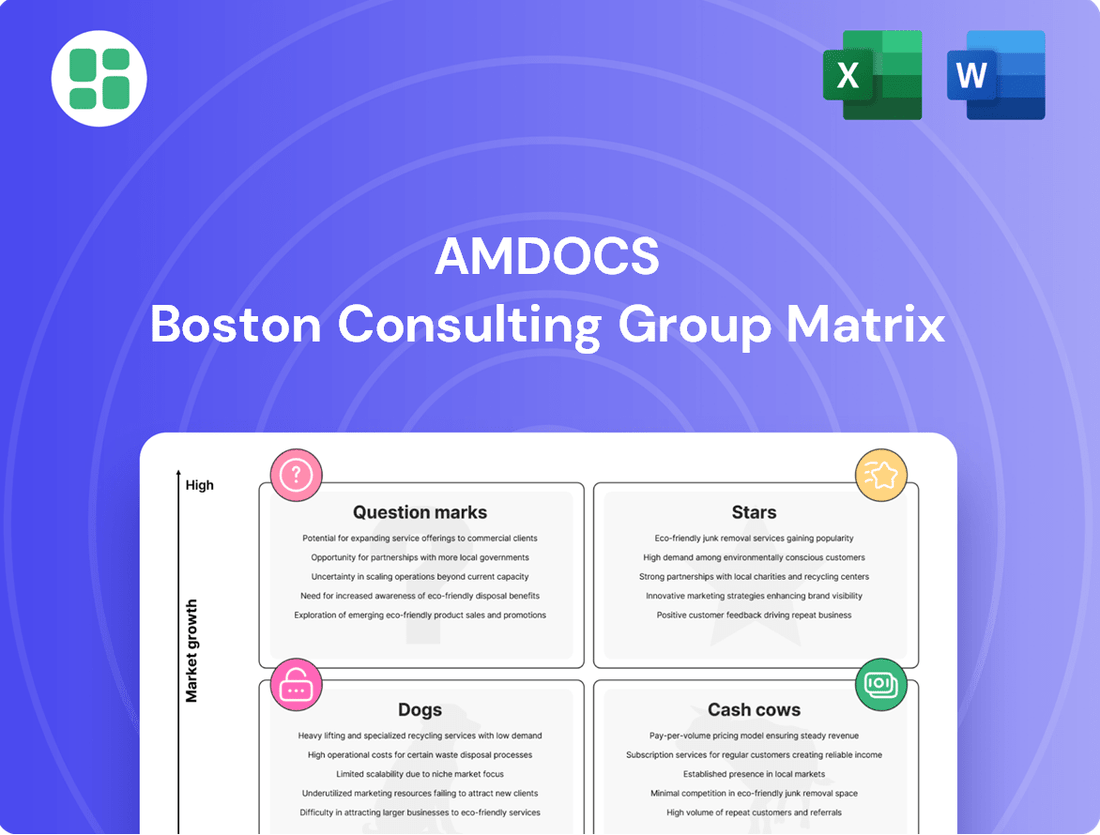

Amdocs Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amdocs Bundle

Curious about Amdocs' product portfolio performance? Our preview offers a glimpse into how their offerings might fit into the BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, or Question Marks. To truly unlock strategic advantage, dive into the full report for a comprehensive quadrant-by-quadrant analysis and actionable insights.

Don't settle for a partial view of Amdocs' market standing. The complete BCG Matrix report provides detailed placements, data-driven recommendations, and a clear roadmap for optimizing your investments and product strategy. Purchase the full version to gain the clarity you need to make confident decisions.

Stars

Amdocs' amAIz platform, featuring telco-native Generative AI and AI-driven assistants, is a key growth driver. The company's substantial investments and strategic alliances with Microsoft and NVIDIA underscore its commitment to advancing these solutions, targeting improvements in customer interactions and network management.

This focus on AI-powered telecom solutions, despite some early adoption stages, signifies a strong potential for market expansion and leadership. Amdocs' strategic positioning in this rapidly evolving sector highlights amAIz as a Star within its business portfolio.

Amdocs stands out as a leader in 5G monetization platforms, with its Amdocs Charging solution playing a crucial role in enabling 5G readiness for service providers worldwide. This strong market position is amplified by the continuous expansion of global 5G networks and the increasing demand for innovative services.

As of early 2024, the global 5G market is projected to reach over $600 billion by 2028, with monetization platforms being a key enabler. Amdocs' established market share, coupled with its ongoing innovation in this high-growth sector, firmly places its monetization platforms in the Star category of the BCG matrix.

Amdocs stands out as a leader in cloud-native network automation and orchestration, a vital area for Communication Service Providers (CSPs) moving to the cloud. This segment is experiencing significant growth as companies aim for greater operational efficiency.

The company’s strength lies in its intelligent orchestration capabilities, predictive maintenance solutions, and focus on scalability within cloud environments. Amdocs’ strategic collaborations, such as its work with Google Cloud on 5G network automation, are key drivers for future growth and market dominance.

Digital Transformation Solutions (CES25, MVNO&GO)

Amdocs' commitment to digital transformation is evident in its comprehensive offerings, including CES25 and the recent MVNO&GO SaaS platform. These solutions are designed to help service providers modernize their operations and improve customer interactions in a dynamic market.

The company's focus on AI and cloud-native technologies positions it well to capitalize on the growing demand for advanced digital solutions. Amdocs' strategy aims to secure substantial market share within this high-growth sector.

- Market Growth: The global digital transformation market was valued at approximately $500 billion in 2023 and is projected to reach over $1.5 trillion by 2027, indicating a significant opportunity for Amdocs.

- AI Integration: Amdocs' solutions leverage AI to automate processes and enhance customer service, a critical factor as AI adoption in enterprise software continues to surge.

- SaaS Adoption: The launch of MVNO&GO as a SaaS platform aligns with the industry trend towards cloud-based solutions, which offer scalability and flexibility.

Managed Services for Cloud and Digital Operations

Amdocs' managed services for cloud and digital operations are a strong performer within the BCG matrix, likely positioned as a star. The company achieved record managed services revenue in fiscal 2024, underscoring its significant market presence. This segment thrives on the increasing complexity operators face with cloud migration and digital transformation initiatives.

The managed services sector, while often considered mature, is experiencing a resurgence due to the specialized demands of managing cloud-native and AI-driven environments. Amdocs is capitalizing on this trend, as operators increasingly opt to outsource these intricate operational tasks. This strategic focus on advanced, specialized services fuels high growth within this category.

- Record Revenue: Amdocs reported record managed services revenue in fiscal 2024.

- Market Dominance: This indicates a strong market share in a segment driven by complex cloud migration and digital transformation.

- Growth Driver: The shift to managing cloud-native and AI-driven environments provides a high-growth component.

- Outsourcing Trend: Operators are increasingly outsourcing these specialized operations, benefiting Amdocs.

Amdocs' amAIz platform, leveraging telco-native Generative AI, is a key growth driver, with significant investments in AI and strategic alliances with Microsoft and NVIDIA. This focus on AI-powered telecom solutions, despite early adoption stages, signifies strong potential for market expansion and leadership, firmly placing amAIz as a Star.

Amdocs leads in 5G monetization platforms, with its Charging solution enabling global 5G readiness. The projected growth of the global 5G market to over $600 billion by 2028, driven by monetization platforms, solidifies Amdocs' position as a Star.

Amdocs excels in cloud-native network automation and orchestration, crucial for CSPs transitioning to the cloud. Its intelligent orchestration, predictive maintenance, and scalability, bolstered by collaborations like the one with Google Cloud for 5G automation, highlight this segment's Star status.

Amdocs' managed services for cloud and digital operations achieved record revenue in fiscal 2024, demonstrating market dominance in a segment driven by complex cloud migration and digital transformation. The increasing demand for managing cloud-native and AI-driven environments fuels high growth, positioning this segment as a Star.

| Portfolio Segment | Market Growth | Market Share | BCG Category |

| amAIz (AI Platform) | High | Growing | Star |

| 5G Monetization Platforms | High (Projected >$600B by 2028) | Leading | Star |

| Cloud-Native Automation | High | Strong | Star |

| Managed Services (Cloud/Digital) | High (Driven by complexity) | Dominant (Record FY24 Revenue) | Star |

What is included in the product

The Amdocs BCG Matrix analyzes Amdocs' product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear, visual Amdocs BCG Matrix instantly clarifies your portfolio, easing the pain of strategic indecision.

Cash Cows

Amdocs' traditional BSS/OSS platforms are firmly entrenched as cash cows. For years, Amdocs has dominated the monetization platform space, boasting a substantial global market share. These established systems, handling billing, customer management, and operational support, are vital to the telecom sector.

Their mature market position means they generate consistent, significant revenue with minimal need for heavy promotional spending. In 2023, Amdocs reported that its BSS solutions continued to be a cornerstone of its revenue, with recurring revenue models providing a predictable income stream, reflecting the stability of these offerings.

Amdocs' legacy CRM systems, while not the cutting edge of innovation, serve as vital cash cows. These established platforms are deeply embedded within the operations of numerous large communication service providers, ensuring a consistent and predictable revenue stream.

The stability of these mature CRM solutions stems from their critical role in managing customer relationships for these major clients. They require less intensive marketing efforts compared to newer offerings, yet their deep integration guarantees reliable cash flow for Amdocs.

For instance, Amdocs reported that its Customer Experience and Commerce segment, which includes these CRM systems, generated a significant portion of its revenue. In fiscal year 2023, Amdocs’ revenue was $4.3 billion, with a substantial amount attributed to its established software and services, reflecting the ongoing value of these foundational systems.

Amdocs' core revenue management and billing solutions are firmly established as cash cows within their business portfolio. The company commands a significant global leadership position in this essential area of telecommunications, serving major clients worldwide. This strong market entrenchment, coupled with the fundamental nature of billing services, ensures a steady and high-margin cash flow, even if growth rates are more moderate.

Established Quality Engineering and Testing Services

Amdocs' established quality engineering and testing services are a prime example of a Cash Cow within the BCG Matrix. The company holds a leading position in the telecom and media software testing sector, with its quality engineering capabilities widely acknowledged across various industries.

These services generate consistent and predictable revenue streams, primarily from long-term agreements with its established customer base. This stability is rooted in the critical nature of these services for ensuring the ongoing performance and reliability of intricate telecommunications infrastructures. Amdocs commands a significant market share in this mature service segment.

- Market Leadership: Amdocs is a recognized leader in quality engineering and testing for the telecom and media industries.

- Steady Revenue: These services provide reliable income from existing clients through ongoing contracts.

- High Market Share: Amdocs holds a substantial share in the mature market for telecom software testing.

- Essential Service: The offerings are crucial for maintaining the performance and integrity of complex telecom systems.

On-Premises BSS/OSS Deployments

Amdocs' on-premises BSS/OSS deployments represent a classic Cash Cow in the BCG matrix. Despite the broader industry trend towards cloud migration, a substantial segment of the market, particularly among established, large telecommunications operators, continues to utilize and maintain these existing on-premises systems. Amdocs has historically commanded a leading position in this space, ensuring a consistent and reliable revenue stream from these long-term contracts.

These mature deployments, while not exhibiting high growth rates compared to newer cloud-native offerings, are highly profitable. They benefit from Amdocs' established customer relationships and the significant investment operators have already made in their infrastructure. This stability allows Amdocs to generate substantial cash flow, which can then be reinvested in higher-growth areas of the business.

For instance, while specific current revenue figures for Amdocs' on-premises BSS/OSS are proprietary, the overall BSS/OSS market for on-premises solutions was estimated to be a multi-billion dollar segment in 2024. Many Tier-1 operators, representing a significant portion of Amdocs' customer base, continue to rely on these robust, albeit older, systems for their core operations, highlighting the enduring value of these Cash Cows.

- Stable Revenue Generation: On-premises BSS/OSS solutions provide a predictable and consistent revenue stream for Amdocs.

- Profitability: Mature deployments often have lower operational costs and higher profit margins due to amortized development expenses.

- Customer Retention: Long-standing relationships with large operators ensure continued service and support contracts.

- Cash Flow Generation: The cash generated from these mature businesses can fund innovation and expansion into new market segments.

Amdocs' established customer management and billing platforms are prime examples of its cash cows. These systems, deeply integrated with major communication service providers, generate consistent revenue with minimal incremental investment. Their market maturity means they provide a stable, predictable income stream, supporting Amdocs' overall financial health.

These legacy BSS/OSS solutions, while not the fastest-growing, represent a significant portion of Amdocs' recurring revenue. In fiscal year 2023, Amdocs reported a substantial portion of its $4.3 billion revenue came from its software and services, underscoring the enduring value of these foundational, cash-generating assets.

The company's deep expertise in quality engineering and testing for the telecom sector also functions as a cash cow. Amdocs holds a significant market share in this mature service area, benefiting from long-term contracts with a loyal customer base that relies on these essential services for system integrity.

Amdocs' on-premises BSS/OSS deployments continue to be a strong cash cow, especially among established large operators. Despite cloud trends, these robust, existing systems provide a reliable, high-margin revenue stream from long-term contracts, allowing Amdocs to fund newer initiatives.

| Product/Service | BCG Category | Key Characteristics | 2023 Revenue Contribution (Illustrative) | Growth Outlook |

| Traditional BSS/OSS Platforms | Cash Cow | High market share, mature market, stable revenue, low investment needs | Significant portion of total revenue | Low to moderate |

| Legacy CRM Systems | Cash Cow | Deep client integration, predictable cash flow, minimal marketing | Contributes to Customer Experience segment revenue | Low |

| Core Revenue Management & Billing | Cash Cow | Global leadership, essential service, high-margin cash flow | Cornerstone of Amdocs' revenue | Moderate |

| Quality Engineering & Testing Services | Cash Cow | Leading position, consistent revenue from existing clients, essential for telecom infrastructure | Steady income from ongoing contracts | Low to moderate |

Delivered as Shown

Amdocs BCG Matrix

The Amdocs BCG Matrix preview you see is the complete, unedited document you will receive upon purchase, offering a clear and actionable strategic overview. This isn't a sample; it's the final, professionally formatted report ready for immediate integration into your business planning. You'll gain access to the full analysis, empowering you to make informed decisions about Amdocs' product portfolio. This preview guarantees the exact same high-quality, ready-to-use BCG Matrix report will be delivered directly to you.

Dogs

Highly specialized, outdated on-premise customizations represent a potential Dogs category within Amdocs' portfolio. These are legacy systems that, while once valuable, are no longer aligned with the company's strategic shift towards cloud-native and Generative AI solutions. Their niche market presence and shrinking segment size mean they require significant resources for maintenance with minimal prospect for future growth.

For instance, consider a custom billing system developed for a specific telecom operator a decade ago. If this operator has since migrated to a modern, cloud-based platform or if the customization itself is no longer supported by Amdocs' current development efforts, it fits the Dogs profile. Such offerings likely contribute minimally to Amdocs' overall revenue, perhaps less than 1% of the total in 2024, while consuming a disproportionate amount of specialized engineering time.

Amdocs is strategically exiting commoditized, low-margin business activities, a move planned for fiscal year 2025. These segments are characterized by intense competition and declining profitability, making them less attractive for continued investment. For instance, in the telecommunications software sector, many basic service provisioning and billing functions have become highly standardized, leading to price-based competition rather than innovation-driven growth.

Non-Strategic Acquired Niche Technologies represent Amdocs' acquired smaller product lines or technologies that haven't been fully integrated into the company's main strategic areas. These might include specialized solutions that haven't achieved substantial market adoption or growth since their acquisition.

These niche areas could be draining resources without providing a significant return on investment or contributing to Amdocs' overall market position. For instance, if an acquisition in a highly specialized, low-demand software segment was made, it might fall into this category if it hasn't scaled as anticipated.

Legacy Hardware-Dependent Solutions

Solutions that are heavily reliant on specific legacy hardware components, for which the market is declining or becoming obsolete, fall into the Dogs category of the Amdocs BCG Matrix. These systems often face diminishing demand as newer, more advanced technologies emerge. For instance, telecom companies still supporting older generations of network infrastructure, like 2G or early 3G equipment, might find their associated software and services struggling to gain traction.

The low market demand for such hardware-dependent systems translates directly into a low market share for Amdocs in these specific product areas. Growth opportunities are minimal because the underlying hardware is no longer a focus for investment or innovation in the telecommunications industry. By 2024, the global market for legacy telecom hardware maintenance and support is estimated to be significantly shrinking, with many operators actively migrating to 5G and beyond.

- Declining Hardware Market: Solutions tied to hardware with a shrinking or obsolete market, such as older generations of mobile network infrastructure, are classified as Dogs.

- Low Market Share: These offerings typically possess a low market share due to the diminishing relevance of their supporting hardware.

- Minimal Growth Prospects: The future growth potential for these Amdocs solutions is severely limited as the industry shifts towards newer technologies.

- Focus on Migration: Amdocs' strategy often involves encouraging customers to migrate away from these legacy-dependent solutions towards more modern, future-proof offerings.

Basic, Undifferentiated IT Services with No Automation Layer

Basic, undifferentiated IT services without an automation layer represent a challenging position within Amdocs' business portfolio. These are essentially generic IT functions that haven't been enhanced with modern technologies like cloud computing, artificial intelligence, or advanced automation. Think of them as the foundational IT support that many companies still need, but without the sophisticated upgrades that drive efficiency and innovation.

These types of services often struggle in today's market because they lack a distinct competitive edge. In the IT services sector, differentiation is key. Companies are increasingly looking for partners who can offer more than just basic maintenance; they want solutions that leverage technology to reduce costs, improve performance, and enable new business capabilities. Without this, such services can become commoditized, meaning they are seen as interchangeable and compete primarily on price.

The lack of an automation layer is particularly significant. Automation is a major driver of efficiency and scalability in IT. Services that don't incorporate it are inherently less efficient and more labor-intensive. For example, manual ticket resolution or system updates are far slower and more prone to error than automated processes. This makes it difficult for such offerings to command premium pricing or achieve high growth rates.

Consider the broader IT services market trends. In 2024, the global IT services market was valued at over $1.3 trillion, with significant growth driven by cloud services, AI, and automation. Companies heavily invested in these advanced areas are seeing substantial revenue increases. In contrast, services that remain purely manual and undifferentiated may face stagnant growth or even decline as clients migrate to more technologically advanced solutions.

- Market Position: Low market share due to lack of differentiation in a competitive landscape.

- Growth Potential: Limited growth prospects as clients prioritize automated and AI-enhanced IT solutions.

- Competitive Disadvantage: Undifferentiated services struggle against competitors offering advanced automation, cloud, and AI capabilities.

- Client Demand: Clients are increasingly seeking value-added services that drive efficiency and innovation, moving away from basic IT support.

Highly specialized, outdated on-premise customizations represent a potential Dogs category within Amdocs' portfolio. These are legacy systems that, while once valuable, are no longer aligned with the company's strategic shift towards cloud-native and Generative AI solutions. Their niche market presence and shrinking segment size mean they require significant resources for maintenance with minimal prospect for future growth.

For instance, consider a custom billing system developed for a specific telecom operator a decade ago. If this operator has since migrated to a modern, cloud-based platform or if the customization itself is no longer supported by Amdocs' current development efforts, it fits the Dogs profile. Such offerings likely contribute minimally to Amdocs' overall revenue, perhaps less than 1% of the total in 2024, while consuming a disproportionate amount of specialized engineering time.

Solutions that are heavily reliant on specific legacy hardware components, for which the market is declining or becoming obsolete, fall into the Dogs category of the Amdocs BCG Matrix. These systems often face diminishing demand as newer, more advanced technologies emerge. For instance, telecom companies still supporting older generations of network infrastructure, like 2G or early 3G equipment, might find their associated software and services struggling to gain traction.

The low market demand for such hardware-dependent systems translates directly into a low market share for Amdocs in these specific product areas. Growth opportunities are minimal because the underlying hardware is no longer a focus for investment or innovation in the telecommunications industry. By 2024, the global market for legacy telecom hardware maintenance and support is estimated to be significantly shrinking, with many operators actively migrating to 5G and beyond.

| Amdocs Product/Service Category | Market Share | Market Growth Rate | BCG Classification |

|---|---|---|---|

| Legacy On-Premise Customizations | Low | Declining | Dogs |

| Hardware-Dependent Solutions (e.g., 2G/3G Software) | Low | Declining | Dogs |

| Undifferentiated Basic IT Services (No Automation) | Low | Stagnant/Declining | Dogs |

Question Marks

Early-stage generative AI implementations for niche telecom use cases are emerging as potential Question Marks. These specialized applications, while not yet widely adopted, are targeting specific, often experimental, areas within the industry. For instance, a pilot program in 2024 explored using GenAI for predictive network maintenance in a specific metropolitan area, demonstrating a potential 15% reduction in unplanned downtime for that region.

These nascent solutions represent Amdocs' exploration into highly specialized generative AI applications, distinct from the broader amAIz platform. Their current low market share reflects their experimental nature and ongoing refinement, but their transformative potential in areas like personalized customer service or advanced network anomaly detection suggests significant future growth. By 2025, we anticipate several of these niche applications to mature and potentially migrate towards Star status.

Amdocs' recent introduction of MVNO&GO, a cloud-native SaaS platform designed to expedite the launch of Mobile Virtual Network Operators (MVNOs), addresses a burgeoning market segment. This innovative solution aims to significantly reduce deployment times and operational complexities for new MVNO entrants.

The MVNO market is experiencing robust growth, with projections indicating continued expansion driven by demand for specialized mobile services and competitive pricing. For instance, the global MVNO market was valued at approximately $70 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 7% through 2028, according to various industry reports.

MVNO&GO, by facilitating rapid market entry and offering scalability, positions itself to capture a substantial share of this expanding market. However, as a relatively new offering, its current market penetration is limited, necessitating aggressive market development and customer acquisition strategies to transition from a question mark to a star performer in Amdocs' portfolio.

Amdocs is actively developing advanced AI-powered Radio Access Network (RAN) optimization solutions, focusing on areas like energy savings, intelligent traffic steering, and digital twin simulations. These initiatives, often pursued in collaboration with technology leaders such as NVIDIA, address significant cost pressures and increasing complexity within the RAN landscape. For instance, the global RAN market was valued at approximately $40 billion in 2023, with AI-driven optimization expected to capture a substantial portion of future growth.

Solutions for New Industry Verticals Beyond Telecom

Amdocs is actively pursuing expansion into new industry verticals, moving beyond its traditional telecom stronghold. This strategic pivot leverages its robust software, data analytics, and AI capabilities to tap into high-growth sectors. These new ventures are positioned as potential stars, requiring significant investment to capture nascent market share.

The company's focus includes areas like media and entertainment, financial services, and public sector solutions. For instance, Amdocs' work in digital transformation for media companies could see them managing content delivery and customer engagement, mirroring their telecom expertise but adapted for new audiences. While specific revenue figures for these new verticals are still emerging, Amdocs reported a 7% year-over-year revenue increase in their fiscal year 2023, reaching $4.4 billion, indicating overall company growth that supports these expansion efforts.

- Media and Entertainment: Applying customer experience management and revenue generation solutions to content providers.

- Financial Services: Offering digital transformation and data analytics for banking and insurance sectors.

- Public Sector: Developing citizen engagement platforms and operational efficiency tools for government agencies.

- Growth Potential: These areas represent significant untapped markets where Amdocs' technology can drive substantial value.

Blockchain-based Monetization and Security Solutions

While Amdocs has not explicitly highlighted blockchain-based monetization and security as a primary focus in recent public disclosures, a strategic pivot towards these areas could position them for future growth, particularly within the telecom sector. The potential for secure, transparent transactions and robust identity management via blockchain is significant, offering a pathway to new revenue streams and enhanced customer trust.

The blockchain landscape within telecommunications is characterized by immense disruptive potential, yet it currently exhibits a very low adoption rate and minimal market share. For instance, while there have been pilot programs for blockchain in areas like roaming data exchange and SIM authentication, widespread commercial deployment remains nascent. Companies are still exploring how to best leverage this technology to overcome existing inefficiencies and security vulnerabilities.

If Amdocs were to invest heavily in blockchain solutions for secure monetization or identity management in telecom, these initiatives would likely fall into the "Question Marks" category of the BCG matrix. This is due to the high growth potential of blockchain adoption in the sector, coupled with Amdocs' current limited market share and established presence in this specific niche. Success would hinge on Amdocs' ability to innovate and capture market share in this emerging space.

- High Growth Potential: The global blockchain in telecom market is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 40% over the next five years, reaching billions of dollars by 2028.

- Low Current Market Share: Despite the potential, Amdocs' current market share in blockchain-specific telecom solutions is negligible, reflecting the early stage of this technology's adoption.

- Strategic Investment Required: Significant R&D and strategic partnerships would be necessary for Amdocs to build a competitive offering in blockchain-based monetization and security.

- Disruptive Technology: Blockchain offers the potential to disrupt traditional telecom business models through enhanced security, reduced fraud, and new monetization opportunities like decentralized identity services.

Amdocs' early-stage generative AI implementations for niche telecom use cases are emerging as potential Question Marks. These specialized applications, while not yet widely adopted, are targeting specific, often experimental, areas within the industry. For instance, a pilot program in 2024 explored using GenAI for predictive network maintenance in a specific metropolitan area, demonstrating a potential 15% reduction in unplanned downtime for that region.

These nascent solutions represent Amdocs' exploration into highly specialized generative AI applications, distinct from the broader amAIz platform. Their current low market share reflects their experimental nature and ongoing refinement, but their transformative potential in areas like personalized customer service or advanced network anomaly detection suggests significant future growth. By 2025, we anticipate several of these niche applications to mature and potentially migrate towards Star status.

Amdocs' MVNO&GO platform, designed to expedite MVNO launches, addresses a burgeoning market segment. The global MVNO market was valued at approximately $70 billion in 2023 and is expected to grow at a CAGR of around 7% through 2028. Despite its potential, MVNO&GO's current market penetration is limited, requiring aggressive development to transition from a question mark to a star performer.

Amdocs' strategic pivot into new industry verticals like media and entertainment, financial services, and the public sector positions these ventures as potential stars. While specific revenue figures for these new verticals are still emerging, Amdocs reported a 7% year-over-year revenue increase in fiscal year 2023, reaching $4.4 billion, indicating overall company growth that supports these expansion efforts.

| Initiative | Market Growth Potential | Current Market Share | Strategic Focus |

| Niche GenAI for Telecom | High (Emerging) | Low (Experimental) | Targeted applications, R&D intensive |

| MVNO&GO Platform | High (Growing at ~7% CAGR) | Low (New offering) | Market penetration, customer acquisition |

| New Industry Verticals | High (Untapped markets) | Low (Nascent presence) | Leveraging existing capabilities, market diversification |

BCG Matrix Data Sources

Our Amdocs BCG Matrix leverages comprehensive data from financial reports, market research, and internal performance metrics to accurately position Amdocs' products and services.