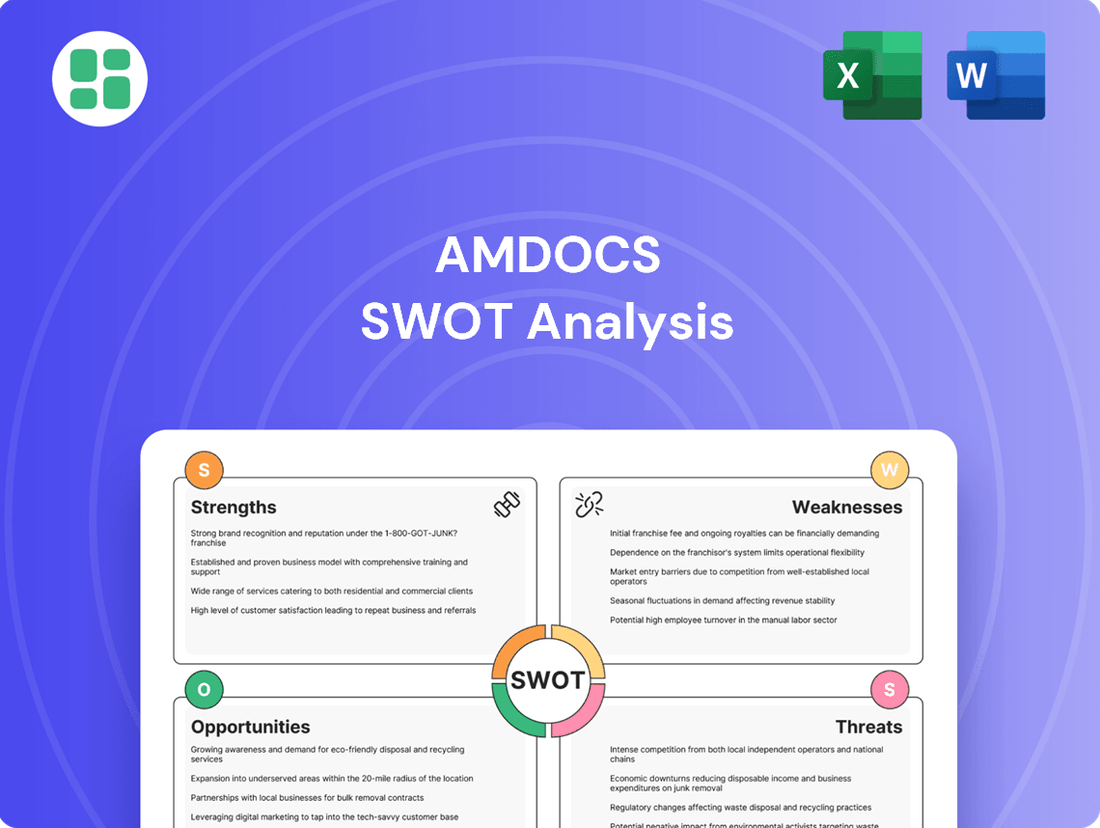

Amdocs SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amdocs Bundle

Amdocs, a leader in telecom software and services, boasts significant strengths in its established customer base and comprehensive product portfolio, but also faces opportunities in cloud migration and digital transformation. However, understanding the nuances of its competitive landscape and potential market shifts is crucial for strategic advantage.

Want the full story behind Amdocs’ strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Amdocs commands a dominant position in crucial segments of the telecom software and services landscape. For 17 years running, they've been recognized as a top player in monetization platforms, a testament to their enduring strength in this vital area.

Their market leadership extends to BSS/OSS, telco IT software and services, and digital enablement systems, where they maintain substantial market shares. This broad leadership highlights Amdocs' deep industry penetration and the trust placed in them by a vast number of clients worldwide.

Amdocs boasts a comprehensive solutions portfolio, covering the entire customer experience lifecycle for communications and media companies. This integrated suite includes everything from billing and customer management to digital transformation and network automation, offering a one-stop shop for service providers. For instance, Amdocs' revenue from its Customer Experience and Commerce segment was approximately $2.9 billion in fiscal year 2023, highlighting the breadth and adoption of its offerings.

Amdocs is strongly positioned to benefit from the worldwide expansion of 5G networks and the increasing adoption of cloud technologies. This strategic focus allows them to tap into a significant growth area within the telecommunications industry.

The company offers specific solutions designed to help service providers monetize 5G services and automate their network operations. Amdocs' expertise in cloud migration services further supports this, enabling clients to transition to more agile and efficient cloud-native environments.

In the first half of fiscal year 2024, Amdocs reported revenue growth driven by these strategic areas, with managed services and software revenue showing particular strength. This indicates a tangible market demand for their 5G and cloud transformation offerings.

Strategic Partnerships and AI/GenAI Integration

Amdocs' strategic partnerships with cloud giants like AWS, Microsoft Azure, and Google Cloud Platform, alongside collaborations with NVIDIA, are significant strengths. These alliances, particularly in the AI and GenAI space, position Amdocs to offer cutting-edge solutions. For instance, Amdocs' commitment to AI integration is evident in its investments, aiming to boost automation and data intelligence for enhanced customer experiences.

These collaborations are crucial for Amdocs' competitive edge in the evolving telecom and media landscape. By leveraging the infrastructure and expertise of hyperscalers, Amdocs can accelerate the deployment of its cloud-native solutions. This synergy is particularly impactful for AI-driven services, where Amdocs can tap into advanced processing capabilities.

The company's focus on AI and GenAI integration across its product suite, including its CES (Customer Engagement Solutions) and OSS/BSS (Operations Support Systems/Business Support Systems) offerings, allows for greater operational efficiency and personalized customer interactions. This strategic direction is supported by Amdocs' ongoing R&D efforts in these transformative technologies.

Key aspects of this strength include:

- Cloud Hyperscaler Alliances: Deep integrations with AWS, Azure, and GCP for scalable and flexible service delivery.

- NVIDIA Collaboration: Leveraging NVIDIA's AI expertise for accelerated computing and advanced AI/GenAI capabilities.

- AI/GenAI Investment: Substantial resource allocation to embed AI and GenAI into Amdocs' core portfolio for enhanced automation and intelligence.

- Innovation in Customer Experience: Driving new revenue streams and improving customer satisfaction through AI-powered solutions.

Stable Revenue Streams from Managed Services and Backlog

A significant portion of Amdocs' financial strength comes from its recurring revenue model, with managed services accounting for roughly 65% of its total income. This recurring income creates a predictable and stable financial base for the company.

Further bolstering this stability is Amdocs' substantial 12-month backlog. As of the second quarter of 2025, this backlog stood at an impressive $4.17 billion. This figure indicates strong ongoing demand for Amdocs' offerings and provides excellent visibility into future revenue streams and cash flow.

- Recurring Revenue Base: Approximately 65% of Amdocs' revenue originates from managed services, ensuring consistent income.

- Strong Backlog: A 12-month backlog of $4.17 billion as of Q2 2025 highlights robust future business.

- Predictable Cash Flows: The combination of managed services and a large backlog offers high predictability for future financial performance.

Amdocs' market leadership in monetization platforms, BSS/OSS, and digital enablement systems provides a strong foundation. Their comprehensive suite of solutions covers the entire customer experience lifecycle for telecom and media companies, ensuring deep industry penetration and client trust.

The company's strategic focus on 5G expansion and cloud adoption is a significant advantage, with tangible revenue growth in the first half of fiscal year 2024 driven by these areas. Amdocs' commitment to AI and GenAI integration, bolstered by key partnerships with cloud hyperscalers and NVIDIA, positions them at the forefront of innovation.

A substantial recurring revenue base, with managed services comprising around 65% of income, coupled with a robust 12-month backlog of $4.17 billion as of Q2 2025, offers exceptional financial stability and revenue visibility.

| Key Strength Area | Description | Supporting Data/Fact |

|---|---|---|

| Market Leadership | Dominant position in telecom software and services. | 17 consecutive years as a top player in monetization platforms. |

| Comprehensive Portfolio | End-to-end customer experience solutions. | FY23 revenue of ~$2.9 billion from Customer Experience and Commerce segment. |

| Strategic Focus | Capitalizing on 5G and cloud adoption. | Revenue growth in H1 FY24 driven by 5G and cloud transformation offerings. |

| Partnerships & AI | Collaborations with cloud giants and NVIDIA for AI/GenAI. | Investments in AI integration for automation and enhanced customer experiences. |

| Financial Stability | Recurring revenue and strong backlog. | ~65% revenue from managed services; $4.17 billion 12-month backlog (Q2 FY25). |

What is included in the product

Delivers a strategic overview of Amdocs’s internal and external business factors, highlighting its strengths in software and services, weaknesses in market diversification, opportunities in cloud and AI, and threats from competition and evolving technology.

Amdocs' SWOT analysis offers a clear roadmap to identify and address market challenges, transforming potential weaknesses into actionable strategies for growth.

Weaknesses

Amdocs' significant concentration within the telecommunications industry, while a historical strength, presents a notable weakness. This deep reliance means the company is particularly susceptible to the cyclical nature and evolving demands of this single sector. For instance, a slowdown in telecom capital expenditures, as seen in some periods of 2023 and early 2024 due to macroeconomic pressures, can directly translate into slower revenue growth for Amdocs.

The company's revenue streams are heavily tied to the health and investment cycles of telecom operators globally. Should major clients postpone network upgrades or reduce spending on software and services, Amdocs' financial performance can be significantly impacted. While Amdocs is actively pursuing diversification, expanding its footprint into other large enterprise markets remains a complex and ongoing strategic challenge, with progress needing to outpace the inherent risks of its core industry focus.

Amdocs operates in a highly competitive telecom software and services sector, facing rivals such as Ericsson, Nokia, and Accenture. This intense environment demands ongoing innovation and substantial investment to defend its market position and avoid revenue decline.

Amdocs' global operations expose it to significant macroeconomic headwinds. For instance, the International Monetary Fund (IMF) projected global growth to slow to 3.2% in 2024, down from 3.5% in 2023, highlighting a challenging operating environment. Fluctuating interest rates, as seen with the Federal Reserve's monetary policy adjustments throughout 2024, can impact client IT spending budgets.

Geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, create uncertainty that can directly affect Amdocs' communication service provider clients. These clients might postpone or scale back investments in new IT infrastructure and services due to economic instability and supply chain disruptions, directly impacting Amdocs' revenue streams.

Potential for Revenue Declines from Phase-outs

Amdocs has navigated periods where revenue from specific regions or from the strategic discontinuation of less profitable business lines has seen a dip. For instance, in fiscal year 2023, while overall revenue grew, the company's reporting indicated shifts in regional performance that necessitated careful attention.

These phase-outs, though beneficial for long-term margin improvement, can introduce short-term revenue volatility. Managing client transitions smoothly during these strategic shifts is crucial for mitigating immediate financial impacts and maintaining client relationships.

- Revenue Fluctuation: Strategic phase-outs can lead to temporary revenue declines, impacting short-term financial reporting.

- Regional Performance: Declines in specific geographic markets can offset growth in others, requiring balanced regional strategies.

- Client Transition Management: The process of moving clients from phased-out services to new offerings demands meticulous planning to avoid revenue gaps.

Challenges in B2B Market Inefficiencies

Amdocs' own research underscores significant inefficiencies within Communication Service Providers' (CSPs) B2B operations, directly impacting revenue generation. These inefficiencies, often stemming from fragmented IT systems and critical skill gaps among CSP personnel, represent a substantial hurdle. For instance, a 2024 industry survey indicated that over 60% of CSPs struggle with manual processes in their B2B sales cycles, leading to an estimated 15% loss in potential B2B revenue.

These challenges highlight that even with Amdocs' robust suite of solutions, there remain opportunities for deeper integration and enhanced functionality to fully resolve client pain points in the complex B2B market. The persistent reliance on legacy systems and the difficulty in upskilling workforces to manage advanced digital platforms are key areas where Amdocs' offerings might require further adaptation or more strategic client engagement to maximize their impact.

- Fragmented B2B Systems: CSPs often operate with siloed platforms, hindering seamless customer experience and order management.

- Skill Gaps: A lack of specialized talent within CSPs to manage and leverage advanced digital B2B solutions is a recurring issue.

- Missed Revenue: Industry data from 2024 suggests that these operational inefficiencies can lead to a significant percentage of lost B2B revenue opportunities for CSPs.

Amdocs' significant concentration within the telecommunications industry, while a historical strength, presents a notable weakness. This deep reliance means the company is particularly susceptible to the cyclical nature and evolving demands of this single sector. For instance, a slowdown in telecom capital expenditures, as seen in some periods of 2023 and early 2024 due to macroeconomic pressures, can directly translate into slower revenue growth for Amdocs.

The company's revenue streams are heavily tied to the health and investment cycles of telecom operators globally. Should major clients postpone network upgrades or reduce spending on software and services, Amdocs' financial performance can be significantly impacted. While Amdocs is actively pursuing diversification, expanding its footprint into other large enterprise markets remains a complex and ongoing strategic challenge, with progress needing to outpace the inherent risks of its core industry focus.

Amdocs operates in a highly competitive telecom software and services sector, facing rivals such as Ericsson, Nokia, and Accenture. This intense environment demands ongoing innovation and substantial investment to defend its market position and avoid revenue decline.

Amdocs' global operations expose it to significant macroeconomic headwinds. For instance, the International Monetary Fund (IMF) projected global growth to slow to 3.2% in 2024, down from 3.5% in 2023, highlighting a challenging operating environment. Fluctuating interest rates, as seen with the Federal Reserve's monetary policy adjustments throughout 2024, can impact client IT spending budgets.

Geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, create uncertainty that can directly affect Amdocs' communication service provider clients. These clients might postpone or scale back investments in new IT infrastructure and services due to economic instability and supply chain disruptions, directly impacting Amdocs' revenue streams.

Amdocs has navigated periods where revenue from specific regions or from the strategic discontinuation of less profitable business lines has seen a dip. For instance, in fiscal year 2023, while overall revenue grew, the company's reporting indicated shifts in regional performance that necessitated careful attention.

These phase-outs, though beneficial for long-term margin improvement, can introduce short-term revenue volatility. Managing client transitions smoothly during these strategic shifts is crucial for mitigating immediate financial impacts and maintaining client relationships.

- Revenue Fluctuation: Strategic phase-outs can lead to temporary revenue declines, impacting short-term financial reporting.

- Regional Performance: Declines in specific geographic markets can offset growth in others, requiring balanced regional strategies.

- Client Transition Management: The process of moving clients from phased-out services to new offerings demands meticulous planning to avoid revenue gaps.

Amdocs' own research underscores significant inefficiencies within Communication Service Providers' (CSPs) B2B operations, directly impacting revenue generation. These inefficiencies, often stemming from fragmented IT systems and critical skill gaps among CSP personnel, represent a substantial hurdle. For instance, a 2024 industry survey indicated that over 60% of CSPs struggle with manual processes in their B2B sales cycles, leading to an estimated 15% loss in potential B2B revenue.

These challenges highlight that even with Amdocs' robust suite of solutions, there remain opportunities for deeper integration and enhanced functionality to fully resolve client pain points in the complex B2B market. The persistent reliance on legacy systems and the difficulty in upskilling workforces to manage advanced digital platforms are key areas where Amdocs' offerings might require further adaptation or more strategic client engagement to maximize their impact.

- Fragmented B2B Systems: CSPs often operate with siloed platforms, hindering seamless customer experience and order management.

- Skill Gaps: A lack of specialized talent within CSPs to manage and leverage advanced digital B2B solutions is a recurring issue.

- Missed Revenue: Industry data from 2024 suggests that these operational inefficiencies can lead to a significant percentage of lost B2B revenue opportunities for CSPs.

Full Version Awaits

Amdocs SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. The Amdocs SWOT analysis you see here is the exact same comprehensive report that will be available to you upon purchase, offering a clear understanding of the company's strategic position.

Opportunities

The worldwide rollout of 5G continues to accelerate, creating a substantial need for service providers to modernize their operations. Amdocs is well-positioned to capitalize on this trend, offering solutions crucial for 5G monetization and the broader digital transformation journey of these companies.

Amdocs' core competencies in areas like network automation, customer experience management, and enabling new 5G-based business models directly address the evolving demands of the telecommunications industry. This strategic alignment allows them to capture a significant share of the market as providers seek to leverage their 5G investments.

For instance, the global 5G services market was projected to reach over $600 billion by 2026, with a significant portion of this growth driven by enterprise solutions and enhanced mobile broadband. Amdocs' revenue from its Network segment, which includes 5G-related offerings, saw a notable increase in fiscal year 2023, reflecting the strong market pull for their digital transformation and monetization capabilities.

The burgeoning field of AI and Generative AI offers Amdocs a significant avenue for growth. By embedding these technologies into its existing solutions for customer experience, network operations, and data management, Amdocs can unlock enhanced automation and efficiency for its clients.

This strategic integration allows Amdocs to deliver more personalized services, a key differentiator in today's competitive market. For instance, AI-driven customer service bots can handle a higher volume of inquiries, freeing up human agents for more complex issues, thereby improving overall customer satisfaction.

Communication service providers are increasingly moving their essential systems and operations to the cloud, and Amdocs' existing cloud services and cloud-native offerings are seeing substantial demand. This shift represents a prime opportunity for Amdocs to secure new projects, expand managed services agreements, and forge strategic alliances, all of which are expected to fuel considerable revenue expansion.

Untapped B2B Market Potential

The B2B market for telecommunications services represents a massive, largely untapped opportunity. Projections indicate this global market will surpass $500 billion by 2025, presenting a significant arena for growth. Amdocs is well-positioned to capitalize on this by enhancing its solutions for Communication Service Providers (CSPs).

Amdocs can develop and deploy advanced tools to streamline CSPs' B2B operations, from sales and customer onboarding to service assurance and complex billing. This focus on B2B efficiency directly addresses key pain points for CSPs, enabling them to unlock new revenue streams and improve customer satisfaction in this lucrative segment.

- Massive Market Size: Global B2B telecom services market projected to exceed $500 billion by 2025.

- Addressing CSP Challenges: Opportunity to solve B2B sales, service delivery, and monetization inefficiencies for CSPs.

- Revenue Growth: Potential to unlock new revenue streams for both Amdocs and its clients through specialized B2B solutions.

- Strategic Focus: Deepening Amdocs' expertise in B2B offerings can solidify its market leadership.

Strategic Mergers, Acquisitions, and Ecosystem Expansion

Amdocs has a robust history of strategic acquisitions, notably integrating Profinit to bolster its data science capabilities and Astadia to accelerate mainframe migration services. These moves directly address critical, evolving market demands. By continuing this acquisition-driven approach and fostering a broader technology ecosystem through partnerships, Amdocs can significantly expand its service portfolio and tap into new market segments.

This strategy directly contributes to strengthening Amdocs' competitive positioning. For instance, the acquisition of Profinit in late 2023 for an undisclosed sum aimed to enhance Amdocs’ cloud-native data and AI capabilities. Expanding its ecosystem allows Amdocs to offer more comprehensive solutions, potentially increasing customer stickiness and revenue streams. This proactive approach to M&A and ecosystem development is crucial for maintaining leadership in the dynamic telecommunications and media software space.

- Acquisition of Profinit (late 2023): Strengthened data science and AI capabilities.

- Acquisition of Astadia (2022): Enhanced mainframe modernization services.

- Ecosystem Expansion: Broadens service offerings and market reach through strategic partnerships.

- Competitive Advantage: Deepens capabilities in high-demand areas like cloud and data analytics.

The ongoing global expansion of 5G networks presents a significant opportunity for Amdocs to assist communication service providers (CSPs) in monetizing their investments and managing complex new services. This includes enabling new business models and enhancing customer experiences, areas where Amdocs possesses deep expertise.

The increasing adoption of cloud technologies by CSPs creates a substantial market for Amdocs' cloud-native solutions and managed services. This shift allows Amdocs to expand its footprint and secure long-term revenue through cloud migration and ongoing support.

Leveraging artificial intelligence, particularly generative AI, offers Amdocs a chance to enhance its existing product suite, driving greater automation and personalized customer interactions for its clients. This technological integration can lead to improved operational efficiency and customer satisfaction.

Amdocs' strategic acquisitions, such as Profinit for data science and Astadia for mainframe modernization, bolster its capabilities in critical growth areas. This proactive approach to expanding its service portfolio through M&A and partnerships is key to capturing new market segments and maintaining a competitive edge.

Threats

The market for telecom software, especially Operations Support System/Business Support System (OSS/BSS), is incredibly crowded. Companies like Ericsson, Nokia, Huawei, Netcracker, Accenture, and Oracle are all vying for the same business. This intense rivalry means Amdocs constantly faces the risk of losing market share and dealing with downward pressure on prices. Staying ahead requires continuous innovation and finding ways to make their products stand out.

The telecommunications and IT sectors are in constant flux, with advancements like 5G, cloud, and AI rapidly reshaping the landscape. Amdocs faces a significant threat if it cannot keep pace with these innovations. For instance, while Amdocs reported revenue of $4.7 billion for the fiscal year ending September 30, 2023, a failure to adapt its offerings to emerging technologies could quickly erode this.

If Amdocs' existing solutions become outdated due to a lag in innovation, its market relevance and revenue streams are at risk. The company's ability to secure new contracts and maintain its existing customer base hinges on its product portfolio reflecting the latest technological demands. This rapid obsolescence is a critical challenge in a sector where yesterday's cutting-edge is today's standard.

Amdocs, as a key player in the telecommunications software and services sector, is inherently exposed to significant cybersecurity risks. The company's reliance on digital infrastructure and the sensitive data it handles for communication providers makes it a prime target. A successful cyberattack could disrupt operations, leading to substantial financial penalties and a severe blow to its reputation.

The evolving nature of cyber threats, from ransomware to sophisticated state-sponsored attacks, poses a constant challenge. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the scale of the threat landscape Amdocs operates within. Any compromise of Amdocs' systems or those of its clients could result in data breaches, service interruptions, and a loss of invaluable customer trust.

Customer Spending Cuts due to Economic Downturns

Global economic volatility, marked by persistent inflationary pressures and ongoing geopolitical instability, is forcing communication service providers (CSPs) to adopt a more cautious approach to spending. This heightened prudence directly translates into a potential slowdown in Amdocs' sales cycle.

A significant economic downturn in 2024 or 2025 could compel clients to delay or even scale back their investments in new software and services. For instance, if global GDP growth forecasts for 2024, which were around 2.6% according to the IMF in early 2024, experience a sharp contraction, CSPs might defer large capital expenditures on digital transformation projects that Amdocs supports. This directly impacts Amdocs' sales pipeline and, consequently, its financial performance.

- Economic Headwinds: Persistent inflation and potential recessions globally could reduce CSPs' discretionary spending.

- Delayed Projects: Clients may postpone or cancel new software and service implementations, impacting Amdocs' revenue forecasts.

- Reduced Investment: A downturn could lead to CSPs cutting back on IT budgets, directly affecting Amdocs' sales pipeline.

- Market Uncertainty: Geopolitical risks contribute to an uncertain business environment, making clients hesitant to commit to new, long-term contracts.

Vendor Lock-in Concerns and Open-Source Alternatives

Clients in the telecommunications sector are increasingly prioritizing flexibility and are often hesitant about vendor lock-in. This growing preference for open-source solutions or the diversification of technology partners presents a significant challenge for Amdocs. The company must actively demonstrate its commitment to open APIs and interoperability to counter this trend and secure long-term engagements.

This shift in client demand means Amdocs needs to highlight its value-added services and adaptability. For instance, as of Q1 2025, the global open-source software market is projected to grow at a compound annual growth rate (CAGR) of over 13%, indicating a strong market pull towards these solutions. Amdocs' strategy must therefore focus on demonstrating how its platforms can integrate seamlessly with other technologies, rather than being a closed ecosystem.

- Growing Demand for Open-Source: The increasing adoption of open-source technologies in the telecom industry directly impacts Amdocs' market position.

- Client Hesitation on Lock-in: Telecom operators are actively seeking to avoid proprietary systems that limit their future choices and increase switching costs.

- Amdocs' Strategic Imperative: Emphasizing open APIs, interoperability, and flexible service models is crucial for Amdocs to remain competitive.

- Market Growth in Open Source: The projected 13% CAGR for the open-source market through 2025 underscores the competitive pressure Amdocs faces.

The intense competition from established players like Ericsson, Nokia, and Huawei, alongside emerging agile competitors, exerts constant downward pressure on Amdocs' pricing and market share. Failure to innovate rapidly in areas like 5G, cloud-native solutions, and AI integration could lead to product obsolescence, as seen with the projected $10.5 trillion global cost of cybercrime by 2025, which highlights the critical need for robust, secure solutions. Economic volatility and geopolitical instability, potentially leading to a sharp contraction in global GDP growth forecasts for 2024 (around 2.6% as of early 2024), could cause clients to delay or cancel significant IT investments, directly impacting Amdocs' revenue pipeline.

| Threat Category | Specific Threat | Impact on Amdocs | Evidence/Data Point |

|---|---|---|---|

| Competition | Intense rivalry from major telecom software providers | Market share erosion, price pressure | Companies like Ericsson, Nokia, Huawei, Netcracker, Accenture, Oracle are direct competitors. |

| Technological Disruption | Lagging behind rapid advancements in 5G, Cloud, AI | Product obsolescence, loss of market relevance | Amdocs reported $4.7 billion revenue in FY2023; failure to adapt risks this. |

| Cybersecurity | Sophisticated and evolving cyber threats | Operational disruption, financial penalties, reputational damage | Global cost of cybercrime projected to reach $10.5 trillion annually by 2025. |

| Economic Headwinds | Global economic volatility, inflation, geopolitical instability | Reduced client spending, delayed projects, impacted sales pipeline | Potential contraction in global GDP growth forecasts for 2024 (IMF early 2024 estimate ~2.6%). |

| Client Preference Shifts | Growing demand for open-source and avoidance of vendor lock-in | Need to demonstrate interoperability and flexibility | Global open-source software market projected CAGR over 13% through 2025. |

SWOT Analysis Data Sources

This Amdocs SWOT analysis is built upon a foundation of robust data, including Amdocs' official financial filings, comprehensive market research reports, and expert industry analyses to provide a thorough and accurate strategic overview.