América Móvil Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

América Móvil Bundle

América Móvil navigates a complex telecom landscape where intense rivalry and significant buyer power are key challenges. The threat of new entrants is moderate, while the bargaining power of suppliers is relatively low due to the scale of América Móvil's operations.

The complete report reveals the real forces shaping América Móvil’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

América Móvil's reliance on a concentrated group of specialized equipment vendors for its advanced network infrastructure, like 5G technology, grants these suppliers considerable bargaining power. The global push for 5G deployment means only a select few companies can provide the necessary cutting-edge solutions, amplifying their leverage.

This dependency creates vulnerability for América Móvil; any price hikes or disruptions from these critical suppliers could directly affect the company's operational expenses and its ability to roll out new services on schedule. For instance, in 2024, the cost of advanced telecommunications equipment saw an average increase of 5-7% globally due to supply chain constraints and high demand.

Switching core network equipment suppliers for a company of América Móvil's scale is incredibly complex and expensive. It involves substantial new capital investment, intricate integration processes, and the very real risk of disrupting services for millions of customers. These high switching costs significantly limit América Móvil's ability to change providers, thereby strengthening the leverage of its current equipment suppliers.

Access to radio spectrum is absolutely critical for any wireless telecommunications company, and in most countries, this access is tightly controlled by government regulatory bodies. These agencies effectively act as suppliers of this essential resource, and their decisions have a profound impact on companies like América Móvil.

Regulators determine how spectrum is allocated, the fees associated with licenses, the terms for renewal, and any obligations regarding network coverage. For instance, in 2024, many Latin American countries held spectrum auctions, with significant upfront costs for operators. Mexico's Federal Telecommunications Institute (IFT) has been instrumental in managing spectrum, influencing the competitive landscape and operational expenses for América Móvil.

Changes in these regulations, such as the introduction of new spectrum bands or adjustments to licensing fees, can directly alter América Móvil's financial projections and strategic direction. The company must constantly adapt its business plans to comply with evolving regulatory frameworks, which can significantly affect its ability to expand services and maintain market share.

Labor and Talent Supply

The availability of skilled labor, especially in critical areas like 5G network deployment, cybersecurity, and AI integration, significantly influences the bargaining power of employees and talent providers. A scarcity of such specialized expertise can lead to increased labor costs and hinder the pace of technological progress for companies like América Móvil.

América Móvil must strategically invest in its workforce through robust talent acquisition programs, comprehensive training initiatives, and effective retention strategies to counter this supplier power. For instance, in 2023, the global demand for cybersecurity professionals outstripped supply by an estimated 3.4 million, a trend that is expected to persist, driving up compensation for these roles.

- Talent Shortage Impact: A lack of specialized tech talent can inflate operational expenses and delay the rollout of new services.

- Strategic Investment: América Móvil's commitment to training and development is crucial for mitigating rising labor costs.

- Market Dynamics: The telecommunications sector, like many others, faces intense competition for a limited pool of highly skilled professionals.

Infrastructure and Tower Providers

América Móvil, despite its vast network, does engage with third-party infrastructure and tower providers, especially for expansion and in specific markets. These external entities can influence costs and access. For instance, the Latin American telecom tower market is a significant and growing sector, with projections indicating continued expansion. In 2023, the market was valued at approximately USD 3.5 billion and is expected to grow at a compound annual growth rate (CAGR) of around 5% through 2028, demonstrating sustained demand and potential leverage for providers.

- Reliance on Third Parties: América Móvil utilizes external tower companies and infrastructure providers, particularly in regions where it doesn't own all necessary assets or for rapid network rollout.

- Cost and Access Factors: Leasing fees and the availability of sites from these providers are key determinants of América Móvil's operational costs and expansion capabilities.

- Market Growth: The expanding Latin American telecom tower market, projected to grow at a CAGR of around 5% through 2028, signifies increasing demand for these services, potentially strengthening supplier bargaining power.

América Móvil's dependence on a limited number of specialized technology vendors, particularly for cutting-edge infrastructure like 5G, significantly boosts supplier bargaining power. The global scarcity of providers capable of delivering such advanced solutions, coupled with high switching costs for a company of América Móvil's scale, creates a strong leverage position for these suppliers.

Government regulators, acting as suppliers of radio spectrum, also wield substantial influence. Their decisions on allocation, fees, and renewal terms directly impact América Móvil's operational costs and strategic planning, as seen in 2024 spectrum auctions across Latin America.

The scarcity of specialized talent, such as cybersecurity professionals, further empowers labor as a supplier, driving up costs and potentially delaying service rollouts. For instance, the global cybersecurity talent gap was estimated at 3.4 million in 2023.

Finally, third-party infrastructure and tower providers, especially in expanding markets like Latin America where the tower market was valued at approximately USD 3.5 billion in 2023, can command higher leasing fees due to sustained demand and growth.

| Supplier Type | Key Factors Influencing Power | Impact on América Móvil | 2024/Recent Data Point |

|---|---|---|---|

| Technology Vendors | Specialized equipment, high switching costs | Increased equipment costs, potential rollout delays | 5-7% global increase in advanced telecom equipment costs (2024) |

| Spectrum Regulators | Spectrum allocation, fees, license terms | Direct impact on operational expenses and strategy | Significant upfront costs in 2024 Latin American spectrum auctions |

| Skilled Labor | Scarcity of specialized talent (e.g., cybersecurity) | Higher labor costs, slower innovation | Global cybersecurity talent gap of 3.4 million (2023) |

| Infrastructure/Tower Providers | Market growth, demand for sites | Higher leasing fees, impact on expansion | Latin American tower market valued at ~USD 3.5 billion (2023), ~5% CAGR projected |

What is included in the product

Tailored exclusively for América Móvil, this analysis dissects the intense competitive landscape, buyer and supplier power, threat of new entrants and substitutes, revealing strategic vulnerabilities and advantages.

Instantly visualize competitive intensity across all five forces, allowing América Móvil to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

América Móvil's extensive reach across Latin America, the US, and parts of Europe means it serves a massive and varied customer base. This broad distribution generally weakens the bargaining power of any single customer or customer group. For instance, in 2023, América Móvil reported over 300 million mobile subscribers, illustrating the scale that dilutes individual customer influence.

Customers in the telecommunications sector, especially those using prepaid mobile services, often exhibit significant price sensitivity. This means they are likely to switch providers if they find better deals or bundled offers elsewhere. For América Móvil, this price sensitivity is a key factor influencing their strategies, particularly in segments where competition is fierce.

While América Móvil has seen robust growth in its postpaid subscriber base, the prepaid segment continues to present challenges due to this price sensitivity. For instance, in 2023, Latin America's mobile market saw intense competition, with operators frequently adjusting pricing to attract and retain prepaid users. This dynamic forces América Móvil to continuously review and refine its pricing models and promotional packages to maintain its customer loyalty and market share.

In key markets like Mexico and Brazil, customers enjoy a wide array of telecommunications providers, significantly boosting their power to switch providers. This competitive environment allows consumers to push for superior service, advanced features, and more attractive pricing, directly impacting América Móvil's pricing strategies and service offerings.

For instance, in Mexico, the telecommunications sector is highly competitive, with multiple players vying for market share. This translates to customers having readily available alternatives if América Móvil's offerings do not meet their expectations. In 2024, the average mobile data consumption in Mexico continued to rise, putting pressure on providers to offer competitive data plans.

Bundling of Services

Bundling services, such as combining mobile, fixed-line, internet, and television, significantly strengthens customer loyalty. By offering these integrated packages, América Móvil makes it more inconvenient and expensive for customers to switch to a competitor, thereby diminishing their bargaining power. This strategy effectively locks in customers, as the perceived cost of unraveling a bundled service often outweighs the benefits of a single-service price comparison.

América Móvil's extensive service offerings are a key enabler of this bundling strategy. For instance, in 2024, a significant portion of their customer base in Latin America was enrolled in multi-play (combining at least two services) or quad-play (combining all four) packages. This focus on bundled services directly impacts customer switching behavior, as evidenced by the lower churn rates observed in markets where these bundles are prevalent.

- Increased Customer Stickiness: Bundled services create higher switching costs for consumers.

- Reduced Individual Service Power: Customers are less likely to negotiate prices on individual services when they benefit from a package deal.

- Enhanced Loyalty: Comprehensive bundles foster stronger customer relationships and reduce the incentive to explore competitor offerings.

- Market Penetration: América Móvil leverages its broad portfolio to offer attractive bundles, capturing a larger share of customer spending.

Impact of Digital Transformation and Customer Experience

The bargaining power of customers is significantly amplified by digital transformation, as consumers now demand seamless, personalized experiences across all touchpoints. Companies failing to adapt risk alienating customers who can easily switch to providers offering superior digital engagement. For América Móvil, this means a constant need to innovate its digital platforms and customer service offerings to retain loyalty and mitigate the growing influence of its customer base.

In 2024, the telecommunications sector saw a pronounced shift towards digital-first customer interactions. For instance, a significant portion of customer service inquiries for major telcos were handled through apps and online portals, reflecting this trend. América Móvil, to counter this rising customer power, has been investing heavily in its digital infrastructure. By mid-2024, the company reported a substantial increase in the adoption of its self-service mobile app, indicating a positive response to enhanced digital offerings.

- Digital Expectations: Customers in 2024 increasingly expect intuitive mobile apps and personalized digital communication from telecom providers.

- Competitive Landscape: Companies like América Móvil face pressure from agile competitors who leverage digital transformation to offer superior customer experiences, thereby increasing customer bargaining power.

- América Móvil's Strategy: Continued investment in digital platforms and customer service is crucial for América Móvil to meet these evolving expectations, enhance customer satisfaction, and reduce the leverage customers hold.

- Data-Driven Personalization: By mid-2024, América Móvil was focusing on utilizing customer data to personalize service offerings, a key strategy to strengthen customer relationships and reduce churn in a highly competitive digital environment.

The bargaining power of customers for América Móvil is influenced by several factors, including the availability of alternatives, price sensitivity, and the increasing demand for digital engagement.

In highly competitive markets like Mexico and Brazil, customers have numerous providers, allowing them to demand better pricing and services. For instance, in 2024, the average mobile data consumption continued to rise, pressuring providers like América Móvil to offer competitive data plans.

Bundling services, such as mobile, internet, and TV, increases customer stickiness and reduces their power to negotiate individual service prices, as seen by high adoption rates of multi-play packages in 2024.

Digital transformation has further empowered customers, who now expect seamless, personalized digital experiences, forcing América Móvil to invest in its digital platforms to retain loyalty.

| Factor | Impact on Customer Bargaining Power | América Móvil's Response (as of mid-2024) |

|---|---|---|

| Availability of Alternatives | High in competitive markets (e.g., Mexico, Brazil) | Focus on service differentiation and bundled offerings |

| Price Sensitivity | Strong, especially in prepaid segments | Continuous review of pricing models and promotions |

| Bundled Services | Reduces power to negotiate individual prices; increases switching costs | Promoting multi-play and quad-play packages; observed lower churn in these segments |

| Digital Expectations | Demand for personalized digital experiences | Investing in digital infrastructure and self-service apps; increased app adoption reported by mid-2024 |

Full Version Awaits

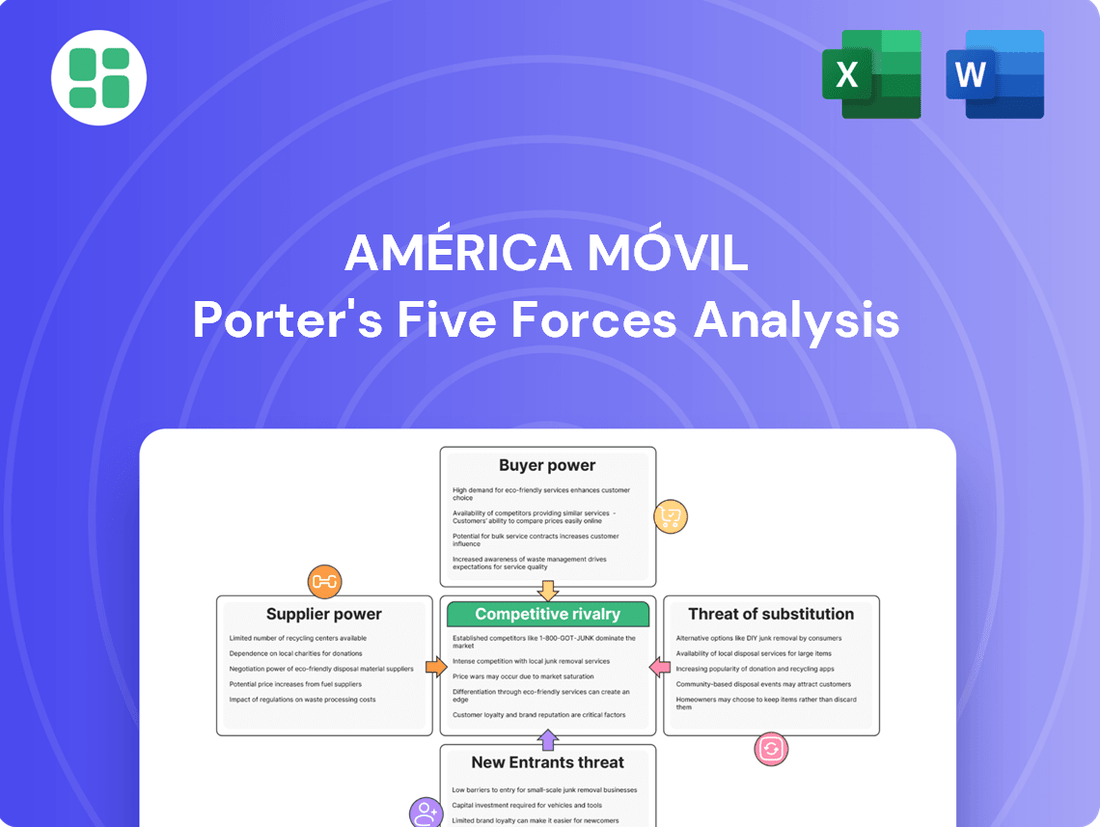

América Móvil Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details América Móvil's competitive landscape through Porter's Five Forces, covering the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the telecommunications sector. This comprehensive analysis is ready for your immediate use.

Rivalry Among Competitors

América Móvil operates in a highly competitive landscape, facing intense rivalry from a multitude of local and global telecommunications providers. This is particularly evident in its core markets like Mexico and Brazil, where established giants such as Telefónica and AT&T are also vying for significant market share. The sheer number of strong players in these key regions fuels aggressive marketing campaigns and price wars, directly impacting profitability and forcing continuous innovation.

The telecommunications sector, particularly in mature markets where América Móvil operates, is characterized by intense price wars and aggressive promotional activities. This competition directly impacts average revenue per user (ARPU) and squeezes profit margins. For instance, in 2023, many Latin American telecom operators, including those in América Móvil's key markets, reported flat or declining ARPU growth, partly due to these competitive pressures and the need to offer attractive bundles to retain subscribers.

América Móvil must continuously adjust its pricing strategies and product portfolios to stay ahead. This involves not only matching competitor prices but also innovating with new service offerings and value-added packages. The company's service revenue growth has indeed faced headwinds in certain segments, underscoring the necessity of these dynamic pricing and promotional efforts to maintain market share and profitability in a highly competitive landscape.

The telecommunications sector demands substantial upfront investment in network infrastructure, a reality underscored by the ongoing global deployment of 5G technology and fiber optic broadband. These high fixed costs mean companies need a large customer base to spread expenses and become profitable, leading to fierce competition as players vie for subscribers to justify their capital outlays.

América Móvil, a major player, demonstrates this commitment with a significant capital expenditure plan, reportedly allocating billions of dollars annually towards network upgrades and expansion, including its 5G rollout. For instance, in 2023, the company invested approximately $7.6 billion in its networks, a substantial portion dedicated to enhancing its 5G capabilities across its Latin American operations.

Market Consolidation and Rationalization

While competitive rivalry remains intense across Latin America, a significant trend towards market consolidation is reshaping the landscape. This consolidation, driven by various factors, aims to create more efficient and rationalized markets, potentially benefiting larger, established players like América Móvil.

For instance, the Brazilian mobile market has seen notable consolidation, with players actively seeking mergers and acquisitions to gain scale and market share. Similarly, potential strategic moves, such as WOM's reported interest in acquiring assets in Chile, signal further shifts in the competitive structure. These actions suggest a move towards fewer, stronger competitors in certain key markets.

This ongoing rationalization can, over time, lead to a reduction in aggressive price wars. As the number of major players decreases, there's a greater likelihood of more stable pricing environments, which could ease margin pressures for dominant operators. For example, if consolidation leads to a more concentrated market in a specific country, the remaining companies might find it more sustainable to avoid deep price cuts.

- Market Consolidation Trend: Ongoing mergers and acquisitions are reducing the number of competitors in various Latin American telecom markets.

- Regional Examples: Brazil's mobile sector has experienced consolidation, and potential deals like WOM's acquisition interests in Chile are indicative of this trend.

- Impact on Rivalry: Consolidation can lead to a more rationalized market, potentially easing long-term price pressures for dominant players.

Differentiation through Technology and Service Quality

América Móvil distinguishes itself by focusing on more than just price, highlighting its expansive network, early adoption of 5G, and overall service quality. This strategy aims to attract and retain a more discerning customer base.

- Extensive Network Coverage: América Móvil boasts a significant presence across Latin America, providing a crucial differentiator in markets where reliable connectivity is paramount.

- 5G Leadership: The company has been a frontrunner in deploying 5G technology in several key markets, offering faster speeds and new service possibilities. For instance, as of early 2024, América Móvil has actively expanded its 5G footprint in countries like Mexico and Brazil.

- Service Quality Emphasis: Beyond network capabilities, América Móvil invests in customer service and innovative digital solutions to enhance user experience and build loyalty.

- Technological Investment: Continued investment in advanced technologies such as 5G and fiber broadband is essential for maintaining a competitive edge and catering to the demand for high-performance services.

Competitive rivalry within América Móvil's operating regions remains a dominant force, characterized by aggressive pricing and promotional activities from both established players like Telefónica and AT&T, and numerous local competitors. This intensity directly pressures average revenue per user (ARPU), as evidenced by generally flat ARPU growth reported across many Latin American telecom markets in 2023. América Móvil's strategic response involves continuous adaptation of its offerings and pricing to maintain market share amidst these challenges.

SSubstitutes Threaten

Over-the-top (OTT) services, such as WhatsApp for messaging and Netflix for entertainment, represent a substantial threat to América Móvil. These platforms leverage the internet to deliver services that directly compete with traditional telecom offerings, eroding revenue streams from voice calls and SMS. For instance, by 2024, it’s estimated that a significant portion of global mobile data traffic is driven by video streaming and messaging apps, directly impacting the demand for traditional voice and text services.

The proliferation of Wi-Fi and public hotspots presents a significant threat of substitutes for América Móvil's mobile data services. With Wi-Fi readily accessible in homes, offices, and a growing number of public locations, consumers can often bypass the need for cellular data, particularly for bandwidth-intensive tasks like streaming video or large downloads. This widespread availability directly erodes the perceived value of mobile data plans, forcing América Móvil to continually differentiate its offerings through superior speed, unwavering reliability, and extensive coverage in areas where Wi-Fi is scarce.

New satellite internet technologies, like SpaceX's Starlink, are emerging as significant substitutes for traditional broadband, especially in areas lacking robust fixed-line or mobile infrastructure. As of early 2024, Starlink has activated service in over 70 countries, demonstrating a rapid global rollout. This expansion directly challenges América Móvil's dominance in providing connectivity, particularly in its Latin American markets where rural penetration is a key focus.

While currently Starlink's user base is a fraction of established providers, its continued growth and decreasing latency present a credible alternative for consumers and businesses seeking internet access. América Móvil's reported investments in infrastructure and exploration of partnerships, such as potential collaborations with SpaceX, highlight their recognition of this evolving competitive landscape and the need to adapt to these disruptive technologies.

Fixed-Wireless Access (FWA)

Fixed-Wireless Access (FWA), particularly with the advent of 5G, presents a significant threat of substitution to traditional fixed-line broadband. This technology uses wireless signals to deliver internet to homes, directly competing with fiber optic and DSL services.

Companies like América Móvil, which operate both fixed-line and wireless networks, face the risk of FWA cannibalizing their existing revenue streams from traditional broadband. For instance, in markets like Brazil, where FWA adoption is gaining traction, this substitution effect could become more pronounced.

- FWA's Competitive Edge: FWA offers a potentially faster deployment and lower infrastructure cost compared to laying fiber, making it an attractive alternative for consumers.

- 5G's Enabling Role: The widespread rollout of 5G networks is a key enabler for FWA, providing the necessary speed and capacity to rival fixed-line services.

- Market Impact: In 2024, the growth of FWA is projected to continue, potentially impacting the market share of established fixed-line providers.

Enterprise Communication Platforms

For América Móvil's enterprise clients, the threat of substitutes in communication is significant. Unified communication platforms and enterprise-grade Voice over Internet Protocol (VoIP) services are increasingly replacing traditional fixed-line voice and data services. These integrated solutions often bundle features like video conferencing, instant messaging, and collaboration tools, making separate telecom services less necessary.

These platforms offer a more comprehensive and often cost-effective communication solution for businesses. For instance, companies can consolidate their internal and external communication needs onto a single platform, streamlining operations and potentially reducing IT overhead. This trend is further accelerated by the growing adoption of cloud-based services, which allow for greater flexibility and scalability.

To counter this, América Móvil needs to continuously innovate and offer compelling corporate data and communication solutions. This includes developing or enhancing its own unified communication offerings and ensuring its pricing remains competitive against these disruptive alternatives. Failure to adapt could lead to a decline in its lucrative enterprise customer base.

- Unified communication platforms often integrate voice, video, messaging, and collaboration tools, reducing reliance on separate legacy systems.

- Enterprise-grade VoIP services provide cost-effective voice communication over data networks, directly competing with traditional circuit-switched telephony.

- América Móvil's ability to retain business clients depends on offering robust and integrated data and communication packages that rival the functionality and value of these substitutes.

The threat of substitutes for América Móvil is multifaceted, encompassing over-the-top (OTT) messaging and voice services, readily available Wi-Fi, emerging satellite internet, and fixed-wireless access (FWA). These alternatives directly siphon demand from traditional revenue streams like voice calls, SMS, and mobile data.

By 2024, video streaming and messaging apps are projected to account for a substantial portion of global mobile data traffic, underscoring the shift away from legacy telecom services. Furthermore, the increasing accessibility of Wi-Fi hotspots in homes, offices, and public spaces directly challenges América Móvil's mobile data revenue.

New technologies like satellite internet, with providers like Starlink expanding rapidly into over 70 countries by early 2024, present a credible substitute, particularly in underserved regions. Similarly, 5G-enabled FWA offers a competitive alternative to fixed-line broadband, with markets like Brazil already seeing increased adoption.

For enterprise clients, unified communication platforms and VoIP services are increasingly replacing traditional fixed-line communications, offering integrated solutions that reduce reliance on separate telecom services. América Móvil must innovate its corporate offerings to remain competitive against these evolving substitutes.

Entrants Threaten

The telecommunications sector demands substantial upfront investment in essential infrastructure like spectrum licenses, cell towers, and fiber optic networks. This high capital expenditure acts as a formidable barrier, deterring new competitors from entering the market.

For instance, América Móvil consistently invests billions in capital expenditures each year to enhance its network capabilities, with significant portions dedicated to 5G deployment. In 2023, the company reported capital expenditures of approximately $8.2 billion, underscoring the scale of investment required to maintain and expand operations in this industry.

The telecommunications sector, particularly for mobile operators like América Móvil, faces significant threats from new entrants due to stringent regulatory hurdles and the complex process of spectrum licensing. Acquiring the necessary licenses and spectrum allocations from government bodies is not only time-consuming but also a substantial financial investment, often creating a high barrier to entry. For instance, spectrum auctions in many Latin American countries can run into hundreds of millions of dollars, as seen in Brazil's 5G spectrum auction in 2021 which generated billions.

Furthermore, existing regulatory frameworks frequently exhibit a bias towards incumbent operators, inadvertently restricting the ease with which new players can enter and compete effectively. This favoritism can manifest in preferential treatment regarding spectrum availability or less stringent compliance requirements for established companies. Navigating and complying with a patchwork of diverse regulations across the multiple countries América Móvil operates in, such as Mexico, Brazil, and Colombia, adds another layer of complexity and cost for any potential new entrant.

América Móvil benefits from an extensive, established network infrastructure built over decades, providing a considerable cost advantage and superior coverage compared to any potential new entrant. In 2023, the company continued its significant capital expenditures, investing billions to upgrade and expand its 5G network across Latin America, further solidifying its market position.

Achieving similar economies of scale and network reach would be incredibly challenging and costly for a newcomer. For instance, the capital required to deploy a nationwide fiber optic network comparable to América Móvil's existing footprint could easily run into billions of dollars, a substantial barrier for any aspiring competitor.

Brand Recognition and Customer Loyalty

América Móvil benefits from significant brand recognition and customer loyalty built over years of operation, making it harder for newcomers to gain traction. For instance, in 2023, América Móvil maintained a dominant market share in several Latin American countries, a testament to its established brand. New entrants face the daunting task of investing heavily in marketing and offering truly compelling value propositions to challenge this loyalty.

Overcoming América Móvil's entrenched brand presence requires substantial marketing expenditure and highly disruptive offerings. Consider that in 2023, the telecommunications industry saw significant marketing spend from established players to retain customers. New entrants must not only match this but also offer something genuinely different to attract a significant customer base away from a trusted provider.

The threat of new entrants is therefore moderated by the high cost and difficulty of building brand equity and customer loyalty in the telecommunications sector. This is evident in the relatively slow pace of major new player entry in many of América Móvil's core markets. Key challenges for new entrants include:

- High customer acquisition costs.

- Need for significant capital for network infrastructure.

- Established brand trust and switching barriers.

- Intense competition from existing, well-capitalized players.

Intense Competition from Incumbents

The threat of new entrants into the telecommunications sector, particularly in Latin America where América Móvil is a dominant force, is significantly dampened by the intense competition already present. Established players like Telefónica and AT&T, alongside América Móvil itself, have built substantial infrastructure and brand loyalty over years of operation. For instance, as of early 2024, América Móvil reported over 300 million mobile subscribers across Latin America, demonstrating its entrenched market position.

Newcomers would face considerable hurdles in matching the scale and service offerings of these incumbents. The capital expenditure required to build out comparable network coverage and acquire spectrum licenses is immense, often running into billions of dollars. Furthermore, existing players are adept at leveraging their economies of scale to offer competitive pricing, making it difficult for new entrants to achieve profitability without a significant, disruptive advantage.

- Established Infrastructure: Incumbents possess extensive fiber optic networks and mobile towers, a costly barrier for new companies to replicate.

- Brand Loyalty and Customer Base: América Móvil and its rivals have cultivated strong brand recognition and a large, loyal customer base, making customer acquisition a significant challenge for new entrants.

- Regulatory Hurdles: Navigating complex and often country-specific telecommunications regulations can be time-consuming and expensive for new market participants.

- Aggressive Competitive Response: Existing players are known to react aggressively to new entrants through price wars or exclusive deals, further deterring market entry.

The threat of new entrants for América Móvil is considerably low due to the immense capital requirements for infrastructure and spectrum acquisition, coupled with established brand loyalty. For instance, in 2023, América Móvil's capital expenditures neared $8.2 billion, highlighting the scale of investment needed to compete. Regulatory complexities and the need to build a nationwide network comparable to América Móvil's existing footprint, which serves over 300 million mobile subscribers as of early 2024, present substantial barriers.

New entrants face formidable challenges in overcoming the established market presence and aggressive competitive responses from incumbents like América Móvil. The cost of acquiring spectrum licenses alone can reach hundreds of millions, as seen in Brazil's 2021 5G auction. Furthermore, developing brand trust and achieving economies of scale to match existing players requires massive, sustained investment, making market entry exceptionally difficult.

| Barrier Type | Description | América Móvil Context (2023-2024 Data) |

|---|---|---|

| Capital Requirements | High upfront investment in network infrastructure and spectrum. | 2023 CapEx ~ $8.2 billion; nationwide network requires billions more. |

| Brand Loyalty & Switching Costs | Established customer base and brand recognition. | Over 300 million mobile subscribers across Latin America (early 2024). |

| Regulatory Hurdles | Complex licensing and compliance across multiple countries. | Spectrum auctions can cost hundreds of millions; diverse regulations in Mexico, Brazil, Colombia. |

| Economies of Scale | Cost advantages from large-scale operations. | Existing infrastructure provides significant cost advantage over newcomers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for América Móvil is built upon a foundation of reliable data, including the company's annual reports, investor presentations, and regulatory filings. This is complemented by insights from reputable industry research firms and macroeconomic databases to provide a comprehensive view of the competitive landscape.