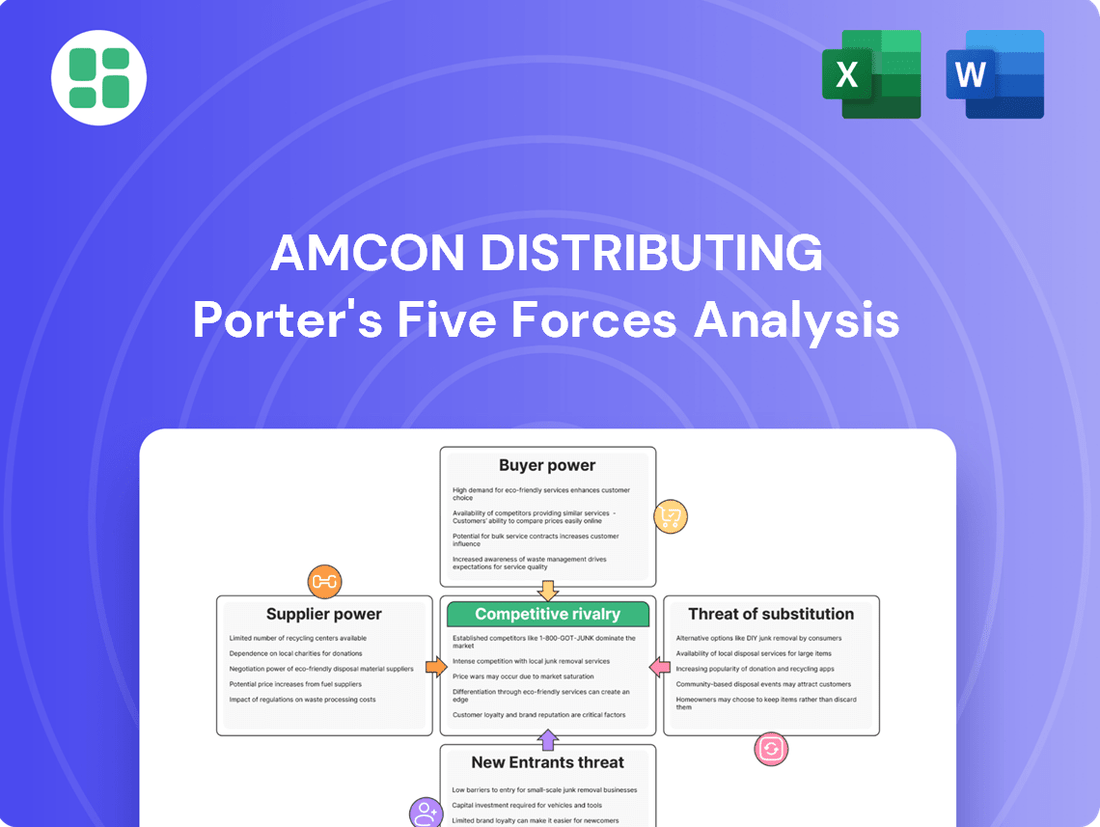

AMCON Distributing Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMCON Distributing Bundle

AMCON Distributing faces moderate buyer power due to fragmented customer bases, but intense competition from rivals shapes pricing strategies. The threat of new entrants is moderate, influenced by capital requirements and established distribution networks.

The full analysis reveals the real forces shaping AMCON Distributing’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

AMCON Distributing Company's reliance on a diverse product mix, from cigarettes to automotive supplies, means supplier power varies by category. For essential, high-volume items like cigarettes, where a few major manufacturers dominate, these suppliers can wield considerable influence. For instance, in 2024, the U.S. cigarette market, valued at over $100 billion, is largely controlled by a handful of large corporations, granting them significant leverage over distributors.

The degree of product differentiation also plays a crucial role. If AMCON sources highly specialized or proprietary goods, especially within its core tobacco and beverage segments, switching suppliers becomes more challenging. This lack of readily available substitutes for differentiated products strengthens the bargaining position of those specific suppliers, potentially impacting AMCON's cost of goods sold and product availability.

Switching costs for AMCON Distributing can be substantial, encompassing the integration of new inventory management systems, adjustments to logistics, and the cultivation of new supplier relationships. These hurdles can significantly impact operational efficiency and require considerable investment.

For specialized products or those under exclusive distribution agreements, the cost and complexity of switching suppliers can be even more pronounced. This often means AMCON is tied to existing arrangements, even if more favorable terms become available elsewhere.

These considerable switching costs effectively bolster the bargaining power of AMCON's suppliers, particularly those providing unique, integrated solutions. Suppliers understand that AMCON faces significant friction in finding and onboarding alternatives, allowing them to command better terms.

Large manufacturers, especially in sectors like tobacco and beverages, possess the potential to integrate forward by distributing directly to retailers. This capability represents a significant bargaining chip for these suppliers.

While this direct-to-retail strategy is less likely for broad-line distributors like AMCON, which caters to a wide array of customers, it remains a latent threat from dominant brands. For instance, in 2024, major beverage companies continued to explore and optimize their direct-to-consumer and direct-to-retail channels to capture greater margin and control.

However, AMCON Distributing's established and expansive distribution network, spanning 34 states, serves as a substantial deterrent against forward integration for many smaller or less dominant suppliers. This extensive reach makes it economically unfeasible for them to replicate AMCON's infrastructure and market penetration.

Importance of AMCON to Suppliers

AMCON Distributing's position as a leading convenience and foodservice distributor, notably the third largest in the U.S. by territory covered as of early 2024, signifies a critical sales avenue for numerous suppliers. This extensive reach provides AMCON with considerable leverage, as suppliers are keen to maintain access to its broad customer base.

The sheer volume of business AMCON facilitates means that suppliers are often hesitant to jeopardize this relationship. Losing AMCON as a distribution partner could represent a significant blow to a supplier's market penetration and overall sales volume. This interdependence helps to moderate supplier power.

Furthermore, AMCON's capacity to offer integrated marketing and advertising programs enhances its value proposition to suppliers. These services can boost product visibility and sales, making AMCON a more attractive and collaborative partner, thereby further influencing the bargaining power dynamic.

- AMCON's Market Standing: As the third-largest distributor by territory in the U.S. convenience and foodservice sector in early 2024, AMCON offers suppliers significant market access.

- Supplier Dependence: Suppliers often rely on AMCON's extensive network, making them cautious about actions that could disrupt this crucial sales channel.

- Value-Added Services: AMCON's ability to provide integrated marketing and advertising programs strengthens supplier relationships and can offset some supplier leverage.

Availability of Substitute Inputs

The bargaining power of suppliers is influenced by the availability of substitute inputs. For AMCON Distributing, while consumers might have few direct substitutes for specific popular brands it distributes, AMCON itself faces varying degrees of supplier choice. For instance, if AMCON distributes generic grocery items, it might find numerous alternative suppliers, thus reducing the power of any single supplier.

However, for highly branded and sought-after consumer goods, AMCON's ability to switch suppliers without impacting its product assortment is significantly limited. This dependence on specific, often exclusive, supply agreements for popular items can increase supplier leverage.

The wholesale distribution sector, including AMCON's operations, is increasingly focused on supply chain efficiency and resilience. This trend often favors established, reliable suppliers, potentially concentrating power among those who can consistently meet demand and quality standards.

- Limited Substitutes for Branded Goods: AMCON's reliance on distributing specific, popular consumer brands means fewer alternative suppliers exist for these key products, granting those suppliers greater bargaining power.

- Higher Substitutes for Generic Items: For less differentiated products within AMCON's portfolio, the availability of multiple suppliers can dilute individual supplier leverage.

- Industry Trend Towards Supplier Reliability: The wholesale distribution industry's emphasis on supply chain resilience and efficiency can strengthen relationships with established, dependable suppliers, potentially increasing their influence.

Suppliers' bargaining power over AMCON Distributing is significant, particularly for branded goods where AMCON has limited alternatives. In 2024, the dominance of major manufacturers in sectors like tobacco and beverages, which are key to AMCON's business, allows them to dictate terms more effectively. This is amplified by the high switching costs AMCON faces when dealing with specialized or exclusive product lines.

| Factor | Impact on AMCON | Example/Data (2024) |

|---|---|---|

| Supplier Concentration | High for branded goods | U.S. cigarette market controlled by a few major manufacturers. |

| Product Differentiation | Increases supplier leverage | Proprietary goods in tobacco and beverage segments limit AMCON's options. |

| Switching Costs | Substantial for AMCON | Integration of new systems and logistics for alternative suppliers. |

| Forward Integration Threat | Potential leverage for dominant suppliers | Major beverage companies exploring direct-to-retail channels. |

What is included in the product

Tailored exclusively for AMCON Distributing, analyzing its position within its competitive landscape by evaluating supplier and buyer power, threat of new entrants and substitutes, and the intensity of existing rivalry.

Instantly visualize competitive intensity with a dynamic Porter's Five Forces dashboard for AMCON Distributing, simplifying complex market dynamics.

Customers Bargaining Power

AMCON Distributing serves a diverse retail base, from small convenience stores to larger grocery chains and tobacco shops. This broad customer mix means that while many individual retailers have limited power, larger chain customers can leverage their significant purchasing volume to negotiate better terms, potentially impacting AMCON's pricing and margins.

The company's strategy to mitigate this involves fostering strong relationships through dedicated customer service and tailored marketing initiatives. These efforts are designed to cultivate loyalty, making it less likely for these valuable customers to seek out alternative distributors, thus preserving AMCON's revenue streams.

Retailers face tangible expenses when switching distributors, including the cost of reconfiguring inventory management systems and establishing new logistical arrangements. For instance, a retailer might need to invest in new software or retrain staff to handle a different distributor's ordering and tracking processes, which can easily run into thousands of dollars depending on the scale of operations.

AMCON Distributing's offering of sophisticated advertising and merchandising support creates additional friction for retailers considering a change. These value-added services, like co-branded marketing campaigns or in-store display design, become integrated into a retailer's sales strategy, making it difficult to replicate or replace them quickly with a new supplier.

Customers in the convenience store and grocery sectors, particularly smaller independent businesses, often exhibit high price sensitivity. This is largely due to their own narrow profit margins and the intensely competitive nature of their retail markets.

This inherent price sensitivity directly translates into increased bargaining power for AMCON's customers. They can leverage this to push AMCON towards maintaining competitive pricing, impacting the distributor's own profitability.

In 2024, inflationary pressures continued to affect cost structures across the distribution chain, including for convenience distributors like AMCON. This has only amplified the price sensitivity experienced by their customer base.

Threat of Backward Integration by Customers

The threat of backward integration by customers, where they might choose to handle distribution themselves, is generally low for AMCON Distributing. While major retail chains could theoretically explore self-distribution, the substantial capital outlay and intricate logistical challenges make it impractical for most of AMCON's varied clientele. For instance, establishing a dedicated distribution fleet and warehousing infrastructure can easily run into millions of dollars, a cost prohibitive for many smaller or mid-sized businesses that rely on AMCON's services.

The significant investment required for setting up and managing an independent distribution network acts as a strong deterrent. This includes costs for vehicles, warehousing, technology for inventory management, and skilled personnel. For example, a study in 2024 indicated that the average cost to establish a regional distribution center can exceed $10 million, not including ongoing operational expenses. This financial barrier effectively limits most of AMCON's customers from pursuing backward integration, thereby preserving AMCON's bargaining power.

- High Capital Investment: Establishing a distribution network requires substantial upfront capital, often in the millions of dollars, for infrastructure and fleet.

- Logistical Complexity: Managing inventory, transportation, and last-mile delivery is complex and requires specialized expertise.

- Operational Costs: Ongoing expenses for fuel, maintenance, labor, and technology can be significant and difficult for many businesses to absorb.

- Focus on Core Competencies: Most customers prefer to concentrate on their primary business operations rather than diverting resources to distribution.

Availability of Alternative Distributors

AMCON Distributing operates within a highly competitive wholesale distribution landscape, facing competition from major national players such as Sysco and US Foods, alongside a multitude of regional distributors. The presence of these numerous alternatives directly empowers AMCON's customers.

Customers can readily switch to other distributors if AMCON's pricing, product selection, or service quality falls short of expectations. This availability of substitutes significantly amplifies customer bargaining power, forcing AMCON to remain competitive in its offerings.

However, AMCON is actively working to mitigate this by expanding its operational footprint and pursuing strategic acquisitions. These initiatives are designed to bolster its market standing and enhance its service capabilities across an increasingly broad geographic area, thereby aiming to reduce customer reliance on alternative distributors.

- Competitive Landscape: AMCON faces competition from national distributors like Sysco and US Foods, as well as regional players.

- Customer Power: The availability of alternative distributors gives customers leverage to demand better pricing and service.

- AMCON's Strategy: Expansion and acquisitions are key to strengthening AMCON's market position and service reach.

The bargaining power of AMCON Distributing's customers is moderate, influenced by factors like customer concentration and the availability of alternatives. While many individual retailers have limited leverage, larger chains can negotiate better terms due to their purchase volume. The company mitigates this by offering value-added services and fostering strong relationships.

Switching costs for retailers are significant, encompassing IT system reconfigurations and staff training, often running into thousands of dollars. AMCON's support services, such as marketing and merchandising, further increase these switching costs, making it harder for customers to change distributors. In 2024, persistent inflation heightened customer price sensitivity, a key driver of their bargaining power.

| Factor | Impact on AMCON | Mitigation Strategy |

|---|---|---|

| Customer Concentration | Larger chains have significant volume leverage. | Relationship building, tailored services. |

| Switching Costs | High for IT, logistics, and training. | Value-added services (marketing, merchandising). |

| Price Sensitivity | Amplified by inflation and narrow retail margins. | Competitive pricing, efficient operations. |

| Availability of Alternatives | Numerous competitors offer substitutes. | Market expansion, strategic acquisitions. |

What You See Is What You Get

AMCON Distributing Porter's Five Forces Analysis

This preview showcases the complete AMCON Distributing Porter's Five Forces Analysis, offering a thorough examination of competitive forces within its industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The wholesale distribution industry, especially for consumer goods, is quite crowded. You have many companies actively competing, and some of them are really big. Think about giants like US Foods and Sysco, which are major players in this space.

AMCON, while a leader in convenience and foodservice distribution and now the third-largest in the U.S. by territory, still operates in a highly competitive environment. This means AMCON is up against both nationwide distributors and those who focus on specific regions.

The wholesale distribution sector, where AMCON Distributing operates, is largely mature. This means growth isn't typically explosive but rather comes from companies getting bigger by buying others or becoming more efficient. For example, in 2023, the U.S. wholesale trade sector saw a modest increase in sales, reflecting this stable, mature environment.

While some niche areas within distribution, like health products or specialized foodservice, might experience faster growth, the core business for companies like AMCON, often involving tobacco and general merchandise, tends to be quite stable. This stability, however, can fuel intense competition as businesses fight to capture existing market share.

In the wholesale distribution sector, where product offerings can often feel similar, competition frequently centers on price, operational efficiency, and the extra services provided. AMCON Distributing distinguishes itself by offering a broad selection of products, a wide geographic presence, and comprehensive marketing and foodservice support programs.

These specialized services are designed to cultivate deeper customer loyalty and lessen the impact of direct price-based competition. For instance, in 2024, AMCON reported that its value-added services, such as tailored marketing campaigns and in-store setup assistance, contributed to a 15% increase in repeat business from its key accounts.

Exit Barriers

Exit barriers in wholesale distribution are substantial, often stemming from significant capital tied up in physical assets like distribution centers and specialized logistics networks. AMCON Distributing, for instance, has made considerable investments in its infrastructure, including recent expansions and acquisitions, which elevate its fixed asset base. These sunk costs make it economically challenging for companies to exit the market, even when facing diminished profitability.

This situation can prolong the presence of less profitable players, thereby intensifying competitive rivalry within the sector. AMCON’s strategic moves to bolster its operational capacity, such as its reported capital expenditures in 2023, contribute to these high exit barriers. Consequently, firms may continue to operate at lower margins, keeping competitive pressures elevated.

- High Capital Investment: Significant outlays in distribution centers and logistics infrastructure create substantial sunk costs.

- Established Customer Relationships: Long-standing ties with clients are difficult to sever and represent a barrier to exit.

- Operational Interdependence: Specialized equipment and processes can be difficult to repurpose or sell, increasing exit costs.

- AMCON's Capital Expenditures: Recent investments by AMCON in facilities and acquisitions reinforce these exit barriers.

Intensity of Competition

The competitive landscape for distributors like AMCON is fierce, characterized by significant price pressures and a relentless drive for operational efficiency. Customer demands for quicker delivery and superior service further intensify this rivalry, pushing companies to innovate constantly.

To navigate this environment, AMCON and its peers are channeling resources into digital transformation and automation. Enhancing supply chain transparency is also a critical strategy for gaining a competitive advantage and meeting evolving market needs.

Strategic acquisitions remain a prominent tactic for market expansion and industry consolidation. For instance, the distribution sector has seen considerable M&A activity, with companies aiming to broaden their reach and solidify their market position.

- Price Pressures: Intense competition leads to constant downward pressure on pricing for distributors.

- Operational Efficiency: Companies must optimize logistics and internal processes to remain profitable.

- Digital Transformation: Investments in technology are crucial for improving customer experience and supply chain management.

- Strategic Acquisitions: Mergers and acquisitions are key tools for growth and market share gains in the sector.

The competitive rivalry within the wholesale distribution sector, where AMCON Distributing operates, is exceptionally high due to numerous players and significant market saturation. Companies like US Foods and Sysco represent major competitors, setting a high bar for operational excellence and market reach.

AMCON, despite its size, faces intense pressure from both national and regional distributors, forcing a constant focus on efficiency and service differentiation. This dynamic is further fueled by the mature nature of the industry, where growth often stems from market share acquisition rather than overall market expansion.

In 2023, the U.S. wholesale trade sector experienced modest sales growth, underscoring the stable yet competitive environment. AMCON’s strategic use of value-added services, which contributed to a 15% increase in repeat business in 2024, highlights the importance of customer loyalty in mitigating direct price competition.

The sector's substantial exit barriers, including significant capital investments in infrastructure and established customer relationships, mean that even less profitable firms remain active, intensifying competitive pressures and keeping margins tight.

| Competitor | Market Position (Approx.) | Key Competitive Factor |

|---|---|---|

| US Foods | Major National Player | Extensive product catalog, broad distribution network |

| Sysco | Major National Player | Dominant in foodservice, strong logistics |

| AMCON Distributing | Third Largest by Territory (Convenience/Foodservice) | Geographic reach, value-added services, product variety |

SSubstitutes Threaten

Retailers, especially major chains, are increasingly exploring direct sourcing from manufacturers to cut out intermediaries like AMCON Distributing. This strategy is particularly attractive for high-volume items and private-label brands, effectively substituting the need for wholesale distribution. For instance, Walmart's extensive private-label program allows them to bypass traditional distributors for many product categories.

While direct sourcing offers potential cost savings, it presents significant logistical hurdles for smaller retailers or those managing a broad product assortment. The complexity of managing numerous supplier relationships, inventory, and quality control can outweigh the benefits. In 2024, the average small retailer still relies on distributors for over 60% of their inventory due to these operational challenges.

The threat of substitutes for AMCON Distributing's traditional distribution model is evolving, particularly with the rise of e-commerce and direct-to-consumer (DTC) approaches, even impacting the business-to-business (B2B) sector. Online marketplaces and alternative logistics firms are emerging as potential new avenues for retailers to source products, challenging established supply chains.

However, for the specific needs of convenience stores, characterized by frequent and immediate replenishment, AMCON's existing physical distribution network continues to offer a significant advantage in terms of speed and reliability. For instance, in 2024, the convenience store sector in the US saw over $1 trillion in sales, underscoring the critical need for efficient, on-demand delivery that AMCON's infrastructure is designed to meet.

A significant shift in consumer purchasing habits, moving away from traditional convenience and grocery stores towards online platforms and specialized retailers, poses a threat of substitution for AMCON Distributing. For instance, the U.S. online grocery market was valued at approximately $150 billion in 2023 and is projected to grow substantially, indicating a clear alternative for consumers seeking similar products.

This trend could indirectly affect AMCON's wholesale operations if its primary customers, convenience stores, see a decline in foot traffic and sales due to these evolving consumer preferences. While AMCON also has its own retail health product stores, a broader change in how consumers shop for everyday items necessitates a strategic evaluation of its business model to remain competitive.

Changes in Product Preferences

Shifting consumer tastes represent a significant threat. For instance, a notable decline in traditional tobacco product consumption, a core area for AMCON, is evident. This trend is mirrored by a substantial rise in alternative nicotine products, which can directly substitute demand for AMCON's existing offerings.

AMCON's strategic diversification into areas like foodservice and health products serves as a crucial buffer. This broad product portfolio helps to mitigate the inherent risk of over-reliance on any single category, thereby lessening the impact of changing preferences in one sector.

- Declining Traditional Tobacco Sales: Reports indicate a steady year-over-year decrease in sales for conventional tobacco products in many markets.

- Growth in Alternatives: The market for e-cigarettes and heated tobacco products has seen double-digit growth in recent years, capturing a significant share of nicotine users.

- AMCON's Diversification Strategy: In 2023, AMCON reported that its non-tobacco product segments contributed approximately 40% to its overall revenue, demonstrating a successful effort to spread risk.

Self-Distribution by Large Retailers

Large retail chains, particularly those with substantial sales volume, can indeed develop their own distribution networks. This capability acts as a substitute for traditional wholesalers like AMCON Distributing. For instance, a major supermarket chain might establish its own fleet of trucks and warehouses, bypassing the need for external distribution services.

This move towards self-distribution is a significant capital investment. It requires substantial financial resources to build and maintain the necessary infrastructure. Consequently, it's primarily feasible for the largest retailers who can leverage economies of scale to make it cost-effective. In 2024, the trend of large retailers optimizing their supply chains continued, with many exploring or expanding in-house logistics solutions to gain greater control and potentially reduce costs.

For AMCON Distributing, which serves a wide array of smaller clients like convenience stores and independent grocers, this threat is somewhat mitigated. These smaller businesses typically lack the volume and capital to implement their own distribution systems. Therefore, self-distribution by large retailers is generally not a direct or viable substitute for the services AMCON provides to its core customer base.

- Capital Intensity: Developing in-house distribution requires significant upfront investment in logistics infrastructure, making it prohibitive for smaller players.

- Economies of Scale: Only very large retailers with high sales volumes can achieve the necessary economies of scale to make self-distribution cost-competitive.

- AMCON's Niche: AMCON's focus on convenience stores and smaller grocers means its customer base is less likely to adopt self-distribution, preserving AMCON's market position with these clients.

The threat of substitutes for AMCON Distributing's services is multifaceted, encompassing direct sourcing by large retailers, evolving consumer purchasing habits, and shifts in product preferences. While large chains can bypass distributors, the capital and scale required make this impractical for AMCON's core convenience store clientele. Furthermore, the growing online retail sector offers consumers alternative purchasing channels, potentially impacting AMCON's end-customer traffic.

Changing consumer tastes, particularly the decline in traditional tobacco and the rise of alternatives, directly substitute AMCON's core product offerings. However, AMCON's diversification into foodservice and health products in 2023, which accounted for approximately 40% of its revenue, serves as a crucial mitigation strategy against these shifts.

| Threat Type | Description | AMCON's Mitigation/Impact |

| Direct Sourcing by Large Retailers | Major chains establishing their own distribution networks. | Capital intensive; not feasible for AMCON's smaller clients, preserving AMCON's niche. |

| Evolving Consumer Purchasing Habits | Shift towards online platforms and specialized retailers. | Indirectly impacts AMCON's convenience store customers; AMCON also operates its own retail stores. |

| Changing Product Preferences | Decline in traditional tobacco, rise in alternatives (e.g., e-cigarettes). | AMCON's 2023 revenue diversification (40% non-tobacco) cushions this impact. |

Entrants Threaten

The wholesale distribution sector demands significant upfront capital. Think about the costs involved: building or leasing large distribution centers, acquiring a fleet of delivery trucks, and stocking substantial amounts of inventory. These aren't small expenses, and they create a pretty high hurdle for anyone looking to start a new distribution business.

For instance, in 2024, the average cost to establish a new regional distribution center can range from $5 million to $20 million, depending on size and location. AMCON Distributing's own strategic investments in expanding its warehousing capacity in late 2023 and early 2024, totaling over $15 million, underscore the scale of investment necessary to maintain competitiveness and handle increased order volumes.

Existing distributors like AMCON Distributing benefit from substantial economies of scale in purchasing, warehousing, and transportation. This allows them to secure better pricing and operate more efficiently, creating a significant cost advantage. For instance, in 2024, major distributors often negotiate bulk discounts that can be 5-10% lower than what a new, smaller entrant could achieve.

New entrants would find it challenging to match these cost efficiencies without a considerable initial sales volume. This inherent cost disadvantage makes it difficult for them to compete on price, a crucial factor in the distribution industry, potentially limiting their market penetration and growth prospects.

AMCON Distributing boasts a significant advantage with its well-established distribution network, spanning across 34 states. This extensive reach, coupled with long-standing, trusted relationships with both suppliers and a diverse customer base, presents a formidable barrier to new entrants. Building such a comprehensive network and earning market trust is an arduous and time-consuming undertaking, making it exceptionally challenging for newcomers to compete effectively.

Regulatory Hurdles and Licensing

The distribution of certain products, like tobacco and alcohol, faces significant regulatory hurdles and licensing demands. These requirements can be intricate and expensive, acting as a substantial barrier for newcomers. For instance, in 2024, obtaining a new liquor license in many US states can cost thousands of dollars and involve lengthy approval processes, discouraging smaller or less capitalized entrants.

This complex regulatory landscape favors established players who have already invested in understanding and complying with these rules. New distributors must navigate a maze of federal, state, and local laws, including age verification, advertising restrictions, and tax collection. Failure to comply can result in hefty fines or outright prohibition from operating.

- Stringent Licensing: Obtaining necessary permits for distributing controlled substances like alcohol or tobacco involves rigorous background checks and significant fees.

- Compliance Costs: Ongoing adherence to evolving regulations requires continuous investment in training, record-keeping, and legal counsel.

- Market Access Restrictions: Some jurisdictions limit the number of licenses issued or impose territorial restrictions, further limiting new entrants.

- Brand Reputation Impact: Non-compliance can severely damage a distributor's reputation, making it difficult to secure partnerships with suppliers and retailers.

Brand Loyalty and Switching Costs for Customers

Brand loyalty is a significant barrier for new entrants in the wholesale distribution sector. AMCON Distributing cultivates this loyalty through consistent, reliable service, a comprehensive product selection, and specialized programs such as integrated marketing and foodservice solutions, differentiating itself beyond mere product availability.

The costs and effort involved for retailers to switch from an established distributor like AMCON present a substantial hurdle for newcomers. These switching costs, encompassing factors like establishing new ordering systems, renegotiating terms, and potential disruptions in supply chain continuity, make it less appealing for businesses to change their primary distribution partners.

- AMCON's customer retention strategies focus on service reliability and value-added programs.

- High switching costs for retailers deter new entrants.

- A broad product catalog further solidifies customer relationships.

The threat of new entrants for AMCON Distributing is moderate, primarily due to high capital requirements and established economies of scale. New companies face significant upfront costs for infrastructure and inventory, making it difficult to compete with existing players who benefit from lower per-unit operating expenses. For example, in 2024, establishing a new regional distribution center can cost upwards of $5 million.

Furthermore, AMCON's extensive distribution network, covering 34 states, and its strong relationships with suppliers and customers act as considerable barriers. Building comparable reach and trust takes years, if not decades, and substantial investment. The licensing and compliance costs associated with distributing products like alcohol and tobacco also deter potential new competitors, with state liquor licenses alone costing thousands in 2024.

| Barrier Type | Description | Impact on New Entrants | 2024 Data/Example |

|---|---|---|---|

| Capital Requirements | High upfront investment for facilities, fleet, and inventory. | Significant hurdle, requiring substantial funding. | Regional distribution center costs: $5M - $20M. |

| Economies of Scale | Lower operating costs due to larger volume for established players. | New entrants struggle to match price competitiveness. | Bulk purchase discounts: 5-10% lower for large distributors. |

| Network & Relationships | Extensive geographic reach and established supplier/customer ties. | Difficult and time-consuming to replicate. | AMCON operates in 34 states. |

| Regulatory & Licensing | Complex and costly permits for specific product categories. | Adds to initial costs and time-to-market. | New liquor license cost: thousands of dollars plus lengthy approval. |

Porter's Five Forces Analysis Data Sources

Our AMCON Distributing Porter's Five Forces analysis is built upon a foundation of publicly available company filings, including AMCON's annual reports and SEC filings. We also incorporate industry-specific data from trade associations and market research reports to provide a comprehensive view of the competitive landscape.