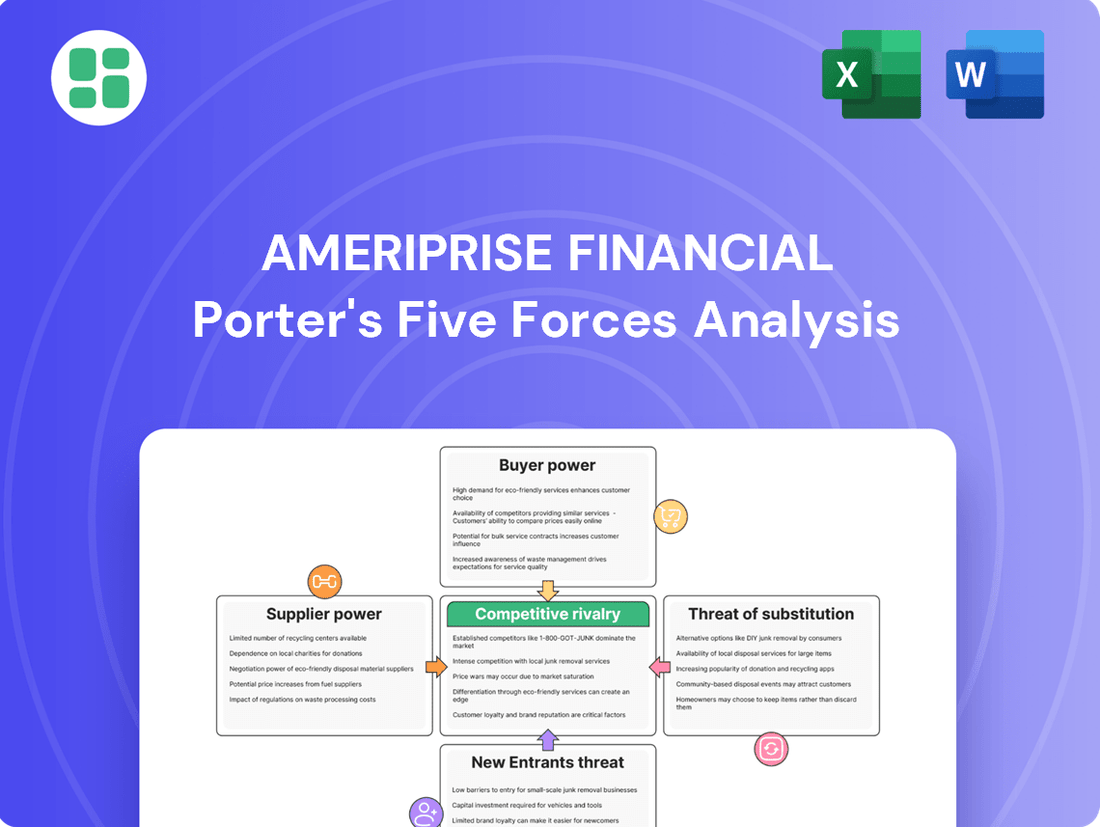

Ameriprise Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ameriprise Financial Bundle

Ameriprise Financial navigates a complex landscape shaped by intense rivalry and significant buyer power. Understanding these forces is crucial for any strategic planner or investor focused on the financial services sector.

The complete report reveals the real forces shaping Ameriprise Financial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ameriprise Financial's reliance on specialized technology and data providers for AI and cybersecurity means these suppliers hold considerable sway. The financial sector's demand for advanced analytics and robust security solutions, coupled with a limited pool of top-tier providers, amplifies their bargaining power. In 2024, spending on AI in financial services was projected to reach over $15 billion globally, highlighting the critical nature of these relationships and the potential for increased costs or limited access to essential tools.

The market for experienced financial advisors is intensely competitive, giving these professionals significant leverage. Ameriprise, like its peers, invests heavily in recruiting and retaining top talent, recognizing that advisors are crucial partners in delivering client value and driving asset growth.

In 2024, the demand for skilled financial advisors remained robust, with industry reports highlighting a persistent shortage of experienced professionals. This scarcity directly translates to increased bargaining power for advisors, who can command better compensation and support structures.

Ameriprise's strategy of offering competitive platforms, advanced technology, and robust support systems underscores the firm's acknowledgment of this supplier power. The ability to attract and retain these advisors is paramount, directly influencing Ameriprise's capacity to grow its assets under management and enhance its service offerings.

The bargaining power of third-party product manufacturers and investment funds for Ameriprise is influenced by their brand recognition and the distinctiveness of their investment strategies. For these external entities, securing a spot on Ameriprise's preferred distribution list, often referred to as gaining 'shelf space,' can be crucial for accessing a broad client base. This often necessitates offering competitive terms or special incentives.

In 2023, the global asset management industry saw significant inflows into passive strategies, with ETFs attracting substantial capital, indicating a preference for cost-effective solutions that could shift bargaining power towards larger, more established index providers. Conversely, niche or actively managed funds with proven alpha generation may command higher fees and exert more influence.

Regulatory and Compliance Services

The bargaining power of suppliers in regulatory and compliance services for Ameriprise Financial is substantial. The financial industry faces a constantly shifting regulatory environment, demanding specialized legal and compliance expertise. Failure to adhere to these regulations can result in severe penalties, making these services critical for Ameriprise. For instance, in 2024, financial institutions globally continued to invest heavily in compliance technology and personnel to navigate complex rules like those governing data privacy and anti-money laundering.

These specialized service providers, often boutique firms or highly experienced legal departments, possess deep knowledge of intricate financial regulations. This specialized knowledge, coupled with the high stakes of non-compliance, gives them considerable leverage. The cost of engaging these experts, while significant, is often viewed as a necessary investment to avoid much larger fines and reputational damage. Reports from 2024 indicated that compliance spending for large financial firms could reach tens of billions of dollars annually, reflecting the criticality of these outsourced or specialized internal functions.

- High Switching Costs: Transitioning to a new regulatory compliance provider involves significant effort in knowledge transfer, system integration, and retraining, making it costly for Ameriprise to switch suppliers.

- Concentration of Expertise: A limited number of firms and individuals possess the deep, specialized knowledge required for navigating complex financial regulations, reducing the pool of viable alternatives for Ameriprise.

- Criticality of Service: The services provided by regulatory and compliance experts are essential for Ameriprise's legal operation and risk mitigation, giving suppliers significant power in negotiations.

- Regulatory Complexity: The ever-evolving and intricate nature of financial regulations necessitates ongoing engagement with specialized suppliers who can interpret and implement these changes effectively.

Infrastructure and Real Estate Providers

Ameriprise Financial's reliance on physical infrastructure, such as offices and branches for its network of financial advisors, grants some bargaining power to real estate and infrastructure providers. The availability of commercial real estate, however, is generally high, and the increasing adoption of remote and hybrid work models by companies like Ameriprise can mitigate this power. For instance, in 2024, many large financial firms continued to optimize their office space, with some reducing their overall square footage by 10-20% as hybrid work arrangements became more entrenched, lessening dependence on specific property owners.

The bargaining power of infrastructure and real estate providers for Ameriprise is further influenced by the company's strategic shifts towards digital operations. As Ameriprise enhances its digital platforms and client engagement tools, the need for extensive physical footprints diminishes. This trend is supported by industry data showing a continued decline in office vacancy rates in many major markets throughout 2024, indicating a buyer's or tenant's market that limits the leverage of landlords.

- Real Estate Dependence: Ameriprise utilizes physical locations for advisors and operations, giving property owners some leverage.

- Mitigating Factors: Widespread commercial real estate availability and the rise of remote/hybrid work models reduce this leverage.

- Digital Transformation: Increasing digital operations lessen the need for physical space, further weakening supplier power.

The bargaining power of Ameriprise Financial's suppliers, particularly in technology and specialized data, is significant. These providers are crucial for AI and cybersecurity, areas experiencing massive investment in financial services. In 2024, global spending on AI in this sector was expected to exceed $15 billion, underscoring the critical nature of these relationships and the potential for increased costs or restricted access to essential tools.

Financial advisors themselves represent a key supplier group, wielding considerable power due to intense market competition for talent. Ameriprise, like its competitors, invests heavily in attracting and retaining these professionals, recognizing their vital role in client service and asset growth. The persistent shortage of experienced advisors in 2024 meant they could negotiate better compensation and support.

Third-party product manufacturers and investment funds also possess bargaining power, especially those with strong brand recognition or unique strategies. Gaining distribution access within Ameriprise is vital for these entities, often leading them to offer competitive terms. The trend towards passive investing in 2023, with significant inflows into ETFs, shifted some power towards larger index providers, though funds with proven alpha could still command higher fees.

Suppliers of regulatory and compliance services hold substantial leverage over Ameriprise Financial. The complex and ever-changing regulatory landscape necessitates specialized expertise, making these services critical for legal operation and risk mitigation. In 2024, financial institutions globally continued significant investments in compliance technology and personnel to navigate rules like data privacy and anti-money laundering, with compliance spending for large firms potentially reaching tens of billions annually.

| Supplier Category | Factors Influencing Bargaining Power | Impact on Ameriprise | 2024 Data/Trends |

| Technology & Data Providers | Specialized knowledge, high demand for AI/cybersecurity | Potential for increased costs, limited access to tools | Global AI spending in financial services > $15 billion |

| Financial Advisors | Market competition, shortage of experienced talent | Higher compensation demands, need for robust support | Persistent shortage of experienced professionals |

| Product Manufacturers/Funds | Brand recognition, investment strategy distinctiveness | Negotiation for distribution access, competitive terms | Shift towards passive investing, ETF inflows |

| Regulatory & Compliance Services | Specialized expertise, critical nature of services, regulatory complexity | Significant costs, essential for legal operation | High compliance spending by financial firms |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Ameriprise Financial's position in the financial services industry.

Gain immediate clarity on competitive pressures with a visual summary of all five forces, simplifying complex strategic analysis.

Customers Bargaining Power

Ameriprise Financial clients, from individuals to institutions, now demand intuitive digital platforms and immediate access to their financial data. This shift is particularly pronounced among younger, tech-savvy demographics who are accustomed to seamless online interactions.

These elevated expectations mean clients are more likely to switch providers if Ameriprise doesn't offer advanced digital tools and personalized, responsive service. For instance, a 2024 survey indicated that 70% of investors consider a firm's digital capabilities a key factor in their decision-making process.

Customers today are incredibly well-informed, thanks to the internet. They can easily research and compare Ameriprise Financial's offerings against competitors, understanding pricing, services, and performance metrics. This readily available information significantly boosts their bargaining power.

While switching financial advisors isn't always instantaneous, the digital landscape is making it simpler. Platforms offering transparent fee structures and easy account transfer processes are emerging, reducing the perceived hassle. For instance, in 2024, many robo-advisors reported significant inflows, indicating a growing willingness among investors to move assets if better value or a more user-friendly experience is perceived elsewhere.

Customers in financial services are highly price-sensitive, often making their provider choice based on cost. This means firms like Ameriprise face constant pressure to offer competitive pricing and review their fee structures. For instance, many investors actively compare advisory fees, with a significant portion willing to switch providers for even a small reduction in costs.

Diversified Service Offerings Reduce Power

Ameriprise Financial's broad range of services, including financial planning, wealth management, asset management, and insurance, significantly diminishes individual customer bargaining power. This integrated approach fosters client loyalty, making it less probable for customers to switch providers as their diverse financial needs are met under one roof. For instance, as of Q1 2024, Ameriprise reported total assets under management and administration of $1.37 trillion, indicating a substantial client base deeply embedded within its ecosystem.

The company's strategy to offer a comprehensive financial solution acts as a deterrent to customers seeking to negotiate terms or switch providers for individual services. By providing a holistic financial experience, Ameriprise increases client stickiness, thereby reducing their ability to exert pressure on pricing or service terms.

- Diversified Offerings: Financial planning, wealth management, asset management, and insurance solutions.

- Client Integration: Comprehensive suite increases client stickiness and reduces the likelihood of switching.

- Reduced Negotiation Power: Customers are less likely to seek better terms when their multiple needs are met by one provider.

- Assets Under Management: Ameriprise managed $1.37 trillion in assets and administration as of Q1 2024, demonstrating significant client commitment.

Institutional and High-Net-Worth Client Influence

While individual retail clients might have less sway, Ameriprise's institutional and high-net-worth clients possess considerable bargaining power. These larger clients manage substantial assets, allowing them to negotiate better terms and demand customized services. For instance, in 2024, a significant portion of Ameriprise's revenue is derived from these sophisticated client segments, making their demands a key factor in the company's operational strategy and profitability.

The ability of these influential clients to shop around for the best deals or to leverage their assets for preferential treatment directly impacts Ameriprise's pricing power and service delivery models. This dynamic is particularly relevant as the financial services industry continues to see consolidation and increased competition for large-scale mandates.

- Institutional clients control significant asset volumes, enabling negotiation leverage.

- High-net-worth individuals can demand tailored and premium services.

- Favorable terms negotiated by large clients can impact Ameriprise's profit margins.

- Client concentration among large accounts highlights their bargaining strength.

Ameriprise Financial faces a growing challenge from well-informed customers who can easily compare services and pricing, increasing their bargaining power. For example, a 2024 survey revealed that 70% of investors prioritize a firm's digital tools when choosing a provider, pushing Ameriprise to enhance its online offerings.

While Ameriprise's integrated approach, managing $1.37 trillion in assets as of Q1 2024, reduces individual client leverage, large institutional and high-net-worth clients wield considerable influence. These clients can negotiate better terms and demand customized services, impacting Ameriprise's profitability.

| Client Segment | Bargaining Power Factors | Impact on Ameriprise |

|---|---|---|

| Retail Clients | Digital expectations, price sensitivity, information access | Pressure on digital investment and fee competitiveness |

| Institutional/HNW Clients | Asset volume, demand for customization, negotiation ability | Influences pricing, service models, and profitability for large accounts |

Full Version Awaits

Ameriprise Financial Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual Ameriprise Financial Porter's Five Forces Analysis, detailing the competitive landscape and strategic considerations for the company. Once you complete your purchase, you’ll get instant access to this exact file, providing a comprehensive understanding of industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes.

Rivalry Among Competitors

Ameriprise operates within a highly fragmented and diverse global financial services industry. Its competitors range from large, well-established institutions like Morgan Stanley, Charles Schwab, and Fidelity Investments, which manage trillions in assets, to countless smaller, independent registered investment advisors, securities brokers, asset managers, banks, and insurance companies.

The battle for skilled financial advisors is incredibly intense. Firms are constantly on the lookout for experienced professionals, actively poaching talent from competitors. This talent war means that even established players like Ameriprise must work hard to keep their best advisors engaged and satisfied.

Ameriprise itself is a player in this talent acquisition game, strategically bringing in advisors to bolster its ranks and drive expansion. This focus on advisor recruitment highlights that the competition isn't just about winning clients' money; it's equally about securing the expertise to manage it effectively. In 2023, the wealth management industry saw significant advisor movement, with many firms reporting net advisor gains through recruitment.

Competitive rivalry in the financial services sector, including for Ameriprise, is largely fueled by firms striving to stand out through personalized advice and novel product offerings. A key differentiator is the commitment to an enhanced client experience, a strategy widely adopted across the industry.

Ameriprise itself emphasizes a client-centric model, integrating technology to deliver a full spectrum of financial services. This approach is crucial in an environment where firms are constantly seeking to deepen client relationships and offer more value.

The landscape is further shaped by the introduction of new financial products, particularly in areas like alternative investments. For instance, in 2024, the alternative investment market continued to see significant inflows, with a notable increase in demand for private equity and real estate funds among retail investors, presenting both opportunities and competitive pressures for firms like Ameriprise to innovate and adapt their product suites.

Market Volatility and Regulatory Pressures

The financial services sector, including Ameriprise Financial, faces significant competitive rivalry driven by market volatility and increasing regulatory scrutiny. Firms must constantly adapt to changing economic conditions and a complex web of rules, which often necessitates substantial investments in compliance and risk management systems. This dynamic environment can squeeze profit margins and alter competitive advantages as companies strive to maintain stability and meet evolving legal requirements.

For instance, the ongoing adjustments to capital requirements and consumer protection laws in 2024 continue to shape how financial institutions operate. These pressures can lead to consolidation as smaller firms struggle to absorb compliance costs, thereby intensifying competition among larger, more established players like Ameriprise. The need to navigate these external forces means that operational efficiency and strategic agility are paramount for sustained success.

- Market Volatility Impact: Increased market swings can lead to unpredictable revenue streams, forcing firms to reallocate resources and potentially impacting investment strategies.

- Regulatory Adaptation Costs: Compliance with new regulations, such as those related to data privacy and investment advisory standards, requires ongoing expenditure, affecting profitability.

- Competitive Response: Firms that can effectively manage volatility and regulatory changes often gain a competitive edge by demonstrating stability and trustworthiness to clients.

Mergers and Acquisitions for Scale and Capabilities

The financial services sector, including firms like Ameriprise Financial, is experiencing a notable surge in mergers and acquisitions. This trend is driven by companies aiming to build scale, gain specialized skills, expand into new geographical areas, or improve operational efficiency.

This consolidation intensifies competition among larger entities for market share and client assets. For instance, in 2024, the wealth management industry saw significant M&A activity, with several multi-billion dollar deals announced, aimed at achieving greater economies of scale and broader service offerings.

- Increased Concentration: M&A activity leads to fewer, larger players dominating the market.

- Capability Acquisition: Firms buy others to gain access to new technologies or specialized services.

- Market Expansion: Acquisitions are used to enter new geographic regions or customer segments.

- Rivalry Intensification: Larger, consolidated entities compete more aggressively for clients and talent.

Competitive rivalry is fierce for Ameriprise Financial due to the fragmented nature of the financial services industry, featuring both large institutions and numerous smaller players. The intense competition for top financial advisors, a trend continuing into 2024 with significant advisor movement reported across the sector, further escalates this rivalry. Firms differentiate themselves through personalized advice, enhanced client experiences, and innovative product offerings, particularly in growing areas like alternative investments, where retail investor demand for private equity and real estate funds saw notable increases in 2024.

| Competitor Type | Examples | Key Competitive Factors |

|---|---|---|

| Large Financial Institutions | Morgan Stanley, Charles Schwab, Fidelity Investments | Asset under management (trillions), breadth of services, brand recognition |

| Independent Advisors/Brokers | Countless smaller firms and individuals | Personalized service, niche expertise, lower overhead |

| Banks & Insurance Companies | Various | Cross-selling opportunities, existing customer base, bundled products |

SSubstitutes Threaten

Robo-advisors present a potent threat of substitution for traditional financial advisory services like those offered by Ameriprise. These platforms, leveraging algorithms for portfolio management and financial planning, cater to a growing segment of cost-sensitive and digitally inclined investors. For instance, by early 2024, the assets under management in robo-advisory services were projected to exceed $2 trillion globally, demonstrating their increasing market penetration and appeal.

Self-directed investment platforms, like Robinhood and Charles Schwab’s online offerings, represent a significant substitute threat to Ameriprise Financial. These platforms allow individuals to manage their own portfolios, bypassing traditional financial advisors. For instance, in Q1 2024, the number of retail investors actively trading on these platforms continued to grow, with many seeking lower fees and greater control over their investments.

The appeal of these platforms lies in their accessibility and cost-effectiveness, particularly for younger or more tech-savvy investors who are comfortable conducting their own research. This trend is evidenced by the increasing adoption rates of robo-advisors and commission-free trading apps, which directly compete for clients who might otherwise seek full-service advisory. By 2024, a substantial portion of retail investment assets were managed through these digital channels.

The threat of substitutes for Ameriprise Financial's core services is significant, particularly from the burgeoning market of financial planning software and apps. These digital tools offer individuals accessible and often low-cost avenues for budgeting, expense tracking, and basic financial goal setting. For instance, by the end of 2023, the personal finance app market saw continued growth, with many users leveraging these platforms for day-to-day financial management, potentially reducing their reliance on traditional advisory services for simpler needs.

Direct-to-Consumer Insurance and Annuity Products

Direct-to-consumer (DTC) insurance and annuity products present a significant threat to Ameriprise Financial. These channels allow consumers to bypass traditional intermediaries, like Ameriprise advisors, and purchase policies or annuities directly from providers or through online marketplaces. This disintermediation can lead to reduced customer acquisition costs for insurers and potentially lower prices for consumers, making these DTC options increasingly attractive.

The rise of digital platforms and fintech companies has amplified this threat. For instance, in 2024, the digital insurance market continued its robust growth, with many consumers demonstrating a willingness to manage their financial products online. This trend directly impacts Ameriprise's annuity and insurance segments by offering consumers alternatives that may be perceived as more convenient or cost-effective, potentially siphoning off market share.

- Growing Digital Adoption: A significant percentage of consumers, particularly younger demographics, prefer online channels for financial product research and purchases.

- Price Sensitivity: DTC models often operate with lower overheads, allowing them to offer competitive pricing that can be a strong draw for cost-conscious consumers.

- Simplified Product Offerings: Some DTC providers focus on simpler, more standardized insurance and annuity products, which appeal to a segment of the market that doesn't require complex financial advice.

- Competitive Landscape: The insurance industry is witnessing increased competition from both established players enhancing their DTC capabilities and new insurtech startups entering the market.

Alternative Investment Vehicles and Digital Assets

The proliferation of alternative investment vehicles, including private equity, private credit, and digital assets like cryptocurrencies, presents a significant threat of substitutes for Ameriprise Financial. These options offer diversification and potentially higher returns, drawing capital away from traditional offerings. For instance, the global alternative assets market was projected to reach $23.2 trillion by the end of 2024, a substantial figure indicating investor interest beyond conventional markets.

While Ameriprise is actively developing its own alternative investment platforms, the ease of access and innovation from fintech firms and specialized digital asset exchanges means investors can bypass traditional advisors. The digital asset market alone saw significant growth, with the total market capitalization of cryptocurrencies fluctuating but remaining a notable investment class. This accessibility allows investors to directly engage with asset classes previously requiring significant capital or specialized knowledge.

The threat is amplified by the increasing sophistication and regulatory clarity surrounding these alternatives. As more institutional capital flows into private markets and digital assets gain broader acceptance, they become more viable substitutes for Ameriprise’s core services. For example, the growth in tokenized real estate or private credit funds accessible through online platforms directly competes with Ameriprise’s wealth management solutions.

- Alternative Asset Market Growth: Projected to reach $23.2 trillion by end of 2024.

- Digital Asset Accessibility: Growing number of platforms offer direct investment in cryptocurrencies and tokenized assets.

- Investor Diversification: Alternatives provide avenues for diversification beyond traditional stocks and bonds.

- Fintech Innovation: Fintech companies are making alternative investments more accessible and user-friendly.

The threat of substitutes for Ameriprise Financial is considerable, stemming from readily available digital platforms and alternative investment avenues. Robo-advisors and self-directed trading apps offer cost-effective and convenient alternatives for a growing segment of investors. For example, by early 2024, global robo-advisory assets were expected to surpass $2 trillion, highlighting their significant market penetration.

Direct-to-consumer (DTC) insurance and annuity products also pose a threat, allowing consumers to bypass traditional advisors. The digital insurance market continued its robust growth in 2024, with many consumers preferring online management of financial products. Furthermore, alternative investments like private equity and digital assets are attracting capital, with the global alternative assets market projected to reach $23.2 trillion by the end of 2024.

| Substitute Category | Key Characteristics | Market Trend/Data Point (2024) | Impact on Ameriprise |

|---|---|---|---|

| Robo-Advisors & Digital Platforms | Low cost, accessibility, self-service | Global AUM projected to exceed $2 trillion | Loss of fee-based advisory clients |

| DTC Insurance & Annuities | Disintermediation, potential lower prices | Digital insurance market growth | Reduced annuity and insurance sales |

| Alternative Investments | Diversification, potentially higher returns | Global alternative assets market projected at $23.2 trillion | Capital diversion from traditional products |

Entrants Threaten

The financial services sector, especially for established, diversified companies like Ameriprise Financial, presents a formidable barrier to new entrants due to exceptionally high capital requirements. These investments are essential for building robust infrastructure, cutting-edge technology, and ensuring strict adherence to complex regulatory frameworks. For instance, in 2024, the average cost to launch a new wealth management firm with a modest digital presence often exceeds several million dollars, a figure that escalates dramatically for firms aiming for national reach and comprehensive service offerings.

Furthermore, Ameriprise's long-standing brand reputation, built over 130 years, acts as a significant deterrent. Cultivating client trust and loyalty in financial services is a lengthy and resource-intensive process. In 2024, studies indicate that over 60% of consumers still prioritize brand recognition and established trust when selecting financial advisors, making it incredibly challenging for new, unproven entities to attract and retain a substantial client base against such deeply ingrained credibility.

The financial services industry, particularly for firms like Ameriprise Financial, is characterized by extensive regulatory hurdles and substantial compliance costs. New entrants must navigate a complex web of licensing requirements, capital adequacy rules, and ongoing reporting mandates, all of which demand significant investment and expertise. For instance, in 2024, the Securities and Exchange Commission (SEC) continued to emphasize robust compliance frameworks, particularly around data privacy and anti-money laundering, adding to the operational burden for any new player.

New companies entering the financial advisory space face a significant hurdle in replicating Ameriprise Financial's established nationwide network of advisors and diverse distribution channels. This requires substantial upfront investment and time to build, making it a formidable barrier.

Developing a strong team of experienced financial advisors and cultivating deep, trust-based client relationships is a lengthy and capital-intensive process. For instance, in 2024, the average time to onboard and fully train a new financial advisor can extend over a year, underscoring the difficulty for newcomers to quickly match Ameriprise's advisor base.

Technological Infrastructure and AI Investment

The threat of new entrants in the financial advisory space, particularly concerning technological infrastructure and AI investment, is significantly mitigated by the substantial capital required. Established firms like Ameriprise Financial have already made considerable investments in robust, secure IT systems and advanced AI platforms for personalized client advice and data analytics. For instance, in 2024, the financial services industry continued to see significant spending on digital transformation initiatives, with many firms allocating billions to enhance their technological capabilities and cybersecurity measures. This creates a high barrier to entry, as newcomers would need to replicate or surpass these existing, costly infrastructures to compete effectively.

New entrants face the daunting task of building sophisticated technological capabilities from scratch, which is a major hurdle. The need for cutting-edge AI-driven platforms for everything from client onboarding and personalized financial planning to sophisticated data analysis and stringent cybersecurity protocols demands immense upfront investment. Consider that major financial institutions are projected to increase their AI spending by over 30% annually through 2025, aiming to leverage these technologies for competitive advantage. This escalating investment landscape makes it exceedingly difficult for new players to enter and immediately challenge incumbents who have already established a strong technological foundation.

- High Capital Outlay: Significant investment is necessary to develop and maintain sophisticated, secure technological infrastructure, including AI-driven platforms.

- AI and Data Analytics Capabilities: New entrants must invest heavily to match the advanced AI and data analytics capabilities that established firms use for personalized advice and operational efficiency.

- Cybersecurity Demands: The imperative for robust cybersecurity to protect sensitive client data presents another substantial and ongoing cost for any new financial services firm.

- Scalability and Integration: Building scalable and seamlessly integrated technological systems that can handle a growing client base and diverse financial products is a complex and expensive undertaking.

Economies of Scale and Cost Advantages

Established players like Ameriprise Financial leverage significant economies of scale. For instance, in 2024, large financial institutions often manage trillions in assets, spreading fixed costs like technology infrastructure and regulatory compliance over a vast base. This translates to a lower cost per dollar managed compared to a new entrant starting with limited capital.

These scale advantages create substantial cost barriers. Ameriprise can invest heavily in proprietary trading platforms, advanced data analytics, and extensive advisor networks, all of which are difficult and expensive for a startup to replicate. This cost differential makes it challenging for new firms to offer competitive pricing on services such as wealth management or investment advice.

- Economies of Scale: Ameriprise benefits from lower per-unit costs due to its large operational size.

- Cost Advantages: Significant investments in technology and infrastructure create a cost barrier for new entrants.

- Asset Management Scale: In 2024, leading firms manage assets in the trillions, reducing average operational costs.

- Marketing Reach: Established brands can achieve broader market penetration at a lower relative cost per customer acquisition.

The threat of new entrants for Ameriprise Financial is considerably low due to substantial barriers. High capital requirements for technology, regulatory compliance, and building brand trust are significant deterrents. For instance, launching a basic wealth management firm in 2024 could easily cost millions, a sum that escalates for comprehensive services.

Established brand loyalty and trust, cultivated over decades, also pose a major challenge. In 2024, consumer preference for recognized and trusted financial advisors remained high, with over 60% prioritizing these factors, making it difficult for new firms to gain traction.

The extensive regulatory landscape and associated compliance costs further solidify Ameriprise's position. Navigating complex licensing and capital adequacy rules demands significant investment and expertise, a burden that new entrants must fully shoulder.

Furthermore, replicating Ameriprise's extensive advisor network and distribution channels requires immense upfront investment and time, presenting another formidable entry barrier.

The need for significant investment in advanced AI and robust cybersecurity infrastructure also deters new entrants. In 2024, financial institutions continued to pour billions into digital transformation, making it difficult for newcomers to match existing technological capabilities.

Economies of scale enjoyed by Ameriprise, managing trillions in assets in 2024, lead to lower per-unit operational costs, creating a cost advantage that new firms struggle to overcome.

| Barrier Type | Description | 2024 Data/Example |

|---|---|---|

| Capital Requirements | High initial investment for technology, infrastructure, and regulatory compliance. | Launching a new wealth management firm in 2024 can cost millions. |

| Brand Reputation & Trust | Long-standing history and client loyalty are difficult to replicate. | Over 60% of consumers prioritize brand recognition when choosing financial advisors in 2024. |

| Regulatory Hurdles | Complex licensing, capital adequacy, and compliance costs. | Ongoing emphasis by SEC on data privacy and AML compliance adds to operational burden. |

| Network & Distribution | Establishing a nationwide advisor network and distribution channels is time-consuming and costly. | Onboarding and training a new financial advisor can take over a year in 2024. |

| Technological Investment | Significant spending required for advanced AI, data analytics, and cybersecurity. | Financial services AI spending projected to increase over 30% annually through 2025. |

| Economies of Scale | Lower per-unit costs due to large operational size and asset management volume. | Leading firms managed trillions in assets in 2024, reducing average operational costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ameriprise Financial is built upon a foundation of comprehensive data, drawing from company annual reports, investor presentations, and filings with regulatory bodies like the SEC. This ensures a robust understanding of internal financial health and strategic direction.

We supplement this internal data with industry-specific market research reports from reputable firms, competitor financial statements, and macroeconomic data to accurately assess the external competitive landscape. This approach allows for a thorough evaluation of industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes.