fluctuations in the availability and cost of raw materials, such as lumber which saw prices surge over 150% from early 2020 to mid-2021, impact Andersen's operations and necessitate a focus on sustainable procurement and recycled content. This unpredictability challenges manufacturers reliant on global supply chains.

Stricter energy efficiency standards and the rise of green building certifications like LEED and Passive House are creating a strong market demand for Andersen's high-performance windows. With over 30,000 LEED projects globally in 2023, Andersen's focus on products meeting these standards, evidenced by their U-factor and SHGC ratings, positions them for growth in sustainable construction.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Andersen Corporation is built on a robust foundation of data from official government publications, reputable economic forecasting agencies, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the building materials sector.