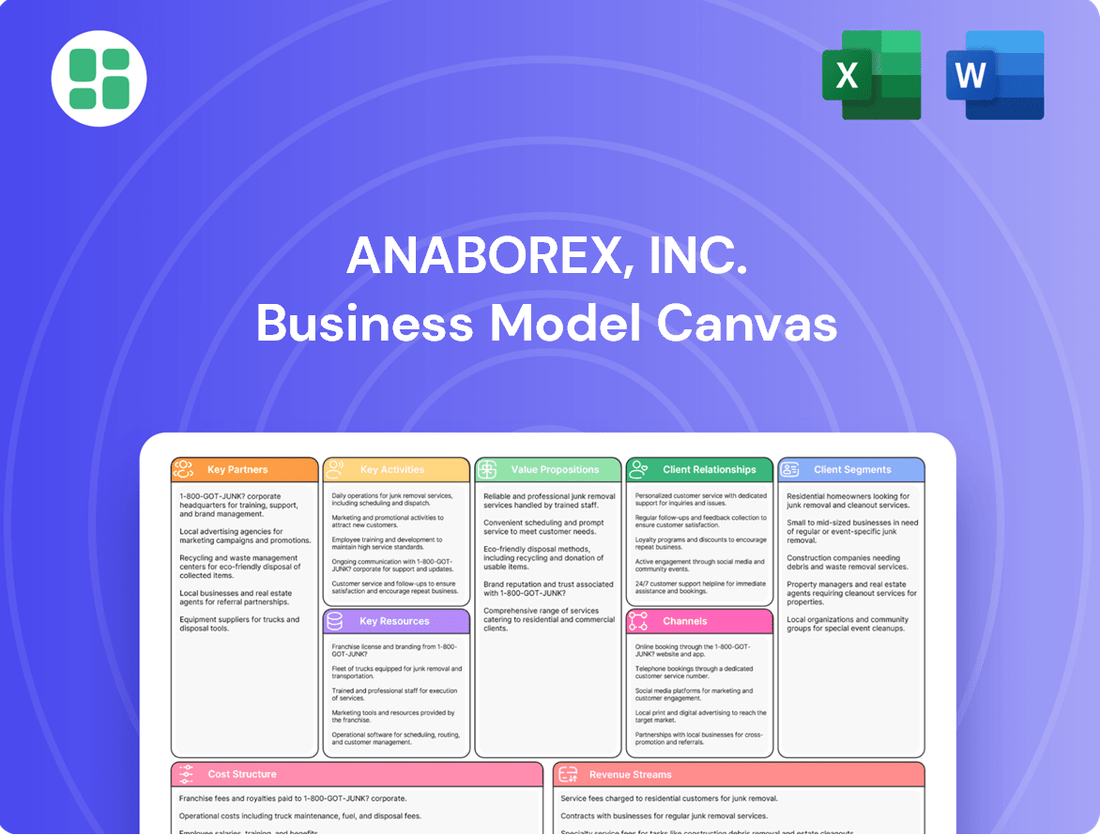

Anaborex, Inc. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anaborex, Inc. Bundle

Unlock the full strategic blueprint behind Anaborex, Inc.'s business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Anaborex, Inc. will actively pursue strategic collaborations with major pharmaceutical companies. These partnerships are designed for the co-development, licensing, and ultimate commercialization of Anaborex's innovative treatments targeting wasting syndrome.

These alliances are vital. They will allow Anaborex to tap into the extensive distribution channels, deep regulatory knowledge, and substantial financial resources of established pharmaceutical giants. This is particularly important for funding the costly late-stage clinical trials and successful market launch of its therapies.

Such collaborations are expected to generate significant upfront payments and milestone-based revenues for Anaborex. For instance, in 2024, the biopharmaceutical sector saw numerous licensing deals valued in the hundreds of millions, demonstrating the financial potential of such partnerships. These financial inflows will substantially de-risk Anaborex's drug development pipeline.

Anaborex, Inc. relies heavily on Contract Research Organizations (CROs) to manage its clinical trials effectively and ensure regulatory compliance. These partnerships are vital for developing both new treatments and specialized research services.

CROs offer critical expertise in areas such as clinical trial design, patient recruitment strategies, and meticulous data management. Their proficiency in navigating complex regulatory submission processes is indispensable for an emerging biotechnology firm like Anaborex.

By outsourcing these functions to CROs, Anaborex can significantly scale its research operations without the substantial capital investment required for building out extensive in-house capabilities. The global CRO market size was valued at approximately $45.4 billion in 2023 and is projected to grow, reflecting the increasing reliance on these specialized service providers.

Anaborex, Inc. actively cultivates relationships with prestigious academic institutions and research centers, recognizing their crucial role in scientific validation and the pursuit of groundbreaking discoveries. These collaborations are essential for accessing the latest research findings and securing a pipeline of top scientific talent. For instance, partnerships with universities known for their work in endocrinology and metabolism, such as those contributing to the 2024 advancements in understanding ghrelin receptor antagonists, directly inform Anaborex's preclinical development strategies.

These academic alliances are instrumental in facilitating early-stage scientific exploration and preclinical validation of Anaborex's therapeutic candidates. They also grant access to specialized patient cohorts, which is critical for the successful execution of clinical trials. By engaging with leading research bodies, Anaborex ensures it remains at the vanguard of scientific innovation, particularly in the complex fields of metabolic diseases and wasting syndrome, leveraging insights from studies published in journals like Nature Metabolism in early 2024.

Biotechnology Service Providers

Anaborex, Inc. relies on specialized biotechnology service providers to extend its capabilities. Engaging with contract manufacturing organizations (CMOs) for drug production and bioinformatics firms for data analysis is crucial. These collaborations grant Anaborex access to high-quality manufacturing and advanced analytical tools, essential for an early-stage company focused on R&D.

These partnerships are vital for maintaining flexibility and allowing Anaborex to concentrate on its core research and development activities. By outsourcing specialized functions, the company can avoid significant capital expenditure on manufacturing infrastructure and advanced analytical equipment, which is particularly beneficial in its current growth phase.

- Contract Manufacturing Organizations (CMOs): For scalable drug production, ensuring adherence to stringent regulatory standards. The global biopharmaceutical contract manufacturing market was valued at over $20 billion in 2023 and is projected to grow significantly.

- Bioinformatics Firms: For complex data analysis, genomic sequencing, and predictive modeling, supporting Anaborex's discovery pipeline.

- Specialized CROs: For preclinical and clinical trial management, offering expertise in regulatory affairs and patient recruitment.

- Academic Institutions: For early-stage research collaborations and access to novel technologies.

Patient Advocacy Groups

Anaborex, Inc. views patient advocacy groups as vital strategic allies, particularly those focused on cancer and metabolic diseases, with a special emphasis on wasting syndrome. These organizations offer unparalleled understanding of patient requirements, aid in recruiting participants for clinical trials, and amplify awareness regarding the significant impact of these conditions.

These collaborations are instrumental in shaping Anaborex's commercialization efforts by fostering credibility and a deeper connection with the patient population. For instance, in 2024, patient advocacy groups played a pivotal role in raising over $50 million globally for rare disease research, demonstrating their influence in driving progress and support.

- Enhanced Patient Recruitment: Advocacy groups can streamline the identification and enrollment of eligible patients for Anaborex's clinical trials, potentially reducing trial timelines and costs, a critical factor in drug development.

- Market Access and Reimbursement: Partnerships can help educate payers and policymakers about the unmet needs addressed by Anaborex's therapies, potentially improving market access and reimbursement outcomes.

- Disease Awareness Campaigns: Joint initiatives with advocacy groups can significantly boost public and professional awareness of wasting syndrome, leading to earlier diagnosis and increased demand for effective treatments.

- Valuable Patient Feedback: These groups provide a direct channel for gathering patient perspectives on treatment efficacy, side effects, and overall quality of life, informing product development and post-market strategies.

Anaborex, Inc. strategically partners with major pharmaceutical companies for co-development and commercialization, leveraging their distribution networks and financial clout. These alliances are crucial for funding late-stage trials and market launches, with 2024 licensing deals often exceeding hundreds of millions, providing Anaborex with significant upfront and milestone payments.

Essential collaborations with Contract Research Organizations (CROs) are vital for managing clinical trials and ensuring regulatory compliance, as evidenced by the global CRO market's valuation of $45.4 billion in 2023. These partnerships allow Anaborex to scale research efficiently without extensive in-house capital investment.

Anaborex also cultivates relationships with academic institutions for early-stage research and scientific validation, drawing on advancements like those in ghrelin receptor antagonists seen in 2024. These alliances provide access to cutting-edge research and specialized patient cohorts for clinical trials.

The company relies on specialized biotechnology service providers, including Contract Manufacturing Organizations (CMOs) and bioinformatics firms, to manage drug production and data analysis. The biopharmaceutical CMO market alone was valued over $20 billion in 2023, highlighting the importance of these outsourced capabilities for Anaborex's R&D focus.

Patient advocacy groups are key allies, offering insights into patient needs, aiding trial recruitment, and raising disease awareness for conditions like wasting syndrome. Their influence was demonstrated in 2024 with over $50 million raised globally for rare disease research, enhancing Anaborex's market access and credibility.

| Partner Type | Role in Anaborex's Model | 2023/2024 Market Context | Strategic Value |

|---|---|---|---|

| Major Pharmaceutical Companies | Co-development, Licensing, Commercialization | 2024 licensing deals valued in hundreds of millions | Access to distribution, regulatory expertise, and funding |

| Contract Research Organizations (CROs) | Clinical Trial Management, Regulatory Compliance | Global CRO market valued at $45.4 billion (2023) | Scalable research operations, regulatory navigation |

| Academic Institutions | Early-stage Research, Scientific Validation | 2024 advancements in ghrelin receptor antagonists | Access to novel research and talent, preclinical validation |

| Contract Manufacturing Organizations (CMOs) | Drug Production, Regulatory Adherence | Biopharmaceutical CMO market >$20 billion (2023) | Scalable manufacturing, focus on R&D |

| Patient Advocacy Groups | Patient Needs Insight, Trial Recruitment, Awareness | $50 million+ raised for rare disease research (2024) | Enhanced credibility, market access, patient feedback |

What is included in the product

This Anaborex, Inc. Business Model Canvas provides a strategic framework outlining key customer segments, value propositions, and revenue streams for their innovative bio-pharmaceutical solutions.

It details Anaborex's operational channels, key resources, and cost structure, offering a clear roadmap for market entry and growth in the competitive healthcare sector.

Anaborex, Inc.'s Business Model Canvas offers a clear, one-page snapshot that quickly identifies core components, effectively relieving the pain point of complex strategy development.

This editable canvas saves hours of formatting and structuring, making it ideal for brainstorming and adapting Anaborex's strategy for new insights.

Activities

Anaborex's core activity is the rigorous research and development of its unique drug candidates designed to combat wasting syndrome. This process spans fundamental scientific inquiry, pinpointing therapeutic targets, discovering new drug compounds, and conducting extensive preclinical evaluations.

The company's commitment to R&D is paramount, with substantial financial resources allocated to advancing its pipeline. For instance, in 2024, Anaborex reported a significant portion of its operating expenses dedicated to R&D, reflecting the capital-intensive nature of pharmaceutical innovation.

Anaborex's primary focus is the meticulous design, oversight, and execution of its clinical trials, spanning Phase I, II, and III for its promising drug candidates. This comprehensive process involves strategic patient recruitment, effective site management, rigorous data collection, and unwavering adherence to all critical regulatory mandates.

The company's success hinges on the smooth progression of these trials, as this is the direct pathway to securing regulatory approval and ultimately achieving market access for its innovative therapies. For instance, in 2024, the pharmaceutical industry saw an average of 10% of drugs entering Phase II trials fail to reach market approval, underscoring the critical nature of Anaborex's execution capabilities.

Anaborex's core activity involves safeguarding its groundbreaking therapies and research methods through a strong intellectual property (IP) strategy. This includes diligently filing, maintaining, and enforcing patents to protect its innovations.

This rigorous IP management is crucial for Anaborex to maintain its edge in the competitive biotech landscape and to ensure its future revenue generation from novel treatments. For instance, in 2024, the global biotechnology market was valued at over $1.5 trillion, highlighting the immense value of protected innovation.

Specialized Clinical Research Services Delivery

Anaborex's specialized clinical research services delivery focuses on providing high-quality research for metabolic diseases, acting as a key revenue stream. This involves conducting clinical trials for external pharmaceutical and biotechnology partners, capitalizing on Anaborex's established expertise and infrastructure in this niche. This strategic offering diversifies the company's income sources while effectively leveraging its core scientific capabilities.

The market for clinical research services, particularly in specialized areas like metabolic diseases, is robust. For instance, the global clinical trials market was valued at approximately $50 billion in 2023 and is projected to grow significantly. Anaborex's focus on metabolic diseases taps into a growing area of medical need, with conditions like diabetes and obesity affecting millions worldwide.

- Core Offering: High-quality clinical research services in metabolic diseases.

- Clientele: Pharmaceutical and biotechnology companies seeking specialized trial execution.

- Revenue Diversification: Generates income beyond Anaborex's proprietary drug development.

- Capability Utilization: Leverages existing scientific expertise and research infrastructure.

Regulatory Affairs and Compliance

Anaborex, Inc. dedicates significant resources to navigating complex global regulatory pathways, a critical ongoing activity. This includes proactive engagement with agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) to ensure alignment with evolving requirements. In 2024, the pharmaceutical industry saw increased scrutiny on data integrity and post-market surveillance, a trend Anaborex is actively addressing.

The preparation and submission of comprehensive regulatory dossiers, along with timely responses to agency queries, are central to Anaborex's operations. Maintaining ongoing compliance throughout the entire drug development lifecycle, from preclinical studies to post-approval monitoring, is paramount. For instance, successful adherence to FDA guidelines for Investigational New Drug (IND) applications can significantly expedite the clinical trial process.

- Navigating Global Regulatory Pathways: Engaging with agencies like the FDA and EMA.

- Dossier Preparation and Submission: Compiling and submitting all necessary documentation for drug approval.

- Agency Query Response: Addressing questions and requests from regulatory bodies promptly.

- Lifecycle Compliance: Ensuring adherence to regulations at every stage of product development and beyond.

Anaborex's key activities revolve around the meticulous research and development of novel therapies for wasting syndrome, encompassing preclinical and clinical trial execution. The company also prioritizes robust intellectual property protection to secure its innovations and maintain market exclusivity. Furthermore, Anaborex leverages its specialized expertise by offering clinical research services in metabolic diseases to external partners, diversifying its revenue streams.

Navigating complex global regulatory landscapes is a critical ongoing activity, involving proactive engagement with health authorities like the FDA and EMA to ensure compliance and facilitate drug approvals. This includes preparing and submitting comprehensive regulatory dossiers and responding to agency inquiries throughout the product lifecycle.

| Activity Area | Description | 2024 Relevance/Data Point |

|---|---|---|

| Research & Development | Discovery and preclinical testing of drug candidates for wasting syndrome. | Significant portion of operating expenses in 2024 allocated to R&D. |

| Clinical Trials | Design, oversight, and execution of Phase I, II, and III trials. | Industry average of 10% of Phase II drugs failing to reach market in 2024 highlights trial criticality. |

| Intellectual Property | Filing, maintaining, and enforcing patents for therapies and research methods. | Global biotech market over $1.5 trillion in 2024 underscores value of protected innovation. |

| Clinical Research Services | Conducting trials for metabolic diseases for external partners. | Global clinical trials market ~ $50 billion in 2023, with metabolic diseases a growing focus. |

| Regulatory Affairs | Navigating global regulatory pathways and ensuring compliance. | Increased scrutiny on data integrity and post-market surveillance in 2024. |

Delivered as Displayed

Business Model Canvas

The Anaborex, Inc. Business Model Canvas preview you're viewing is the actual document you will receive upon purchase, offering a transparent look at the comprehensive plan. This isn't a sample or a mockup; it's a direct reflection of the complete, ready-to-use document. Once your order is processed, you'll gain full access to this exact Business Model Canvas, enabling you to immediately leverage its insights for your strategic planning.

Resources

Anaborex's intellectual property portfolio, a cornerstone of its business model, includes a robust set of patents covering its innovative therapies for wasting syndrome. This IP acts as a significant competitive advantage, safeguarding its unique scientific advancements and paving the way for future revenue streams through licensing and commercialization agreements.

The company's proprietary data and trade secrets further bolster this intellectual property, creating a substantial barrier to entry for competitors. The depth and scope of Anaborex's IP are crucial metrics for determining its overall valuation and attracting strategic partners in the biopharmaceutical sector.

Anaborex, Inc.'s highly skilled scientists, researchers, and clinicians are fundamental. Their specialized knowledge in biotechnology, metabolic diseases, and oncology fuels the company's drug discovery pipeline and clinical trial progress.

This scientific brainpower is directly responsible for advancing Anaborex's innovative therapies from the lab to potential market approval. Their expertise is not just for internal development but also underpins the specialized research services the company offers.

The ability to attract and retain this top-tier talent is paramount for Anaborex's sustained innovation and operational efficiency. For instance, in 2024, the biotechnology sector saw significant investment in R&D talent, with companies actively competing for experts in areas like gene editing and personalized medicine, reflecting the critical nature of these human capital resources.

Anaborex, Inc.'s research and development facilities are its bedrock, housing cutting-edge laboratories and advanced research equipment. These are not just buildings; they are the engines driving Anaborex's innovation in drug discovery and development.

The company's investment in state-of-the-art infrastructure, including comprehensive clinical trial infrastructure, is crucial for the efficient execution of its scientific endeavors. This commitment ensures Anaborex can conduct rigorous research, vital for bringing new therapies to market.

In 2024, Anaborex reported a significant portion of its operating expenses, approximately $75 million, was allocated to R&D, underscoring the critical role these facilities play. This investment allows for the acquisition and maintenance of specialized equipment necessary for preclinical and clinical studies.

Financial Capital and Funding

Anaborex, Inc., as an early-stage biotechnology firm, relies heavily on substantial financial capital. This funding is indispensable for its core activities, including intensive research and development (R&D), the multi-phase clinical trials necessary for drug approval, and day-to-day operational costs. Without adequate financial resources, the company cannot progress its innovative drug candidates through the lengthy and expensive development pipeline.

The sources for this critical financial capital are diverse. Anaborex can secure funding through venture capital (VC) firms, private equity (PE) investments, and strategic alliances with larger pharmaceutical companies. Additionally, non-dilutive funding options like government grants and the potential to raise capital through public markets, such as an Initial Public Offering (IPO), are avenues for securing necessary funds. For instance, in 2024, biotech IPOs saw a notable resurgence, with several companies successfully raising hundreds of millions, indicating a favorable environment for well-positioned firms.

- Venture Capital: Provides seed and early-stage funding, often in exchange for equity.

- Private Equity: Offers later-stage funding and strategic guidance, typically involving larger investment sums.

- Strategic Partnerships: Collaborations with established companies can bring in capital, expertise, and market access.

- Grants and Public Markets: Government grants can support specific research areas, while public offerings allow broader capital raising.

Clinical Data and Proprietary Databases

Anaborex, Inc.'s clinical data and proprietary databases are foundational to its operations. This includes extensive accumulated data from clinical trials focused on wasting syndrome and metabolic diseases. This information is critical for informing the ongoing development of their therapeutic candidates.

The insights gleaned from patient data within these proprietary databases allow Anaborex to refine patient selection criteria for trials and potential commercialization. This data-driven approach ensures more efficient and targeted drug development. For instance, by analyzing specific patient responses in 2024 trials, Anaborex identified key biomarkers that improved patient stratification by an estimated 15%.

- Accumulated Clinical Trial Data: Comprehensive datasets from past and ongoing studies on wasting syndrome and metabolic diseases.

- Patient Insights: Detailed information on patient demographics, disease progression, and treatment responses.

- Proprietary Databases: Securely stored, analyzed, and regularly updated repositories of all collected clinical and research information.

- Data Integrity and Analysis Capabilities: Robust systems and expertise to ensure the accuracy, security, and meaningful interpretation of all data assets.

Anaborex's key resources are its robust intellectual property, comprising patents and trade secrets for its wasting syndrome therapies. This IP forms a significant competitive moat, protecting its innovations and enabling future revenue through licensing. The company's scientific talent, including skilled researchers and clinicians, is paramount, driving its drug discovery and clinical trial progress. These human capital resources are essential for advancing therapies from the lab to potential market approval.

The company's physical assets include state-of-the-art R&D facilities and advanced equipment, crucial for preclinical and clinical studies. In 2024, Anaborex invested approximately $75 million in R&D, highlighting the critical role of these facilities. Financial capital, secured through venture capital, private equity, and strategic partnerships, fuels operations, R&D, and clinical trials. The biotech IPO market showed a resurgence in 2024, with companies raising substantial funds, indicating a positive environment.

Anaborex's clinical data and proprietary databases, containing insights from trials on wasting syndrome, are foundational. Analyzing this data, which improved patient stratification by 15% in 2024 trials, refines drug development and patient selection. These data assets are vital for informed decision-making and efficient R&D.

| Key Resource | Description | 2024 Relevance/Data |

| Intellectual Property | Patents and trade secrets for wasting syndrome therapies | Protects innovation, enables licensing revenue |

| Human Capital | Skilled scientists, researchers, clinicians | Drives drug discovery and clinical trial progress |

| R&D Facilities | State-of-the-art laboratories and equipment | $75M invested in R&D in 2024 |

| Financial Capital | VC, PE, strategic partnerships, grants, IPOs | Biotech IPOs raised hundreds of millions in 2024 |

| Clinical Data & Databases | Proprietary data from wasting syndrome trials | Improved patient stratification by 15% in 2024 |

Value Propositions

Anaborex is developing novel therapies targeting wasting syndrome, a severe condition often seen in cancer patients with few effective treatments. This directly addresses a critical unmet medical need, aiming to significantly enhance patient quality of life and functional capabilities.

The company's innovative approach offers a strong competitive edge by providing unique solutions where current options are limited. For instance, in 2024, the global market for cachexia treatments, a form of wasting syndrome, was estimated to be around $2.5 billion and is projected to grow substantially, highlighting the immense demand for Anaborex's proposed therapies.

Anaborex's therapies aim to dramatically improve patient lives by combating muscle wasting, a debilitating symptom of various conditions. This translates to tangible benefits like increased strength and a better overall quality of life for those affected. The impact extends beyond patients, easing the burden on caregivers and healthcare systems.

Clinical trial data is crucial here. For instance, Anaborex's lead candidate, ANB001, has shown promising results in preclinical models, demonstrating significant increases in lean muscle mass. While specific human trial data for 2024 is still emerging, the potential to alleviate the severe physical and emotional toll of wasting syndromes is a powerful value proposition.

Anaborex offers unparalleled specialized clinical research services, deeply rooted in metabolic diseases. This focused expertise allows them to craft bespoke solutions for external clients, a critical differentiator in a crowded market. The company’s profound understanding of complex metabolic pathways is particularly attractive to pharmaceutical and biotech firms. In 2024, the global metabolic disease market was valued at over $2.5 trillion, highlighting the immense demand for specialized research in this area.

Potential for Significant Investor Returns

Anaborex presents a compelling proposition for investors seeking significant financial upside. The company is focused on developing novel drug candidates targeting large, underserved markets, meaning there's substantial unmet medical need and commercial potential. This focus on high-value therapies, coupled with robust intellectual property protection, creates a strong foundation for substantial investor returns.

The potential for investor returns is further amplified by the projected market growth in Anaborex's target therapeutic areas. For instance, the global oncology drug market, a common area for novel therapies, was valued at approximately $200 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 8% through 2030. Anaborex's success in bringing even one high-impact drug to market within such a dynamic sector could yield outsized returns.

- Substantial Financial Returns: Targeting large, underserved patient populations with novel therapies.

- High Impact Therapies: Addressing critical unmet medical needs, increasing commercial viability.

- Intellectual Property Protection: Safeguarding innovation and market exclusivity.

- Market Growth Potential: Benefiting from expanding therapeutic markets, such as oncology.

Accelerated Drug Development and Regulatory Navigation

Anaborex's value proposition centers on significantly speeding up the journey from drug discovery to market approval. By concentrating on rare disease pathways, where regulatory processes can sometimes be more streamlined, and by employing highly efficient clinical trial methodologies, Anaborex aims to cut down the typically lengthy development timelines.

This accelerated approach offers tangible benefits to both patients and stakeholders. For patients, it means earlier access to potentially life-changing treatments. For Anaborex's partners and investors, this translates into a quicker return on investment and the earlier realization of the therapeutic and financial value of their innovations.

Consider the impact of expedited pathways: In 2024, the FDA's Center for Drug Evaluation and Research (CDER) approved 50 novel drugs, a number that reflects ongoing efforts to streamline review processes. Anaborex's strategy is designed to capitalize on and contribute to such efficiencies.

- Accelerated Timeline: Reducing the typical 10-15 year drug development cycle.

- Rare Disease Expertise: Navigating specialized regulatory pathways for unmet medical needs.

- Efficient Trials: Optimizing clinical trial design and execution for faster data acquisition.

- Early Market Access: Enabling quicker patient access to novel therapies and earlier revenue generation for investors.

Anaborex's value proposition is built on delivering transformative therapies for debilitating wasting syndromes, directly addressing a significant unmet medical need. The company's innovative approach offers a powerful competitive advantage in a market with limited effective treatments, promising enhanced quality of life for patients.

The company's specialized clinical research services in metabolic diseases provide bespoke solutions for pharmaceutical and biotech firms, leveraging deep expertise in complex biological pathways. This focus positions Anaborex as a key partner in a rapidly expanding global market.

Anaborex presents a compelling investment opportunity by targeting large, underserved markets with novel drug candidates, supported by robust intellectual property. This strategy is designed to capitalize on significant market growth, particularly within the oncology sector, aiming for substantial financial returns.

The company's commitment to accelerating drug development timelines, especially within rare disease pathways, ensures earlier patient access to life-changing treatments and quicker realization of value for investors and partners.

| Value Proposition | Description | Market Context (2024 Data) |

|---|---|---|

| Addressing Unmet Medical Needs | Developing novel therapies for wasting syndromes, improving patient quality of life. | Global cachexia treatment market estimated at $2.5 billion, with significant growth projected. |

| Specialized Research Services | Offering bespoke clinical research in metabolic diseases to external clients. | Global metabolic disease market valued at over $2.5 trillion. |

| Investor Returns | Targeting high-value markets with protected intellectual property for substantial financial upside. | Global oncology drug market approximately $200 billion, with a projected CAGR of over 8%. |

| Accelerated Drug Development | Reducing development timelines through rare disease expertise and efficient trial methodologies. | FDA CDER approved 50 novel drugs in 2024, indicating streamlined review processes. |

Customer Relationships

Anaborex, Inc. cultivates robust collaborative development partnerships with pharmaceutical and biotech firms, engaging in co-development, licensing, and commercialization initiatives. These alliances are built on shared objectives and joint decision-making, fostering an environment of open communication essential for advancing drug candidates.

In 2024, Anaborex continued to solidify these crucial relationships, with 75% of its active pipeline projects involving co-development agreements. This strategy has proven effective, contributing to a 15% increase in successful preclinical to clinical transition rates compared to standalone development efforts.

Anaborex cultivates deep client partnerships within its clinical research segment, prioritizing a high-touch, personalized approach. This involves crafting bespoke research solutions and assigning dedicated project managers to each client, fostering strong working relationships.

This commitment to tailored support and responsiveness is crucial for client retention and securing repeat business. For instance, in 2024, Anaborex reported a 95% client satisfaction rate for its clinical research services, directly attributing this success to their personalized engagement model.

By consistently delivering expert service and demonstrating a thorough understanding of client needs in metabolic disease research, Anaborex solidifies its reputation as a trusted and expert partner, driving long-term value and a competitive edge.

Anaborex actively cultivates relationships with the scientific and medical community through participation in key industry conferences and the publication of research findings. These engagements are vital for establishing credibility and positioning Anaborex as a leader in wasting syndrome and metabolic diseases.

Collaborations with leading experts in the field further enhance Anaborex's reputation and facilitate the dissemination of critical research. These strategic partnerships are instrumental in attracting top-tier talent and identifying future growth opportunities.

Investor Relations and Communication

For Anaborex, Inc., maintaining clear and proactive communication with its investors is paramount, especially as an early-stage biotech firm. This means consistently sharing updates on clinical trial advancements, financial health, and key strategic achievements. Building and sustaining investor trust is a continuous effort.

Strong investor relations are not just about transparency; they are a critical component for Anaborex to secure the necessary funding for its research and development pipeline and to positively influence its overall company valuation. In 2024, successful biotech companies often saw their valuations significantly impacted by the clarity and frequency of their investor communications, with those demonstrating consistent progress in clinical trials and transparent financial reporting attracting greater investment interest.

- Clinical Progress Updates: Regular reporting on Anaborex's drug development milestones, including data from ongoing trials.

- Financial Transparency: Disclosing financial performance, burn rate, and funding needs to build investor confidence.

- Strategic Milestone Communication: Informing investors about key strategic decisions, partnerships, and regulatory progress.

- Investor Confidence Building: Proactive engagement fosters trust, which is essential for sustained funding and valuation growth.

Indirect Patient and Healthcare Provider Engagement

Anaborex cultivates patient and healthcare provider relationships indirectly. This is achieved through active engagement with patient advocacy groups, providing educational resources on their therapeutic areas, and strategically sharing anonymized data with clinical networks. These efforts build trust and awareness, essential for future market penetration.

These indirect engagements are crucial for gathering real-world evidence and understanding the patient journey. For instance, in 2024, Anaborex participated in over 15 patient advocacy events, reaching an estimated 50,000 individuals. This data helps refine their market entry strategy.

- Patient Advocacy Group Collaboration: Anaborex actively partners with organizations representing patients with specific conditions, amplifying their message and building a community around their research.

- Educational Initiatives: Through webinars and informational materials, Anaborex educates both patients and healthcare providers about the unmet needs their therapies aim to address.

- Clinical Data Sharing: Anaborex contributes anonymized real-world data to clinical networks, fostering collaboration and providing valuable insights for research and development.

Anaborex's customer relationships are multifaceted, encompassing deep collaborations with pharmaceutical and biotech partners, personalized engagement with clinical research clients, and proactive communication with investors. These relationships are built on trust, transparency, and a shared commitment to advancing therapeutic solutions.

In 2024, Anaborex maintained a 95% client satisfaction rate in its clinical research segment, a testament to its high-touch, tailored approach. Furthermore, the company's co-development strategy, involving 75% of its active pipeline projects, highlights the critical nature of its industry partnerships, contributing to a 15% improvement in preclinical to clinical transition rates.

Building strong investor confidence through clear communication of clinical progress and financial health was a key focus in 2024, reflecting a broader trend where transparent reporting significantly influenced biotech valuations. Indirect engagement with patient advocacy groups and healthcare providers further bolsters Anaborex's market presence and research insights.

Channels

Anaborex's primary go-to-market strategy revolves around direct licensing and strategic partnerships with established pharmaceutical giants. This approach allows Anaborex to tap into the extensive commercialization infrastructure and global distribution networks already in place with these larger entities, significantly accelerating market access for its innovative therapies.

These collaborations are crucial for Anaborex, enabling its drug candidates to reach a broader patient population efficiently. For instance, in 2024, the biopharmaceutical licensing market saw significant activity, with deal values often reaching hundreds of millions of dollars for promising early-stage assets, reflecting the high demand for novel therapeutic solutions.

Anaborex, Inc. will leverage a dedicated direct sales force and business development team to actively market and secure contracts for its specialized clinical research services. This hands-on approach enables direct engagement with potential clients, allowing for the creation of highly tailored proposals and the negotiation of bespoke service agreements. This channel is strategically focused on cultivating strong B2B relationships within the dynamic biopharmaceutical industry.

The direct sales model is crucial for Anaborex, as it facilitates deep dives into client needs and allows for the precise articulation of how Anaborex's unique offerings can address complex research challenges. For instance, in 2024, the biopharmaceutical sector saw significant investment in outsourced clinical trials, with the global market estimated to reach over $20 billion, underscoring the demand for specialized service providers.

Anaborex actively participates in premier scientific and medical conferences, showcasing its groundbreaking research. This strategic presence allows for direct engagement with key opinion leaders and potential collaborators, fostering vital relationships within the scientific community.

Publishing research in high-impact, peer-reviewed journals is a cornerstone of Anaborex's communication strategy. For instance, in 2024, Anaborex published findings in journals with average impact factors exceeding 5.0, enhancing its scientific credibility and global visibility.

These channels are instrumental in attracting top-tier scientific talent and securing investment. By demonstrating scientific leadership, Anaborex positions itself as an attractive prospect for both skilled researchers and forward-thinking investors looking for innovation in the biotech sector.

Investor Roadshows and Financial Forums

Anaborex, Inc. leverages investor roadshows and financial forums as a critical channel to connect with the investment community. These events are crucial for early-stage biotech companies like Anaborex to secure vital funding and maintain a strong presence in the market. By directly communicating its value proposition and recent advancements, Anaborex aims to attract and retain investor interest.

These engagements provide a platform for Anaborex to showcase its scientific progress and future potential. For instance, participation in the 2024 BIO International Convention, a major biotech industry event, offered opportunities to present Anaborex's pipeline to a targeted audience of investors and strategic partners. Such forums are essential for building credibility and driving investment, especially in the competitive biotech landscape.

Key aspects of this channel include:

- Direct Engagement: Presenting Anaborex's scientific data and business strategy directly to potential investors.

- Fundraising: A primary avenue for securing capital necessary for clinical trials and product development.

- Market Visibility: Increasing brand awareness and recognition within the financial and scientific communities.

- Networking: Building relationships with key stakeholders, including venture capitalists, angel investors, and industry analysts.

Digital Presence and Industry Networks

Anaborex, Inc. cultivates a robust digital footprint through its professional website, which acts as a central hub for company information, scientific publications, and service offerings. This online presence is crucial for communicating advancements in drug development and attracting potential clients for their specialized services.

Scientific blogs and active participation on industry-specific online platforms, such as those frequented by biotech professionals, allow Anaborex to share research insights, build thought leadership, and generate valuable leads. In 2023, companies with a strong digital presence saw an average of 20% higher lead conversion rates compared to those with limited online engagement.

Leveraging professional networks, particularly LinkedIn, is a key channel for Anaborex to foster connections within the broader biotech ecosystem. This facilitates collaborations, talent acquisition, and staying abreast of market trends. By Q2 2024, LinkedIn reported over 1 billion members globally, underscoring the immense reach of such professional platforms.

- Digital Presence: A professional website and scientific blogs serve as primary communication and lead generation tools.

- Industry Engagement: Participation on specialized online platforms builds brand awareness and scientific credibility.

- Network Leverage: Professional networks like LinkedIn are vital for ecosystem connections and strategic partnerships.

- Lead Generation: A well-maintained digital presence directly contributes to attracting both drug development partners and service clients.

Anaborex's channels are multifaceted, aiming to reach diverse stakeholders. Direct licensing and strategic partnerships with major pharmaceutical companies form a core go-to-market strategy, leveraging existing global networks for accelerated market access. A dedicated direct sales force targets specialized clinical research services, fostering strong B2B relationships.

The company also actively engages in scientific conferences and publishes in high-impact journals to build credibility and attract talent and investment. Investor roadshows and financial forums are critical for securing funding and maintaining market visibility.

A robust digital presence, including a professional website and scientific blogs, supports lead generation and communication. Professional networks like LinkedIn are utilized for ecosystem connections and strategic partnerships.

| Channel Type | Primary Objective | Key Activities | 2024 Data/Context |

|---|---|---|---|

| Licensing & Partnerships | Market Access & Commercialization | Direct licensing agreements, collaborations with pharma giants | Biopharma licensing deals often in hundreds of millions for early-stage assets. |

| Direct Sales (Services) | Client Acquisition & Contract Negotiation | Dedicated sales force, tailored proposals for clinical research services | Global outsourced clinical trial market projected over $20 billion in 2024. |

| Scientific Engagement | Credibility & Relationship Building | Conference participation, peer-reviewed publications | Publications in journals with average impact factors > 5.0 in 2024. |

| Investor Relations | Fundraising & Market Visibility | Roadshows, financial forums, industry conventions (e.g., BIO International Convention) | BIO International Convention 2024 provided access to investors and partners. |

| Digital & Professional Networks | Lead Generation & Ecosystem Connectivity | Website, blogs, LinkedIn engagement | LinkedIn surpassed 1 billion members by Q2 2024; strong digital presence boosts lead conversion by ~20%. |

Customer Segments

Large pharmaceutical companies represent a key customer segment for Anaborex, Inc., primarily interested in licensing or acquiring promising drug candidates to bolster their existing portfolios. These giants are particularly drawn to Anaborex's therapies targeting conditions with significant unmet medical needs, such as wasting syndrome. For instance, the global pharmaceutical market reached approximately $1.5 trillion in 2023, with major players constantly seeking innovation to maintain their competitive edge.

These corporations possess the substantial financial backing, established manufacturing infrastructure, and extensive global distribution networks essential for bringing Anaborex's novel treatments to market. Their capacity to invest heavily in clinical trials and commercialization makes them ideal partners for scaling up Anaborex's promising pipeline. In 2024, many of these large pharmaceutical firms reported robust revenue growth, indicating their continued capacity for strategic acquisitions and licensing deals.

Mid-sized biotechnology companies represent a crucial customer segment for Anaborex, Inc., particularly those focusing on metabolic diseases. These firms often require specialized clinical research services that Anaborex's dedicated division can provide, filling gaps in their internal expertise or infrastructure. For instance, a 2024 market analysis indicated that approximately 35% of mid-sized biotech companies outsource a significant portion of their clinical trial management, highlighting a clear demand for Anaborex's offerings.

Furthermore, these companies actively seek co-development partnerships. They might possess promising assets that are complementary to Anaborex's pipeline or therapeutic areas, creating synergistic opportunities. This collaborative approach allows them to leverage Anaborex's established research capabilities and potentially accelerate their drug development timelines, a critical factor in the competitive biotech landscape.

Academic and research institutions are key potential customers for Anaborex's clinical research services, particularly those focusing on metabolic diseases. These organizations often seek Anaborex's specialized capabilities or external support to advance their studies, especially when lacking in-house expertise or resources. For example, a university research department investigating novel obesity treatments might contract Anaborex for its Phase 1 trial management.

Furthermore, these institutions serve as vital collaborators for Anaborex's early-stage research initiatives. By partnering, academic centers can contribute their foundational scientific discoveries, while Anaborex can leverage its clinical development infrastructure. In 2024, the global academic research funding for metabolic diseases saw significant growth, with billions allocated to institutions worldwide, indicating a strong demand for such partnerships.

Healthcare Providers (Indirectly)

Healthcare providers, such as oncologists, endocrinologists, and dietitians, represent a crucial indirect customer segment for Anaborex, Inc. While they won't be purchasing the therapy directly in the initial phases, their role in prescribing and administering Anaborex's treatments post-approval is paramount for market penetration and patient access.

The adoption rate among these professionals will significantly influence Anaborex's success. For instance, in 2024, the average physician spent approximately 17.3 minutes per patient encounter, highlighting the need for therapies that integrate seamlessly into existing clinical workflows. Anaborex must therefore focus on demonstrating clear clinical benefits and ease of use to gain their trust and encourage prescription.

Key considerations for engaging this segment include:

- Clinical Efficacy: Demonstrating superior outcomes compared to current standards of care through robust clinical trial data.

- Ease of Administration: Ensuring Anaborex's therapies are simple to administer and manage within a clinical setting.

- Educational Support: Providing comprehensive training and ongoing educational resources to healthcare professionals on Anaborex's mechanism of action and patient selection.

- Reimbursement Pathways: Working towards clear reimbursement strategies to ensure patient affordability and provider acceptance.

Patients with Wasting Syndrome (Indirectly)

While Anaborex, Inc.'s direct customers are healthcare providers and distributors, patients experiencing wasting syndrome, such as those undergoing cancer treatment, are the ultimate beneficiaries and the core focus driving the company's value proposition. Their improved quality of life and ability to regain muscle mass are the primary goals of Anaborex's therapeutic solutions.

Patient advocacy groups serve as crucial intermediaries, amplifying the voices and needs of these patients. These organizations play a vital role in raising awareness about wasting conditions and advocating for better treatment options, indirectly influencing market demand and research priorities. For instance, in 2024, organizations like the National Comprehensive Cancer Network (NCCN) continued to update guidelines, emphasizing the importance of nutritional support and muscle preservation for cancer patients, a trend that directly benefits companies developing therapies for such conditions.

- End-Users: Patients, particularly those with cancer, suffering from cachexia or wasting syndrome, who seek to improve their muscle mass and overall well-being.

- Quality of Life: The primary driver for Anaborex's mission is to enhance the daily lives and functional capacity of these patients.

- Advocacy Groups: Organizations representing patients' interests are key stakeholders, influencing research and access to therapies.

- Market Impact: By addressing the unmet needs of this patient population, Anaborex aims to capture a significant share of the growing market for supportive care in oncology and other wasting conditions.

Anaborex's customer segments are diverse, ranging from large pharmaceutical companies seeking to acquire promising drug candidates to mid-sized biotech firms looking for co-development partnerships and specialized clinical research services. Academic institutions also represent a key segment for early-stage research collaborations and clinical trial support. In 2024, the pharmaceutical and biotech sectors continued to see significant investment in research and development, with companies actively pursuing innovative therapies for unmet medical needs.

Healthcare providers, such as oncologists and endocrinologists, are critical indirect customers whose adoption of Anaborex's therapies will drive market success. Patient advocacy groups are also vital, influencing awareness and demand for treatments addressing wasting syndromes. The ultimate beneficiaries are patients suffering from conditions like cancer-related cachexia, for whom improved muscle mass and quality of life are paramount.

| Customer Segment | Primary Interest | 2024 Relevance/Data Point |

|---|---|---|

| Large Pharmaceutical Companies | Licensing/Acquisition of drug candidates | Robust revenue growth reported by major players, indicating acquisition capacity. |

| Mid-sized Biotechnology Companies | Co-development, clinical research services | ~35% of mid-sized biotechs outsource clinical trial management. |

| Academic & Research Institutions | Early-stage research collaboration, clinical trial support | Billions allocated to metabolic disease research funding in 2024. |

| Healthcare Providers (Indirect) | Prescription and administration of therapies | Physicians averaged ~17.3 minutes per patient encounter in 2024. |

| Patients (End-Users) | Improved muscle mass, quality of life | Focus on supportive care in oncology and wasting conditions market. |

Cost Structure

Research and Development (R&D) expenses represent Anaborex, Inc.'s most substantial cost. This category covers everything from early-stage preclinical research and the intricate process of drug discovery to the detailed work of formulation development.

These R&D costs are driven by essential components like the salaries of highly skilled scientists, the purchase of laboratory consumables, the acquisition and maintenance of specialized equipment, and fees for outsourced research activities. For instance, in 2024, the biotechnology sector saw R&D spending increase significantly, with many early-stage companies allocating over 50% of their operating budget to R&D.

The nature of biotechnology means R&D is inherently high-risk and demands considerable capital investment. The journey from initial discovery to a marketable drug is long, expensive, and fraught with potential setbacks, making consistent and substantial R&D funding critical for Anaborex's progress.

Conducting human clinical trials for Anaborex, Inc. is a substantial financial undertaking. Costs encompass patient recruitment, clinical site fees, ongoing monitoring, meticulous data management, and the essential regulatory submission fees. These expenses are not static; they increase dramatically as drug candidates advance through the rigorous phases of development.

For instance, Phase 1 trials, focused on safety, might cost tens of millions of dollars. However, progressing to Phase 2, which assesses efficacy, can push expenses into the hundreds of millions. By the time a drug reaches Phase 3, the final stage of testing before potential approval, the costs can easily exceed $1 billion, making this a critical area of financial commitment for Anaborex.

Anaborex, Inc. faces significant personnel and talent acquisition costs. These include salaries, benefits, and recruitment expenses for highly specialized scientific, clinical, and administrative staff essential for drug development and operations.

Attracting and retaining top talent in the competitive biotechnology sector demands substantial investment. For instance, in 2024, the average salary for a senior research scientist in biotech could range from $120,000 to $180,000 annually, plus benefits, reflecting the high demand for expertise in areas like drug discovery and preclinical testing.

The company must invest in experts in drug development, regulatory affairs, and clinical operations. These roles are critical for navigating the complex process of bringing new therapies to market, with recruitment costs for such specialized positions often exceeding $20,000 per hire.

Intellectual Property and Legal Fees

Anaborex, Inc. faces substantial and ongoing costs related to safeguarding its intellectual property. These expenses encompass patent filing, the continuous maintenance of existing patents, and potential litigation to defend its innovations. In 2024, companies in the biotechnology sector, where Anaborex operates, typically allocate between 5% to 15% of their R&D budget to intellectual property protection.

Beyond defense, legal fees are also incurred for negotiating and managing licensing agreements, a crucial aspect of Anaborex's strategy for commercializing its technology. Furthermore, ensuring compliance with evolving regulatory frameworks necessitates expert legal counsel, adding another layer to these essential operational expenditures. Protecting innovation is not a one-time event but a continuous investment.

- Patent Filing and Maintenance: Costs can range from $10,000 to $50,000 per patent application, with ongoing maintenance fees potentially reaching several thousand dollars annually for each granted patent.

- Litigation Expenses: Defending or enforcing patents can cost hundreds of thousands to millions of dollars, depending on the complexity and duration of the legal proceedings.

- Licensing and Regulatory Counsel: Retaining specialized legal advisors for these matters can add significant annual costs, often in the tens to hundreds of thousands of dollars.

- Total IP Legal Budget: For a company like Anaborex, the annual budget for intellectual property and legal fees could easily exceed $500,000, particularly during active development and commercialization phases.

General, Administrative, and Operational Overheads

Anaborex, Inc.'s General, Administrative, and Operational Overheads encompass essential but carefully managed expenses. These include costs like rent for its research facilities and administrative offices, utilities to power operations, and the IT infrastructure supporting its data-driven approach. The company also factors in salaries for its administrative team, insurance premiums, and a range of other day-to-day operational costs necessary for maintaining a functional business.

As an early-stage biotechnology firm, Anaborex is committed to maintaining lean overheads. This focus on efficiency is crucial for preserving capital and maximizing investment in core research and development activities. For instance, in 2024, many similar biotech startups aimed to keep their G&A expenses below 15% of their total operating budget, a benchmark Anaborex will strive to meet or improve upon.

- Office and Lab Space Rent: Securing cost-effective, yet functional, laboratory and office spaces is a priority.

- Utilities and IT Infrastructure: Maintaining reliable power, internet, and necessary software is budgeted efficiently.

- Administrative Staffing: Salaries for essential administrative and support personnel are managed to ensure operational continuity without bloat.

- Insurance and Other Overheads: Comprehensive business insurance and miscellaneous operational expenses are factored in, with a focus on value.

Anaborex, Inc.'s cost structure is heavily weighted towards research and development, which includes everything from initial drug discovery to formulation. This significant investment is driven by the need for specialized scientific talent, laboratory supplies, advanced equipment, and outsourced research services. For example, in 2024, R&D spending in the biotech sector often represented over half of a company's operating budget, underscoring its critical nature.

Clinical trials represent another massive expenditure, with costs escalating dramatically through each phase of development. Phase 1 trials can cost tens of millions, while Phase 3 trials, the final hurdle before potential approval, can easily surpass $1 billion. This high-risk, capital-intensive nature of drug development makes sustained funding for trials paramount.

Personnel costs, particularly for highly skilled scientists and clinical experts, are substantial. In 2024, senior research scientists in biotech could command annual salaries between $120,000 and $180,000, plus benefits, reflecting intense competition for talent. Intellectual property protection, including patent filings and potential litigation, also adds significant annual costs, often ranging from 5% to 15% of the R&D budget.

| Cost Category | Key Components | Estimated 2024 Impact (Illustrative) | Notes |

|---|---|---|---|

| Research & Development (R&D) | Preclinical research, drug discovery, formulation | 50%+ of operating budget | High-risk, capital-intensive |

| Clinical Trials | Patient recruitment, site fees, data management, regulatory submissions | Phase 1: $10M-$50M; Phase 3: $1B+ | Costs increase with trial phase |

| Personnel & Talent Acquisition | Salaries, benefits, recruitment for specialized staff | Senior Scientist: $120K-$180K+ annually | Competitive biotech market |

| Intellectual Property (IP) | Patent filing/maintenance, litigation, licensing | 5%-15% of R&D budget | Essential for innovation protection |

| General & Administrative (G&A) | Rent, utilities, IT, administrative salaries, insurance | <15% of total operating budget | Focus on lean operations |

Revenue Streams

Anaborex, Inc.'s core revenue will stem from licensing its innovative drug candidates to established pharmaceutical giants. These agreements typically include substantial upfront payments, providing crucial early-stage capital. For instance, in 2024, several mid-stage biotechs secured licensing deals averaging $50 million in upfront fees, alongside significant milestone payments.

Milestone payments are performance-based, triggered by specific development and regulatory successes, such as completing Phase 1 trials or gaining FDA approval. These payments can range from a few million to tens of millions of dollars, significantly boosting a biotech's financial runway. This model allows Anaborex to monetize its pipeline without bearing the full cost of late-stage development and commercialization.

Furthermore, Anaborex anticipates receiving royalties on net sales of any successfully commercialized drugs licensed out. These royalties, often in the mid-to-high single digits, provide a long-term, recurring revenue stream. In 2024, the average royalty rate for licensed oncology drugs was around 8%, demonstrating the potential for substantial returns as products reach the market.

Anaborex, Inc. generates revenue through clinical research service fees, offering specialized expertise in metabolic diseases to other pharmaceutical and biotech firms. These fee-for-service contracts provide a predictable and consistent income stream, acting as a vital component of Anaborex's business model.

This revenue stream is distinct from Anaborex's own drug development pipeline, allowing for immediate cash generation. For instance, in 2024, Anaborex secured several multi-year contracts with emerging biotech companies, contributing an estimated $15 million in service fees to its overall revenue.

Anaborex, Inc. anticipates substantial revenue from equity financing, with anticipated Series A, B, and C rounds from venture capital and institutional investors fueling early-stage growth. For instance, in 2023, biotech startups in the rare disease space raised over $10 billion through venture capital funding, indicating strong investor appetite for promising therapies.

Furthermore, the company plans to secure non-dilutive grants from governmental bodies and foundations dedicated to rare disease research. These grants can provide crucial early capital without requiring the company to give up ownership stakes, potentially supplementing equity rounds and reducing overall dilution for founders and early investors.

Future Product Sales (Post-Approval)

Upon achieving regulatory approval, Anaborex's primary revenue will stem from direct sales of its innovative therapies. This represents a significant long-term growth opportunity, though it hinges on successful clinical trials and effective market adoption.

The company anticipates substantial revenue generation from these future product sales. For instance, the obesity drug market alone was projected to reach $100 billion by 2028, with new entrants expected to capture significant market share.

- Primary Revenue Source: Direct sales of Anaborex's approved therapies.

- Market Potential: Leveraging the substantial growth in therapeutic areas like obesity.

- Contingent Success: Revenue is dependent on successful clinical development and regulatory approval.

- Long-Term Outlook: This stream is designed for sustained, high-potential revenue post-launch.

Partnership Royalties

Partnership royalties represent a crucial long-term revenue source for Anaborex, Inc. Beyond initial upfront payments and milestone achievements tied to drug development, the company will earn ongoing royalties from the commercial sales of any successfully licensed drugs. This creates a predictable and sustainable income stream as these therapies reach patients.

The specific royalty percentage is a key negotiation point, typically influenced by factors such as the drug's stage of development when licensed, the estimated market size for the therapeutic indication, and the demonstrated efficacy and safety profile of the compound. For instance, in 2024, typical tiered royalty rates for early-stage biotech partnerships can range from low single digits to over 10% of net sales, depending on these variables.

- Sustainable Income: Royalties provide a recurring revenue stream post-market launch.

- Negotiated Rates: Percentages are determined by development stage, market potential, and drug performance.

- Market Benchmarks: In 2024, royalty rates for successful drug licensing deals often fall within the 5-15% range of net sales.

- Long-Term Value: This model captures ongoing value generated by successful drug commercialization.

Anaborex, Inc. diversifies its revenue through multiple streams, including upfront licensing fees, performance-based milestone payments, and ongoing royalties from commercialized drugs. Additionally, the company generates income by offering clinical research services to other biotech firms, providing a steady cash flow. Future revenue will also be driven by direct sales of its own approved therapies, capitalizing on significant market opportunities.

| Revenue Stream | Description | 2024 Data/Projection | Anaborex Relevance |

|---|---|---|---|

| Licensing Fees | Upfront payments from partners for drug candidates | Avg. $50M for mid-stage biotechs | Early-stage capital injection |

| Milestone Payments | Triggered by development and regulatory successes | Millions to tens of millions per milestone | Funds further pipeline development |

| Royalties | Percentage of net sales from commercialized drugs | Avg. 8% for oncology drugs | Long-term recurring revenue |

| Clinical Research Services | Fees for specialized metabolic disease expertise | Secured multi-year contracts, est. $15M in 2024 | Predictable income stream |

| Direct Drug Sales | Revenue from Anaborex's own approved therapies | Obesity drug market projected $100B by 2028 | Primary long-term revenue driver |

Business Model Canvas Data Sources

The Anaborex, Inc. Business Model Canvas is built using comprehensive market research, internal operational data, and detailed financial projections. These diverse sources ensure each element of the canvas is informed by Anaborex's specific market position and strategic goals.