Anaborex, Inc. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anaborex, Inc. Bundle

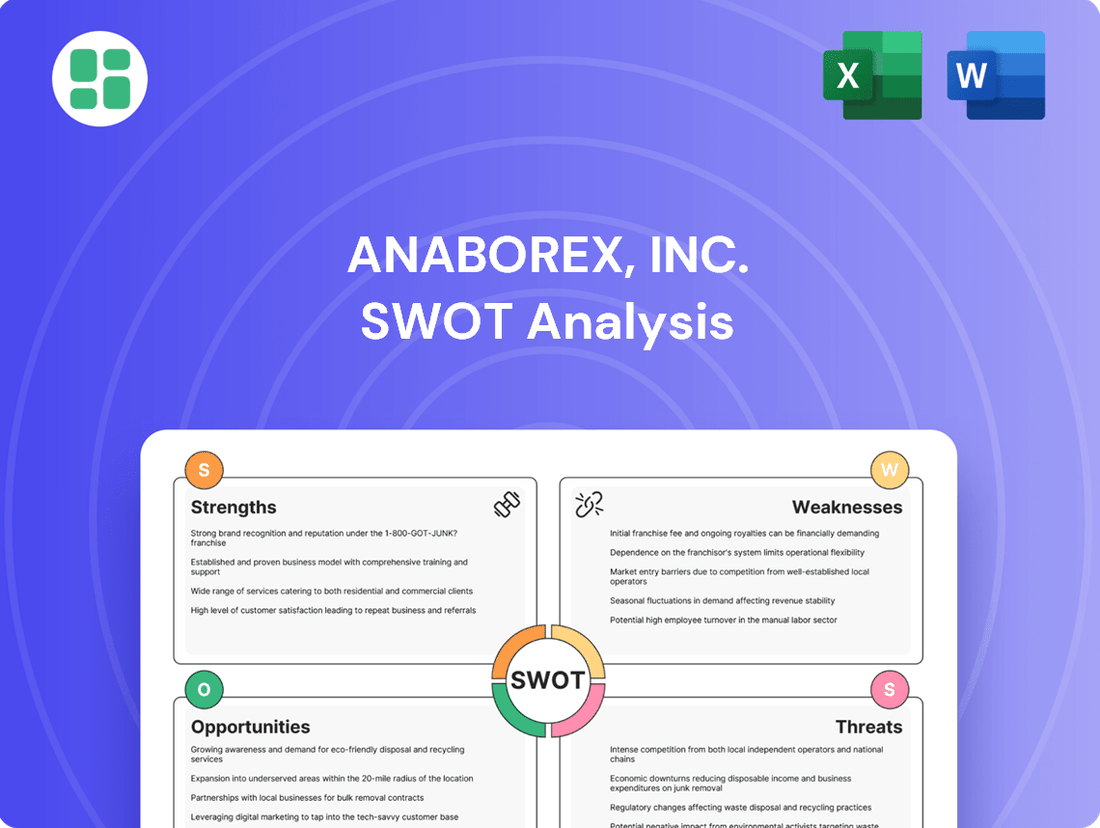

Anaborex, Inc. presents a compelling mix of internal strengths and external opportunities, but also faces significant competitive threats and potential weaknesses. Understanding these dynamics is crucial for anyone looking to invest, partner, or compete in this space.

Want the full story behind Anaborex, Inc.'s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Anaborex, Inc.'s strength lies in its niche therapeutic focus on wasting syndrome, especially in cancer patients. This specialization targets a significant unmet medical need, allowing for concentrated R&D.

By concentrating on this specific area, Anaborex can develop highly effective and differentiated treatments. This targeted approach fosters deep expertise and builds a strong reputation within this high-demand therapeutic niche.

Anaborex, Inc.'s dual business model, encompassing both drug development and clinical research services, creates a robust foundation. This diversification offers multiple avenues for revenue generation, lessening reliance on any single segment.

The company's specialization in metabolic diseases positions it within a growing market. While drug development is inherently capital-intensive and carries significant risk, the clinical research services segment can provide a more predictable and immediate revenue stream, helping to buffer the financial demands of R&D.

This integrated approach allows Anaborex to potentially leverage shared scientific expertise and infrastructure across its operations. For instance, insights gained from clinical research services could inform and accelerate its own drug development pipeline, creating synergistic benefits.

Anaborex, Inc.'s early-stage status fuels exceptional agility, allowing swift adaptation to novel scientific breakthroughs and evolving market demands, a stark contrast to larger, more encumbered pharmaceutical giants. This inherent flexibility fosters a fertile ground for pioneering drug discovery and development, paving the way for potentially groundbreaking therapeutic solutions.

The company's capacity to pivot rapidly based on preclinical and early clinical data is a significant strength, enabling proactive optimization of its drug pipeline. For instance, in 2024, early positive results from Anaborex's Phase 1 trial for its lead compound, ANX-001, allowed for an accelerated progression into Phase 2 trials, demonstrating this agility in action and potentially shaving years off traditional development timelines.

Proprietary Research and Technology

Anaborex, Inc.'s development of 'novel therapies' signifies a core strength in its proprietary research and technology. This focus on unique mechanisms of action and drug candidates is designed to build a strong intellectual property (IP) portfolio, a critical asset in the competitive biotechnology landscape. A robust IP position not only offers a significant competitive advantage but also enhances the potential for substantial returns through commercialization or strategic licensing agreements.

This technological edge is a key differentiator, attracting vital investment and fostering lucrative partnership opportunities. For instance, companies with strong IP often command higher valuations, as seen in the biotech sector where successful patent filings can directly translate to market exclusivity and pricing power. Anaborex's commitment to innovation in its proprietary technology is therefore foundational to its growth strategy and market standing.

- Proprietary technology underpins Anaborex's development of unique therapeutic approaches.

- A strong intellectual property (IP) portfolio derived from this technology provides a significant competitive moat.

- This IP is crucial for attracting investment and securing strategic partnerships within the biotechnology industry.

- The ability to develop novel therapies with distinct mechanisms of action can lead to premium market positioning and pricing power.

Leveraging Market Growth in Wasting Syndrome and Metabolic Diseases

The global market for wasting syndrome treatments is experiencing robust expansion, with projections indicating continued growth. Similarly, the metabolic diseases sector, encompassing conditions like diabetes and obesity, represents a substantial and expanding area of clinical research and therapeutic development. These trends are largely fueled by the increasing prevalence of chronic illnesses and a global demographic shift towards older populations, both of which heighten the demand for effective interventions.

Anaborex, Inc. is strategically positioned to benefit from these favorable market dynamics. The company's therapeutic pipeline is designed to address critical unmet needs within wasting syndrome and metabolic disease treatment paradigms. Furthermore, Anaborex offers specialized clinical research services, which are in high demand as pharmaceutical and biotechnology companies seek to advance their own pipelines in these lucrative areas.

This confluence of market growth and Anaborex's specific offerings creates a powerful tailwind. For instance, the global metabolic disease market was valued at over $700 billion in 2023 and is expected to reach approximately $1 trillion by 2030, showcasing significant upside potential. The wasting syndrome market, while smaller, is also on a strong upward trajectory, driven by advancements in understanding and treating conditions like cancer cachexia and sarcopenia.

- Growing Market Size: The metabolic disease market is projected to exceed $1 trillion by 2030, indicating substantial growth opportunities.

- Increasing Prevalence: Rising rates of chronic diseases and an aging global population are key drivers for demand in both wasting syndrome and metabolic disease treatments.

- Anaborex's Strategic Fit: The company's therapeutic pipeline and clinical services directly align with the needs of these expanding markets.

- Favorable Business Environment: The current market conditions provide a supportive backdrop for Anaborex's growth and potential for increased profitability.

Anaborex, Inc. possesses a distinct advantage through its specialized focus on wasting syndrome, particularly within the oncology patient population. This niche specialization addresses a critical unmet medical need, allowing for concentrated research and development efforts.

The company's dual business model, combining drug development with clinical research services, provides a diversified revenue stream and financial stability. This integrated approach fosters synergistic benefits, where insights from clinical research can accelerate the company's own drug development pipeline.

Anaborex's agility as an early-stage company enables rapid adaptation to scientific advancements and market shifts. This flexibility was evident in 2024 when positive Phase 1 data for ANX-001 allowed for an accelerated move into Phase 2 trials, demonstrating efficient pipeline progression.

The company's proprietary technology and commitment to developing novel therapies with unique mechanisms of action are core strengths. This focus on innovation builds a robust intellectual property (IP) portfolio, crucial for competitive advantage, investment attraction, and potential licensing opportunities.

What is included in the product

Delivers a strategic overview of Anaborex, Inc.’s internal and external business factors, highlighting its competitive position and market challenges.

Anaborex, Inc.'s SWOT analysis offers a clear, actionable framework to identify and address pain points in their pain relief strategy.

Weaknesses

Anaborex, Inc., as an early-stage biotechnology firm, is burdened by exceptionally high research and development costs. The intricate and lengthy process of bringing novel therapies to market, encompassing discovery, preclinical testing, and multiple phases of human clinical trials, inherently leads to significant financial outlays over extended periods. This prolonged development timeline means the company is likely to incur substantial operating losses, often referred to as a high financial burn rate, for several years before any potential product can generate revenue.

The financial strain of these R&D expenditures requires Anaborex to constantly seek new funding. For instance, many early-stage biotech companies in 2024 and 2025 are relying heavily on venture capital rounds and public offerings to sustain operations. Without consistent access to capital, the company's ability to advance its pipeline and reach crucial development milestones is severely jeopardized, making effective financial management paramount to its survival and progress.

Anaborex, Inc.'s future hinges significantly on the successful development and market approval of its innovative wasting syndrome treatments. The inherent risk in drug development means that setbacks in clinical trials, unforeseen safety concerns, or a lack of demonstrated efficacy for any of its key drug candidates could substantially diminish the company's market value and operational capacity.

As an emerging player in the pharmaceutical and contract research organization (CRO) space, Anaborex, Inc. faces a significant hurdle in its limited market presence and brand recognition. Established companies in the sector, with years of operation and proven track records, naturally command greater visibility and trust among potential clients and partners.

The challenge for Anaborex is to carve out its niche and build credibility in a crowded field. This necessitates substantial investment in strategic marketing initiatives, a robust sales force, and dedicated efforts to foster strong relationships within the industry. Overcoming this initial deficit is crucial for Anaborex to compete effectively and secure its position.

Intense Competition

The biotechnology and clinical research landscape is intensely competitive, with Anaborex, Inc. facing a crowded field of both established giants and nimble startups. This fierce rivalry extends to securing crucial market share, attracting top-tier scientific talent, and obtaining vital funding. For instance, in 2024, the global biotech market was valued at approximately $1.7 trillion, with significant investment flowing into R&D, creating a demanding environment for smaller players.

Anaborex must contend with larger, more resource-rich corporations that often possess deeper pipelines, established commercial infrastructure, and greater financial reserves. This disparity can present significant hurdles in areas like talent acquisition and the formation of strategic partnerships, which are critical for advancing drug development and market penetration. The ability to attract and retain key personnel is paramount, as demonstrated by the high demand for experienced biopharma professionals, with salary benchmarks rising significantly in 2024-2025.

- Market Saturation: Numerous companies are developing similar therapeutic approaches, diluting potential market impact.

- Resource Disparity: Larger competitors can outspend Anaborex on R&D, marketing, and talent acquisition.

- Talent Competition: Attracting and retaining specialized scientific and clinical talent is a constant challenge, with demand often outstripping supply.

- Partnership Hurdles: Securing collaborations with established pharmaceutical companies can be difficult for emerging biotechs due to risk aversion and existing commitments.

Regulatory Hurdles and Approval Timelines

Anaborex, Inc. faces significant regulatory hurdles in bringing its novel therapies to market. The process for gaining approval from bodies like the FDA is inherently complex, lengthy, and costly, with no guarantee of success. For instance, the average time for a new drug approval in the US has historically been around 10 years, and this timeline can be further extended by unforeseen issues during clinical trials or review periods.

Delays in securing regulatory approvals can severely impact Anaborex's commercialization strategy and financial forecasts. Unexpected requirements or rejections can push back revenue generation, increase development expenses, and erode investor confidence. This unpredictability in timelines and outcomes is a critical weakness that requires robust contingency planning and substantial financial reserves.

- Lengthy Approval Processes: The typical drug development lifecycle, from discovery to market, can span over a decade, demanding immense capital and patience.

- Unpredictable Outcomes: Regulatory agencies may require additional data or impose specific conditions, leading to unforeseen delays and increased costs for Anaborex.

- Financial Strain: Extended approval timelines directly impact cash flow and profitability, potentially requiring Anaborex to seek additional funding rounds at unfavorable terms.

Anaborex, Inc. faces a significant hurdle in its limited market presence and brand recognition, making it difficult to compete with established companies. This lack of visibility requires substantial investment in marketing and sales to build credibility in a crowded sector.

The biotechnology and clinical research landscape is intensely competitive, with Anaborex encountering both large corporations and agile startups. This rivalry impacts securing market share, attracting talent, and obtaining vital funding. For example, the global biotech market was valued at approximately $1.7 trillion in 2024, highlighting the intense competition for resources.

Anaborex must contend with larger, more resource-rich corporations that possess deeper pipelines and established commercial infrastructure. This disparity creates challenges in talent acquisition and forming strategic partnerships, crucial for advancing drug development. The demand for experienced biopharma professionals in 2024-2025 has driven up salary benchmarks significantly.

| Weakness | Description | Impact |

| Limited Market Presence | Lack of established brand recognition and client base. | Difficulty attracting early customers and partners compared to established firms. |

| Intense Competition | Operating in a crowded market with numerous players. | Challenges in gaining market share, securing funding, and attracting top talent. |

| Resource Disparity | Smaller financial and operational resources compared to larger competitors. | Inability to match competitor spending on R&D, marketing, and talent acquisition. |

| Talent Acquisition | Struggles to attract and retain specialized scientific and clinical personnel. | Potential delays in research and development due to a lack of skilled staff. |

What You See Is What You Get

Anaborex, Inc. SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Anaborex, Inc. can forge strategic partnerships with major pharmaceutical giants to co-develop its pipeline drugs. These alliances offer crucial access to substantial funding, specialized R&D expertise, and established global distribution networks, significantly boosting commercialization prospects.

Collaborating with other biotechnology firms or leading academic research institutions on clinical trials for its services can broaden Anaborex's market penetration and attract a more diverse clientele. For instance, by leveraging the 2024 surge in biotech R&D spending, which saw a notable increase in collaborative ventures, Anaborex could secure vital resources.

Such strategic alliances are instrumental in mitigating the inherent risks associated with drug development and expediting the journey from laboratory to market. This approach aligns with industry trends where companies are increasingly pooling resources to navigate complex regulatory landscapes and accelerate innovation.

Anaborex, Inc. has a significant opportunity to broaden its clinical research services beyond metabolic diseases. Exploring adjacent therapeutic areas, such as oncology or rare diseases, where Anaborex might leverage existing research methodologies or build upon its scientific foundation, could unlock new revenue streams. This diversification is particularly attractive given the projected growth in the global clinical trials market, which was valued at approximately $52.1 billion in 2023 and is expected to reach $92.4 billion by 2030, growing at a CAGR of 8.5%.

Anaborex can leverage AI and machine learning to streamline its drug discovery pipeline. For instance, companies like Recursion Pharmaceuticals have seen significant acceleration in identifying potential drug candidates by employing AI-driven platforms, reducing discovery timelines by as much as 50% in some preclinical stages. This efficiency gain is crucial for Anaborex to bring novel therapies to market faster.

Advanced genomics and bioinformatics tools offer opportunities to optimize clinical trial design. By utilizing these technologies, Anaborex can better stratify patient populations, ensuring that trials recruit individuals most likely to respond to a given treatment. This precision approach, exemplified by the success of targeted therapies in oncology where patient stratification can improve trial success rates by 10-20%, can lead to more robust data and quicker regulatory approvals.

The integration of these technological advancements can provide Anaborex with a substantial competitive advantage. Companies that effectively harness AI and big data analytics in R&D are better positioned to identify novel therapeutic targets and develop more effective treatments. In 2024, the global biotech AI market was valued at over $2 billion and is projected to grow at a CAGR of over 35% through 2030, indicating a strong trend towards data-driven innovation.

Addressing Unmet Medical Needs

Anaborex, Inc. can capitalize on the significant unmet medical need in treating wasting syndromes, particularly cachexia in cancer patients. This focus presents a substantial market opportunity for innovative therapies. The global cachexia market was valued at approximately USD 1.5 billion in 2023 and is projected to grow, indicating strong demand for effective treatments.

Increased awareness and improved diagnostic capabilities for these debilitating conditions offer Anaborex a chance to establish itself as a frontrunner. By developing and marketing a successful treatment, the company could capture a considerable portion of this expanding market, potentially reaching billions in revenue by 2025.

- Unmet Need: Wasting syndromes, especially cancer-related cachexia, affect millions globally, with limited effective treatment options.

- Market Growth: The cachexia market is expected to see robust growth, driven by an aging population and increased cancer diagnoses.

- Leadership Potential: Anaborex can position itself as a leader by addressing this critical therapeutic gap with its innovative approach.

Geographic Market Expansion

Anaborex, Inc. has a significant opportunity to expand its geographic reach once its current therapies demonstrate success. This strategic move could target regions with a high incidence of the diseases Anaborex addresses, such as obesity and related metabolic disorders. For instance, the global obesity market was valued at approximately $140 billion in 2023 and is projected to grow substantially, presenting a fertile ground for expansion.

Further opportunities lie in entering established markets with robust healthcare systems and a demonstrated willingness to adopt innovative treatments. This includes countries in Western Europe and parts of Asia, where Anaborex could leverage existing distribution networks and partnerships. The company could also explore emerging markets where the prevalence of metabolic diseases is rising rapidly, offering a chance to capture market share early.

- Target Emerging Markets: Focus on regions like Southeast Asia and Latin America, where the metabolic disease burden is increasing, with projected CAGR of over 5% for the obesity market in these regions through 2028.

- Penetrate Developed Markets: Establish a presence in North America and Europe, leveraging their advanced healthcare infrastructure and higher disposable incomes, contributing to an estimated 60% of the global pharmaceutical market value.

- Strategic Partnerships: Collaborate with local distributors and healthcare providers to navigate regulatory landscapes and build market access efficiently in new territories.

- Adapt Offerings: Tailor Anaborex's therapies or services to meet the specific needs and economic conditions of diverse geographic markets.

Anaborex, Inc. can leverage advancements in artificial intelligence and machine learning to accelerate its drug discovery and development processes. By integrating AI platforms, similar to those used by industry leaders that have reduced preclinical timelines by up to 50%, Anaborex can identify promising drug candidates more efficiently.

The company has a significant opportunity to expand its service offerings into adjacent therapeutic areas beyond metabolic diseases, such as oncology or rare diseases. This diversification could tap into growing markets, with the global clinical trials market projected to reach $92.4 billion by 2030, growing at an 8.5% CAGR.

Addressing the unmet medical need in wasting syndromes, particularly cancer-related cachexia, presents a substantial market opportunity, estimated at $1.5 billion in 2023. Anaborex can position itself as a leader by developing effective treatments for these debilitating conditions, which affect millions globally.

Expanding Anaborex's geographic reach into key markets like Western Europe and Asia, alongside emerging markets with rising metabolic disease prevalence, offers significant growth potential. The global obesity market alone was valued at $140 billion in 2023, indicating substantial opportunities for expansion.

Threats

Clinical trial failures represent a significant threat to Anaborex, Inc. The inherent unpredictability of drug development means that even promising candidates can falter at any phase, failing to prove efficacy or safety. For instance, in 2023, the biopharmaceutical industry saw an average failure rate of approximately 90% for drugs entering Phase 1 clinical trials, highlighting the high stakes involved.

Such setbacks can result in substantial financial write-offs, damage Anaborex's reputation within the scientific and investment communities, and potentially halt the progression of crucial product pipelines. A major trial failure could severely undermine investor confidence and impact the company's ability to secure future funding, thereby jeopardizing its long-term growth strategy.

Anaborex, Inc. faces intensifying regulatory scrutiny, a common challenge in the biotech sector. For instance, the FDA's drug approval process, while crucial for safety, can lead to significant delays. In 2024, the average review time for novel drugs remained a critical factor for companies like Anaborex, potentially impacting revenue timelines.

Policy shifts, such as potential price controls on pharmaceuticals, represent a significant threat. Discussions around drug pricing in the United States throughout 2024 and into 2025 could directly affect Anaborex's future profitability if new policies are enacted that limit revenue potential for its pipeline or marketed products.

As an early-stage biotechnology firm, Anaborex, Inc. faces significant hurdles in securing the substantial capital required for its ambitious research and development initiatives. The company's reliance on external funding sources like venture capital and potential public offerings makes it vulnerable to shifts in the investment landscape. For instance, a recent report indicated that venture capital funding for biotech startups saw a notable slowdown in late 2023 and early 2024, with deal volumes decreasing compared to prior years.

Economic volatility and a potential downturn in the broader market could further exacerbate these funding challenges. Failure to meet critical development milestones, such as successful clinical trial results or regulatory approvals, would severely impact Anaborex's ability to attract and retain investors, thereby threatening the continuity of its operations and the advancement of its promising drug pipeline.

Intellectual Property Infringement and Competition

The biotechnology sector is intensely competitive, posing a significant threat to Anaborex, Inc. Competitors may develop comparable therapies or contest the company's intellectual property, potentially impacting market position and financial performance.

Patent expirations or the introduction of similar drugs, often termed 'me-too' drugs, can diminish Anaborex's market share and profitability. For instance, the global biopharmaceutical market, valued at approximately $1.7 trillion in 2023, is characterized by rapid innovation and intense patent battles, with many blockbuster drugs facing patent cliffs in the coming years.

- Patent Challenges: Competitors may seek to invalidate Anaborex's patents or argue non-infringement.

- Emergence of 'Me-Too' Drugs: Similar therapies with potentially lower R&D costs could dilute Anaborex's market presence.

- Innovation Pressure: Continuous investment in novel research and development is crucial to stay ahead of the curve.

- Market Share Erosion: Failure to innovate or defend IP could lead to a decline in Anaborex's revenue streams.

Talent Acquisition and Retention

The biotechnology industry, including companies like Anaborex, Inc., demands highly specialized expertise across scientific, clinical, and business functions. This intense need for skilled professionals creates a competitive landscape where attracting and retaining top talent is a significant hurdle. Larger, established biopharma firms, with their greater resources and brand recognition, often pose a substantial challenge to smaller companies in securing these sought-after individuals.

Competition for talent isn't just from established players; other well-funded startups are also vying for the same limited pool of highly qualified scientists and business leaders. This can drive up compensation expectations and make retention more difficult. For instance, in 2024, the average salary for a senior research scientist in biotech in major hubs like Boston or San Francisco could easily exceed $150,000 annually, plus significant equity. The loss of even a few key personnel can have a cascading negative effect on Anaborex's research timelines and overall operational continuity.

Consider these specific talent-related challenges:

- Specialized Skill Gap: The scarcity of professionals with niche expertise in areas like gene editing or novel drug delivery systems remains a persistent issue.

- Competitive Compensation: To attract top talent, Anaborex may need to offer compensation packages that rival those of larger, more profitable organizations.

- Retention Incentives: Beyond salary, retaining key employees requires robust benefits, opportunities for professional growth, and a compelling company mission.

- Impact of Turnover: A high turnover rate among critical scientific staff can lead to project delays, increased recruitment costs, and a potential loss of institutional knowledge.

Anaborex, Inc. faces a critical threat from the inherent unpredictability of clinical trials, where failure rates remain exceptionally high. In 2023, the biopharmaceutical industry reported an average failure rate of approximately 90% for drugs entering Phase 1, underscoring the substantial risk. Such setbacks can lead to significant financial losses, damage investor confidence, and impede future funding, potentially halting pipeline progression.

Intensifying regulatory scrutiny, exemplified by the FDA's drug approval process, presents another significant challenge. The average review time for novel drugs in 2024 continued to be a critical factor, potentially delaying Anaborex's revenue generation timelines. Furthermore, potential policy shifts, such as drug pricing controls discussed throughout 2024 and into 2025, could directly impact future profitability and revenue potential.

The company's reliance on external funding makes it vulnerable to economic volatility and shifts in the investment landscape, with venture capital funding for biotech startups showing a slowdown in late 2023 and early 2024. Intense competition within the biotechnology sector, valued at roughly $1.7 trillion in 2023, also poses a threat, as competitors may develop similar therapies or challenge intellectual property, potentially eroding market share.

The demand for highly specialized talent in biotech creates a competitive environment where attracting and retaining skilled professionals is difficult, especially when competing with larger, more established firms. In 2024, senior research scientist salaries in biotech hubs often exceeded $150,000 annually, plus equity, making talent acquisition costly and retention challenging, with turnover risking project delays and loss of institutional knowledge.

SWOT Analysis Data Sources

This Anaborex, Inc. SWOT analysis is built upon a foundation of robust data, including Anaborex's official financial filings, comprehensive market research reports, and expert commentary from industry analysts to ensure a thorough and accurate assessment.