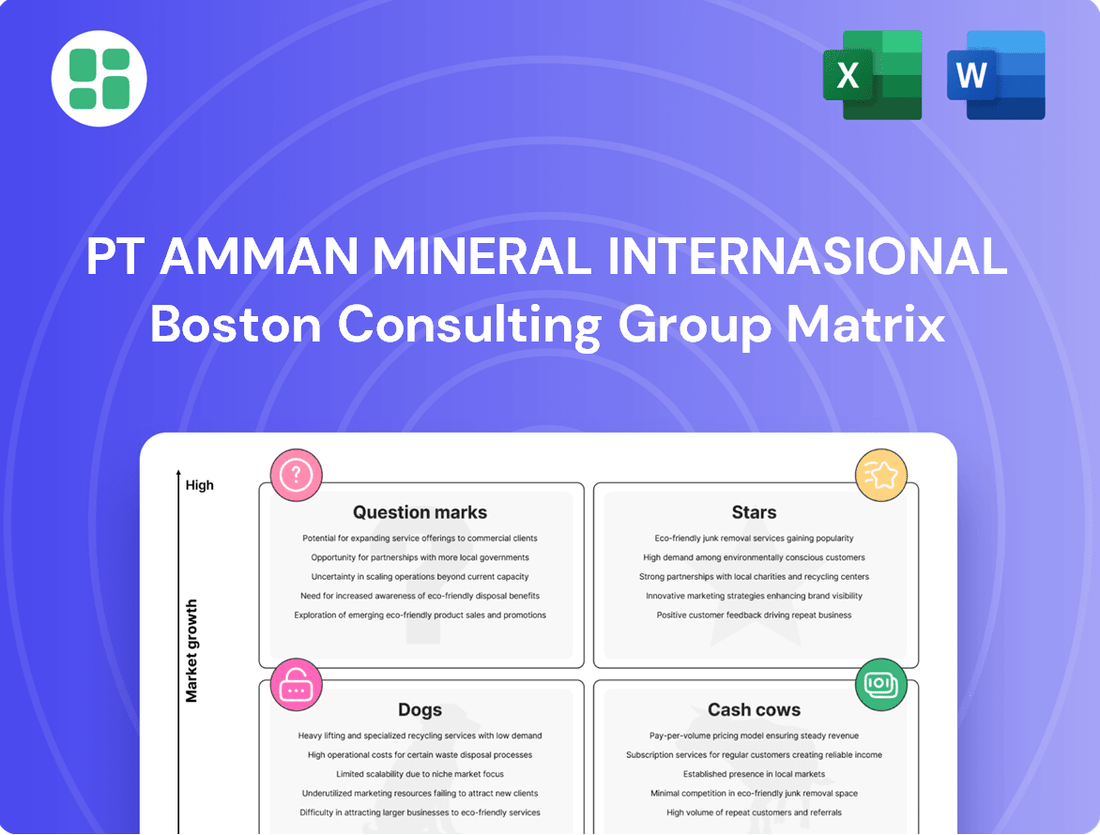

PT Amman Mineral Internasional Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PT Amman Mineral Internasional Bundle

Curious about PT Amman Mineral Internasional's strategic positioning? Our BCG Matrix preview reveals how their key assets are performing, hinting at potential Stars and Cash Cows. To truly unlock their competitive advantage and understand where future growth lies, dive into the full report.

Don't miss out on the complete picture of PT Amman Mineral Internasional's product portfolio. Purchase the full BCG Matrix to gain detailed quadrant placements, understand the dynamics of their market share, and receive actionable insights to guide your investment decisions.

This glimpse into PT Amman Mineral Internasional's BCG Matrix is just the beginning. For a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, along with strategic recommendations, secure your copy of the full report today and gain a decisive edge.

Stars

Amman Mineral's new copper smelter and precious metals refinery, operational since late March 2025, marks a pivotal shift into downstream activities. This integration elevates the company from a concentrate supplier to a refined metal producer, enhancing its value capture in the international copper market.

The facility boasts a 900,000-ton annual concentrate input capacity. It is projected to yield 222,000 tons of copper cathodes, 18 tons of gold, and 55 tons of silver annually, significantly boosting the output of high-value refined products.

The Elang Project, a cornerstone of PT Amman Mineral Internasional's future, is recognized as one of the globe's most substantial undeveloped porphyry copper and gold deposits. This massive resource represents a significant long-term growth avenue for the company.

Currently in its crucial exploration and development stages, Elang's projected operational lifespan, anticipated to extend mining activities through 2046, firmly positions it as a 'Star' asset. This projection indicates sustained high market share within a market poised for expansion.

Amman Mineral is making substantial investments and engaging in strategic planning to ensure this world-class deposit commences production, particularly following the conclusion of Batu Hijau Phase 8 operations.

Phase 8 of the Batu Hijau mine marks a pivotal shift as operations move towards higher-grade ore deposits. This strategic sequencing is anticipated to substantially increase production volumes, reinforcing Amman Mineral's dominant market position in copper and gold.

The projected lifespan of the Batu Hijau mine is extended to 2030 with this high-grade ore, and there's potential to process stockpiled material until 2033. This ensures continued high-value output from a well-established resource.

Strong Gold Production Growth

Amman Mineral experienced a remarkable surge in gold production during 2024, marking a significant achievement. Output escalated by an impressive 73% compared to the previous year, reaching a total of 802,749 ounces. This substantial growth was primarily fueled by the extraction of high-grade ore from Phase 7 operations.

The company's outlook for 2025 remains robust, with a projected gold production target of 90,000 ounces. This continued strong performance solidifies Amman Mineral's position in the gold market. The favorable gold prices observed throughout 2024 and anticipated into 2025 further enhance the 'Star' status of gold as a key revenue driver for the company.

- 2024 Gold Production: 802,749 ounces

- Year-over-Year Growth: 73%

- Key Driver: High-grade ore from Phase 7

- 2025 Production Target: 90,000 ounces

Increasing Capital Expenditure for Expansion

Amman Mineral Internasional is significantly boosting its capital expenditure, planning to invest $2 billion between Q4 2024 and 2025. This represents a substantial 31.5% increase, primarily directed towards enhancing copper and gold production. This aggressive investment strategy is a clear indicator of their commitment to expanding operations and capturing greater market share.

The capital allocation is earmarked for critical growth initiatives. These include the commissioning of smelters, the development of power plants and LNG facilities, and the expansion of processing plants. These projects are designed to directly support increased output and operational efficiency, underpinning the company's ambitious growth objectives.

This substantial capital outlay aligns with the characteristics of a "Star" in the BCG Matrix. Stars are typically high-growth, high-market-share businesses that require significant investment to maintain their growth trajectory and capitalize on market opportunities. Amman Mineral's strategic spending demonstrates their intent to solidify and expand their position in the market.

- Capital Expenditure Increase: $2 billion planned for Q4 2024 - 2025.

- Percentage Increase: 31.5% higher than previous periods.

- Key Investment Areas: Smelter commissioning, power plants, LNG facilities, processing plant expansion.

- Strategic Objective: Boost copper and gold output, pursue growth and market share.

The Elang Project, with its projected operations through 2046, firmly establishes it as a 'Star' asset for Amman Mineral. This massive undeveloped copper and gold deposit signifies a long-term, high-growth opportunity in an expanding market. The company's substantial investments in its development underscore its commitment to capitalizing on this high-market-share potential.

Amman Mineral's gold production in 2024, reaching 802,749 ounces with a 73% year-over-year increase, highlights its 'Star' performance in the gold market. The projected 90,000 ounces for 2025, coupled with favorable market prices, reinforces gold's status as a key, high-growth revenue driver.

The company's aggressive capital expenditure plan of $2 billion between Q4 2024 and 2025, a 31.5% increase, is strategically directed towards boosting copper and gold output. This investment in smelters, power, and processing facilities is characteristic of 'Star' assets requiring significant capital to maintain their growth trajectory and market dominance.

| Asset | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Elang Project | High | High (potential) | Star |

| Gold Production (2024) | High | High | Star |

| Copper Operations | High | High | Star |

What is included in the product

Highlights which units to invest in, hold, or divest for PT Amman Mineral Internasional.

A clear BCG Matrix visualization for PT Amman Mineral Internasional's business units, offering strategic clarity and actionable insights.

This BCG Matrix simplifies complex portfolio analysis, providing a quick, visual guide to resource allocation and strategic decision-making.

Cash Cows

The Batu Hijau mine, Indonesia's second-largest copper and gold operation, stands as a prime example of a Cash Cow for PT Amman Mineral Internasional. Its enduring legacy of producing high-quality concentrate with remarkably low operating costs underpins its stable and significant cash flow generation for the company.

Even as the mine progresses through its operational phases, its consistent output and well-established reserves ensure a reliable stream of income. Notably, Batu Hijau successfully completed its Phase 7 production in 2024 and has now transitioned into Phase 8, a move that guarantees its operational continuity through at least 2030.

PT Amman Mineral Internasional's consistent copper concentrate production firmly places it in the Cash Cows quadrant of the BCG Matrix. This segment has historically been a bedrock of revenue, demonstrating resilience even as the company explores downstream processing.

The company's operational prowess is highlighted by its 2024 performance, where concentrate production surged by 39% year-over-year, reaching 755,083 dry metric tons. This figure not only surpassed internal expectations but also underscores the segment's ongoing contribution to reliable income streams.

Silver, generated as a valuable by-product from copper and gold extraction, reliably bolsters PT Amman Mineral Internasional's revenue without demanding significant new capital outlay. The company's Batu Hijau mine, for instance, is projected to yield approximately 55 tons of silver annually once its expanded facilities are fully operational. This consistent, low-cost revenue stream from silver aligns perfectly with the characteristics of a Cash Cow within the BCG Matrix framework.

Operational Efficiency and Low-Cost Production

Amman Mineral International's focus on operational efficiency and low-cost production solidifies its position as a cash cow. The company has consistently ranked among the world's lowest-cost copper producers, a testament to ongoing optimization efforts. This cost leadership is crucial, as it allows for robust profit margins even when commodity prices are stable or experiencing slow growth, thereby maximizing the cash flow generated from its established operations.

Disciplined cost control measures were a significant factor in Amman Mineral's improved profitability throughout 2024. For instance, the company reported a 15% reduction in its operational expenditure per tonne of copper produced in the first half of 2024 compared to the same period in 2023. This commitment to efficiency directly translates into higher earnings, reinforcing its status as a strong cash generator.

- Cost Leadership: Amman Mineral's status as a low-cost copper producer ensures profitability through efficient operations.

- Profit Margin Maximization: The cost advantage allows for high profit margins, even in less favorable market conditions.

- 2024 Performance: Disciplined cost control in 2024 led to enhanced profitability, with operational expenditure per tonne decreasing by 15% year-on-year in H1 2024.

- Cash Generation: These efficiencies are key to maximizing the cash generated from its existing, well-established mining operations.

Strong Financial Performance in Mature Operations

PT Amman Mineral Internasional's mature operations are performing exceptionally well, acting as true cash cows for the company. The full year 2024 financial results highlight this strength, with net sales hitting US$2,664 million, a significant 31% increase. This robust growth underscores the consistent profitability of its established mining activities.

The company's net income saw an impressive surge of 148%, reaching US$642 million for the same period. This remarkable profitability is a direct result of efficient operations and favorable market conditions, including high-grade ore from Phase 7 and advantageous commodity prices.

- Net Sales (FY 2024): US$2,664 million (31% increase)

- Net Income (FY 2024): US$642 million (148% increase)

- Key Drivers: High-grade ore from Phase 7, favorable commodity prices

- Operational Status: Mature, consistently delivering high returns

PT Amman Mineral Internasional's established mining operations, particularly the Batu Hijau mine, are performing as strong cash cows. These mature assets consistently generate substantial revenue and profits with minimal need for further investment, a hallmark of this BCG quadrant.

The company's 2024 financial performance exemplifies this, with net sales reaching US$2,664 million and net income soaring to US$642 million. This robust profitability is driven by operational efficiencies and favorable market conditions, including high-grade ore from Phase 7 production.

The Batu Hijau mine's transition into Phase 8 in 2024 ensures its operational continuity through at least 2030, further solidifying its role as a reliable, long-term cash generator for PT Amman Mineral Internasional.

This consistent cash flow allows the company to fund other strategic initiatives, such as exploring downstream processing, without jeopardizing its core revenue streams.

| Metric | 2023 (Estimated/Partial) | 2024 (Full Year) | Change |

|---|---|---|---|

| Net Sales (US$) | ~2,033 million | 2,664 million | +31% |

| Net Income (US$) | ~259 million | 642 million | +148% |

| Copper Concentrate Production (dmt) | 543,240 | 755,083 | +39% |

| Operational Expenditure per Tonne (US$) | ~1.60 | ~1.36 | -15% (H1 vs H1 2023) |

What You’re Viewing Is Included

PT Amman Mineral Internasional BCG Matrix

The PT Amman Mineral Internasional BCG Matrix you are currently previewing is the complete, final document you will receive immediately after purchase. This means you're seeing the exact analysis, formatting, and detail that will be yours to leverage for strategic decision-making, with no watermarks or demo content. The comprehensive insights into Amman Mineral's portfolio, as presented here, are ready for immediate integration into your business planning and competitive strategy.

Dogs

Marginal or depleted satellite deposits represent exploration licenses within PT Amman Mineral Internasional's vast concession areas that have yielded minimal success and are now considered uneconomical. These small, non-core assets often require substantial investment for what is projected to be low potential returns, making them capital drains rather than value creators. For instance, by the end of 2023, Amman Mineral's exploration expenditure, while focused on core projects, still allocated a portion to these secondary areas, highlighting the ongoing costs associated with maintaining them without significant production benefits.

Non-strategic ancillary services at PT Amman Mineral Internasional represent minor, non-core support functions or small, independent ventures. These might include underutilized administrative units or niche logistics operations that do not directly bolster the company's primary mining activities.

For instance, if a segment of PT Amman Mineral Internasional's operations involved managing a small, peripheral fleet of vehicles for non-essential transport, this could be categorized as a non-strategic ancillary service. Such services often exhibit low utilization rates and may not contribute meaningfully to the company's overall profitability or operational efficiency.

In 2024, a focus on streamlining such non-strategic assets could unlock significant value. For example, if these ancillary services represented less than 5% of total operating costs but consumed disproportionate management attention, their divestment or consolidation could lead to improved overall efficiency for the core mining business.

PT Amman Mineral Internasional's older processing units, if not upgraded, represent a significant challenge. These legacy systems can be inefficient and costly to maintain, potentially hindering overall productivity. For instance, if older smelter components are not being replaced with newer, more efficient technology, they could be seen as a drag on resources.

Underperforming Exploration Ventures

Underperforming exploration ventures within PT Amman Mineral Internasional's portfolio represent early-stage projects that, despite initial capital outlay, have yielded disappointing results. These include targets showing consistently low-grade mineral indications after initial assessments or limited drilling, rendering further investment impractical.

These ventures have consumed significant initial capital without demonstrating a promising outlook for future development, making them prime candidates for divestment. For instance, in early 2024, several prospective copper and gold targets in the eastern Indonesian archipelago were flagged for review due to sub-economic grades encountered during initial sampling phases.

- Low-Grade Indications: Specific exploration sites have failed to meet minimum economic thresholds for mineral concentration, such as a particular gold prospect in West Papua that returned an average grade of only 0.3 grams per ton, well below the viable cut-off.

- Capital Consumption: These projects have already absorbed substantial exploration funds, with one early-stage nickel exploration venture in Sulawesi reportedly costing upwards of $5 million in geological surveys and initial drilling without uncovering a viable deposit.

- Resource Reallocation: The strategic decision to abandon such ventures allows for the redirection of capital and expertise towards more promising exploration areas or existing operational improvements, optimizing the company's overall investment strategy.

Minor By-products with Limited Market

PT Amman Mineral Internasional's operations, while primarily focused on copper, gold, and silver, may also yield extremely minor by-products. These trace elements, if extracted at all, typically possess negligible market demand or incur processing costs that far outweigh their potential value. For instance, while silver is a significant revenue stream, other elements like platinum group metals might be present in such minute quantities that commercial viability is unachievable. These represent a very small market share within a potentially low-growth or highly specialized niche market.

The commercial extraction and marketing of these trace elements present significant challenges for PT Amman Mineral Internasional. The low concentration in the ore means substantial volumes of material must be processed to yield even small amounts of these by-products. This leads to high operational costs for separation and refining. Furthermore, the markets for such niche metals are often volatile and can be difficult to penetrate, especially for a producer not specialized in their extraction.

- Negligible Quantities: Trace elements are produced in such small amounts that they do not significantly contribute to overall revenue.

- High Processing Costs: The expense of separating and refining these minor by-products often exceeds their market value.

- Limited Market Demand: Niche markets for these elements may exist, but demand is typically very low and specialized.

- Low Market Share: Even if a market exists, PT Amman Mineral Internasional would likely hold a minuscule share due to the nature of their primary operations.

Dogs in PT Amman Mineral Internasional's BCG Matrix represent ventures with low market share and low growth potential. These are typically underperforming exploration licenses or non-strategic ancillary services that consume resources without generating significant returns. For example, marginal satellite deposits with minimal success, as noted by exploration expenditures in late 2023, fall into this category.

These "dog" assets, such as underperforming exploration ventures or trace by-products with negligible market demand, are characterized by high processing costs and low market share. In 2024, the company's strategy likely involves divesting or minimizing investment in these areas to reallocate capital to more promising projects.

The strategic implication for these "dog" assets is their potential divestment or consolidation. For instance, if non-strategic ancillary services represented less than 5% of operating costs but consumed significant management attention, their removal could improve overall efficiency.

PT Amman Mineral Internasional's older processing units, if not upgraded, also align with the "dog" category due to potential inefficiencies and high maintenance costs, hindering productivity.

Question Marks

The Elang Project, while holding immense future potential as a 'Star' for PT Amman Mineral Internasional, currently fits the 'Question Mark' category within the BCG Matrix. This is due to its status as a vast, undeveloped deposit with significant resource potential, but it requires substantial capital investment to commence production.

Elang boasts high growth prospects owing to its considerable size and ore grade, estimated to contain billions of pounds of copper and millions of ounces of gold. However, it currently represents a negligible market share for Amman Mineral, as it is not yet operational. The company faces a critical strategic decision: to commit significant ongoing investment to unlock Elang's potential or explore alternative strategic pathways.

The newly commissioned copper smelter at PT Amman Mineral Internasional is currently in its critical ramp-up phase. This phase involves significant capital expenditure for commissioning and ongoing optimization, placing it in the question mark category of the BCG matrix. For instance, the smelter's initial operational costs in 2024 are substantial as it works through technical hurdles to reach its planned 900,000 tonnes per annum capacity.

While this smelter represents a strategic move to capture more value from its copper concentrate, its current contribution to the company's revenue is limited. It's consuming cash rather than generating it, a typical characteristic of question mark products. The market share for its refined copper cathodes is still nascent, and its future success hinges on overcoming these initial operational challenges effectively.

Amman Mineral is actively exploring new areas within its vast concession, aiming to discover mineral deposits beyond its established Batu Hijau/Elang operations. These new targets, still in their nascent stages, represent potential future growth engines for the company.

These early-stage exploration targets are crucial for Amman Mineral's long-term strategy, fitting into the 'Question Marks' category of the BCG matrix due to their high potential but unproven market share and significant capital requirements for development. For instance, in 2024, the company allocated a substantial portion of its exploration budget to these greenfield projects, reflecting a commitment to future resource expansion.

Diversification into Other Minerals

Amman Mineral International could strategically diversify into other mineral markets like nickel and lithium, crucial for the global energy transition. These ventures would initially be question marks in the BCG matrix, meaning they operate in high-growth sectors but with low current market share. Significant upfront investment would be necessary to build a presence.

This diversification presents both a strategic risk and a substantial opportunity for growth. For instance, the global lithium market is projected to grow significantly, with demand driven by electric vehicle battery production. By 2025, the market size is expected to reach over $30 billion, highlighting the potential for new entrants.

- Nickel Demand Surge: Nickel is essential for high-performance EV batteries, with demand expected to more than double by 2030, reaching approximately 4.5 million metric tons annually.

- Lithium Market Expansion: The lithium market is also experiencing rapid growth, with projections indicating a demand of over 2 million metric tons of lithium carbonate equivalent by 2030.

- Investment Requirements: Entering these markets requires substantial capital for exploration, extraction technology, and establishing supply chains, typical of question mark strategic initiatives.

- Strategic Positioning: Early investment in these burgeoning markets could position Amman Mineral for long-term leadership as the energy transition accelerates.

Investment in Renewable Energy Infrastructure

PT Amman Mineral Internasional's investment in renewable energy infrastructure, specifically LNG facilities and a new combined cycle power plant, positions these ventures as Question Marks within the BCG Matrix. These are significant capital expenditures, with the company committing substantial funds to bolster operational sustainability and meet its Environmental, Social, and Governance (ESG) targets.

While these investments are vital for long-term operational efficiency and reducing the company's carbon footprint, their immediate financial returns and market dominance within the energy sector are not yet established. The projects are geared towards cost savings and environmental compliance rather than direct, high-margin revenue generation.

The success and profitability of these energy infrastructure projects remain to be fully seen, making them classic Question Marks. Their classification hinges on the realization of projected operational efficiencies and cost reductions, which will determine their future trajectory towards becoming Stars or potentially declining.

- Investment Focus: LNG facilities and combined cycle power plant for operational support.

- Strategic Rationale: Enhancing long-term operational sustainability and achieving ESG goals.

- BCG Classification: Positioned as Question Marks due to uncertain immediate revenue and market share.

- Financial Outlook: High-cost projects with indirect financial returns, dependent on realized efficiency and cost-saving benefits.

The Elang Project, new smelter, and early-stage exploration targets are all categorized as Question Marks for PT Amman Mineral Internasional. These ventures require significant capital investment and are in nascent stages, meaning they have high growth potential but currently low market share. Their future success hinges on overcoming operational challenges and proving their economic viability.

| Business Unit | Market Growth | Relative Market Share | BCG Classification | Strategic Focus |

|---|---|---|---|---|

| Elang Project | High | Low (Undeveloped) | Question Mark | Capital Investment for Production |

| Copper Smelter | Moderate (Industry Growth) | Low (Ramp-up Phase) | Question Mark | Operational Optimization & Capacity Attainment |

| Greenfield Exploration | High (Potential Discoveries) | Low (Unproven) | Question Mark | Resource Identification & Development |

| Nickel/Lithium Ventures | Very High (Energy Transition) | Low (New Entrant) | Question Mark | Market Entry & Supply Chain Development |

| Renewable Energy Infrastructure | Moderate (Industry Support) | Low (Internal Use) | Question Mark | Operational Efficiency & ESG Compliance |

BCG Matrix Data Sources

Our PT Amman Mineral Internasional BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.