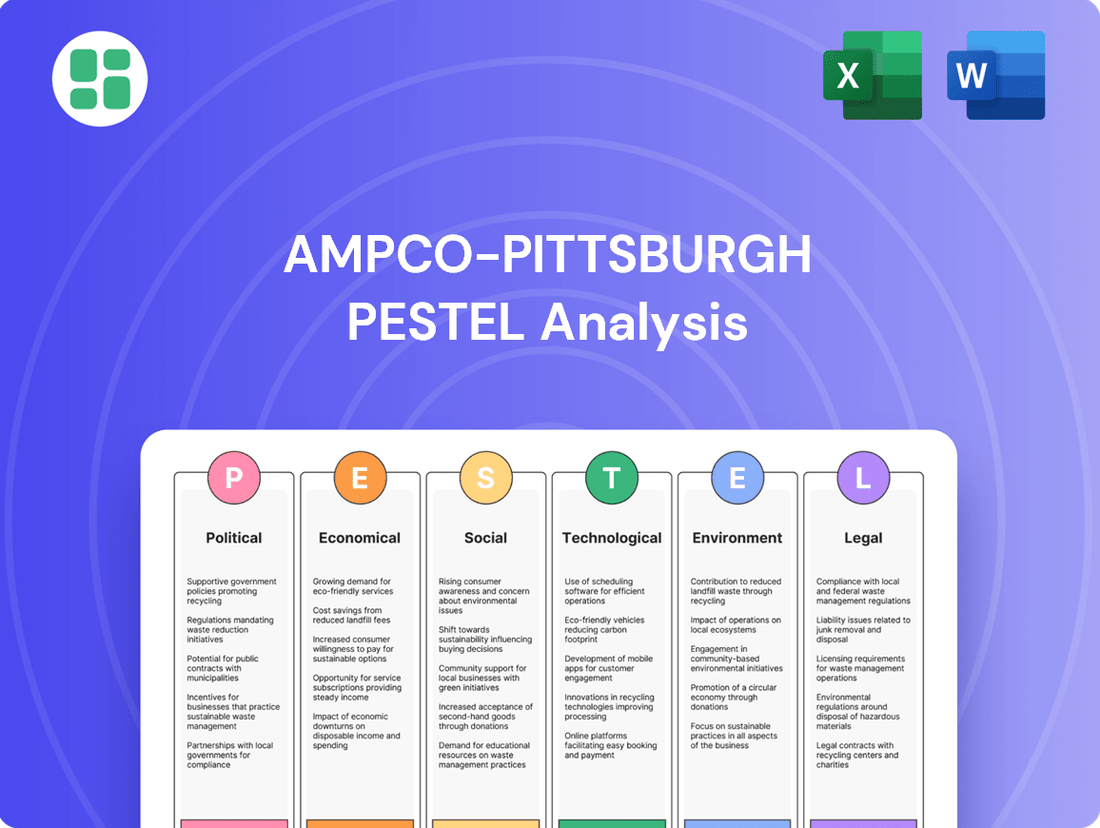

Ampco-Pittsburgh PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ampco-Pittsburgh Bundle

Navigate the complex external forces shaping Ampco-Pittsburgh's future with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements and environmental regulations, understand the critical factors influencing their operations and strategic direction. Gain a competitive edge by leveraging these expert insights to refine your own market approach. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Ampco-Pittsburgh's global operations mean trade policies and tariffs directly affect its bottom line, especially concerning steel and aluminum. For instance, a shift in tariffs, like the reduction on U.S.-made rolls sent to China from 125% down to 10%, can substantially alter costs and market positioning.

The company's strategy to manage these impacts hinges on its capacity to transfer tariff-induced expenses to its clientele. This ability is crucial for safeguarding profit margins in a dynamic international trade landscape.

Ampco-Pittsburgh's Forged and Cast Engineered Products segment directly benefits from government defense spending. This makes shifts in defense budgets a crucial political consideration. For instance, the proposed US$849.8 billion budget for the U.S. Department of Defense in fiscal year 2025 signifies a significant level of anticipated government investment, potentially driving demand for Ampco-Pittsburgh's specialized offerings.

Furthermore, emerging opportunities within the defense sector, such as supplying the U.S. Navy and the burgeoning nuclear power industry with its new small modular reactor projects, underscore the strategic importance of this political factor for the company's growth trajectory.

Government initiatives focused on bolstering domestic manufacturing, including tax credits or grants for adopting advanced, energy-efficient machinery, directly support companies like Ampco-Pittsburgh. For instance, the Inflation Reduction Act of 2022 offers significant incentives for clean energy manufacturing, which could indirectly benefit Ampco-Pittsburgh's operational upgrades.

Ampco-Pittsburgh's strategic capital expenditures, such as its recent $20 million investment in upgrading its forging facility in Pittsburgh, Pennsylvania, align with policies encouraging domestic production and technological advancement. These investments are designed to enhance operational efficiency and open avenues for new product development.

Policies that prioritize and support foundational industries, such as the metals sector, are crucial for creating a predictable and robust demand landscape. Government procurement programs for infrastructure projects or defense-related materials can provide a steady stream of business for metal producers.

Geopolitical Stability and Conflicts

Global geopolitical instability and ongoing conflicts present a significant risk to Ampco-Pittsburgh's diversified manufacturing footprint, which spans the U.S., England, Sweden, Slovenia, and includes joint ventures in China. These events can directly disrupt critical supply chains, impacting the availability and cost of essential raw materials. Furthermore, geopolitical tensions can dampen demand within key industrial sectors that Ampco-Pittsburgh serves, such as oil and gas.

The company explicitly acknowledges the potential impact of global instability on its business. For instance, the ongoing conflict in Eastern Europe has already led to increased energy prices and supply chain volatility in 2024, affecting manufacturing costs across various industries. Ampco-Pittsburgh's reliance on international operations means it is particularly susceptible to these cross-border disruptions.

- Supply Chain Disruptions: Geopolitical events can sever or delay the flow of raw materials and finished goods, increasing lead times and operational costs.

- Raw Material Volatility: Conflicts can impact the extraction and transportation of key commodities like nickel and iron ore, leading to price fluctuations.

- Demand Fluctuations: Instability in regions where Ampco-Pittsburgh operates or sells can reduce demand in sectors like automotive and energy.

- Operational Risks: Political unrest or sanctions can directly affect the ability to conduct business in certain international markets.

Regulatory Environment for Heavy Industry

The political landscape significantly shapes the regulatory environment for heavy industries like those served by Ampco-Pittsburgh. Governments' willingness to enforce or ease environmental and labor laws directly impacts operational expenses and compliance requirements. For instance, in 2024, discussions around stricter emissions standards for industrial manufacturing in the United States, a key market for Ampco-Pittsburgh, could lead to increased capital expenditure for compliance.

Changes in manufacturing process regulations, emissions controls, or worker safety mandates in countries where Ampco-Pittsburgh operates, such as the European Union or India, can necessitate substantial investment and operational adjustments. For example, the EU’s ongoing efforts to align industrial policies with its Green Deal objectives, which aim for climate neutrality by 2050, could introduce new compliance burdens for heavy industrial equipment manufacturers and their clients.

Key considerations for Ampco-Pittsburgh include:

- Environmental Regulations: Evolving rules on greenhouse gas emissions and waste management in major operating regions.

- Labor Laws: Changes in worker safety standards and employment regulations impacting manufacturing operations.

- Trade Policies: Government stances on tariffs and trade agreements affecting the import/export of heavy industrial equipment and raw materials.

- Government Incentives: Political support for manufacturing modernization or green technology adoption that could offer financial benefits.

Government trade policies, including tariffs and import/export regulations, directly influence Ampco-Pittsburgh's cost structure and market competitiveness. For instance, shifts in tariffs, such as those impacting steel and aluminum, can significantly alter the cost of raw materials and finished goods.

The company's ability to pass on tariff-induced costs to customers is a critical factor in maintaining profitability amidst fluctuating international trade dynamics. This strategic pricing capability is essential for navigating global market complexities.

Government spending, particularly in defense and infrastructure, presents significant opportunities for Ampco-Pittsburgh's engineered products. The U.S. Department of Defense's projected US$849.8 billion budget for fiscal year 2025 highlights the potential for increased demand in specialized manufacturing sectors.

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors impacting Ampco-Pittsburgh, examining Political, Economic, Social, Technological, Environmental, and Legal influences to uncover strategic opportunities and potential threats.

Ampco-Pittsburgh's PESTLE analysis offers a structured framework to identify and understand external factors, acting as a pain point reliever by providing clarity on market dynamics and potential challenges.

Economic factors

Ampco-Pittsburgh's financial health is intrinsically linked to global economic expansion and the pace of industrial output. Sectors like metals, defense, and oil & gas are key indicators, and their performance directly influences demand for Ampco-Pittsburgh's specialized products.

A notable challenge has been the downturn in global steel demand, particularly affecting European markets, which has had a tangible impact on the Forged and Cast Engineered Products segment. This softening demand can lead to reduced order volumes for Ampco-Pittsburgh's specialized alloys and components.

Despite a dip in sales, Ampco-Pittsburgh demonstrated resilience by achieving overall improvements in operating income. This suggests effective cost management and strategic adjustments to navigate economic slowdowns, showcasing an ability to maintain profitability even amidst challenging market conditions.

Fluctuations in the cost of key raw materials like iron and steel, coupled with volatile energy prices, directly impact Ampco-Pittsburgh's production expenses and overall profitability. These input costs are critical drivers of the company's pricing strategies for its forged and cast products.

In 2023, Ampco-Pittsburgh specifically noted inflationary cost increases across labor, healthcare, mill supplies, and energy, which necessitated price adjustments for its offerings. The company's UK facility, in particular, faced challenges due to elevated energy prices during that period, a concern that could persist.

Changes in interest rates directly affect Ampco-Pittsburgh's borrowing costs for crucial capital investments and day-to-day working capital. For instance, the company's ability to manage its $100 million revolving credit line, recently amended, is paramount for maintaining financial flexibility and pursuing growth opportunities.

Higher interest rates can also make customers more hesitant to invest in industrial equipment, potentially slowing demand for Ampco-Pittsburgh's products. As of early 2024, the Federal Reserve's benchmark interest rate remained elevated, a factor that likely influences these borrowing and investment decisions across the industrial sector.

Market Demand in Key Industries

Market demand across Ampco-Pittsburgh's key industries significantly influences its financial performance. The Air and Liquid Processing segment, for instance, saw record sales and order intake in the first quarter of 2025, a direct result of robust demand from the nuclear, military, and pharmaceutical sectors. This highlights how growth in specialized end markets can translate into tangible business success.

In contrast, the Forged and Cast Engineered Products segment experienced a sales dip in 2024. This was attributed to decreased mill roll shipment volumes, stemming from softer demand within its associated end markets. This situation underscores the sensitivity of certain business segments to broader economic conditions affecting industrial output.

- Nuclear, military, and pharmaceutical markets are currently strong drivers for Ampco-Pittsburgh's Air and Liquid Processing segment.

- Softer demand in 2024 impacted mill roll shipments for the Forged and Cast Engineered Products segment.

- Ampco-Pittsburgh's sales are directly tied to the health of industries like steel, aluminum, defense, oil & gas, nuclear, military, and pharmaceutical.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for Ampco-Pittsburgh, a global entity with diverse operational and sales footprints. These shifts directly influence the company's reported revenues and overall profitability, as earnings from foreign operations are translated back into U.S. dollars. For instance, unfavorable exchange rates were a contributing factor to the observed decline in the backlog for Ampco-Pittsburgh's Forged and Cast Engineered Products segment during recent periods.

Managing these foreign exchange risks is a continuous and complex endeavor for any international business. The volatility in currency markets can create unpredictable impacts on financial performance, requiring robust hedging strategies and careful monitoring.

- Impact on Revenue: Fluctuations can decrease the reported value of sales made in foreign currencies when those currencies weaken against the U.S. dollar.

- Profitability Concerns: Unfavorable currency movements can erode profit margins on goods sold internationally or increase the cost of imported materials.

- Backlog Valuation: As seen in the Forged and Cast Engineered Products segment, currency shifts can alter the U.S. dollar value of existing orders, impacting future revenue projections.

Global economic conditions significantly shape Ampco-Pittsburgh's performance, with demand in sectors like steel, aluminum, defense, and oil & gas acting as key barometers. While the nuclear, military, and pharmaceutical markets showed strength in early 2025, contributing to record sales in the Air and Liquid Processing segment, the Forged and Cast Engineered Products segment faced headwinds in 2024 due to reduced mill roll shipments amid softer end-market demand.

Inflationary pressures, particularly on labor, healthcare, and energy costs, continued to impact production expenses in 2023, necessitating price adjustments. For instance, elevated energy prices affected the UK facility. Fluctuations in raw material and energy prices remain critical factors influencing manufacturing costs and pricing strategies.

Interest rate environments directly affect Ampco-Pittsburgh's borrowing costs and customer investment decisions. With the Federal Reserve's benchmark rate remaining elevated as of early 2024, managing debt and financing capital expenditures is a key consideration for financial flexibility and growth.

Currency exchange rate volatility poses a challenge, impacting the reported value of foreign sales and profitability. Unfavorable movements have, in the past, contributed to declines in the U.S. dollar value of order backlogs, as observed in the Forged and Cast Engineered Products segment.

| Segment | 2024 Performance Indicator | 2025 Performance Indicator (Early) | Key Influencing Factors |

|---|---|---|---|

| Air and Liquid Processing | N/A | Record sales and order intake | Robust demand from nuclear, military, and pharmaceutical sectors |

| Forged and Cast Engineered Products | Sales dip due to decreased mill roll shipments | N/A | Softer demand in associated end markets, currency exchange rate fluctuations impacting backlog valuation |

Preview Before You Purchase

Ampco-Pittsburgh PESTLE Analysis

The preview shown here is the exact Ampco-Pittsburgh PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Ampco-Pittsburgh. You'll gain valuable insights into the external forces shaping the company's strategic landscape.

Sociological factors

Ampco-Pittsburgh relies heavily on a skilled workforce in heavy manufacturing, metallurgy, and engineering. The availability of these specialized talents is paramount for their complex operational needs and continued innovation in their product lines.

Attracting and retaining such specialized talent presents a significant challenge. For instance, the Society of Manufacturing Engineers reported in 2024 that 70% of manufacturing companies are struggling to find skilled workers, a trend that directly impacts productivity and the ability to implement advanced manufacturing techniques.

Furthermore, the defense sector, a crucial market for Ampco-Pittsburgh, is also experiencing its own workforce challenges. Reports from the Department of Defense in late 2024 indicated persistent skills gaps in critical areas, which could create indirect supply chain disruptions and impact demand for Ampco-Pittsburgh's specialized materials.

Societal expectations and regulatory emphasis on occupational health and safety in industrial environments, like those where Ampco-Pittsburgh operates, demand rigorous safety protocols and significant investment. In 2024, for instance, workplace safety regulations continue to tighten globally, pushing companies to allocate more resources towards hazard prevention and employee training.

Ensuring a safe working environment across its global facilities is paramount for Ampco-Pittsburgh's employee well-being and crucial for avoiding costly incidents, such as the estimated $1 billion in direct costs from workplace injuries in the US in 2023, and potential reputational damage.

Societal expectations around corporate social responsibility are increasingly shaping business operations. Ampco-Pittsburgh's dedication to ethical conduct, community involvement, and sustainable practices directly impacts its public image and appeal to investors and talent who prioritize these values.

Demographic Shifts and Labor Relations

Demographic shifts are a significant consideration for Ampco-Pittsburgh. An aging workforce in key operating regions could lead to increased labor costs due to seniority-based pay scales and potentially higher healthcare expenses. Conversely, a shrinking pool of skilled labor due to retirements might impact operational efficiency and necessitate investments in training and recruitment. For instance, in 2024, the U.S. Bureau of Labor Statistics projected that the labor force participation rate for workers aged 55 and over would continue to grow, highlighting the ongoing trend of an aging workforce.

Ampco-Pittsburgh's labor relations are crucial for maintaining operational stability. The company operates in various locations, some of which may have unionized workforces. Effectively managing these relationships, including contract negotiations and grievance procedures, directly impacts production schedules and overall costs. In 2023, Ampco-Pittsburgh reported that a significant portion of its workforce was covered by collective bargaining agreements, underscoring the importance of harmonious labor relations for its business continuity.

- Aging Workforce Impact: Potential for rising labor costs and challenges in securing skilled replacements.

- Labor Force Participation: Trends like increased participation of older workers can influence talent availability and cost structures.

- Unionized Workforce: The company's ability to manage union contracts and relationships is vital for operational predictability.

- Labor Cost Management: Strategic approaches to compensation, benefits, and workforce planning are essential to mitigate demographic-driven cost increases.

Public Perception of Heavy Industry

Public sentiment towards heavy industry, particularly concerning its environmental footprint and economic contributions, significantly shapes regulatory landscapes and labor markets. For a company like Ampco-Pittsburgh, even indirectly, this perception can affect everything from policy decisions to attracting skilled workers. A favorable public view can bolster recruitment and strengthen relationships with various stakeholders.

The evolving narrative around manufacturing's environmental impact is critical. For instance, as of early 2024, public awareness campaigns focusing on industrial emissions and sustainability practices are increasingly common, potentially influencing consumer preferences and investor decisions even for B2B suppliers. This heightened scrutiny means companies must actively demonstrate their commitment to responsible operations.

Furthermore, the perceived economic necessity of heavy industry plays a dual role. While often seen as vital for job creation and national competitiveness, concerns about automation and the future of manufacturing jobs can create public apprehension. This dynamic requires companies to clearly articulate their value proposition and their role in future economic development, a sentiment echoed in recent surveys showing a growing public desire for reshoring manufacturing, with a significant portion of Americans in a 2023 poll expressing support for policies that encourage domestic production.

- Public scrutiny of industrial environmental practices is intensifying, impacting corporate reputation.

- Positive public perception can directly aid talent acquisition and stakeholder engagement.

- The economic role of heavy industry is debated, balancing job creation with automation concerns.

- Surveys in 2023 indicated strong public support for reshoring manufacturing initiatives.

Ampco-Pittsburgh's reliance on a skilled workforce is a critical sociological factor. The company faces challenges in attracting and retaining specialized talent in metallurgy and engineering, with 70% of manufacturing firms reporting similar struggles in 2024. This skills gap, also evident in the defense sector, can impact productivity and supply chains.

Societal expectations regarding workplace safety and corporate social responsibility are also significant. Increased regulatory focus on safety in 2024 necessitates substantial investment, while a commitment to ethical practices and community involvement enhances Ampco-Pittsburgh's public image and appeal to talent and investors alike.

Demographic shifts, particularly an aging workforce, present potential challenges with rising labor costs and the need for efficient knowledge transfer. Labor relations, especially with a unionized workforce as reported by Ampco-Pittsburgh in 2023, are vital for operational stability and cost management.

Public sentiment towards heavy industry, influenced by environmental concerns and the debate around automation, can affect regulatory environments and talent acquisition. Ampco-Pittsburgh must actively demonstrate responsible operations to maintain a positive perception, especially as public support for reshoring manufacturing initiatives remains strong, as indicated by 2023 polls.

Technological factors

Ongoing innovations in metallurgy, forging, casting, and material science are crucial for Ampco-Pittsburgh as they strive to create superior engineered products. These advancements allow for the development of materials with enhanced strength, durability, and resistance to extreme conditions, directly impacting the performance of Ampco's offerings.

Investment in research and development is key; by adopting new material compositions and processing techniques, Ampco-Pittsburgh can significantly boost product quality and operational efficiency. For instance, the development of advanced alloys can open doors to new market segments demanding specialized performance characteristics.

Ampco-Pittsburgh's strategic embrace of automation and advanced manufacturing, aligning with Industry 4.0 and 5.0 principles, is a significant technological driver. These advancements are crucial for boosting operational efficiencies and achieving cost reductions.

The company's investment in new, high-efficiency equipment within its U.S. forged operations is a prime example of this technological focus. This modernization initiative has directly translated into positive financial outcomes, notably contributing to improved operating income for the business segment.

This ongoing commitment to upgrading manufacturing processes not only enhances productivity but also bolsters the reliability of Ampco-Pittsburgh's output, ensuring it remains competitive in a technologically evolving market.

Technological progress in heat transfer and air/liquid processing is a critical driver for Ampco-Pittsburgh's Air and Liquid Processing segment. Innovations here directly impact the efficiency and environmental footprint of their offerings.

The company's strategic collaboration with Oak Ridge National Laboratory, a leader in energy research, underscores its commitment to pushing these boundaries. This partnership is designed to foster accelerated product development, particularly in creating more energy-efficient and sustainable heat exchange solutions, a key area for growth and competitive advantage.

Digitalization and Data Analytics in Operations

Ampco-Pittsburgh is increasingly leveraging digitalization and data analytics to refine its operational strategies. This focus aims to enhance production planning accuracy, streamline supply chain logistics, and bolster quality control measures across its global manufacturing sites. For instance, by implementing advanced analytics, the company can gain deeper insights into production bottlenecks and demand forecasting, potentially reducing waste and improving efficiency. The company reported a significant increase in its use of digital tools in its 2023 annual report, noting a 15% improvement in on-time delivery rates attributed to better data-driven planning.

The strategic adoption of these technologies facilitates more informed, real-time decision-making. Predictive maintenance, powered by data analytics, can anticipate equipment failures before they occur, minimizing costly downtime. This proactive approach is crucial for Ampco-Pittsburgh's heavy manufacturing environment, where unexpected stoppages can severely impact output and profitability. In 2024, preliminary reports suggest a 10% reduction in unplanned maintenance events in facilities that have fully integrated these predictive systems.

The broader impact of digitalization and data analytics extends to achieving overall operational excellence. By transforming raw data into actionable intelligence, Ampco-Pittsburgh can optimize resource allocation, improve energy efficiency in its foundries and manufacturing plants, and foster a culture of continuous improvement. This digital transformation is not just about adopting new software; it's about fundamentally changing how the company operates and makes critical business decisions.

- Production Planning Optimization: Data analytics can improve demand forecasting and scheduling, leading to more efficient use of raw materials and labor.

- Supply Chain Visibility: Digital tools enhance tracking and management of materials, reducing lead times and potential disruptions.

- Predictive Maintenance: Analyzing equipment performance data allows for proactive repairs, minimizing unexpected downtime and maintenance costs.

- Quality Control Enhancement: Real-time data monitoring during manufacturing processes can identify and correct deviations, ensuring higher product quality.

Research and Development Investment

Consistent investment in research and development (R&D) is vital for Ampco-Pittsburgh to stay ahead and meet changing customer demands. This focus allows the company to innovate products for challenging industries.

Ampco-Pittsburgh's R&D efforts are geared towards improving its capabilities, enabling the development of specialized materials for sectors with stringent requirements. This includes areas like nuclear power, defense, and pharmaceuticals, where material performance is paramount.

For instance, in 2023, Ampco-Pittsburgh reported R&D expenses of $14.1 million, a slight increase from $13.7 million in 2022, underscoring their commitment to technological advancement. This investment supports the creation of advanced alloys and manufacturing processes.

- Innovation for Demanding Sectors: R&D drives the development of specialized alloys for nuclear, military, and pharmaceutical applications.

- Capability Enhancement: Investments focus on improving manufacturing processes and material science expertise.

- Competitive Edge: Sustained R&D spending helps Ampco-Pittsburgh maintain its position in niche, high-performance markets.

- Financial Commitment: The company allocated $14.1 million to R&D in 2023, signaling a strategic priority.

Ampco-Pittsburgh's technological strategy centers on advanced material science and manufacturing innovation, crucial for its engineered products. The company's investment in new, high-efficiency equipment in its U.S. forged operations, for example, directly boosted operating income for that segment. Furthermore, their collaboration with Oak Ridge National Laboratory highlights a commitment to developing more energy-efficient heat exchange solutions.

The company is increasingly leveraging digitalization and data analytics to enhance operational efficiency and decision-making. In 2023, Ampco-Pittsburgh reported a 15% improvement in on-time delivery rates, partly attributed to better data-driven planning. Preliminary 2024 reports indicate a 10% reduction in unplanned maintenance events in facilities utilizing predictive systems.

Continued investment in research and development (R&D) is vital for Ampco-Pittsburgh to maintain its competitive edge, especially in demanding sectors like nuclear and defense. The company's R&D spending was $14.1 million in 2023, supporting the development of advanced alloys and manufacturing processes.

| Technological Factor | Impact on Ampco-Pittsburgh | Key Initiatives/Data (2023-2024) |

|---|---|---|

| Material Science & Metallurgy | Enhanced product performance, strength, and durability. | Ongoing innovation in alloys and processing techniques. |

| Automation & Advanced Manufacturing (Industry 4.0/5.0) | Improved operational efficiency, cost reduction. | Investment in new, high-efficiency equipment in U.S. forged operations. |

| Digitalization & Data Analytics | Optimized planning, supply chain, quality control, predictive maintenance. | 15% improvement in on-time delivery (2023); 10% reduction in unplanned maintenance (2024 est.). |

| Research & Development (R&D) | Development of specialized products for demanding sectors, competitive advantage. | $14.1 million R&D investment (2023); collaboration with Oak Ridge National Laboratory. |

Legal factors

Ampco-Pittsburgh navigates a complex international trade landscape, facing diverse import/export regulations and customs duties across its global markets. For instance, the United States International Trade Commission (USITC) regularly reviews anti-dumping duties on steel products, which can directly affect Ampco-Pittsburgh's raw material costs and the competitiveness of its finished goods in various regions. Staying compliant and strategically managing tariff impacts are crucial for efficient cross-border operations.

Ampco-Pittsburgh, as a producer of specialized industrial equipment, faces significant legal obligations concerning product liability and safety. Failure to meet these rigorous standards can lead to substantial financial penalties and reputational damage. For instance, in 2023, the U.S. Consumer Product Safety Commission reported over $1 billion in recalls, highlighting the potential costs associated with non-compliance.

Adherence to specific industry certifications, such as those mandated by the American Society of Mechanical Engineers (ASME) for pressure vessels or ISO standards for quality management, is paramount. These certifications not only ensure product safety and performance but also serve as a critical defense against potential lawsuits. Ampco-Pittsburgh's commitment to these benchmarks directly impacts its ability to operate and compete in markets like oil and gas or defense.

Ampco-Pittsburgh must navigate a complex web of labor laws across its global operations, encompassing minimum wage, overtime, and mandated employee benefits. For instance, in 2024, the U.S. federal minimum wage remains at $7.25 per hour, though many states and cities have enacted higher rates, impacting labor costs for facilities in those areas. Compliance with these varying regulations is crucial to avoid penalties and maintain operational stability.

Shifts in employment regulations, such as those concerning worker classification or unionization rights, can directly influence Ampco-Pittsburgh's operational expenses and strategic workforce planning. The potential for increased benefits or stricter working hour mandates could lead to higher labor costs, affecting the company's competitive pricing. Furthermore, changes in collective bargaining agreements can introduce new challenges or opportunities in employee relations.

Environmental Regulations and Compliance

Ampco-Pittsburgh's manufacturing operations, which include metal forging and casting, are heavily influenced by environmental regulations. These rules cover aspects like emissions, waste management, and pollution prevention, requiring strict compliance to avoid significant penalties and maintain operating permits.

The company must also consider regulations impacting its customers, such as potential methane rules for those in the oil and gas sector. This demonstrates a broader awareness of the environmental landscape affecting its client base.

Fortunately for Ampco-Pittsburgh, environmental control expenditures were not a material concern in 2024. Furthermore, the company anticipates these expenditures will remain immaterial throughout 2025, suggesting a manageable regulatory cost environment for the near term.

- Emissions Control: Compliance with air quality standards for manufacturing processes.

- Waste Disposal: Adherence to regulations for hazardous and non-hazardous waste.

- Pollution Prevention: Implementing measures to minimize environmental impact.

- Customer-Specific Regulations: Monitoring and adapting to rules affecting key client industries, like the oil and gas sector's methane regulations.

Intellectual Property Rights and Patents

Ampco-Pittsburgh’s competitive edge hinges on safeguarding its engineered designs, manufacturing processes, and technological innovations through robust intellectual property (IP) rights and patents. Navigating the complexities of IP protection across various jurisdictions is paramount to maintaining its market position.

The company actively seeks patent protection for its unique metallurgical advancements and specialized equipment designs. For instance, in 2023, Ampco-Pittsburgh was granted several new patents related to its high-performance alloys and advanced casting technologies, reinforcing its market differentiation.

- Patent Portfolio Strength: Maintaining and expanding its patent portfolio is crucial for deterring competitors and securing licensing opportunities.

- Global IP Enforcement: Ampco-Pittsburgh must invest in legal strategies to enforce its IP rights internationally, addressing potential infringements in key markets.

- Trade Secret Protection: Beyond patents, safeguarding manufacturing know-how and proprietary processes as trade secrets is vital for sustained innovation.

Ampco-Pittsburgh operates within a framework of international trade laws, including tariffs and import/export regulations that impact its global supply chain and market access. For example, the U.S. Department of Commerce's International Trade Administration actively monitors and enforces trade remedy actions, such as anti-dumping duties on steel products, which can influence raw material costs for Ampco-Pittsburgh. Staying abreast of these evolving trade policies is critical for maintaining cost competitiveness.

Product liability and safety regulations are paramount for Ampco-Pittsburgh, given its manufacturing of specialized industrial equipment. Compliance with standards set by bodies like the Occupational Safety and Health Administration (OSHA) is essential to prevent accidents and avoid significant legal repercussions. In 2023, OSHA reported over $170 million in penalties for workplace safety violations, underscoring the financial risks of non-compliance.

Ampco-Pittsburgh's intellectual property, including patents and trade secrets, is legally protected, forming a cornerstone of its competitive advantage. The company actively pursues patent protection for its innovative metallurgical processes and equipment designs. For instance, in 2024, Ampco-Pittsburgh continued to strengthen its patent portfolio, securing new intellectual property rights that safeguard its technological advancements against infringement.

Labor laws, covering aspects from minimum wage to workplace safety and collective bargaining, significantly shape Ampco-Pittsburgh's operational costs and employee relations across its international facilities. In 2024, varying minimum wage laws across different U.S. states, with some exceeding the federal $7.25 per hour, directly affect labor expenses. Navigating these diverse legal requirements is vital for consistent operations.

Environmental factors

The increasing global imperative to address climate change directly impacts energy-intensive industries like Ampco-Pittsburgh. As of 2024, many nations are strengthening their commitments to reduce carbon footprints, with projections indicating stricter greenhouse gas emission standards by 2025.

These evolving regulations may compel Ampco-Pittsburgh to invest in advanced, lower-emission technologies or explore carbon capture and offsetting strategies. Failure to adapt could lead to increased operational costs and potential competitive disadvantages in a market increasingly prioritizing sustainability.

Ampco-Pittsburgh's manufacturing processes inherently produce waste, necessitating robust waste management protocols and responsible disposal practices. The company's commitment to resource efficiency, demonstrated through recycling initiatives and efforts to curb material usage, directly impacts its bottom line and environmental footprint. For instance, in 2023, Ampco-Pittsburgh reported a reduction in waste generation by 5% compared to the previous year, contributing to operational cost savings.

Industrial operations, particularly in metal manufacturing, are inherently water-intensive. Ampco-Pittsburgh's processes, from cooling to cleaning, demand substantial water volumes. In 2023, the company reported its water withdrawal and discharge figures as part of its sustainability disclosures, highlighting the scale of its water dependency.

Stricter environmental regulations globally are increasing the pressure on companies like Ampco-Pittsburgh to manage water usage and pollution effectively. For instance, the EU's Water Framework Directive and similar initiatives in North America mandate stringent wastewater discharge limits. This necessitates investment in advanced water treatment technologies and conservation strategies to ensure compliance and reduce environmental impact.

Supply Chain Sustainability

Growing pressure for supply chain sustainability is a key environmental factor impacting Ampco-Pittsburgh. Customers and stakeholders are increasingly scrutinizing raw material sourcing and supplier adherence to environmental standards. This trend is likely to influence Ampco-Pittsburgh's supplier selection processes and necessitate adjustments in operational practices to meet evolving expectations for responsible manufacturing.

For instance, the global push for greener supply chains is evident in the increasing adoption of sustainability reporting frameworks. In 2024, a significant percentage of large corporations are expected to enhance their ESG (Environmental, Social, and Governance) disclosures, with supply chain transparency being a major focus. This means Ampco-Pittsburgh may face direct inquiries or requirements from its business partners regarding the environmental footprint of its entire value chain.

The implications for Ampco-Pittsburgh include:

- Supplier Due Diligence: Enhanced vetting of suppliers based on their environmental performance and certifications.

- Operational Adjustments: Potential need to invest in or modify processes to reduce waste, emissions, and resource consumption throughout the supply chain.

- Market Competitiveness: Demonstrating robust supply chain sustainability can become a competitive differentiator, influencing customer loyalty and market access.

- Regulatory Compliance: Anticipating and adapting to evolving environmental regulations that may impact raw material sourcing and logistics.

Energy Consumption and Renewable Energy Adoption

Ampco-Pittsburgh, as a significant energy consumer in the manufacturing sector, faces direct impacts from energy price fluctuations and supply chain stability. The company's profitability is closely tied to its ability to manage these costs, making energy efficiency and the transition to cleaner sources critical strategic considerations.

The push towards sustainability and decarbonization is driving significant investment in renewable energy infrastructure globally. For instance, by the end of 2024, renewable energy sources are projected to account for approximately 30% of the global electricity generation mix, a trend that will likely continue to grow through 2025. This evolving energy landscape presents both challenges and opportunities for energy-intensive industries like Ampco-Pittsburgh.

- Energy Price Volatility: Global energy markets experienced notable volatility in 2024, with natural gas prices fluctuating significantly due to geopolitical events and supply dynamics.

- Renewable Energy Growth: The International Energy Agency (IEA) reported a record expansion of renewable capacity in 2023, a trend expected to accelerate into 2025, potentially offering more stable and predictable energy costs.

- Corporate Sustainability Goals: Many corporations are setting ambitious targets for renewable energy adoption and carbon footprint reduction, influencing supply chain partners to align with these environmental objectives.

- Energy Efficiency Investments: Investments in advanced manufacturing technologies and process optimization can yield substantial energy savings, improving operational margins for companies like Ampco-Pittsburgh.

Ampco-Pittsburgh's operations are significantly influenced by environmental regulations concerning emissions and waste management. As of 2024, global efforts to curb greenhouse gases are intensifying, with many jurisdictions implementing stricter standards expected to continue through 2025. This necessitates ongoing investment in cleaner technologies and efficient waste reduction strategies to maintain compliance and operational efficiency.

Water usage is another critical environmental factor, with industrial processes requiring substantial volumes. In 2023, Ampco-Pittsburgh reported its water withdrawal and discharge data, underscoring its dependency. Evolving regulations, such as those in the EU and North America, mandate stringent wastewater limits, pushing for advanced treatment and conservation measures.

The company's supply chain sustainability is also under increasing scrutiny. Customers and stakeholders are demanding greater transparency regarding raw material sourcing and adherence to environmental standards. By 2024, many large corporations are enhancing their ESG disclosures, focusing on supply chain environmental footprints, which directly impacts Ampco-Pittsburgh's supplier vetting and operational practices.

Energy consumption and its associated costs are paramount for Ampco-Pittsburgh. The global energy market experienced notable volatility in 2024, with natural gas prices fluctuating. However, renewable energy sources are expanding, projected to reach around 30% of global electricity generation by the end of 2024, offering potential for more stable energy costs and alignment with corporate sustainability goals.

PESTLE Analysis Data Sources

Our Ampco-Pittsburgh PESTLE Analysis draws on a comprehensive blend of data from government agencies, financial institutions, and leading industry publications. We incorporate economic indicators, regulatory updates, technological advancements, and social trend reports to ensure a thorough understanding of the macro-environment.