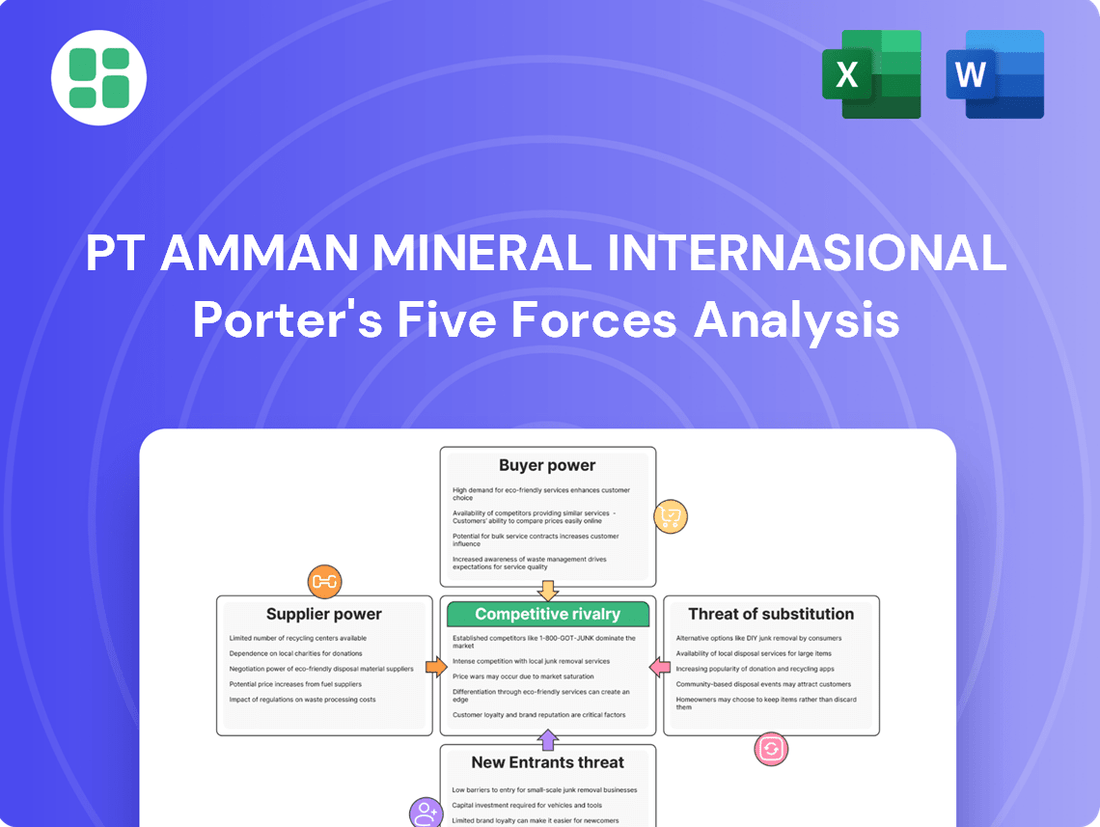

PT Amman Mineral Internasional Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PT Amman Mineral Internasional Bundle

PT Amman Mineral Internasional operates within a dynamic mining sector, where supplier bargaining power is significantly influenced by the scarcity of specialized equipment and expertise. The threat of substitutes, while present in the broader commodities market, is relatively low for their core copper and gold products. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping PT Amman Mineral Internasional’s industry—from buyer power to the threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration for PT Amman Mineral Internasional is a key factor influencing bargaining power. For specialized mining equipment and heavy machinery, the market often features a limited number of global manufacturers. If PT Amman Mineral Internasional relies heavily on a few of these dominant suppliers for proprietary technologies or unique components, these suppliers can wield significant power. For instance, in 2023, the global mining equipment market was dominated by a few major players like Caterpillar and Komatsu, indicating a potential for high supplier leverage if Amman Mineral's needs align with their specialized offerings.

Switching costs play a significant role in assessing the bargaining power of suppliers for PT Amman Mineral Internasional. If it's expensive or difficult for Amman Mineral to switch from one supplier to another, the existing suppliers hold more power. This can involve substantial upfront investments like re-tooling machinery, retraining personnel on new systems, or obtaining new certifications for materials, all of which can be costly and time-consuming.

For PT Amman Mineral Internasional, these switching costs could be particularly high if they rely on specialized equipment or proprietary technologies provided by a specific supplier. Long-term maintenance contracts or exclusive agreements for critical components also lock in suppliers, increasing their leverage. For instance, if a key mining equipment supplier requires extensive integration with Amman Mineral's existing operational technology, the cost and complexity of switching to a different provider could be prohibitive, thereby strengthening that supplier's bargaining position.

The uniqueness of inputs significantly impacts the bargaining power of suppliers for PT Amman Mineral Internasional. If suppliers provide highly specialized or patented materials, technology, or services that are critical for copper and gold mining and processing, their leverage increases substantially. Amman Mineral's operations, particularly at its Batu Hijau mine, may depend on niche inputs with few readily available alternatives, thereby strengthening supplier influence.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers for PT Amman Mineral Internasional is a nuanced consideration. While major mining operations are capital-intensive, making it challenging for typical raw material suppliers to directly enter the mining or processing business, specialized technology or equipment providers could pose a more plausible threat. If a supplier possesses proprietary technology crucial for extraction or processing, they might leverage this capability to integrate forward, thereby becoming a competitor rather than a vendor.

For instance, a company that supplies advanced ore processing machinery could potentially acquire or develop its own mining concessions if the economics and technological barriers become manageable. This would shift them from a supplier role to a direct competitor, altering the power dynamics significantly. Such a move is more likely if the supplier sees substantial untapped profit potential in controlling the entire value chain, from resource extraction to refined product.

While specific instances of this occurring directly with PT Amman Mineral Internasional's primary suppliers are not publicly detailed, the general principle remains. The bargaining power of suppliers is amplified if they have the means and motivation to bypass their customers and capture the value further down the chain. This necessitates PT Amman Mineral Internasional maintaining strong supplier relationships and potentially exploring alternative sourcing or in-house capabilities for critical technologies.

Key considerations regarding this threat include:

- Supplier Technological Dependency: The degree to which PT Amman Mineral Internasional relies on specialized, proprietary technology from its suppliers.

- Supplier Financial Capacity: The ability of suppliers to fund the significant capital expenditures required for mining and processing operations.

- Market Incentives for Suppliers: The potential profitability and strategic advantages for suppliers to enter the mining sector themselves.

- Competitive Landscape: The existing competitive intensity within the mining sector, which could influence a supplier's decision to integrate forward.

Importance of Amman Mineral to Suppliers

Amman Mineral's significance as a customer directly influences its suppliers' bargaining power. If Amman Mineral constitutes a substantial portion of a supplier's annual revenue, that supplier is likely to be more accommodating to Amman Mineral's demands to preserve a crucial business relationship. This dependence can limit the supplier's ability to exert significant leverage.

Conversely, if Amman Mineral represents only a minor segment of a supplier's overall client base, the supplier holds a stronger position. In such scenarios, the supplier can afford to be less flexible, as losing Amman Mineral's business would not critically impact their financial performance. This dynamic shifts the bargaining power more towards the supplier.

- Customer Dependence: Amman Mineral's purchasing volume can make or break smaller suppliers, thereby reducing the supplier's bargaining power.

- Supplier Market Share: If Amman Mineral sources from a few dominant suppliers, those suppliers gain leverage.

- Contractual Agreements: Long-term supply contracts can lock in prices and terms, diminishing immediate bargaining power for either party.

- Diversification of Suppliers: Amman Mineral's ability to source from multiple suppliers weakens the power of any single supplier.

The bargaining power of suppliers for PT Amman Mineral Internasional is influenced by the concentration of suppliers in the market. For specialized mining equipment, a limited number of global manufacturers often dominate, potentially giving them significant leverage if Amman Mineral relies on their proprietary technology. For instance, in 2023, major players like Caterpillar and Komatsu held substantial market share in mining equipment, highlighting this concentration.

Switching costs for PT Amman Mineral Internasional are a critical factor; high costs associated with re-tooling or retraining can empower suppliers. The uniqueness of inputs, especially for specialized extraction or processing technologies, further amplifies supplier influence. While forward integration by suppliers is less common due to high capital requirements, specialized technology providers could pose a threat if they see value in controlling the entire chain.

Amman Mineral's significance as a customer also plays a role. If Amman Mineral represents a large portion of a supplier's revenue, the supplier's bargaining power is diminished. Conversely, if Amman Mineral is a small client, the supplier has more leverage. This dynamic is crucial in understanding the supplier-supplier relationship.

| Factor | Impact on Amman Mineral | Example/Data (2023/2024) |

|---|---|---|

| Supplier Concentration | High potential leverage for dominant suppliers | Major mining equipment manufacturers (e.g., Caterpillar, Komatsu) held significant market share. |

| Switching Costs | Increases supplier power if high | Costs include re-tooling, retraining, and integration of proprietary tech. |

| Uniqueness of Inputs | Amplifies supplier influence for critical, specialized components | Dependence on niche extraction technologies with few alternatives. |

| Forward Integration Threat | Low for most, but possible for specialized tech providers | Potential for tech firms to enter mining if profitable. |

| Customer Dependence | Reduces supplier power if Amman Mineral is a major client | Amman Mineral's large-scale operations can influence supplier terms. |

What is included in the product

This Porter's Five Forces analysis of PT Amman Mineral Internasional evaluates the intensity of competition, the bargaining power of buyers and suppliers, the threat of new entrants, and the risk of substitute products within the Indonesian copper and gold mining sector.

A clear, one-sheet summary of all five forces—perfect for quick decision-making regarding PT Amman Mineral Internasional's competitive landscape.

Customers Bargaining Power

PT Amman Mineral Internasional's customer base for copper and gold is characterized by a relatively fragmented market, as these are global commodities. However, significant off-take agreements with large industrial consumers or metal traders can create pockets of buyer concentration. For instance, major smelters and refineries, which process the raw materials, represent key customers. While specific buyer concentration data for Amman Mineral is not publicly detailed in readily available reports, the broader copper market in 2024 saw demand driven by sectors like construction, automotive, and electronics, with large manufacturers in these industries being significant purchasers.

For PT Amman Mineral Internasional, the bargaining power of customers is significantly influenced by buyer volume and purchase size. Large-volume buyers, such as major smelters or international commodity traders, possess considerable leverage. Their substantial orders allow them to negotiate for lower per-unit prices or more favorable payment and delivery terms, directly impacting the company's revenue and profit margins.

The bargaining power of customers is significantly influenced by product standardization. Copper and gold, the primary outputs of PT Amman Mineral Internasional, are largely considered commodities. This means they are fundamentally undifferentiated on the global market, making it easy for buyers to compare and switch between suppliers based on price alone.

While Amman Mineral focuses on producing high-purity metals, the core nature of copper and gold as commodities means that, from a buyer's perspective, the underlying product offers little unique differentiation. This lack of inherent product distinction amplifies customer bargaining power, as they can readily seek out the most competitive pricing from various producers.

Buyer's Threat of Backward Integration

The threat of backward integration by customers for PT Amman Mineral Internasional is relatively low. While large industrial buyers, particularly those in downstream processing, might theoretically consider acquiring mining assets, the immense capital expenditure and operational complexity involved make this an unlikely strategy for most. For instance, establishing a new mine often requires billions of dollars in investment and years of development, a significant barrier for even major consumers of mined commodities.

The capital intensity of the mining sector acts as a substantial deterrent. Developing new mining operations demands enormous upfront investment in exploration, land acquisition, infrastructure, and specialized equipment. This high barrier to entry significantly limits the ability of most customers to realistically integrate backward into PT Amman Mineral Internasional’s core business of resource extraction and primary processing.

- High Capital Requirements: Establishing a new mine can cost upwards of $1 billion, making backward integration prohibitively expensive for most buyers.

- Operational Complexity: Mining involves specialized expertise in geology, engineering, and environmental management, which customers may lack.

- Long Development Cycles: From discovery to production, mines can take 5-15 years to develop, a timeline that may not align with customer strategic needs.

- Limited Customer Base for Backward Integration: Only the largest industrial conglomerates with significant financial resources and a strategic imperative would even consider such a move.

Price Sensitivity of Buyers

PT Amman Mineral Internasional's buyers, particularly those in industries like electronics and automotive, exhibit varying degrees of price sensitivity. For these sectors, the cost of copper and gold can represent a significant portion of their total product expenses. For instance, in 2024, the average price of copper hovered around $9,500 per metric ton, while gold prices fluctuated, often exceeding $2,300 per ounce. This cost directly impacts their manufacturing margins.

The criticality of copper and gold to a buyer's product quality also shapes their sensitivity. If these metals are essential for performance or aesthetic appeal, buyers may be less inclined to switch suppliers based solely on minor price differences. However, if the metals are more commoditized inputs, price becomes a more dominant factor in purchasing decisions. The profitability of the buyer's own business is another key determinant; highly profitable firms might absorb higher raw material costs more readily than those operating on thinner margins.

- Price Sensitivity: Buyers in sectors like electronics and automotive are sensitive to price fluctuations of copper and gold.

- Cost Impact: Copper prices around $9,500/ton and gold prices above $2,300/oz in 2024 significantly affect buyer production costs.

- Product Importance: The role of metals in product quality influences whether buyers prioritize price or supplier reliability.

- Buyer Profitability: A buyer's own profit margins dictate their capacity to absorb higher raw material expenses.

The bargaining power of PT Amman Mineral Internasional's customers is moderate, primarily driven by the commodity nature of copper and gold, which allows for easy switching between suppliers based on price. Buyers' significant purchase volumes, especially from large industrial consumers and commodity traders, grant them leverage to negotiate favorable terms. While backward integration is unlikely due to high capital and operational barriers, price sensitivity remains a key factor for customers in sectors like electronics and automotive, directly impacting Amman Mineral's revenue.

| Factor | Impact on Amman Mineral | 2024 Market Context |

|---|---|---|

| Buyer Concentration | Moderate to High for large off-takers | Demand driven by construction, automotive, electronics |

| Product Standardization | High (Commodities) | Copper and gold are undifferentiated globally |

| Switching Costs | Low for buyers | Easy to switch suppliers based on price |

| Price Sensitivity | Varies by industry; high for electronics/auto | Copper ~$9,500/ton; Gold >$2,300/oz |

Full Version Awaits

PT Amman Mineral Internasional Porter's Five Forces Analysis

This preview showcases the PT Amman Mineral Internasional Porter's Five Forces Analysis, detailing the competitive landscape for the company. You're looking at the actual document, which meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy.

Rivalry Among Competitors

The copper and gold mining sector in Indonesia is characterized by a concentrated number of major players, with PT Freeport Indonesia and PT Merdeka Copper Gold being significant competitors to PT Amman Mineral Internasional. Globally, the market is more fragmented, featuring numerous large-scale mining operations across various continents, each vying for resources and market share.

The copper and gold mining industry is currently experiencing robust growth, driven by strong global demand for these essential commodities. This positive market trend generally moderates the intensity of competitive rivalry, as companies can expand operations and increase output to meet rising demand without necessarily engaging in aggressive market share battles.

In 2024, the outlook for copper demand remained exceptionally strong, fueled by the accelerating energy transition and infrastructure development worldwide. Projections indicated a significant supply deficit, with prices reflecting this tightness. Similarly, gold prices have shown resilience, supported by its role as a safe-haven asset and ongoing central bank purchases, contributing to a favorable market environment for producers.

PT Amman Mineral Internasional, like other players in the mining sector, faces significant exit barriers. The highly specialized nature of mining assets, from extraction equipment to processing facilities, makes them difficult and costly to repurpose or sell. Decommissioning these assets also involves substantial environmental remediation and regulatory compliance costs, effectively locking companies into operations even when unprofitable.

Furthermore, long-term contracts with suppliers and offtakers, as well as social obligations to local communities and employees, create further inertia. For instance, PT Amman Mineral Internasional's operations at the Batu Hijau mine are subject to agreements that extend for many years. These commitments make a swift or clean exit from the industry extremely challenging, potentially prolonging the presence of less competitive firms and contributing to industry overcapacity.

Product Differentiation

While copper and gold are fundamentally commodities, differentiation in the mining sector is increasingly driven by factors beyond the raw product itself. Companies like PT Amman Mineral Internasional are focusing on building trust and value through consistent quality and reliable supply chains. This is crucial for securing long-term offtake agreements and maintaining investor confidence.

Amman Mineral's strategic investment in downstream processing, particularly its smelter project, represents a significant move towards product differentiation. By processing the ore into more refined products, the company can capture greater value and potentially offer customized solutions to its customers. This vertical integration can also lead to greater control over product specifications and purity.

- Quality and Purity: While raw copper and gold are largely undifferentiated, Amman Mineral's smelter aims to produce high-purity copper cathodes, a key differentiator in the market.

- Supply Chain Reliability: Consistent production and efficient logistics are vital. Amman Mineral's operational track record contributes to its reputation for reliability.

- Sustainability Practices: Increasingly, buyers consider environmental, social, and governance (ESG) factors. Amman Mineral's commitment to sustainable mining operations can be a significant differentiator. For instance, in 2023, the company reported significant progress in its ESG initiatives, aligning with global trends.

- Downstream Integration: The development of the Amman Mineral smelter is a prime example of moving up the value chain, differentiating from competitors who only export raw ore.

Fixed Costs and Capacity

The mining sector, including operations like those of PT Amman Mineral Internasional, is inherently capital-intensive, meaning it carries substantial fixed costs. These costs, such as those for exploration, equipment purchase, and infrastructure development, remain largely the same regardless of production levels. For instance, the initial investment in a large-scale copper and gold mine can easily run into billions of dollars.

This high fixed-cost structure creates significant pressure for companies to achieve high capacity utilization. When demand falters or prices drop, the imperative to cover these fixed costs can drive aggressive price competition among industry players. Companies may lower prices to maintain sales volume and keep their operations running efficiently, even if profit margins shrink.

- High Fixed Costs: Mining operations require massive upfront capital for exploration, machinery, and infrastructure, creating a significant cost base that must be covered.

- Capacity Utilization Pressure: To offset these fixed costs, companies are incentivized to operate at high capacity, which can intensify competition when demand is weak.

- Price Sensitivity: The need to maintain production levels can lead to a greater sensitivity to price fluctuations, potentially resulting in price wars during downturns.

- Industry Example: In 2024, major mining companies continued to invest heavily in new projects and technology upgrades, reinforcing the capital-intensive nature of the industry and the ongoing need for efficient capacity management.

Competitive rivalry within the Indonesian copper and gold mining sector is influenced by a few major players, including PT Freeport Indonesia and PT Merdeka Copper Gold, who compete directly with PT Amman Mineral Internasional. While the global market is more fragmented, the presence of these significant domestic competitors shapes the competitive landscape.

The industry's robust growth, driven by strong demand for copper and gold in 2024, generally softens intense rivalry as companies can expand production. However, the capital-intensive nature of mining, with high fixed costs, creates pressure for high capacity utilization, potentially leading to price competition when demand softens.

Differentiation efforts, such as PT Amman Mineral Internasional's investment in a smelter for higher-purity copper cathodes and a focus on supply chain reliability and sustainability, aim to carve out market advantages. These strategies are crucial for securing offtake agreements and maintaining investor confidence in a market where raw commodities are otherwise undifferentiated.

SSubstitutes Threaten

The threat of substitutes for copper and gold, key products for PT Amman Mineral Internasional, is a significant consideration. For copper, aluminum is a viable substitute in electrical wiring due to its lower cost and comparable conductivity, though it is less efficient and heavier. Fiber optics are also replacing copper in high-speed data transmission, offering greater bandwidth and immunity to electromagnetic interference.

In the case of gold, its role as an investment is challenged by other precious metals like silver and platinum, which can offer similar diversification benefits. Furthermore, various financial instruments, including bonds, equities, and even cryptocurrencies, provide alternative avenues for wealth preservation and growth, potentially diverting investment capital away from gold.

The threat of substitutes for copper and gold is a significant factor for PT Amman Mineral Internasional. While direct substitutes offering identical performance at a lower price are scarce, advancements in material science continually introduce alternatives that can chip away at demand. For example, in electrical conductivity, aluminum is a long-standing substitute for copper, often priced lower. However, aluminum's lower conductivity and higher weight typically mean more material is needed for equivalent performance, impacting its overall cost-effectiveness and application range.

In 2024, the price of copper has experienced volatility, influenced by global economic conditions and supply chain dynamics. For instance, the LME copper price has fluctuated, impacting its competitiveness against materials like aluminum. Similarly, gold, primarily valued for its investment and jewelry appeal, faces fewer direct performance-based substitutes in its core applications. However, alternative investment vehicles and changing consumer preferences for luxury goods can indirectly affect demand.

Technological progress is a key driver in the substitute threat. Innovations in lightweight alloys or advanced polymers could reduce the reliance on copper in sectors like automotive manufacturing, where weight reduction is a priority. Similarly, the development of more efficient energy storage solutions might lessen the demand for certain gold applications in electronics. These shifts, driven by efficiency gains and cost reductions in alternative materials, could gradually erode the market share of traditional metals.

The propensity for buyers to substitute away from PT Amman Mineral Internasional's copper and gold products is generally low, especially for industrial applications where performance and reliability are paramount. For instance, the electrical conductivity of copper is difficult to match economically by alternatives like aluminum in many high-demand sectors. In 2024, global copper demand was projected to remain robust, driven by electrification and infrastructure projects, indicating buyer stickiness.

While awareness of potential substitutes like recycled metals or alternative materials exists, the ease of switching for large-scale industrial users is often hindered by established supply chains, technical specifications, and the significant capital investment required to retool production processes. The perceived benefits of substitutes, such as cost savings, must outweigh these switching costs and any potential performance compromises. For example, while aluminum is lighter and cheaper per unit weight, its lower conductivity means more material is needed for the same electrical performance, impacting overall cost-effectiveness in many copper-centric applications.

Changing Consumer Preferences and Regulations

Shifting consumer tastes toward lighter, more energy-efficient materials could eventually impact demand for copper, even as its role in green technologies grows. For instance, advancements in composite materials or novel alloys might offer alternatives in specific applications, although widespread substitution remains a long-term consideration.

Regulatory shifts, particularly those focused on environmental sustainability, could also influence material choices. Stricter emissions standards or mandates for recycled content might favor materials with a lower carbon footprint or easier recyclability, potentially creating a competitive pressure point for copper producers if innovation in other materials outpaces copper's sustainability efforts.

- Evolving Consumer Preferences: Demand for lightweight and high-performance materials in sectors like automotive and electronics could drive innovation in alternative materials.

- Regulatory Landscape: Increasing environmental regulations, such as those promoting circular economy principles or carbon-neutral manufacturing, may favor materials with demonstrably lower environmental impact throughout their lifecycle.

- Material Innovation: Ongoing research and development in areas like advanced composites, graphene, and novel alloys present potential long-term substitutes for copper in certain high-value applications.

- Green Energy Demand vs. Substitution: While copper is critical for electric vehicles and renewable energy infrastructure, the pace of material science innovation means that even in these growth areas, alternative solutions could emerge over time.

Technological Advancements in Substitutes

Ongoing research and development in substitute materials, such as advanced polymers and composites, presents a significant threat to copper's demand in various sectors. For instance, breakthroughs in lightweight, high-strength composites could reduce reliance on copper in automotive and aerospace applications, areas where copper demand was robust in 2024.

Innovations that dramatically improve the cost-effectiveness or performance of alternatives to gold, like lab-grown diamonds or alternative investment vehicles, could also impact gold's market. The increasing efficiency and scalability of synthetic diamond production, for example, have already begun to influence the jewelry market, a key consumer of gold.

- Material Science Innovation: Continuous advancements in material science are crucial for identifying and evaluating potential substitutes for both copper and gold.

- Cost-Effectiveness: Breakthroughs that make alternative materials significantly cheaper than copper or gold will heighten the threat of substitution.

- Performance Improvements: Substitutes offering comparable or superior performance characteristics in key applications will gain market share.

- Market Penetration: The rate at which these advanced substitutes are adopted across industries will determine the magnitude of the threat.

The threat of substitutes for PT Amman Mineral Internasional's core products, copper and gold, is a nuanced challenge. While direct, perfect substitutes are rare, advancements in material science and evolving investment landscapes continuously introduce viable alternatives that can impact demand. For copper, aluminum remains a key substitute in electrical applications due to cost, though its lower conductivity and higher weight can offset savings. In 2024, copper prices saw significant fluctuations, influenced by global economic sentiment and supply chain issues, affecting its competitiveness against aluminum.

Gold's primary appeal as an investment and in jewelry faces competition from other precious metals like silver and platinum, offering similar diversification. Furthermore, a growing array of financial instruments, from bonds and equities to cryptocurrencies, provides alternative wealth preservation and growth avenues, potentially diverting capital from gold. The increasing efficiency of lab-grown diamonds also presents a growing substitute threat in the jewelry sector.

Technological progress is a major driver of substitute threats. Innovations in lightweight materials for automotive or advanced polymers could reduce copper's use, even as its demand in green technologies like electric vehicles and renewable energy infrastructure remains strong. For instance, the global push for electrification in 2024 continued to bolster copper demand, but the long-term threat from material innovation persists.

Buyer propensity to substitute is often low in critical industrial applications where copper's performance is essential. However, switching costs, including retooling and supply chain integration, can be substantial. Regulatory shifts promoting sustainability or circular economy principles could also favor materials with lower environmental footprints, potentially impacting copper if its sustainability initiatives do not keep pace with alternatives.

| Substitute Material | Primary Application | Key Advantage | Key Disadvantage | 2024 Market Context |

| Aluminum | Electrical Wiring | Lower Cost | Lower Conductivity, Higher Weight | Price volatility impacted competitiveness vs. copper. |

| Fiber Optics | High-Speed Data Transmission | Higher Bandwidth, EMI Immunity | Higher Installation Cost, Fragility | Continued adoption in telecommunications. |

| Silver/Platinum | Investment, Jewelry | Diversification Benefits | Lower Recognition as a Store of Value (vs. Gold) | Demand influenced by industrial use and investor sentiment. |

| Financial Instruments (Bonds, Equities, Crypto) | Investment, Wealth Preservation | Potential for Higher Returns, Diversification | Market Volatility, Different Risk Profiles | Significant capital flows observed across asset classes in 2024. |

| Lab-Grown Diamonds | Jewelry | Lower Cost, Ethical Sourcing Perception | Perceived Value/Resale Value Lower than Mined Diamonds | Increasing market penetration and acceptance. |

Entrants Threaten

Entering the copper and gold mining sector, particularly at the scale PT Amman Mineral Internasional operates, demands immense capital. Costs for initial exploration alone can run into tens of millions of dollars, followed by the significant investment needed for mine development, acquiring specialized heavy machinery, and constructing sophisticated processing facilities such as smelters.

For instance, a new large-scale mine development project can easily require billions of dollars in upfront investment. These substantial financial hurdles effectively deter many potential new players from even attempting to enter the market, thereby protecting existing, established companies.

The threat of new entrants in the copper and gold mining sector, specifically concerning access to raw materials, is significantly dampened by the sheer difficulty of securing viable reserves. Established companies like PT Amman Mineral Internasional often hold the rights to the most economically extractable deposits, making it incredibly hard for newcomers to find and secure their own. For instance, as of early 2024, the global exploration success rate for new copper deposits remains low, with many of the world's richest known ore bodies already under concession.

Government policies and regulations significantly shape the threat of new entrants in Indonesia's mining sector, directly impacting companies like PT Amman Mineral Internasional. Stricter environmental standards, mandatory licensing, and the need for various permits create substantial hurdles, increasing both the complexity and the financial outlay required to start operations. For example, Indonesia's past concentrate export bans, while aimed at promoting domestic processing, directly raised the barrier to entry for new players who might have relied on exporting raw materials.

Economies of Scale and Experience Curve

Established players like Amman Mineral benefit significantly from economies of scale in mining and processing. Their substantial operational capacity allows for lower per-unit costs, a crucial advantage in the capital-intensive mining sector.

Amman Mineral's accumulated experience curve also creates a formidable barrier. Years of operational refinement lead to greater efficiency, optimized resource extraction, and better risk management, which new entrants would struggle to replicate quickly.

- Economies of Scale: Larger production volumes lead to reduced average costs for Amman Mineral, making it harder for smaller new entrants to match their pricing.

- Experience Curve: Amman Mineral's long-standing operations translate into improved efficiency and lower operational costs over time, a benefit not readily available to newcomers.

- Capital Intensity: The mining industry requires immense upfront capital, which new entrants would need to secure, often at less favorable terms than established firms.

Brand Loyalty and Distribution Channels

While brand loyalty is generally low in commodity markets, PT Amman Mineral Internasional benefits from deeply entrenched relationships with its buyers. These established connections, often cemented through long-term contracts, make it challenging for new entrants to secure consistent off-take agreements, a critical factor for market penetration.

Access to efficient and reliable distribution channels is another significant barrier. New competitors would need to invest heavily in developing or acquiring the infrastructure and logistics necessary to move their products, a hurdle that PT Amman Mineral Internasional has already overcome through years of operation and strategic partnerships.

Consider the implications for a new copper and gold producer aiming to enter the Indonesian market. Securing a buyer for a significant portion of output, perhaps 50% or more, is crucial. For example, if PT Amman Mineral Internasional's 2024 production is projected at 250,000 tonnes of copper concentrate, a new entrant would need to find buyers for a substantial volume to achieve economies of scale and competitive pricing.

- Established Buyer Relationships: PT Amman Mineral Internasional's long-standing ties with major smelters and industrial consumers create a stable demand base, difficult for newcomers to replicate.

- Distribution Network Control: The company's access to and control over efficient logistics, including ports and transportation, provides a significant advantage in cost and reliability.

- Barriers to Entry: The capital and time required to build similar buyer relationships and distribution networks represent a substantial deterrent for potential new entrants in the copper and gold sector.

- Market Access Challenges: New entrants face the arduous task of not only producing but also securing market access, a process PT Amman Mineral Internasional has streamlined through its operational history.

The threat of new entrants into the copper and gold mining sector, especially for large-scale operations like PT Amman Mineral Internasional, is significantly constrained by the immense capital requirements. Initial exploration, mine development, machinery acquisition, and processing facility construction can easily run into billions of dollars, creating a formidable financial barrier. Furthermore, securing access to viable ore reserves is a major challenge, as most economically extractable deposits are already under concession, with low exploration success rates globally as of early 2024.

Government regulations in Indonesia, including stringent environmental standards, licensing, and permitting, add further complexity and cost for potential new entrants. Established companies also benefit from economies of scale and an experience curve that leads to greater operational efficiency and cost advantages, making it difficult for newcomers to compete on price. These factors combined with entrenched buyer relationships and established distribution networks create substantial barriers to entry.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Billions of USD required for exploration, development, and infrastructure. | Prohibitive for most potential new players. |

| Resource Availability | Economically viable deposits are often already secured by established firms. | Difficulty in finding and securing sufficient reserves. |

| Regulatory Hurdles | Complex licensing, permitting, and environmental compliance. | Increases cost, time, and operational complexity. |

| Economies of Scale & Experience | Lower per-unit costs and optimized operations for established players. | New entrants struggle to match competitive pricing and efficiency. |

| Buyer Relationships & Distribution | Long-term contracts and established logistics networks. | Challenges in securing off-take agreements and market access. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for PT Amman Mineral Internasional is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and relevant regulatory filings. We also incorporate insights from reputable industry research firms and macroeconomic data to provide a robust assessment of the competitive landscape.