Andersen Corporation Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andersen Corporation Bundle

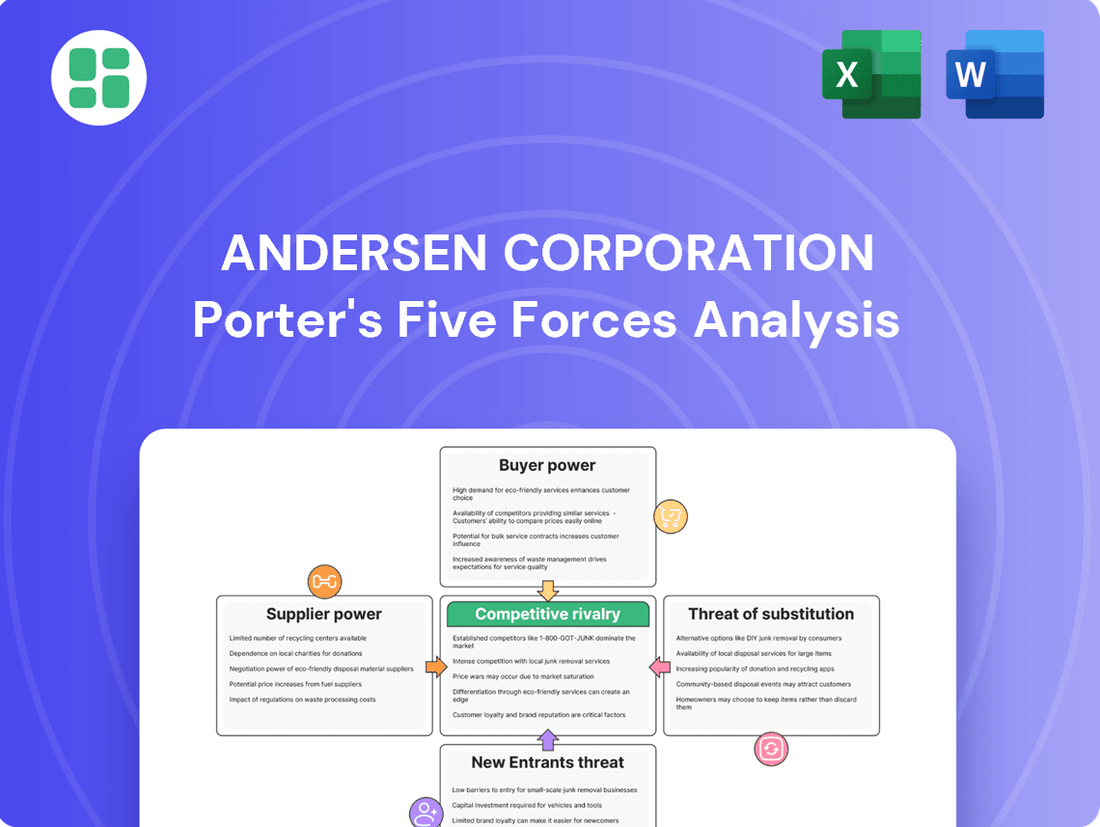

Andersen Corporation navigates a complex landscape shaped by intense rivalry and the constant threat of substitutes. Understanding the bargaining power of both buyers and suppliers is crucial for maintaining market share and profitability in the window and door industry.

The complete report reveals the real forces shaping Andersen Corporation’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Andersen Corporation, a leader in the windows and doors industry, faces potential supplier power due to its reliance on key raw materials like wood, glass, vinyl, and aluminum. If these materials are sourced from a limited number of large suppliers, those suppliers gain leverage. This concentration allows them to influence pricing and contract terms, potentially impacting Andersen's manufacturing costs and profitability.

The global market for these essential inputs has experienced significant volatility. For instance, in 2023, the price of aluminum saw fluctuations driven by energy costs and geopolitical factors, directly affecting window frame manufacturers. Similarly, disruptions in timber supply chains, exacerbated by extreme weather events in 2024, have led to increased costs for wood-based products, further empowering concentrated suppliers in this segment.

High switching costs significantly bolster the bargaining power of Andersen Corporation's suppliers. For instance, if Andersen needs to change suppliers for specialized glass or unique frame materials, the process can be both expensive and lengthy. This often involves retooling manufacturing lines, the rigorous process of re-qualifying new materials, and the potential risk of affecting product quality or existing certifications. These factors make it difficult for Andersen to switch, thereby strengthening the supplier's position.

When suppliers offer highly specialized or patented inputs, their leverage over Andersen Corporation grows significantly. For instance, if a supplier holds exclusive rights to a unique high-performance glass formulation essential for Andersen's premium window lines, Andersen faces limited alternatives. This dependency can force Andersen to accept less favorable pricing or terms, impacting its cost structure and profitability.

Forward Integration Threat

The threat of suppliers integrating forward into window and door manufacturing is a potential concern for Andersen Corporation. This means suppliers could start making and selling finished windows and doors themselves, directly competing with Andersen. While this is less likely for basic material providers, it's a more significant risk for those supplying specialized components if they perceive greater profitability in the end-product market.

For instance, a manufacturer of high-performance glass or advanced frame materials might consider moving into direct sales if they believe they can capture more value by controlling the entire production process. This forward integration by suppliers would essentially turn them into rivals, intensifying competition and potentially impacting Andersen's market share and pricing power.

- Forward Integration Risk: Suppliers potentially entering Andersen's core window and door manufacturing business.

- Component Supplier Threat: Specialized component makers are more likely candidates for forward integration due to potential higher margins in finished goods.

- Competitive Landscape Shift: Successful supplier integration would increase competition, potentially affecting Andersen's market position and profitability.

Impact of Supply Chain Disruptions

Ongoing global supply chain disruptions, coupled with persistent labor shortages and escalating input costs for materials like steel, cement, timber, PVC resin, and aluminum, have profoundly affected the construction sector. This environment significantly amplifies the bargaining power of suppliers.

These constraints on availability and heightened demand empower suppliers, allowing them to command higher prices for essential materials and extend lead times for delivery. For instance, the Producer Price Index for construction inputs saw a notable increase in early 2024, reflecting these inflationary pressures.

- Elevated Material Costs: Suppliers can dictate higher prices due to limited supply and robust demand.

- Extended Lead Times: Manufacturers face longer waits for crucial components, impacting production schedules.

- Increased Supplier Leverage: Suppliers gain significant power in negotiations due to the critical nature of their products and market conditions.

Andersen Corporation's suppliers hold considerable power, especially those providing specialized or patented materials, limiting Andersen's alternatives and enabling them to dictate terms. The threat of forward integration by these suppliers, turning them into competitors, further amplifies their leverage. Market-wide supply chain issues and rising input costs in 2024, impacting everything from timber to aluminum, have significantly empowered suppliers, allowing them to increase prices and extend delivery times, directly affecting Andersen's operational costs and production schedules.

| Material | 2023 Price Change (Approx.) | 2024 Outlook | Supplier Power Factor |

|---|---|---|---|

| Aluminum | +8% | Stable to +5% | High (Energy Costs) |

| Timber | +12% | +7% | High (Weather Disruptions) |

| Specialized Glass | +5% | +4% | Very High (Patented Tech) |

| PVC Resin | +6% | +5% | Moderate to High |

What is included in the product

This analysis unpacks the competitive forces shaping Andersen Corporation's industry, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing Andersen Corporation's Porter's Five Forces, offering a clear path to strategic advantage.

Customers Bargaining Power

Andersen Corporation's customer base, while served by intermediaries like dealers and retailers, is ultimately composed of highly fragmented end-users. Homeowners and commercial builders represent millions of individual purchasing decisions, meaning no single customer can significantly influence Andersen's pricing or terms.

This widespread distribution network, while reaching many, ensures that individual customers have limited leverage. For instance, in 2024, the U.S. housing market saw millions of new home constructions and renovations, with each homeowner making an independent choice for window and door suppliers.

Customers have a significant advantage due to the wide availability of alternatives in the windows and doors market. Major competitors such as Pella, Marvin, and JELD-WEN, alongside many smaller regional manufacturers, offer a diverse range of products.

This abundance of choices empowers customers to easily switch to other brands if Andersen's pricing is perceived as too high or if its product selection doesn't align with their specific requirements. For instance, the global windows and doors market was valued at approximately $200 billion in 2023, indicating a highly competitive landscape.

Price sensitivity remains a key driver for Andersen Corporation's customers, especially in new construction and major renovation projects where windows and doors represent a significant investment. During 2024, elevated inflation and interest rates have amplified this sensitivity, forcing manufacturers to focus on cost competitiveness to maintain market share.

Low Switching Costs for End-Users

The bargaining power of customers for Andersen Corporation is significantly influenced by low switching costs for end-users, such as homeowners and builders. These customers can readily shift to alternative window and door manufacturers if they perceive better value, enhanced features, or improved product availability from a competitor. This ease of transition directly amplifies their leverage in price and feature negotiations.

For instance, while Andersen's dealers might incur some costs in changing suppliers due to inventory management and existing business relationships, the ultimate consumer faces minimal barriers. This dynamic means that Andersen must continuously innovate and offer competitive pricing to retain its customer base, as a homeowner deciding on new windows for a renovation can easily compare options from various brands without substantial commitment.

- Low switching costs for end-users empower customers to easily choose between window and door brands.

- Homeowners and builders can quickly opt for competitors offering better value, features, or availability.

- This ease of transition increases customer bargaining power, influencing pricing and product demands.

Customer Demand for Energy Efficiency and Customization

Customers are increasingly demanding products that align with their values and lifestyle preferences. In 2024, this trend is particularly evident in the building materials sector, where energy efficiency and aesthetic customization are paramount. Andersen Corporation, a leading window and door manufacturer, faces significant customer power due to these evolving expectations. Consumers are actively seeking out windows and doors that offer superior insulation, contributing to lower energy bills and a reduced environmental footprint. For instance, ENERGY STAR certified windows, which meet strict energy performance criteria, saw continued strong demand in 2024.

Beyond energy efficiency, the desire for personalized living spaces drives demand for customization. Homeowners are specifying unique features such as minimalist designs, larger glass lites for enhanced natural light, and specific material choices like natural wood or low-maintenance vinyl. Manufacturers that can offer a broad range of customization options, while maintaining quality and competitive pricing, are better positioned to retain customer loyalty. Conversely, companies unable to adapt to these specific aesthetic and functional requirements may find their bargaining power diminished as customers readily seek alternatives that better meet their vision.

- Growing Demand for Energy Efficiency: In 2024, consumer spending on energy-efficient home improvements continued to rise, with a particular focus on windows and doors that reduce heating and cooling costs.

- Aesthetic Customization Trends: Minimalist designs and larger glass panels are key aesthetic preferences influencing purchasing decisions, pushing manufacturers to innovate in product design and material offerings.

- Material Preferences: While vinyl remains popular for its cost-effectiveness and low maintenance, there's a notable resurgence in demand for wood and wood-clad windows, reflecting a desire for natural aesthetics and premium quality.

- Impact on Manufacturer Power: Andersen Corporation's ability to offer a diverse portfolio of energy-efficient and customizable products directly impacts its ability to negotiate with customers, as failure to meet these demands shifts power towards the consumer.

Andersen Corporation faces moderate customer bargaining power, primarily driven by a fragmented customer base and the availability of numerous competitors. While individual homeowners have limited sway, collective consumer demand for specific features like energy efficiency and customization significantly influences Andersen's product development and pricing strategies.

The ease with which consumers can switch brands, coupled with their increasing price sensitivity, amplifies their leverage. For instance, in 2024, the U.S. residential construction market, a key segment for Andersen, saw millions of new homes and renovations, each representing an opportunity for competitors to capture market share by meeting evolving consumer demands for both performance and aesthetics.

| Factor | Description | Impact on Andersen | 2024 Data/Trend |

|---|---|---|---|

| Customer Fragmentation | Millions of individual homeowners and builders. | Low individual customer influence. | Millions of housing starts/renovations in 2024. |

| Availability of Alternatives | Numerous competitors like Pella, Marvin, JELD-WEN. | Empowers customers to switch easily. | Global windows and doors market valued at ~$200 billion in 2023. |

| Switching Costs | Minimal for end-users. | Increases customer leverage. | Homeowners face few barriers to comparing brands. |

| Price Sensitivity | Amplified by inflation and interest rates in 2024. | Forces Andersen to focus on cost competitiveness. | Elevated inflation impacting consumer purchasing power. |

| Demand for Customization & Efficiency | Growing consumer preference for specific features. | Requires Andersen to offer diverse, innovative products. | Strong demand for ENERGY STAR certified windows. |

Full Version Awaits

Andersen Corporation Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Andersen Corporation, detailing the competitive landscape and strategic implications for the company's industry position. What you see here is the exact, professionally formatted document you will receive immediately after purchase, offering comprehensive insights without any placeholders or surprises. This thorough analysis covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the fenestration market, providing actionable intelligence for strategic decision-making.

Rivalry Among Competitors

Andersen Corporation faces intense competition in the North American windows and doors market from established giants like Pella, Marvin, and JELD-WEN. These rivals offer extensive product portfolios, vying aggressively for both residential and commercial project business.

While the U.S. window and door market is expected to see growth, 2023 experienced a slowdown with a dip in shipments, especially in residential new construction. This trend is anticipated to continue into 2024, creating a more competitive environment.

The market slowdown means companies will fight harder for market share, potentially leading to increased price competition and more aggressive marketing efforts. This dynamic intensifies rivalry among existing players as they navigate a less expansive growth landscape.

Manufacturers in the window and door industry, including Andersen Corporation, fiercely compete by differentiating their products. This differentiation manifests in a wide array of styles, from traditional to modern, and through the use of various materials like wood, vinyl, fiberglass, and aluminum, each offering distinct aesthetic and performance benefits.

Performance options are a critical battleground, with companies emphasizing energy efficiency ratings, such as U-factor and Solar Heat Gain Coefficient, and impact resistance for areas prone to severe weather. The integration of smart home technology, allowing for remote operation and monitoring, is also becoming a significant differentiator. For instance, Andersen’s commitment to innovation is evident in its diverse product lines, such as the 100 Series, 200 Series, 400 Series, A-Series, and E-Series, each tailored to specific market needs and price points, enabling them to capture a broader customer base and maintain a competitive edge.

High Fixed Costs and Exit Barriers

The window and door manufacturing sector, including companies like Andersen Corporation, is characterized by substantial capital outlays. This means significant investment is required for advanced manufacturing equipment, expansive production facilities, and robust distribution channels, resulting in high fixed costs.

These considerable fixed costs, coupled with the specialized nature of assets within the industry, create significant barriers to exiting the market. Consequently, companies often find it more economically viable to continue operating and competing, even when market conditions are unfavorable, thereby intensifying the competitive rivalry among existing players.

For instance, in 2024, the capital expenditure for upgrading automated production lines in the building products sector can easily range from millions to tens of millions of dollars, making it difficult for firms to divest without substantial losses. This economic reality compels companies to remain engaged in the market, leading to sustained competitive pressure.

- High Capital Investment: Significant upfront costs for machinery and facilities in window and door manufacturing.

- Substantial Exit Barriers: Specialized assets and high fixed costs make leaving the industry costly.

- Intensified Rivalry: Companies are incentivized to stay and compete, even in challenging economic periods.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) are on the rise within the building products industry. Manufacturers are actively consolidating to gain market share, a move exacerbated by persistent high raw material costs and ongoing supply chain disruptions. For instance, in 2024, the construction materials sector saw significant M&A activity, with deals aimed at achieving economies of scale and improving operational efficiency.

This wave of consolidation means that companies like Andersen Corporation face an increasingly competitive landscape. As larger entities emerge through these mergers, they possess greater resources and market influence, intensifying the rivalry for Andersen and other independent players. This dynamic can lead to price pressures and a heightened need for innovation to maintain competitive positioning.

- Increased M&A activity in building products during 2024.

- Drivers include market share growth and cost pressures.

- Consolidation creates larger, more dominant competitors.

- Intensified rivalry for remaining industry participants.

Competitive rivalry within the windows and doors sector is fierce, driven by a few large, established players like Pella and Marvin, alongside Andersen Corporation. The market is characterized by product differentiation through materials, styles, and performance features, with companies heavily investing in innovation and brand reputation.

A market slowdown in residential construction, observed in 2023 and projected for 2024, intensifies this rivalry as companies fight harder for market share. This environment encourages aggressive pricing and marketing strategies among existing competitors.

High capital investments in manufacturing and substantial exit barriers mean companies are compelled to remain active, further fueling competition. Additionally, increased merger and acquisition activity in 2024 consolidates the market, creating larger, more formidable rivals that pressure independent players.

| Key Competitors | Product Focus | Market Share (Estimated 2023/2024) | Differentiation Strategy |

| Andersen Corporation | Windows, Doors | Significant (Top 3 in North America) | Broad product range, innovation, brand loyalty |

| Pella Corporation | Windows, Doors | Significant (Top 3 in North America) | Design customization, energy efficiency, premium offerings |

| Marvin | Windows, Doors | Substantial (Top 5 in North America) | High-end custom solutions, premium materials, architectural focus |

| JELD-WEN | Windows, Doors, Other Building Products | Substantial (Top 5 in North America) | Volume production, broad distribution, value-oriented |

SSubstitutes Threaten

The threat of substitutes for Andersen Corporation's products primarily stems from alternative building envelope solutions that can reduce the reliance on traditional windows and doors. Innovations like advanced insulation techniques, passive house designs, and integrated wall systems aim to minimize the need for extensive fenestration, thereby offering a potential substitute. For instance, in 2024, the global passive house market was valued at approximately $10 billion and is projected to grow significantly, indicating a rising interest in energy-efficient building methods that might lessen the demand for standard window installations.

Despite these emerging alternatives, windows and doors continue to be essential components in both residential and commercial construction. Their fundamental roles in providing natural light, ventilation, and aesthetic appeal are difficult to fully replace with current substitute technologies. While advanced insulation can reduce heat transfer, it doesn't replicate the visual and functional aspects of a window. The market for windows and doors remained robust in 2024, with the global market size estimated to be over $150 billion, underscoring their continued importance in the building industry.

While smart windows offer advanced climate control and security, the broader smart home technology ecosystem presents potential, albeit currently limited, substitutes. For instance, smart thermostats and automated blinds can manage indoor temperature and light, indirectly impacting the perceived need for some smart window functionalities. However, these systems are largely seen as complementary, enhancing the overall smart home experience rather than directly replacing the core benefits of smart windows.

A key substitute for Andersen's new window and door products, particularly in new construction, is the option to renovate or repair existing buildings. As housing starts saw a slowdown in 2024, many property owners shifted their focus to upgrades and maintenance of current structures.

This trend towards renovation, rather than complete replacement, means that while demand for building products persists, it often moves away from new construction projects and towards refurbishment. For instance, the U.S. Census Bureau reported a notable decrease in new housing unit authorizations throughout 2023 and into early 2024, signaling a greater emphasis on the existing housing stock.

DIY Solutions and Lower-Cost Alternatives

For budget-conscious consumers or those undertaking smaller projects, the threat of substitutes is notable. Lower-cost, generic window and door options, or even do-it-yourself installations, can fulfill basic needs without the premium associated with Andersen's products. These alternatives, while often lacking in longevity and energy performance, present a compelling price advantage.

The availability of DIY kits and less premium brands means consumers can opt for cheaper replacements, especially for non-critical areas of their homes. For instance, in 2024, the home improvement market saw continued growth in the mid-tier and value segments, indicating a willingness among some homeowners to trade down for cost savings. This segment of the market is particularly susceptible to substitutes that offer a lower upfront investment.

- DIY Installation Kits: Generic window and door installation kits are readily available at big-box retailers, offering a significantly lower price point compared to professional installation and premium brands.

- Lower-Cost Brands: Numerous manufacturers offer windows and doors at substantially lower prices, catering to consumers prioritizing initial cost over long-term durability or advanced features.

- Second-Hand Market: In some regions, salvaged or refurbished windows and doors can be acquired at a fraction of the new cost, serving as a viable substitute for specific renovation needs.

Security Glass Advancements

Innovations in security glass, such as laminated or tempered glass and multi-layered security films, provide a significant alternative to traditional security measures like bars or shutters. These advancements offer enhanced protection against forced entry directly within the window and door systems themselves. For instance, laminated glass, commonly used in automotive windshields, is increasingly adopted in architectural applications for its shatter-resistant properties.

The increasing availability and effectiveness of advanced security glass present a threat of substitution for Andersen Corporation. As these glass technologies improve and become more cost-competitive, they can replace the need for supplementary security hardware. This trend means consumers may opt for integrated security features rather than adding external deterrents, potentially impacting demand for certain product lines.

- Enhanced Protection: Laminated and tempered glass significantly increases resistance to breakage and forced entry.

- Integrated Solution: Security glass offers a discreet, built-in security feature, unlike external bars or shutters.

- Cost-Effectiveness: As technology advances, integrated security glass may become a more economical choice over time compared to retrofitting additional security.

The threat of substitutes for Andersen Corporation's offerings is multifaceted, encompassing everything from energy-efficient building designs to lower-cost alternatives. While traditional windows and doors remain essential, emerging technologies and market shifts present viable alternatives that could impact demand. For example, the growing popularity of passive house designs, valued at approximately $10 billion globally in 2024, highlights a trend towards minimizing fenestration, thereby reducing reliance on standard window installations.

Furthermore, the renovation market's strength in 2024, fueled by a slowdown in new housing starts, means many homeowners are opting for upgrades rather than complete replacements. This shift, supported by data showing fewer new housing unit authorizations in early 2024 compared to previous years, redirects some demand away from new construction products. Even in the premium segment, innovations like advanced security glass offer integrated protection, potentially substituting for traditional security add-ons.

| Substitute Category | Description | 2024 Market Insight |

|---|---|---|

| Energy-Efficient Designs | Passive house, integrated wall systems | Passive House Market: ~$10 billion (2024) |

| Renovation Focus | Upgrading existing structures vs. new builds | Shift towards refurbishment due to slower housing starts |

| Cost-Conscious Options | DIY kits, lower-cost brands | Growth in mid-tier and value segments of home improvement |

| Security Enhancements | Advanced security glass, films | Increasing adoption for integrated protection |

Entrants Threaten

High capital requirements act as a significant deterrent for new players looking to enter the window and door manufacturing sector. Andersen Corporation, for instance, operates in an industry demanding substantial upfront investment in advanced manufacturing facilities, specialized machinery, and continuous research and development to stay competitive. These considerable financial outlays create a formidable barrier, making it challenging for nascent companies to establish a foothold and compete effectively with established entities.

Established brand loyalty and reputation present a significant barrier for new entrants into the window and door market. Andersen Corporation, for instance, has cultivated a formidable brand image, consistently recognized as America's most trusted brand in its sector. This deep-seated customer trust, built over decades, makes it incredibly challenging for newcomers to replicate the same level of brand recognition and product confidence quickly.

Andersen Corporation's extensive distribution network presents a formidable barrier to new entrants. The company leverages a vast ecosystem of independent dealers, retailers, and home improvement centers throughout North America and globally, a structure built over decades.

Building a comparable distribution reach requires substantial capital investment and significant time to cultivate relationships with these channel partners, making it difficult for newcomers to gain market access and compete effectively.

Economies of Scale in Manufacturing and Procurement

Economies of scale significantly deter new entrants in the window and door manufacturing industry. Established companies like Andersen Corporation leverage their massive production volumes to secure lower per-unit manufacturing costs. This advantage extends to procurement, where large orders for materials such as vinyl, glass, and aluminum result in substantial price discounts compared to what a new, smaller player could negotiate.

For instance, in 2024, Andersen Corporation's extensive supply chain network allows them to command better pricing from suppliers, a benefit a startup would struggle to replicate. This cost advantage means new entrants would likely face higher initial production expenses, making it challenging to compete on price with established, scaled manufacturers without considerable upfront investment and market penetration.

- Lower per-unit production costs for large manufacturers due to high output volumes.

- Negotiating power with suppliers for raw materials, leading to reduced input costs.

- Higher initial operating costs for new entrants, impacting price competitiveness.

- Significant capital investment required for new entrants to achieve comparable scale.

Regulatory and Certification Hurdles

The threat of new entrants in the building products industry, including for companies like Andersen Corporation, is significantly tempered by substantial regulatory and certification hurdles. Navigating complex building codes, energy efficiency standards such as ENERGY STAR, and rigorous product certifications demands considerable investment in research, development, and compliance testing. For instance, in 2024, the average cost for a new building product to achieve UL certification can range from $5,000 to $20,000 or more, depending on the product's complexity and the required testing protocols.

These requirements act as a formidable barrier, deterring potential competitors who may lack the financial resources or technical expertise to meet these stringent demands. New market entrants must demonstrate that their products not only perform as advertised but also adhere to safety and environmental regulations, a process that can be both time-consuming and capital-intensive. This ensures that established players, who have already invested in and mastered these compliance processes, maintain a competitive advantage.

- Regulatory Compliance Costs: New entrants face significant upfront costs to ensure products meet building codes and energy efficiency standards.

- Certification Processes: Obtaining necessary product certifications, like ENERGY STAR or specific safety ratings, can be lengthy and expensive.

- Technical Expertise: Understanding and implementing complex regulatory requirements necessitates specialized knowledge that startups may not possess.

- Market Access Barriers: Failure to meet these standards can prevent products from being sold in key markets, effectively blocking market entry.

The threat of new entrants for Andersen Corporation is significantly mitigated by the high capital requirements inherent in window and door manufacturing. Establishing state-of-the-art production facilities and investing in continuous innovation demands substantial financial outlay, creating a formidable barrier for aspiring competitors. For instance, the cost of advanced machinery alone can run into millions of dollars, a significant hurdle for startups in 2024.

Furthermore, Andersen's established brand equity and widespread distribution network, cultivated over decades, present a substantial challenge for new players. Replicating this level of customer trust and market penetration requires immense time and capital investment. The company's economies of scale also grant it a cost advantage, as larger production volumes lead to lower per-unit manufacturing and procurement expenses, making it difficult for new entrants to compete on price.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

| Capital Requirements | High investment in manufacturing, R&D, and machinery. | Deters entry due to significant upfront costs. | Millions of dollars for advanced production lines. |

| Brand Loyalty & Reputation | Strong customer trust and recognition. | Difficult for newcomers to build comparable brand equity. | Andersen's consistent ranking as a top-trusted brand. |

| Distribution Network | Extensive network of dealers and retailers. | Challenging market access for new entrants. | Decades to build comparable reach and relationships. |

| Economies of Scale | Lower per-unit costs due to high production volume. | New entrants face higher initial operating costs. | Better supplier pricing for large-volume orders. |

| Regulatory & Certification Hurdles | Compliance with building codes and standards. | Time-consuming and costly for new products. | $5,000-$20,000+ for product certifications like UL. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Andersen Corporation is built upon a foundation of publicly available financial statements, annual reports, and investor relations materials. We supplement this with insights from reputable industry research firms and trade publications that cover the building materials and home improvement sectors.