AMCON Distributing SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMCON Distributing Bundle

AMCON Distributing leverages its established distribution network and diverse product catalog, but faces challenges from intense competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want to fully grasp AMCON Distributing's competitive edge and potential vulnerabilities? Purchase the complete SWOT analysis to unlock actionable insights, detailed market context, and expert commentary, empowering your investment or strategic decisions.

Strengths

AMCON Distributing boasts a remarkably diverse product portfolio, encompassing everything from cigarettes and tobacco to candy, groceries, beverages, foodservice items, and even automotive supplies. This broad range allows them to serve a wide spectrum of retailers, including convenience stores, grocery stores, and specialized tobacco shops.

This extensive product offering and customer base significantly reduces AMCON's reliance on any single product category or customer segment. For instance, in fiscal year 2023, AMCON reported net sales of $1.17 billion, demonstrating the substantial revenue generated from this diversified approach.

Such diversification is a key strength, helping to stabilize revenue streams and effectively mitigate risks associated with potential fluctuations in demand for specific products or changes within particular retail sectors.

AMCON Distributing boasts an impressive distribution network spanning 34 states, anchored by 14 strategically located distribution centers. This extensive infrastructure provides a significant competitive advantage, particularly across the Central, Rocky Mountain, and Mid-South regions of the United States. The company's commitment to growth is evident in its recent expansions, including the acquisition of new facilities, designed to bolster its capacity and better serve its expanding customer base.

AMCON Distributing has a proven track record of expanding its reach and capabilities through strategic acquisitions. The integration of companies like Arrowrock Supply, Burklund Distributors, Inc., and Richmond Master Distributors, Inc. showcases this strength. These moves not only boost market share but also bring in enhanced operational expertise and resources.

This acquisition strategy directly benefits AMCON's retail partners by providing them access to advanced advertising and marketing programs. For example, following the acquisition of Burklund Distributors in late 2023, AMCON was able to leverage its existing infrastructure to offer expanded services to a wider customer base. This integration is key to their growth model.

Retail Health Product Segment

AMCON Distributing's retail health product segment, comprising 15 health and natural product stores across the Midwest and Florida, represents a significant strength by diversifying its revenue streams beyond wholesale distribution. This strategic move allows AMCON to directly engage with consumers in the burgeoning health and wellness market. The company is well-positioned to capitalize on the increasing consumer demand for functional foods and dietary supplements, a sector experiencing robust growth.

The health and wellness industry is a key growth driver, with market research indicating continued expansion. For instance, the global dietary supplements market was valued at approximately $150 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 8% through 2030. AMCON's retail presence allows it to tap into this expanding consumer spending.

- Diversified Business Model: Operates 15 health and natural product stores, reducing reliance on wholesale.

- Market Alignment: Taps into the growing consumer demand for health and wellness products.

- Growth Potential: Positioned to benefit from the projected expansion of the functional foods and dietary supplements market.

- Direct Consumer Access: Provides direct engagement with end-users, offering valuable market insights.

Strong Balance Sheet Management and Liquidity

AMCON Distributing demonstrates exceptional strength in its balance sheet management and liquidity, a crucial advantage in the demanding distribution sector. This focus ensures the company can navigate economic fluctuations and seize growth opportunities. For instance, AMCON has a history of consistent dividend payments, marking 18 consecutive years of returns to shareholders, a testament to its financial resilience.

This financial discipline is further evidenced by its robust liquidity position. A healthy current ratio, which stood at 2.05 as of the first quarter of 2024, indicates AMCON's strong ability to meet its short-term obligations.

- Consistent Dividend Payments: AMCON has maintained dividend payments for 18 consecutive years, highlighting financial stability and a commitment to shareholder returns.

- Strong Liquidity: The company's current ratio was 2.05 in Q1 2024, signifying ample liquid assets to cover short-term liabilities.

- Prudent Financial Management: This focus on balance sheet health and liquidity is a key driver of AMCON's operational strength and long-term viability.

AMCON Distributing's diversified product range, from tobacco to groceries and automotive supplies, serves a broad retail base, reducing dependence on any single category. This strategy is reflected in their substantial net sales, which reached $1.17 billion in fiscal year 2023, demonstrating the revenue-generating power of this broad approach and mitigating sector-specific risks.

The company's extensive distribution network, covering 34 states with 14 distribution centers, provides a significant competitive edge, particularly in key regions. Strategic acquisitions, such as those of Arrowrock Supply and Burklund Distributors, Inc., further enhance their market share and operational capabilities, directly benefiting retail partners through improved services.

AMCON's foray into retail health products, with 15 stores in the Midwest and Florida, taps into the growing health and wellness market, projected to see continued expansion. The global dietary supplements market, valued at approximately $150 billion in 2023, exemplifies this trend, positioning AMCON to capitalize on increasing consumer spending in this sector.

Financially, AMCON Distributing exhibits strong balance sheet management and liquidity. A notable achievement is their record of 18 consecutive years of dividend payments, underscoring financial resilience. In Q1 2024, their current ratio stood at a healthy 2.05, indicating a robust ability to meet short-term obligations.

What is included in the product

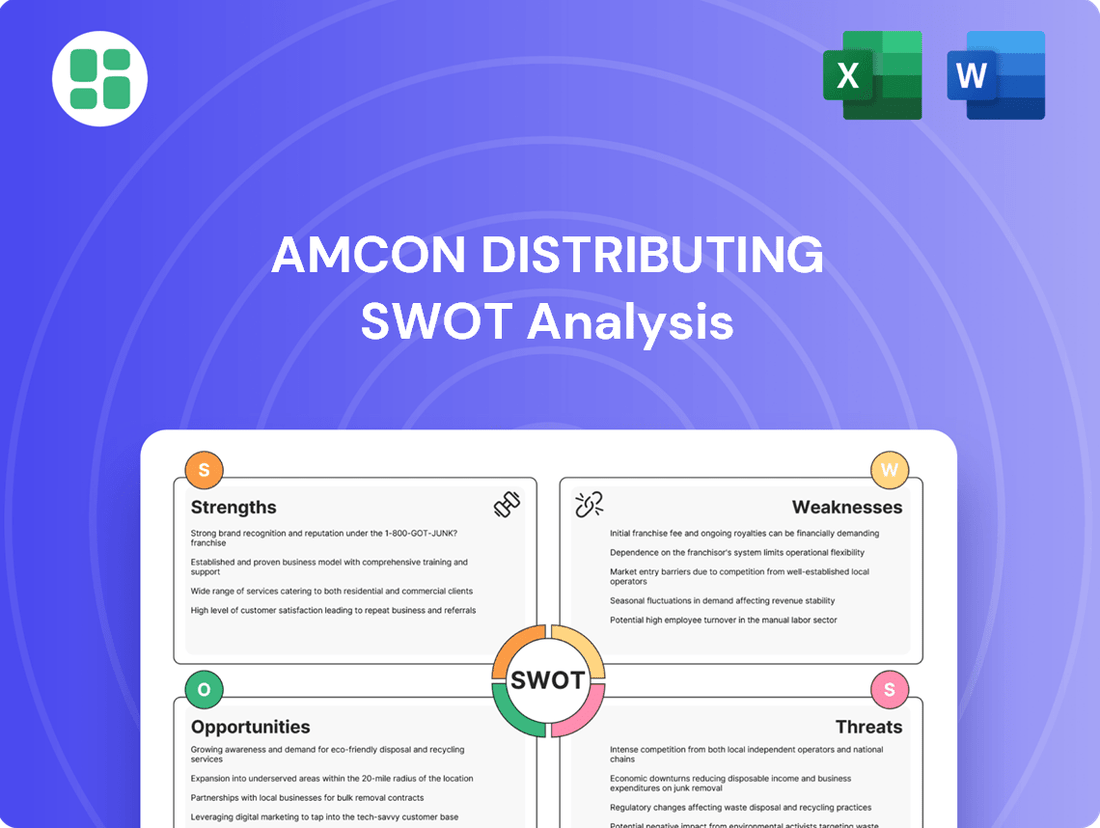

Delivers a strategic overview of AMCON Distributing’s internal and external business factors, highlighting its strengths in distribution, weaknesses in market share, opportunities in emerging markets, and threats from competition.

Provides a clear, actionable SWOT analysis of AMCON Distributing, highlighting key areas to address competitive pressures and operational inefficiencies.

Weaknesses

AMCON Distributing's heavy reliance on traditional tobacco products presents a significant weakness. In fiscal years 2023 and 2024, approximately 62% of the company's revenue stemmed from cigarette sales. This dependence makes AMCON vulnerable to the ongoing decline in smoking prevalence, driven by increasing health awareness and stricter government regulations.

AMCON operates in a wholesale distribution sector known for its thin profit margins. For instance, in the third quarter of fiscal year 2025, the company reported a gross profit margin of roughly 6.7%.

This low margin environment is further pressured by escalating operational expenses. Costs associated with transportation, fuel, labor, and the price of goods themselves are all on the rise, making it difficult to maintain healthy profitability.

AMCON Distributing's reliance on distributing consumer products makes it highly susceptible to economic downturns. For instance, persistent inflation throughout 2023 and into early 2024 has eroded consumer purchasing power, directly impacting demand for non-essential goods that distributors like AMCON handle. This reduced discretionary spending can lead to lower sales volumes and put pressure on the company's ability to maintain healthy profit margins, especially when coupled with rising operational costs.

Intense Competition and Market Pressures

AMCON Distributing operates within a wholesale distribution sector characterized by fierce competition. This intense environment is fueled by larger, more established distributors, the increasing prevalence of direct-to-manufacturer sales models, and shifting customer demands for streamlined B2B e-commerce experiences. For instance, the broader wholesale trade sector saw revenue growth, but margins remain tight due to these pressures.

This competitive landscape demands constant vigilance and innovation from AMCON. To thrive, the company must continuously adapt its strategies to maintain its market share and profitability in the face of these powerful market forces. The need to differentiate and offer superior value is paramount in this crowded marketplace.

- Intense Rivalry: AMCON faces competition from larger distributors with greater economies of scale and broader product portfolios.

- Direct Sales Threat: Manufacturers increasingly bypass distributors, selling directly to customers, eroding traditional distribution channels.

- Evolving Customer Demands: B2B customers expect digital-first experiences, efficient ordering, and faster delivery, requiring significant investment in technology and logistics.

- Margin Squeeze: The competitive nature of the market often leads to price wars, putting pressure on profit margins for all players.

Supply Chain Disruptions and Operational Costs

AMCON Distributing, like many wholesale distributors, faces significant vulnerability to global supply chain disruptions. Geopolitical tensions, ongoing port congestion, and the increasing frequency of natural disasters can severely impact the timely flow and cost of goods. For instance, the lingering effects of the COVID-19 pandemic continued to strain global shipping networks throughout 2024, leading to elevated freight costs and delivery delays for many sectors.

These external pressures are compounded by rising operational costs. Tariffs imposed on imported goods and persistent labor shortages in key logistics and warehousing roles add a substantial financial burden. These factors directly challenge AMCON's ability to maintain operational efficiency and manage its cost of goods sold effectively. For example, the US Bureau of Labor Statistics reported that trucking industry labor costs saw a notable increase in 2024, a direct pass-through cost for distributors.

- Supply Chain Volatility: Global events continue to create unpredictable lead times and increased shipping expenses.

- Rising Tariffs: Changes in trade policy can directly inflate the cost of imported inventory.

- Labor Shortages: Difficulty in finding and retaining qualified staff in warehousing and transportation impacts operational capacity and wages.

- Increased Freight Costs: Elevated fuel prices and carrier capacity issues contribute to higher transportation expenses.

AMCON's significant reliance on traditional tobacco products, accounting for approximately 62% of revenue in fiscal years 2023-2024, leaves it exposed to declining smoking rates and stricter regulations.

The company navigates a wholesale distribution landscape with notoriously thin profit margins, exemplified by a gross profit margin of around 6.7% in Q3 FY2025, further squeezed by rising operational costs like transportation and labor.

Intense competition from larger players and the growing trend of direct-to-manufacturer sales present challenges, while evolving B2B customer expectations for digital experiences necessitate ongoing technological investment.

AMCON is also vulnerable to supply chain disruptions, increased freight costs, and labor shortages, all of which can inflate the cost of goods and impact operational efficiency.

Same Document Delivered

AMCON Distributing SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual AMCON Distributing SWOT analysis, ensuring transparency and quality. Purchase unlocks the full, detailed report, providing comprehensive insights.

Opportunities

AMCON Distributing has a prime opportunity to broaden its product offerings by focusing on high-growth sectors, notably health and wellness and newer tobacco alternatives. The health and wellness market, in particular, is experiencing robust expansion, with consumers increasingly seeking healthier, functional, and plant-based products. For instance, the global health and wellness market was valued at approximately $4.5 trillion in 2023 and is expected to continue its upward trajectory, presenting a significant avenue for AMCON to tap into.

AMCON Distributing can significantly boost its operational efficiency and profit margins by embracing advanced automation and AI for tasks like demand forecasting and inventory management. For instance, in 2024, companies leveraging AI for supply chain optimization reported an average reduction in inventory holding costs by 15-20%.

Investing in a robust digital transformation strategy, including B2B e-commerce platforms, will elevate the customer experience. This allows for features like online self-service portals, real-time order tracking, and tailored services, potentially increasing customer retention by up to 10% as seen in industry benchmarks.

Foodservice is a booming sector for convenience stores, with some now seeing it as their primary revenue driver, even eclipsing traditional tobacco sales. This presents a significant opportunity for AMCON Distributing.

AMCON can leverage this growth by enhancing its foodservice offerings, potentially introducing more diverse prepared meal options and ready-to-eat items. The company's existing advertising and design expertise can be a powerful tool to help its retail partners differentiate their foodservice operations from quick-service restaurants, attracting more customers.

Strategic Acquisitions and Geographic Expansion

AMCON Distributing has explicitly stated its intention to pursue strategic acquisitions within the convenience and foodservice distribution sectors. This proactive approach signals a clear pathway for accelerated growth, aiming to consolidate market presence and capture a larger share. For instance, during fiscal year 2023, AMCON reported a 10.5% increase in revenue, partly driven by its strategic focus on expanding its distribution network, a trend management anticipates continuing into 2024 and 2025.

Expanding geographically through targeted acquisitions offers a dual benefit: increased market share and enhanced economies of scale. By integrating new territories or bolstering existing ones via M&A, AMCON can leverage its operational efficiencies more effectively. This strategy could lead to improved purchasing power and reduced per-unit distribution costs, directly impacting profitability.

- Strategic Acquisitions: AMCON's stated goal to acquire convenience and foodservice distributors provides a direct route for market expansion and revenue growth.

- Geographic Footprint: Opportunities exist to enter new markets or deepen penetration in current regions through carefully selected acquisitions.

- Economies of Scale: Successful integration of acquired entities can lead to significant cost savings and improved operational efficiencies.

- Market Share Growth: Expanding through acquisitions is a proven method to quickly increase market share and competitive positioning.

Sustainability Initiatives and Eco-friendly Practices

The growing consumer and regulatory push towards sustainability presents a significant opportunity for AMCON Distributing. Companies are increasingly scrutinizing their supply chains for environmental impact, making eco-friendly practices a key differentiator. For instance, the global market for sustainable packaging is projected to reach $400 billion by 2027, indicating a strong demand for greener alternatives that AMCON can leverage.

By integrating sustainable initiatives, AMCON can enhance its brand image and appeal to a broader customer base. This includes adopting energy-efficient logistics, reducing waste throughout its operations, and sourcing products from environmentally conscious suppliers. Such moves not only align with evolving customer values but also proactively address upcoming regulatory requirements, potentially opening doors to new partnerships and business streams.

- Market Growth: The global green logistics market is expected to grow significantly, with projections suggesting an expansion driven by environmental concerns and cost-saving potential.

- Consumer Preference: Studies in 2024 show a marked increase in consumer willingness to pay a premium for products from companies with strong sustainability commitments.

- Regulatory Tailwinds: Upcoming environmental regulations in key markets are likely to favor distributors who have already implemented eco-friendly practices.

- Competitive Advantage: Early adoption of sustainable practices can position AMCON ahead of competitors, attracting environmentally conscious clients and talent.

AMCON Distributing can capitalize on the burgeoning foodservice trend within convenience stores, a sector increasingly recognized as a primary revenue driver. By enhancing its own foodservice offerings with diverse prepared meals and ready-to-eat items, AMCON can assist its retail partners in standing out from competitors. This strategic focus is supported by industry data showing a significant shift in consumer spending towards convenience-based food solutions.

The company's stated intention to pursue strategic acquisitions in convenience and foodservice distribution presents a clear path for accelerated growth and market consolidation. This proactive approach aims to expand AMCON's distribution network and capture a larger market share, a strategy that has already shown positive results, with a 10.5% revenue increase in fiscal year 2023. Management anticipates this growth trajectory to continue through 2024 and 2025.

Expanding its geographic footprint through targeted acquisitions offers AMCON Distributing enhanced economies of scale and improved operational efficiencies. Integrating new territories or strengthening existing ones via M&A can boost purchasing power and reduce per-unit distribution costs, directly impacting profitability. This strategic move positions AMCON for greater market penetration and competitive advantage.

AMCON Distributing has a significant opportunity to integrate sustainability into its operations, aligning with growing consumer and regulatory demands for eco-friendly practices. By adopting energy-efficient logistics and reducing waste, AMCON can enhance its brand image and appeal to environmentally conscious clients. The global market for sustainable packaging alone is projected to reach $400 billion by 2027, highlighting a strong demand for greener alternatives.

| Opportunity Area | Market Trend/Data Point | Potential Impact for AMCON |

|---|---|---|

| Foodservice Expansion | Foodservice is becoming a primary revenue driver for convenience stores. | Enhance own offerings, help partners differentiate, attract more customers. |

| Strategic Acquisitions | 10.5% revenue increase in FY23 partly due to network expansion. | Accelerated growth, market consolidation, increased market share. |

| Geographic Expansion | Acquisitions lead to economies of scale and cost efficiencies. | Improved purchasing power, reduced per-unit costs, enhanced profitability. |

| Sustainability Initiatives | Global sustainable packaging market projected to reach $400B by 2027. | Enhanced brand image, appeal to eco-conscious consumers, regulatory compliance. |

Threats

The persistent decline in traditional cigarette sales, driven by growing health awareness and aggressive anti-smoking campaigns, directly threatens AMCON's core business. This trend is exacerbated by increasing excise taxes, which make products less affordable. For instance, the U.S. Surgeon General reported in 2023 that smoking rates among adults have fallen significantly over the decades, a pattern expected to continue.

Furthermore, the tightening regulatory landscape presents another substantial hurdle. Stricter rules on tobacco marketing, sales channels, and even product formulations, as seen with potential flavor bans in various regions, could severely curtail AMCON's ability to generate revenue and maintain profit margins.

The wholesale distribution sector faces fierce price wars, a reality that directly impacts AMCON Distributing. With input costs like fuel and labor climbing, profit margins are getting squeezed tighter. For instance, the U.S. Producer Price Index for finished goods saw a significant increase in late 2024, reflecting these pressures.

AMCON's ability to absorb these rising costs without alienating customers by raising prices is a critical challenge. If they can't pass on increased expenses, their financial performance could take a serious hit. This delicate balancing act is crucial for maintaining market share and profitability in a competitive landscape.

AMCON faces a significant threat from rapidly evolving consumer preferences, particularly the increasing demand for healthier product options and a more personalized, digital shopping journey. This shift challenges traditional distribution models that may not be agile enough to adapt. For instance, a 2024 Nielsen report indicated that 60% of consumers globally are actively seeking healthier food and beverage choices, a trend that could bypass distributors focused on conventional offerings.

The burgeoning e-commerce sector and the rise of direct-to-consumer (DTC) strategies present another substantial threat. Manufacturers increasingly see value in selling directly to their end customers, potentially cutting out intermediaries like AMCON. This trend is accelerating, with global e-commerce sales projected to reach $7.4 trillion by 2025, according to Statista, suggesting a growing opportunity for manufacturers to bypass traditional distribution channels and directly engage with consumers.

Supply Chain Volatility and Geopolitical Instability

AMCON Distributing faces significant threats from ongoing supply chain volatility, exacerbated by geopolitical instability. Events like the ongoing conflicts in Eastern Europe and trade disputes continue to create unpredictable shipping delays and surcharges, directly impacting AMCON's operational efficiency and cost management. For example, the average cost of shipping a 40-foot container globally saw significant fluctuations throughout 2024, with some routes experiencing increases of over 50% compared to pre-pandemic levels.

These disruptions can translate into higher import costs and difficulties in maintaining optimal inventory levels. AMCON's ability to reliably source and deliver products is directly challenged by these external factors, potentially leading to lost sales and decreased customer satisfaction. The unpredictability also makes it harder to forecast demand and manage working capital effectively.

- Geopolitical Tensions: Ongoing conflicts and trade policy shifts create a volatile operating environment.

- Increased Costs: Supply chain disruptions lead to higher freight charges and potential tariffs, impacting margins.

- Inventory Challenges: Unpredictable lead times make it difficult to maintain adequate stock levels, risking stockouts.

- Operational Unpredictability: Difficulty in forecasting and managing product delivery schedules affects overall business planning.

Labor Market Challenges and Wage Inflation

AMCON Distributing, like much of the wholesale trade sector, is grappling with persistent labor shortages, especially within its warehousing and logistics operations. The competition for qualified personnel remains intense, driving up recruitment and retention costs.

The rising cost of labor, including wages and benefits, presents a significant challenge. For instance, the U.S. Bureau of Labor Statistics reported average hourly earnings for non-supervisory employees in transportation and warehousing increasing by approximately 5.5% year-over-year through early 2025. This upward pressure on expenses is compounded by the necessity to invest in upskilling the workforce to adapt to increasing automation in the sector.

- Labor Shortages: Difficulty finding and keeping staff in critical logistics and warehousing roles.

- Wage Inflation: Increased wage and benefit costs directly impacting operating expenses.

- Upskilling Costs: Investment required to train employees for automated environments.

- Profitability Impact: Potential squeeze on margins if rising labor costs cannot be offset by efficiency gains or price adjustments.

The increasing prevalence of vaping and alternative nicotine products poses a direct threat to AMCON's traditional tobacco distribution model. As consumer preferences shift away from combustible cigarettes, AMCON must adapt its product portfolio or risk losing market share. For example, a late 2024 industry report indicated that sales of e-cigarettes and related products in the U.S. grew by over 15% in the preceding year, outpacing traditional tobacco sales growth.

The competitive landscape is intensifying with the emergence of new players and the consolidation of existing ones. AMCON faces pressure from distributors who are more agile in adopting new technologies and product categories. This could lead to price erosion and reduced market penetration for AMCON if they cannot match the competitive strategies of rivals.

The ongoing consolidation within the retail sector means AMCON is increasingly dealing with fewer, larger customers. This gives these large retailers more bargaining power, potentially leading to squeezed margins for distributors like AMCON. For instance, major convenience store chains continue to merge, creating entities with significant purchasing leverage.

AMCON Distributing's reliance on a product category facing secular decline is a significant threat, further compounded by the rise of direct-to-consumer (DTC) models. Manufacturers increasingly explore selling directly to consumers, bypassing traditional distributors. This trend, accelerated by digital platforms, could erode AMCON's customer base and revenue streams. For instance, a 2025 forecast by eMarketer suggests DTC sales will continue to capture a larger portion of overall consumer spending across various industries.

| Threat Category | Specific Threat | Impact on AMCON | Supporting Data/Trend |

| Market Shift | Rise of Vaping & Alternatives | Declining demand for traditional cigarettes; need for portfolio diversification. | U.S. e-cigarette sales grew 15% in 2024. |

| Competitive Landscape | New Entrants & Consolidation | Increased price competition; potential loss of market share. | Industry reports highlight growing market concentration. |

| Customer Power | Retailer Consolidation | Reduced bargaining power for distributors; margin pressure. | Major convenience store chains continue M&A activity. |

| Distribution Model | Direct-to-Consumer (DTC) | Potential disintermediation; loss of manufacturer relationships. | DTC sales projected to capture larger consumer spending share by 2025. |

SWOT Analysis Data Sources

This AMCON Distributing SWOT analysis is built upon a robust foundation of data, incorporating official financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic perspective.