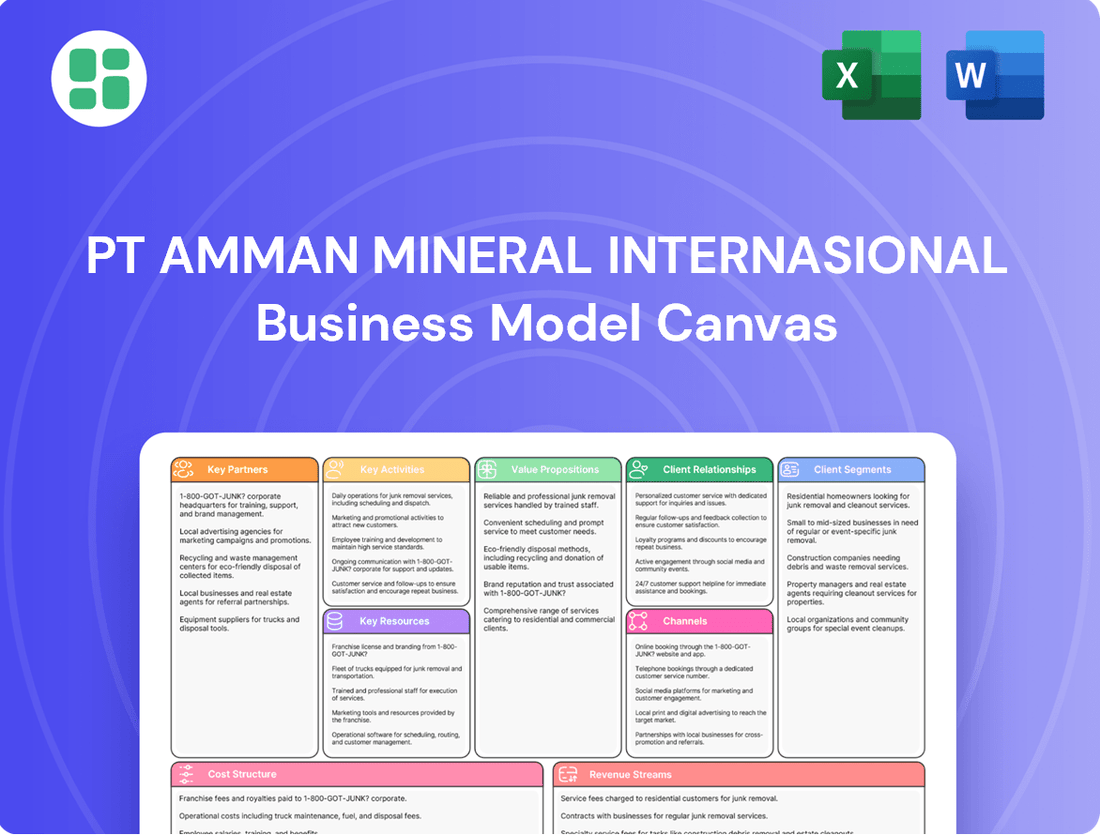

PT Amman Mineral Internasional Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PT Amman Mineral Internasional Bundle

Discover the strategic core of PT Amman Mineral Internasional's operations with our comprehensive Business Model Canvas. This detailed breakdown reveals their key partners, customer relationships, and revenue streams, offering invaluable insights into their market dominance. Ready to dissect success?

Partnerships

PT Amman Mineral Internasional's relationship with Indonesian governmental bodies, including the Ministry of Trade and the Ministry of Energy and Mineral Resources, is foundational. These collaborations are essential for securing vital operational permits and ensuring strict adherence to the nation's mining laws and environmental standards.

This partnership directly supports national strategic initiatives, such as the development of a copper smelter. This project is a key component of the government's broader agenda to boost downstream industries, adding significant value to raw mineral exports and fostering domestic processing capabilities.

In 2023, the Indonesian government continued to emphasize downstream processing, with significant investments planned for mineral processing facilities. Amman Mineral's smelter project is a prime example of this policy in action, aiming to transform raw copper concentrate into higher-value products.

PT Amman Mineral Internasional's business model is significantly strengthened by its key subsidiaries, which form crucial internal partnerships. These entities are vital for an integrated operational approach.

PT Amman Mineral Nusa Tenggara (AMNT) spearheads mining and exploration, forming the bedrock of the company's resource acquisition. In 2023, AMNT's production of copper concentrate reached 1.4 million tonnes, with gold production at 50.7 tonnes, showcasing its operational capacity.

PT Amman Mineral Industri (AMIN) handles smelting and refining, adding value to the extracted minerals. This subsidiary is key to controlling the downstream process and ensuring quality output. The company has invested heavily in its smelter complex, aiming for a processing capacity of 1.5 million tonnes of concentrate per year by 2025.

Further supporting the operational efficiency are PT Amman Mineral Integrasi (AMIG) for skilled manpower and PT Amman Nusantara Gas (ANG) for energy infrastructure. These partnerships ensure a stable and skilled workforce and reliable energy supply, critical for continuous mining and processing operations.

Amman Mineral relies on technology and infrastructure providers for its massive projects. This includes partnerships with specialized contractors for the construction of critical facilities like their copper smelter and power generation plants. These collaborations are essential for bringing advanced technology and engineering expertise to bear on complex development phases.

Key partnerships in this area involve companies such as China Non-ferrous Metal Industry's Foreign Engineering and Construction Co., Ltd (NFC) and PT Pengembangan Industri Logam (PT PIL). These entities play a crucial role in executing large-scale infrastructure development and driving technological progress within Amman Mineral's operations.

Energy Suppliers

Amman Mineral's operations depend heavily on a consistent and clean energy source. To secure this, they've established crucial relationships with energy providers.

A significant partnership involves a preliminary agreement with PT Pertamina (Persero), Indonesia's state-owned oil and gas company. This collaboration focuses on supplying liquefied natural gas (LNG) to power Amman Mineral's facilities.

This strategic alliance with Pertamina is designed to ensure a stable energy supply, which is vital for the continuous mining and processing activities. It also aligns with their commitment to more sustainable energy solutions for their long-term operational requirements.

Key aspects of this partnership include:

- Securing LNG Supply: A preliminary agreement is in place with PT Pertamina (Persero) for the provision of LNG.

- Powering Operations: The LNG will fuel Amman Mineral's power plants, ensuring consistent energy for mining and processing.

- Long-Term Sustainability: This partnership supports both operational needs and environmental objectives through a cleaner fuel source.

Local Communities and Stakeholders

PT Amman Mineral Internasional prioritizes robust engagement with local communities and stakeholders in West Nusa Tenggara, specifically near its Batu Hijau mine. This is crucial for maintaining its social license to operate and fostering sustainable development. The company actively partners on initiatives aimed at community betterment, boosting local employment opportunities, and implementing environmental stewardship programs. These collaborations directly contribute to the economic growth and social well-being of the region.

In 2024, Amman Mineral continued its commitment through various programs. For instance, its community empowerment initiatives focused on skills training and entrepreneurship, with over 500 individuals participating in vocational courses. The company also reported that approximately 75% of its operational workforce in the Batu Hijau area comprises local residents, underscoring its dedication to local employment. Environmental partnerships included reforestation efforts covering over 100 hectares and water resource management projects.

- Community Development: Focused on education, health, and infrastructure improvements, with a 2024 budget allocation of IDR 50 billion for these programs.

- Local Employment: Aiming to maximize local hiring, with a target of 80% local workforce participation by 2025 in operational roles.

- Environmental Initiatives: Including biodiversity monitoring and waste management, supported by IDR 20 billion in 2024 for environmental conservation projects.

Amman Mineral's key partnerships extend to specialized contractors and technology providers crucial for large-scale infrastructure development, such as their copper smelter and power generation facilities. These collaborations ensure the integration of advanced engineering and cutting-edge technology into their complex projects.

A significant energy partnership is the preliminary agreement with PT Pertamina (Persero) for liquefied natural gas (LNG) supply. This aims to secure a stable and cleaner energy source for Amman Mineral's operations, supporting both continuous production and environmental objectives.

The company also fosters strong relationships with local communities in West Nusa Tenggara, focusing on development, employment, and environmental stewardship. In 2024, over 500 individuals participated in vocational training, and approximately 75% of the operational workforce near Batu Hijau are local residents.

| Partner Type | Key Partners | Role/Focus | 2024 Data/Focus |

|---|---|---|---|

| Governmental Bodies | Ministry of Trade, Ministry of Energy and Mineral Resources | Permits, regulatory compliance, national strategic initiatives | Emphasis on downstream processing, smelter development |

| Subsidiaries | PT AMNT, PT AMIN, PT AMIG, PT ANG | Mining, smelting, refining, manpower, energy infrastructure | AMNT produced 1.4M tonnes copper concentrate in 2023 |

| Infrastructure & Technology | NFC, PT PIL | Smelter construction, power plants, engineering expertise | Driving technological progress in operations |

| Energy Providers | PT Pertamina (Persero) | LNG supply for power generation | Preliminary agreement for stable, cleaner energy |

| Local Communities | Regional stakeholders | Social license, community development, local employment | 500+ in vocational training, 75% local workforce |

What is included in the product

This Business Model Canvas outlines PT Amman Mineral Internasional's strategy for extracting and processing copper and gold, focusing on efficient resource utilization and stakeholder engagement.

It details key partners in mining operations, value propositions centered on responsible resource development, and customer relationships with global metal buyers.

PT Amman Mineral Internasional's Business Model Canvas provides a clear, actionable framework to address the complex challenges of resource extraction and community engagement, offering a structured approach to mitigating operational risks and fostering sustainable development.

Activities

Amman Mineral is deeply engaged in exploring and developing its significant mineral resources. This includes the continued operations at the renowned Batu Hijau mine, a cornerstone of its production, and the strategic advancement of the Elang project, which represents a key component of its future growth strategy.

These activities are crucial for extending the operational life of existing mines and ensuring a robust pipeline of future production. This involves extensive geological surveys and drilling programs, vital for understanding and quantifying the economic viability of these reserves.

For context, as of the first half of 2024, Amman Mineral reported significant progress in its exploration and development efforts, with capital expenditure allocated towards these key areas to support long-term value creation and maintain its position as a leading copper and gold producer.

PT Amman Mineral Internasional's core activity centers on large-scale open-pit mining at its Batu Hijau site, efficiently extracting copper and gold. This involves meticulous management of complex mining plans, including the crucial transition to new phases like Phase 8. This phase necessitates substantial waste removal and continuous optimization of ore recovery to maximize yield.

In 2024, the company continued its focus on operational efficiency. For instance, the Batu Hijau mine, a key asset, is designed for long-term production. The company's strategic planning includes managing the transition to deeper ore bodies, which inherently involves increased waste stripping ratios but is essential for sustained resource access.

After extracting the raw ore, PT Amman Mineral Internasional engages in crucial mineral processing and concentration activities. The primary goal is to transform the mined material into a high-grade copper concentrate, which is a valuable commodity in the global market. This process also efficiently recovers significant amounts of gold and silver as valuable by-products, enhancing the overall economic yield of the operation.

The technical steps involved are sophisticated, beginning with crushing and grinding the ore to reduce its particle size. This prepares the material for the flotation process, a key separation technique. Flotation selectively separates the valuable copper, gold, and silver minerals from the non-valuable rock and waste material, creating a concentrated product ready for export and sale.

In 2023, PT Amman Mineral Internasional processed approximately 30.3 million tonnes of ore. This resulted in the production of 770,000 tonnes of copper concentrate. This concentrate contained an estimated 2.3 million ounces of gold and 23.1 million ounces of silver, highlighting the significant value captured through these processing activities.

Smelting and Refining

Smelting and refining are critical activities for PT Amman Mineral Internasional, focusing on transforming raw copper concentrate into more valuable refined products. The company operates a new copper smelter and precious metal refinery (PMR) to achieve this downstream processing. This strategic move significantly enhances domestic value addition by producing copper cathodes, gold bullion, and silver bullion.

These operations are central to the business model, allowing Amman Mineral to capture greater value from its mining output. The smelter and refinery are designed to process a substantial volume of concentrate, turning it into marketable commodities with higher price points than raw concentrate.

- Copper Smelter Capacity: The new smelter is designed to process 900,000 tonnes of copper concentrate annually.

- Precious Metal Refinery Output: The PMR is projected to produce approximately 50 tonnes of gold and 160 tonnes of silver annually.

- Value Addition: This downstream processing converts concentrate into high-purity copper cathodes, gold, and silver, increasing the overall revenue potential.

Infrastructure Development and Maintenance

PT Amman Mineral Internasional's key activities include the ongoing development and maintenance of its critical infrastructure. This encompasses significant investments in power generation, such as gas and steam power plants, alongside LNG facilities to ensure a stable and cost-effective energy supply.

The company also focuses on maintaining and upgrading its port facilities, which are essential for the efficient import of supplies and export of its mineral products. Furthermore, robust management of its processing plants is crucial for maximizing operational capacity and the quality of its output.

These infrastructure activities are fundamental to supporting the company's current operational needs and its ambitious expansion plans. For instance, as of early 2024, the company continued its significant capital expenditure on infrastructure projects aimed at enhancing its production capabilities and logistical efficiency.

- Power Generation: Investment in gas and steam power plants, plus LNG facilities, ensures energy security.

- Port Operations: Maintaining and developing port infrastructure is key for supply chain management.

- Processing Plants: Continuous upgrades to processing facilities boost efficiency and output quality.

- Expansion Support: Infrastructure development directly underpins the company's strategic growth initiatives.

PT Amman Mineral Internasional's key activities revolve around the efficient extraction and processing of copper and gold. This includes the operation of the Batu Hijau mine and the development of the Elang project. The company processes ore to produce high-grade copper concentrate, also recovering gold and silver as by-products.

Further value is added through smelting and refining, transforming concentrate into copper cathodes, gold bullion, and silver bullion. Critical infrastructure, including power generation and port facilities, is maintained and developed to support these operations and future expansion.

| Key Activity | Description | 2024/2025 Focus/Data |

|---|---|---|

| Mining & Development | Extraction of copper and gold from Batu Hijau, development of Elang project. | Continued Phase 8 transition at Batu Hijau, focusing on waste removal and ore recovery optimization. Significant capital expenditure allocated to exploration and development in H1 2024. |

| Mineral Processing | Crushing, grinding, and flotation to produce copper concentrate and recover precious metals. | Processed approximately 30.3 million tonnes of ore in 2023, yielding 770,000 tonnes of copper concentrate. |

| Smelting & Refining | Operating a copper smelter and precious metal refinery for downstream processing. | New smelter capacity of 900,000 tonnes of concentrate annually; PMR to produce ~50 tonnes gold and ~160 tonnes silver annually. |

| Infrastructure Management | Maintaining and upgrading power generation, LNG facilities, and port operations. | Ongoing investment in power plants and LNG facilities for energy security; focus on logistical efficiency for supply chain. |

Full Document Unlocks After Purchase

Business Model Canvas

The PT Amman Mineral Internasional Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it represents the full, unedited content and structure of the deliverable. Upon completing your order, you will gain immediate access to this comprehensive Business Model Canvas, ready for your immediate use and analysis.

Resources

Amman Mineral's Batu Hijau mine and the undeveloped Elang deposit hold substantial copper and gold reserves. These reserves are the bedrock of the company's operations, making it a significant force in the global mining sector.

In 2023, Batu Hijau produced 314,000 tonnes of copper and 347,000 ounces of gold. The Elang deposit, when developed, is projected to significantly extend the company's operational life and production capacity.

PT Amman Mineral Internasional boasts extensive mining and processing infrastructure, crucial for its operations. This includes a fleet of large-scale mining equipment designed for efficient ore extraction.

The company operates a sophisticated processing plant capable of concentrating extracted metals. This infrastructure is key to transforming raw ore into valuable intermediate products.

A significant recent development is the commissioning of a new copper smelter and precious metal refinery. This integrated facility, operational as of 2024, allows for the final refining of metals, enhancing the value chain and enabling the company to capture higher margins on its output.

PT Amman Mineral Internasional's power generation and energy facilities are a cornerstone of its business model, ensuring operational continuity. The company operates its own gas and steam power plants, alongside LNG facilities, which are critical for uninterrupted mining and processing activities.

This self-sufficiency in energy supply is particularly vital given the demanding nature of its operations. For instance, in 2024, the company's ability to manage its power needs directly impacts its production output and cost efficiency, reducing vulnerability to external grid fluctuations and pricing volatility.

Skilled Workforce and Management Expertise

Amman Mineral's success hinges on its extensive team of skilled professionals. This includes geologists identifying valuable ore bodies, engineers designing efficient extraction processes, and operational staff ensuring smooth day-to-day activities. Their collective knowledge is foundational to the company's ability to manage complex mining, processing, and refining operations.

The management expertise within Amman Mineral is equally vital. These leaders guide strategic decisions, oversee financial performance, and ensure compliance with industry regulations. Their experience in navigating the intricacies of the global mining sector is a significant asset, directly impacting the company's operational efficiency and long-term viability.

As of 2024, Amman Mineral International Tbk (AMMN) reported a substantial workforce, underscoring the importance of human capital. The company's ability to attract and retain talent across various disciplines, from exploration to corporate governance, is a key determinant of its operational capacity and competitive edge in the market.

- Geological and Engineering Prowess: Expertise in resource identification and extraction techniques.

- Operational Excellence: Skilled workforce for efficient mining, processing, and refining.

- Strategic Management: Experienced leadership in navigating complex industry challenges and ensuring regulatory compliance.

Financial Capital and Investment Capacity

PT Amman Mineral Internasional's financial capital and investment capacity are underpinned by substantial financial resources. The company has allocated a significant capital expenditure budget of US$1.4 billion for the 2024-2025 period. This funding is critical for sustaining ongoing operations, driving expansion initiatives, and implementing necessary technological advancements.

The company's robust financial performance in 2024 directly bolsters its capacity for future investments. This strong financial standing provides the necessary foundation for strategic growth and development.

- Capital Expenditure: US$1.4 billion allocated for 2024-2025.

- Purpose: Funding operations, expansion, and technological upgrades.

- Financial Health: Strong 2024 performance enables future investment.

Amman Mineral's key resources include its vast copper and gold reserves at Batu Hijau and Elang, which are central to its production. The company also possesses advanced mining and processing infrastructure, including specialized equipment and a sophisticated processing plant. A significant recent addition is its new copper smelter and precious metal refinery, operational since 2024, which enhances its value chain.

Furthermore, its self-sufficient energy infrastructure, comprising gas and steam power plants and LNG facilities, ensures operational continuity. This is crucial for managing production costs and output efficiency, especially in 2024. The company's human capital, encompassing skilled geologists, engineers, and experienced management, is also a vital resource, driving operational success and strategic decision-making.

| Resource Category | Specific Assets/Capabilities | Key Data/Facts (2024 Relevance) |

|---|---|---|

| Mineral Reserves | Batu Hijau mine, Elang deposit | Substantial copper and gold reserves |

| Infrastructure | Mining equipment, processing plant, smelter, refinery | New smelter/refinery commissioned in 2024 |

| Energy Facilities | Gas and steam power plants, LNG facilities | Ensures operational continuity and cost efficiency |

| Human Capital | Skilled workforce, experienced management | Crucial for operations, strategy, and compliance |

Value Propositions

Amman Mineral is a key player in producing high-quality copper, gold, and silver. They supply exceptionally clean copper concentrate and are expanding into refined copper cathodes, gold bullion, and silver bullion.

These refined metals meet strict global quality benchmarks. This makes them highly attractive to industrial clients who depend on pure and consistent metal inputs for their manufacturing processes.

In 2023, Amman Mineral's production reached significant levels, with copper concentrate sales volume of 1.3 million wet metric tons. Their focus on quality ensures a premium market position.

Amman Mineral's integrated downstream processing capabilities are a cornerstone of its business model, transforming raw concentrate into higher-value refined products domestically. This strategic shift from merely exporting concentrate allows the company to capture more value within Indonesia.

By operating its own smelter and refinery, Amman Mineral significantly enhances Indonesia's standing in the international copper market. This integration ensures a more reliable and consistent supply of refined copper, benefiting both domestic industries and international buyers.

In 2024, Amman Mineral's smelter and refinery project, located in Sumbawa, West Nusa Tenggara, is on track to commence operations. This facility is designed to process 900,000 tonnes of copper concentrate annually, marking a significant step towards full downstream integration.

PT Amman Mineral Internasional consistently ranks among the globe's most cost-effective copper producers. This advantage stems from the inherent quality of its mineral reserves and ongoing efforts to refine operational processes, ensuring high efficiency.

These operational efficiencies directly fuel competitive pricing strategies and contribute to strong profitability, even when global commodity markets experience volatility. For instance, in 2023, the company's all-in sustaining costs (AISC) for copper were reported to be significantly below the industry average, underscoring its low-cost advantage.

Contribution to National Economic Development

Amman Mineral contributes significantly to Indonesia's economic development by investing in downstream industries, thereby adding value to extracted resources and promoting industrialization. This strategic focus directly supports the nation's agenda for economic self-sufficiency and growth.

The company creates substantial local employment opportunities, directly benefiting communities and contributing to higher living standards. In 2024, Amman Mineral's operations are projected to generate thousands of direct and indirect jobs, a crucial factor in reducing unemployment and fostering economic stability.

- Local Employment: Targeting over 10,000 direct and indirect jobs in 2024 through its mining and processing activities.

- Downstream Investment: Allocating significant capital towards developing smelter and refinery facilities, enhancing the value chain.

- Government Alignment: Directly supporting Indonesia's resource downstreaming policies and industrial development goals.

- Economic Multiplier Effect: Stimulating local economies through procurement of goods and services from Indonesian suppliers.

Commitment to Sustainable and Responsible Mining

Amman Mineral is deeply committed to sustainable and responsible mining. This means they prioritize not only extracting valuable resources but also doing so in a way that respects the environment and the communities where they operate. They focus on robust environmental management systems, proactive community development programs, and maintaining the highest safety standards across all their operations.

This dedication to responsible practices is more than just a policy; it's a core part of their business model. By operating sustainably, Amman Mineral aims to build and maintain trust with all their stakeholders, from local residents and government bodies to investors and employees. This trust is crucial for their long-term success and for creating lasting value.

In 2024, for instance, Amman Mineral continued its significant investment in community development initiatives. Their programs focus on education, health, and economic empowerment, aiming to foster self-sufficiency and improve the quality of life for local populations. These efforts are designed to ensure that the benefits of mining are shared broadly and responsibly.

- Environmental Stewardship: Implementing advanced water management and land rehabilitation techniques to minimize ecological impact.

- Community Engagement: Investing in local infrastructure, education, and healthcare to support sustainable community growth.

- Safety Culture: Maintaining rigorous safety protocols and training programs to protect their workforce and prevent accidents.

- Stakeholder Trust: Building transparent relationships with communities and regulators to ensure long-term social license to operate.

Amman Mineral offers high-quality copper, gold, and silver, with a strategic expansion into refined copper cathodes, gold bullion, and silver bullion. These refined products meet stringent global quality standards, making them ideal for industrial consumers requiring pure and consistent inputs. The company's commitment to downstream integration, exemplified by its Sumbawa smelter and refinery project commencing operations in 2024, allows it to capture greater value domestically.

The company's value proposition is further strengthened by its position as a cost-effective producer, with 2023 all-in sustaining costs for copper reported significantly below the industry average. This efficiency translates to competitive pricing and robust profitability, even amidst market fluctuations. Furthermore, Amman Mineral is a significant contributor to Indonesia's economic development, creating thousands of jobs in 2024 and aligning with the nation's resource downstreaming policies.

Amman Mineral’s dedication to responsible mining is a core tenet, encompassing environmental stewardship, community development, and stringent safety standards. Their 2024 investments in community programs focus on education, health, and economic empowerment, aiming to foster local self-sufficiency and improve quality of life. This commitment builds essential stakeholder trust, ensuring a sustainable social license to operate.

| Value Proposition | Key Features | Supporting Data/Facts (as of latest available, including 2024 projections) |

|---|---|---|

| High-Quality Metal Production | Copper, Gold, Silver; Refined Copper Cathodes, Gold Bullion, Silver Bullion | Supplies exceptionally clean copper concentrate; expanding into refined products meeting strict global benchmarks. |

| Downstream Integration & Value Capture | Domestic Smelter & Refinery Operations | Sumbawa smelter/refinery project on track for 2024 operations, processing 900,000 tonnes copper concentrate annually. |

| Cost Leadership & Competitive Pricing | Efficient Operations, High-Quality Reserves | Consistently ranks among globe's most cost-effective copper producers; 2023 AISC for copper significantly below industry average. |

| Economic & Social Contribution | Job Creation, Downstream Investment, Government Alignment | Targeting over 10,000 direct/indirect jobs in 2024; significant capital for downstream facilities; supports Indonesia's downstreaming policies. |

| Sustainable & Responsible Operations | Environmental Stewardship, Community Development, Safety Culture | Investing in community programs (education, health, economy) in 2024; advanced water management and land rehabilitation techniques. |

Customer Relationships

Amman Mineral International cultivates direct relationships with major industrial buyers, primarily focusing on those needing substantial quantities of copper cathodes and gold bullion. These are not casual transactions; they are built on trust and reliability.

The company secures these crucial partnerships through long-term supply contracts, ensuring a steady demand for its products. Consistency in product quality is paramount, forming the bedrock of these enduring commercial ties.

In 2024, Amman Mineral's commitment to direct engagement is underscored by its significant production capacity, aiming to be a major global supplier. This direct approach allows for tailored solutions and a deeper understanding of industrial client needs.

PT Amman Mineral Internasional is strategically forging partnerships and off-take agreements with major customers. This approach is designed to lock in demand for its refined copper and gold products, providing a crucial layer of revenue predictability. For instance, securing long-term contracts with large industrial consumers or smelters can significantly de-risk future sales projections.

These collaborations aren't just about sales; they bolster Amman Mineral's standing as a dependable supplier in the global commodities market. By guaranteeing a consistent buyer, the company strengthens its market position and can potentially negotiate more favorable terms. This is particularly vital in a volatile commodity market where demand can fluctuate.

In 2024, the global demand for copper, a key output for Amman Mineral, remained robust, driven by the ongoing energy transition and infrastructure development. Analysts projected a continued upward trend, making these strategic off-take agreements even more valuable for ensuring consistent revenue streams and supporting the company's expansion plans.

Amman Mineral prioritizes transparency with its public investors through consistent financial reporting, including earnings presentations and public disclosures. This open communication about operational performance, ongoing projects, and financial standing is crucial for fostering investor confidence.

In 2024, Amman Mineral International Tbk (AMMN) reported a significant increase in revenue, reaching IDR 18.7 trillion in the first nine months, up from IDR 12.8 trillion in the same period of 2023. This growth underscores the company's operational momentum and its ability to communicate this progress effectively to stakeholders.

Government and Regulatory Compliance

PT Amman Mineral Internasional places significant emphasis on cultivating robust relationships with government and regulatory bodies. This involves a steadfast commitment to adhering to all applicable laws and regulations, securing essential permits for its operations, and actively aligning its strategic objectives with national development goals. This proactive approach is crucial for ensuring the continuity of its mining and processing activities and fostering ongoing governmental support.

In 2024, the company continued its engagement with Indonesian authorities to ensure compliance with environmental, social, and governance (ESG) standards. This included ongoing dialogue regarding the development of its processing facilities and adherence to local content requirements. For instance, the company's commitment to local employment and procurement remains a key aspect of its relationship management with regional governments.

- Regulatory Adherence: Ensuring all operational activities, from exploration to processing, comply with national mining laws, environmental protection acts, and labor regulations.

- Permitting and Licensing: Actively managing and renewing all necessary permits, including environmental permits and operational licenses, to maintain legal standing.

- Strategic Alignment: Collaborating with government entities to align mining operations with national strategic interests, such as resource downstreaming and economic development initiatives.

- Stakeholder Engagement: Maintaining open communication channels with ministries, regional governments, and regulatory agencies to address concerns and foster a collaborative environment.

Community Engagement and Social Responsibility

Amman Mineral actively cultivates strong ties with its surrounding communities by implementing a range of social and environmental programs. These efforts underscore the company's commitment to corporate social responsibility, directly addressing local needs and fostering a cooperative operating atmosphere.

In 2024, Amman Mineral continued its focus on community development, investing in initiatives aimed at improving education, health, and economic opportunities. For instance, the company supported local schools with essential learning materials and infrastructure upgrades, impacting over 5,000 students.

- Community Development: Ongoing investment in local infrastructure and social programs.

- Environmental Stewardship: Implementation of programs focused on conservation and sustainable resource management.

- Stakeholder Engagement: Regular dialogues and feedback mechanisms with community leaders and residents.

- Economic Empowerment: Initiatives to support local businesses and provide skills training to residents.

Amman Mineral International fosters direct, long-term relationships with major industrial buyers of copper and gold, built on reliability and consistent quality. These partnerships are solidified through off-take agreements and supply contracts, ensuring predictable revenue streams and strengthening the company's market position.

The company prioritizes transparent communication with public investors through regular financial reporting, including earnings presentations and disclosures. This openness builds confidence and reflects operational momentum, as seen in its significant revenue growth in early 2024.

Crucially, Amman Mineral maintains strong ties with government and regulatory bodies, ensuring strict compliance with laws and regulations while aligning operations with national development goals. This includes ongoing engagement on ESG standards and local content requirements.

Community engagement is also central, with investments in social and environmental programs to address local needs and foster cooperation. These initiatives focus on improving education, health, and economic opportunities for residents.

| Key Relationship Focus | Strategy | 2024 Data/Observation |

| Industrial Buyers | Long-term supply contracts, consistent quality | Secured off-take agreements, robust demand for copper driven by energy transition. |

| Public Investors | Transparent financial reporting, earnings presentations | IDR 18.7 trillion revenue (9M 2024) vs. IDR 12.8 trillion (9M 2023), up 46%. |

| Government & Regulators | Regulatory adherence, strategic alignment, ESG compliance | Ongoing dialogue on ESG standards and local content; adherence to mining laws. |

| Local Communities | Social and environmental programs, economic empowerment | Investments in education (over 5,000 students impacted) and local infrastructure. |

Channels

Amman Mineral’s direct sales and marketing teams are pivotal in forging relationships with industrial clients, offering customized solutions for their copper, gold, and silver needs. This direct engagement facilitates a deeper understanding of customer requirements, enabling the negotiation of bespoke sales agreements. For instance, in 2024, the company continued to focus on securing long-term offtake agreements with major smelters and refiners, ensuring stable demand for its concentrate output.

PT Amman Mineral Internasional leverages extensive global logistics and shipping networks to transport its copper and gold concentrate to international buyers. This involves a complex multimodal approach, ensuring products reach markets efficiently.

The company's operations at the Batu Hijau mine are intrinsically linked to its port facilities, which are vital for the smooth and cost-effective export of its mineral products. In 2024, the global shipping industry continued to navigate fluctuating freight rates, with key routes experiencing dynamic pricing influenced by geopolitical events and demand shifts.

The official company website and dedicated investor relations portals are crucial channels for PT Amman Mineral Internasional to communicate with financial stakeholders and the public. These platforms offer direct access to vital documents like annual reports, detailed financial statements, and timely news releases, ensuring transparency and accessibility of corporate information.

Industry Conferences and Trade Shows

Participation in industry conferences and trade shows is a key channel for PT Amman Mineral Internasional to enhance its market presence and foster business growth. These events offer a platform to demonstrate its operational expertise and technological advancements to a targeted audience of industry professionals and potential clients.

These gatherings are crucial for Amman Mineral to gain insights into emerging market trends, regulatory changes, and competitive landscapes. For instance, in 2024, the global mining industry saw significant investment in sustainable practices, a trend that Amman Mineral actively engages with at these events.

- Market Visibility: Showcasing capabilities and projects to a broad industry audience.

- Networking: Connecting with potential customers, suppliers, and strategic partners.

- Trend Analysis: Gathering intelligence on new technologies and market demands.

- Business Development: Identifying new opportunities and strengthening existing relationships.

Public Relations and Media Outlets

PT Amman Mineral Internasional actively manages its public relations and media relationships to highlight its operational successes and strategic advancements. In 2024, the company continued to focus on transparent communication regarding its mining operations and sustainability programs, aiming to foster trust and understanding with the public and stakeholders.

The company's engagement with media outlets serves as a crucial channel for disseminating information about its commitment to environmental, social, and governance (ESG) principles. This proactive approach helps to shape a positive public perception and reinforce its brand image as a responsible industry player.

- Media Engagement: PT Amman Mineral Internasional's PR strategy involves regular press releases and media briefings to update on project milestones and corporate social responsibility initiatives.

- Brand Image: By consistently communicating its achievements and sustainability efforts, the company aims to cultivate a favorable brand image among investors, local communities, and the broader public.

- Information Dissemination: Media outlets are utilized to inform the public about the company's contributions to economic development and its adherence to stringent operational standards.

PT Amman Mineral Internasional utilizes direct sales, global logistics, and port facilities as key channels for product distribution and market access. These channels are supported by robust communication strategies through its website, investor relations portals, industry events, and public relations efforts. In 2024, the company focused on securing long-term offtake agreements and navigating fluctuating global shipping rates.

Customer Segments

Global industrial copper buyers represent a critical customer segment for PT Amman Mineral Internasional, encompassing international manufacturers and diverse industries that demand substantial volumes of refined copper cathodes. These buyers utilize copper for essential applications across sectors like electrical wiring, construction, and electronics manufacturing.

The strategic commissioning of Amman's smelter is specifically geared towards efficiently serving this significant global market. This focus highlights the company's commitment to meeting the high-volume needs of international industrial consumers.

In 2024, global copper demand is projected to remain robust, driven by infrastructure development and the ongoing transition towards electric vehicles and renewable energy sources. For instance, the International Copper Study Group (ICSG) reported that global refined copper usage reached approximately 25.8 million metric tons in 2023, with expectations for continued growth in 2024.

Precious metals refiners and traders are key customers for companies like PT Amman Mineral Internasional, particularly for by-product gold and silver. These businesses rely on a consistent supply of high-purity bullion to meet the demands of the global market, which includes jewelry manufacturing, industrial applications, and investment vehicles. In 2024, the global gold market, for instance, saw significant activity with central banks continuing to be net buyers, and investment demand remaining robust, underscoring the importance of reliable sources of refined precious metals.

PT Amman Mineral Internasional's sulfuric acid, a by-product of smelting, serves critical industrial needs. This segment includes fertilizer manufacturers who rely on sulfuric acid for producing essential agricultural nutrients. In 2024, the global fertilizer market was valued at approximately $250 billion, highlighting the significant demand for key inputs like sulfuric acid.

Beyond agriculture, a broad range of chemical manufacturers constitute another vital customer segment. These businesses utilize sulfuric acid in diverse processes, from metal processing and refining to the production of dyes, pigments, and detergents. The industrial chemical sector's robust activity in 2024, driven by manufacturing output, underscores the consistent demand from these users.

Commodity Traders (Historically for Concentrate)

Historically, commodity traders were a primary customer base for copper concentrate, particularly before Indonesia's copper concentrate export ban and PT Amman Mineral Internasional's smelter became fully operational. This segment was crucial for offloading the company's concentrate production.

While the landscape has significantly changed, some concentrate sales to these traders may still occur, but these are now subject to specific government approvals and regulations. This indicates a strategic shift away from relying heavily on this segment.

For instance, in 2023, PT Amman Mineral Internasional's production of copper concentrate was substantial, with the focus increasingly shifting towards domestic processing. The company's smelter ramp-up in 2024 is designed to capture more value domestically, reducing the volume available for export, even to historical trader partners.

- Historical Reliance: Commodity traders were the main buyers of copper concentrate before domestic smelter operations scaled up.

- Regulatory Shift: Export of concentrate is now highly restricted, requiring special permits, impacting this customer segment.

- Strategic Pivot: PT Amman Mineral Internasional is prioritizing domestic processing, diminishing the importance of concentrate exports to traders.

Strategic Global Partners

Strategic Global Partners are key players for PT Amman Mineral Internasional, focusing on large multinational corporations that require consistent, high-volume supply of critical raw materials like copper and gold. These partnerships are built on long-term stability and often involve bespoke contract terms tailored to the specific needs of these global entities.

For instance, in 2024, PT Amman Mineral Internasional continued to solidify its position as a reliable supplier, with significant export volumes contributing to its revenue streams. These strategic alliances are crucial for managing market volatility and ensuring predictable demand for its output.

- Long-Term Supply Agreements: Securing multi-year contracts with major international buyers.

- Customized Offtake Arrangements: Negotiating specific delivery schedules, quality standards, and pricing mechanisms.

- Strategic Resource Access: Providing global partners with access to significant reserves of copper and gold.

Global industrial copper buyers are PT Amman Mineral Internasional's primary customers, seeking refined copper cathodes for manufacturing sectors like electrical and construction. The company's smelter expansion in 2024 directly targets these high-volume international demands, aligning with a robust global copper market driven by electrification and infrastructure projects.

Precious metals refiners and traders are crucial for PT Amman Mineral Internasional's by-product gold and silver. These entities require high-purity bullion for jewelry, industrial uses, and investment, with 2024 showing continued strong demand from central banks and investors.

PT Amman Mineral Internasional's sulfuric acid serves fertilizer manufacturers, a sector valued at approximately $250 billion in 2024, and diverse chemical producers. These industrial consumers rely on sulfuric acid for essential processes, reflecting sustained manufacturing activity in 2024.

| Customer Segment | Key Products Supplied | 2024 Market Context/Data Point |

|---|---|---|

| Global Industrial Copper Buyers | Refined Copper Cathodes | Global refined copper usage projected for continued growth in 2024, following ~25.8 million metric tons in 2023 (ICSG). |

| Precious Metals Refiners & Traders | By-product Gold & Silver Bullion | Robust investment demand and continued central bank buying characterized the gold market in 2024. |

| Fertilizer Manufacturers | Sulfuric Acid | The global fertilizer market was valued at approximately $250 billion in 2024. |

| Chemical Manufacturers | Sulfuric Acid | Industrial chemical sector activity in 2024 was strong, driven by manufacturing output. |

Cost Structure

Capital expenditures are a major component of Amman Mineral Internasional's cost structure, especially for ongoing expansion projects. These investments are crucial for bringing new facilities online and increasing operational capacity.

A significant chunk of these costs is dedicated to completing and commissioning key infrastructure like the copper smelter, precious metal refinery, and power plants. Expansion of the processing plant also requires substantial capital outlay.

For the period spanning Q4 2024 through 2025, Amman has earmarked an impressive US$1.4 billion for these capital expenditure initiatives. This highlights the company's commitment to growth and development.

PT Amman Mineral Internasional's mining and processing operational costs encompass direct expenses for ore extraction, crushing, grinding, and flotation. These include significant outlays for fuel, explosives, specialized labor, and the continuous maintenance of heavy mining equipment. Effectively managing these expenditures is paramount to achieving and sustaining a competitive low-cost production profile in the global copper and gold markets.

Operating vast mining and processing operations, especially with the addition of a new smelter, demands significant energy input. This makes energy and fuel costs a critical element of PT Amman Mineral Internasional's cost structure.

The company's expenses are heavily influenced by the cost of electricity generation, which relies significantly on fuels like Liquefied Natural Gas (LNG). Furthermore, the consumption of various fuels by heavy machinery used in extraction and transportation adds substantially to these operational expenditures.

For instance, in 2023, PT Amman Mineral Internasional reported that the construction and operation of its smelter, a key driver of energy demand, was progressing. While specific 2024 energy cost figures are still emerging, the scale of operations suggests these costs will remain a dominant factor, potentially impacting profitability if fuel prices fluctuate significantly.

Labor and Personnel Costs

As a large-scale mining operation, PT Amman Mineral Internasional faces substantial labor and personnel costs. These expenses are tied to their extensive workforce, which includes highly skilled engineers, geologists, and operational staff essential for managing complex mining processes.

These costs encompass not only base salaries and wages but also comprehensive benefits packages, which are crucial for attracting and retaining top talent in a competitive industry. Furthermore, ongoing investment in training and development programs ensures their employees remain proficient with the latest mining technologies and safety protocols.

- Salaries and Wages: Covering the compensation for a large, skilled workforce.

- Employee Benefits: Including health insurance, retirement plans, and other welfare programs.

- Training and Development: Investing in skill enhancement and safety education for all personnel.

- Contract Labor: Costs associated with temporary or specialized external workforce.

Environmental and Safety Compliance Costs

PT Amman Mineral Internasional faces significant expenses related to environmental and safety compliance, a crucial element of its cost structure. These costs are directly tied to the nature of mining operations, which inherently carry environmental risks and require rigorous safety measures.

Adhering to Indonesia's stringent environmental regulations and maintaining high safety standards in its mining activities, particularly at the Batu Hijau mine, involves substantial investments. For instance, in 2024, the company continued its commitment to environmental stewardship through ongoing projects and operational adjustments designed to minimize its ecological footprint.

These expenditures encompass a range of activities:

- Environmental Management Systems: Implementing and maintaining robust systems to monitor and manage environmental impacts, including waste management and pollution control.

- Reclamation and Rehabilitation Efforts: Setting aside funds and executing plans for land reclamation and site rehabilitation post-mining operations to restore affected areas.

- Safety Protocols and Training: Investing in advanced safety equipment, regular training for personnel, and implementing strict safety procedures to prevent accidents and ensure a secure working environment.

- Compliance Monitoring and Reporting: Costs associated with regular audits, environmental impact assessments, and reporting to regulatory bodies to ensure ongoing adherence to legal requirements.

Capital expenditures represent a substantial portion of Amman Mineral Internasional's cost structure, particularly for ongoing expansion projects like the copper smelter and refinery. These investments are critical for increasing operational capacity and bringing new facilities online.

Operational costs are heavily influenced by energy and fuel consumption, with LNG being a key fuel source for power generation. The extensive use of fuel by heavy machinery in extraction and transportation also contributes significantly to these expenditures.

Labor and personnel costs are also a major factor, covering a large, skilled workforce and including salaries, benefits, and training. Environmental and safety compliance, including reclamation and rehabilitation efforts, represent further significant expenses.

| Cost Category | Description | Key Drivers | 2024/2025 Focus |

|---|---|---|---|

| Capital Expenditures | Investment in new facilities and expansion | Smelter, refinery, power plants, processing plant expansion | US$1.4 billion earmarked for Q4 2024 - 2025 |

| Operational Costs | Direct expenses for mining and processing | Fuel, explosives, maintenance, labor | Managing fuel costs (e.g., LNG) is critical |

| Personnel Costs | Wages, benefits, and training for workforce | Skilled engineers, geologists, operational staff | Attracting and retaining top talent |

| Environmental & Safety | Compliance with regulations and safety measures | Waste management, pollution control, reclamation, safety training | Minimizing ecological footprint, adhering to Indonesian regulations |

Revenue Streams

PT Amman Mineral Internasional's primary revenue stream is the sale of refined copper cathodes. This became a significant revenue source following the commissioning of their smelter, allowing them to process mined copper into a higher-value product. In 2023, the company reported significant progress in its smelter operations, contributing to its overall revenue generation strategy.

Gold bullion sales represent a crucial revenue stream for PT Amman Mineral Internasional, stemming from gold produced as a valuable co-product of its copper-gold mining activities. This segment contributes significantly to the company's overall financial performance, often featuring attractive profit margins.

In 2024, the company's gold production is projected to be a key driver of its top line. For instance, during the first quarter of 2024, PT Amman Mineral Internasional reported significant gold output, which directly translates into substantial revenue from bullion sales, bolstering its financial results.

Silver, recovered as a valuable by-product from copper-gold ore processing, represents a distinct revenue stream for PT Amman Mineral Internasional. While its contribution is generally less significant than that of copper and gold, these silver sales bolster the company's overall financial performance.

In 2024, PT Amman Mineral Internasional's financial reports indicated that silver sales contributed a notable portion to their revenue mix, underscoring its importance. For instance, the company's Q1 2024 financial results showed that while copper and gold were the primary drivers, the silver component was substantial enough to impact profitability positively.

Sulfuric Acid Sales

PT Amman Mineral Internasional's copper smelter operation generates sulfuric acid as a valuable by-product. This acid is then sold to a range of industrial clients, adding a supplementary revenue stream to the company's core business.

This diversified product offering, while not the primary focus, contributes to overall financial performance. For instance, in 2023, the company reported significant production of sulfuric acid, which was successfully marketed.

- By-product Monetization: Sulfuric acid, a direct result of copper smelting, is captured and sold.

- Industrial Customer Base: The acid serves various industrial sectors requiring this chemical.

- Revenue Diversification: This sales activity provides an additional, albeit secondary, income source.

- 2023 Performance Insight: Amman Mineral's 2023 operational reports highlight the successful sale of by-product sulfuric acid, contributing to revenue diversification.

Copper Concentrate Sales (Transitional/Conditional)

PT Amman Mineral Internasional anticipates generating revenue from copper concentrate sales during its transition phase, a stream that is both transitional and conditional. This revenue generation is contingent upon securing necessary government permits and aligns with Indonesia's policy to eventually ban raw mineral exports.

- Transitional Revenue: Sale of copper concentrate as the company moves towards producing fully refined copper products.

- Conditional Sales: Revenue is dependent on obtaining specific government permits for concentrate export.

- Policy Alignment: This stream supports Indonesia's broader objective of increasing domestic processing and value addition for its mineral resources.

- Market Context: The global copper market in 2024 continues to show strong demand, driven by electrification and infrastructure development, which supports the potential value of concentrate sales.

PT Amman Mineral Internasional's revenue streams are built upon the sale of its mined and processed commodities. The primary revenue driver is refined copper cathodes, a result of their smelter operations. Gold bullion sales, derived from gold as a co-product, also contribute significantly. Additionally, silver, a by-product of copper-gold processing, and sulfuric acid, a by-product of smelting, provide supplementary income, diversifying the company's revenue base.

| Revenue Stream | Primary Product | 2024 Projection/Activity | 2023 Activity |

|---|---|---|---|

| Copper Sales | Refined Copper Cathodes | Key revenue driver post-smelter commissioning. | Significant contribution following smelter operations. |

| Gold Sales | Gold Bullion | Projected to be a key driver of top-line growth; Q1 2024 saw significant output. | Contributes significantly to financial performance. |

| Silver Sales | Silver (By-product) | Notable portion of revenue mix; Q1 2024 results showed substantial impact. | Bolsters overall financial performance. |

| Sulfuric Acid Sales | Sulfuric Acid (By-product) | Supplementary income from industrial clients. | Successful marketing of significant production reported. |

| Copper Concentrate Sales | Copper Concentrate | Transitional revenue, contingent on permits; strong global demand in 2024. | Potential revenue source during transition. |

Business Model Canvas Data Sources

The PT Amman Mineral Internasional Business Model Canvas is built upon a foundation of robust financial reports, comprehensive market research, and internal operational data. These sources are crucial for accurately defining customer segments, value propositions, and revenue streams.