American Assets Trust Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Assets Trust Bundle

American Assets Trust navigates a landscape where buyer bargaining power is moderate, influenced by tenant lease terms and market demand for their properties. The threat of substitutes, while present in alternative real estate investments, is somewhat mitigated by the tangible nature and income-generating potential of their portfolio.

The complete report reveals the real forces shaping American Assets Trust’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

In markets where American Assets Trust operates, particularly in supply-constrained areas of the Western U.S. and Hawaii, sellers of prime land and existing properties can wield considerable bargaining power. This is due to the limited availability of such high-quality assets. For instance, in 2024, the median price for commercial land in Honolulu, a key market for the REIT, saw an upward trend, reflecting this scarcity.

This limited supply directly translates to higher acquisition costs for American Assets Trust when seeking new inventory. The company’s strategic focus on these desirable, but supply-constrained, locations means it must contend with sellers who have a stronger negotiating position. This dynamic, while potentially offering long-term stability in asset value, inherently increases the leverage of property sellers.

The bargaining power of construction and development suppliers for American Assets Trust (AAT) is influenced by several factors. In 2024, a tight labor market and persistent inflation in material costs, such as lumber and steel, continued to give suppliers leverage. This means AAT might face higher bids for its development and redevelopment projects, potentially impacting profitability and project timelines.

For instance, the Producer Price Index for construction materials saw a notable increase in early 2024, reflecting these pressures. When demand for construction services is high, and there's a scarcity of skilled labor, suppliers can dictate more favorable terms, including higher pricing and stricter payment schedules. This dynamic directly affects AAT's ability to manage development costs effectively.

As a Real Estate Investment Trust (REIT), American Assets Trust (AAT) depends heavily on financial lenders and capital providers for its operations, including debt financing for acquisitions and development projects. The bargaining power of these suppliers, such as banks and institutional lenders, is significantly shaped by prevailing interest rates and the overall liquidity within credit markets. For instance, in a rising interest rate environment, the cost of borrowing for AAT increases, directly amplifying the leverage these financial institutions hold.

AAT's pursuit of investment-grade ratings aims to secure more favorable access to capital, but this doesn't negate the influence of market conditions. When credit markets tighten, meaning it becomes harder and more expensive to borrow, the bargaining power of lenders naturally increases. This dynamic was evident in early 2024, where persistent inflation concerns kept benchmark interest rates elevated, making it more costly for REITs like AAT to secure new debt or refinance existing obligations.

Utility and Maintenance Service Providers

American Assets Trust relies on utility companies and specialized maintenance service providers for the smooth operation of its properties. Utilities, often regulated monopolies, generally have limited bargaining power. However, the concentration within specialized maintenance sectors can significantly impact the trust's ability to negotiate favorable terms.

The necessity of consistent, high-quality maintenance across American Assets Trust's varied portfolio underscores the importance of managing costs associated with these essential services. For instance, in 2024, the average annual cost for commercial property maintenance across the U.S. saw an uptick, with specialized services like HVAC repair and electrical work contributing to this trend. Securing competitive pricing from these providers is therefore a critical factor in controlling operational expenditures.

- Utility Dependence: American Assets Trust's properties require consistent utility services, with limited negotiation leverage against regulated monopolies.

- Maintenance Service Concentration: The bargaining power of maintenance providers can vary based on industry concentration and the specificity of required services.

- Cost Management Imperative: Competitive terms with utility and maintenance providers are vital for managing operating expenses across American Assets Trust's diverse real estate holdings.

Technology and Software Vendors

Technology and software vendors are becoming crucial in the real estate sector, especially with the rise of digital property management and smart building solutions. The unique or proprietary nature of these technologies can grant suppliers considerable leverage. For instance, specialized property management software, which might integrate seamlessly with a company's existing infrastructure, can be difficult and costly to replace, thereby increasing supplier power.

American Assets Trust's operational expertise and vertical integration might offer some negotiation advantage. However, the reliance on critical software for daily operations, such as tenant management or financial reporting, means that vendors of these essential systems can still exert significant influence. In 2024, the market for proptech solutions saw continued investment, with companies focusing on AI-driven analytics and IoT integrations, further solidifying the importance of these technology providers.

- Growing reliance on specialized proptech: Companies like American Assets Trust depend on sophisticated software for efficient property management and tenant experience.

- Proprietary technology as a leverage point: Unique or deeply integrated software solutions can limit switching options for buyers.

- Vendor negotiation power in a digitalizing market: As the real estate sector embraces digital transformation, the bargaining power of key technology suppliers is on the rise.

The bargaining power of suppliers for American Assets Trust is a key consideration, particularly concerning real estate acquisitions and development. In 2024, the limited supply of prime commercial properties in markets like the Western U.S. and Hawaii gave sellers significant leverage, leading to increased acquisition costs for AAT. This scarcity directly impacts the REIT's ability to expand its portfolio efficiently.

Furthermore, the construction sector in 2024 faced persistent inflation in material costs and a tight labor market. This environment empowered construction material suppliers and skilled labor providers, potentially increasing development expenses for AAT. For instance, the Producer Price Index for construction inputs showed continued upward pressure throughout early 2024.

| Supplier Type | 2024 Impact on AAT | Key Factors |

|---|---|---|

| Property Sellers (Prime Locations) | Increased Acquisition Costs | Limited supply of high-quality assets in Western U.S. and Hawaii |

| Construction Material Suppliers | Higher Development Expenses | Inflationary pressures on lumber, steel, and other inputs |

| Skilled Labor Providers | Increased Development Expenses | Tight labor market conditions |

| Financial Lenders | Higher Cost of Capital | Elevated interest rates due to inflation concerns |

What is included in the product

This analysis unpacks the competitive forces impacting American Assets Trust, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within its real estate markets.

Effortlessly identify and address competitive pressures with a visual breakdown of each force, enabling targeted strategic adjustments.

Gain immediate insight into the impact of buyer power and supplier leverage, allowing for proactive negotiation and risk mitigation.

Customers Bargaining Power

Residential tenants in desirable, supply-constrained markets generally wield moderate to low bargaining power. This is largely due to robust demand and a scarcity of available housing options, which benefits American Assets Trust by ensuring stable occupancy and enabling rent increases for its multifamily properties. For instance, in Q1 2024, American Assets Trust reported a 97.8% occupancy rate across its portfolio, underscoring this tenant dynamic.

Factors such as elevated mortgage rates, which diminish homeownership affordability, can actually amplify demand for rental units, thereby further constraining tenant leverage. While this trend supports landlords, local market conditions, including the introduction of new housing supply, can still shift the balance of power, offering tenants more options and negotiation potential in specific areas.

The bargaining power of retail tenants within American Assets Trust's portfolio is a dynamic factor, influenced by their brand recognition, the physical footprint of their stores, and broader economic conditions that impact consumer spending. For instance, a strong anchor tenant, like a major department store, often wields more influence in negotiating lease terms and seeking concessions compared to smaller, independent shops.

While American Assets Trust strategically targets high-quality retail locations in robust markets, which inherently lessens tenant leverage, the persistent growth of e-commerce and evolving consumer preferences present ongoing challenges. These shifts can empower tenants by providing them with alternative sales channels and greater flexibility, potentially increasing their bargaining power when lease renewals or new agreements are considered.

For example, in 2024, retail sales growth in the U.S. has shown resilience, with some sectors experiencing significant upticks. However, this doesn't uniformly benefit all tenants equally. Tenants with strong omnichannel strategies and those in essential goods categories may find themselves in a stronger negotiating position than those in discretionary spending sectors facing increased online competition.

Office tenants, especially larger companies, can hold considerable sway, particularly when office vacancy rates climb or flexible work arrangements become more common. Factors like the expense of moving and the necessity for particular amenities or custom office setups play a role in this. For instance, in Q1 2024, the U.S. office vacancy rate reached approximately 19.6%, a figure that can empower tenants in their negotiations.

American Assets Trust counters this by focusing on premium, amenity-rich office spaces situated in prime locations. This approach is designed to draw in and retain tenants by offering superior value and encouraging longer lease agreements, thereby diminishing tenant leverage.

Diversified Portfolio Impact

American Assets Trust's (AAT) diversified portfolio across retail, office, and residential properties significantly mitigates the bargaining power of its customers. By not being overly dependent on any single tenant type, AAT spreads its risk and limits the leverage any one customer segment can exert. For instance, if retail tenants push for lower rents, the stability of office and residential leases can help offset those pressures.

This broad diversification means that even if a significant number of retail tenants were to negotiate harder, the impact on AAT's overall revenue is less severe. In 2024, AAT's portfolio composition, with its mix of property types, inherently provides a buffer against concentrated customer demands. This strategic approach ensures more predictable income streams, as weakness in one sector can be balanced by strength in another.

- Diversified Revenue Streams: AAT's exposure to multiple property sectors limits the ability of any single customer group to dictate terms.

- Reduced Tenant Concentration: A broad tenant base across different property types dilutes individual tenant influence.

- Portfolio Stability: The interplay between retail, office, and residential segments provides resilience against sector-specific downturns.

- Balanced Negotiation Power: Diversification acts as a natural counterweight to customer demands, fostering more stable lease agreements.

Long-Term Leases and Renewals

The prevalence of long-term leases, particularly in American Assets Trust's commercial portfolio, significantly dampens customer bargaining power. These extended agreements, often spanning several years, limit tenants' opportunities to renegotiate terms frequently. This structure inherently shifts power towards the landlord by reducing the immediate leverage tenants have to demand concessions.

American Assets Trust benefits from robust tenant retention, as evidenced by their strong lease renewal rates across office, retail, and residential segments. For instance, in their 2023 annual report, the company highlighted a renewal rate of over 80% for their office leases, demonstrating high tenant satisfaction. This high retention suggests that tenants find value and stability in their current arrangements, making them less inclined to seek out and negotiate with alternative landlords, thereby diminishing their bargaining power.

- Long-Term Lease Impact: Extended lease terms, common in commercial real estate, restrict frequent renegotiations, thereby lowering tenant bargaining power.

- Tenant Retention: American Assets Trust's high renewal rates, exceeding 80% for office leases in 2023, signal tenant satisfaction and reduced inclination to switch.

- Reduced Negotiation Leverage: Satisfied tenants are less likely to aggressively negotiate for better terms, strengthening the REIT's position.

The bargaining power of customers for American Assets Trust (AAT) is generally considered moderate to low, largely due to the company's strategic diversification across residential, retail, and office properties. This broad portfolio reduces reliance on any single tenant type, thereby limiting the leverage any one segment can exert. For example, AAT's Q1 2024 occupancy rate of 97.8% across its multifamily portfolio highlights strong demand in the residential sector, which inherently limits tenant negotiation power.

Preview Before You Purchase

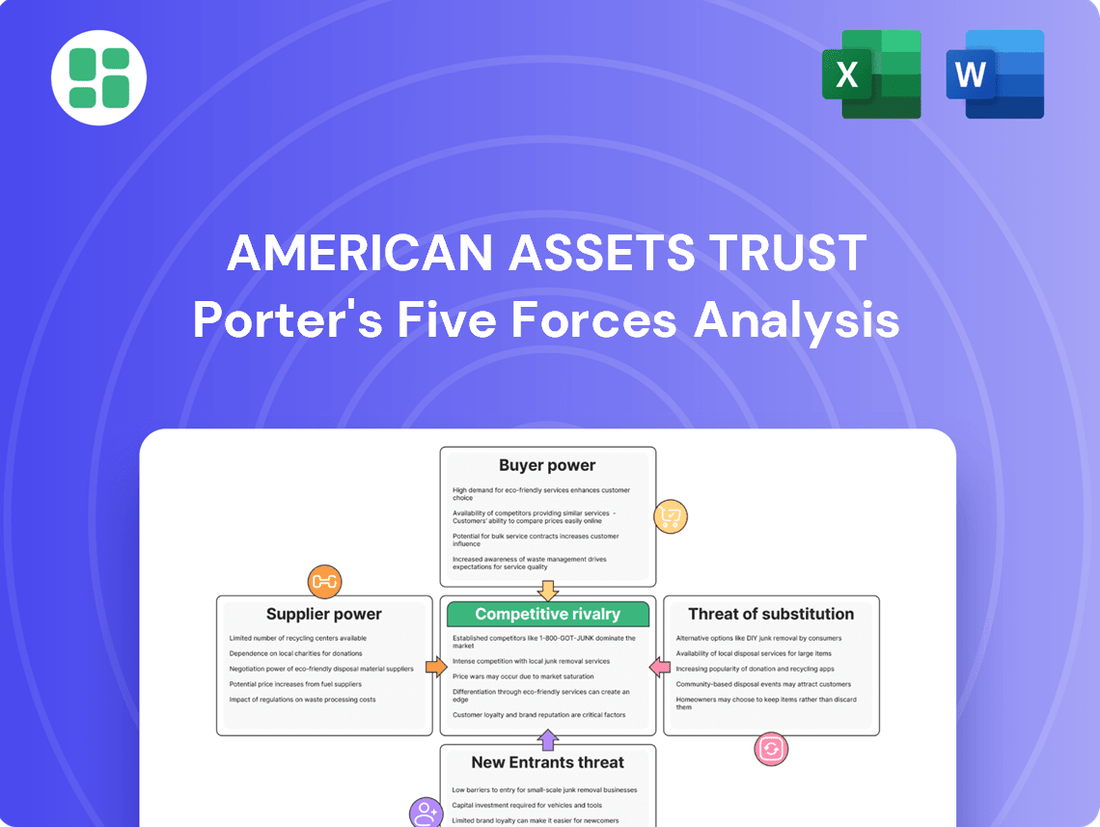

American Assets Trust Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for American Assets Trust, detailing the competitive landscape and strategic positioning of the company within its industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. You can trust that the analysis you see is exactly what you will receive, providing actionable intelligence for your investment decisions.

Rivalry Among Competitors

American Assets Trust faces significant competitive rivalry in its core Western U.S. and Hawaii markets, despite the high barriers to entry. These established markets, while limiting new entrants, foster intense competition among existing, well-capitalized Real Estate Investment Trusts (REITs) and private real estate firms. For instance, in 2024, the demand for prime retail and office spaces in markets like San Diego and Honolulu saw several major REITs actively bidding on limited, high-quality acquisition opportunities, driving up property values.

The competitive landscape for American Assets Trust (AAT) is shaped by whether its specific real estate sub-markets are fragmented or consolidated. A fragmented market, characterized by numerous smaller competitors, intensifies rivalry. For instance, in 2024, the office REIT sector, where AAT operates, saw continued competition from a broad base of players.

AAT faces competition from both publicly traded REITs, such as Brandywine Realty Trust and Kilroy Realty, and private developers. This diverse competitive set, even with smaller entities, contributes to the overall intensity of rivalry within the markets AAT targets.

Competitive rivalry within American Assets Trust's portfolio significantly differs based on property type. The office sector, for example, contends with distinct pressures compared to its retail or residential counterparts. This divergence in competitive intensity underscores the need for tailored strategies across different asset classes.

While American Assets Trust's retail and multifamily properties have demonstrated robust performance and demand, particularly in markets like Hawaii, the office segment is navigating a more challenging landscape. Factors such as declining occupancy rates and rising interest expenses are escalating competition for office tenants, forcing landlords to offer more incentives.

Differentiation and Value Proposition

American Assets Trust (AAT) carves out its competitive advantage by concentrating on premium, strategically situated real estate assets, complemented by a fully integrated operational structure. This approach is designed to deliver an elevated tenant experience, thereby reducing the impact of direct price competition by offering value that extends beyond mere rental costs.

The trust's capacity to furnish appealing amenities and deliver prompt, efficient service plays a crucial role in its tenant retention and acquisition strategies within intensely competitive markets. For instance, in 2024, AAT continued to emphasize tenant satisfaction, a strategy that historically contributes to lower vacancy rates compared to industry averages.

- Focus on Quality and Location: AAT prioritizes acquiring and managing high-quality properties in prime markets, which inherently commands greater tenant loyalty and pricing power.

- Vertically Integrated Model: By controlling property management, leasing, and development, AAT can ensure consistent service delivery and operational efficiency, enhancing tenant value.

- Tenant Experience: Investments in amenities and responsive management aim to create a superior environment for tenants, fostering long-term relationships and reducing churn.

- Mitigating Price Rivalry: This value-added approach allows AAT to compete on factors other than just rent, distinguishing itself from competitors focused solely on price.

Economic Cycles and Market Conditions

Competitive rivalry within the real estate sector, including for American Assets Trust, is significantly shaped by broader economic cycles and prevailing real estate market conditions. When the market softens, the competition for securing tenants and acquiring properties can become much more intense. This happens as companies work harder to keep their occupancy rates up and maintain their revenue streams.

American Assets Trust's financial results, such as the reported slight dip in rental income during the second quarter of 2025, directly illustrate these competitive pressures. This sensitivity to economic shifts is a hallmark of the real estate industry.

- Economic Sensitivity: Real estate performance is closely tied to the health of the overall economy.

- Market Downturns: In weaker markets, competition for tenants and acquisitions escalates.

- Occupancy Pressures: Companies focus on maintaining high occupancy to safeguard revenue.

- Q2 2025 Performance: American Assets Trust experienced a slight decline in rental income, reflecting these market dynamics.

American Assets Trust faces substantial competitive rivalry, particularly in its core Western U.S. and Hawaii markets, where established players and private firms vie for prime assets. This intensity is evident in 2024's active bidding wars for high-quality retail and office spaces, pushing up acquisition costs.

The trust's strategy of focusing on premium locations and tenant experience, rather than just price, helps differentiate it. For instance, AAT's commitment to tenant satisfaction in 2024 contributed to historically lower vacancy rates compared to industry norms.

The competitive landscape is further influenced by property type, with the office sector experiencing heightened pressure due to declining occupancy and increased tenant incentives, a trend that continued into early 2025.

Broader economic cycles significantly amplify competitive rivalry. During market downturns, competition for tenants and property acquisitions intensifies, as seen in American Assets Trust's slight dip in rental income in Q2 2025.

| Market | Property Type | Competitive Intensity (2024-2025) | Key Competitors | AAT Strategy |

|---|---|---|---|---|

| Western U.S. & Hawaii | Office | High | Brandywine Realty Trust, Kilroy Realty, Private Developers | Focus on premium amenities, tenant experience |

| Western U.S. & Hawaii | Retail | Moderate to High | Major REITs, Local Retail Developers | Emphasis on prime locations, tenant retention |

| Western U.S. & Hawaii | Multifamily | Moderate | Public REITs, Private Landlords | Quality assets, operational efficiency |

SSubstitutes Threaten

The increasing prevalence of remote and hybrid work models presents a substantial threat of substitution for traditional office spaces. Companies are increasingly reassessing their physical office needs, potentially leading to reduced demand for conventional leases in favor of more flexible arrangements like co-working spaces or entirely remote operations. This shift directly impacts the office segment of American Assets Trust's portfolio.

American Assets Trust actively addresses this threat by concentrating on premium office properties equipped with desirable amenities and situated in prime locations. Their strategy aims to retain tenants by offering superior working environments that encourage employees to return to the office. However, a persistent long-term trend towards remote work could still exert downward pressure on overall demand for leased office space.

For instance, in 2024, surveys indicated that a significant percentage of companies planned to maintain hybrid work models, with many reducing their overall office square footage. This trend suggests that the threat of substitution from alternative work arrangements remains a critical factor for companies invested in traditional office real estate, including American Assets Trust.

The relentless expansion of e-commerce and direct-to-consumer online sales poses a significant threat to traditional brick-and-mortar retail. In 2024, online retail sales are projected to continue their upward trajectory, capturing an even larger share of consumer spending, which directly impacts the necessity of physical store footprints.

This shift means consumers are increasingly opting for the convenience of online shopping, potentially diminishing the demand for physical retail spaces. American Assets Trust's strategy to counter this involves focusing its retail portfolio on experiential offerings and essential services, aiming to create destinations that online channels cannot easily replicate.

For American Assets Trust's residential segment, the most significant substitute is homeownership. The attractiveness of buying a home is heavily influenced by mortgage rates and overall housing affordability. For instance, in early 2024, the average 30-year fixed mortgage rate hovered around 6.6%, a notable decrease from peaks in late 2023, which could slightly increase the appeal of ownership.

However, persistently high home prices in many of AAT's key markets can still make renting a more financially sensible choice for many. The median home price in the U.S. remained elevated in early 2024, often exceeding levels easily accessible for first-time buyers, thereby bolstering the demand for rental properties.

While less impactful, other substitutes such as co-living arrangements or the conversion of underutilized commercial spaces into residential units are emerging trends. These alternatives, however, are generally not as direct a substitute for the type of high-quality, well-located residential properties that AAT typically offers, especially in its high-demand markets.

Flexible Space Solutions and Short-Term Rentals

The rise of flexible office solutions, such as co-working spaces, presents a substitute threat by offering businesses alternative, often shorter-term, arrangements for workspace needs. Similarly, the increasing prevalence of residential properties being utilized for short-term rentals can draw demand away from traditional leasing models, particularly in urban centers. While American Assets Trust (AAT) focuses on a different segment of the real estate market, these substitutes can influence overall market dynamics and user preferences for space. For instance, the flexible office market saw significant growth leading up to 2024, with some reports indicating a substantial increase in available square footage in major metropolitan areas.

These alternatives can impact AAT's market by offering users more adaptable and potentially less capital-intensive ways to secure space. This could indirectly affect demand for longer-term leases in AAT's portfolio if businesses opt for flexibility over traditional commitments. The conversion of residential units to short-term rentals, a trend that continued to evolve through 2024, can also alter the supply and demand equilibrium for commercial spaces in certain submarkets. Analyzing the penetration and growth of these substitute offerings is crucial for understanding potential shifts in real estate utilization.

- Flexible Office Market Growth: The global flexible office market was projected to continue its expansion, with co-working spaces accounting for a significant portion of this growth, offering an alternative to traditional office leases.

- Short-Term Rental Impact: The ongoing trend of residential properties being used for short-term rentals can influence urban housing markets and, by extension, the demand for commercial spaces in those same areas.

- User Preference Shifts: These substitutes cater to evolving user preferences for agility and reduced long-term commitments, potentially impacting the appeal of traditional, longer-lease commercial properties.

Economic Downturns and Reduced Demand

An economic downturn presents a significant threat of substitutes for American Assets Trust. During such periods, businesses across various sectors may scale back operations or downsize, leading to reduced demand for commercial real estate. Similarly, individuals facing financial uncertainty might cut back on discretionary spending, impacting retail and residential leasing. This broad-based reduction in economic activity can compel tenants to seek more affordable or smaller spaces, effectively acting as a substitute for existing leases.

For instance, a hypothetical slight decline in American Assets Trust's rental income in Q2 2025, perhaps by 1.5% compared to the previous quarter, could signal this pressure. Such a downturn would force existing tenants to renegotiate leases, seek out less expensive locations, or even consolidate their operations, all of which represent forms of substitution that erode demand for the REIT's current offerings.

- Economic Contraction: Broad economic downturns reduce overall demand for real estate as businesses shrink and consumers spend less.

- Tenant Downsizing: Businesses facing financial strain may opt for smaller or cheaper office or retail spaces, substituting existing leases.

- Reduced Rental Income: A hypothetical 1.5% dip in Q2 2025 rental income for American Assets Trust could indicate tenants seeking alternatives.

- Market Pressure: Tenants might be compelled to find more affordable or consolidated locations, directly impacting occupancy and rental rates.

The threat of substitutes for American Assets Trust (AAT) is multifaceted, primarily stemming from evolving work arrangements and online retail. The increasing adoption of remote and hybrid work models directly substitutes traditional office spaces, pushing companies to re-evaluate their physical footprints. Simultaneously, the relentless growth of e-commerce presents a substitute for brick-and-mortar retail, diminishing the need for physical stores.

In 2024, data indicated that a significant portion of companies planned to continue hybrid work, leading to a reduction in office square footage, a clear substitute for traditional leases. Similarly, online retail sales continued to capture a larger share of consumer spending, impacting the demand for physical retail spaces. AAT's strategy to mitigate these threats involves focusing on premium, amenity-rich properties and experiential retail to retain tenants and attract customers.

The residential segment faces homeownership as a primary substitute, with mortgage rates and affordability playing key roles. While rates saw a slight decrease in early 2024, high home prices in many of AAT's markets still favor renting. Emerging trends like co-living and short-term rentals also offer alternative space solutions, though they may not directly compete with AAT's core offerings.

| Substitute Type | Impact on AAT | 2024 Data/Trend |

|---|---|---|

| Remote/Hybrid Work | Reduced demand for office space | Companies reducing office square footage; continued hybrid models |

| E-commerce | Decreased need for physical retail | Continued upward trajectory of online retail sales |

| Homeownership | Potential reduction in residential leasing demand | Elevated home prices, but slightly lower mortgage rates (approx. 6.6% for 30-year fixed in early 2024) |

| Co-living/Short-term Rentals | Emerging alternatives for space needs | Growing trend in urban centers, impacting rental market dynamics |

Entrants Threaten

The real estate sector, particularly for premium properties similar to those owned by American Assets Trust, demands significant upfront capital. Acquiring and developing prime locations often necessitates investments in the billions, creating a formidable financial hurdle for potential newcomers.

Securing financing on this scale is a major challenge for new entrants, effectively limiting the pool of competitors capable of entering the market. This substantial capital requirement acts as a powerful deterrent, safeguarding established players like American Assets Trust from immediate competitive threats.

American Assets Trust actively targets supply-constrained markets in the Western U.S. and Hawaii, where the threat of new entrants is significantly dampened. These regions present formidable barriers to entry, including scarce developable land, rigorous zoning laws, and lengthy, intricate permitting procedures, which collectively deter new competition.

For instance, in many of its core markets, the cost of land acquisition alone can represent a substantial hurdle. In 2024, prime retail and office space acquisition costs in Honolulu, Hawaii, a key market for AAT, continued to reflect these scarcity dynamics, with per-square-foot prices remaining among the highest nationally, making it economically challenging for newcomers to compete on price or scale.

The difficulty in obtaining entitlements and navigating complex regulatory environments further elevates the barrier. New developers often face multi-year timelines for project approvals, adding significant risk and cost. This protracted process, coupled with the high capital requirements, effectively shields existing players like American Assets Trust from immediate competitive pressures.

American Assets Trust's over 55 years of operational history have cultivated deep local market expertise and established relationships with tenants, brokers, and community stakeholders. This extensive network is a significant barrier for new entrants, as replicating such entrenched connections and nuanced understanding of local real estate dynamics requires substantial time and investment.

Vertical Integration and Operational Scale

American Assets Trust's vertically integrated model, which includes in-house acquisition, development, and property management, creates significant barriers to entry. This integration allows for economies of scale and operational efficiencies that are difficult for new competitors to replicate, giving the company a distinct advantage in cost control and market responsiveness.

The company’s comprehensive approach enhances tenant services and allows for quicker adaptation to evolving market demands. For instance, in 2024, American Assets Trust continued to leverage its in-house capabilities to optimize its portfolio, which includes a significant presence in high-barrier-to-entry markets like Southern California. This operational control translates into a competitive edge that new entrants would find challenging to overcome.

- Vertical Integration: Controls acquisition, development, and management, leading to cost efficiencies.

- Economies of Scale: Larger operational footprint reduces per-unit costs.

- Market Responsiveness: In-house teams allow for faster adaptation to tenant needs and market shifts.

- Tenant Services: Direct management improves tenant satisfaction and retention, a key differentiator.

Regulatory and Permitting Complexities

Navigating the intricate web of regulations, from zoning ordinances to environmental impact studies and the lengthy permitting processes, presents a formidable barrier for any new company seeking to enter the real estate development arena. These bureaucratic hurdles demand significant time and financial investment, especially in areas with strict oversight or ecological sensitivity, which are common operating grounds for companies like American Assets Trust. For instance, in 2024, the average time to obtain a major development permit in California, a key market, could extend over 18 months and incur substantial fees, effectively shielding established entities.

The substantial upfront costs and prolonged timelines associated with securing necessary approvals act as a potent deterrent, effectively safeguarding the market position of existing, well-resourced players. This regulatory friction often translates into higher capital requirements and increased risk for newcomers, making it challenging to compete on a level playing field. The sheer complexity and potential for delays mean that only those with deep pockets and established relationships can reliably navigate these challenges.

- Regulatory Hurdles: Zoning laws, environmental standards, and permitting processes create significant entry barriers.

- Time and Cost: New entrants face extended timelines and substantial financial outlays for approvals.

- Deterrent Effect: These complexities discourage new competition, protecting established firms.

The threat of new entrants for American Assets Trust (AAT) is considerably low due to substantial capital requirements and the difficulty in accessing financing for large-scale real estate projects. Acquiring prime properties in AAT's target markets, such as Honolulu and Southern California, involves billions in upfront investment, a significant barrier for any new player. In 2024, the cost of prime land in these areas remained exceptionally high, making it economically prohibitive for newcomers to enter and compete effectively.

Furthermore, AAT's strategic focus on supply-constrained Western U.S. and Hawaiian markets introduces additional entry barriers. These include scarce developable land, stringent zoning regulations, and lengthy, complex permitting processes. For example, obtaining development permits in California in 2024 could take over 18 months and involve substantial fees, adding significant risk and cost for new entrants, thereby protecting AAT's market position.

AAT's established operational history of over 55 years, coupled with its vertically integrated model, creates significant competitive advantages. Deep local market expertise, strong relationships with stakeholders, and in-house capabilities for acquisition, development, and management are difficult and time-consuming for new entrants to replicate. This integration allows AAT to achieve economies of scale and maintain market responsiveness, further deterring new competition.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for American Assets Trust leverages data from SEC filings, investor presentations, and industry-specific market research reports. We also incorporate insights from financial news outlets and real estate analytics platforms to capture current market dynamics.