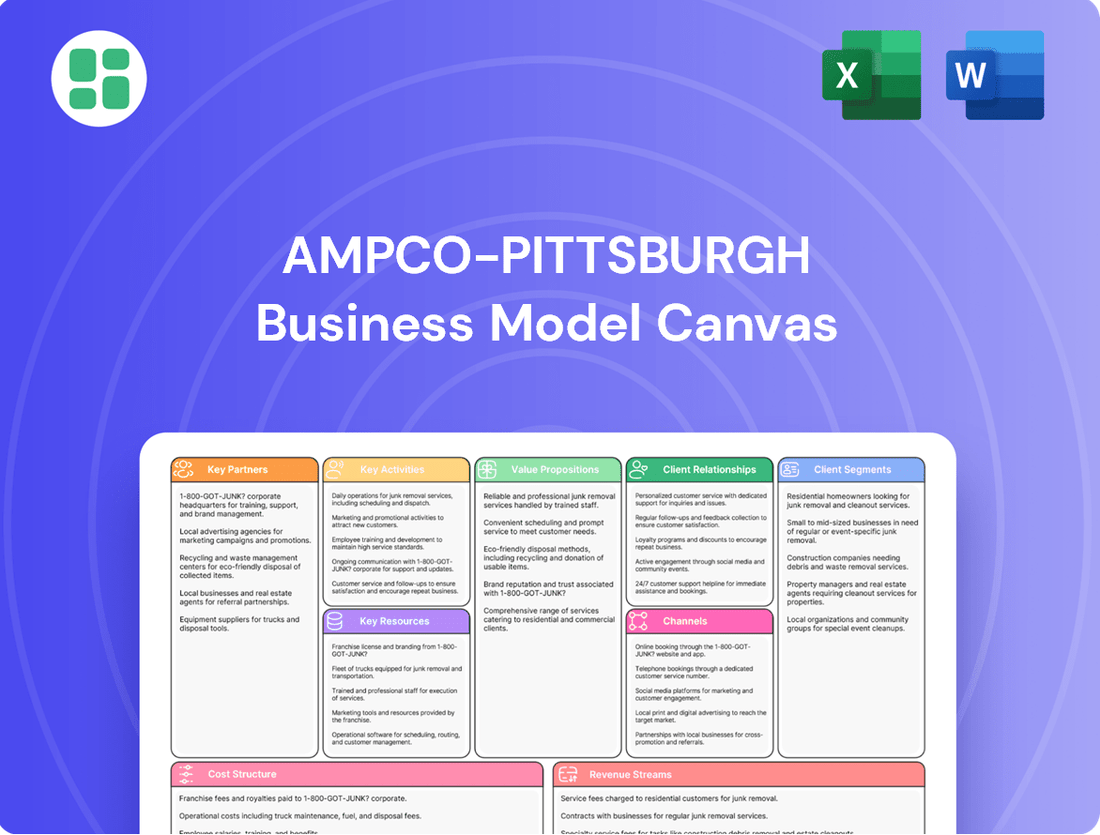

Ampco-Pittsburgh Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ampco-Pittsburgh Bundle

Unlock the strategic core of Ampco-Pittsburgh's operations with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a powerful framework for understanding their market success. Dive into the specifics and see how you can apply these proven strategies to your own ventures.

Partnerships

Ampco-Pittsburgh depends on a consistent flow of essential raw materials, including iron, steel, and various non-ferrous metals, to fuel its core forging and casting activities. These partnerships are fundamental to maintaining operational continuity.

Cultivating robust relationships with a variety of dependable raw material providers is paramount for Ampco-Pittsburgh to ensure uninterrupted production and effectively navigate the inherent volatility in material costs. For instance, in 2024, the global steel market experienced price fluctuations influenced by geopolitical events and supply chain disruptions, underscoring the importance of diversified sourcing.

The company's proficiency in sourcing these critical inputs directly influences its manufacturing timelines and overall financial performance. Efficient procurement allows Ampco-Pittsburgh to meet customer demand promptly and manage its cost of goods sold effectively, impacting profitability.

Ampco-Pittsburgh's alliances with top technology and equipment suppliers are crucial for securing cutting-edge manufacturing tools, including advanced forging presses and sophisticated heat-treating furnaces. These collaborations allow the company to upgrade its production capacity, boost operational efficiency, and uphold superior product standards.

These strategic partnerships are vital for Ampco-Pittsburgh's ability to integrate the latest technological advancements into its operations. For instance, the company's recent capital expenditures in its U.S. forged products division underscore the ongoing reliance on these vendor relationships to acquire and implement state-of-the-art machinery. This ensures their competitive edge in the market.

Ampco-Pittsburgh actively partners with research institutions and specialized engineering firms to fuel product innovation and enhance its manufacturing processes. These collaborations are crucial for developing advanced material compositions and optimizing production techniques for its engineered products.

These R&D collaborations enable Ampco-Pittsburgh to explore new applications for its materials, particularly in demanding sectors such as defense and nuclear industries. This strategic focus ensures the company remains responsive to evolving customer requirements and adheres to stringent industry standards.

Strategic Joint Ventures

Ampco-Pittsburgh actively engages in strategic joint ventures, notably three operating in China. These partnerships are crucial for its global expansion strategy, particularly within the Forged and Cast Engineered Products segment. By collaborating in these international markets, the company gains access to local expertise and new customer bases.

These joint ventures enable Ampco-Pittsburgh to tap into the significant manufacturing and consumption power of China. For instance, as of the first quarter of 2024, Ampco-Pittsburgh reported that its joint ventures contributed to its overall revenue, demonstrating their financial significance. This collaboration allows for optimized production and distribution, enhancing the company's competitive edge in the global engineered products landscape.

- Global Reach Expansion: The three Chinese joint ventures are instrumental in extending Ampco-Pittsburgh's operational footprint and market access internationally.

- Leveraging Local Expertise: These partnerships provide invaluable insights into local market dynamics, regulatory environments, and customer preferences.

- Accessing New Customer Segments: Joint ventures facilitate entry into previously untapped customer groups, boosting sales potential.

- Optimizing Operations: The collaborations can lead to more efficient production processes and streamlined distribution networks, especially for engineered products.

Financial Institutions and Lenders

Ampco-Pittsburgh's relationships with financial institutions and lenders are foundational to its operational and strategic flexibility. These partnerships are crucial for securing essential credit facilities, effectively managing the company's liquidity, and financing significant capital expenditures. For instance, in 2024, Ampco-Pittsburgh finalized an amended and restated credit facility, underscoring the ongoing reliance on these key relationships to support its global working capital needs and advance its long-term strategic objectives.

These financial alliances provide the necessary capital to fuel growth and maintain operational stability. The ability to access credit lines and favorable lending terms directly impacts Ampco-Pittsburgh's capacity to invest in new technologies, expand its manufacturing capabilities, and navigate market fluctuations. The recent credit facility amendment, effective in 2024, demonstrates a commitment from lenders to support the company's future endeavors.

- Access to Credit Facilities: Essential for managing short-term obligations and funding growth initiatives.

- Liquidity Management: Partnerships enable robust cash flow management and financial stability.

- Capital Expenditure Financing: Securing funds for plant upgrades, equipment acquisition, and strategic investments.

- Strategic Financial Support: The 2024 credit facility amendment highlights lender confidence in Ampco-Pittsburgh's long-term strategy.

Ampco-Pittsburgh's key partnerships extend to its customer base, particularly those in demanding sectors like oil and gas, defense, and industrial manufacturing. These relationships are vital for securing long-term contracts and understanding evolving product requirements.

Collaborating closely with these customers allows Ampco-Pittsburgh to co-develop specialized alloys and components that meet stringent performance specifications. For example, in 2024, the company continued to supply critical forged components to major players in the energy sector, highlighting the importance of these customer partnerships for sustained revenue and innovation.

These deep customer engagements provide valuable feedback loops, enabling Ampco-Pittsburgh to refine its offerings and maintain a competitive edge in niche markets.

What is included in the product

A strategic overview of Ampco-Pittsburgh's operations, detailing its customer segments, value propositions, and key resources to illustrate its market position.

Ampco-Pittsburgh's Business Model Canvas offers a structured approach to dissecting complex operations, simplifying strategic planning and identifying areas for improvement.

It provides a clear, visual framework that helps untangle intricate business processes, reducing the pain of information overload and fostering focused decision-making.

Activities

Ampco-Pittsburgh's core activity revolves around manufacturing custom-designed iron and steel rolls, crucial for industries like steel and aluminum production. This intricate process demands deep knowledge in metallurgy, casting, and forging to create high-performance products that meet precise customer specifications.

In 2023, Ampco-Pittsburgh reported net sales of $898.5 million, with their Forged Products segment, which includes roll manufacturing, contributing significantly. The company's strategic focus on manufacturing efficiencies and enhancing machine uptime within this segment aims to bolster profitability and customer satisfaction.

Ampco-Pittsburgh's core operations revolve around specialized metalworking processes like open-die forging and centrifugal casting. These techniques are essential for manufacturing large, intricate metal parts that are vital for demanding sectors such as defense, oil and gas, and plastic extrusion.

The company's commitment to precision engineering and stringent quality control ensures these components meet the rigorous specifications required by its industrial clientele. For instance, the U.S. forged business has recently benefited from investments in new equipment, contributing to improved operational efficiency and output.

Ampco-Pittsburgh's Air and Liquid Heat Transfer Product Manufacturing segment is a cornerstone of their operations, focusing on the creation of essential components like coils, finned tubing, and other heat transfer solutions. This specialized manufacturing capability allows them to serve critical sectors.

This segment excels in designing and producing custom-engineered equipment tailored for diverse industrial and commercial needs. A significant area of focus is the nuclear power generation market and supplying the U.S. Navy, both of which demand highly specialized technical expertise and stringent manufacturing standards.

The Air and Liquid Products (ALP) segment has demonstrated robust performance, achieving record sales and order intake, underscoring the strong demand for their specialized heat transfer products in demanding applications.

Research and Development

Ampco-Pittsburgh's commitment to research and development is a cornerstone of its business strategy. This involves significant ongoing investment to drive product innovation and refine manufacturing techniques. For instance, in 2023, the company reported R&D expenses of $15.2 million, highlighting its dedication to staying at the forefront of metallurgical advancements.

The company actively explores novel materials and seeks to enhance the performance characteristics of its existing product lines. This proactive approach ensures that Ampco-Pittsburgh's offerings align with, and often exceed, evolving industry standards and the specific needs of its diverse customer base. These product innovations are critical growth engines for the company.

- Material Science Exploration: Investigating advanced alloys and composites for improved strength, durability, and specialized applications.

- Process Optimization: Developing more efficient and sustainable manufacturing methods to reduce costs and environmental impact.

- Customer-Centric Solutions: Collaborating with clients to engineer bespoke materials and products that address unique operational challenges.

- Performance Enhancement: Continuously improving the metallurgical properties of products to deliver superior performance in demanding environments.

Global Sales, Marketing, and Distribution

Ampco-Pittsburgh manages a worldwide sales and marketing operation to connect with varied customer bases in North America, Asia, Europe, and the Middle East. This includes direct sales efforts, overseeing distribution partnerships, and engaging in trade shows to showcase specialized equipment and win new business.

The company's distribution strategy relies on both direct product delivery and utilizing third-party logistics providers. For instance, in 2023, Ampco-Pittsburgh reported net sales of $786.3 million, reflecting the reach of its global sales and distribution network.

- Global Reach: Servicing customers across North America, Asia, Europe, and the Middle East.

- Sales Channels: Employing direct sales and managing third-party distribution networks.

- Market Engagement: Participating in industry events to promote engineered products and secure contracts.

- Logistics: Delivering products directly or through external carriers.

Ampco-Pittsburgh's key activities center on specialized manufacturing processes, including the creation of custom iron and steel rolls, open-die forging, and centrifugal casting for critical industries. They also focus on producing heat transfer components for sectors like nuclear power and the U.S. Navy.

The company's commitment to research and development is a significant activity, with $15.2 million invested in 2023 for product innovation and process optimization. This includes exploring advanced materials and enhancing product performance to meet evolving industry demands.

Global sales and marketing efforts are crucial, managing worldwide operations across North America, Asia, Europe, and the Middle East through direct sales and distribution partnerships. This ensures their specialized equipment reaches diverse customer bases.

| Key Activity | Description | 2023 Financial Impact |

|---|---|---|

| Specialized Manufacturing | Production of custom iron/steel rolls, forged products, and heat transfer components. | Net sales of $898.5 million, with Forged Products a significant contributor. |

| Research & Development | Product innovation, material science exploration, and process optimization. | $15.2 million invested in R&D. |

| Global Sales & Marketing | Worldwide distribution and customer engagement across multiple continents. | Net sales of $786.3 million reflecting global reach. |

Full Version Awaits

Business Model Canvas

The Ampco-Pittsburgh Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, unaltered file, ready for your use. Once your order is processed, you will gain full access to this exact same Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Ampco-Pittsburgh operates specialized manufacturing facilities across the globe, including locations in the United States, England, Sweden, and Slovenia. These sites are outfitted with advanced machinery crucial for their core operations, such as forging, casting, and the fabrication of heat transfer products.

The company's commitment to operational efficiency is evident in its investment in newly installed, high-efficiency equipment within these facilities. These physical assets are the bedrock of Ampco-Pittsburgh's production capabilities, directly impacting their ability to meet market demand and maintain product quality.

Ampco-Pittsburgh's core strength lies in its highly skilled workforce, comprising experienced engineers, metallurgists, and technicians. This human capital is paramount, directly influencing the quality and innovation of their specialty metal products.

Their collective expertise in custom engineering and intricate manufacturing processes is what allows Ampco-Pittsburgh to develop tailored solutions for the most demanding industrial sectors. This deep knowledge base ensures they can meet unique client specifications with precision.

For instance, in 2023, Ampco-Pittsburgh reported that its workforce's specialized skills were instrumental in securing contracts for advanced materials in sectors like aerospace and defense, where precision and reliability are non-negotiable.

Ampco-Pittsburgh's proprietary technology and intellectual property are core to its value proposition, even if not always patented. Their custom-designed and highly engineered products imply unique manufacturing processes and deep technical expertise. This know-how allows them to create specialized components and equipment that adhere to rigorous industry specifications, giving them a distinct edge.

Strong Customer Relationships

Ampco-Pittsburgh's strong customer relationships are a cornerstone of its business model. These aren't just transactional ties; they represent deep, established partnerships, particularly with major players in the metals, defense, and oil & gas sectors. This enduring loyalty translates directly into a predictable revenue stream and provides invaluable feedback on evolving market demands.

These relationships are a critical intangible asset, fostering stability and driving growth by ensuring consistent business. For instance, in 2023, Ampco-Pittsburgh reported that a significant portion of its revenue came from repeat customers, highlighting the strength of these long-term connections.

- Customer Loyalty: Deeply entrenched relationships in core industries like metals and defense.

- Market Insights: Direct access to customer needs and future market trends.

- Revenue Stability: Predictable order flow from established clients.

- Competitive Advantage: Barriers to entry for competitors due to these strong ties.

Financial Capital and Liquidity

Ampco-Pittsburgh's financial capital, including its cash and access to credit, is crucial for funding day-to-day operations, significant capital investments, and pursuing new strategic opportunities. This financial strength directly impacts its ability to invest in growth and meet its financial commitments.

The company's liquidity and its capacity to obtain financing are key indicators of its financial health and its potential for future investment. Adequate financial resources allow Ampco-Pittsburgh to navigate market fluctuations and seize growth opportunities.

- Financial Capital: Adequate financial resources are necessary for funding operations, capital expenditures, and strategic initiatives.

- Liquidity Position: The company's ability to meet short-term obligations is a critical component of its financial stability.

- Access to Credit: Securing financing through credit facilities enhances the company's capacity for investment and managing financial needs.

- Investment Capacity: A strong financial foundation enables Ampco-Pittsburgh to invest in growth, innovation, and market expansion.

Ampco-Pittsburgh's key resources are its specialized manufacturing facilities, a highly skilled workforce, proprietary technology, strong customer relationships, and robust financial capital. These elements collectively enable the company to produce high-quality, custom-engineered specialty metal products for demanding industries.

The company's global manufacturing footprint, including sites in the US, England, Sweden, and Slovenia, is equipped with advanced forging, casting, and fabrication machinery. In 2023, Ampco-Pittsburgh continued to invest in upgrading these facilities, enhancing operational efficiency and production capacity.

Its workforce of skilled engineers and metallurgists is critical for innovation and meeting complex client specifications, as demonstrated by their role in securing advanced materials contracts in 2023. The company also leverages proprietary manufacturing processes and deep technical expertise, providing a significant competitive advantage.

Ampco-Pittsburgh's enduring customer loyalty, particularly in sectors like defense and oil & gas, ensures revenue stability, with a significant portion of revenue in 2023 derived from repeat business. This financial strength allows for continued investment in growth and operational improvements.

| Key Resource | Description | 2023 Impact/Data |

|---|---|---|

| Manufacturing Facilities | Global specialized production sites (US, UK, Sweden, Slovenia) with advanced equipment. | Continued investment in high-efficiency equipment upgrades. |

| Skilled Workforce | Experienced engineers, metallurgists, and technicians. | Instrumental in securing advanced materials contracts in aerospace and defense. |

| Proprietary Technology & IP | Unique manufacturing processes and deep technical know-how. | Enables custom-engineered products meeting rigorous industry standards. |

| Customer Relationships | Long-standing partnerships in metals, defense, and oil & gas. | Significant portion of 2023 revenue generated from repeat customers. |

| Financial Capital | Cash reserves and access to credit facilities. | Supports operations, capital investments, and strategic initiatives. |

Value Propositions

Ampco-Pittsburgh's value proposition centers on its high-performance engineered products, including forged and cast rolls and open-die forgings. These are crafted for extreme industrial settings, ensuring exceptional longevity and dependable operation in places like steel mills and oil & gas operations.

Ampco-Pittsburgh's core value proposition lies in its ability to craft custom-designed products, offering bespoke solutions that perfectly align with the distinct specifications and performance needs of its industrial and commercial clientele. This high degree of customization is especially critical for demanding applications within the defense sector and for specialized industrial equipment, where off-the-shelf solutions often fall short.

For instance, in 2023, Ampco-Pittsburgh reported that a substantial portion of its revenue was driven by these specialized, engineered solutions, underscoring the market's demand for tailored metallurgical products. This focus on precision engineering allows them to address niche market requirements, differentiating them from competitors who may offer more standardized product lines.

Ampco-Pittsburgh's Air and Liquid Processing segment provides specialized solutions like custom-engineered finned tube heat exchange coils and large custom air handling systems. These are vital for efficient thermal management in demanding sectors.

These advanced systems are crucial for critical applications in nuclear, military, pharmaceutical, and healthcare industries, ensuring reliable performance and safety. For instance, in 2024, the demand for high-efficiency HVAC systems in healthcare facilities saw a significant uptick, driven by stricter air quality regulations.

The company also offers centrifugal pumps, further enhancing its capabilities in fluid processing. This integrated approach allows Ampco-Pittsburgh to deliver comprehensive solutions for complex operational needs, supporting industries where precision and durability are paramount.

Engineering Expertise and Technical Support

Ampco-Pittsburgh's engineering expertise and technical support are crucial value propositions, offering customers comprehensive assistance from initial design through post-sale service. This deep technical knowledge helps clients optimize product performance and tackle complex industrial issues.

For instance, in 2023, the company’s focus on engineered solutions contributed to its backlog, reflecting customer reliance on its technical capabilities. This support extends to application engineering, ensuring their specialized materials and equipment are precisely suited for unique customer requirements.

- Product Design Assistance: Tailoring solutions to specific customer needs.

- Application Engineering: Ensuring optimal integration and performance in diverse industrial settings.

- After-Sales Service: Providing ongoing support for maintenance and troubleshooting.

- Problem-Solving: Addressing complex operational challenges with technical acumen.

Reliability and Long-Term Durability

Ampco-Pittsburgh's value proposition centers on the exceptional reliability and long-term durability of its products. This is paramount for clients in demanding sectors like steel manufacturing and oil and gas, where equipment failure can lead to significant financial losses due to operational downtime. For instance, in 2024, the industrial equipment sector continued to emphasize resilience, with companies prioritizing suppliers offering extended product lifecycles to mitigate unforeseen costs.

This focus on durability directly translates into a lower total cost of ownership for customers. By investing in Ampco-Pittsburgh's robust equipment, clients can expect consistent operational performance over extended periods, reducing the need for frequent replacements or costly repairs. This predictable performance is a key driver for repeat business and customer loyalty.

The company's commitment to quality materials and manufacturing processes underpins this core value. This ensures that their products can withstand harsh operating environments and continuous use, a critical factor for industries where performance is non-negotiable.

Key aspects of this value proposition include:

- Extended Equipment Lifespan: Products are engineered for longevity, minimizing replacement cycles.

- Reduced Operational Downtime: High reliability ensures continuous production and service delivery for clients.

- Lower Total Cost of Ownership: Durability leads to reduced maintenance, repair, and replacement expenses over time.

- Consistent Performance: Customers benefit from predictable and stable operational output from Ampco-Pittsburgh's equipment.

Ampco-Pittsburgh's value proposition is built on delivering high-performance, custom-engineered solutions designed for extreme industrial environments. Their expertise in metallurgy and precision manufacturing ensures products offer exceptional longevity and reliability, crucial for sectors like steel, oil & gas, and defense. For instance, in 2023, the company highlighted its strong backlog driven by demand for these specialized engineered solutions, indicating customer trust in their tailored capabilities.

The company also provides critical air and liquid processing systems, including custom heat exchangers and air handling units, vital for thermal management in demanding industries such as nuclear and pharmaceuticals. In 2024, the healthcare sector's increased focus on air quality regulations further amplified the need for such advanced systems.

Ampco-Pittsburgh differentiates itself through its deep engineering expertise and comprehensive technical support, assisting clients from initial design to post-sale service. This commitment ensures optimal product performance and effective problem-solving for complex industrial challenges, as evidenced by their continued focus on engineered solutions contributing to their business backlog.

The reliability and durability of Ampco-Pittsburgh's products offer a lower total cost of ownership, minimizing downtime and replacement costs for clients in high-stakes industries. This focus on extended equipment lifespan and consistent performance is a key driver for customer loyalty, particularly as the industrial equipment sector in 2024 continued to prioritize resilience and long-term value.

| Value Proposition Element | Description | Key Benefit to Customer | Supporting Evidence/Example |

|---|---|---|---|

| Custom Engineered Solutions | Bespoke products tailored to specific performance needs. | Optimal integration and efficiency in demanding applications. | Strong backlog driven by demand for specialized engineered solutions (2023). |

| High-Performance Materials & Durability | Products designed for extreme environments and long service life. | Reduced downtime, lower total cost of ownership, consistent operation. | Industrial equipment sector emphasis on resilience and extended lifecycles (2024). |

| Technical Expertise & Support | Comprehensive assistance from design to after-sales service. | Optimized product performance, effective problem-solving for complex challenges. | Customer reliance on technical capabilities reflected in company focus (2023). |

| Specialized Processing Systems | Custom finned tube heat exchangers and air handling systems. | Efficient thermal management in critical sectors like healthcare and nuclear. | Increased demand for high-efficiency HVAC in healthcare due to air quality regulations (2024). |

Customer Relationships

Ampco-Pittsburgh cultivates strong customer relationships through its direct sales force and specialized technical support teams. This approach allows for in-depth understanding of client requirements and the provision of tailored solutions. For instance, in 2023, the company's focus on customer engagement contributed to its ability to secure significant orders, reflecting the value placed on responsive and expert assistance.

Ampco-Pittsburgh cultivates enduring customer connections through long-term contracts, especially with key players in heavy industry for its forged and cast rolls. These agreements, often spanning multiple years, provide a stable revenue stream and underscore the trust clients place in Ampco's specialized products.

These strategic partnerships are more than just transactional; they facilitate joint efforts in product innovation and refinement. This collaborative approach ensures Ampco's offerings remain at the forefront of industry needs, solidifying its position as a preferred supplier. For instance, in 2023, Ampco reported that a significant portion of its revenue was derived from these long-term customer relationships.

Ampco-Pittsburgh builds strong customer relationships by co-developing and delivering highly customized engineered products. This collaborative approach, where solutions are tailored to specific and evolving demands, fosters deep customer loyalty. For instance, in 2024, a significant portion of their revenue was driven by these bespoke projects, reflecting a commitment to unique problem-solving over standardized offerings.

After-Sales Service and Maintenance

Ampco-Pittsburgh offers comprehensive after-sales service, including maintenance, repairs, and replacement parts, to ensure the longevity and optimal performance of its engineered products.

This dedication to ongoing support builds customer trust and guarantees continued operational efficiency for clients relying on Ampco-Pittsburgh's durable equipment.

- After-Sales Support: Maintenance, repair services, and readily available replacement parts are key offerings.

- Customer Retention: This focus on post-purchase support fosters long-term relationships and repeat business.

- Product Longevity: Ensuring clients can maintain and repair their equipment maximizes the lifespan of Ampco-Pittsburgh's durable products.

Industry-Specific Account Management

Ampco-Pittsburgh likely utilizes industry-specific account management to cater to its diverse customer base, which includes sectors like metals, defense, oil & gas, and HVAC. This approach allows for a deeper understanding of each sector's unique needs and challenges.

These specialized teams foster stronger relationships by providing tailored solutions and expert advice, leading to more effective service delivery. For instance, in 2023, Ampco-Pittsburgh reported that its Forged Products segment, which serves many of these key industries, saw significant order activity, underscoring the importance of these dedicated relationships.

- Metals Sector Focus: Dedicated account managers understand the cyclical nature and specific material requirements of the metals industry.

- Defense & Aerospace Specialization: Teams are equipped to handle the stringent quality and certification demands of defense clients.

- Oil & Gas Expertise: Account managers are knowledgeable about the high-performance material needs and operational environments in this sector.

- HVAC Solutions: Specialized support ensures that the unique cooling and heating system demands are met efficiently.

Ampco-Pittsburgh's customer relationships are built on a foundation of tailored solutions and dedicated support, fostering loyalty across key industrial sectors. Their direct sales force and specialized technical teams ensure a deep understanding of client needs, leading to customized engineered products. This commitment to partnership is reflected in their long-term contracts and collaborative innovation efforts, with a significant portion of 2023 revenue stemming from these enduring connections.

| Customer Relationship Aspect | Description | Impact/Example |

|---|---|---|

| Direct Sales & Technical Support | Personalized engagement and expert assistance. | Contributed to securing significant orders in 2023, highlighting responsiveness. |

| Long-Term Contracts | Multi-year agreements with key industry players. | Provide stable revenue and underscore client trust in specialized products. |

| Co-Development & Customization | Collaborative development of unique engineered solutions. | Drives deep customer loyalty, with bespoke projects forming a significant revenue driver in 2024. |

| After-Sales Service | Maintenance, repair, and replacement parts. | Ensures product longevity and client operational efficiency, building trust. |

| Industry-Specific Account Management | Tailored approaches for sectors like metals, defense, oil & gas, and HVAC. | Fosters stronger relationships by addressing unique sector demands, as seen in the robust activity in the Forged Products segment in 2023. |

Channels

Ampco-Pittsburgh's direct sales force is crucial for its business model, serving as the primary interface with major industrial clients and defense contractors. This approach is essential for selling their highly engineered, custom products, which often involve intricate technical specifications and long sales cycles.

This direct channel enables deep engagement, allowing for detailed technical consultations and the negotiation of complex, long-term agreements. In 2023, Ampco-Pittsburgh reported that its direct sales efforts contributed significantly to its backlog, particularly within its Forged & Machined Products segment, underscoring the channel's importance in securing substantial orders.

Ampco-Pittsburgh maintains a strategic network of global sales offices spanning North America, Asia, Europe, and the Middle East. This international footprint ensures a local presence, facilitating direct engagement with a diverse global customer base and supporting market penetration in key regions. These offices are vital for understanding regional demands and providing tailored customer service.

Ampco-Pittsburgh leverages third-party carriers and customer-arranged transportation for global product delivery, ensuring specialized equipment reaches industrial sites efficiently. This approach is crucial for their large, often custom-built, metallurgical furnaces and processing equipment.

In 2024, Ampco-Pittsburgh's reliance on these logistical channels underpins their ability to serve a worldwide customer base, facilitating the movement of heavy machinery. The company's commitment to reliable delivery is a key component of its customer value proposition.

Industry Trade Shows and Conferences

Ampco-Pittsburgh leverages industry trade shows and conferences as a key channel to connect with its target markets in metals, defense, and heat transfer. These events are crucial for demonstrating new product innovations and showcasing the company's advanced manufacturing capabilities directly to potential and existing clients.

Participation in these gatherings is instrumental in lead generation and reinforcing Ampco-Pittsburgh's brand visibility within its specialized sectors. For instance, in 2024, the company actively engaged in events like the AISTech conference, a premier gathering for iron and steel professionals, allowing for direct interaction and feedback.

The strategic presence at these conferences allows Ampco-Pittsburgh to:

- Showcase new product lines and technological advancements.

- Network with key decision-makers and potential clients.

- Gather market intelligence and competitive insights.

- Reinforce brand recognition and industry leadership.

Online Presence and Investor Relations Portal

Ampco-Pittsburgh’s official website and its dedicated investor relations portal are crucial communication hubs, even if they don't directly sell their complex engineered products. These platforms are designed to inform and engage a broad audience, from potential investors to industry analysts.

- Information Dissemination: The website acts as a central repository for detailed product specifications, company history, and operational highlights, ensuring stakeholders have access to comprehensive data.

- Financial Transparency: The investor relations section provides easy access to quarterly and annual financial reports, SEC filings, and management presentations, fostering trust and accountability. For instance, in 2023, the company reported net sales of $1.1 billion, with these channels being key to communicating such performance metrics.

- Stakeholder Engagement: These digital channels offer direct contact points for inquiries, facilitating communication with investors, customers, and the media, thereby supporting a proactive approach to corporate communications.

- Brand Building: By showcasing their expertise, project successes, and commitment to innovation, Ampco-Pittsburgh uses these online presences to strengthen its brand reputation within the industrial sector.

Ampco-Pittsburgh utilizes a direct sales force to engage with its core industrial and defense clients, crucial for custom-engineered products. This direct channel allows for in-depth technical discussions and the negotiation of complex, long-term contracts, as evidenced by significant backlog contributions in 2023.

A global network of sales offices in North America, Asia, Europe, and the Middle East ensures local market presence and tailored customer service. These offices are vital for understanding regional demands and facilitating direct engagement with a diverse international customer base.

Industry trade shows and conferences, such as AISTech in 2024, serve as key channels for showcasing innovations and engaging with potential clients. These events are instrumental for lead generation and reinforcing brand visibility within specialized sectors like metals and defense.

The company's website and investor relations portal are essential for information dissemination and financial transparency, providing access to product details and reports. These digital platforms foster stakeholder engagement and build brand reputation.

| Channel | Primary Function | Key Activity/Benefit | 2023/2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Client engagement for custom products | Technical consultation, contract negotiation | Significant backlog contribution in Forged & Machined Products |

| Global Sales Offices | Market penetration and local support | Understanding regional demands, customer service | Facilitates engagement with diverse global customer base |

| Trade Shows & Conferences | Product showcasing and lead generation | Demonstrating innovations, networking | Active participation in events like AISTech in 2024 |

| Website & Investor Relations | Information hub and stakeholder communication | Product specs, financial reports, brand building | Key for communicating performance metrics, e.g., $1.1 billion net sales in 2023 |

Customer Segments

The Metals Industry segment is a cornerstone for Ampco-Pittsburgh, encompassing steel, aluminum, and other metal producers. These companies rely heavily on Ampco-Pittsburgh's forged hardened steel rolls and cast rolls, essential components for their hot and cold rolling mills. The demand here is for rolls that offer exceptional durability and high performance to ensure efficient and consistent metal production quality.

Ampco-Pittsburgh is a key supplier to the Defense Contractors and Military segment, providing essential open-die forgings and specialized air and liquid processing equipment like centrifugal pumps. This sector, particularly the United States Navy, relies on Ampco-Pittsburgh for components that must adhere to exceptionally rigorous military specifications and unwavering reliability for mission-critical applications.

Customers in the oil and gas industry rely on Ampco-Pittsburgh's open-die forgings for critical components like drill collars, valve bodies, and pump shafts. These applications demand exceptional strength and durability to withstand the harsh pressures and corrosive environments inherent in exploration and production. For instance, Ampco-Pittsburgh's specialized alloys are engineered to meet stringent industry standards, ensuring operational integrity in offshore and onshore operations.

Industrial Manufacturers

Industrial Manufacturers represent a core customer base for Ampco-Pittsburgh, seeking specialized heat transfer solutions for diverse applications. This segment includes companies across various industrial sectors that require custom-engineered coils, finned tubing, and air handling systems to optimize their manufacturing processes and facilities. For instance, in 2024, the industrial manufacturing sector continued to invest in energy-efficient equipment, driving demand for advanced thermal management technologies.

These clients often operate in environments where precise temperature control and efficient air processing are critical for product quality and operational efficiency. Ampco-Pittsburgh's offerings cater to these needs, providing tailored solutions that integrate seamlessly into complex industrial setups. The company's ability to deliver custom designs is a key differentiator for these customers.

- Diverse Applications: Serving sectors like chemical processing, food and beverage, and general manufacturing.

- Customization Needs: Requiring bespoke heat transfer coils and finned tubing for specific operational parameters.

- Energy Efficiency Focus: Customers are increasingly seeking solutions that reduce energy consumption in 2024.

- Process Optimization: Solutions are vital for maintaining product integrity and maximizing production output.

Nuclear Power and Pharmaceutical/Biomedical Research Markets

Ampco-Pittsburgh's Air and Liquid Processing segment serves the nuclear power and pharmaceutical/biomedical research markets with highly specialized equipment. These sectors demand unwavering quality, exceptional reliability, and strict adherence to regulatory standards, making them ideal customers for Ampco's custom-engineered solutions.

These specialized markets require precision equipment such as custom-designed heat exchangers and air handling units for their critical systems. For instance, in nuclear power, containment vessel cooling systems and reactor coolant loops rely on robust heat transfer solutions. Similarly, pharmaceutical manufacturing relies on sterile air handling units to maintain controlled environments for drug production.

The stringent requirements of these industries translate into a need for equipment that can withstand extreme conditions and meet rigorous validation protocols. Ampco-Pittsburgh's expertise in fabricating equipment that complies with standards like ASME Boiler and Pressure Vessel Code and cGMP (current Good Manufacturing Practice) is crucial for these customers.

- Nuclear Power Market Needs: High-reliability heat exchangers for cooling systems, robust air handling units for containment areas, and materials resistant to radiation and corrosion.

- Pharmaceutical/Biomedical Research Market Needs: Sterile air handling units for cleanrooms, sanitary heat exchangers for processing, and materials that prevent contamination.

- Regulatory Compliance: Both sectors operate under strict regulatory frameworks requiring extensive documentation and validation of equipment performance.

- Market Value: The global nuclear power market was valued at approximately $100 billion in 2023, while the biopharmaceutical market reached over $450 billion in 2023, highlighting the significant scale of these sectors.

Ampco-Pittsburgh's customer base is diverse, spanning heavy industries like metals, oil and gas, and defense. These sectors demand highly durable, high-performance components such as forged steel rolls and open-die forgings. Reliability and adherence to stringent specifications are paramount for these clients.

Industrial manufacturers and specialized sectors like nuclear power and pharmaceuticals represent another key segment. These customers seek custom-engineered solutions, particularly in heat transfer and air processing. Energy efficiency and regulatory compliance are significant drivers for these markets.

| Customer Segment | Key Needs | 2024/Recent Data Point |

|---|---|---|

| Metals Industry | Durable, high-performance rolls for rolling mills | Continued investment in modernization of steel production facilities. |

| Defense Contractors/Military | Reliable, specification-compliant forgings and equipment | U.S. defense spending projected to remain robust. |

| Oil & Gas | Strong, durable forgings for harsh environments | Focus on efficiency and resilience in upstream operations. |

| Industrial Manufacturers | Custom heat transfer solutions, energy efficiency | Increased demand for energy-saving industrial equipment. |

| Nuclear Power | High-reliability heat exchangers, regulatory compliance | Global nuclear power capacity expected to grow. |

| Pharmaceutical/Biomedical | Sterile air handling, process integrity | Growth in biopharmaceutical market driven by R&D. |

Cost Structure

Raw material costs represent a substantial component of Ampco-Pittsburgh's expense. The company relies heavily on iron, steel, and various alloys for its manufacturing processes, particularly for forged and cast items. These materials are fundamental to the quality and performance of their specialized products.

The price volatility of these commodities directly impacts Ampco-Pittsburgh's cost of goods sold. For instance, in 2023, global steel prices experienced fluctuations, influenced by factors such as supply chain disruptions and demand shifts, which would have translated into variable raw material expenses for the company.

Manufacturing and Production Costs are a significant component for Ampco-Pittsburgh, encompassing direct labor, the substantial energy required for furnaces and machinery, and the general overheads of running their global production sites. For example, in 2023, the company reported cost of sales of $1.03 billion, reflecting these operational expenditures.

The company actively invests in enhancing manufacturing efficiencies and improving machine uptime. These strategic investments are designed to directly address and optimize these core production expenses, aiming for better cost control and operational leverage.

Ampco-Pittsburgh's cost structure heavily relies on capital expenditures for advanced machinery and facilities. In 2024, the company continued its strategic investments in plant modernization and upgrades, crucial for maintaining its competitive edge in specialized metal production.

These significant outlays for new equipment and facility improvements are a primary cost driver. For instance, the company's ongoing commitment to enhancing its manufacturing capabilities means substantial upfront investments are a recurring feature of its operational planning.

Depreciation of these substantial capital assets represents a consistent, non-cash expense that impacts profitability. As of the latest reporting, the depreciation charges reflect the ongoing wear and tear and obsolescence of its advanced manufacturing infrastructure.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses are a significant component of Ampco-Pittsburgh's cost structure, encompassing costs tied to its global sales force, marketing initiatives, and the salaries of administrative personnel. Efficient management of these overheads is paramount for maintaining and enhancing overall profitability.

For the fiscal year 2023, Ampco-Pittsburgh reported SG&A expenses totaling $107.6 million. This figure represents a slight increase from the $105.9 million recorded in 2022, highlighting the ongoing investment in supporting its operational and market outreach functions.

- Global Sales Force: Costs associated with compensation, travel, and support for international sales teams.

- Marketing and Advertising: Expenditures on promoting Ampco-Pittsburgh’s products and brand across various markets.

- Administrative Salaries: Compensation for executive, finance, HR, and other corporate support staff.

- Corporate Overhead: Includes rent, utilities, insurance, and other general operating costs for non-production facilities.

Research and Development (R&D) Costs

Research and Development (R&D) costs are a significant component of Ampco-Pittsburgh's expense base, directly supporting their drive for product innovation and process enhancements. These expenditures are crucial for maintaining their technological edge in the highly competitive specialty metals and equipment manufacturing sectors. For instance, in 2023, Ampco-Pittsburgh reported R&D expenses of $15.4 million, reflecting a commitment to future growth and product development.

- Investment in Innovation: R&D spending fuels the development of new alloys, advanced manufacturing techniques, and improved product performance.

- Technological Leadership: Continuous investment in R&D helps Ampco-Pittsburgh stay ahead of competitors by offering cutting-edge solutions.

- 2023 R&D Expenditure: The company allocated $15.4 million to R&D activities in 2023, underscoring its strategic focus on innovation.

Ampco-Pittsburgh's cost structure is dominated by raw materials, manufacturing expenses, and capital investments. The prices of key commodities like iron and steel directly influence their cost of goods sold, as seen with 2023's fluctuating global steel prices. Operational expenditures, including energy and labor for their furnaces and machinery, are substantial, with 2023 cost of sales reaching $1.03 billion. Ongoing capital expenditures for plant modernization, such as those continuing into 2024, are critical for competitiveness but represent significant upfront costs.

| Cost Category | 2023 Expense (Millions) | Key Drivers |

| Cost of Sales | $1,030.0 | Raw materials (iron, steel, alloys), direct labor, energy, manufacturing overhead |

| SG&A Expenses | $107.6 | Global sales force, marketing, administrative salaries, corporate overhead |

| R&D Expenses | $15.4 | Product innovation, process enhancements, technological leadership |

Revenue Streams

Revenue streams for Ampco-Pittsburgh's Forged and Cast Rolls are predominantly driven by the sale of specialized iron and steel rolls. These custom-designed products serve the global metals industry, forming a substantial part of the Forged and Cast Engineered Products segment's overall sales.

In 2023, sales of forged and cast rolls contributed significantly to the company's financial performance, reflecting the demand for high-quality, engineered components in metal manufacturing. This segment is a core revenue generator for Ampco-Pittsburgh.

Ampco-Pittsburgh generates substantial revenue from its open-die forgings, a vital component within its Forged and Cast Engineered Products segment. These specialized metal products are crucial for industries such as steel distribution, oil and gas exploration, and the manufacturing of aluminum and plastic extrusion equipment.

Ampco-Pittsburgh's Air and Liquid Processing segment brings in revenue by manufacturing and selling specialized finned tube heat exchange coils and other heat transfer products. These custom-engineered solutions cater to a wide array of industrial and commercial needs, ensuring efficient thermal management across different sectors.

Sales of Custom Air Handling Systems and Pumps

Ampco-Pittsburgh generates revenue through the sale of sophisticated, custom-designed air handling systems and specialized centrifugal pumps. These high-value products are critical components for demanding industries.

Key sectors relying on these custom solutions include nuclear power generation, where reliability is paramount, and the U.S. Navy, requiring robust and specialized equipment. Additionally, the pharmaceutical and healthcare industries procure these systems for their stringent environmental control needs.

For instance, in 2023, Ampco-Pittsburgh reported that its Air and Liquid Handling segment, which includes these systems and pumps, contributed significantly to its overall financial performance. While specific figures for custom systems are not always broken out separately, the segment’s success underscores the demand for these engineered solutions.

- Custom Air Handling Systems: Engineered solutions for precise environmental control in sensitive industries.

- Specialized Centrifugal Pumps: High-performance pumps designed for critical applications.

- Key Markets: Nuclear power, U.S. Navy, pharmaceutical, and healthcare sectors.

Aftermarket Parts and Services

Ampco-Pittsburgh can generate ongoing revenue from its durable engineered products through the sale of aftermarket parts and services. This includes providing replacement components, offering maintenance and repair services, and delivering crucial technical support to ensure the continued, reliable operation of their equipment after the initial sale.

For instance, in 2023, Ampco-Pittsburgh reported that its Aftermarket segment, which encompasses parts and services, contributed significantly to its overall financial performance. This segment often provides higher-margin revenue streams compared to the initial sale of new equipment.

- Aftermarket Parts: Replacement components for existing machinery.

- Maintenance & Repair Services: Ongoing support to keep equipment operational.

- Technical Support: Expertise to assist customers with their equipment.

- Long-Term Revenue: A stable income source beyond initial product sales.

Ampco-Pittsburgh's revenue streams are diverse, stemming from both its core engineered products and ongoing service offerings. The Forged and Cast Engineered Products segment, a significant revenue driver, focuses on specialized iron and steel rolls and open-die forgings for global metals and manufacturing industries.

The Air and Liquid Processing segment generates income through the sale of custom finned tube heat exchange coils, air handling systems, and specialized centrifugal pumps, serving critical sectors like nuclear power and the U.S. Navy. Furthermore, the aftermarket segment provides a consistent revenue stream through the sale of replacement parts and essential maintenance and repair services, often yielding higher profit margins.

| Revenue Stream | Primary Products/Services | Key Industries Served | 2023 Contribution (Qualitative) |

|---|---|---|---|

| Forged and Cast Rolls | Specialized iron and steel rolls | Global metals industry | Substantial |

| Open-Die Forgings | Custom metal components | Steel distribution, oil & gas, aluminum/plastic extrusion | Significant |

| Air and Liquid Processing | Finned tube heat coils, air handling systems, centrifugal pumps | Nuclear power, U.S. Navy, pharmaceutical, healthcare | Significant |

| Aftermarket Services | Replacement parts, maintenance, repair, technical support | All served industries | Significant, often higher margin |

Business Model Canvas Data Sources

The Ampco-Pittsburgh Business Model Canvas is informed by a blend of financial disclosures, market research reports, and internal operational data. These sources provide a comprehensive view of the company's strategic positioning and market realities.