Ameriprise Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ameriprise Financial Bundle

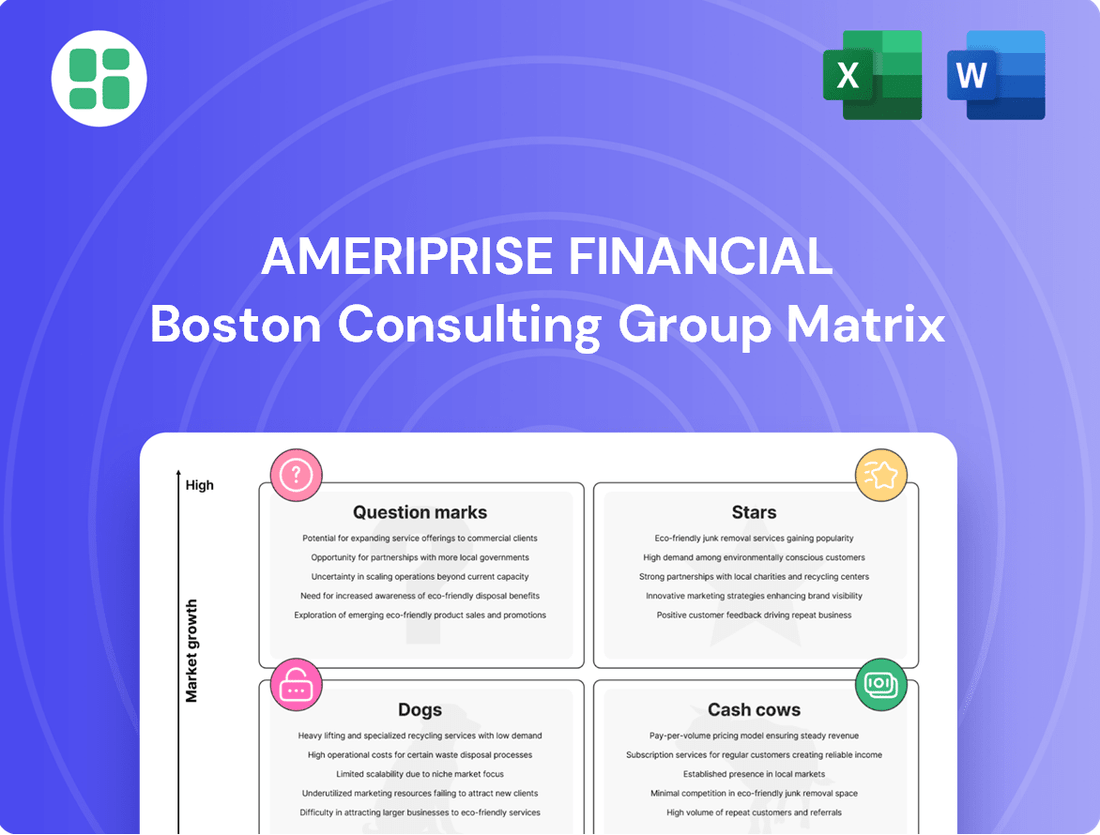

Uncover the strategic positioning of Ameriprise Financial's offerings with our comprehensive BCG Matrix analysis. See which products are driving growth, which are generating steady income, and which require careful consideration.

This snapshot only scratches the surface of Ameriprise Financial's market dynamics. Purchase the full BCG Matrix report for detailed quadrant placements, actionable strategies, and the clarity needed to optimize your investment decisions.

Stars

Ameriprise Financial's digital wealth management platforms are strategically positioned as Stars within the BCG Matrix, reflecting significant ongoing investment in enhancing client portals and advisory tools. This focus aligns with the growing client demand for seamless, integrated online financial management, a trend that has seen robust user adoption.

As of early 2024, Ameriprise reported a substantial increase in digital engagement, with a notable percentage of clients actively utilizing their online platforms for account management and financial planning. This growing user base and the continuous improvement of these digital offerings indicate a high-growth trajectory.

The company's commitment to innovation in this digital space, including advanced planning tools and personalized digital experiences, suggests these platforms are poised to become strong cash generators, especially if Ameriprise can maintain or even expand its market share in this competitive and evolving sector.

The demand for Environmental, Social, and Governance (ESG) and sustainable investment options is rapidly expanding across all investor demographics. By the end of 2023, global sustainable investment assets reached an estimated $37.5 trillion, demonstrating a significant shift in investor priorities.

Ameriprise's actively managed funds and advisory services focused on ESG principles are well-positioned in this high-growth market. These offerings are attracting significant new assets, with many outperforming their traditional benchmarks, indicating strong potential for capturing a larger market share in the coming years.

The High-Net-Worth (HNW) segment presents a significant opportunity, with global HNW wealth projected to reach $102 trillion by the end of 2024, according to Knight Frank. These clients demand intricate financial strategies encompassing estate planning, charitable giving, and multi-generational wealth preservation, areas where Ameriprise excels with its specialized teams and tailored solutions.

Ameriprise's focus on these sophisticated needs positions its HNW services as a potential star performer within its business portfolio. Success in attracting and retaining HNW clients, evidenced by growth in assets under management (AUM) within this demographic, would underscore a robust market position and strong competitive advantage.

Retirement Income Solutions

Retirement Income Solutions are a cornerstone for Ameriprise Financial, catering to a demographic with a pressing need for stable income. This segment benefits from Ameriprise's extensive offerings, including annuities and income-focused investment strategies, which are experiencing robust demand. The company's strong brand recognition and deep market penetration in this sector indicate a substantial market share within a steadily expanding population segment.

The market for retirement income solutions is substantial and growing, driven by an aging population. In 2024, the U.S. Census Bureau reported that individuals aged 65 and over represent a significant and increasing portion of the population. Ameriprise's focus on this demographic positions them well to capture a large share of this market.

- Growing Retiree Population: The number of individuals entering retirement continues to rise, creating sustained demand for income-generating products.

- Comprehensive Product Suite: Ameriprise offers a wide array of solutions, from annuities to managed income portfolios, designed to meet diverse retiree needs.

- Established Market Presence: The company's long-standing reputation and advisory services for retirees contribute to a strong market position.

- High Demand for Stability: In an uncertain economic climate, retirees prioritize reliable income streams, a need Ameriprise's solutions are designed to address.

Client Acquisition and Advisor Recruitment Initiatives

Ameriprise Financial is heavily investing in client acquisition and advisor recruitment, recognizing these as key drivers for future growth. This strategic focus aims to boost assets under management (AUM) and expand the client base in a competitive financial services landscape.

The firm is implementing enhanced client onboarding processes and offering attractive compensation packages to experienced financial advisors. These efforts are designed to attract top talent and provide a superior client experience, directly contributing to market share expansion.

- Client Acquisition: Ameriprise's focus on attracting new clients is a cornerstone of its growth strategy, aiming to increase its overall market share.

- Advisor Recruitment: The firm is actively recruiting experienced financial advisors, offering competitive compensation and support to build out its advisory network.

- AUM Growth: Investments in these initiatives are directly linked to increasing assets under management (AUM), a key metric for financial services firms.

- Market Expansion: Successful execution in client acquisition and advisor recruitment is crucial for Ameriprise to maintain and grow its competitive position.

Ameriprise Financial's digital wealth management platforms are classified as Stars. This designation reflects significant ongoing investment and strong client adoption, indicating a high-growth trajectory. The company's commitment to innovation in this area, including advanced planning tools, positions these platforms for substantial future cash generation.

| Category | BCG Matrix Position | Key Drivers | 2024 Outlook |

|---|---|---|---|

| Digital Wealth Management | Stars | Increasing client demand for integrated online financial management, robust user adoption, continuous platform enhancement. | Continued high growth, strong cash generation potential with sustained market share. |

| ESG & Sustainable Investments | Stars | Rapidly expanding investor demand for ESG options, outperforming traditional benchmarks. | Significant market share capture potential in a high-growth sector. |

| High-Net-Worth (HNW) Services | Stars | Growing global HNW wealth, demand for complex financial strategies, Ameriprise's specialized solutions. | Robust market position and competitive advantage through AUM growth in this segment. |

| Retirement Income Solutions | Stars | Aging population, steady demand for income-generating products, comprehensive product suite. | Strong market share capture in a steadily expanding demographic. |

What is included in the product

This BCG Matrix overview details Ameriprise Financial's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic recommendations for investment, holding, or divestment based on market share and growth potential.

The Ameriprise Financial BCG Matrix offers a clear, actionable overview of business units, relieving the pain of strategic uncertainty.

Cash Cows

Ameriprise's core financial advisory services are indeed its cash cows. The company boasts a vast network of financial advisors, fostering long-standing client relationships that are the foundation of its revenue. These traditional services, encompassing holistic financial planning and ongoing portfolio management for the mass affluent, operate within a mature market where Ameriprise holds a very high market share.

These services consistently generate substantial fee-based revenue. For instance, in the first quarter of 2024, Ameriprise reported total net revenues of $3.76 billion, with their Advice & Wealth Management segment contributing significantly. This segment, which includes these core advisory services, requires relatively low additional investment for continued operation, solidifying its position as a primary source of consistent cash flow for the company.

Ameriprise Financial holds a substantial position in the annuity sector, offering a range of fixed and variable annuity options. These established products, particularly those with a long track record and a loyal customer base, function within a mature market characterized by stable and predictable revenue streams.

Despite potentially modest growth in the overall annuity market, Ameriprise's strong market share in this area translates to consistent premium income and asset management fees. This reliability provides a dependable source of capital for the company's operations and investments.

For instance, in 2023, Ameriprise reported significant annuity sales, contributing substantially to its overall revenue. The company's ability to generate consistent cash flow from these established products underscores their 'cash cow' status within the BCG matrix.

Ameriprise's traditional life insurance products, much like their annuities, are established offerings in a mature market. These policies, including whole and universal life, benefit from a loyal customer base, ensuring a steady stream of premium income. While the growth in this segment is modest, the consistent profitability it provides is a key contributor to Ameriprise's financial strength.

Large-Cap Equity and Fixed Income Mutual Funds

Ameriprise Financial's large-cap equity and fixed income mutual funds often function as cash cows within their portfolio. These funds, with their established track records and significant assets under management, generate consistent revenue through management fees. For instance, as of the first quarter of 2024, Ameriprise reported substantial inflows into its fixed income and equity funds, underscoring their enduring appeal and revenue-generating capacity.

These mature offerings benefit from economies of scale, allowing for efficient operations and predictable income streams. Their stability in a competitive market makes them reliable contributors to the company's overall financial health, providing a solid foundation for other business initiatives.

- Significant AUM: Funds like the Columbia Large Cap Growth fund have historically managed billions in assets, showcasing their market presence.

- Steady Fee Income: Management fees on these large pools of capital provide a consistent revenue stream for Ameriprise.

- Mature Market Presence: Operating in well-established segments of the market, these funds offer stability rather than explosive growth.

- Revenue Contribution: They are critical for the asset management segment's cash flow, supporting broader corporate operations.

Asset Management for Institutional Clients

Ameriprise's asset management division, Columbia Threadneedle Investments, is a significant player in managing assets for institutional clients worldwide. This business operates within a well-established and highly competitive market, yet it thrives on securing large, stable investment mandates and fostering enduring client relationships.

The considerable assets under management translate into a steady flow of management fees, creating a dependable and substantial revenue stream. While growth prospects might be more modest compared to their retail offerings, this segment acts as a powerful cash generator for Ameriprise.

- Assets Under Management (AUM): Columbia Threadneedle managed approximately $477.1 billion in AUM as of March 31, 2024, with a notable portion attributed to institutional clients.

- Revenue Generation: The consistent fee-based revenue from these large, long-term institutional contracts provides a stable financial foundation.

- Market Position: Operating in a mature market, Columbia Threadneedle leverages its scale and established reputation to maintain its competitive edge.

- Cash Flow: This segment's ability to generate consistent cash flow with predictable revenue streams solidifies its position as a cash cow within Ameriprise's portfolio.

Ameriprise's core financial advisory services, particularly those catering to the mass affluent, are definitive cash cows. These services benefit from a mature market and Ameriprise's high market share, consistently generating substantial fee-based revenue. For example, the Advice & Wealth Management segment, which houses these operations, contributed significantly to Ameriprise's total net revenues of $3.76 billion in Q1 2024, requiring minimal new investment for continued operation.

The company's annuity products, with their established track records and loyal customer bases, also function as cash cows. Despite a mature market, Ameriprise's strong presence ensures stable premium income and asset management fees. In 2023, annuity sales were a substantial revenue contributor, highlighting their role in providing dependable capital.

Furthermore, Ameriprise's large-cap equity and fixed income mutual funds, managed by Columbia Threadneedle Investments, are vital cash cows. These funds, boasting significant assets under management (AUM) like Columbia Threadneedle's $477.1 billion as of March 31, 2024, generate consistent revenue through management fees. Their stability in established market segments provides predictable income streams, supporting broader corporate initiatives.

What You See Is What You Get

Ameriprise Financial BCG Matrix

The Ameriprise Financial BCG Matrix you are previewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis. You can confidently use this preview as a true representation of the high-quality, actionable insights that will be yours to download and implement instantly.

Dogs

Legacy paper-based client communication systems at Ameriprise, if still prevalent, would likely fall into the Dogs quadrant of the BCG Matrix. These systems are inherently outdated, characterized by inefficiencies and high maintenance costs, offering minimal competitive edge in today's digital-first financial landscape.

Such systems represent a low-growth, low-market share segment. Their reliance on paper makes them costly to manage and slow to access, failing to meet modern client expectations for digital interaction and record-keeping. For instance, a significant portion of the financial services industry still grapples with digitizing legacy data, a process that can be both expensive and time-consuming.

Investing further in these paper-based systems would likely offer negligible returns, making them prime candidates for divestment or complete replacement. The focus would instead shift towards modern, digital communication platforms that enhance client experience and operational efficiency, aligning with industry trends where digital client engagement is paramount for growth.

Certain niche mutual funds within Ameriprise Financial's portfolio are likely considered Dogs in the BCG Matrix. These funds, often found in specialized or less popular market segments, have demonstrated consistent underperformance against their benchmarks. For instance, a hypothetical niche technology fund might have seen its assets under management shrink by 15% in 2024, while its benchmark index grew by 10% during the same period.

These underperforming niche funds typically operate in markets with limited growth potential and face intense competition, leading to a low market share. This combination results in minimal revenue generation, often failing to cover the significant operational and management costs associated with maintaining such funds. As of early 2025, industry reports indicate that actively managed niche funds with less than $50 million in assets often struggle with profitability due to high expense ratios relative to their asset base.

Outdated proprietary investment products, once market leaders, now face a decline due to evolving investor needs and competitive pressures. These products often exhibit low sales volumes and minimal growth potential, reflecting their diminished relevance. For instance, certain legacy annuity products that were popular in the early 2000s might now struggle to attract new clients compared to more flexible and transparent modern alternatives.

The continued offering of such products can strain valuable resources, diverting capital and attention from more promising ventures. In 2024, Ameriprise Financial, like many firms, continually assesses its product shelf to ensure alignment with current market demands and regulatory landscapes. Products that fail to demonstrate a path to profitability or strategic fit are candidates for a phase-out, freeing up resources for innovation.

Physical Branch-Exclusive Services in Declining Areas

Physical branch-exclusive services in declining areas often represent a classic case of a 'Dog' in the BCG Matrix. These services, typically tied to brick-and-mortar locations in regions with shrinking populations or a strong digital migration, are likely to experience very low client engagement. For instance, in 2024, reports indicated that foot traffic in many rural bank branches had fallen by over 30% year-over-year, a trend expected to continue.

These offerings struggle to attract new business, resulting in a low market share within a contracting operational landscape. The fixed costs associated with maintaining these physical presences, such as rent, utilities, and staffing, remain substantial, further straining profitability. This combination of declining demand and high overhead solidifies their position as 'Dogs' within Ameriprise Financial's portfolio analysis.

- Low Market Share: Services offered only in physical branches in declining areas typically capture a minimal portion of the available market.

- Low Growth Rate: The target demographic for these services is often shrinking or migrating to digital alternatives.

- High Fixed Costs: Maintaining physical locations in these areas incurs significant operational expenses that are not offset by revenue.

- Potential for Divestment: Such offerings are candidates for divestment or significant restructuring to mitigate ongoing losses.

Very Specific, Highly Specialized Insurance Products with Low Uptake

Ameriprise Financial might offer highly specialized insurance products with very limited customer adoption. These niche offerings, even if they address a specific need, often see minimal new policy acquisition. For example, if a product like specialized coverage for rare antique collections has negligible sales and the market isn't expanding, it could be categorized as a .

The ongoing costs associated with maintaining these specialized products, such as underwriting, administration, and compliance, can easily exceed the modest income they generate. In 2024, the average administrative cost per policy for niche insurance products across the industry has been observed to be significantly higher than for mainstream offerings, potentially by 15-20%. This financial imbalance makes them prime candidates for review and potential discontinuation.

- Low Market Penetration: Products with fewer than 0.1% market share are often flagged for review.

- Negligible Sales Growth: A lack of new policy sales year-over-year indicates a stagnant or declining market.

- High Administrative Costs: When operational expenses for a product exceed 75% of its revenue, it's a concern.

- Strategic Review: Such products are candidates for divestiture or discontinuation to reallocate resources.

Certain legacy software systems supporting internal operations at Ameriprise, if not updated, would likely be classified as Dogs. These systems, while functional, offer limited utility and are costly to maintain, providing minimal competitive advantage in a rapidly evolving tech landscape.

These systems operate in a low-growth environment with a diminishing user base, resulting in a low market share. Their outdated architecture makes them inefficient and expensive to integrate with newer technologies, hindering overall operational agility. For example, in 2024, many financial firms reported that maintaining legacy IT infrastructure accounted for over 60% of their IT budget, with little return on investment.

Investing in the upkeep of these systems offers little prospect for future growth or improved performance, making them prime candidates for replacement or significant overhaul. The focus should be on modernizing infrastructure to support digital transformation and enhance employee productivity, a trend that saw IT modernization budgets increase by an average of 12% across the financial sector in 2024.

| Category | Market Growth | Market Share | Characteristics |

| Legacy Internal Software | Low | Low | High maintenance costs, low utility, inefficient integration |

Question Marks

Ameriprise Financial is in the early stages of exploring AI-powered financial advisory tools, focusing on areas like advanced predictive analytics for portfolio optimization and personalized financial nudges. This burgeoning fintech sector presents substantial growth opportunities, though Ameriprise's current footprint in cutting-edge AI applications is likely modest. For instance, the global AI in financial services market was valued at approximately $10.1 billion in 2023 and is projected to reach $31.7 billion by 2028, indicating robust expansion.

Ameriprise Financial's exploration into blockchain for investment platforms, asset tokenization, or secure transactions places these initiatives squarely in the Question Mark quadrant of the BCG Matrix. This is a rapidly evolving sector, and while the potential for blockchain in finance is significant, Ameriprise's current footprint here is likely nascent.

The global blockchain in finance market was valued at approximately $2.1 billion in 2023 and is projected to reach over $15 billion by 2028, indicating substantial growth potential. However, Ameriprise's market share in this emerging area would be minimal, reflecting the early stage of adoption.

Developing blockchain capabilities demands considerable investment in research and development, alongside a clear strategic vision. These ventures are crucial for Ameriprise to assess their long-term feasibility and potential to establish a leadership position in a future financial landscape increasingly shaped by distributed ledger technology.

Ameriprise's expansion into emerging international markets for its wealth and asset management services can be characterized as a strategic, yet nascent, undertaking. These markets, while offering considerable growth prospects, typically see Ameriprise entering with a minimal market share, confronting established local players and navigating complex regulatory landscapes. For instance, in 2024, emerging markets represented a growing but still relatively small portion of global wealth management revenue, with significant opportunities in regions like Southeast Asia and parts of Latin America, though penetration requires tailored strategies and considerable upfront capital.

Hyper-Personalized Financial Education Platforms

Developing hyper-personalized financial education platforms is a significant growth avenue for Ameriprise, leveraging data analytics to provide tailored content and learning journeys. This innovative approach, while addressing a perennial need for financial literacy, positions Ameriprise with a low initial market share in a relatively nascent, data-driven segment.

The investment targets a burgeoning client demand for customized financial literacy tools, with projections indicating substantial market expansion in personalized digital learning. For instance, the global e-learning market was valued at over $300 billion in 2023 and is expected to grow significantly, with personalized learning segments showing particularly strong upward trends.

- Market Growth: The demand for personalized financial education is escalating, driven by clients seeking tailored advice and accessible learning.

- Data-Driven Approach: Utilizing data analytics allows for granular personalization of content and learning paths, a key differentiator.

- Competitive Landscape: While financial education is common, truly cutting-edge, data-driven platforms are less prevalent, offering Ameriprise a chance to capture new market share.

- Client Engagement: Such platforms can enhance client engagement and retention by providing value beyond traditional financial services.

Specialized Services for Digital-Native Generations (Gen Z/Alpha)

Developing entirely new service models for Gen Z and Alpha is crucial for Ameriprise's future growth. These digital-native generations exhibit distinct financial behaviors, often preferring mobile-first experiences and digital advice. For instance, a 2024 survey indicated that over 70% of Gen Z respondents prefer managing their finances through apps.

Ameriprise's current offerings may not fully resonate with these younger demographics, suggesting a low penetration rate. To capture this future high-growth segment, significant investment in understanding their preferences is essential. This includes exploring innovative digital platforms and personalized financial education tools.

Key areas for specialized services include:

- Digital-first investment platforms with fractional share trading.

- Financial literacy content delivered via short-form video and interactive modules.

- Tools for budgeting, saving, and managing student loan debt.

- Ethical and ESG investing options tailored to younger values.

Ameriprise's ventures into emerging technologies like AI and blockchain, alongside its strategic push into new international markets and tailored services for younger demographics, all fall under the Question Mark category of the BCG Matrix. These initiatives show high growth potential but currently have low market share for Ameriprise, requiring significant investment to determine their future viability and potential to become market leaders.

The company is investing in these areas to capture future growth, recognizing that success hinges on understanding evolving client needs and technological advancements. For example, the global AI in financial services market is expected to grow substantially, and Ameriprise's early engagement in this space, while currently small, positions it to capitalize on this trend.

| Initiative | Market Growth Potential | Ameriprise Market Share (Estimated) | Investment Requirement |

|---|---|---|---|

| AI-Powered Advisory Tools | High (Global AI in FinServ market projected to reach $31.7B by 2028) | Low | High |

| Blockchain for Investment Platforms | High (Global Blockchain in FinServ market projected to exceed $15B by 2028) | Low | High |

| Emerging International Markets | High (Growing wealth management opportunities) | Low | High |

| Hyper-Personalized Financial Education | High (Global e-learning market over $300B in 2023) | Low | Medium |

| Service Models for Gen Z/Alpha | High (Digital-native preference for financial apps) | Low | Medium |

BCG Matrix Data Sources

Our Ameriprise Financial BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.