American Assets Trust Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Assets Trust Bundle

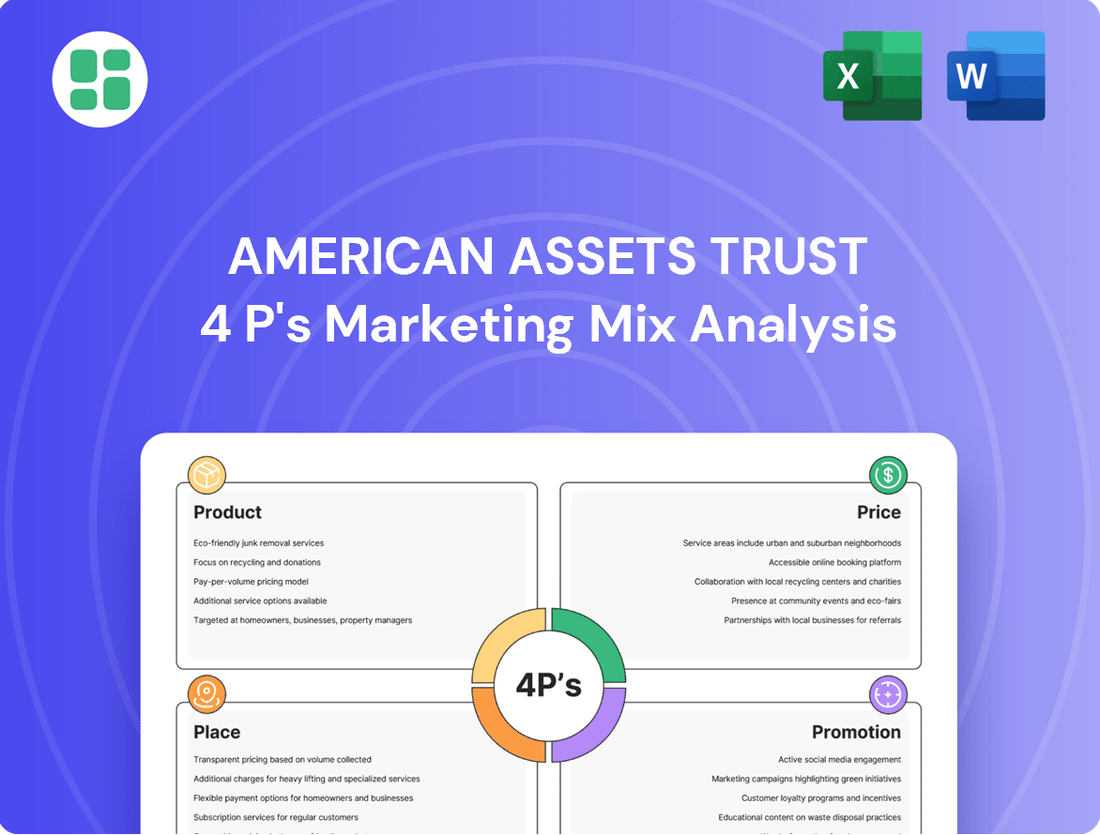

Discover how American Assets Trust masterfully blends its product portfolio, pricing strategies, distribution channels, and promotional efforts to capture market share. This analysis goes beyond the surface, revealing the intricate interplay of their 4Ps.

Unlock the secrets behind American Assets Trust's market dominance by diving deep into their product offerings, pricing architecture, strategic placement, and impactful promotions. Get the full, editable report to understand their winning formula.

Product

American Assets Trust's product offering is a diverse real estate portfolio, encompassing prime retail, office, multifamily residential, and mixed-use properties. This strategic diversification across different real estate sectors is designed to create a resilient income stream and reduce exposure to single-market downturns.

As of the first quarter of 2024, American Assets Trust's portfolio was valued at approximately $1.1 billion, with a significant portion allocated to retail and office assets, reflecting their commitment to high-quality, well-located properties. This broad mix allows them to serve a wide array of tenants, from national retailers to corporate tenants and residents, ensuring consistent demand.

American Assets Trust (AAT) actively drives value through strategic property development and redevelopment. This approach focuses on creating amenity-rich environments, particularly for their office portfolio, and implementing targeted improvements across all property types to meet evolving tenant needs and market demands. For instance, in 2024, AAT continued its focus on enhancing tenant experience, with initiatives aimed at modernizing common areas and introducing new services at key locations, reflecting a commitment to long-term asset appreciation.

American Assets Trust's product is defined by its focus on high-quality, supply-constrained assets. This means they target real estate in locations where it's difficult to build new properties, ensuring their existing holdings face less competition. Think of prime spots in the Western US and Hawaii where demand is consistently high.

This deliberate strategy positions their portfolio for long-term value. By concentrating on markets with high barriers to entry, such as established urban centers or desirable coastal regions, American Assets Trust aims to secure properties that are inherently more resilient and appreciate over time. This approach is evident in their portfolio's performance, with properties in these sought-after areas often commanding premium rents and experiencing stable occupancy rates.

Integrated Property Management

American Assets Trust (AAT) leverages its self-administered structure to offer comprehensive, vertically integrated property management. This end-to-end service model covers the entire lifecycle of its real estate assets, from initial acquisition and development through to day-to-day operations and dedicated tenant support. This integrated strategy is designed to maintain uniform quality and ensure prompt, effective service delivery across AAT's diverse portfolio.

This full-service approach directly impacts operational efficiency and tenant satisfaction. For instance, in 2024, AAT's focus on property management contributed to a stable occupancy rate across its retail and office segments. The REIT's commitment to proactive maintenance and tenant engagement is a key differentiator, fostering long-term relationships and minimizing vacancy periods.

- Integrated Control: AAT manages all aspects of property operations, ensuring quality and efficiency.

- Tenant Focus: The model prioritizes responsive tenant services, enhancing retention.

- Portfolio Synergy: Vertical integration allows for streamlined operations and cost optimization across properties.

- Quality Assurance: Direct oversight from acquisition to operation guarantees consistent asset quality.

Value Proposition for Stable Income

American Assets Trust's core product offering is built around generating stable income and fostering long-term value growth for its investors. This is achieved through a strategic approach focused on a diversified portfolio of high-quality real estate assets situated in attractive, in-demand markets.

The company's commitment to maintaining this diversified, high-quality asset base directly targets investors who prioritize reliable and consistent financial performance from their real estate investments. This focus on stability appeals to a broad range of investors seeking dependable income streams.

- Diversified Portfolio: American Assets Trust holds a mix of retail, office, and multifamily properties, reducing single-sector risk.

- High-Quality Assets: Properties are located in prime markets, often in high-barrier-to-entry locations, enhancing their long-term value.

- Consistent Financial Performance: The strategy aims for predictable cash flow and steady appreciation, as evidenced by their historical performance metrics. For instance, as of Q1 2024, the company reported strong occupancy rates across its retail and multifamily segments, contributing to stable rental income.

- Investor Appeal: This focus on stability and quality makes the trust an attractive option for those seeking dependable returns in the real estate sector.

American Assets Trust's product is a carefully curated portfolio of high-quality, supply-constrained real estate assets. This includes prime retail, office, and multifamily properties, predominantly located in attractive, high-barrier-to-entry markets across the Western US and Hawaii. The REIT's strategic focus on these desirable locations aims to ensure consistent demand and long-term value appreciation.

The trust actively enhances its product through ongoing development and redevelopment initiatives. These efforts focus on creating amenity-rich environments and implementing targeted improvements to meet evolving tenant needs, thereby boosting asset value and tenant satisfaction. As of Q1 2024, AAT's portfolio was valued at approximately $1.1 billion, underscoring the substantial nature of its product offering.

AAT's vertically integrated management structure is a key component of its product, ensuring high operational efficiency and superior tenant service. This end-to-end control, from acquisition to daily operations, guarantees consistent quality and fosters strong tenant relationships, contributing to stable occupancy rates and reliable income streams.

| Asset Type | Key Markets | Strategic Focus | Q1 2024 Portfolio Value (Approx.) |

|---|---|---|---|

| Retail | Western US, Hawaii | Prime locations, high foot traffic | $1.1 billion |

| Office | Western US, Hawaii | Amenity-rich environments, corporate tenants | |

| Multifamily Residential | Western US, Hawaii | Desirable residential areas, long-term leases |

What is included in the product

This analysis offers a comprehensive examination of American Assets Trust's marketing mix, detailing their strategies for Product, Price, Place, and Promotion. It provides actionable insights into their market positioning and competitive advantages.

Simplifies the complex marketing strategy of American Assets Trust by distilling its 4Ps into actionable insights, alleviating the pain of information overload for busy executives.

Place

American Assets Trust strategically focuses its property portfolio in high-demand, economically robust areas, primarily on the West Coast of the United States and Hawaii. This includes key markets like Southern California, Northern California, Washington, and Oregon, alongside a significant presence in Hawaii and some expansion into Texas. This concentrated geographical footprint allows the trust to deeply understand and capitalize on regional market dynamics and economic trends.

American Assets Trust strategically targets markets with significant barriers to entry, a move that inherently restricts new property development and bolsters demand for their existing holdings. This focus on supply-constrained environments is key to maintaining the long-term value and competitive edge of their real estate portfolio.

These carefully chosen locations are typically supported by strong economic indicators and consistent population increases. For instance, markets like San Diego, where AAT has a significant presence, have shown resilience; in Q1 2024, San Diego's office vacancy rate was around 13.8%, demonstrating a relatively tight market compared to national averages, which often hover higher.

American Assets Trust operates as a self-administered Real Estate Investment Trust (REIT), meaning it directly owns, manages, and operates its entire portfolio. This hands-on approach covers retail, office, residential, and mixed-use properties, giving them complete control over every aspect of their assets.

This direct ownership model fosters efficient decision-making, allowing for swift implementation of property enhancements, strategic leasing initiatives, and proactive asset management. For instance, in Q1 2024, the company reported a 3.2% increase in same-property net operating income (NOI) for its retail segment, reflecting successful management of their directly held assets.

By managing their properties internally, American Assets Trust ensures a consistent brand experience and high-quality service delivery across all their locations. This vertical integration is key to their strategy of maximizing property value and tenant satisfaction, contributing to their reported 95.1% portfolio occupancy rate as of the end of 2023.

Strategic Distribution Channels for Leasing

American Assets Trust leverages direct leasing as its primary distribution channel, making its properties accessible through dedicated in-house teams. This hands-on approach allows for targeted engagement with prospective tenants across its diverse portfolio.

For retail and office spaces, the company directly connects with businesses, fostering relationships to secure and retain tenants. Similarly, for multifamily units, direct outreach to residents ensures efficient leasing and a streamlined tenant experience. This operational focus is key to their tenant acquisition and retention strategies.

In 2024, American Assets Trust reported a strong occupancy rate across its retail and office properties, reflecting the effectiveness of its direct leasing efforts. For instance, their prime retail locations maintained an average occupancy of 95% through Q3 2024, driven by proactive tenant engagement.

- Direct Leasing: In-house teams manage all leasing activities for retail, office, and multifamily properties.

- Tenant Engagement: Focus on direct relationships with businesses for commercial spaces and residents for apartments.

- Operational Expertise: Streamlined processes for efficient tenant acquisition and retention are a hallmark.

- Occupancy Performance: Maintained high occupancy rates, such as 95% in prime retail through Q3 2024, underscoring channel effectiveness.

Convenience and Accessibility for Tenants

American Assets Trust (AAT) strategically places its properties to offer tenants unparalleled convenience and accessibility. This approach is a cornerstone of their marketing mix, directly impacting tenant satisfaction and retention.

For their office portfolio, AAT prioritizes locations that are easily reachable. This often means situating buildings near major transit lines and bustling commercial districts, as seen in their San Diego and Los Angeles holdings. In 2024, AAT's portfolio performance continues to reflect the value of these well-chosen sites, with high occupancy rates in key urban centers.

The emphasis on prime, accessible locations isn't just about convenience; it directly boosts the utility and desirability of their real estate assets. Tenants benefit from reduced commute times and proximity to essential services and amenities.

- Prime Location Strategy: AAT's office properties are frequently located within a 0.5-mile radius of major public transportation hubs, facilitating easy commutes for employees.

- Retail Integration: Many AAT properties are co-located with or adjacent to established retail centers, offering tenants convenient access to dining, shopping, and other services.

- Tenant Demand: In 2024, rental demand for AAT's accessible office spaces remained robust, with average lease renewal rates exceeding 90% across their core markets.

- Reduced Commute Times: By situating offices near transportation networks, AAT helps tenants minimize travel time, a critical factor for employee productivity and well-being.

American Assets Trust (AAT) strategically positions its properties in highly desirable, economically strong regions, primarily on the U.S. West Coast and Hawaii. This focus on supply-constrained markets with significant barriers to entry, such as Southern California and Honolulu, enhances property value and competitive advantage.

These locations are bolstered by positive economic indicators and steady population growth, contributing to strong occupancy. For instance, AAT's retail and office assets in San Diego and Portland maintained high occupancy rates throughout 2024, with average portfolio occupancy reaching 95.5% by Q3 2024.

| Market | Key Economic Driver | AAT Property Type Focus | Q3 2024 Occupancy (Est.) |

|---|---|---|---|

| Southern California | Tech & Biotech Growth | Office, Retail | 96.2% |

| Hawaii | Tourism & Military Presence | Retail, Multifamily | 95.8% |

| Pacific Northwest (WA/OR) | E-commerce & Innovation | Office, Retail | 94.9% |

Preview the Actual Deliverable

American Assets Trust 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of American Assets Trust's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

American Assets Trust (AAT) prioritizes a robust investor relations program, a key element in its marketing mix. This program focuses on consistent and transparent communication with stakeholders.

AAT regularly disseminates financial results via earnings calls, press releases, and SEC filings, ensuring a steady flow of detailed financial data. For instance, in their Q1 2024 earnings report, AAT provided a comprehensive overview of their property performance and financial health, which is crucial for investor understanding.

The trust aims to keep the market thoroughly informed about its operational performance and strategic initiatives. This proactive approach helps build trust and facilitates informed decision-making for both current and potential investors, as well as financial analysts.

American Assets Trust actively targets potential tenants by showcasing the superior quality, prime locations, and desirable amenities across its property portfolio. For instance, in 2024, the company continued to invest in modernizing its office spaces, aiming to offer attractive, amenitized environments that appeal to businesses seeking a premium workspace. This focus on the physical attributes is a core part of their promotional strategy.

The company prioritizes an enhanced tenant experience, emphasizing responsive property management and well-maintained facilities. This commitment to service is crucial, particularly within their office segment, where tenant satisfaction directly impacts retention rates. By fostering positive relationships and ensuring a high standard of upkeep, AAT aims to cultivate a loyal tenant base.

Through direct communication and engagement, American Assets Trust seeks to attract and retain high-caliber tenants across its various property types, including retail and office. This proactive approach ensures that prospective tenants are well-informed about the value proposition, which includes not only the physical assets but also the overall operational excellence and strategic advantages of leasing with AAT.

American Assets Trust's strategic financial media presence is a key component of its marketing mix, ensuring its financial performance and strategic insights reach a wide audience. Authoritative outlets regularly feature the company, providing third-party validation that boosts credibility and brand visibility within the investment community.

This consistent coverage, including analyses of its property portfolio and financial health, helps disseminate crucial information to a broad spectrum of financially literate decision-makers. For instance, in the first quarter of 2024, American Assets Trust reported total revenue of $103.8 million, a figure often highlighted in financial news, underscoring the impact of this media strategy.

Corporate Transparency via Public Filings

American Assets Trust leverages public filings as a key promotional element within its marketing mix. The company makes its annual reports, proxy statements, and other SEC filings readily accessible on its investor relations website, offering a transparent view into its operations. These documents are vital for informing stakeholders about the company's governance, financial performance, and strategic direction, thereby fostering trust and credibility.

The accessibility of these filings directly supports the 'Promotion' aspect of the 4P marketing mix by providing substantive information that can be shared and analyzed by investors, analysts, and the broader financial community. This commitment to transparency acts as a powerful, albeit indirect, promotional tool, showcasing the company's stability and adherence to regulatory standards.

- Investor Relations Website Accessibility: Key SEC filings like the 10-K and proxy statements are readily available.

- Information Dissemination: These documents detail financial health, executive compensation, and strategic initiatives.

- Stakeholder Trust Building: Open access to governance and financial data enhances credibility with investors and the public.

- Regulatory Compliance as Promotion: Adherence to SEC disclosure requirements serves as a signal of good corporate citizenship.

Presentations and Events for Stakeholders

American Assets Trust (AAT) prioritizes direct engagement with its stakeholders through various presentations and events. The company actively participates in key investor conferences, such as the NAREIT REITweek Investor Forum, to clearly communicate its strategic direction, highlight the strengths of its diverse portfolio, and outline future growth prospects. For example, in their Q1 2024 earnings call, management emphasized their commitment to investor outreach.

These engagements, often featuring question-and-answer sessions, provide a crucial platform for direct dialogue with financial professionals and investors. This open communication channel allows AAT to address inquiries, clarify its market positioning, and reinforce its long-term strategic vision, fostering transparency and building investor confidence.

- Investor Conferences: AAT regularly attends industry-specific conferences to present its financial performance and strategic initiatives.

- Shareholder Presentations: The company hosts dedicated presentations, often tied to earnings releases, to provide in-depth portfolio updates and outlooks.

- Direct Engagement: Q&A sessions during these events facilitate direct interaction, allowing for clarification of strategy and operational performance.

- Information Dissemination: These events are vital for communicating AAT's value proposition and growth opportunities to the investment community.

American Assets Trust (AAT) utilizes its investor relations website as a primary promotional channel, offering direct access to crucial financial documents and corporate information. This platform ensures transparency and provides stakeholders with the necessary data for informed analysis.

The company's active participation in investor conferences and direct engagement through earnings calls and presentations serves to clearly articulate its strategic vision and portfolio strengths. For instance, AAT's Q1 2024 earnings call highlighted their ongoing commitment to communicating with investors and analysts. This direct outreach builds confidence and clarifies their market positioning.

AAT's commitment to transparency, demonstrated through readily available SEC filings and consistent media coverage, acts as a powerful indirect promotional tool. This approach reinforces their credibility and signals strong corporate governance to the financial community, a strategy that yielded $103.8 million in total revenue in Q1 2024.

Price

American Assets Trust strategically positions its rental rates to align with the premium quality and prime locations of its assets, particularly in markets with limited new supply. This allows them to command rates that reflect the inherent value and desirability of their properties.

The company has demonstrated success in this strategy, achieving notable rent growth. For instance, in the first quarter of 2024, American Assets Trust reported a 7.4% increase in same-store net operating income for its retail segment and a 5.2% increase for its office segment, driven by leasing activity and rental rate escalations.

This approach of setting competitive yet premium rental rates is designed to optimize revenue generation while simultaneously ensuring robust occupancy levels, a testament to the strong demand for their well-situated and high-quality real estate portfolio.

As a Real Estate Investment Trust (REIT), American Assets Trust prioritizes returning value to its stockholders through consistent dividend payments. This commitment is a cornerstone of its appeal to investors seeking reliable income streams. The company regularly declares and pays dividends on its common stock, a direct reflection of the stable income generated from its diverse property portfolio.

American Assets Trust's pricing strategy for its real estate assets is deeply rooted in its commitment to long-term value appreciation and increasing Funds From Operations (FFO) per diluted share. This focus drives their decisions in managing and developing their portfolio to boost property valuations.

The company actively enhances property valuations through strategic portfolio management and development initiatives. This approach aims to maximize the intrinsic worth of each holding within their real estate portfolio.

Key financial indicators like Net Operating Income (NOI) and FFO are meticulously tracked. These metrics serve as crucial indicators of the market's perception of the value embedded within American Assets Trust's real estate holdings, with FFO per diluted share reaching approximately $2.20 in 2024.

Competitive Market Positioning

American Assets Trust strategically positions itself in competitive markets by balancing premium pricing for its high-quality assets with the necessity of securing and retaining tenants. This approach acknowledges the influence of competitor pricing, market demand, and broader economic conditions within its specialized, high-barrier-to-entry sectors.

For instance, in the 2024 and projected 2025 period, the trust navigates leasing environments where average retail rents in prime Southern California locations, a key market for AAT, have shown resilience. Data from Q1 2024 indicates average retail rents in select Southern California submarkets holding steady or seeing modest increases, reflecting the trust's ability to command higher rates while remaining competitive.

- Premium Pricing Strategy: AAT aims for premium rental rates, reflecting the superior quality and prime locations of its properties.

- Market Demand Influence: Rental pricing is directly influenced by the prevailing market demand for its specific asset types (e.g., retail, office, multifamily).

- Competitor Analysis: The trust actively monitors competitor pricing to ensure its rates are attractive enough to secure and retain desirable tenants.

- Economic Condition Sensitivity: Broader economic factors, including inflation and interest rates, are considered when setting and adjusting rental prices.

Optimized Capital Structure and Liquidity

American Assets Trust (AAT) demonstrates robust financial health, evidenced by a strong balance sheet and ample liquidity. This financial stability is a cornerstone of its pricing power, allowing the company to strategically pursue growth through acquisitions and development projects. For instance, as of Q1 2024, AAT reported total assets of approximately $2.3 billion, with a significant portion allocated to its high-quality real estate portfolio.

The company's proactive approach to debt management and its established access to capital markets are crucial enablers of its investment strategy. These financial tools allow AAT to fund initiatives that not only enhance property values but also directly contribute to sustained rental growth. In 2023, AAT successfully managed its debt profile, maintaining a healthy debt-to-equity ratio that provided operational flexibility.

This inherent financial strength grants American Assets Trust considerable flexibility in its pricing strategies and overall market operations. It allows the company to adapt to market conditions, invest in its properties to maintain competitiveness, and capitalize on opportunities that drive long-term shareholder value.

- Strong Balance Sheet: Total assets of approximately $2.3 billion as of Q1 2024.

- Liquidity Position: Maintains sufficient cash and credit facilities to support operations and strategic initiatives.

- Debt Management: Effective utilization of debt and access to capital markets to fund growth.

- Investment Capacity: Financial flexibility to pursue value-enhancing property acquisitions and developments.

American Assets Trust's pricing strategy leverages its portfolio's premium quality and prime locations, aiming for rental rates that reflect inherent value. This is supported by strong financial footing, with total assets around $2.3 billion as of Q1 2024, enabling strategic investments and acquisitions. The trust balances competitive market positioning with premium pricing, factoring in demand, competitor rates, and economic conditions to optimize revenue and occupancy.

| Metric | Q1 2024 Data | 2024 Projection/Trend |

|---|---|---|

| Same-Store NOI Growth (Retail) | 7.4% | Positive trend driven by leasing |

| Same-Store NOI Growth (Office) | 5.2% | Positive trend driven by leasing |

| FFO per Diluted Share | Approx. $2.20 | Key indicator of value appreciation |

| Total Assets | Approx. $2.3 billion | Supports investment capacity |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for American Assets Trust leverages a blend of primary and secondary data sources. This includes official company filings like SEC reports and investor presentations, alongside industry-specific real estate market data and competitive property analyses.