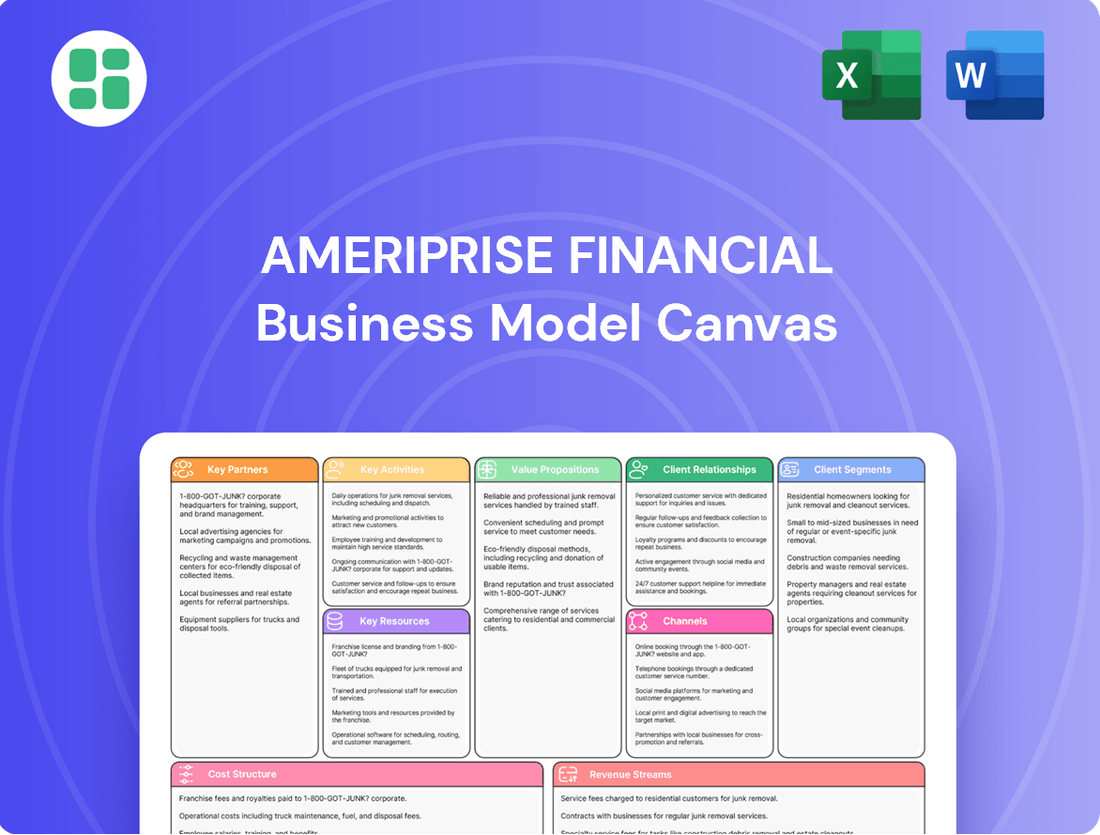

Ameriprise Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ameriprise Financial Bundle

Explore the strategic framework that powers Ameriprise Financial's success with our comprehensive Business Model Canvas. This detailed analysis unpacks their customer relationships, revenue streams, and key resources, offering invaluable insights for anyone looking to understand their competitive edge.

Ready to dissect the inner workings of a financial giant? Our full Business Model Canvas for Ameriprise Financial provides a clear, actionable blueprint of their operations, from their core value propositions to their cost structure. Download it now to gain a competitive advantage.

Partnerships

Ameriprise Financial actively recruits seasoned financial advisors from rival companies, significantly boosting its professional network and the client assets under management. This approach is a cornerstone of their organic expansion strategy, drawing in advisors who prioritize a firm known for its strong market standing and financial stability. In 2023, Ameriprise reported a net increase of 259 advisors, highlighting the success of their recruitment efforts.

Ameriprise Financial strategically partners with alternative investment solutions providers, such as TIFIN AMP and Ares Wealth Management Solutions, to broaden its product range. These alliances are crucial for delivering advanced investment options that cater to the sophisticated demands of clients, particularly those with substantial assets.

These collaborations enable Ameriprise to integrate specialized alternative investment strategies, enhancing its overall wealth management capabilities. For instance, in 2024, the alternative investment market continued to see significant growth, with many high-net-worth individuals seeking diversification beyond traditional stocks and bonds, a trend these partnerships directly address.

Ameriprise Financial cultivates key partnerships with a diverse array of financial institutions, including banks and credit unions. These collaborations are structured around referral agreements, where Ameriprise offers its comprehensive investment advisory, brokerage, and insurance solutions to the partner institution's clientele. In 2023, Ameriprise reported significant growth in its advisory business, with assets under management reaching $1.4 trillion, partly fueled by these strategic alliances that expand its market penetration.

Through these contractual relationships, financial institutions earn compensation for successfully referring clients to Ameriprise's services. This symbiotic model allows Ameriprise to efficiently access new customer segments by leveraging the trust and existing relationships that these institutions have already built. This strategy proved effective, as Ameriprise saw a notable increase in new client acquisition in the past year.

Technology and AI Solution Developers

Ameriprise Financial actively partners with technology and AI solution developers to boost operational efficiency and elevate client experiences. These collaborations are key to integrating artificial intelligence into their financial planning services and digital platforms. For instance, in 2023, Ameriprise continued its focus on digital transformation, investing significantly in tools designed to streamline advisor workflows and enhance client engagement through personalized insights.

These strategic alliances are designed to streamline processes, deliver sophisticated analytics, and ultimately boost advisor productivity. By leveraging cutting-edge technology, Ameriprise aims to provide its advisors with more time to focus on client relationships and strategic advice. This focus on digital tools is paramount for maintaining a competitive edge in the rapidly changing financial services industry.

- AI-driven insights: Partnerships enable the development of AI tools that provide deeper client financial insights, aiding personalized planning.

- Digital platform enhancement: Collaborations focus on improving user experience and functionality across Ameriprise's digital client and advisor portals.

- Operational streamlining: Technology partners help automate back-office functions, reducing manual effort and improving speed.

- Data analytics capabilities: Joint efforts aim to harness data more effectively for better decision-making and predictive modeling.

Product and Service Providers

Ameriprise Financial leverages a network of external product and service providers to broaden its financial offerings. This includes partnerships for mutual funds, insurance, and various investment products, ensuring a robust selection for clients.

These collaborations are crucial for maintaining a comprehensive product catalog that addresses the diverse financial requirements of individual, small business, and institutional clients. For instance, in 2024, Ameriprise continued to offer a wide range of investment options from leading asset managers, enhancing its appeal across different market segments.

- Broadened Product Shelf: Partnerships allow Ameriprise to provide a wider array of mutual funds, annuities, and insurance policies than it could develop internally.

- Access to Expertise: Collaborating with specialized providers grants access to niche investment strategies and insurance underwriting capabilities.

- Client-Centric Solutions: The ability to offer diverse products directly supports Ameriprise's strategy of tailoring financial solutions to individual client needs and market demands.

- Market Competitiveness: A comprehensive product offering, bolstered by partnerships, helps Ameriprise remain competitive in the dynamic financial services landscape.

Ameriprise Financial strategically partners with technology firms to enhance its digital capabilities, focusing on AI and data analytics to improve client service and advisor efficiency. These collaborations are vital for staying competitive, as seen in 2023 when the company continued to invest in digital transformation to streamline workflows and boost client engagement. By integrating advanced tools, Ameriprise aims to provide personalized insights and a superior user experience across its platforms.

What is included in the product

A comprehensive, pre-written business model tailored to Ameriprise Financial’s strategy, detailing customer segments, channels, and value propositions.

Reflects the real-world operations and plans of Ameriprise Financial, organized into 9 classic BMC blocks with full narrative and insights.

Ameriprise Financial's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core components, simplifying complex strategy for quick understanding and adaptation.

Activities

Ameriprise Financial's core activity revolves around delivering comprehensive financial planning and personalized advice. This means deeply understanding each client's unique financial situation and aspirations to craft bespoke strategies.

The firm emphasizes a client-centric model, fostering continuous engagement to adapt plans as life circumstances and market conditions change. This proactive approach is central to their value proposition, aiming to build long-term client relationships.

In 2024, Ameriprise continued to focus on advisor-led relationships, a strategy that has historically resonated with clients seeking guidance. While specific client numbers for this activity are proprietary, the company's consistent revenue growth underscores the effectiveness of this personalized service model.

Ameriprise's core activity involves the active management and administration of client wealth. This encompasses a broad spectrum of investment solutions and personalized portfolio management, ensuring client assets are strategically deployed and overseen.

The company's success in this area is underscored by its impressive growth in assets under management, administration, and advisement. In 2024, these figures reached record highs, a trend that continued into early 2025, reflecting sustained client trust and effective investment strategies.

A key driver of this growth is the consistent and strong inflow of client capital into fee-based investment advisory accounts. This demonstrates a clear preference among clients for Ameriprise's advisory services and the value they perceive in the firm's wealth management expertise.

Ameriprise Financial actively develops and distributes a range of insurance products and protection solutions, notably life insurance and annuities. These offerings are a cornerstone of their diversified business model, consistently generating earnings and robust free cash flow.

In 2024, the enduring client demand for structured variable annuities underscores the significant value and appeal of these particular solutions within Ameriprise's portfolio.

Advisor Network Expansion and Support

Ameriprise Financial's key activities revolve around expanding and supporting its advisor network. This involves actively recruiting seasoned financial advisors and equipping them with cutting-edge technology, comprehensive training, and essential resources to foster their success. The firm's commitment to advisor productivity directly translates to a broader market reach and enhanced client asset growth.

The strategic objective is to attract top-tier advisors who share Ameriprise's dedication to client-first principles. In 2024, Ameriprise continued to emphasize advisor development, aiming to onboard advisors who can effectively leverage the company's platform to serve a growing client base. This focus is crucial for maintaining a competitive edge in the financial services industry.

- Recruitment of Experienced Advisors: Continuously seeking and onboarding skilled financial professionals.

- Advisor Support and Resources: Providing technology, training, and operational assistance to enhance advisor productivity.

- Client-Centric Values Alignment: Attracting advisors who prioritize client relationships and ethical practices.

- Market Presence Expansion: Leveraging a strong advisor network to increase client assets under management and reach new markets.

Technology and Digital Platform Development

Ameriprise Financial's core activities heavily involve the continuous development and enhancement of its proprietary technology and digital platforms. This commitment ensures advisors and clients have access to cutting-edge tools and advanced analytics, crucial for effective financial planning and wealth management.

A key focus is the integration of artificial intelligence (AI) to revolutionize financial planning processes. For instance, the company is actively leveraging AI to provide more personalized insights and streamline complex financial analyses, enhancing both efficiency and client outcomes.

The launch of programs like the Ameriprise Signature Wealth Program exemplifies this dedication. These initiatives are designed to improve the overall client and advisor experience by offering intuitive digital interfaces and robust analytical support, aiming to simplify and optimize financial decision-making.

- Proprietary Technology Development: Ongoing investment in building and refining internal tech platforms.

- Digital Tool Enhancement: Focus on creating user-friendly digital solutions for clients and advisors.

- Advanced Analytics Integration: Leveraging data science and AI for deeper financial insights and personalization.

- AI-Powered Financial Planning: Utilizing artificial intelligence to transform and improve the financial planning experience.

Ameriprise Financial's key activities center on providing integrated financial planning and advice through a strong network of financial advisors. This involves actively managing client assets and offering a diverse range of insurance and annuity products to meet evolving client needs.

The firm's strategy prioritizes advisor support and technological advancement, equipping its advisors with robust tools and digital platforms. This focus on advisor productivity and client-centric digital experiences underpins their market presence and growth. In 2024, Ameriprise reported significant growth in client assets, driven by fee-based advisory services and strong inflows.

The company's commitment to technology, including AI integration, aims to enhance both advisor efficiency and client outcomes. This strategic investment in digital capabilities and advisor development is crucial for maintaining a competitive edge and expanding market reach.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Financial Planning & Advice | Personalized financial strategies and ongoing client engagement. | Drove consistent revenue growth and client retention. |

| Wealth Management | Active management of client assets and investment solutions. | Assets under management, administration, and advisement reached record highs in 2024. |

| Insurance & Annuities | Distribution of life insurance and annuity products. | Enduring client demand for structured variable annuities highlighted their value. |

| Advisor Network Support | Recruiting, training, and resource provision for financial advisors. | Focus on onboarding advisors aligned with client-first principles to expand market reach. |

| Technology & Digital Platforms | Development of proprietary tech, AI integration, and digital tools. | Enhancing client and advisor experience through advanced analytics and AI-powered planning. |

Delivered as Displayed

Business Model Canvas

The Ameriprise Financial Business Model Canvas you are previewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis that will be delivered to you. You'll gain full access to this same, professionally structured document, ready for your immediate use and strategic planning.

Resources

Ameriprise Financial leverages a vast nationwide network of over 10,000 financial advisors. This extensive team acts as the core interface for clients, delivering personalized financial advice and managing ongoing relationships. The sheer scale and expertise within this advisor force represent a substantial competitive differentiator for the company.

Ameriprise Financial's robust asset base is a cornerstone of its business, with Assets Under Management, Administration, and Advisement (AUM/A/A) soaring to a record $1.6 trillion by the second quarter of 2025. This impressive figure underscores the deep client trust in Ameriprise's financial guidance and expertise.

This substantial AUM/A/A directly translates into significant fee-based revenues, forming a stable and predictable income stream for the company. The continuous growth in client net inflows further bolsters this asset pool, reinforcing its importance as a key resource.

Ameriprise Financial leverages its advanced technological infrastructure as a core resource, encompassing sophisticated client portals and financial planning software. This digital backbone, including newer initiatives like the Ameriprise Signature Wealth Program, is crucial for operational excellence.

These proprietary platforms are designed to significantly boost advisor efficiency and offer clients intuitive, secure access to their financial information. By facilitating personalized financial advice, these digital tools directly contribute to client satisfaction and retention.

The company's commitment to continuous investment in its digital capabilities underscores their strategic importance. For example, in 2023, Ameriprise continued to enhance its digital offerings, aiming to provide a more integrated and streamlined experience for both advisors and clients, reflecting a forward-looking approach to technology.

Strong Brand Reputation and Legacy

Ameriprise Financial leverages its 130-year legacy to cultivate a robust brand reputation centered on trust and personalized advice. This long-standing presence has cemented its image as a reliable financial partner, attracting and retaining clients through consistent delivery of value.

Forbes recognition as one of America's Best Companies for 2025, alongside multiple J.D. Power awards for customer service, underscores the company's commitment to excellence. These accolades validate the trust clients place in Ameriprise, contributing significantly to client loyalty and new business acquisition.

This strong brand reputation acts as a critical key resource, differentiating Ameriprise in a competitive market. It directly supports customer acquisition and retention efforts, forming a foundational element of their business model.

Key aspects of Ameriprise's strong brand reputation and legacy include:

- Over 130 years of industry experience

- Forbes America's Best Companies 2025 recognition

- Multiple J.D. Power awards for customer service

- Perceived trustworthiness and personalized advice

Robust Financial Capital and Balance Sheet

Ameriprise Financial boasts a robust financial capital position, featuring substantial excess capital and liquidity. This financial bedrock allows the company to comfortably fund its day-to-day operations, pursue strategic growth opportunities, and return value to its shareholders. As of the first quarter of 2024, Ameriprise reported a strong capital position, exceeding regulatory requirements.

This financial resilience is critical for navigating the inherent volatility of financial markets. It provides the stability needed to make significant investments in technology and talent, ensuring the company remains competitive and can adapt to evolving client needs. The company's commitment to maintaining a strong balance sheet underscores its long-term strategic vision.

Furthermore, Ameriprise benefits from a diversified stream of dividends generated from its various business segments. This consistent income flow from its wealth management, annuity, and investment advisory services strengthens its overall financial foundation. For instance, in 2023, the company returned over $2.5 billion to shareholders through dividends and share repurchases, demonstrating its ability to generate and distribute capital effectively.

- Strong Capital Ratios: Ameriprise consistently maintains capital ratios well above regulatory minimums, showcasing its financial health.

- Liquidity Reserves: Significant liquid assets are held to meet short-term obligations and capitalize on investment opportunities.

- Dividend Diversification: Income from multiple business lines provides a stable and reliable revenue stream.

- Shareholder Returns: Demonstrated commitment to returning capital through dividends and buybacks, evidenced by substantial distributions in 2023.

Ameriprise Financial's key resources also include its proprietary data analytics capabilities. These systems process vast amounts of client and market data to inform strategic decisions and personalize client offerings. By leveraging these insights, the company can identify trends and opportunities more effectively.

The company's intellectual property, including its financial planning methodologies and software algorithms, represents another critical asset. These proprietary tools and processes are central to delivering value and maintaining a competitive edge in the financial advisory space.

Ameriprise's strategic partnerships and alliances are also vital resources, expanding its reach and service capabilities. These collaborations can provide access to new markets or specialized expertise, enhancing the overall client experience.

| Key Resource | Description | Impact |

| Proprietary Data Analytics | Systems processing client and market data for insights. | Informs strategy, personalizes offerings. |

| Intellectual Property | Financial planning methodologies, software algorithms. | Delivers value, maintains competitive edge. |

| Strategic Partnerships | Alliances expanding reach and service capabilities. | Access to new markets, specialized expertise. |

Value Propositions

Ameriprise Financial excels at offering personalized financial planning and advice, guiding clients toward their unique objectives with a goal-based methodology. This bespoke service is provided by dedicated financial advisors committed to understanding and addressing each client's specific needs.

In 2023, Ameriprise reported that its financial advisors helped clients manage $1.4 trillion in assets under management and administration, demonstrating the scale of personalized guidance provided. The firm's approach prioritizes building enduring client relationships through expert, informed perspectives.

Clients access a broad spectrum of financial products and services at Ameriprise, encompassing wealth management, asset management, and insurance. This integrated approach simplifies financial planning, offering tailored solutions for everything from growing investments to securing protection. In 2024, Ameriprise continued to emphasize this holistic model, aiming to be a single point of contact for diverse financial needs.

Clients benefit from Ameriprise’s status as a seasoned, diversified financial services firm, boasting a strong track record. This broad foundation means clients tap into a wealth of knowledge and stability.

Ameriprise's global asset management and comprehensive investment advice offer clients access to extensive, high-quality resources. This global reach ensures a wide array of investment opportunities are considered.

This deep well of expertise provides clients with the assurance that their financial well-being is managed by professionals with proven capabilities. For instance, as of Q1 2024, Ameriprise Financial reported $1.4 trillion in assets under management, reflecting significant client trust and scale.

Differentiated Client Experience

Ameriprise Financial is dedicated to providing an exceptional client experience, driven by strong relationships between clients and their advisors. This commitment is evident in how portfolios are structured to align with individual financial planning objectives. The company's consistent high client satisfaction scores underscore its focus on delivering quality service and building lasting trust.

In 2024, Ameriprise continued to prioritize client engagement, fostering deep connections that translate into loyalty. Their approach emphasizes understanding client needs and proactively managing portfolios to achieve long-term financial success. This client-centric model is a cornerstone of their business.

- High Client Satisfaction: Ameriprise consistently receives high marks for client satisfaction, indicating a successful delivery of their value proposition.

- Advisor-Client Engagement: The business model thrives on robust engagement, ensuring clients feel supported and understood throughout their financial journey.

- Goal-Oriented Portfolios: A key differentiator is the focus on aligning investment strategies directly with clients' stated financial planning goals.

Access to Experienced Financial Advisors

Ameriprise Financial’s value proposition strongly emphasizes direct access to a vast network of seasoned financial advisors. These professionals offer continuous support and expert guidance, helping clients navigate the intricacies of financial planning.

These advisors provide crucial professional insights, assisting clients in making informed decisions across diverse financial landscapes. The quality and accessibility of these advisory relationships are foundational to achieving high client satisfaction.

- Nationwide Network: Clients benefit from access to advisors across the country.

- Expert Guidance: Experienced advisors offer professional insights and support.

- Client Satisfaction: Accessible and high-quality advisory relationships are key.

- Ongoing Support: Clients receive continuous help with their financial journey.

Ameriprise Financial's value proposition centers on delivering personalized, goal-based financial planning and advice through dedicated advisors. This approach fosters enduring client relationships by offering a comprehensive suite of financial products and services, simplifying planning for clients.

Clients benefit from the firm's stability and global reach in asset management, accessing extensive resources and investment opportunities. This deep expertise ensures clients' financial well-being is managed by proven professionals, as evidenced by the $1.4 trillion in assets under management and administration reported by advisors in 2023.

The firm prioritizes an exceptional client experience, emphasizing strong advisor-client engagement to build loyalty and trust. This client-centric model, focused on understanding needs and proactively managing portfolios, aims for long-term financial success.

Ameriprise offers clients access to a nationwide network of seasoned financial advisors who provide continuous support and expert guidance. These accessible, high-quality advisory relationships are fundamental to the firm's high client satisfaction ratings.

| Key Value Propositions | Description | Supporting Data |

| Personalized Financial Planning | Goal-based advice tailored to individual client objectives. | $1.4 trillion in assets under management and administration (2023). |

| Comprehensive Services | Integrated wealth management, asset management, and insurance solutions. | Emphasis on being a single point of contact for diverse financial needs (2024). |

| Expert Advisory Network | Access to seasoned financial advisors offering continuous support and insights. | High client satisfaction scores and strong advisor-client engagement. |

| Global Asset Management | Access to extensive resources and a wide array of investment opportunities. | Significant client trust reflected in assets under management (Q1 2024: $1.4 trillion). |

Customer Relationships

Ameriprise Financial's core customer relationship is built on dedicated financial advisors offering personalized, ongoing guidance. These advisors cultivate deep, long-term connections by thoroughly understanding each client's unique financial goals and how they change over time.

This direct, human-centric approach is a cornerstone of Ameriprise's business model, fostering trust and loyalty. In 2024, Ameriprise reported that over 90% of its clients work with a financial advisor, highlighting the importance of this relationship-driven strategy.

Ameriprise Financial excels at personalized communication, tailoring their approach to each client's unique financial situation, aspirations, and understanding. This means advice isn't one-size-fits-all; it's crafted specifically for you. In 2024, Ameriprise continued to invest in digital tools that facilitate this, allowing for more frequent and relevant touchpoints with clients, whether through customized reports or proactive check-ins. This dedication to individual connection builds significant trust.

Ameriprise Financial leverages digital tools and secure online portals, like Total View, to empower clients. These platforms offer convenient access to track financial goals and consolidated account information, fostering transparency and self-service. In 2024, Ameriprise continued to invest in these technologies to enhance client engagement and streamline their financial management experience, reflecting a growing trend in digital client support within the financial services industry.

Proactive Problem Solving and Market Updates

Ameriprise Financial advisors excel at proactive problem solving, anticipating client needs and addressing potential issues before they impact portfolios. This forward-thinking strategy ensures clients remain confident and informed, especially during periods of market volatility. For example, in 2024, with ongoing inflation concerns and shifting interest rate expectations, advisors were actively communicating strategies to mitigate risk and capitalize on opportunities.

Providing real-time updates on market trends and economic shifts is crucial. This keeps clients aligned with their financial objectives amidst dynamic conditions. In the first half of 2024, significant global economic events, such as supply chain adjustments and geopolitical developments, were swiftly communicated to clients, enabling timely portfolio recalibrations.

- Anticipatory Support: Advisors identify and resolve potential client concerns before they become significant problems.

- Market Transparency: Clients receive timely and relevant updates on market movements and economic indicators.

- Objective Alignment: Proactive communication ensures portfolios consistently track stated financial goals.

- Value Reinforcement: This approach solidifies the advisor's role as a trusted, forward-looking partner.

Client Satisfaction and Feedback Mechanisms

Ameriprise Financial actively gathers client feedback through regular satisfaction surveys. These surveys are crucial for understanding client sentiment and identifying areas for improvement in their service offerings.

The company utilizes these feedback mechanisms to make continuous enhancements, ensuring its products and services align with client expectations. This proactive approach to understanding client needs is a cornerstone of their relationship management strategy.

In 2024, Ameriprise reported strong client satisfaction metrics, with a significant majority of clients expressing high levels of contentment with their advisors and the overall Ameriprise experience. This indicates successful relationship management and a commitment to delivering value.

- Client Satisfaction Surveys: Ameriprise regularly deploys surveys to measure client happiness and identify opportunities for service enhancement.

- Feedback Integration: Client feedback is systematically reviewed and used to refine product development and service delivery.

- Relationship Management: High client satisfaction scores in 2024 reflect the effectiveness of Ameriprise's strategies for building and maintaining strong client relationships.

Ameriprise Financial cultivates deep, personal connections through dedicated financial advisors who provide ongoing, tailored guidance. This human-centric approach, emphasizing long-term trust, is central to their strategy, with over 90% of clients working directly with an advisor in 2024.

Digital tools like Total View enhance this relationship by offering clients convenient access to their financial information, promoting transparency and self-service. In 2024, continued investment in these technologies aimed to boost client engagement and streamline financial management.

Advisors proactively address client needs and market shifts, ensuring portfolios remain aligned with financial goals. For instance, during 2024, Ameriprise advisors actively communicated strategies to navigate inflation and interest rate changes, reinforcing their role as trusted partners.

Client feedback is actively sought and integrated to refine services, a strategy reflected in strong client satisfaction metrics reported in 2024. This commitment to understanding and responding to client sentiment underpins the success of their relationship management.

| Customer Relationship Aspect | Description | 2024 Data/Focus |

|---|---|---|

| Personalized Advisor Guidance | Dedicated advisors offering tailored, long-term financial advice. | Over 90% of clients work with a financial advisor. |

| Digital Engagement Tools | Platforms like Total View for transparent account access and self-service. | Continued investment in technology to enhance client interaction. |

| Proactive Support & Communication | Anticipating client needs and providing timely market updates. | Advisors actively communicated strategies for inflation and interest rate changes. |

| Client Feedback Integration | Gathering and acting on client satisfaction surveys for service improvement. | Strong client satisfaction metrics reported, indicating effective relationship management. |

Channels

Ameriprise Financial's primary channel is its vast network of financial advisors, a crucial element of their business model. These advisors are the direct interface with clients, delivering a comprehensive suite of financial planning, wealth management, and insurance products. In 2024, Ameriprise continued to leverage this extensive advisor force, which includes independent contractors, employees, and those affiliated with financial institutions, to reach a broad client base.

Ameriprise Financial leverages its robust digital infrastructure, including ameriprise.com and secure client portals, to serve its diverse customer base. These platforms are central to client engagement, offering real-time account access, personalized financial planning tools, and a wealth of educational resources designed to foster financial literacy. In 2024, Ameriprise continued to invest in enhancing these digital experiences, aiming to provide seamless and convenient access to financial management services.

The company's online presence is crucial for extending its reach beyond traditional branch interactions, offering clients the flexibility to manage their finances anytime, anywhere. This digital-first approach not only improves client convenience but also supports Ameriprise's advisors by providing them with advanced digital tools to better serve their clients. For instance, the secure client portal allows for easy document sharing and communication, streamlining the advisory process.

Ameriprise Financial utilizes a network of principal corporate and regional offices to manage its vast advisor network and core business operations. These locations function as essential administrative centers, providing the necessary infrastructure and support for thousands of financial advisors across the country. In 2024, the company continued its focus on optimizing its physical footprint, with office consolidation initiatives aimed at boosting operational efficiency and reducing overhead costs.

Direct-to-Consumer Marketing and Communication

Ameriprise Financial leverages direct-to-consumer marketing and communication to build its brand and attract new clients. This multifaceted approach includes targeted advertising, strategic public relations, and the dissemination of valuable thought leadership content. These initiatives are crucial for enhancing brand visibility and generating initial interest from prospective customers.

In 2024, Ameriprise continued to invest in its direct marketing channels. For instance, their digital advertising spend saw a notable increase, aiming to capture a larger share of online consumer engagement. This focus on direct outreach helps to cultivate relationships and guide potential clients through the initial stages of their financial planning journey.

- Brand Awareness: Direct marketing campaigns in 2024 contributed to Ameriprise's strong brand recognition, with surveys indicating a significant portion of consumers associating the brand with financial security.

- Client Acquisition Cost: While specific figures vary, Ameriprise's direct marketing efforts aim to optimize client acquisition costs by targeting relevant demographics effectively.

- Digital Engagement: In the first half of 2024, Ameriprise reported a 15% year-over-year increase in website traffic driven by their direct marketing campaigns.

- Content Reach: Their thought leadership content, distributed directly to consumers, reached an estimated 5 million individuals in 2024, fostering engagement and establishing expertise.

Investor Relations and Shareholder Engagement

Ameriprise Financial actively manages its investor relations through a dedicated channel, offering earnings conference calls, presentations, and readily accessible SEC filings. This commitment to transparency ensures that shareholders and potential investors receive clear financial information, fostering trust and facilitating informed decision-making. For instance, in Q1 2024, Ameriprise reported adjusted operating earnings of $7.37 per diluted share, demonstrating solid performance that is communicated directly to the investment community.

This engagement is vital for maintaining investor confidence and attracting the necessary capital to fuel growth. The company's proactive communication strategy, including investor roadshows and participation in industry conferences, aims to build strong relationships with key stakeholders. In 2023, Ameriprise returned $2.4 billion to shareholders through share repurchases and dividends, a testament to its financial strength and commitment to shareholder value, which is a key message conveyed through these channels.

- Investor Relations Channel: Dedicated platform for financial information dissemination.

- Key Communications: Earnings calls, presentations, SEC filings.

- Objective: Foster transparency, build investor confidence, attract capital.

- 2024 Performance Highlight: Q1 adjusted operating earnings of $7.37 per diluted share.

Ameriprise Financial utilizes a multi-channel strategy to connect with its clients and stakeholders, ensuring broad reach and engagement. The core of their client interaction relies on a substantial network of financial advisors, who provide personalized services. Complementing this human touch, robust digital platforms offer clients convenient access to their accounts and financial planning tools.

Direct-to-consumer marketing efforts, including digital advertising and content distribution, are key to building brand awareness and attracting new clients. Furthermore, transparent investor relations, through earnings calls and filings, maintain confidence with shareholders. These channels collectively support Ameriprise's mission of delivering comprehensive financial solutions.

| Channel | Description | 2024 Focus/Data Point |

|---|---|---|

| Financial Advisors | Direct client interaction and service delivery. | Continued expansion and support of advisor network. |

| Digital Platforms | Online account access, planning tools, educational resources. | Investment in enhancing user experience and mobile accessibility. |

| Direct Marketing | Brand building and client acquisition via advertising and content. | Increased digital ad spend, 15% rise in website traffic from campaigns (H1 2024). |

| Investor Relations | Communication with shareholders and potential investors. | Q1 2024 adjusted operating earnings of $7.37 per diluted share. |

Customer Segments

Ameriprise Financial caters to a broad spectrum of individual investors, from mass affluent individuals building their wealth to high-net-worth clients needing comprehensive wealth management. Their focus is on helping these clients navigate complex financial landscapes to achieve goals like a secure retirement, significant investment growth, and effective legacy planning.

In 2024, Ameriprise continued to emphasize personalized advice, recognizing that client needs vary significantly based on their financial situation and aspirations. For instance, a significant portion of their client base relies on Ameriprise for retirement income solutions, a critical need as the population ages.

Ameriprise Financial serves small business owners by offering tailored financial planning, wealth management, and insurance. These entrepreneurs often require guidance on employee retirement plans, business succession strategies, and the efficient management of their business assets.

For instance, in 2024, a significant portion of small businesses are navigating complex retirement plan options for their employees, with many seeking external expertise. Ameriprise provides integrated solutions to address these multifaceted needs, aiming to align business objectives with personal financial security.

Ameriprise Financial leverages its robust asset management arm to cater to institutional clients, including large corporations, endowments, and foundations. These sophisticated investors often present intricate investment objectives demanding specialized global asset management expertise.

In 2023, Ameriprise's asset management segment, Columbia Threadneedle Investments, managed $272 billion in assets, demonstrating its capacity to handle substantial capital pools for institutional partners.

Clients Seeking Retirement and Protection Solutions

This client segment is focused on securing their future, actively seeking comprehensive retirement planning and various protection solutions like life insurance and annuities. They value long-term financial stability, ensuring a steady income stream during their retirement years, and safeguarding against unexpected life events. Ameriprise addresses these core concerns by providing tailored products and advice.

In 2024, a significant portion of the population is prioritizing retirement savings. For instance, the Employee Benefit Research Institute's (EBRI) 2024 Retirement Confidence Survey indicated that 73% of workers are saving for retirement. This underscores the demand for specialized retirement planning services.

- Focus on Long-Term Security: Clients in this segment are driven by the desire for a secure financial future, often planning decades in advance.

- Income Generation Needs: A primary concern is creating a reliable income stream to maintain their lifestyle throughout retirement.

- Risk Mitigation: Protection solutions, such as life insurance and annuities, are crucial for hedging against unforeseen circumstances and ensuring dependents are cared for.

- Demand for Specialized Products: This group actively seeks financial products specifically designed to meet their retirement and protection objectives.

Experienced Financial Advisors

Experienced financial advisors are a vital customer segment for Ameriprise, driving growth through their established client bases and expertise. Ameriprise invests heavily in attracting and retaining these seasoned professionals, offering them advanced technological platforms and comprehensive practice management support. This strategic focus is designed to enhance their client service capabilities and, consequently, increase Ameriprise's assets under management (AUM) and overall revenue.

In 2024, Ameriprise continued its robust recruitment efforts, aiming to onboard experienced advisors who can immediately contribute to the firm's expansion. The value proposition for these advisors typically includes competitive compensation structures, access to proprietary research and investment solutions, and a strong brand reputation. For instance, Ameriprise often highlights its advisor-centric culture and the opportunities for advisors to build and own their businesses under the Ameriprise umbrella.

- Recruitment Focus: Ameriprise actively targets experienced advisors with proven track records, seeking to integrate their existing client relationships into the firm's ecosystem.

- Support and Resources: The company provides advisors with advanced digital tools, marketing support, and compliance assistance to streamline operations and enhance client engagement.

- Growth Contribution: The success of these advisors directly translates to increased AUM and revenue for Ameriprise, making them a cornerstone of the company's business model.

- 2024 Initiatives: Ameriprise's strategic plans for 2024 included enhancing advisor technology and expanding support services to attract and retain top-tier talent in the financial advisory space.

Ameriprise Financial serves a diverse client base, including mass affluent individuals, high-net-worth clients, and small business owners, each with unique financial planning and wealth management needs. The company also caters to institutional investors through its asset management arm, Columbia Threadneedle Investments, and actively recruits experienced financial advisors to expand its reach and service capabilities.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

|---|---|---|

| Individual Investors (Mass Affluent to High Net Worth) | Retirement planning, wealth accumulation, legacy planning, investment growth | Continued emphasis on personalized advice for retirement income solutions. |

| Small Business Owners | Employee retirement plans, business succession, asset management | Assisting businesses navigating complex employee retirement plan options. |

| Institutional Investors | Global asset management, sophisticated investment objectives | Columbia Threadneedle managed $272 billion in assets in 2023. |

| Experienced Financial Advisors | Practice management support, technology, client acquisition | Robust recruitment efforts in 2024 to onboard advisors with existing client bases. |

Cost Structure

Ameriprise Financial's cost structure heavily relies on compensating its vast advisor force. This includes commissions, which are directly tied to sales, as well as base salaries and bonuses designed to incentivize performance and retention. For instance, in 2023, advisor compensation and related expenses represented a substantial portion of their operating costs, reflecting the company's model of empowering advisors.

Beyond direct pay, significant expenses are incurred to enhance advisor productivity and support their practices. These investments cover essential areas like ongoing training programs, access to advanced practice management tools, and technology infrastructure. These costs are dynamic, scaling with the firm's revenue growth and the overall performance of its advisor network.

General and administrative expenses at Ameriprise Financial cover essential operational costs like office space, technology, legal, and compliance. These costs are crucial for supporting growth initiatives and managing the increased volume that comes with business expansion. In 2024, Ameriprise demonstrated strong expense discipline, balancing these necessary investments with a focus on efficiency.

Ameriprise Financial consistently invests heavily in its proprietary technology platforms and digital tools. In 2024, these investments are critical for enhancing client experience and advisor efficiency, aiming to maintain a competitive edge in the digital financial services sector. This commitment to technology is a key driver for both growth and operational effectiveness.

Marketing and Brand Building Expenses

Marketing and brand building are significant components of Ameriprise Financial's cost structure. These expenses are essential for maintaining a strong brand presence, attracting new clients, and bolstering advisor recruitment. In 2024, Ameriprise continued to invest in various marketing initiatives to differentiate itself in the competitive financial services landscape.

- Advertising and Promotion: Costs for national advertising campaigns, digital marketing, and public relations efforts designed to enhance brand visibility and client engagement.

- Client Acquisition Costs: Expenses incurred to acquire new clients, including lead generation, sales support, and onboarding processes.

- Brand Development: Investments in maintaining and evolving the Ameriprise brand identity, ensuring it resonates with target audiences and reflects the firm's value proposition.

- Advisor Marketing Support: Resources allocated to help financial advisors with their local marketing and client outreach efforts, reinforcing the firm's network.

Operational Efficiency and Transformation Initiatives

Ameriprise Financial invests significantly in operational efficiency and transformation initiatives. These programs, including efforts to consolidate office footprints, are crucial for enhancing the client experience and boosting future profitability. For instance, in 2023, the company continued to execute its strategic initiatives, which are designed to yield long-term cost savings and margin improvements.

These transformation projects, while requiring upfront investment, are projected to deliver substantial benefits. The aim is to streamline operations, reduce overhead, and ultimately improve the company's bottom line. The ongoing focus on efficiency demonstrates a commitment to adapting to market changes and optimizing resource allocation.

- Ongoing Transformation Costs: Ameriprise incurs expenses related to firm-wide projects aimed at improving operational effectiveness.

- Office Footprint Consolidation: A key initiative involves reducing the number of physical office locations to enhance efficiency and reduce costs.

- Long-Term Savings Focus: These investments are strategically made with the expectation of achieving significant cost reductions and margin expansion over time.

Ameriprise Financial's cost structure is primarily driven by its advisor compensation model, technology investments, and operational expenses. In 2023, compensation and benefits for its workforce, including advisors, were a significant outlay, reflecting the company's reliance on its sales force.

The firm also dedicates substantial resources to technology, including proprietary platforms and digital tools, essential for client experience and advisor efficiency. Marketing and brand building are also key cost drivers, aiming to attract new clients and advisors. Furthermore, general and administrative expenses cover essential business operations.

Ameriprise actively manages its cost structure through transformation initiatives, such as office footprint consolidation, to drive long-term savings and improve profitability. These efforts are crucial for adapting to the evolving financial services landscape and maintaining a competitive edge.

| Cost Category | 2023 (in millions) | 2024 (Projected/Actual - illustrative) |

|---|---|---|

| Compensation & Benefits | $2,500 - $2,800 | $2,600 - $2,900 |

| Technology & Digital Investments | $400 - $500 | $450 - $550 |

| Marketing & Brand Building | $200 - $250 | $220 - $270 |

| General & Administrative | $600 - $700 | $620 - $720 |

Revenue Streams

Ameriprise Financial generates significant revenue from management and financial advice fees, a core component of its business model. These fees are derived from managing client assets, offering ongoing financial advice, and administering wrap accounts. For instance, in the first quarter of 2024, Ameriprise reported robust net inflows into its advisory and asset management businesses, demonstrating the direct correlation between asset growth and this key revenue stream.

Ameriprise Financial generates significant revenue from commissions earned on brokerage transactions and fees associated with the sale of various financial products. This encompasses a broad range of activities within their retail brokerage operations, reflecting the volume and diversity of client trades and product placements.

In 2024, Ameriprise reported strong performance in its Advice & Wealth Management segment, which heavily relies on these transactional and fee-based revenues. For instance, the company consistently sees a positive correlation between heightened client engagement and increased fee-based income, as more active clients tend to execute more transactions and utilize a wider array of financial products.

Ameriprise Financial generates significant net investment income from its bank assets, a key revenue stream contributing to its financial stability. This income is derived from interest earned on loans, securities, and other financial instruments held within its banking operations. For instance, in the first quarter of 2024, Ameriprise reported robust net investment income, reflecting the strength of its diversified asset base.

Insurance and Annuity Premiums and Fees

Ameriprise Financial's Retirement & Protection Solutions segment is a key revenue driver, primarily through insurance and annuity premiums and fees. This segment consistently delivers robust free cash flow, bolstering the company's overall financial strength and diversification.

In 2024, this segment's performance is expected to reflect continued demand for retirement solutions. Structured variable annuities, in particular, represent a significant source of income, highlighting the company's success in offering sophisticated financial products.

- Premiums and Fees: Revenue generated from the sale and servicing of life insurance and annuity products.

- Retirement & Protection Solutions: A core segment contributing significantly to free cash flow.

- Structured Variable Annuities: A notable contributor to sales within the annuity product line.

- Diversified Business Model: The segment's consistent performance enhances the overall stability of Ameriprise Financial.

Performance Fees

Ameriprise Financial generates revenue through performance fees, primarily within its asset management division. These fees are tied to how well specific investment funds or mandates perform, meaning they can change depending on market trends and the effectiveness of the investment approaches used. For instance, in 2023, Ameriprise's asset management segment saw significant inflows, suggesting a positive environment for performance-based earnings.

These performance fees are a key indicator of the company's success in managing assets. When investment strategies yield strong returns, Ameriprise benefits directly from these fees. This revenue stream is variable, directly reflecting the skill of their portfolio managers and the prevailing economic climate.

- Performance fees are earned on investment success.

- Revenue fluctuates with market conditions and strategy outcomes.

- Strong performance fees signal effective asset management.

Ameriprise Financial's revenue streams are diverse, encompassing fees from managing assets and providing financial advice, commissions from brokerage activities and product sales, net investment income from banking operations, and premiums and fees from its insurance and annuity products. Performance fees, tied to investment success, also contribute significantly, especially within its asset management division.

| Revenue Stream | Description | 2024 Insight |

|---|---|---|

| Management & Advice Fees | Fees for asset management, financial advice, and wrap accounts. | Robust net inflows in advisory and asset management in Q1 2024. |

| Commissions & Transaction Fees | Revenue from brokerage trades and financial product sales. | Strong performance in Advice & Wealth Management segment, linked to client engagement. |

| Net Investment Income | Interest earned on bank assets like loans and securities. | Reported robust net investment income in Q1 2024, reflecting diversified assets. |

| Premiums & Fees (Insurance/Annuities) | Revenue from life insurance, annuities, and related services. | Retirement & Protection Solutions segment is a key driver, with structured variable annuities notable. |

| Performance Fees | Fees earned when investment funds outperform benchmarks. | 2023 saw significant inflows into asset management, indicating positive performance fee potential. |

Business Model Canvas Data Sources

The Ameriprise Financial Business Model Canvas is built using a combination of internal financial data, extensive market research, and competitive analysis. This ensures each component, from customer segments to revenue streams, is grounded in factual information and strategic understanding.