América Móvil PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

América Móvil Bundle

América Móvil operates within a dynamic global landscape, significantly influenced by political stability across Latin America, economic fluctuations impacting consumer spending, and rapid technological advancements in telecommunications. Understanding these external forces is crucial for strategic planning and competitive advantage. Download our comprehensive PESTLE analysis to gain actionable insights into how these factors are shaping América Móvil's future and to inform your own market strategies.

Political factors

América Móvil navigates a complex web of regulatory scrutiny, especially in its home market of Mexico. The Federal Telecommunications Institute (IFT) has been a key player, implementing and revising asymmetric measures designed to curb the company's significant market share and encourage a more competitive environment. These regulations, notably updated in late 2024 and taking effect in January 2025, represent a continuous effort to level the playing field for smaller operators.

The IFT's asymmetric measures, which could include price controls or obligations for network sharing, aim to reduce América Móvil's dominance. The company, however, has voiced its reservations, suggesting these regulatory interventions may not fully reflect the evolving competitive dynamics within the Mexican telecommunications sector. This ongoing tension highlights the delicate balance between fostering competition and allowing established players to operate effectively.

Governments throughout Latin America are increasingly focused on digital inclusion initiatives, creating both avenues for growth and regulatory considerations for telecom providers. América Móvil's strategic alliances, like its collaboration with SpaceX for satellite internet, directly support these government objectives by targeting underserved remote areas. For instance, Brazil's National Broadband Plan aims to connect millions of households, a goal that companies like América Móvil can contribute to through expanded infrastructure and innovative solutions.

América Móvil's operations span regions with varying degrees of political stability, notably Latin America, the United States, and Central/Eastern Europe. Political shifts and uncertainty, as experienced in Mexico, can directly affect consumer purchasing power and overall investor sentiment towards the company.

For instance, during periods of political transition in Mexico, there can be a noticeable slowdown in discretionary spending, impacting mobile service upgrades and new device purchases. This sensitivity means América Móvil's substantial capital expenditure plans, crucial for network expansion and technological advancement, are closely tied to the perceived political and economic stability of its key markets.

In 2024, regulatory environments in Latin America continue to evolve, with governments in countries like Brazil and Colombia implementing new policies related to spectrum allocation and data privacy. These changes can present both opportunities and challenges for América Móvil, potentially affecting its cost structure and competitive positioning.

Antitrust and Competition Regulations

América Móvil operates under intense antitrust scrutiny across its key markets, particularly in Mexico where it's designated as a dominant economic player. This designation has led to ongoing regulatory interventions aimed at fostering competition, such as restrictions on exclusive offers and mandated contract lengths to curb monopolistic tendencies.

These regulatory actions directly impact América Móvil's business strategies and revenue streams. For instance, in 2023, Mexican regulators continued to enforce rules preventing bundled services that could disadvantage smaller competitors. The company has also faced significant financial penalties; in prior years, it incurred fines for alleged breaches of competition laws, underscoring the financial risks associated with these regulations.

- Mexico's Federal Economic Competition Commission (COFECE) continues to monitor América Móvil's market share, which has historically exceeded 50% in key segments.

- Regulatory measures in 2024 focus on ensuring fair access to infrastructure for rival operators.

- Fines levied in previous years for anti-competitive practices have amounted to millions of dollars, impacting profitability.

Spectrum Allocation and Licensing

Government decisions on spectrum allocation directly impact América Móvil's ability to expand its network and enhance service quality, particularly for the crucial 5G rollout. These decisions shape the competitive landscape and the cost of essential radio frequencies.

Regulatory bodies are exploring incentives like potential discounts on spectrum payments, contingent on companies fulfilling coverage obligations. This approach, observed in various markets, aims to encourage broader network reach, which is a strategic advantage for América Móvil in underserved areas.

New telecom legislation may introduce requirements for user identity verification during service activation and ongoing maintenance. Such regulations, designed to enhance security and accountability, could influence operational processes for América Móvil and its customer onboarding procedures.

- Spectrum Availability: Access to sufficient and appropriately priced spectrum is fundamental for network capacity and technological advancement.

- Licensing Costs: The financial burden of acquiring and maintaining spectrum licenses is a significant operational expense for América Móvil.

- Coverage Mandates: Government policies often tie spectrum access to commitments for expanding network coverage, especially in rural or less populated regions.

- Regulatory Compliance: Adherence to new laws regarding user identification and data privacy is essential for continued service provision.

Political stability across América Móvil's operating regions, particularly in Latin America, directly influences consumer spending and investor confidence. For example, political transitions in Mexico can lead to a slowdown in discretionary spending, impacting service upgrades and device purchases, thereby affecting the company's capital expenditure plans.

Governments are increasingly prioritizing digital inclusion, prompting regulatory frameworks that encourage expanded network reach, especially in underserved areas. América Móvil's strategic partnerships, like those involving satellite internet, align with these government objectives, potentially creating growth opportunities while navigating evolving regulations.

Antitrust scrutiny remains a significant political factor, with regulators in Mexico, a key market, designating América Móvil as a dominant player. This has led to ongoing interventions aimed at fostering competition, such as restrictions on bundled services and mandated contract lengths, impacting revenue streams and operational strategies.

Spectrum allocation decisions by governments are critical for América Móvil's network expansion and 5G rollout, influencing the competitive landscape and operational costs. Regulatory bodies are also exploring incentives, such as spectrum payment discounts tied to coverage obligations, to encourage broader network deployment.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting América Móvil, providing a comprehensive overview of the macro-environmental landscape.

It offers strategic insights into how these external forces create both challenges and opportunities for the telecommunications giant.

This PESTLE analysis for América Móvil offers a concise overview of external factors, serving as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

Macroeconomic conditions in América Móvil's key markets, particularly Mexico, directly influence consumer spending habits. Economic uncertainty can lead to a reduction in discretionary spending, impacting prepaid subscriber segments which are more sensitive to economic downturns.

América Móvil experienced robust revenue growth in Q1 and Q2 of 2025, demonstrating resilience. However, a subsequent economic slowdown in Mexico resulted in a net loss of prepaid users, highlighting the vulnerability of this segment to macroeconomic shifts.

The company's strategic focus on expanding its postpaid and fixed-line services is a key factor in mitigating the impact of economic volatility. These higher-value services tend to be more stable, providing a buffer against fluctuations in prepaid consumer spending.

América Móvil's financial results are heavily impacted by currency fluctuations due to its extensive operations in various countries. The company experienced significant foreign exchange gains in the second quarter of 2025. This was primarily fueled by a weakening U.S. dollar relative to several Latin American currencies, which played a key role in its profit turnaround during that period.

Conversely, when local currencies in its operating regions depreciate against the Mexican peso, América Móvil's reported revenues can appear higher upon conversion. This dynamic highlights the sensitivity of its top-line figures to the prevailing foreign exchange environment.

América Móvil has earmarked US$6.7 billion for capital expenditures in 2025. This strategic investment, a modest decrease from 2024, is primarily directed towards modernizing its network, accelerating 5G rollout, and expanding its fiber optic infrastructure.

These significant capital outlays are designed to solidify América Móvil's technological edge and boost its market position. The company is also leveraging this capex to grow its cloud services and data center capabilities, indicating a forward-looking strategy in a competitive telecommunications landscape.

Market Competition and Consolidation

América Móvil navigates a fiercely competitive telecommunications landscape, contending with established players and emerging Mobile Virtual Network Operators (MVNOs). This intense rivalry, particularly in Latin America, has historically pressured pricing and market share. For instance, in 2023, the Latin American telecom market continued to see dynamic shifts, with various operators adjusting their strategies to maintain competitiveness.

Despite ongoing competition, the sector anticipates a degree of rationalization and consolidation. Examples include major players like Telefónica strategically divesting from specific Latin American markets, a trend that could foster a less fragmented and more predictable competitive environment. This potential consolidation could translate into improved operational efficiencies and healthier profit margins for remaining entities by 2024-2025.

The impact of consolidation on América Móvil's market position is significant. As larger competitors streamline operations or exit, opportunities may arise for América Móvil to expand its footprint or gain market share in previously contested regions. This strategic realignment is a key factor in the company's outlook for the coming years.

Key competitive dynamics include:

- Intense Price Competition: Ongoing pressure on service pricing from both legacy competitors and new MVNO entrants.

- Market Rationalization: Anticipated consolidation through strategic exits and mergers, potentially reducing the number of major players.

- Regional Focus: América Móvil's strategic decisions are heavily influenced by competitive shifts within specific Latin American countries.

Subscriber Mix and Revenue Growth Drivers

América Móvil's revenue growth is increasingly powered by its postpaid mobile and fixed broadband subscriber base. This segment represents a move towards higher-value services, offering greater long-term stability.

The company demonstrated significant gains in Q2 2025, adding millions of postpaid mobile customers and hundreds of thousands of new fixed broadband connections. Key markets like Brazil and Mexico were particularly strong contributors to this expansion.

- Postpaid Subscriber Growth: Millions added in Q2 2025, indicating a preference for premium services.

- Broadband Expansion: Hundreds of thousands of new fixed broadband accesses secured, boosting connectivity revenue.

- Geographic Strength: Brazil and Mexico are leading the subscriber acquisition charge.

- Revenue Diversification: Shift from prepaid to postpaid and broadband enhances revenue quality.

Economic factors significantly shape América Móvil's performance, with consumer spending in key markets like Mexico directly impacting its subscriber base. While the company showed revenue resilience in early 2025, a subsequent economic slowdown led to a net loss of prepaid users, underscoring the segment's sensitivity to economic downturns.

América Móvil's strategic shift towards higher-value postpaid and fixed-line services is crucial for mitigating economic volatility. These segments offer greater stability, providing a buffer against the fluctuations seen in prepaid consumer spending.

Currency fluctuations also play a vital role in América Móvil's financial reporting. The company reported significant foreign exchange gains in Q2 2025, largely due to a weakening U.S. dollar against several Latin American currencies, which positively impacted its profit turnaround.

The company's capital expenditure plan for 2025, totaling US$6.7 billion, is a significant investment aimed at network modernization, 5G rollout, and fiber optic expansion. This investment is critical for maintaining its competitive edge and expanding its cloud and data center capabilities in a dynamic market.

| Financial Metric | Q1 2025 | Q2 2025 | Full Year 2025 (Projected) |

|---|---|---|---|

| Revenue Growth | Robust | Strong | Positive Outlook |

| Prepaid Subscriber Change | Slight Decline (Post Slowdown) | Net Loss | Monitoring Required |

| Postpaid Subscriber Growth | Significant Increase | Millions Added | Continued Expansion |

| Capital Expenditures | US$1.675 Billion (Q1) | US$1.675 Billion (Q2) | US$6.7 Billion Total |

| Foreign Exchange Impact | Neutral | Significant Gains | Influential Factor |

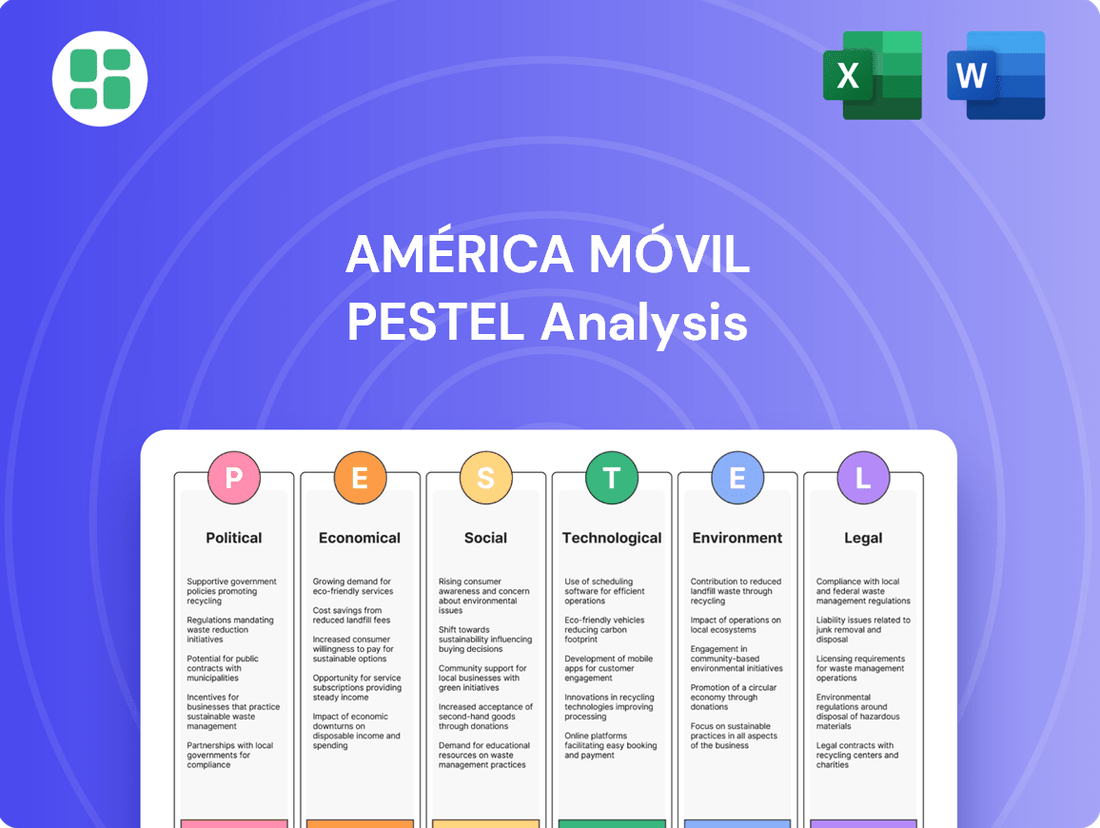

Preview Before You Purchase

América Móvil PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of América Móvil.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting América Móvil.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into América Móvil's strategic landscape.

Sociological factors

Consumers are increasingly drawn to premium digital services, marking a notable move away from prepaid plans towards postpaid subscriptions. This shift is also fueling a surge in demand for fixed broadband, highlighting a clear preference for dependable, high-speed internet access and integrated service packages.

América Móvil is strategically responding to this trend by investing heavily in upgrading its network infrastructure to support these evolving consumer needs. The company's emphasis on expanding its postpaid and fixed-line offerings has proven effective, contributing to robust subscriber growth in these segments.

For instance, in the first quarter of 2024, América Móvil reported that its postpaid customer base continued to expand, reflecting the success of its strategy to capture value from this growing segment of the market.

América Móvil is deeply committed to digital inclusion, actively working to bring internet access to communities that have traditionally been underserved. This effort is crucial for fostering social equality and, importantly for the company, expanding its potential customer base by bringing more people online.

The company's initiatives, such as its collaboration with Ericsson on digital inclusion projects, highlight this dedication. By bridging the connectivity gap, América Móvil not only empowers vulnerable groups with access to information and communication technologies but also lays the groundwork for future growth in these emerging markets.

Societal demand for robust, high-speed internet is a powerful force shaping América Móvil's investment strategy. The widespread adoption of 5G and fiber-to-the-home (FTTH) is directly linked to this growing need for seamless connectivity, driven by escalating data usage and the increasing reliance on digital services and content. América Móvil's proactive expansion in these advanced network technologies underscores its commitment to meeting these evolving consumer expectations.

Cultural Adaptation and Local Content

América Móvil's operations span diverse regions, necessitating significant cultural adaptation. In 2024, the company continued to prioritize local content strategies, particularly within its expanding digital services. This approach is vital for resonating with distinct linguistic and cultural nuances across Latin America, the United States, and Central and Eastern Europe.

The streaming market, a key growth area for América Móvil, exemplifies this need. By offering content that reflects local tastes and languages, the company aims to boost customer engagement and deepen market penetration. For instance, in Brazil, a significant market, local language productions and culturally relevant narratives are key differentiators.

- Localized Content Investment: América Móvil's commitment to local content is reflected in its increased investment in original productions tailored for specific Latin American markets throughout 2024.

- Linguistic Adaptation: Services are continuously adapted to cater to the primary languages and dialects of each operating region, ensuring accessibility and user comfort.

- Cultural Resonance: Marketing campaigns and service offerings are designed to align with local cultural values and trends, enhancing brand perception and customer loyalty.

Digital Literacy and Skill Development

América Móvil understands that digital literacy is crucial for both individual economic advancement and fostering a climate of innovation. By prioritizing training in fundamental and advanced digital skills, alongside crucial online safety education for younger demographics, the company directly addresses societal needs. This initiative not only enhances employment prospects and encourages entrepreneurial ventures but also cultivates a more informed and engaged customer base, ready to leverage digital services. For instance, in 2024, América Móvil continued its focus on digital inclusion programs, aiming to reach millions of users across Latin America with essential digital skills training.

The company's commitment is reflected in its ongoing investment in digital education. This strategic focus on skill development is designed to bridge the digital divide and empower communities. By equipping individuals with the necessary tools to navigate the digital landscape, América Móvil contributes to broader economic growth and social progress. Their efforts in 2025 are expected to further expand these training initiatives, particularly in regions with lower internet penetration rates.

- Digital Skills Training: América Móvil provides training in basic and technical digital competencies.

- Online Safety Focus: Special emphasis is placed on educating children and teenagers about safe online practices.

- Societal Impact: These programs aim to boost employment opportunities and promote entrepreneurship.

- Customer Base Development: Fostering a digitally capable customer base enhances service adoption and engagement.

Societal expectations for seamless connectivity are driving América Móvil's investment in advanced networks like 5G and fiber. This demand is fueled by increased data consumption and reliance on digital services, with the company actively expanding these technologies to meet consumer needs. For instance, in Q1 2024, América Móvil noted continued growth in its postpaid subscriber base, a direct result of aligning its offerings with these evolving preferences for premium, reliable internet.

The company's strategy also centers on digital inclusion, aiming to connect underserved communities and expand its market reach. By bridging the digital divide, América Móvil not only promotes social equality but also cultivates future customer growth. This commitment is exemplified by collaborations focused on bringing more people online, thereby broadening the base for digital services.

América Móvil's success hinges on adapting to diverse cultural landscapes by investing in localized content and linguistic services. This strategy is crucial for resonating with distinct regional tastes, particularly in the growing streaming market, where culturally relevant narratives enhance customer engagement and market penetration. For example, in 2024, the company increased its investment in original productions tailored for specific Latin American markets, aiming for deeper market penetration.

Furthermore, América Móvil prioritizes digital literacy, offering training in essential digital skills and online safety. These initiatives empower individuals, boost employment, and foster entrepreneurship, ultimately creating a more engaged and capable customer base ready to utilize digital services. The company's digital inclusion programs in 2024 aimed to equip millions across Latin America with these vital skills.

Technological factors

América Móvil is heavily investing in its 5G network, prioritizing its rollout and expansion across Latin America. This aggressive strategy is a significant technological factor, with a substantial portion of their capital expenditure dedicated to upgrading their infrastructure.

By 2025, the company expects continued growth in 5G adoption, building on its existing network that already serves numerous cities and has attracted millions of subscribers. This focus on high-speed mobile connectivity is crucial for future revenue streams and competitive positioning.

América Móvil is heavily investing in Fiber-to-the-Home (FTTH) technology, a significant upgrade from older copper networks. This transition not only boosts energy efficiency but also dramatically increases data transmission speeds, essential for modern digital services.

The company's fixed network modernization is a strategic imperative, acting as the vital backbone for its entire telecommunications infrastructure. This enhanced backbone is crucial for optimizing data flow and directly supports the performance and expansion of mobile technologies, including 5G.

By mid-2024, América Móvil reported substantial progress in its fiber deployment across Latin America, with millions of new fiber homes passed. This aggressive rollout is key to delivering premium broadband experiences and laying the groundwork for future high-bandwidth applications and services.

América Móvil, a telecommunications giant, is strategically positioned to capitalize on the burgeoning fields of the Internet of Things (IoT) and Artificial Intelligence (AI). These advanced technologies are poised to unlock novel service offerings, significantly boost operational efficiencies, and deliver groundbreaking solutions for both enterprise clients and individual consumers. For instance, the global IoT market is projected to reach $1.1 trillion by 2026, a testament to its transformative potential, and América Móvil's infrastructure is ideal for supporting this growth.

By integrating AI into its network management and customer service operations, América Móvil can anticipate and address issues proactively, leading to improved service quality and reduced costs. The company's investment in R&D for AI-driven analytics, for example, could lead to personalized customer experiences and optimized network resource allocation. In 2024, investments in AI within the telecommunications sector are expected to surge, with companies focusing on AI for network optimization and predictive maintenance.

To fully harness these technological advancements, América Móvil's strategy will likely involve forging key strategic alliances with technology providers and fostering robust internal development capabilities. This dual approach ensures access to cutting-edge innovation while building proprietary expertise. Partnerships in areas like edge computing and AI-powered data analytics will be crucial for creating differentiated value propositions in the competitive telecom landscape.

Network Infrastructure and Energy Efficiency

América Móvil is actively upgrading its network infrastructure to boost efficiency and sustainability. This involves optimizing radio electrical consumption and phasing out older equipment. These efforts are crucial for managing the increased traffic that comes with 5G deployment.

The company's 5G rollout is designed with energy efficiency in mind. While 5G technology handles more data, América Móvil is implementing solutions to ensure that energy consumption per gigabyte transmitted either stays the same or decreases. This commitment supports a more environmentally friendly network operation.

Specific initiatives include:

- Network Modernization: Ongoing upgrades to core and radio access networks.

- Energy Optimization: Implementing advanced power management techniques for base stations.

- 5G Efficiency: Leveraging new technologies to reduce energy use per data unit.

- Legacy Equipment Replacement: Phasing out older, less energy-efficient hardware.

Cloud and Data Center Investments

América Móvil has recently concluded a significant three-year investment phase focused on modernizing its technological infrastructure, with a substantial portion dedicated to enhancing its cloud and data center capabilities. These upgrades are vital for managing the escalating volumes of data traffic characteristic of the digital age.

These strategic investments are designed to bolster América Móvil's capacity to support a growing array of digital services and ensure the robustness and adaptability of its network operations. For instance, by 2024, the company's capital expenditures were projected to continue supporting these modernization efforts, aiming for greater efficiency and service delivery.

The company's commitment to improving its cloud and data center facilities directly addresses the need for scalable and resilient IT environments. This allows América Móvil to more effectively deploy new technologies and respond to evolving market demands, ensuring a competitive edge in its service offerings.

- Infrastructure Modernization: Completion of a three-year cycle to upgrade core network and data center facilities.

- Data Traffic Support: Investments are crucial for handling increasing data consumption across its network.

- Digital Service Enablement: Enhanced cloud and data center capabilities facilitate the launch and scaling of new digital offerings.

- Network Resilience: Upgrades improve the overall stability and scalability of network operations, ensuring service continuity.

América Móvil's technological advancements are centered on expanding its 5G network and fiber-optic infrastructure, aiming to enhance data speeds and service offerings. By 2025, the company anticipates significant growth in 5G adoption, building on its existing network that already serves millions of subscribers across numerous cities.

The company is also heavily investing in Fiber-to-the-Home (FTTH) technology, a move that not only boosts energy efficiency but also dramatically increases data transmission speeds. By mid-2024, América Móvil reported passing millions of new homes with fiber, a crucial step for delivering premium broadband and supporting future high-bandwidth applications.

Furthermore, América Móvil is strategically integrating AI and IoT into its operations to unlock new service offerings and improve efficiency. Investments in AI for network optimization are expected to surge in 2024, with the company focusing on AI-driven analytics for personalized customer experiences and optimized network resource allocation.

América Móvil has also recently concluded a three-year investment phase focused on modernizing its cloud and data center capabilities, essential for managing escalating data traffic and ensuring network resilience. These upgrades are vital for supporting a growing array of digital services and maintaining a competitive edge.

| Technology Focus | Key Initiatives | Projected Impact/Status |

|---|---|---|

| 5G Network Expansion | Prioritizing rollout and expansion across Latin America. | Continued growth in 5G adoption expected by 2025; millions of subscribers already on the network. |

| Fiber-to-the-Home (FTTH) | Upgrading from copper networks to fiber optic. | Millions of new fiber homes passed by mid-2024; enhanced data transmission speeds and energy efficiency. |

| AI & IoT Integration | Leveraging AI for network management and customer service; exploring IoT service offerings. | AI investments in telecom expected to surge in 2024; potential for novel services and operational efficiencies. |

| Cloud & Data Center Modernization | Upgrading core network and data center facilities. | Completion of a three-year investment cycle; crucial for managing data traffic and enabling digital services. |

Legal factors

América Móvil navigates a complex regulatory landscape, particularly in Mexico, where the Federal Telecommunications Institute (IFT) enforces asymmetric regulations. These rules, designed to foster competition, impose specific obligations on América Móvil due to its significant market share. For instance, the IFT mandates that the company provide unlocked mobile devices and prohibits certain restrictive contract clauses, impacting its operational flexibility and revenue models.

These regulatory impositions necessitate continuous adaptation and compliance efforts from América Móvil. The company's business practices are directly shaped by these mandates, requiring adjustments in product offerings, service agreements, and pricing strategies. América Móvil actively engages with these rulings, often challenging them through legal avenues, reflecting the ongoing tension between regulatory oversight and its business objectives.

América Móvil, operating across numerous Latin American nations, faces a complex web of data privacy and protection laws. Many of these jurisdictions are actively implementing regulations that mirror the General Data Protection Regulation (GDPR) framework.

This trend necessitates that América Móvil continuously updates its privacy protocols, ensuring robust data handling, transparent consent mechanisms, and adherence to new reporting obligations. For instance, Brazil's LGPD, effective since September 2020, imposes stringent rules on personal data processing, with significant fines for non-compliance, impacting how América Móvil manages customer information.

América Móvil frequently encounters antitrust investigations and the possibility of penalties stemming from practices regulators deem anti-competitive. For instance, in 2023, the Mexican Federal Economic Competition Commission (COFECE) continued its scrutiny of the telecom sector, which significantly impacts América Móvil's operations, with ongoing reviews of market dominance in fixed and mobile services.

Regulatory bodies possess the authority to perform economic replicability tests and oversee procurement activities to foster a more equitable competitive landscape. This ensures that dominant players, like América Móvil, do not leverage their position to stifle smaller competitors or inflate prices, a critical aspect of market oversight in 2024.

The company's substantial market share across various telecommunications segments, including mobile subscribers and broadband internet, remains under constant evaluation by authorities. In 2024, América Móvil held a commanding presence in Mexico, often exceeding 60% market share in mobile services, making it a prime subject for competition enforcement actions.

Licensing and Spectrum Regulation

América Móvil's operations are fundamentally shaped by the legal framework governing telecommunications licenses and spectrum usage across its markets. These regulations dictate the terms under which the company can operate, expand its network, and offer services. For instance, the process and cost of spectrum auctions, along with the renewal of existing licenses, directly impact capital expenditure and future growth strategies. In 2024, regulatory bodies in Latin America continue to refine spectrum allocation policies, balancing the need for expanded broadband access with revenue generation for governments.

Obligations tied to spectrum acquisition, such as mandatory coverage targets in underserved areas, are critical considerations. These mandates can influence investment decisions and operational priorities. For example, in Brazil, the 2021 spectrum auction included commitments for 5G network deployment in smaller cities and rural areas, a model that could influence future auctions in other América Móvil operating countries.

Changes in these legal and regulatory landscapes can swiftly alter the competitive dynamics. New entrants, differing license fee structures, or revised national broadband plans can create both opportunities and challenges for established players like América Móvil. Regulatory decisions on net neutrality and data privacy also play a significant role in how services are delivered and monetized.

Key aspects of licensing and spectrum regulation impacting América Móvil include:

- Spectrum Auction Dynamics: The cost and availability of radio spectrum, essential for mobile services, are determined by auction processes, which can require significant upfront investment.

- License Renewal Processes: The renewal of operating licenses, often granted for fixed terms, involves navigating regulatory reviews and potential new conditions or fees.

- Coverage and Service Mandates: Licenses frequently come with obligations to expand network coverage to specific geographic areas or deploy certain technologies, influencing capital allocation.

- Regulatory Changes: Shifts in telecommunications laws, such as those concerning competition, pricing, or data handling, can reshape the market and impact profitability.

Consumer Protection Legislation

Consumer protection legislation significantly shapes América Móvil's operational framework, dictating how it handles service agreements, device sales, and customer engagement across its various markets. These laws are crucial for maintaining trust and ensuring fair practices.

Recent regulatory shifts, particularly those mandating the unlocking of devices and eliminating minimum service contract durations, directly impact América Móvil's business model. For instance, the push for unlocked devices, a trend gaining momentum globally, means consumers can switch providers more easily, potentially increasing churn rates and requiring América Móvil to focus more on service quality and competitive pricing to retain subscribers. This aligns with a broader trend where regulators are prioritizing consumer choice and flexibility in the telecommunications sector.

- Regulatory Mandates: Laws requiring unlocked devices and prohibiting minimum contract terms empower consumers.

- Increased Competition: These regulations foster a more competitive landscape, pushing providers to enhance service offerings.

- Consumer Choice: Consumers benefit from greater flexibility in choosing plans and devices, leading to potentially lower overall costs.

- Market Adaptation: América Móvil must adapt its strategies to a market where customer loyalty is earned through superior service rather than contractual obligations.

Legal and regulatory frameworks are paramount for América Móvil, influencing everything from spectrum acquisition to consumer protection. In 2024, regulators continued to scrutinize market dominance, particularly in Mexico where América Móvil often holds over 60% of the mobile market share, leading to ongoing antitrust reviews.

Data privacy laws, mirroring GDPR, are increasingly stringent across Latin America, as seen with Brazil's LGPD, impacting how América Móvil handles customer data and requiring robust compliance protocols to avoid significant fines.

Telecommunications licensing and spectrum usage remain critical, with ongoing policy refinements in Latin America for spectrum allocation, balancing broadband expansion with government revenue. Obligations like mandatory coverage targets in underserved areas, as seen in Brazil's 2021 spectrum auction, shape capital expenditure and operational priorities for the company.

Consumer protection legislation, mandating unlocked devices and prohibiting minimum contract terms, empowers consumers and forces América Móvil to compete on service quality rather than contractual lock-ins, a trend evident across its operating regions.

| Regulatory Area | Key Impact on América Móvil | Example/Data Point (2023-2024) |

|---|---|---|

| Antitrust & Competition | Scrutiny of market dominance, potential penalties | Mexico's COFECE continued market dominance reviews in fixed/mobile services. |

| Data Privacy | Compliance with evolving laws (e.g., LGPD) | Brazil's LGPD fines can be up to 2% of revenue, impacting data handling. |

| Spectrum Allocation | Cost and availability of essential radio spectrum | Ongoing policy refinements for spectrum auctions in Latin America. |

| Consumer Protection | Mandates for unlocked devices, no minimum contracts | Increased focus on service quality to retain subscribers due to higher churn potential. |

Environmental factors

América Móvil is actively pursuing a net-zero emissions goal by 2050, a significant undertaking that shapes its business approach. This commitment is backed by concrete interim targets, aiming for a substantial reduction in absolute Scope 1 and 2 greenhouse gas emissions by 2030, using 2019 as a baseline. For instance, by the end of 2023, the company reported a notable decrease in its carbon footprint, demonstrating tangible progress towards these ambitious environmental objectives.

América Móvil is making substantial investments to boost energy efficiency within its vast network operations. A key strategy involves the ongoing transition to fiber-to-the-home (FTTH) technology, which is inherently more energy-efficient than older copper-based systems. This shift, coupled with the accelerated decommissioning of legacy networks, is a significant step towards reducing the company's overall energy footprint.

Further contributing to these efficiency efforts are software enhancements and the implementation of dual-band technology across its network. These advancements allow for optimized power usage, ensuring that resources are utilized more effectively. For instance, by mid-2024, América Móvil reported that its fiber deployment had reached over 40 million homes passed in Mexico alone, a testament to the scale of this energy-conscious infrastructure upgrade.

América Móvil actively integrates circular economy principles to boost operational efficiency and foster sustainable ecosystems, focusing on minimizing waste generation. This commitment extends to robust waste management strategies, particularly for the significant electronic waste (e-waste) stemming from its extensive network infrastructure and a vast customer base.

In 2023, the company reported handling a substantial volume of e-waste, with over 85% of collected materials being channeled towards recycling and reuse programs. This proactive approach not only addresses environmental concerns but also contributes to resource conservation, aligning with global sustainability targets and regulatory expectations for the telecommunications sector.

Climate Change Strategy and Reporting

América Móvil actively addresses climate change through a dedicated strategy overseen by a board member, focusing on enhancing operational efficiency and reducing greenhouse gas emissions. This commitment is underscored by their annual reporting of their carbon footprint, adhering to the Greenhouse Gas Protocol, and seeking independent verification for their sustainable financing initiatives, showcasing a robust environmental governance framework.

In 2023, América Móvil reported a reduction in its Scope 1 and Scope 2 emissions by 4.5% compared to the previous year, reaching 1.3 million tons of CO2 equivalent. The company's renewable energy procurement efforts also saw an increase, with 65% of its electricity consumption sourced from renewable providers by the end of 2023, a significant jump from 52% in 2022.

- Climate Strategy Leadership: A dedicated Climate Strategy is driven by a board member, ensuring high-level oversight and integration into business operations.

- Emissions Reporting: Annual reporting of carbon footprint aligns with the Greenhouse Gas Protocol, providing transparency on environmental impact.

- Sustainable Financing Assurance: Seeking independent assurance for sustainable financing efforts builds credibility and trust in their environmental commitments.

- Renewable Energy Adoption: América Móvil aims to increase its reliance on renewable energy sources to power its operations, contributing to emission reduction targets.

Biodiversity Programs and Resource Conservation

América Móvil actively engages in biodiversity programs, extending its environmental commitment beyond carbon emissions. The company supports research initiatives focused on species conservation within its operational areas, specifically targeting the reduction of human-wildlife conflicts. This approach underscores a dedication to preserving local ecosystems where its infrastructure is present.

Furthermore, América Móvil prioritizes broader resource conservation, with a notable emphasis on water management. This strategic focus on water is integral to its overarching sustainability strategy, aiming to significantly minimize its environmental footprint across all operations. The company's efforts in resource conservation reflect a holistic view of environmental responsibility.

For instance, in 2023, América Móvil reported a 5% reduction in water consumption across its Latin American operations compared to 2022, achieving this through enhanced water recycling and efficiency measures in its facilities. The company also initiated pilot programs in Mexico and Brazil to mitigate wildlife impact on its network infrastructure, collaborating with local conservation groups.

- Biodiversity Support: Funding research for species conservation and human-wildlife conflict mitigation in operational regions.

- Resource Management: Implementing water conservation strategies, including recycling and efficiency improvements.

- 2023 Water Reduction: Achieved a 5% decrease in water consumption across Latin American operations year-over-year.

- Wildlife Mitigation Pilots: Launched initiatives in Mexico and Brazil to reduce wildlife-related network disruptions.

América Móvil's environmental strategy is robust, targeting net-zero emissions by 2050 with interim goals for significant Scope 1 and 2 emission reductions by 2030. The company is actively transitioning to energy-efficient fiber-to-the-home technology and enhancing network operations through software and dual-band advancements. By mid-2024, fiber deployment alone had passed over 40 million homes in Mexico.

Circular economy principles guide waste management, particularly for electronic waste, with over 85% of collected materials recycled or reused in 2023. The company's commitment to climate action is evident in its annual carbon footprint reporting and its increasing reliance on renewable energy, which accounted for 65% of its electricity consumption by the end of 2023, up from 52% in 2022.

Beyond emissions, América Móvil engages in biodiversity programs, supporting species conservation and mitigating human-wildlife conflicts. Water management is also a priority, with a 5% reduction in water consumption across Latin American operations in 2023 compared to 2022, achieved through recycling and efficiency measures.

| Environmental Metric | 2022 | 2023 | Target |

|---|---|---|---|

| Scope 1 & 2 Emissions (Million Tons CO2e) | 1.36 | 1.30 | Significant Reduction by 2030 |

| Renewable Energy Share | 52% | 65% | Increasing |

| E-waste Recycling/Reuse Rate | N/A | >85% | N/A |

| Water Consumption Reduction (LATAM) | Baseline | 5% Reduction | N/A |

PESTLE Analysis Data Sources

Our PESTLE analysis for América Móvil is informed by a comprehensive review of data from international financial institutions, national statistical offices, and leading telecommunications industry research firms. This ensures a robust understanding of global economic trends, regulatory landscapes, and technological advancements impacting the company.