América Móvil Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

América Móvil Bundle

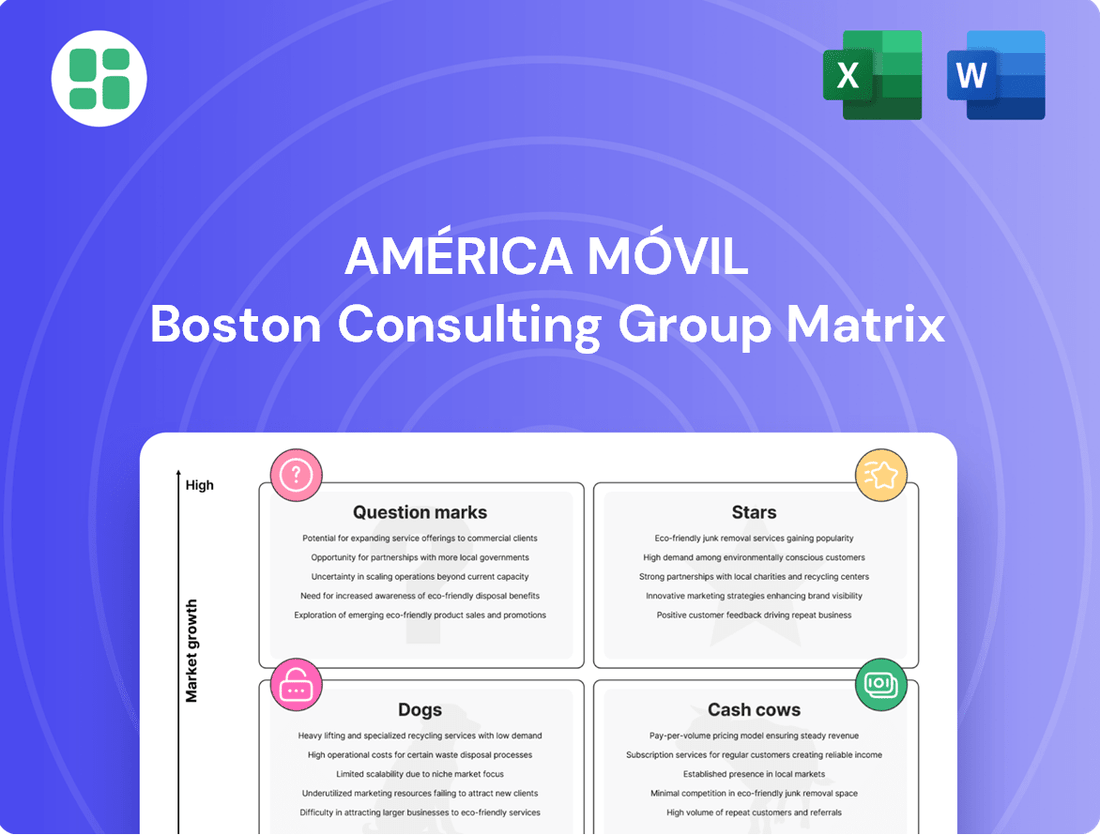

Curious about América Móvil's strategic positioning? This preview offers a glimpse into how their diverse portfolio might be categorized within the BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, or Question Marks. To truly understand their competitive landscape and uncover actionable strategies for growth and resource allocation, dive into the full BCG Matrix report.

Unlock the complete América Móvil BCG Matrix and gain a comprehensive understanding of their market share and growth potential. This detailed analysis will equip you with the insights needed to make informed decisions about where to invest and which business units to nurture or divest. Purchase the full report for a strategic roadmap to optimize América Móvil's performance.

Stars

América Móvil's postpaid mobile services, especially with its 5G focus, are a clear Star in its BCG matrix. The company is seeing significant growth in its postpaid subscriber numbers, largely fueled by the increasing availability and uptake of 5G technology across its Latin American operations.

Markets such as Brazil, Mexico, and Colombia are at the forefront of this expansion, contributing substantially to new postpaid customer acquisitions. This demonstrates América Móvil's strong position within a segment that is experiencing rapid growth and high demand.

The substantial increase in revenue generated from these postpaid services further reinforces their status as a Star product. For example, in 2024, América Móvil reported continued strength in its mobile segment, with postpaid ARPU (Average Revenue Per User) showing positive trends in key markets, reflecting successful monetization of 5G investments and data-intensive services.

América Móvil's fiber optic broadband segment is a clear star in its BCG Matrix, fueled by substantial infrastructure investments. In 2024, the company reported record additions of fixed broadband accesses, particularly in key markets like Mexico and Brazil, underscoring the success of its fiber expansion strategy.

This segment thrives in a high-growth Latin American market where demand for faster, more reliable internet speeds continues to surge. América Móvil's aggressive build-out and strong operational execution have solidified its leadership position in this expanding sector.

América Móvil's corporate networks and enterprise solutions are performing exceptionally well, demonstrating significant revenue increases. This segment is a clear Star in the BCG Matrix, driven by the booming demand for business-to-business digital transformation services.

In 2024, this sector has seen sustained growth, with reports indicating a substantial uptick in revenue from cloud services and advanced data solutions. Businesses are heavily investing in these areas, solidifying América Móvil's strong market standing.

Overall 5G Mobile Services in Latin America

The Latin American 5G mobile services sector is a dynamic growth area for América Móvil, positioning it as a Star in the BCG matrix. By the end of 2024, 5G connections in the region are expected to have nearly doubled, showcasing a substantial increase in user adoption and network build-out. América Móvil is a key player in this expansion, actively investing in and deploying 5G infrastructure across its markets.

This robust growth, coupled with América Móvil's strong market presence in the region, solidifies 5G mobile services as a Star. The company is capitalizing on the increasing demand for faster mobile speeds and enhanced connectivity, driving significant revenue potential.

- Market Growth: 5G connections in Latin America are projected to see substantial growth, nearly doubling in 2024.

- América Móvil's Position: The company is a leading operator, actively deploying 5G and capturing a growing user base.

- Strategic Classification: The combination of high growth and strong market share places 5G services as a Star.

Mobile Data Services

Mobile data services are a powerhouse for América Móvil, representing its largest and fastest-growing revenue stream in the Latin American telecom sector. This segment is crucial, benefiting from increasing smartphone adoption and the ever-growing demand for digital content. In 2024, the demand for mobile data continues to surge, fueled by video streaming, social media, and cloud-based applications.

América Móvil's vast network infrastructure and substantial subscriber base position it to effectively capitalize on this trend. The company's ability to provide reliable and widespread mobile data access is a key competitive advantage. This strong market position, coupled with high growth, firmly places mobile data services as a Star in América Móvil's BCG Matrix.

- Largest Revenue Segment: Mobile data services contribute the most to América Móvil's overall revenue.

- High Growth Potential: The segment is experiencing rapid expansion due to increasing data consumption.

- Dominant Market Share: América Móvil holds a significant portion of the mobile data market in Latin America.

- Strategic Importance: Essential for modern connectivity, driving smartphone usage and digital services.

América Móvil's postpaid mobile services, particularly its 5G offerings, are a standout Star in its BCG matrix. The company has witnessed a significant increase in postpaid subscribers, largely driven by the expanding availability and adoption of 5G technology across Latin America. Markets such as Brazil, Mexico, and Colombia are leading this growth, contributing substantially to new postpaid customer acquisitions.

This strong performance is further validated by the considerable revenue generated from these services. In 2024, América Móvil reported continued strength in its mobile segment, with postpaid ARPU showing positive trends in key markets, reflecting successful monetization of 5G investments and data-intensive services.

The fiber optic broadband segment is another clear Star for América Móvil, bolstered by substantial infrastructure investments. In 2024, the company achieved record additions of fixed broadband accesses, especially in Mexico and Brazil, highlighting the success of its fiber expansion strategy. This segment is thriving in a high-growth Latin American market where demand for faster, more reliable internet speeds is surging.

Corporate networks and enterprise solutions are also performing exceptionally well, showing significant revenue increases and marking them as a Star. This segment is driven by the booming demand for business-to-business digital transformation services, with sustained growth reported in 2024, particularly in cloud services and advanced data solutions.

Mobile data services represent a powerhouse for América Móvil, being its largest and fastest-growing revenue stream in the Latin American telecom sector. This segment is crucial, benefiting from increasing smartphone adoption and the ever-growing demand for digital content. In 2024, the demand for mobile data continues to surge, fueled by video streaming, social media, and cloud-based applications.

| Segment | Market Growth | Company Position | BCG Classification | 2024 Data Highlight |

|---|---|---|---|---|

| Postpaid Mobile Services (5G) | High (5G adoption) | Strong Market Share | Star | Positive ARPU trends in key markets |

| Fiber Optic Broadband | High (demand for speed) | Market Leader | Star | Record fixed broadband access additions |

| Corporate Networks & Enterprise Solutions | High (digital transformation) | Leading Provider | Star | Substantial revenue increase in cloud/data solutions |

| Mobile Data Services | Very High (content consumption) | Dominant Share | Star | Largest and fastest-growing revenue stream |

What is included in the product

América Móvil's BCG Matrix analyzes its portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

The América Móvil BCG Matrix provides a clear, one-page overview of each business unit's position, relieving the pain point of strategic ambiguity.

Cash Cows

América Móvil's established 4G mobile subscriber base is a prime example of a Cash Cow within the BCG Matrix. Despite the ongoing rollout of 5G, 4G LTE continues to be the backbone of mobile connectivity in Latin America, powering the vast majority of wireless connections. In 2024, it's estimated that over 80% of mobile subscriptions in the region still rely on 4G technology.

América Móvil boasts an enormous and mature 4G subscriber base across its extensive operations in Latin America. This large, loyal customer segment consistently delivers significant and stable revenue streams, acting as a reliable source of cash flow for the company. Even as the growth rate for 4G adoption naturally decelerates, the sheer scale of these subscribers ensures its continued importance as a major cash generator.

América Móvil's core fixed broadband business, excluding fiber, represents a significant cash cow. This segment benefits from a large, established customer base that consistently generates revenue, even in a mature market. The company’s extensive network infrastructure supports these non-fiber connections, ensuring a stable and predictable income stream.

As of the first quarter of 2024, América Móvil reported that its fixed broadband services continued to be a strong contributor to its overall performance. While specific figures for the non-fiber segment are not always granularly broken out, the company's consistent revenue growth in broadband, driven by its vast subscriber numbers across Latin America, underscores the cash-generating power of this mature business line. This segment requires minimal incremental investment compared to new technology deployments, allowing it to efficiently convert revenue into free cash flow.

Traditional mobile voice services, though no longer the primary growth driver, continue to be a crucial element within América Móvil's bundled offerings. Despite the overall decline in standalone voice usage, its inclusion in comprehensive plans helps maintain customer loyalty and contributes to a stable ARPU. In 2024, América Móvil reported that a significant portion of its mobile revenue still stemmed from these bundled packages, underscoring voice's foundational role.

Pay TV Services (in mature, high-share markets)

América Móvil's Pay TV services, particularly in mature markets where it commands a significant share, continue to be a robust cash generator. Despite minor fluctuations in subscriber numbers, the segment reported impressive revenue growth in the second quarter of 2025. This suggests that even in markets with limited overall expansion, América Móvil effectively leverages its high market penetration to drive substantial cash flow, likely through a combination of premium content and strategic service bundling.

The financial performance highlights the enduring strength of this segment:

- Revenue Growth: Q2 2025 saw notable revenue increases in Pay TV services within established, high-share markets.

- Cash Flow Generation: The segment acts as a significant cash cow, contributing strongly to the company's overall financial health.

- Monetization Strategies: Success is attributed to effective monetization, potentially through premium content and bundled offerings.

- Market Position: High market share in mature regions allows for continued profitability despite slower overall market growth.

Extensive Network Infrastructure

América Móvil's extensive network infrastructure, a result of decades of investment across Latin America and Europe, serves as a foundational cash cow. This robust network underpins all its service offerings, from mobile and fixed-line telephony to broadband internet. In 2024, the company continued to leverage this asset, which provides a stable and predictable revenue stream from its massive subscriber base, funding other strategic initiatives.

The sheer scale of América Móvil's network is a significant competitive advantage. As of the first quarter of 2024, the company reported over 300 million mobile subscribers and approximately 36 million fixed-line connections across its operating regions. This vast reach ensures consistent cash flow generation, even with ongoing capital expenditures for network upgrades and maintenance.

- Network Scale: Over 300 million mobile subscribers and 36 million fixed-line connections as of Q1 2024.

- Revenue Stability: The established infrastructure generates consistent cash flow, supporting overall business operations.

- Competitive Moat: The extensive network is a significant barrier to entry for competitors in its core markets.

- Investment Leverage: While requiring maintenance, the network's existing capacity allows for efficient rollout of new services.

América Móvil's established 4G mobile subscriber base remains a significant cash cow, powering a substantial portion of its revenue. Despite the ongoing transition to 5G, the sheer volume of 4G users ensures consistent cash flow generation. In 2024, it's estimated that over 80% of mobile connections in Latin America still utilize 4G technology, highlighting the segment's enduring strength.

The company's mature fixed broadband business, excluding fiber, also functions as a strong cash cow. This segment benefits from a large and loyal customer base that provides stable, predictable revenue streams. América Móvil's extensive infrastructure supports these connections, allowing for efficient cash generation with minimal incremental investment compared to newer technologies.

Traditional mobile voice services, while not a growth engine, remain a vital component of América Móvil's bundled offerings. These services contribute to customer loyalty and a stable average revenue per user (ARPU). In 2024, a significant portion of mobile revenue was still derived from these bundled packages, underscoring voice's foundational role in generating consistent cash.

América Móvil's Pay TV services, particularly in markets where it holds a high share, continue to be a robust cash generator. Despite minor subscriber fluctuations, the segment reported impressive revenue growth in Q2 2025, showcasing effective monetization strategies and high market penetration driving substantial cash flow.

| Segment | BCG Category | Key Characteristics | 2024/2025 Data Point |

|---|---|---|---|

| 4G Mobile Subscribers | Cash Cow | Large, loyal base, stable revenue | >80% of mobile connections in LatAm are 4G (2024) |

| Fixed Broadband (Non-Fiber) | Cash Cow | Mature market, consistent income | Strong contributor to Q1 2024 performance |

| Traditional Mobile Voice | Cash Cow | Bundled services, ARPU stability | Significant portion of mobile revenue from bundles (2024) |

| Pay TV Services | Cash Cow | High market share, effective monetization | Notable revenue growth in Q2 2025 |

What You’re Viewing Is Included

América Móvil BCG Matrix

The América Móvil BCG Matrix you see here is the complete, unwatermarked document you will receive immediately after purchase. This preview accurately represents the final, professionally formatted report, ensuring you get exactly what you need for strategic analysis without any hidden surprises or demo content.

Dogs

América Móvil's legacy fixed voice lines are firmly in the Dogs category of the BCG Matrix. This segment is experiencing a consistent decline in subscribers and service revenue, reflecting a shrinking market with limited future growth potential. By the end of 2023, fixed voice lines represented a smaller and smaller portion of América Móvil's overall revenue, a trend that continued into early 2024.

América Móvil's prepaid mobile segment in markets like Brazil and Mexico is facing significant challenges, characterized by substantial net losses in subscribers. This decline is largely attributed to intense competition and high churn rates, where customers frequently switch providers. For instance, in Brazil, the prepaid market is notoriously competitive, with numerous players vying for customer loyalty, leading to increased acquisition costs and reduced profitability for established providers like América Móvil.

These prepaid segments are best categorized as Dogs within the BCG Matrix. They represent areas of low market growth and declining market share for América Móvil, indicating a need for strategic re-evaluation. The ongoing subscriber attrition in these segments suggests that the company may need to consider divestment or a significant restructuring of its offerings to mitigate further losses and reallocate resources to more promising business units.

Traditional copper-based fixed broadband, often referred to as DSL, is a legacy technology within América Móvil's portfolio. As the industry races towards fiber optics, DSL is experiencing a significant decline. In 2024, the global fixed broadband market saw continued growth in fiber subscriptions, while DSL connections continued their downward trend, reflecting a shrinking customer base for this older technology.

Outdated Pay TV Technologies

América Móvil's Pay TV segment faces challenges with older technologies like satellite Direct-to-Home (DTH). In markets where competition is fierce or subscriber numbers are shrinking, these DTH services likely experience high customer turnover and a diminished market presence.

These older platforms are often less cost-effective to maintain and may not contribute substantially to the company's overall earnings. For instance, while América Móvil's consolidated Pay TV revenue might show some upward movement, the underlying performance of these legacy technologies could be dragging down overall profitability.

- Subscriber Churn: Older DTH services in mature markets often see higher churn rates as consumers migrate to more flexible or feature-rich alternatives.

- Market Share Erosion: In competitive landscapes, these technologies struggle to maintain or grow their share against newer, often internet-based, video delivery methods.

- Operational Inefficiency: Maintaining satellite infrastructure and older set-top boxes can be more costly compared to modern IP-based delivery systems.

Underperforming Regional Mobile Operations

Certain mobile operations within América Móvil's Central American portfolio are facing headwinds. For instance, some markets have seen a decline in subscriber numbers. In 2023, for example, a few of these regional segments reported a drop in their customer base, impacting overall revenue generation.

These underperforming segments are characterized by low market growth and, in some cases, a shrinking market share. This situation necessitates a careful strategic evaluation. The company needs to determine whether these operations can be revitalized through targeted investments and operational improvements, or if a divestment strategy would be more beneficial for the group's overall performance.

- Subscriber Decline: Specific Central American markets have experienced a negative trend in subscriber growth in recent years.

- Operational Challenges: Factors such as cybersecurity incidents have contributed to these operational difficulties and subscriber churn.

- Low Growth Environment: These regional operations are operating in markets with limited expansion potential.

- Strategic Review Needed: América Móvil must assess these segments for potential turnaround strategies or possible divestment.

América Móvil's legacy fixed voice lines and traditional copper-based broadband (DSL) are clear examples of Dogs in the BCG Matrix. These segments face declining subscriber bases and revenues due to technological obsolescence and market shifts towards fiber optics and mobile alternatives. For instance, DSL connections globally continued their downward trend in 2024, while fiber subscriptions grew, highlighting the shrinking market for older fixed-line technologies.

The prepaid mobile segments in highly competitive markets like Brazil, along with certain older Pay TV Direct-to-Home (DTH) services and specific Central American mobile operations, also fall into the Dog category. These areas are characterized by low growth, declining market share, and operational inefficiencies, often exacerbated by high churn rates and intense competition. América Móvil's strategic focus needs to address these underperforming units, potentially through divestment or significant restructuring to reallocate resources effectively.

Question Marks

América Móvil is actively pursuing digital transformation, pouring resources into areas like new digital content platforms, fintech solutions, and advanced cloud services. While its current market share in these emerging digital services might be modest, the significant growth potential positions them as potential future stars. For instance, the global fintech market alone was projected to reach over $2.4 trillion by 2024, highlighting the vast opportunity.

These nascent digital offerings are classic examples of Question Marks in the BCG matrix. They demand substantial investment to build brand recognition, develop robust infrastructure, and capture market share in highly competitive and rapidly evolving landscapes. The success of these ventures hinges on América Móvil's ability to innovate and adapt quickly to changing consumer demands and technological advancements.

América Móvil's advanced IoT and M2M solutions, while seeing growth in basic connections, may face challenges in capturing significant market share within more complex, high-value IoT segments like smart cities and industrial IoT platforms. These areas represent substantial future growth opportunities, but the company's current penetration could be relatively low, indicating a need for targeted strategic investment to bolster its position in these lucrative markets.

América Móvil is exploring 5G Fixed Wireless Access (FWA) as a broadband alternative, positioning it as a Question Mark in its portfolio. While FWA shows significant growth potential, América Móvil's current market share in this niche is likely modest compared to its established fiber infrastructure. This suggests an opportunity for substantial expansion if the company invests aggressively and customer adoption accelerates.

Expansion into New, Highly Competitive Geographic Niches

Expansion into new, highly competitive geographic niches for América Móvil would likely be classified as Stars or Question Marks within the BCG Matrix. These markets, while offering high growth potential, demand significant capital investment and sophisticated strategies to gain traction against established players. For instance, entering a densely populated, technologically advanced European market with strong incumbent operators would require a substantial upfront commitment.

- High Growth Potential: These new niches often represent emerging markets or segments with rapidly increasing demand for telecommunications services, driven by digital transformation and increasing smartphone penetration.

- Intense Competition: Established global and regional players already possess significant market share, brand recognition, and infrastructure, making it challenging for América Móvil to quickly capture a dominant position.

- Substantial Investment Needs: Acquiring spectrum, building out new network infrastructure, marketing, and adapting to local regulatory environments necessitate considerable financial outlay.

- Strategic Maneuvering Required: Success hinges on innovative service offerings, competitive pricing, strategic partnerships, and efficient operational execution to differentiate and attract customers.

New B2B 5G-enabled Solutions (e.g., Private Networks, Network Slicing)

América Móvil's new B2B 5G-enabled solutions, such as private networks and network slicing, are positioned as Question Marks within its BCG matrix. While the enterprise sector offers substantial avenues for 5G revenue generation, these advanced services are still in their nascent stages of deployment and monetization across Latin America. For instance, while global 5G enterprise revenue is projected to reach hundreds of billions by 2028, Latin American operators are just beginning to tap into this potential.

These solutions are characterized by a low current market share due to their complexity and the ongoing build-out of 5G infrastructure. However, their future growth potential is exceptionally high as businesses increasingly demand tailored, high-performance connectivity for critical operations. This aligns with the overall trend where enterprise 5G spending is expected to significantly outpace consumer spending in the coming years.

- Low Current Market Share: Adoption of private 5G networks and network slicing by Latin American enterprises is still limited.

- High Future Growth Potential: The demand for dedicated, high-speed, and secure enterprise connectivity is rapidly increasing.

- Investment Required: Significant investment in infrastructure and specialized sales capabilities is necessary to capture this market.

- Strategic Importance: These services are crucial for América Móvil to diversify its revenue streams beyond traditional mobile and broadband.

América Móvil's ventures into new digital services, such as fintech and advanced cloud solutions, are prime examples of Question Marks. These areas, while holding immense future growth potential, currently have modest market shares due to their nascent nature and intense competition. The global fintech market's projected growth to over $2.4 trillion by 2024 underscores the opportunity, but requires significant investment to establish a strong foothold.

Similarly, advanced IoT and M2M solutions, particularly in high-value segments like smart cities, represent Question Marks. While basic connections are growing, capturing significant share in these complex, high-growth areas demands targeted strategic investment. América Móvil's exploration of 5G Fixed Wireless Access (FWA) also falls into this category, with significant growth potential but currently a modest market share compared to established broadband alternatives.

The company's new B2B 5G-enabled solutions, including private networks and network slicing, are also classified as Question Marks. Despite the high future growth potential driven by enterprise demand for dedicated connectivity, their current market share in Latin America is limited. This necessitates substantial investment in infrastructure and specialized sales to capitalize on the projected growth in enterprise 5G spending.

| Business Unit/Service | Market Growth Rate | Relative Market Share | BCG Category |

|---|---|---|---|

| Fintech Solutions | High | Low | Question Mark |

| Advanced Cloud Services | High | Low | Question Mark |

| Smart City IoT Solutions | High | Low | Question Mark |

| 5G Fixed Wireless Access (FWA) | High | Low | Question Mark |

| B2B 5G Private Networks | High | Low | Question Mark |

BCG Matrix Data Sources

Our América Móvil BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.