Ampco-Pittsburgh Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ampco-Pittsburgh Bundle

Ampco-Pittsburgh operates within an industry shaped by significant buyer power, particularly from large industrial customers, and a moderate threat of substitutes for its specialized metal products. Understanding the intensity of these forces is crucial for any stakeholder looking to navigate this competitive landscape.

The complete report reveals the real forces shaping Ampco-Pittsburgh’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ampco-Pittsburgh's Forged and Cast Engineered Products segment heavily depends on raw materials such as iron and steel. The metals industry, particularly in 2024, continues to grapple with supply chain disruptions, including significant price fluctuations and ongoing geopolitical instability affecting material availability.

The bargaining power of suppliers is amplified when there are few specialized providers of critical inputs like high-quality steel or specific alloys. This limited supplier base for Ampco-Pittsburgh means these suppliers can exert considerable influence, potentially driving up the cost of essential raw materials for the company.

Switching raw material suppliers for Ampco-Pittsburgh, particularly for specialized alloys crucial in defense or high-performance sectors, often entails extensive qualification procedures and extended lead times. These substantial switching costs diminish Ampco-Pittsburgh's operational flexibility, thereby enhancing the bargaining leverage of its current suppliers.

For highly engineered products, suppliers offering unique material compositions or specialized processing techniques can significantly influence Ampco-Pittsburgh's operations. This uniqueness, especially in niche sectors such as defense or advanced industrial applications, bestows considerable power upon these suppliers. For instance, in 2024, the demand for specialized alloys used in aerospace components, a key market for Ampco-Pittsburgh, saw a notable increase, tightening supply for certain proprietary materials.

Impact of Energy Costs on Suppliers

Energy costs are a major factor for suppliers in the steel and metal production sector. When energy prices rise, these suppliers face higher operational expenses. For instance, in 2024, global energy markets experienced significant volatility, directly impacting the cost of raw materials and production for many metal suppliers.

This increase in energy expenses can translate into higher prices for components and services provided to manufacturers like Ampco-Pittsburgh. Suppliers can leverage these increased costs to exert greater bargaining power, especially for energy-intensive processes such as forging and casting, which are crucial for Ampco-Pittsburgh's operations.

- Energy Price Volatility: Global energy prices saw notable fluctuations throughout 2024, impacting input costs for metal suppliers.

- Supplier Cost Pass-Through: Increased energy expenses in 2024 led many suppliers to pass these costs onto their customers, including those in the metals industry.

- Impact on Energy-Intensive Processes: Forging and casting, critical for Ampco-Pittsburgh, are particularly sensitive to energy price hikes, strengthening supplier leverage.

Labor Shortages in Supplier Industries

Labor shortages are significantly impacting supplier industries, including those that provide raw materials to the metals manufacturing sector. This scarcity of skilled workers can create production bottlenecks and drive up labor expenses for these suppliers.

These increased costs and potential production delays translate into higher prices or extended delivery times for companies like Ampco-Pittsburgh. Consequently, suppliers facing these challenges gain leverage, enabling them to negotiate more favorable terms and pricing.

- Skilled Worker Deficit: The metals manufacturing supply chain, from raw material providers to specialized component manufacturers, is experiencing a notable shortage of qualified personnel.

- Production & Cost Pressures: This labor gap directly leads to constrained production capacity and escalating labor costs for suppliers, impacting their operational efficiency.

- Supplier Leverage: With fewer available workers, suppliers are in a stronger position to dictate terms, potentially leading to price increases or longer lead times for their customers, including Ampco-Pittsburgh.

- Impact on Ampco-Pittsburgh: These supplier-driven cost increases and delivery delays can directly affect Ampco-Pittsburgh's manufacturing costs and its ability to meet customer demand efficiently.

Ampco-Pittsburgh's reliance on specialized alloys and raw materials, coupled with limited suppliers in 2024, grants significant bargaining power to its suppliers. High switching costs for critical materials further solidify this supplier leverage.

Increased energy costs and labor shortages in 2024 directly translated into higher operational expenses for metal suppliers, enabling them to pass these costs onto Ampco-Pittsburgh. This dynamic strengthens the suppliers' ability to dictate terms and pricing.

The unique material compositions and specialized processing offered by certain suppliers, particularly for defense and aerospace applications in 2024, provide them with considerable influence over Ampco-Pittsburgh's production capabilities and costs.

| Factor | Impact on Suppliers | Leverage on Ampco-Pittsburgh | 2024 Data Point |

|---|---|---|---|

| Limited Suppliers | Concentrated market power | Higher prices, less negotiation flexibility | Few specialized alloy providers |

| Switching Costs | Reduced customer mobility | Supplier retention, price control | Extensive qualification processes |

| Energy Costs | Increased operational expenses | Cost pass-through, price increases | Global energy price volatility |

| Labor Shortages | Production constraints, higher wages | Price escalation, longer lead times | Skilled worker deficit in metals sector |

What is included in the product

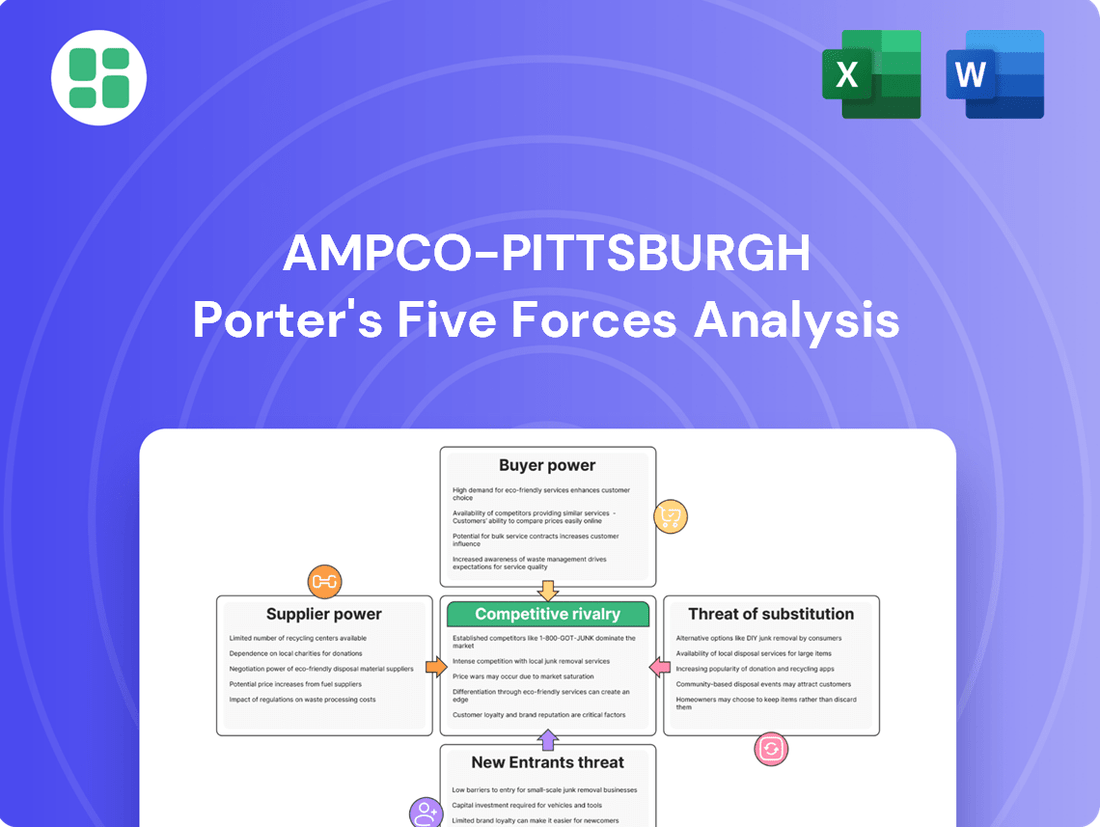

This analysis dissects the competitive forces impacting Ampco-Pittsburgh, evaluating industry rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes.

Quickly identify and address competitive threats with a visual breakdown of each Porter's Five Force, enabling proactive strategy adjustments.

Customers Bargaining Power

Customer concentration can be a significant factor in bargaining power. For Ampco-Pittsburgh, the Forged and Cast Engineered Products segment experienced a notable level of concentration in 2024, with a single customer representing 11% of its net sales. This suggests that this particular customer could wield considerable influence due to their substantial order volume.

Large customers, particularly those involved in critical sectors like defense or large-scale industrial projects, often possess strong bargaining leverage. Their ability to place significant orders, coupled with the potential financial impact of losing their business, empowers them to negotiate more favorable terms, potentially affecting Ampco-Pittsburgh's pricing and profitability.

Conversely, the Air and Liquid Processing segment of Ampco-Pittsburgh demonstrates a more dispersed customer base. This lack of high customer concentration implies that individual customers in this segment likely have less individual bargaining power, as the loss of any single customer would have a less pronounced effect on overall sales.

Customer price sensitivity for Ampco-Pittsburgh's offerings varies significantly. For highly specialized items like custom-designed iron and steel rolls or mission-critical forgings, performance and reliability often trump price, diminishing customer bargaining power. This is because these components are integral to complex manufacturing processes where failure is extremely costly.

However, when Ampco-Pittsburgh deals in more standardized or commoditized products, customers tend to be more focused on price. This increased price sensitivity directly enhances their bargaining power, as they have more readily available alternatives from competitors. For instance, in 2024, the global industrial roll market saw pricing pressures in segments with lower customization, impacting margins for suppliers.

Customers of Ampco-Pittsburgh face a moderate threat from substitute products. While Ampco-Pittsburgh's specialty steel products are often critical for demanding applications, customers can explore alternatives. These might include sourcing from international competitors, though these may not always match the specific quality or performance characteristics.

For instance, while additive manufacturing, or 3D printing, is advancing, it's not yet a direct substitute for many of Ampco-Pittsburgh's core offerings in high-performance alloys. However, the increasing availability and improving capabilities of these substitutes can empower customers, especially if standard product lines are more easily replaced.

Customer Switching Costs

For customers in the metals, defense, and oil & gas sectors, switching suppliers for highly specialized components presents substantial hurdles. These include rigorous re-qualification processes, extensive testing, and the potential for significant disruptions to their own manufacturing operations.

These high switching costs effectively diminish customer bargaining power. The inconvenience and expense associated with changing suppliers often outweigh any perceived benefits from lower prices.

- High Re-qualification Costs: Industries like aerospace and defense often require extensive recertification of new suppliers, a process that can take months and cost millions.

- Production Disruption Risk: In continuous manufacturing processes, such as in the steel industry, a supplier change can lead to costly downtime and quality control issues.

- Specialized Equipment Integration: Many specialized components require specific integration with existing customer machinery, making a switch complex and expensive.

- Limited Supplier Alternatives: For highly niche products, the number of qualified alternative suppliers may be very small, further increasing the cost and difficulty of switching.

Defense and Oil & Gas Industry Dynamics

Customers in the defense and oil & gas sectors, while often needing specialized solutions, face unique industry pressures that shape their bargaining power. Global defense spending saw an estimated increase to over $2.4 trillion in 2024, yet complex procurement cycles and the dominance of major contractors can limit individual customer leverage.

The oil & gas market's customer dynamics are heavily swayed by fluctuating commodity prices and significant capital expenditure decisions. For instance, in early 2024, oil prices experienced volatility, directly impacting the negotiation strength of buyers and their willingness to commit to large orders.

- Defense Sector: Increasing global defense budgets (e.g., exceeding $2.4 trillion in 2024) are counterbalanced by lengthy, intricate procurement processes and the substantial influence of prime contractors, potentially diminishing the bargaining power of individual entities.

- Oil & Gas Sector: Customer negotiation strength is directly tied to global commodity price swings and the industry's capital expenditure cycles, influencing demand and pricing power.

Ampco-Pittsburgh's customers exhibit varying degrees of bargaining power, influenced by factors like order concentration and price sensitivity. For highly specialized products, where performance is paramount, customer leverage is lower. However, for more commoditized offerings, price sensitivity increases, granting customers greater negotiation power, as evidenced by pricing pressures in standardized industrial roll markets during 2024.

The threat of substitutes for Ampco-Pittsburgh's products is moderate. While direct replacements for high-performance alloys are limited, advancements in areas like additive manufacturing could offer alternatives for certain applications. Furthermore, high switching costs for customers in sectors like defense and oil & gas, due to re-qualification and integration complexities, significantly reduce their bargaining power.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation (2024) |

|---|---|---|

| Customer Concentration | Higher for concentrated customers | Single customer represented 11% of Forged and Cast Engineered Products net sales. |

| Price Sensitivity | Higher for commoditized products | Pricing pressures observed in standardized industrial roll segments. |

| Switching Costs | Lower for customers with high switching costs | Rigorous re-qualification, production disruption risks, and specialized equipment integration create high switching costs. |

| Availability of Substitutes | Higher when substitutes are readily available | Advancements in additive manufacturing pose a moderate threat for some applications. |

Preview Before You Purchase

Ampco-Pittsburgh Porter's Five Forces Analysis

This preview showcases the complete Ampco-Pittsburgh Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. You are looking at the actual, professionally formatted analysis, ready for your immediate use and integration into your strategic planning.

Rivalry Among Competitors

Ampco-Pittsburgh faces a competitive market where established players like Triad Metals Inc. and Irwin Car and Equipment are significant rivals. The presence of larger, diversified companies alongside specialized niche competitors intensifies this rivalry.

The global steel industry's ongoing merger and acquisition (M&A) activity, as seen with companies like Cleveland-Cliffs acquiring Cliffs Natural Resources in 2020 for $10.4 billion, continues to reshape the competitive environment, potentially increasing the scale and reach of some players.

The growth rate within the industries Ampco-Pittsburgh operates in significantly shapes competitive rivalry. Sectors like defense and oil & gas are seeing robust growth and increased investment through 2024 and into 2025, which typically fuels demand and can attract new entrants, intensifying competition.

However, the steel industry, a key market for Ampco-Pittsburgh's mill rolls, experienced softer end-market demand in late 2024. This slowdown directly impacted shipment volumes for the company's Forged and Cast Engineered Products segment, suggesting that in certain segments, growth deceleration can lead to more aggressive pricing and competition among existing players as they vie for a shrinking pool of orders.

Ampco-Pittsburgh differentiates itself through custom-engineered products such as specialty rolls and forgings, along with bespoke heat transfer coils. This specialization allows the company to command higher prices and reduces direct competition based on cost for these unique solutions.

While specialization offers a competitive edge, Ampco-Pittsburgh faces more intense rivalry in its segments offering more standardized products. For instance, in the U.S. market for steel mill rolls, the company competes with several other manufacturers, some of whom may have greater scale or lower cost structures for less specialized offerings.

Exit Barriers

Ampco-Pittsburgh faces substantial exit barriers due to the immense capital required for its manufacturing facilities, such as foundries and forging operations. These specialized assets, coupled with unique equipment, represent significant sunk costs, making it difficult and costly for companies to leave the market.

These high fixed costs can compel firms to continue operating even when market conditions are unfavorable, often resorting to aggressive pricing strategies to keep production lines running and cover overhead. This can intensify competition and pressure margins across the industry.

- High Capital Intensity: Ampco-Pittsburgh's operational setup demands significant investment in specialized manufacturing equipment and facilities.

- Sunk Costs: The specialized nature of its assets means they have limited alternative uses, increasing the cost of exiting the business.

- Incentive to Stay: High fixed costs encourage continued operation, even in periods of low demand, to spread costs over a larger output.

Global and Regional Competition

Ampco-Pittsburgh navigates a competitive landscape populated by both domestic and international entities. Its operational footprint spans the United States, England, Sweden, and Slovenia, alongside strategic joint ventures in China, highlighting a broad competitive reach.

The European steel sector, a key operational area for Ampco-Pittsburgh, has seen subdued demand, intensifying competitive pressures and affecting profitability in these regions. This market condition means Ampco-Pittsburgh is contending with rivals in an environment where market share is harder to gain and retain.

Furthermore, global trade dynamics, including evolving policies and tariffs, significantly shape the competitive environment. For instance, shifts in trade agreements can alter cost structures and market access for Ampco-Pittsburgh and its competitors, potentially favoring or disadvantaging certain players based on their geographic production and sales strategies.

- Global Footprint: Operates in US, UK, Sweden, Slovenia, and China.

- European Market Challenges: Faces depressed demand in European steel markets.

- Trade Policy Impact: Global trade policies and tariffs influence competitive dynamics.

Ampco-Pittsburgh faces intense rivalry from both large, diversified competitors and specialized niche players, particularly in its core markets like steel mill rolls. The company's strategy of offering custom-engineered products helps mitigate direct price competition, but more standardized offerings see heightened rivalry. For example, in 2024, the steel industry experienced softer demand, leading to increased competition for orders.

The company's global presence, with operations in the US, Europe, and joint ventures in China, means it contends with a wide array of international competitors. Market conditions, such as subdued demand in European steel markets through 2024, further intensify these rivalries, forcing companies to compete more aggressively for market share.

Exit barriers are substantial for Ampco-Pittsburgh due to the high capital investment in specialized manufacturing assets like foundries and forging operations. These sunk costs incentivize companies to remain in the market, even during downturns, potentially leading to price wars as firms try to cover fixed expenses.

| Competitor Type | Examples | Impact on Ampco-Pittsburgh |

|---|---|---|

| Large Diversified Players | Companies with broader product lines and greater scale | Can leverage economies of scale, potentially offering lower prices on standardized products. |

| Specialized Niche Competitors | Firms focusing on specific product categories or customer segments | Directly compete in specialized areas, requiring Ampco-Pittsburgh to maintain product differentiation. |

| International Competitors | Companies operating in global markets, including those in China and Europe | Benefit from different cost structures or trade policies, influencing global pricing and market access. |

SSubstitutes Threaten

The threat of substitutes for Ampco-Pittsburgh's products, particularly its specialty metal alloys and forged products, is evolving with advancements in materials science. High-performance polymers and carbon composites are emerging as viable alternatives in certain applications, especially where weight reduction or specific non-metallic properties are paramount. For instance, the automotive sector's increasing demand for lighter materials to improve fuel efficiency presents an opportunity for these substitutes.

While these advanced materials may not directly replace heavy-duty steel or iron rolls used in demanding industrial processes, they represent a growing, long-term threat for specific market segments. For example, in aerospace and high-performance sporting goods, composites have already significantly penetrated markets traditionally dominated by metals. This trend is expected to continue as material technology improves and costs become more competitive, potentially impacting demand for certain Ampco-Pittsburgh offerings.

Additive manufacturing, or 3D printing, presents a growing threat to traditional manufacturing processes used by companies like Ampco-Pittsburgh. This technology allows for the creation of intricate metal parts with enhanced design flexibility and material efficiency, speeding up prototyping significantly.

While 3D printing may not yet fully replace the production of Ampco-Pittsburgh's large, high-value components, its rapid advancement means it could soon offer viable alternatives to conventionally cast or forged parts. For instance, the global 3D printing market for metals was valued at approximately $3.1 billion in 2023 and is projected to grow substantially, indicating increasing adoption across industries.

In the Air and Liquid Processing segment, the threat of substitutes is evolving with the rise of advanced heat exchange technologies. Smart heat exchange systems, leveraging AI and IoT, promise enhanced efficiency and control, potentially outperforming traditional coil systems in specific applications.

Furthermore, the growing integration of renewable energy sources like solar thermal collectors and geothermal systems presents a significant alternative. These systems offer more sustainable and potentially lower operational cost solutions for heat transfer needs, impacting demand for conventional methods.

Material Efficiency and Design Optimization

Advances in material science and design software are creating more efficient ways to use existing materials. For instance, sophisticated CAD and simulation tools allow engineers to optimize product designs, potentially reducing the need for specialized forged or cast components by achieving desired performance with less material or through alternative manufacturing methods. This optimization can extend the lifespan and improve the functionality of components, acting as an indirect substitute.

The drive for sustainability and cost reduction further fuels innovation in material efficiency. Companies are increasingly exploring ways to achieve similar or better performance using less material or more readily available, lower-cost alternatives. This trend can impact demand for specialized metal products if alternative solutions become more viable and economical.

- Design Optimization: Engineering software enables lighter, stronger designs that may reduce material requirements for components.

- Material Substitution: Development of advanced composites or high-performance alloys could replace traditional forged or cast metals in certain applications.

- Extended Product Lifespan: Improved design and material durability can mean fewer replacements are needed, impacting demand for new components.

Cost-Performance Trade-offs

Customers frequently weigh the cost against the performance when deciding whether to switch to a substitute product. For instance, if alternative steel alloys can deliver similar strength and durability to Ampco-Pittsburgh's specialized products but at a lower price point, the threat of substitution naturally grows. This dynamic is particularly pronounced in sectors where cost efficiency is paramount.

In 2024, for example, the global specialty steel market faced increasing pressure from advanced composite materials. While composites can offer higher strength-to-weight ratios, their initial cost was often a barrier. However, as manufacturing techniques for composites improved, their price point became more competitive, presenting a direct challenge to traditional steel applications in industries like automotive and aerospace, where Ampco-Pittsburgh operates.

- Cost-Sensitivity: Industries where material costs represent a significant portion of total production expenses are more susceptible to substitution.

- Performance Parity: When substitutes achieve performance levels comparable to existing offerings, the cost advantage becomes a primary decision driver.

- Innovation Impact: Advancements in substitute technologies that reduce costs or enhance performance can rapidly alter the competitive landscape.

The threat of substitutes for Ampco-Pittsburgh's offerings is influenced by material science advancements and cost-performance trade-offs. While high-performance polymers and composites offer weight advantages, their adoption is often tempered by initial costs, particularly in heavy industrial applications where Ampco-Pittsburgh excels. However, ongoing innovation in these substitute materials, coupled with increasing demand for efficiency, presents a growing long-term challenge.

The global market for advanced composites, for example, saw significant growth, with some segments reaching billions in valuation by 2024. This expansion indicates a widening array of applications where these materials can compete with traditional metals. Furthermore, additive manufacturing, or 3D printing, is rapidly maturing, offering more cost-effective and efficient production of complex metal parts, a trend that could disrupt conventional casting and forging processes.

| Substitute Category | Key Advantages | Potential Impact on Ampco-Pittsburgh |

|---|---|---|

| Advanced Composites | Lightweight, High Strength-to-Weight Ratio | Threatens traditional metal applications in aerospace, automotive, and sports equipment sectors. |

| Additive Manufacturing (3D Printing) | Design Flexibility, Material Efficiency, Rapid Prototyping | Could offer alternative production methods for specific metal components, challenging conventional forging and casting. |

| High-Performance Polymers | Corrosion Resistance, Electrical Insulation, Lower Density | May replace metals in certain niche applications where these properties are critical. |

Entrants Threaten

The significant capital required to establish operations in the engineered products sector acts as a substantial barrier to entry. Companies need to invest heavily in specialized manufacturing equipment like forging presses and casting machinery, alongside advanced processing technologies. For instance, a new, fully equipped foundry facility can easily cost tens of millions of dollars to build and outfit, not including ongoing operational expenses.

Ampco-Pittsburgh's reliance on specialized expertise and advanced technology presents a formidable barrier to new entrants. The company's operations demand deep engineering knowledge, extensive metallurgical understanding, and highly specific manufacturing capabilities, all of which are difficult and time-consuming to replicate. For instance, in 2024, the global specialty metals market, where Ampco-Pittsburgh operates, continues to see high barriers to entry due to the need for significant capital investment in research and development and specialized equipment.

In sectors like defense and oil & gas, deep-seated relationships with major clients and the stringent demands for certifications act as formidable entry barriers. Newcomers face the uphill battle of building trust and navigating lengthy qualification procedures, particularly for mission-critical components.

Economies of Scale and Experience Curve

Existing players in the specialty metals and equipment manufacturing sector, such as Ampco-Pittsburgh, benefit significantly from economies of scale. This allows them to spread fixed costs over a larger production volume, leading to lower per-unit costs in manufacturing, raw material procurement, and distribution. For instance, in 2023, Ampco-Pittsburgh reported net sales of $969.3 million, indicating a substantial operational footprint that new entrants would find challenging to match from the outset.

New companies entering this market would face considerable difficulty in achieving comparable cost efficiencies. Without the established volume and integrated supply chains of incumbents, they would likely incur higher per-unit expenses, making it tough to compete on price. This cost disadvantage is further amplified by the steep learning curve associated with complex metallurgical processes and specialized equipment manufacturing.

The experience curve, which reflects the reduction in costs as cumulative production increases, also presents a barrier. Ampco-Pittsburgh, with its long history and accumulated knowledge, has optimized its production methods and operational workflows over time. This accumulated expertise translates into greater efficiency and potentially higher quality, which are difficult and costly for newcomers to replicate quickly.

- Economies of Scale: Ampco-Pittsburgh's substantial revenue base, like the $969.3 million in net sales for 2023, allows for cost absorption across production, procurement, and distribution.

- Cost Disadvantage for New Entrants: Start-ups would struggle to achieve similar per-unit cost efficiencies due to lower initial volumes and less established supply chains.

- Experience Curve Advantage: Incumbents possess accumulated knowledge and optimized processes, creating a significant learning curve barrier for new competitors in specialized manufacturing.

Regulatory and Environmental Hurdles

The metals manufacturing and industrial processing sectors are heavily regulated, with strict environmental and safety standards. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act and Clean Water Act, which impose significant compliance costs on facilities. New entrants must navigate these complex rules, which often require substantial upfront investment in pollution control technology and permitting processes.

Complying with these regulations presents a considerable financial and operational barrier. For example, obtaining permits for new manufacturing facilities can take years and involve extensive environmental impact assessments. These hurdles deter potential new competitors by increasing the capital required and the time to market, thereby protecting existing players like Ampco-Pittsburgh.

- Stringent Environmental Regulations: Compliance with EPA standards for emissions and waste disposal is mandatory.

- Safety Standards: Adherence to OSHA and industry-specific safety protocols adds operational complexity.

- Permitting Processes: Obtaining necessary permits for new facilities is a lengthy and costly undertaking.

- Capital Investment: Significant upfront investment is needed for pollution control and safety equipment.

The threat of new entrants for Ampco-Pittsburgh is relatively low due to substantial capital requirements for specialized equipment and advanced technology, making it difficult for newcomers to compete effectively. For instance, in 2024, the global specialty metals market continues to demand significant R&D investment and specialized machinery, creating high entry barriers. Furthermore, stringent environmental regulations and lengthy permitting processes, as enforced by agencies like the EPA in 2024, add considerable cost and time to market for potential new players.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of specialized manufacturing equipment (e.g., forging presses). | Significant financial hurdle for new entrants. |

| Technology & Expertise | Need for deep engineering and metallurgical knowledge. | Time-consuming and costly to acquire and replicate. |

| Regulatory Compliance | Adherence to strict environmental and safety standards (e.g., EPA regulations in 2024). | Increases upfront investment and time to market. |

| Economies of Scale | Incumbents benefit from lower per-unit costs due to high production volumes. | New entrants face cost disadvantages. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ampco-Pittsburgh leverages data from SEC filings, annual reports, and industry-specific market research reports to assess competitive dynamics.