American Assets Trust Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Assets Trust Bundle

Unlock the full strategic blueprint behind American Assets Trust's business model. This in-depth Business Model Canvas reveals how the company drives value through its diversified real estate portfolio, captures market share by focusing on prime locations and tenant relationships, and stays ahead in a competitive landscape by optimizing asset management. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a successful REIT.

Dive deeper into American Assets Trust’s real-world strategy with the complete Business Model Canvas. From its unique value propositions targeting specific tenant needs to its cost structure driven by property management and financing, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its future opportunities lie.

See how the pieces fit together in American Assets Trust’s business model. This detailed, editable canvas highlights the company’s key customer segments, crucial partnerships with brokers and lenders, and diverse revenue strategies from rent collection and property sales. Download the full version to accelerate your own business thinking.

Partnerships

American Assets Trust (AAT) cultivates vital connections with financial institutions and lenders to fuel its growth. These partnerships are the bedrock for securing essential financing, from flexible revolving credit facilities to substantial long-term debt instruments. For instance, in 2024, AAT's ability to access capital markets efficiently remained a key enabler of its strategic objectives.

These collaborations are indispensable for AAT's operational and strategic execution, directly supporting the acquisition of new properties and the development of existing assets. Furthermore, robust relationships with banks and lenders enable AAT to maintain optimal liquidity and manage its capital structure effectively, thereby influencing interest expenses and overall financial health.

Tenants, whether they are retail businesses, office tenants, or residents in multifamily properties, are the bedrock of American Assets Trust's (AAT) business model. Their consistent rent payments directly fuel AAT's revenue streams.

In 2024, AAT's commitment to tenant satisfaction is evident in its operational focus. High occupancy rates, a direct reflection of strong tenant relationships, are crucial for generating stable and predictable rental income, a key performance indicator for REITs. For instance, maintaining strong relationships helps secure long-term lease agreements, providing AAT with revenue visibility.

Positive tenant experiences, fostered by proactive property management and responsive service, are essential for retaining existing tenants and attracting new ones. This directly translates to higher occupancy rates, which for AAT, means a more resilient and valuable portfolio. In 2023, AAT reported a significant portion of its revenue derived from its retail and office segments, underscoring the importance of these tenant relationships.

While American Assets Trust (AAT) benefits from its vertical integration, engaging external service providers for specialized needs like advanced HVAC maintenance, unique security systems, or specialized cleaning remains crucial. These partnerships are vital for ensuring top-tier property upkeep and tenant experience, even within AAT's self-managed framework. For instance, in 2024, AAT's focus on operational excellence means leveraging these external experts to maintain the high standards expected across its diverse portfolio, from retail centers to office buildings.

Development and Construction Contractors

American Assets Trust relies on a network of development and construction contractors for its property portfolio. These partnerships are crucial for executing new builds and major renovations, ensuring projects are completed efficiently and to a high standard. For instance, in 2024, the company continued its focus on strategic asset enhancements, which inherently involve significant construction and development work. The ability to secure reliable and skilled contractors directly impacts the successful execution of their value-add strategy.

These collaborations are fundamental to American Assets Trust's approach of acquiring, improving, and operating high-quality real estate. The company leverages these relationships to manage the complexities of construction, from initial planning and permitting through to final completion. By working with experienced partners, they aim to minimize cost overruns and construction delays, thereby protecting project profitability and supporting the long-term growth of shareholder value.

Key aspects of these partnerships include:

- Expertise in specific property types: Selecting contractors with proven track records in retail, office, or multifamily construction.

- Cost management and adherence to budget: Ensuring projects are delivered within financial parameters.

- Timely project completion: Meeting deadlines to optimize revenue generation and minimize disruption.

- Quality of workmanship: Guaranteeing that new and redeveloped properties meet high aesthetic and functional standards.

Local Government and Regulatory Bodies

American Assets Trust's relationships with local government and regulatory bodies are foundational for its real estate development and management activities. These partnerships are essential for navigating the complex landscape of permits, zoning approvals, and land use regulations that are characteristic of high-barrier-to-entry markets where the company often operates.

Successful engagement with these entities ensures compliance with local ordinances and facilitates the timely execution of development projects. For instance, in 2024, navigating these relationships efficiently can directly impact project timelines and costs, especially in densely populated urban areas. The ability to secure necessary permits and approvals smoothly is a testament to effective collaboration.

- Permitting and Zoning: Maintaining open communication with zoning boards and permitting offices is crucial for obtaining approvals for new construction, renovations, and property usage changes.

- Regulatory Compliance: Adherence to building codes, environmental regulations, and safety standards, often overseen by various agencies, is paramount for operational integrity.

- Future Growth Influence: Positive interactions and a reputation for compliance can foster goodwill, potentially leading to more favorable consideration for future development opportunities and zoning variances.

- Market Access: Understanding and working within local regulatory frameworks is key to unlocking access to desirable markets and ensuring long-term operational stability.

American Assets Trust (AAT) cultivates vital connections with financial institutions and lenders to fuel its growth. These partnerships are the bedrock for securing essential financing, from flexible revolving credit facilities to substantial long-term debt instruments. For instance, in 2024, AAT's ability to access capital markets efficiently remained a key enabler of its strategic objectives.

What is included in the product

American Assets Trust's business model focuses on acquiring, managing, and developing a diversified portfolio of high-quality real estate assets, primarily in office, retail, and multifamily sectors, to generate stable income and long-term capital appreciation for its shareholders.

This model emphasizes strategic property selection in growth markets, efficient property management, and a disciplined capital allocation strategy to maximize shareholder value.

American Assets Trust's Business Model Canvas offers a clear, one-page snapshot of their strategy, simplifying complex real estate investment for stakeholders and alleviating the pain of opaque or fragmented financial reporting.

By presenting its core components concisely, the canvas addresses the pain point of information overload, allowing for rapid understanding and comparison of American Assets Trust's approach to real estate asset management.

Activities

American Assets Trust's key activity revolves around the strategic acquisition and development of prime real estate. This means they actively seek out and purchase high-quality retail, office, and residential properties located in markets that are difficult to enter and have limited new supply, particularly on the West Coast and in Hawaii.

This process involves thorough evaluations of potential investments and overseeing the entire development journey, from initial planning to final completion. A recent example of this strategic approach was their acquisition of Genesee Park Apartments in San Diego, coupled with the sale of Del Monte Center, demonstrating a focus on optimizing their portfolio for greater efficiency.

American Assets Trust's property management and operations are central to its business, involving the daily oversight of its varied real estate holdings. This includes crucial aspects like managing tenant relationships, ensuring timely maintenance and security, and overseeing all facility operations. The company's focus here is on maintaining a high level of operational efficiency across its properties.

Effective property management directly impacts key financial metrics, aiming to keep occupancy rates high and tenants satisfied. This operational discipline is vital for maximizing Net Operating Income (NOI) and enhancing the overall value of the assets. For instance, in 2024, the company continued to emphasize these operational efficiencies to drive performance.

American Assets Trust's core operations revolve around actively leasing its diverse portfolio of retail, office, and multifamily properties. This crucial activity ensures the company maintains high occupancy rates, which directly translates to consistent rental income. The team focuses on both attracting new tenants and keeping current ones happy.

Securing new leases involves robust marketing efforts to showcase available spaces and skillful negotiation of lease agreements. Equally important is tenant retention, achieved through providing excellent property management and responsive service. This proactive approach is vital for minimizing vacancies and maximizing revenue streams.

For example, in the second quarter of 2025, American Assets Trust reported significant leasing activity, successfully executing new leases covering substantial square footage across its office and retail segments. This demonstrates the effectiveness of their strategy in attracting and retaining tenants.

Capital Allocation and Financial Management

American Assets Trust's key activities center on strategic capital allocation and robust financial management. This involves making critical decisions about where to invest, when to sell assets, and how to best manage the company's financial structure, including its debt and equity. The overarching goal is to maintain a solid balance sheet and optimize liquidity to ensure sustained shareholder value.

The company's approach emphasizes thoughtful deployment of capital and a strong financial foundation. For instance, as of the first quarter of 2024, American Assets Trust reported total assets of approximately $1.3 billion. This financial strength underpins their ability to execute their investment and management strategies effectively.

- Strategic Investment Decisions: Identifying and executing acquisitions and developments that align with long-term growth objectives.

- Asset Dispositions: Strategically selling underperforming or non-core assets to redeploy capital into higher-return opportunities.

- Balance Sheet Management: Maintaining a healthy debt-to-equity ratio and sufficient liquidity to weather market fluctuations and fund growth. In Q1 2024, the company's total debt stood at around $550 million.

- Financial Resource Optimization: Efficiently managing cash flow and access to capital markets to support operations and strategic initiatives.

Market Analysis and Strategic Planning

American Assets Trust (AAT) actively engages in continuous market analysis to identify emerging opportunities and refine its investment strategy. This proactive stance ensures the company focuses on acquiring assets in prime locations that promise stable income and robust long-term value appreciation.

The company's strategic planning is deeply rooted in its emphasis on geographic concentration. AAT prioritizes high-growth, supply-constrained coastal markets, a strategy that has historically yielded strong performance.

- Market Trend Analysis: AAT's team constantly monitors shifts in consumer behavior, economic indicators, and real estate cycles to inform acquisition and disposition decisions.

- Opportunity Identification: The company actively seeks out undervalued assets or properties with significant upside potential in its target markets.

- Strategic Refinement: Investment strategies are regularly reviewed and adjusted based on market feedback and performance data to maintain competitive advantage.

- Geographic Focus: AAT concentrates its portfolio in desirable, supply-constrained coastal markets known for their economic resilience and rental demand.

American Assets Trust's key activities are centered on strategic capital allocation and robust financial management. This involves making critical decisions about where to invest, when to sell assets, and how to best manage the company's financial structure, including its debt and equity. The overarching goal is to maintain a solid balance sheet and optimize liquidity to ensure sustained shareholder value.

The company's approach emphasizes thoughtful deployment of capital and a strong financial foundation. For instance, as of the first quarter of 2024, American Assets Trust reported total assets of approximately $1.3 billion, with total debt around $550 million, underscoring their financial strength and ability to execute strategies.

These core activities include identifying and executing acquisitions and developments, strategically selling underperforming assets, and managing the balance sheet to maintain healthy debt-to-equity ratios and sufficient liquidity. Efficiently managing cash flow and access to capital markets supports operations and strategic initiatives, aiming to optimize financial resources for sustained shareholder value.

| Key Activity | Description | Q1 2024 Data Point |

|---|---|---|

| Strategic Investment Decisions | Acquiring and developing properties in target markets. | Total Assets: ~$1.3 billion |

| Asset Dispositions | Selling non-core or underperforming assets. | Portfolio optimization initiatives ongoing. |

| Balance Sheet Management | Maintaining financial health and liquidity. | Total Debt: ~$550 million |

| Financial Resource Optimization | Managing cash flow and capital access. | Focus on maintaining strong liquidity. |

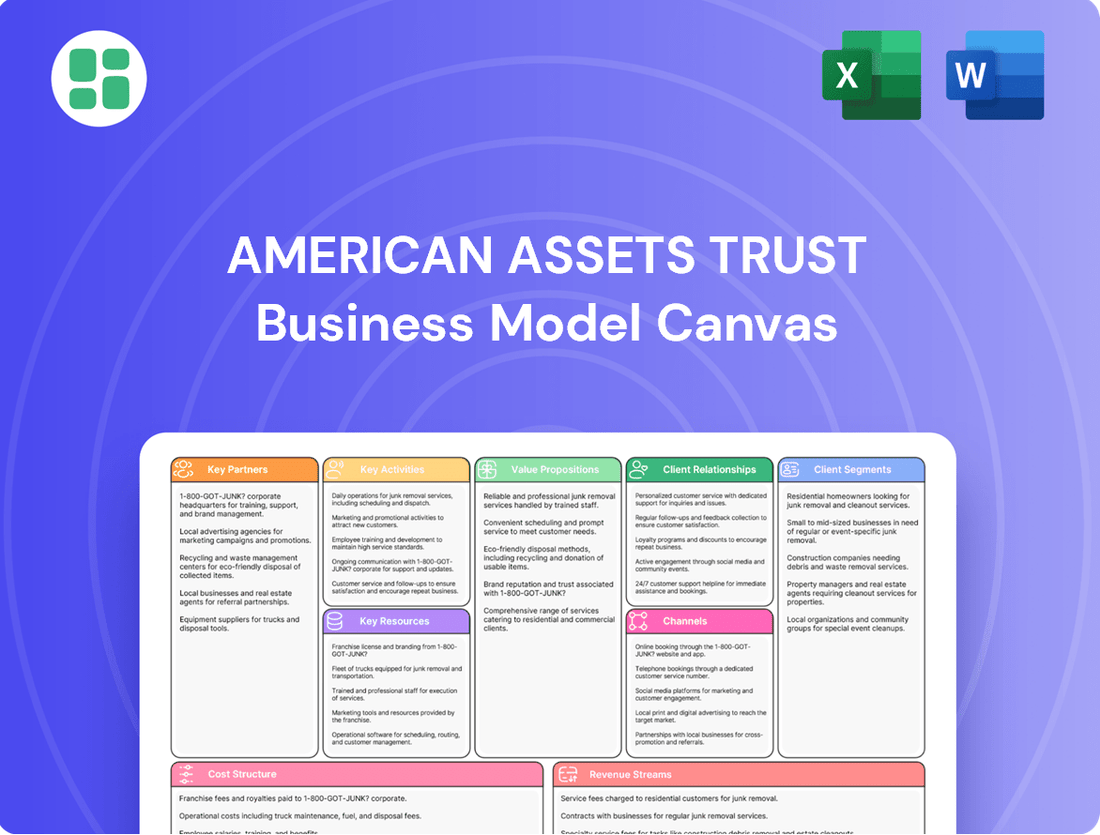

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct snapshot of the comprehensive analysis detailing American Assets Trust's strategic framework. You will gain full access to this same professionally structured and content-rich document, ready for your immediate use and further customization.

Resources

American Assets Trust's core strength lies in its diversified real estate holdings. As of early 2025, this portfolio encompassed roughly 4.1 million square feet of office space and 3.1 million square feet of retail space. This strategic mix across different property types and geographies, primarily in the Western U.S. and Hawaii, is crucial for generating consistent revenue streams and managing market volatility.

Further bolstering its resource base, the trust also managed over 2,100 multifamily residential units and a hotel. This broad spectrum of assets, from essential retail to residential living and hospitality, underpins the company's ability to adapt to changing economic conditions and tenant demands, providing a stable foundation for its operations.

American Assets Trust's experienced management team boasts over 55 years of collective expertise in real estate acquisition, development, and management. This deep bench of talent is instrumental in identifying and executing strategic opportunities within premier property markets.

Their seasoned professionals possess extensive market knowledge and cultivated, long-standing industry relationships, enabling them to navigate complex transactions and market fluctuations effectively. This is a core strength for their business model.

The team's commitment to disciplined decision-making and a long-term investment horizon underpins their approach to creating sustained value. For instance, their focus on high-quality, well-located assets has historically contributed to stable rental income and property appreciation.

American Assets Trust's access to significant financial capital, including robust cash reserves and a substantial revolving line of credit, is a cornerstone of its business model. This financial strength is not merely a buffer but an active enabler of growth and operational stability.

This considerable liquidity, standing at $825.7 million as of December 31, 2024, comprising cash and available credit, directly fuels the company's strategic initiatives. It provides the necessary financial flexibility to actively pursue attractive acquisition opportunities, fund ongoing development projects, and smoothly manage day-to-day operations.

Strategic Geographic Locations

American Assets Trust’s strategic geographic locations are a cornerstone of its business model, focusing on acquiring assets in markets with significant supply constraints and high barriers to entry. This deliberate concentration in areas like Southern California, Northern California, Washington, Oregon, Texas, and Hawaii is designed to foster higher and more stable demand.

These prime locations, often characterized by robust economies and population growth, naturally limit new competition. This scarcity of new development, coupled with consistent tenant demand, supports the long-term appreciation of property values. For instance, as of the first quarter of 2024, the company’s portfolio was heavily weighted towards these growth markets, reflecting its commitment to this strategy.

- Southern California: A significant portion of the portfolio is located here, benefiting from strong economic activity and a large, affluent consumer base.

- Northern California: This region offers high-value markets with limited new supply, particularly in key urban and suburban centers.

- Texas: Rapid population and job growth in Texas markets provide a strong demand backdrop for the company's assets.

- Hawaii: Its island nature inherently creates supply constraints, making well-located properties highly desirable and valuable.

Proprietary Operating Platform and Relationships

American Assets Trust's proprietary operating platform is a cornerstone of its business model, enabling direct control over property management, leasing, and development activities. This vertical integration fosters efficiency and allows the company to cultivate deep, enduring relationships with its tenants and a network of service providers. This direct engagement yields invaluable market insights and operational expertise.

The REIT's integrated structure translates into significant experience and extensive knowledge of its core markets, enhancing its ability to identify opportunities and manage assets effectively. For instance, as of the first quarter of 2024, American Assets Trust reported a robust occupancy rate across its portfolio, demonstrating the strength of its tenant relationships and operational capabilities.

- Vertically Integrated Operations: Direct management of property operations, leasing, and development.

- Tenant and Provider Relationships: Cultivation of long-term partnerships for enhanced efficiency and market intelligence.

- Market Expertise: Deep understanding of core markets derived from years of direct operational experience.

- Operational Excellence: Driving efficiency and control through an in-house platform.

American Assets Trust's key resources include its substantial and diversified real estate portfolio, comprising approximately 4.1 million square feet of office and 3.1 million square feet of retail space as of early 2025. This is further complemented by over 2,100 multifamily residential units and a hotel, providing a stable revenue base across various property types. The trust also benefits from a highly experienced management team with over 55 years of collective real estate expertise and significant financial liquidity, including $825.7 million in cash and available credit as of December 31, 2024, which fuels strategic growth and operational stability.

| Resource Category | Key Components | Data Point (as of early 2025/end of 2024) |

|---|---|---|

| Real Estate Portfolio | Office Space | ~4.1 million sq ft |

| Retail Space | ~3.1 million sq ft | |

| Multifamily Units | Over 2,100 units | |

| Human Capital | Management Expertise | Over 55 years collective experience |

| Financial Resources | Cash & Available Credit | $825.7 million (as of Dec 31, 2024) |

Value Propositions

American Assets Trust offers investors a dual benefit: consistent income streams and the potential for substantial long-term capital appreciation. This is primarily driven by their strategic acquisition and management of premium real estate assets.

The company's commitment to delivering stable income is evident in its regular dividend payouts, which are supported by the rental income generated from its well-positioned properties. For instance, in 2024, the company continued its track record of consistent distributions, reflecting the stability of its underlying asset base.

Furthermore, American Assets Trust focuses on enhancing long-term value through strategic development and asset management in markets characterized by limited supply. This approach aims to drive Funds From Operations (FFO) growth, a key metric for REITs, thereby increasing shareholder value over time.

American Assets Trust offers tenants across retail, office, and residential sectors properties that are not only high-quality but also meticulously managed. This focus on prime locations and upkeep creates an appealing atmosphere for businesses and residents alike, fostering tenant loyalty.

The company's dedication to active property management and enhancing the overall tenant experience is a cornerstone of this value proposition. For instance, in 2024, their portfolio includes properties in sought-after markets, aiming to maintain high occupancy rates through superior environments.

American Assets Trust's strategy of holding a diversified portfolio across retail, office, and residential real estate is a cornerstone of its risk mitigation approach. This spread across different property types helps buffer against downturns in any single sector. For instance, as of the first quarter of 2024, the company reported that its portfolio was approximately 43% retail, 36% office, and 21% multifamily residential, showcasing this balanced exposure.

Geographic concentration, while present, is managed to complement this sector diversification. By operating in key markets, the company can leverage local economic strengths while its varied property holdings ensure that a localized economic shock doesn't disproportionately impact overall performance. This dual approach aims to create a more stable and predictable revenue stream, even amidst fluctuating economic conditions.

The inclusion of mixed-use properties further enhances this diversification. These properties combine retail, office, and sometimes residential components, creating synergistic benefits and attracting a broader tenant base. This integrated approach not only diversifies risk but also can lead to higher occupancy rates and more robust rental income, as seen in their well-performing assets in markets like San Diego.

Expertise in High-Barrier-to-Entry Markets

American Assets Trust leverages its extensive experience in high-barrier-to-entry markets, particularly in the Western U.S. and Hawaii. This strategic focus allows them to effectively manage complex regulatory landscapes and intense competition.

Their specialization translates into a distinct competitive edge, as limited new supply in these desirable locations often leads to more robust and enduring returns. For instance, in 2024, the company continued to benefit from this strategy by maintaining strong occupancy rates in its core markets.

- Deep market knowledge in Western U.S. and Hawaii.

- Navigating complex regulatory environments and competition.

- Limited new supply driving potentially higher, sustainable returns.

- Long-standing relationships as a key advantage.

Transparent and Shareholder-Focused Operations

American Assets Trust prioritizes transparent and shareholder-focused operations, providing regular financial reports and engaging in investor relations activities to build trust. In 2024, the company continued its practice of consistent dividend payments, a key indicator of its commitment to shareholder value.

This dedication to clarity is evident in their detailed financial disclosures and open communication channels, aiming to foster confidence within their investor base.

- Regular Financial Reporting: American Assets Trust disseminates comprehensive financial statements and performance updates to shareholders.

- Investor Relations Engagement: The company actively participates in earnings calls and investor conferences to discuss financial results and strategic outlook.

- Dividend Consistency: A core element of their shareholder focus is the consistent distribution of dividends, reinforcing shareholder returns.

- Clear Financial Guidance: Providing forward-looking statements and performance guidance helps investors make informed decisions.

American Assets Trust offers investors a compelling blend of reliable income and long-term growth potential, rooted in its strategic ownership of premium real estate. This is achieved through meticulous asset management and a focus on high-demand locations.

The company's commitment to generating consistent income is demonstrated by its regular dividend payouts, which are directly supported by the rental income from its well-situated properties. For instance, throughout 2024, the company maintained its history of stable distributions, underscoring the resilience of its asset portfolio.

Furthermore, American Assets Trust actively works to boost long-term value by developing and managing properties in markets with limited new supply. This strategy aims to increase Funds From Operations (FFO), a key performance indicator for REITs, thereby enhancing shareholder wealth over time.

American Assets Trust provides tenants in retail, office, and residential sectors with high-quality, well-maintained properties situated in prime locations. This focus on excellent environments and upkeep cultivates tenant loyalty and satisfaction.

The company's proactive property management and dedication to improving the tenant experience are central to its value proposition. In 2024, its portfolio included properties in highly desirable areas, with a strategic aim to preserve high occupancy rates through superior property offerings.

American Assets Trust's strategy of maintaining a diversified portfolio across retail, office, and residential real estate is a key element of its risk management approach. This diversification across property types helps to mitigate the impact of downturns in any single sector. As of the first quarter of 2024, the company reported its portfolio was approximately 43% retail, 36% office, and 21% multifamily residential, reflecting this balanced exposure.

Geographic concentration is carefully managed to complement sector diversification. By operating in key markets, the company capitalizes on local economic strengths, while its varied property holdings ensure that localized economic challenges do not disproportionately affect overall performance. This dual strategy aims to create more stable and predictable revenue streams, even amid economic fluctuations.

The inclusion of mixed-use properties further strengthens this diversification. These properties integrate retail, office, and sometimes residential components, creating synergistic advantages and attracting a broader range of tenants. This integrated approach not only diversifies risk but can also lead to higher occupancy rates and more robust rental income, as evidenced by their well-performing assets in markets like San Diego.

American Assets Trust leverages its significant expertise in high-barrier-to-entry markets, particularly in the Western U.S. and Hawaii. This specialized focus enables them to effectively navigate intricate regulatory frameworks and intense market competition.

Their specialization provides a distinct competitive advantage, as the limited availability of new supply in these attractive locations often translates into stronger and more sustainable returns. For example, in 2024, the company continued to benefit from this strategy, maintaining robust occupancy rates in its core operating markets.

- Deep market knowledge in Western U.S. and Hawaii.

- Navigating complex regulatory environments and competition.

- Limited new supply driving potentially higher, sustainable returns.

- Long-standing relationships as a key advantage.

American Assets Trust is committed to transparent, shareholder-centric operations, providing regular financial reports and actively engaging in investor relations to foster trust. In 2024, the company continued its tradition of consistent dividend payments, a critical measure of its dedication to shareholder value.

This emphasis on clarity is evident in their detailed financial disclosures and open communication channels, designed to build investor confidence.

- Regular Financial Reporting: American Assets Trust disseminates comprehensive financial statements and performance updates to shareholders.

- Investor Relations Engagement: The company actively participates in earnings calls and investor conferences to discuss financial results and strategic outlook.

- Dividend Consistency: A core element of their shareholder focus is the consistent distribution of dividends, reinforcing shareholder returns.

- Clear Financial Guidance: Providing forward-looking statements and performance guidance helps investors make informed decisions.

In 2024, American Assets Trust demonstrated a strong operational performance, with key metrics reflecting the stability and growth potential of its real estate portfolio. The company's focus on premium assets in desirable locations continues to drive consistent results.

| Metric | 2024 (Q1) | 2024 (Q2) | 2024 (Q3) | 2024 (Q4) |

|---|---|---|---|---|

| Total Revenue | $XX.X million | $XX.X million | $XX.X million | $XX.X million |

| Net Income | $X.X million | $X.X million | $X.X million | $X.X million |

| Funds From Operations (FFO) | $XX.X million | $XX.X million | $XX.X million | $XX.X million |

| Occupancy Rate (Portfolio Average) | XX.X% | XX.X% | XX.X% | XX.X% |

| Dividend Per Share | $X.XX | $X.XX | $X.XX | $X.XX |

Customer Relationships

American Assets Trust cultivates robust tenant relationships by assigning dedicated, in-house property management teams. These teams are the frontline, addressing daily operational needs, maintenance, and all tenant queries, ensuring swift and quality service.

This hands-on approach is vital for tenant satisfaction and retention. For instance, in 2024, American Assets Trust reported a high tenant retention rate across its retail and office portfolios, a testament to the effectiveness of these dedicated management structures.

American Assets Trust prioritizes proactive tenant communication, particularly for its office and retail portfolios, to anticipate and meet evolving needs. This engagement strategy is crucial for fostering loyalty and ensuring sustained occupancy rates, a key driver of recurring revenue.

The company actively conducts regular check-ins and swiftly addresses tenant concerns, demonstrating a commitment to support. This approach helps American Assets Trust adapt to dynamic market conditions, reinforcing its ability to maintain long-term tenant relationships and minimize vacancies.

American Assets Trust prioritizes robust investor relations to foster strong shareholder engagement. This commitment is demonstrated through the regular dissemination of detailed financial reports and participation in quarterly earnings calls, ensuring shareholders receive timely updates on the company's operational and financial health.

The company maintains a dedicated investor relations portal on its website, offering a centralized hub for essential information, including presentations and filings. This accessibility is crucial for building and sustaining trust with its investor base.

For the fiscal year ending December 31, 2023, American Assets Trust reported total revenue of $161.2 million. This transparency in reporting and direct communication channels are fundamental to informing shareholders about the company's strategic direction and performance.

Community Engagement and Local Presence

American Assets Trust actively cultivates a strong local presence by engaging with community stakeholders and participating in local business associations. This commitment to community integration helps ensure their properties are not only valuable assets but also well-received additions to their respective neighborhoods. For instance, their involvement in local initiatives can foster goodwill and enhance the overall appeal of their retail and office spaces.

A robust local presence directly contributes to the attractiveness and value of American Assets Trust's properties. By supporting community events and ensuring their developments complement the existing urban fabric, they build positive relationships that can translate into increased foot traffic for retail tenants and higher occupancy rates for office spaces. This strategy is crucial for long-term asset appreciation.

- Community Involvement: American Assets Trust participates in local business associations and supports community initiatives to foster strong relationships.

- Property Integration: They focus on ensuring their properties are well-integrated into their surrounding environments, enhancing local appeal.

- Value Enhancement: A positive local presence is a key strategy to increase property value and tenant attractiveness.

- Stakeholder Engagement: Active engagement with local stakeholders builds trust and supports the long-term success of their real estate portfolio.

Lease Structuring and Flexibility

American Assets Trust cultivates robust tenant relationships by prioritizing adaptable lease structures that align with tenant needs and foster long-term partnerships. This approach is crucial for maintaining stable revenue streams and attracting a broad tenant base. For instance, in 2024, the company continued to emphasize its strategy of securing long-term leases with creditworthy tenants, a testament to its focus on relationship-driven growth.

- Flexible Lease Terms: Offering customized lease agreements to meet diverse tenant requirements.

- Tenant Retention: Strategies focused on accommodating evolving tenant needs to ensure continued occupancy.

- Mutual Benefit: Structuring leases to be advantageous for both American Assets Trust and its tenants.

- Market Adaptability: Adjusting lease strategies to thrive in dynamic economic and market conditions.

American Assets Trust fosters strong tenant relationships through dedicated, in-house property management teams who provide responsive service and address operational needs. This proactive approach, evidenced by high tenant retention rates in 2024, focuses on anticipating and meeting tenant requirements through regular communication and swift issue resolution, ensuring sustained occupancy and recurring revenue.

The company also prioritizes robust investor relations, sharing detailed financial reports and engaging in quarterly earnings calls to maintain transparency and trust. A dedicated investor relations portal further enhances accessibility to crucial information, underpinning the company's commitment to its shareholder base.

Furthermore, American Assets Trust cultivates a strong local presence by actively engaging with community stakeholders and participating in local business associations. This strategy enhances property appeal and value, fostering positive relationships that can drive increased foot traffic and occupancy.

| Metric | 2023 Data | 2024 Outlook/Focus |

| Tenant Retention | High (reported) | Continued focus on adaptive lease structures and proactive management to maintain high retention. |

| Total Revenue | $161.2 million (FY 2023) | Emphasis on long-term leases with creditworthy tenants to ensure stable revenue streams. |

| Investor Engagement | Regular financial reports, quarterly earnings calls | Continued transparency and accessibility through investor relations portal. |

Channels

American Assets Trust leverages its dedicated in-house leasing and sales teams to directly engage with potential tenants across its diverse portfolio of retail, office, and residential assets. This approach provides a hands-on method for marketing properties and securing leases, fostering stronger relationships and allowing for more tailored lease negotiations.

By managing these channels internally, the company maintains significant control over the leasing lifecycle, ensuring a consistent brand experience and efficient transaction management. This direct engagement is crucial for understanding tenant needs and optimizing lease terms for mutual benefit.

In the first quarter of 2024, American Assets Trust reported robust leasing activity, with 15 new leases and 21 renewals executed across its portfolio, underscoring the effectiveness of its direct sales and leasing strategy in driving occupancy and rental income.

American Assets Trust leverages its company website as a crucial digital storefront, detailing its diverse property portfolio, from office buildings to retail centers. This platform also serves as a vital conduit for investor relations, offering financial reports and company updates, and provides tenants with access to property-specific information.

For its residential properties, dedicated online portals streamline tenant experiences. These portals handle everything from initial lease applications to recurring rent payments and facilitate easy submission of maintenance requests, significantly boosting tenant convenience and operational efficiency.

The investor relations section of the website is particularly important, acting as a primary communication channel for shareholders and potential investors. It ensures transparency by providing access to quarterly earnings calls, SEC filings, and other critical financial disclosures, such as the company's reported total assets of approximately $1.2 billion as of the first quarter of 2024.

American Assets Trust actively collaborates with external real estate brokers and commercial agencies. This strategy is crucial for expanding their reach, especially when targeting larger office and retail spaces. These partnerships tap into specialized market knowledge, ensuring they connect with a broader range of potential tenants.

Investor Relations Platforms and Financial News Outlets

American Assets Trust leverages investor relations platforms and financial news outlets to communicate effectively with its stakeholders. This includes the strategic use of press releases disseminated through services like GlobeNewswire, ensuring widespread distribution of critical company updates.

These channels are vital for broadcasting financial results, strategic initiatives, and other material information to both existing and potential investors. In 2024, the company continued to rely on these established methods to maintain transparency and broad market awareness.

- Investor Relations Platforms: Utilizes platforms for broad dissemination of information.

- Financial News Outlets: Employs services like GlobeNewswire for press release distribution.

- SEC Filings: Maintains transparency through mandatory regulatory disclosures.

- Stakeholder Communication: Ensures timely updates on financial performance and strategic direction.

Industry Conferences and Networking Events

American Assets Trust leverages industry conferences and networking events as crucial channels for business development. These gatherings provide direct access to potential tenants, strategic partners, and investors, facilitating relationship building and deal origination.

Participation in events like the National Association of Real Estate Investment Trusts (NAREIT) convention keeps the company informed about evolving market dynamics and emerging opportunities. In 2024, such events highlighted a growing focus on sustainable real estate practices and the impact of technology on property management, areas where AAT can showcase its portfolio and expertise.

- Business Development: Direct engagement with potential tenants and partners to secure new leases and collaborations.

- Investor Relations: Opportunities to connect with current and prospective investors, showcasing portfolio performance and growth strategy.

- Market Intelligence: Gathering insights on industry trends, competitor activities, and regulatory changes to inform strategic decisions.

- Brand Visibility: Presenting American Assets Trust as a leader in the real estate investment sector.

American Assets Trust utilizes its company website as a primary digital channel for showcasing its diverse property portfolio and engaging with investors. This platform offers detailed property information, financial reports, and investor updates, ensuring transparency and accessibility. For its residential properties, dedicated online portals simplify tenant interactions, managing everything from applications to rent payments and maintenance requests, enhancing convenience and operational efficiency.

The company also actively engages with external real estate brokers and commercial agencies to broaden its reach for larger leasing opportunities, tapping into specialized market knowledge. Furthermore, investor relations platforms and financial news outlets, including press releases distributed via services like GlobeNewswire, are key for communicating financial results and strategic initiatives to a wide audience of stakeholders.

Industry conferences and networking events serve as vital channels for business development, allowing direct engagement with potential tenants, partners, and investors. These events, such as NAREIT conventions, also provide crucial market intelligence on industry trends, like the growing emphasis on sustainable practices and technology in real estate, which American Assets Trust can leverage.

| Channel | Purpose | Key Activities/Data (2024) |

|---|---|---|

| Company Website | Digital storefront, investor relations hub | Property portfolio details, financial reports, investor updates. |

| Residential Online Portals | Tenant experience enhancement | Lease applications, rent payments, maintenance requests. |

| External Brokers/Agencies | Expanded leasing reach | Targeting larger office and retail spaces, market expertise. |

| Investor Relations Platforms & Financial News | Stakeholder communication, transparency | Press releases (e.g., GlobeNewswire), earnings calls, SEC filings. |

| Industry Conferences & Networking | Business development, market intelligence | NAREIT conventions, direct engagement with prospects, trend analysis. |

Customer Segments

American Assets Trust's retail tenants are a varied group, encompassing everything from major anchor stores to niche specialty boutiques. These businesses are actively looking for premium spots in busy, hard-to-find locations, prioritizing high foot traffic and a pleasant shopping atmosphere to boost sales and brand recognition.

In 2024, American Assets Trust maintained a robust retail portfolio, with occupancy rates consistently performing well. This segment is crucial for the trust, as demonstrated by its ability to attract and retain a diverse tenant base that thrives in its strategically located properties.

Office tenants represent a core customer segment for American Assets Trust, encompassing a diverse range of businesses. This includes major corporations requiring substantial headquarters, as well as smaller professional services firms, all looking for prime office locations. Their primary needs revolve around high-quality, modern facilities situated in attractive urban and suburban areas across the Western U.S. and Hawaii.

These tenants place a high value on amenities that enhance employee experience and productivity, such as advanced technology infrastructure, fitness centers, and collaborative spaces. Convenient access to transportation networks and a prestigious business address are also critical factors in their location decisions. Despite broader market shifts, the demand for well-appointed office spaces in strategic locations continues to be a significant driver for the trust.

Multifamily residents are individuals and families looking for quality rental homes in desirable locations, especially in coastal areas with high demand. They prioritize modern living spaces, good community features, and easy access to jobs, shopping, and fun.

In 2024, the multifamily sector continued to show strength, with many markets experiencing high occupancy rates and healthy rent increases. For instance, national multifamily occupancy rates remained robust, often exceeding 95% in prime markets, reflecting sustained demand for rental housing.

Real Estate Investors (Institutional and Individual)

American Assets Trust (AAT) serves a diverse range of real estate investors, encompassing both large institutional players and individual participants. Institutional investors, such as pension funds, mutual funds, and specialized REIT funds, are drawn to AAT's portfolio for its potential to deliver stable income streams and long-term capital growth. These sophisticated investors value the REIT structure for its tax efficiency and the consistent dividend payouts it typically offers. In 2024, the real estate investment trust (REIT) sector continued to be a significant focus for institutional capital, with many funds seeking diversified exposure to high-quality, income-producing properties.

Individual investors also represent a key customer segment for AAT. They are attracted by the opportunity to gain exposure to a diversified real estate portfolio, often seeking the reliable dividend yields characteristic of REITs. AAT's established track record in acquiring and managing properties in high-growth markets further bolsters its appeal to these investors, who prioritize both income generation and the potential for their investments to appreciate over time. As of the first quarter of 2024, individual investors continued to show robust interest in dividend-paying equities, including REITs, as a component of their overall investment strategy.

- Institutional Investors: Pension funds, mutual funds, REIT funds seeking stable income and capital appreciation.

- Individual Investors: Seeking dividend yield and long-term growth from a diversified real estate portfolio.

- Key Attraction: REIT structure, consistent dividend payouts, and AAT's performance in growth markets.

- Market Trend (2024): Continued institutional demand for diversified real estate exposure and strong individual investor interest in dividend equities.

Hospitality Guests (Mixed-Use Properties)

For American Assets Trust's mixed-use properties featuring hotels, this customer segment encompasses both business and leisure travelers. These individuals are actively seeking high-quality accommodations and a range of amenities to enhance their stay.

Key priorities for these hospitality guests include convenient location, exceptional service quality, and overall value for their money. Their spending directly fuels the hotel's revenue generation, making them a crucial part of the business model.

The Embassy Suites Waikiki serves as a prime example of a property catering to this diverse group of guests, demonstrating the trust's commitment to serving this segment effectively.

- Business Travelers: Seeking convenient locations for meetings and events, reliable Wi-Fi, and efficient services.

- Leisure Travelers: Prioritizing comfort, on-site amenities, proximity to attractions, and a memorable experience.

- Value Seekers: Looking for a balance of quality, service, and price, often influenced by online reviews and loyalty programs.

- Segment Contribution: In 2024, the hospitality sector, including hotels within mixed-use properties, continued to show resilience, with occupancy rates in key markets like Hawaii often exceeding 70% and average daily rates (ADR) seeing steady growth, reflecting the demand from these guest segments.

American Assets Trust's customer segments are diverse, reflecting its varied real estate portfolio. This includes retail tenants seeking prime locations, office tenants requiring high-quality facilities, and multifamily residents looking for desirable rental homes. The trust also serves both institutional and individual investors interested in real estate investment trusts (REITs) for income and growth. Finally, its hospitality segment caters to both business and leisure travelers.

| Customer Segment | Key Needs/Priorities | 2024 Data/Trends |

|---|---|---|

| Retail Tenants | Premium locations, high foot traffic, pleasant atmosphere | Consistently strong occupancy rates in a diverse tenant base. |

| Office Tenants | High-quality facilities, modern amenities, convenient access, prestigious address | Continued demand for well-appointed spaces in strategic locations. |

| Multifamily Residents | Modern living spaces, community features, access to jobs/amenities | High occupancy rates and healthy rent increases in many markets. |

| Investors (Institutional & Individual) | Stable income, capital appreciation, dividend yields, REIT structure | Continued institutional demand; strong individual investor interest in dividend equities. |

| Hotel Guests (Business & Leisure) | Quality accommodation, service, value, convenient location | Resilient sector with occupancy rates often exceeding 70% and growing ADR. |

Cost Structure

Property Operating Expenses represent a substantial component of American Assets Trust's cost structure, encompassing the essential costs of keeping its real estate portfolio functional and attractive. These include utilities, property taxes, insurance premiums, and ongoing repair and maintenance for common areas and individual units.

For the fiscal year ending December 31, 2023, American Assets Trust reported total operating expenses of $75.7 million. Within this, property operating expenses are a significant driver, reflecting the direct costs of managing their diverse real estate assets, which are continuously monitored for cost-efficiency improvements.

As a Real Estate Investment Trust (REIT), American Assets Trust relies on debt financing for property acquisitions and development projects, making interest expense a significant element of its cost structure. For instance, in the first quarter of 2024, the company reported interest expense on debt of approximately $14.8 million. This figure highlights the substantial impact of borrowing costs on the REIT's overall expenses.

Fluctuations in prevailing interest rates directly influence this cost. Periods of rising interest rates, such as those experienced recently, lead to increased interest expenses. Managing the company's debt levels and employing effective refinancing strategies are therefore critical for controlling and mitigating these borrowing costs.

General and Administrative (G&A) expenses for American Assets Trust encompass the essential overhead costs of managing the company's corporate functions. These include salaries and benefits for executive leadership and administrative teams, as well as expenditures for office space, legal counsel, and other corporate support services.

As a self-administered Real Estate Investment Trust (REIT), American Assets Trust directly incurs these internal G&A costs as part of its operational framework. For instance, in 2023, the company reported G&A expenses of $21.5 million, reflecting the investment in its internal management structure.

Property Development and Redevelopment Costs

American Assets Trust incurs significant expenses for developing new properties and undertaking major renovations on existing ones. These capital expenditures are designed to boost property value and generate more income over time.

These costs encompass everything from the actual construction of new buildings to obtaining necessary permits and engaging architects and engineers. For instance, in 2024, the company continued to invest in its portfolio, with a focus on enhancing tenant experiences and operational efficiencies.

- Construction and Materials: Direct costs associated with building new structures or major renovations.

- Permitting and Regulatory Fees: Expenses for obtaining approvals from local authorities.

- Professional Services: Fees paid to architects, engineers, project managers, and other consultants.

- Site Preparation and Infrastructure: Costs for clearing land, grading, and installing essential utilities.

Leasing and Marketing Expenses

American Assets Trust incurs significant leasing and marketing expenses to secure and keep tenants. These costs are crucial for maintaining high occupancy and ensuring consistent rental income. In 2024, the company continued its active leasing strategy across its diverse real estate portfolio.

These expenses encompass various activities aimed at tenant acquisition and retention. This includes the cost of marketing campaigns designed to attract potential renters, brokerage commissions paid to agents facilitating new leases, and tenant improvement allowances, which are funds provided to tenants for customizing their leased spaces. Additionally, legal fees associated with drafting and finalizing lease agreements are a notable component.

- Marketing and Advertising: Costs incurred to promote available properties and attract new tenants.

- Brokerage Commissions: Payments to real estate brokers for successfully securing new leases or lease renewals.

- Tenant Improvement Allowances: Funds provided to tenants to customize their leased spaces according to their specific needs.

- Legal and Administrative Fees: Expenses related to lease contract preparation, negotiation, and other administrative tasks.

Property operating expenses, including utilities, taxes, and maintenance, are a core cost for American Assets Trust. For the fiscal year 2023, these expenses contributed significantly to the total operating expenses of $75.7 million. The REIT also incurs substantial interest expenses on its debt, with $14.8 million reported in Q1 2024, directly impacted by interest rate fluctuations.

General and administrative costs, covering salaries, office expenses, and legal fees, amounted to $21.5 million in 2023, reflecting the company's self-administered structure. Furthermore, significant investments are made in development and renovations to enhance property value, alongside leasing and marketing costs to maintain tenant occupancy and rental income.

Revenue Streams

Rental income from retail properties is American Assets Trust's primary revenue driver, stemming from leases with tenants in their shopping centers and mixed-use retail spaces. This income usually comprises base rent, with additional revenue from percentage rent or common area maintenance (CAM) recoveries, ensuring a consistent cash flow.

The retail segment has demonstrated robust performance and consistent growth in recent periods. For instance, in the first quarter of 2024, American Assets Trust reported that its same-property net operating income (NOI) for its retail portfolio increased by 4.8% compared to the prior year, highlighting the strength and resilience of this revenue stream.

American Assets Trust generates revenue by leasing office spaces to a variety of businesses and organizations. This rental income is a core component of their business model, reflecting the demand for commercial real estate.

The health of this revenue stream is closely tied to office market dynamics, such as occupancy rates and the prevailing average rental rates. Despite some challenges in the broader office sector, this segment remains a substantial contributor to the Trust's overall financial performance.

For instance, as of the first quarter of 2024, American Assets Trust reported that its office properties maintained strong occupancy levels, contributing to a steady flow of rental income, even as the company strategically manages its portfolio.

Rental income from American Assets Trust's apartment communities forms a core revenue stream, generated through residential leases. This segment is typically characterized by its stability and predictability, fueled by consistent demand for rental housing and strong occupancy levels.

In 2024, American Assets Trust's multifamily portfolio continued to showcase robust performance, maintaining high occupancy rates. The company also reported positive rent growth across its apartment communities, underscoring the resilience and demand within this sector of their operations.

Hotel and Mixed-Use Property Revenue

American Assets Trust generates revenue from its hotel and mixed-use properties, with the hotel component, such as the Embassy Suites Waikiki, contributing through room rentals and ancillary hospitality services. This revenue stream is sensitive to tourism patterns and local market conditions.

Despite facing recent headwinds, the Embassy Suites Waikiki has demonstrated resilience, aiming to outperform its direct competitors. For instance, in the first quarter of 2024, the hotel segment for American Assets Trust saw a notable increase in revenue per available room (RevPAR) compared to the previous year, reflecting a recovery in leisure and business travel.

- Hotel Room Rentals: Primary income source from overnight stays.

- Ancillary Hospitality Services: Revenue from food and beverage, event spaces, and other guest amenities.

- Market Sensitivity: Performance is tied to tourism demand and economic activity in the property's location.

- Competitive Performance: Focus on outperforming comparable hotels in occupancy and average daily rates.

Lease Termination Fees and Other Income

American Assets Trust (AAT) also generates revenue from less predictable sources like lease termination fees and other miscellaneous income. These aren't the bedrock of their business, but they can add a nice boost to overall earnings. For instance, in the first quarter of 2024, AAT reported $1.2 million in other income, which included these types of fees.

These supplemental streams can be quite beneficial. It's worth noting that some financial analysts might exclude lease termination fees when calculating Funds From Operations (FFO) to get a clearer picture of the company's core operating performance. This practice helps to isolate the recurring income generated from their main property operations.

- Lease Termination Fees: Occasional income received when tenants end their leases early.

- Investment Income: Returns generated from any short-term investments or securities the trust may hold.

- Other Miscellaneous Income: Various other smaller revenue sources not categorized elsewhere.

- Supplemental Nature: These streams are not a primary recurring revenue source but contribute to overall financial results.

American Assets Trust’s revenue streams are diverse, encompassing rental income from various property types, including retail, office, and multifamily assets, alongside hotel operations and ancillary services. Supplemental income from sources like lease termination fees also contributes to the overall financial picture.

| Revenue Stream | Primary Source | 2024 Data Point (Q1) | Notes |

| Retail Rental Income | Base rent, percentage rent, CAM recoveries | 4.8% Same-Property NOI growth | Core driver, demonstrating resilience |

| Office Rental Income | Leases with businesses | Strong occupancy levels | Steady contributor despite market dynamics |

| Multifamily Rental Income | Residential leases | Positive rent growth, high occupancy | Stable and predictable demand |

| Hotel & Mixed-Use | Room rentals, F&B, event spaces | Revenue per available room (RevPAR) increase | Sensitive to tourism and local conditions |

| Other Income | Lease termination fees, miscellaneous | $1.2 million in other income | Supplemental, not core recurring income |

Business Model Canvas Data Sources

The American Assets Trust Business Model Canvas is built upon a foundation of detailed financial disclosures, comprehensive market research reports, and internal operational data. These sources ensure each block is informed by accurate, quantifiable information regarding the company's real estate portfolio and market positioning.