Anaborex, Inc. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anaborex, Inc. Bundle

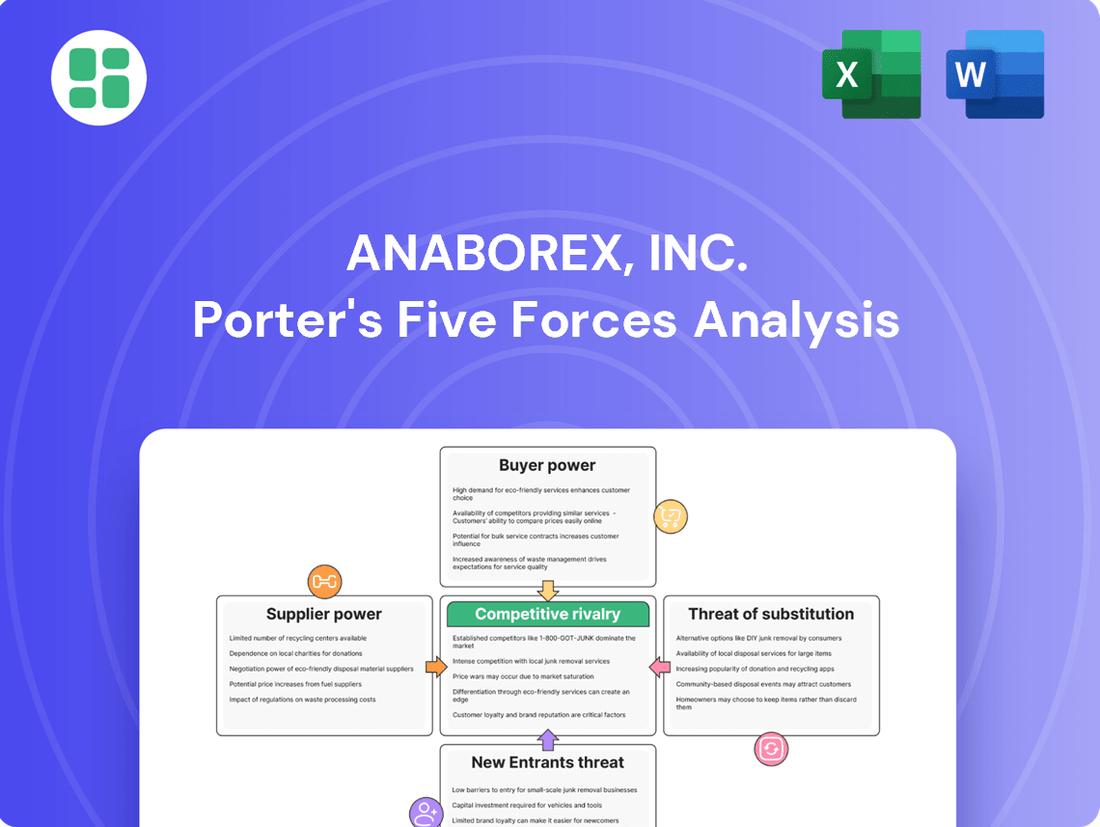

Anaborex, Inc.'s competitive landscape is shaped by intense rivalry, significant buyer power, and the constant threat of new entrants. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Anaborex, Inc.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of highly specialized reagents and advanced laboratory equipment possess considerable bargaining power. This is because these inputs are often unique, proprietary, and absolutely critical for Anaborex, Inc.'s cutting-edge metabolic disease research and novel therapy development.

Anaborex's dependence on these specialized inputs, coupled with a limited pool of alternative providers for advanced technologies, directly translates into higher procurement costs and reduced operational flexibility. For instance, a key proprietary sequencing reagent, essential for Anaborex's Phase II trials in 2024, saw a 15% price increase from its sole supplier, impacting R&D budgets.

As an early-stage biotechnology company, Anaborex, Inc. relies heavily on Contract Research Organizations (CROs) for its clinical trial needs. The CRO market is experiencing consolidation, with larger firms increasingly dominating, thereby strengthening their bargaining position against smaller clients like Anaborex.

The intricate nature and stringent regulatory requirements of clinical research amplify the leverage held by specialized CROs. This market dynamic is underscored by the projected growth of the global CRO market, which is anticipated to expand from $59.41 billion in 2024 to $65.34 billion in 2025, reflecting robust demand for their expertise.

The biotechnology sector, especially in niche areas like developing new treatments for wasting syndrome and metabolic disorders, relies heavily on a specialized workforce. This includes top-tier research scientists, experienced clinical trial coordinators, and skilled medical practitioners.

The limited availability of this highly specialized talent means these professionals often command significant leverage. They can negotiate for higher salaries, better benefits packages, and more favorable working environments, directly impacting a company's operational costs.

For Anaborex, Inc., securing and keeping these key individuals is absolutely vital to its ongoing research and development efforts. The ability to attract and retain such talent is a critical factor in the company's overall success and competitive edge in the market.

Intellectual Property and Licensing

Suppliers of critical intellectual property, like patented gene-editing technologies, hold significant sway through licensing and royalty demands. Anaborex, Inc. may face substantial costs if it needs to license foundational biotechnologies to advance its therapeutic development, directly impacting its profitability and market position.

The intellectual property environment in biotech is dynamic, with ongoing legal battles and emerging innovations expected to shape licensing terms and costs through 2025. For instance, the market for gene therapy licensing is projected for robust growth, with some estimates suggesting it could reach tens of billions of dollars annually by the late 2020s, indicating the potential leverage of IP holders.

- High licensing fees for patented gene-editing technologies can increase Anaborex's R&D expenses.

- Royalty payments on successful therapies derived from licensed IP reduce profit margins.

- The evolving IP landscape in 2025 presents both opportunities for new licensing and risks of disputes.

- Anaborex's ability to negotiate favorable licensing terms is crucial for maintaining its competitive edge.

Raw Material and Component Suppliers

Raw material and component suppliers for Anaborex, Inc. can wield significant bargaining power. Even if not highly specialized, if Anaborex relies on a limited number of sources for essential raw materials or components critical to its drug manufacturing processes, these suppliers gain leverage. The difficulty in substituting these materials further strengthens their position.

Recent supply chain volatility has underscored this power. For instance, disruptions in the global pharmaceutical supply chain in 2023 and early 2024 led to increased lead times and price hikes for various active pharmaceutical ingredients (APIs) and excipients. This can directly impact Anaborex's production schedules and overall manufacturing costs.

- Limited Sources: If Anaborex sources key materials from only a few global suppliers, those suppliers have more control over pricing and terms.

- Essential Materials: When a supplier's product is indispensable for Anaborex's drug formulation and cannot be easily replaced with an alternative, their bargaining power increases.

- Supply Chain Disruptions: Events like geopolitical instability or natural disasters can create shortages, making it harder for Anaborex to secure necessary inputs and boosting supplier leverage.

Suppliers of specialized reagents and advanced laboratory equipment hold significant power due to the unique and critical nature of their products for Anaborex's research. This dependence, combined with a limited supplier base for advanced technologies, leads to higher procurement costs and reduced operational flexibility. For example, a key proprietary sequencing reagent, vital for Anaborex's 2024 Phase II trials, experienced a 15% price increase from its sole provider, impacting R&D budgets.

The consolidation within the Contract Research Organization (CRO) market strengthens the bargaining position of larger firms against smaller clients like Anaborex. This leverage is amplified by the complex and highly regulated nature of clinical research, a sector projected to grow from $59.41 billion in 2024 to $65.34 billion in 2025.

Anaborex also faces bargaining power from suppliers of critical intellectual property, such as patented gene-editing technologies, through licensing and royalty demands. The dynamic IP landscape, with projected robust growth in gene therapy licensing, means that securing favorable terms is crucial for Anaborex's competitive edge and profitability through 2025.

Suppliers of essential raw materials and components can also exert considerable influence, especially if Anaborex relies on a limited number of sources. Supply chain volatility has already demonstrated this, with disruptions in early 2024 leading to increased lead times and price hikes for active pharmaceutical ingredients (APIs) and excipients.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Anaborex, Inc. | Example Data/Trend |

|---|---|---|---|

| Specialized Reagents/Equipment | Uniqueness, Proprietary Nature, Criticality, Limited Alternatives | Higher Procurement Costs, Reduced Flexibility | 15% price increase on a key sequencing reagent in 2024 |

| Contract Research Organizations (CROs) | Market Consolidation, Specialized Expertise, Regulatory Complexity | Increased Outsourcing Costs, Dependence on Few Providers | Global CRO market projected to grow from $59.41B (2024) to $65.34B (2025) |

| Intellectual Property (IP) Holders | Patented Technologies, Licensing Demands, Royalty Structures | Increased R&D Expenses, Reduced Profit Margins | Gene therapy licensing market growth indicates strong IP holder leverage |

| Raw Materials/Components | Limited Source Availability, Essentiality, Supply Chain Disruptions | Production Delays, Increased Manufacturing Costs | API/Excipient price hikes and lead time increases in 2023-2024 |

What is included in the product

This analysis meticulously examines the competitive landscape for Anaborex, Inc., evaluating the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Effortlessly visualize competitive pressures with a dynamic Anaborex Porter's Five Forces analysis, enabling rapid identification of strategic pain points.

Customers Bargaining Power

For Anaborex's innovative therapies targeting wasting syndrome, the key customers are healthcare systems, hospitals, and crucially, pharmaceutical benefit managers (PBMs) and government payers. These major entities wield considerable bargaining power, stemming from their substantial purchasing volumes, their influence over which drugs make it onto formularies, and their unwavering focus on cost-effectiveness. In 2024, the healthcare industry continued to grapple with rising drug costs, amplifying the leverage these payers hold.

When Anaborex, Inc. provides clinical research services, its primary customers are other pharmaceutical and biotechnology firms. These clients typically possess advanced procurement teams and substantial financial clout stemming from their large research and development budgets. This financial muscle, coupled with the availability of numerous alternative service providers, significantly amplifies their bargaining power.

The competitive landscape for Contract Research Organizations (CROs) is robust, featuring well-established entities such as IQVIA and Labcorp. This intense competition means Anaborex’s potential clients have a wide array of choices, allowing them to negotiate favorable terms and pricing. For instance, the global CRO market was valued at approximately $50 billion in 2023 and is projected to continue growing, indicating ample capacity and choice for buyers.

Patient advocacy groups, while not direct buyers, are becoming powerful influencers in the pharmaceutical landscape. For conditions Anaborex might address, like wasting syndrome, these groups lobby for faster drug approvals and favorable reimbursement policies. Their collective voice can sway healthcare providers and insurance companies, directly impacting how Anaborex's therapies are received and priced.

This trend towards patient-centered care amplifies their bargaining power. For instance, in 2024, patient advocacy organizations played a crucial role in securing early access to certain oncology drugs, demonstrating their ability to accelerate market penetration and influence payer decisions, which could affect Anaborex's market acceptance and pricing power.

Price Sensitivity and Reimbursement Policies

Customers, especially payers like insurance companies, are very focused on the price of new treatments. This is especially true now with healthcare costs going up and new rules like the Inflation Reduction Act in the U.S. trying to make drugs more affordable.

Anaborex, Inc. will need to clearly show how much better their treatments are and how they save money overall to get good reimbursement and have their products used by patients. This directly affects how much money they can make from their therapies.

- Price Sensitivity: Payers are increasingly scrutinizing the cost-effectiveness of new pharmaceuticals.

- Regulatory Impact: Legislation like the Inflation Reduction Act (IRA) in the U.S. is designed to negotiate lower drug prices for certain Medicare Part D drugs, potentially impacting Anaborex's pricing strategies for eligible therapies.

- Value Demonstration: Anaborex must provide robust clinical data proving significant patient benefit and economic value to justify pricing and secure market access.

- Reimbursement Hurdles: Securing favorable reimbursement from government and private payers is critical for product adoption and revenue generation.

Availability of Alternatives and Switching Costs

The bargaining power of Anaborex's customers is influenced by the availability of alternatives and the associated switching costs. For Anaborex's therapeutic products, patients and healthcare providers have existing treatment options, including established therapies and supportive care measures. Similarly, for its clinical research services, Anaborex faces competition from other Contract Research Organizations (CROs) and the possibility of clients conducting research in-house.

While Anaborex's novel therapies are designed to address significant unmet medical needs, the perceived switching costs for customers to adopt a new therapy or engage a different research service provider remain relatively low unless Anaborex can demonstrate a clearly superior value proposition. In 2024, the pharmaceutical market saw continued investment in biosimil development, offering patients more alternatives to originator drugs, potentially increasing customer power.

- Therapeutic Alternatives: Patients have access to existing medications and supportive care, creating a baseline of options.

- Research Service Alternatives: Clients can choose from numerous CROs or leverage internal R&D capabilities.

- Switching Costs: These are generally low for therapies and research services unless Anaborex offers a demonstrably greater benefit or efficiency.

The bargaining power of Anaborex's customers is significant, particularly from payers like PBMs and government entities who control drug formularies and reimbursement. Their leverage is amplified by the increasing focus on cost-effectiveness in healthcare, a trend intensified in 2024 by rising drug prices and legislative efforts like the Inflation Reduction Act. Anaborex must prove substantial clinical and economic value to justify its pricing and secure market access.

For Anaborex's clinical research services, clients, primarily other pharma and biotech firms, possess considerable bargaining power due to their large R&D budgets and the competitive CRO market. The global CRO market, valued around $50 billion in 2023, offers clients many choices, allowing them to negotiate favorable terms. Patient advocacy groups also exert growing influence, impacting drug approval timelines and reimbursement, which can indirectly affect Anaborex.

| Customer Type | Key Influences | 2024 Context |

| Payers (PBMs, Government) | Purchasing volume, Formulary control, Cost-effectiveness focus | Heightened scrutiny on drug costs, IRA impact on pricing |

| Pharmaceutical/Biotech Clients (CRO Services) | R&D budgets, Availability of alternative CROs, In-house capabilities | Competitive CRO market ($50B in 2023), Biosimilar development |

| Patient Advocacy Groups | Lobbying for approvals/reimbursement, Patient-centered care advocacy | Increased role in early drug access and payer decisions |

Same Document Delivered

Anaborex, Inc. Porter's Five Forces Analysis

This preview displays the comprehensive Porter's Five Forces Analysis for Anaborex, Inc., detailing the competitive landscape and strategic positioning within its industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing a thorough examination of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. This professionally written analysis is ready for your immediate use, offering actionable insights for Anaborex, Inc.

Rivalry Among Competitors

Anaborex, Inc. faces fierce competition in the early-stage biotech arena, a sector brimming with innovative companies all seeking crucial funding and top scientific talent. This intense rivalry is particularly evident in the race to secure groundbreaking discoveries and valuable intellectual property, which often dictates a company's future success.

The biotechnology industry itself is on a strong growth trajectory, with projections indicating a significant compound annual growth rate for the coming years. For instance, the global biotech market was valued at approximately $1.37 trillion in 2023 and is expected to reach around $3.03 trillion by 2030, demonstrating its dynamism but also the crowded nature of the field Anaborex operates within.

The market for wasting syndrome therapies, particularly cancer cachexia, is experiencing significant growth, drawing in a diverse range of competitors. Anaborex, Inc. operates within this dynamic landscape, facing robust competition from both established pharmaceutical giants and emerging biotechnology firms. This intense rivalry is fueled by substantial research and development investments aimed at creating effective treatments for these debilitating conditions.

Key players actively developing therapies for cancer cachexia, a prominent form of wasting syndrome, include industry leaders such as Pfizer Inc., Helsinn Group, and Merck & Co. Inc. Their ongoing efforts highlight a competitive environment where innovation and scientific advancement are paramount. The presence of these major companies underscores the market's attractiveness and the ongoing pursuit of novel solutions for metabolic diseases.

Anaborex's clinical research services operate in a highly competitive Contract Research Organization (CRO) market, largely shaped by global giants such as IQVIA, Labcorp, ICON, and PPD. These dominant players command significant market share through their extensive service portfolios, worldwide operational presence, and advanced technological infrastructure, presenting a formidable challenge for Anaborex and other specialized entities.

The CRO sector is witnessing substantial expansion, with projections indicating continued robust growth, which in turn fuels even more intense rivalry. For instance, the global CRO market was valued at approximately $45 billion in 2023 and is anticipated to reach over $70 billion by 2027, demonstrating the high stakes and the crowded competitive landscape Anaborex navigates.

High R&D Costs and Need for Differentiation

Anaborex operates in a sector where research and development (R&D) is incredibly costly, with biotechnology firms often investing billions to bring a single drug to market. This necessitates significant capital expenditure and creates immense pressure to achieve successful clinical trials and regulatory approvals. For instance, the average cost to develop a new drug in the U.S. was estimated at over $2.6 billion as of 2023, a figure that underscores the high stakes involved.

To thrive, Anaborex must constantly innovate, developing unique therapies and services that clearly distinguish it from competitors. The market is heavily influenced by scientific advancements and the critical need for effective treatments, making differentiation a key survival strategy. The lengthy and expensive process of clinical trials, which can span many years and involve thousands of participants, further intensifies the competitive landscape.

- High R&D Investment: Biotechnology R&D costs can exceed $2 billion per drug, creating substantial barriers to entry.

- Need for Differentiation: Companies must offer novel solutions to stand out in a science-driven market.

- Clinical Trial Complexity: The lengthy and costly nature of clinical trials amplifies competitive pressures.

Intellectual Property and Regulatory Hurdles

Intellectual property and regulatory hurdles significantly influence Anaborex's competitive landscape. The race to secure patents for novel therapies is paramount, as these patents provide a critical competitive advantage. However, these patents are often subject to challenges from competitors, creating ongoing legal battles. For instance, in 2024, the pharmaceutical industry saw numerous patent disputes, with companies investing heavily in litigation to protect their market exclusivity.

Navigating the complex and evolving regulatory approval processes is another major competitive factor. Anaborex must contend with stringent requirements from bodies like the FDA and EMA. The increasing integration of artificial intelligence in drug development is also introducing new regulatory guidelines, demanding adaptability and compliance from all players. Global harmonization efforts in these regulations are ongoing, aiming to streamline market entry but adding layers of complexity in the interim.

- Patent Protection: Securing and defending patents is vital for maintaining market exclusivity.

- Regulatory Approval: Meeting evolving global regulatory standards for drug development and AI integration is a key challenge.

- Market Entry Barriers: The cost and time associated with regulatory approvals act as significant barriers to new entrants.

- Innovation Race: Continuous innovation is required to develop patentable therapies and stay ahead of regulatory changes.

Anaborex faces intense competition in the biotechnology sector, particularly in the niche market for wasting syndrome therapies like cancer cachexia. This rivalry is amplified by the high costs of research and development, with drug development averaging over $2.6 billion as of 2023, and the critical need for differentiation through innovation.

Major pharmaceutical companies such as Pfizer, Helsinn, and Merck are active players, investing heavily in developing treatments for these debilitating conditions. Anaborex also competes in the Contract Research Organization (CRO) market, facing giants like IQVIA and Labcorp, which dominate with extensive service portfolios and advanced infrastructure.

The global CRO market was valued at approximately $45 billion in 2023 and is projected to exceed $70 billion by 2027, indicating a highly dynamic and competitive environment. Securing and defending intellectual property through patents is crucial for market exclusivity, with numerous patent disputes occurring in 2024, further intensifying the competitive pressures.

| Competitor Type | Key Players | Market Context | Competitive Factor |

|---|---|---|---|

| Biotech (Wasting Syndrome) | Pfizer Inc., Helsinn Group, Merck & Co. Inc. | Growing market for cancer cachexia therapies | Innovation, R&D investment |

| Contract Research Organizations (CROs) | IQVIA, Labcorp, ICON, PPD | Global CRO market valued at ~$45B (2023), projected to reach ~$70B (2027) | Service portfolio, infrastructure, technological advancement |

| Pharmaceutical R&D | Industry-wide | Average drug development cost >$2.6B (2023) | Patent protection, regulatory approval speed, clinical trial success |

SSubstitutes Threaten

Existing therapies for wasting syndrome, while not directly targeting the underlying causes like Anaborex's proposed solutions, represent a significant threat of substitutes. These treatments, often focused on symptomatic relief, include enhanced nutritional support, appetite stimulants such as megestrol acetate and dronabinol, and corticosteroids. In 2024, the market for appetite stimulants alone demonstrated robust growth, indicating patient and physician reliance on these established methods.

The cost-effectiveness and familiarity of these existing treatments pose a direct challenge. For instance, many nutritional supplements and corticosteroids are widely available and covered by insurance, making them a more accessible option compared to potentially novel and costly therapies. This accessibility can lead patients and healthcare providers to favor these known quantities, limiting Anaborex's market penetration.

Non-pharmacological lifestyle and dietary interventions present a significant threat to Anaborex, Inc. These approaches, including specialized diets and exercise, offer alternative methods for managing muscle wasting and metabolic issues without relying on pharmaceuticals. For instance, the global market for health and wellness foods, which often incorporate dietary interventions, was projected to reach over $1.1 trillion in 2024, highlighting the substantial consumer interest in these non-drug solutions.

For Anaborex's clinical research services, a significant substitute comes from the in-house R&D departments of large pharmaceutical and biotech firms. These companies often possess the infrastructure and expertise to conduct trials internally, bypassing the need for external CROs. For instance, in 2024, major pharmaceutical companies continued to invest heavily in their internal research capabilities, with R&D spending by the top 10 pharma companies projected to exceed $100 billion.

Furthermore, the clinical research market is populated by a wide spectrum of other Contract Research Organizations (CROs). These range from comprehensive, full-service providers to highly specialized niche players focusing on specific therapeutic areas or trial phases. This competitive landscape means clients have numerous alternative CROs to choose from, potentially impacting Anaborex's pricing power and market share.

Generic and Biosimilar Drugs

While Anaborex, Inc. concentrates on developing innovative, novel therapies, the wider pharmaceutical landscape is significantly impacted by the emergence of generic and biosimilar drugs once their respective patents expire. This trend introduces a competitive pressure that can influence pricing strategies for new market entrants, even those with proprietary technologies.

The threat of substitutes, particularly from generics and biosimilars, creates an environment where the perceived value of new drugs is often benchmarked against more affordable alternatives. For instance, in 2024, the global market for biosimilars continued its robust growth, with projections indicating it could reach over $200 billion by 2030, demonstrating the significant cost-saving potential and market share capture these products represent.

- Market Pressure: The increasing prevalence and acceptance of generics and biosimilars exert downward pressure on pricing expectations for all new pharmaceutical products, including those from companies like Anaborex.

- Patent Cliff Impact: As blockbuster drugs lose patent protection, the subsequent availability of significantly cheaper generics can reshape patient and payer behavior, favoring cost-effectiveness.

- Anaborex's Position: Although Anaborex's early-stage, proprietary therapies are not direct substitutes, the overall market dynamic influenced by generics and biosimilars necessitates a strong value proposition and clear differentiation for new treatments.

- Long-Term Strategy: Companies must consider the long-term impact of patent expirations on their product portfolios and develop strategies to mitigate the threat of substitutes, potentially through continuous innovation or strategic partnerships.

Emerging Technologies and Alternative Modalities

The threat of substitutes for Anaborex, Inc. is significant due to the rapid evolution of biotechnology. New therapeutic modalities, such as gene therapy or cell therapy, could emerge as viable alternatives for treating wasting syndrome or related metabolic conditions. For example, the global gene therapy market was valued at approximately $12.5 billion in 2023 and is projected to grow substantially, indicating a strong potential for these advanced treatments to displace existing or novel approaches.

These emerging technologies, including precision medicine, offer the potential for highly targeted treatments that could prove more effective or have fewer side effects than Anaborex's current offerings. The increasing investment in these areas, with venture capital funding for biotech startups reaching tens of billions in 2024, underscores the competitive landscape. Companies focusing on these next-generation therapies may eventually offer superior solutions, thereby reducing the competitive advantage of Anaborex's novel approaches.

- Emerging Technologies: Gene therapy, cell therapy, and precision medicine are key substitutes.

- Market Growth: The gene therapy market's projected growth highlights the increasing viability of these alternatives.

- Investment Trends: Significant venture capital in biotech signals a robust pipeline of potential substitutes.

- Competitive Impact: These advanced therapies could offer greater efficacy and fewer side effects, challenging Anaborex's market position.

Existing therapies for wasting syndrome, while not directly targeting underlying causes, represent a significant threat. Treatments like nutritional support and appetite stimulants such as megestrol acetate are familiar and often covered by insurance, making them more accessible than potentially novel, costly therapies. In 2024, the appetite stimulant market showed strong growth, indicating reliance on these established methods.

Non-pharmacological interventions, including specialized diets and exercise, also serve as substitutes. The global health and wellness food market, projected to exceed $1.1 trillion in 2024, demonstrates substantial consumer interest in these non-drug solutions for metabolic issues.

For Anaborex's clinical research services, in-house R&D departments of large pharmaceutical firms are key substitutes, possessing infrastructure for internal trials. In 2024, top pharmaceutical companies' R&D spending was expected to surpass $100 billion, highlighting their internal capabilities.

The broader pharmaceutical market faces pressure from generics and biosimilars. The global biosimilar market, projected to reach over $200 billion by 2030, signifies the significant cost-saving potential these products offer, influencing pricing expectations for new entrants.

Emerging biotechnologies like gene and cell therapy are also significant substitutes. The gene therapy market, valued at approximately $12.5 billion in 2023, is growing rapidly, indicating their potential to displace current approaches. Venture capital funding for biotech in 2024 reached tens of billions, fueling the development of these advanced, potentially more effective alternatives.

| Substitute Category | Examples | 2024 Market Indicator | Impact on Anaborex |

|---|---|---|---|

| Existing Therapies | Nutritional support, appetite stimulants (megestrol acetate) | Appetite stimulant market growth | Accessibility and familiarity favor established treatments. |

| Lifestyle Interventions | Specialized diets, exercise | Health & wellness food market > $1.1 trillion | Consumer preference for non-drug solutions. |

| In-house R&D | Large pharma R&D departments | Top 10 pharma R&D spend > $100 billion | Reduces demand for external clinical research services. |

| Generics & Biosimilars | Off-patent drug equivalents | Biosimilar market > $200 billion by 2030 | Downward pressure on pricing for new therapies. |

| Emerging Biotech | Gene therapy, cell therapy | Gene therapy market ~$12.5 billion (2023) | Potential for superior efficacy, challenging market position. |

Entrants Threaten

The biotechnology sector, particularly drug development, necessitates immense capital for research, preclinical and clinical trials, and manufacturing. Anaborex, Inc., like other early-stage biotech firms, needs substantial funding to progress its drug candidates. Securing this investment, especially for early-stage projects, is competitive, though projections suggest a hopeful uptick in biotech funding in 2025.

New entrants into Anaborex, Inc.'s market confront significant challenges due to extensive regulatory hurdles. The path to market for new therapies, particularly those involving novel mechanisms like Anaborex's, is heavily regulated, often requiring years of rigorous testing and data submission to bodies like the FDA. For instance, the average time for a new drug to go from discovery to approval in the US was around 10-12 years in recent years, with costs often exceeding $2 billion per approved drug.

Anaborex, Inc. faces substantial threats from new entrants due to the formidable intellectual property barriers in the biotechnology sector. Established players, including Anaborex, possess vast patent portfolios that protect their drug compounds, manufacturing techniques, and therapeutic uses.

New companies entering this market must either innovate and secure their own unique intellectual property or face the considerable expense of licensing existing patents. For instance, the average cost to patent a new drug in the US can run into millions of dollars, a significant hurdle for startups.

Need for Specialized Expertise and Talent

Developing innovative treatments for conditions like wasting syndrome, as Anaborex, Inc. does, demands a highly specialized workforce. This includes experts in scientific research, clinical trials, and regulatory affairs. New entrants face a significant hurdle in accessing this talent.

The global demand for skilled professionals in areas critical to Anaborex's operations, such as biopharmaceutical research and development, outstrips supply. For instance, in 2023, the biotechnology sector experienced a notable increase in job openings for specialized roles, making recruitment competitive.

- High Demand for Specialized Skills: Fields like molecular biology and clinical pharmacology are experiencing shortages.

- Talent Acquisition Costs: New companies must offer competitive salaries and benefits to attract top talent, increasing operational expenses.

- Retention Challenges: Established firms often have more resources to retain key personnel, posing a retention risk for newcomers.

Brand Recognition and Established Relationships

The threat of new entrants for Anaborex, Inc. is significantly influenced by brand recognition and established relationships within the pharmaceutical and contract research organization (CRO) sectors. Existing players, including major pharmaceutical companies and large CROs, already possess strong brand equity, built over years of successful product development and service delivery. For instance, in 2024, the top five global pharmaceutical companies reported revenues ranging from approximately $40 billion to over $100 billion, underscoring their market dominance and the trust they command.

These established entities benefit from deep-rooted networks with healthcare providers, a crucial element for clinical trial recruitment and market penetration. Furthermore, long-standing relationships with key opinion leaders (KOLs) and regulatory bodies like the FDA are invaluable assets. New entrants face the formidable challenge of building this trust and reputation from the ground up. In a highly regulated industry where credibility and robust clinical validation are non-negotiable, this process can be lengthy and resource-intensive.

- Brand Equity: Established pharmaceutical firms and CROs enjoy substantial brand recognition, a critical factor in securing partnerships and market share.

- Network Advantage: Existing companies have cultivated extensive networks with healthcare providers, facilitating clinical trial operations and patient access.

- KOL and Regulatory Relationships: Long-standing connections with key opinion leaders and regulatory agencies provide a significant competitive edge and streamline approval processes.

- Barriers to Entry: New entrants must overcome substantial hurdles in establishing credibility and demonstrating clinical efficacy to compete effectively.

The threat of new entrants for Anaborex, Inc. is moderated by the substantial capital requirements in drug development. The average cost to bring a new drug to market can exceed $2 billion, and securing funding for early-stage biotech is competitive, though biotech funding is projected for a hopeful uptick in 2025.

Significant regulatory hurdles and extensive patent portfolios create formidable barriers to entry. New companies must navigate years of rigorous testing and data submission, often costing millions in patent filings, to gain market access and protect their innovations.

Access to specialized talent and established industry relationships also limits new entrants. The demand for skilled professionals in biotech outstrips supply, and newcomers struggle to build the brand recognition and trust that established players leverage with healthcare providers and regulatory bodies.

| Barrier Type | Description | Estimated Cost/Time (Illustrative) |

| Capital Requirements | Funding research, trials, and manufacturing | >$2 billion per drug |

| Regulatory Hurdles | FDA approval process | 10-12 years average |

| Intellectual Property | Patent filing and protection | Millions of dollars |

| Talent Acquisition | Hiring specialized workforce | Competitive salaries, high demand |

| Brand & Relationships | Building trust and networks | Years of operation, significant investment |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Anaborex, Inc. is built upon a foundation of industry-specific market research reports, financial filings from Anaborex and its competitors, and insights gleaned from trade publications and economic databases.