AMCON Distributing PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMCON Distributing Bundle

Navigate the complex external environment impacting AMCON Distributing with our detailed PESTEL analysis. Understand the political, economic, social, technological, environmental, and legal factors that are shaping the company's trajectory and competitive landscape. Gain a strategic advantage by leveraging these critical insights to inform your investment decisions and business strategies. Download the full PESTEL analysis now for actionable intelligence you can trust.

Political factors

Government regulations on tobacco and nicotine products are a significant political factor for AMCON Distributing. Changes in federal, state, and local laws concerning sales, marketing, taxation, and distribution of these products directly influence AMCON's operations and profitability. For instance, the U.S. Food and Drug Administration (FDA) continues to review and potentially implement new regulations on e-cigarettes and other novel tobacco products, which could alter market dynamics.

Stricter age verification requirements, such as those reinforced by the Prevent All Cigarette Trafficking (PACT) Act, and potential flavor bans on e-cigarettes, as seen in some states, can directly curtail sales volumes. Furthermore, increases in federal and state excise taxes on tobacco products, like the federal excise tax on cigarettes, which has remained at $1.01 per pack since 2009 but is subject to potential adjustments, can impact consumer purchasing power and AMCON's revenue streams. Staying abreast of these evolving legislative landscapes is vital for AMCON's strategic planning and risk management.

AMCON Distributing's operations in the grocery and beverage sector are heavily influenced by a complex web of food safety, labeling, and health regulations. Agencies such as the Food and Drug Administration (FDA) set stringent standards that AMCON must adhere to, impacting everything from product sourcing to packaging. Failure to comply can lead to significant penalties, costly product recalls, and severe damage to the company's reputation, as seen in past industry-wide challenges with supply chain integrity.

Looking ahead, potential shifts in regulatory landscapes, particularly concerning nutritional content disclosure or ethical sourcing mandates, could necessitate adjustments in AMCON's product portfolio and distribution strategies. For instance, evolving guidelines around sugar content or origin traceability could require substantial changes to product formulations or supplier relationships, impacting operational costs and market competitiveness.

AMCON Distributing's retail health product segment is directly influenced by healthcare policy. For instance, changes in Medicare Part D coverage or new regulations on over-the-counter drug sales could significantly impact product demand and profitability. The Centers for Medicare & Medicaid Services (CMS) frequently updates reimbursement policies, which can affect the affordability and accessibility of certain health products for consumers.

Evolving pharmaceutical regulations, such as those impacting generic drug approvals or prescription requirements for certain medications, also pose a direct risk. For example, a shift towards requiring prescriptions for products previously available over-the-counter could reduce sales volume for AMCON. The Food and Drug Administration's (FDA) oversight of drug labeling and marketing plays a crucial role in consumer purchasing decisions.

Labor Laws and Minimum Wage Policies

Government policies on minimum wage and labor laws significantly affect AMCON Distributing's operating expenses, especially given its large distribution and retail workforce. For instance, a federal minimum wage hike to $15 per hour, as proposed in some legislative discussions, could substantially increase payroll costs.

Changes in regulations regarding working conditions or union activities also pose potential risks. For example, stricter overtime rules or new collective bargaining agreements could necessitate adjustments to staffing and compensation, directly impacting AMCON's profitability.

- Federal Minimum Wage: Discussions around a $15 federal minimum wage continue, which would directly impact AMCON's labor costs.

- State-Level Wage Increases: Many states have already implemented higher minimum wages, with some reaching $15 or more by 2024, affecting regional operational costs for AMCON.

- Worker Protection Laws: Evolving regulations on benefits, safety, and scheduling can alter employment practices and increase compliance expenses.

Trade Policies and Import/Export Regulations

AMCON Distributing's reliance on international sourcing makes it susceptible to shifts in global trade policies. For instance, the United States' imposition of tariffs on certain goods from China in 2018 and ongoing adjustments to trade agreements, such as the USMCA, directly impact procurement costs and the competitiveness of imported products. These changes can create supply chain volatility, forcing distributors to absorb higher costs or pass them on to consumers.

Geopolitical tensions and rising protectionist sentiments globally pose a significant risk. A recent example is the European Union's ongoing review of trade relations and potential retaliatory measures against certain countries, which could disrupt established supply chains for electronics or machinery that AMCON might distribute. Such disruptions can lead to increased lead times and higher operational expenses, directly affecting profit margins.

Monitoring international trade relations is crucial for maintaining supply chain resilience. For example, the World Trade Organization (WTO) reported a slowdown in global trade growth projections for 2024-2025, citing increased trade restrictions and geopolitical uncertainty. AMCON must proactively identify alternative sourcing regions and develop contingency plans to mitigate the impact of potential trade barriers or sudden import/export regulation changes.

- Tariff Impact: Increased tariffs on goods sourced from key manufacturing hubs can raise AMCON's cost of goods sold by an estimated 5-15% depending on product category.

- Supply Chain Diversification: AMCON's strategy to diversify sourcing away from single-country reliance, aiming for a 30% reduction in single-country dependency by 2025, mitigates risks from localized trade disputes.

- Regulatory Compliance Costs: Navigating evolving import/export regulations, including new documentation requirements or product standards, can add 2-4% to administrative overhead.

- Trade Agreement Sensitivity: Changes in trade agreements, like potential renegotiations of existing pacts, could affect the preferential duty rates AMCON currently benefits from, impacting landed costs.

Government regulations on tobacco and nicotine products are a significant political factor for AMCON Distributing. Changes in federal, state, and local laws concerning sales, marketing, taxation, and distribution of these products directly influence AMCON's operations and profitability. For instance, the U.S. Food and Drug Administration (FDA) continues to review and potentially implement new regulations on e-cigarettes and other novel tobacco products, which could alter market dynamics.

Stricter age verification requirements, such as those reinforced by the Prevent All Cigarette Trafficking (PACT) Act, and potential flavor bans on e-cigarettes, as seen in some states, can directly curtail sales volumes. Furthermore, increases in federal and state excise taxes on tobacco products, like the federal excise tax on cigarettes, which has remained at $1.01 per pack since 2009 but is subject to potential adjustments, can impact consumer purchasing power and AMCON's revenue streams. Staying abreast of these evolving legislative landscapes is vital for AMCON's strategic planning and risk management.

AMCON Distributing's operations in the grocery and beverage sector are heavily influenced by a complex web of food safety, labeling, and health regulations. Agencies such as the Food and Drug Administration (FDA) set stringent standards that AMCON must adhere to, impacting everything from product sourcing to packaging. Failure to comply can lead to significant penalties, costly product recalls, and severe damage to the company's reputation, as seen in past industry-wide challenges with supply chain integrity.

Looking ahead, potential shifts in regulatory landscapes, particularly concerning nutritional content disclosure or ethical sourcing mandates, could necessitate adjustments in AMCON's product portfolio and distribution strategies. For instance, evolving guidelines around sugar content or origin traceability could require substantial changes to product formulations or supplier relationships, impacting operational costs and market competitiveness.

AMCON Distributing's retail health product segment is directly influenced by healthcare policy. For instance, changes in Medicare Part D coverage or new regulations on over-the-counter drug sales could significantly impact product demand and profitability. The Centers for Medicare & Medicaid Services (CMS) frequently updates reimbursement policies, which can affect the affordability and accessibility of certain health products for consumers.

Evolving pharmaceutical regulations, such as those impacting generic drug approvals or prescription requirements for certain medications, also pose a direct risk. For example, a shift towards requiring prescriptions for products previously available over-the-counter could reduce sales volume for AMCON. The Food and Drug Administration's (FDA) oversight of drug labeling and marketing plays a crucial role in consumer purchasing decisions.

Government policies on minimum wage and labor laws significantly affect AMCON Distributing's operating expenses, especially given its large distribution and retail workforce. For instance, a federal minimum wage hike to $15 per hour, as proposed in some legislative discussions, could substantially increase payroll costs.

Changes in regulations regarding working conditions or union activities also pose potential risks. For example, stricter overtime rules or new collective bargaining agreements could necessitate adjustments to staffing and compensation, directly impacting AMCON's profitability.

- Federal Minimum Wage: Discussions around a $15 federal minimum wage continue, which would directly impact AMCON's labor costs.

- State-Level Wage Increases: Many states have already implemented higher minimum wages, with some reaching $15 or more by 2024, affecting regional operational costs for AMCON.

- Worker Protection Laws: Evolving regulations on benefits, safety, and scheduling can alter employment practices and increase compliance expenses.

AMCON Distributing's reliance on international sourcing makes it susceptible to shifts in global trade policies. For instance, the United States' imposition of tariffs on certain goods from China in 2018 and ongoing adjustments to trade agreements, such as the USMCA, directly impact procurement costs and the competitiveness of imported products. These changes can create supply chain volatility, forcing distributors to absorb higher costs or pass them on to consumers.

Geopolitical tensions and rising protectionist sentiments globally pose a significant risk. A recent example is the European Union's ongoing review of trade relations and potential retaliatory measures against certain countries, which could disrupt established supply chains for electronics or machinery that AMCON might distribute. Such disruptions can lead to increased lead times and higher operational expenses, directly affecting profit margins.

Monitoring international trade relations is crucial for maintaining supply chain resilience. For example, the World Trade Organization (WTO) reported a slowdown in global trade growth projections for 2024-2025, citing increased trade restrictions and geopolitical uncertainty. AMCON must proactively identify alternative sourcing regions and develop contingency plans to mitigate the impact of potential trade barriers or sudden import/export regulation changes.

- Tariff Impact: Increased tariffs on goods sourced from key manufacturing hubs can raise AMCON's cost of goods sold by an estimated 5-15% depending on product category.

- Supply Chain Diversification: AMCON's strategy to diversify sourcing away from single-country reliance, aiming for a 30% reduction in single-country dependency by 2025, mitigates risks from localized trade disputes.

- Regulatory Compliance Costs: Navigating evolving import/export regulations, including new documentation requirements or product standards, can add 2-4% to administrative overhead.

- Trade Agreement Sensitivity: Changes in trade agreements, like potential renegotiations of existing pacts, could affect the preferential duty rates AMCON currently benefits from, impacting landed costs.

| Political Factor | Description | Impact on AMCON | Example/Data Point (2024-2025) |

|---|---|---|---|

| Tobacco & Nicotine Regulation | FDA oversight, state flavor bans, excise taxes. | Affects sales volume, pricing, and market access. | Federal cigarette excise tax remains $1.01/pack; some states considering flavor bans for e-cigarettes in 2024. |

| Food Safety & Labeling | FDA standards for grocery/beverage products. | Requires compliance in sourcing, packaging; risk of recalls. | Ongoing FDA scrutiny of supply chain integrity for food products. |

| Healthcare Policy | Medicare Part D, OTC drug regulations. | Influences demand and profitability for health products. | CMS updates reimbursement policies impacting consumer access to health items. |

| Labor Laws | Minimum wage, worker protection. | Increases operating expenses (payroll, compliance). | Continued state-level minimum wage hikes; federal $15/hour wage discussions persist. |

| Global Trade Policy | Tariffs, trade agreements (USMCA). | Impacts procurement costs, supply chain stability. | WTO projected slower global trade growth for 2024-2025 due to trade restrictions. |

What is included in the product

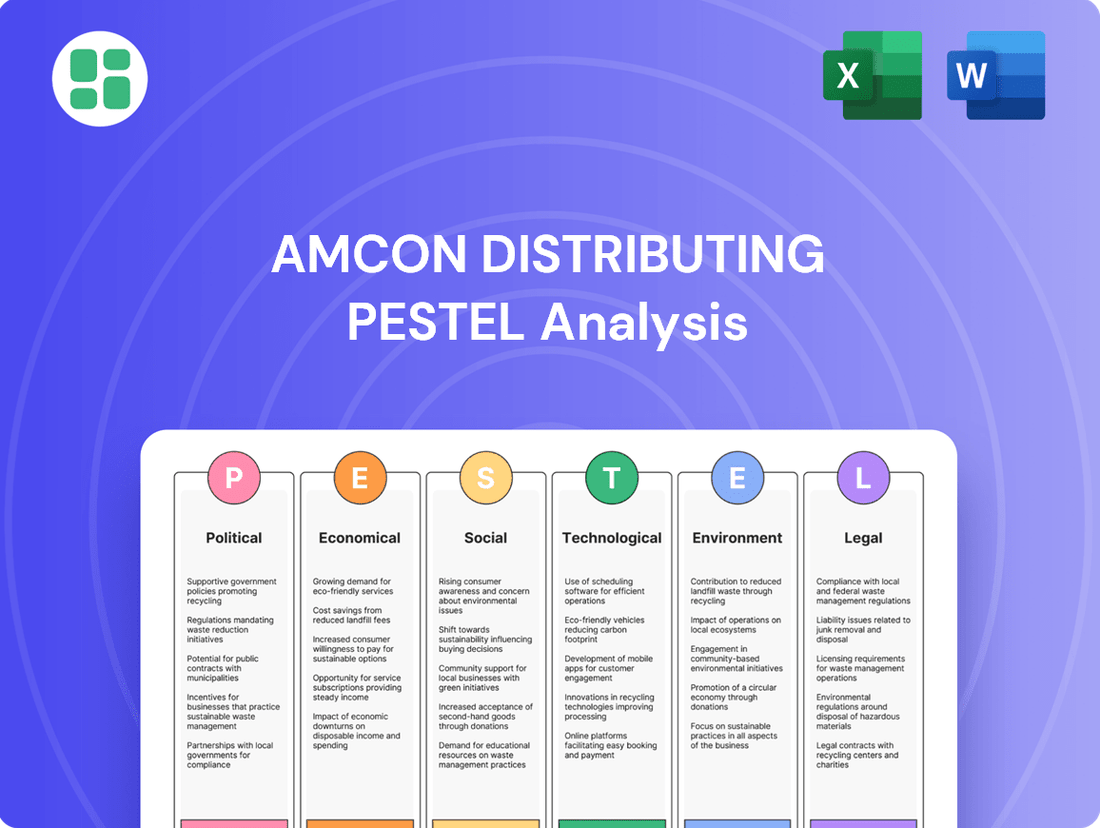

This PESTLE analysis examines the external macro-environmental factors impacting AMCON Distributing across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats within AMCON Distributing's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, translating complex external factors into actionable insights for AMCON Distributing.

Helps support discussions on external risk and market positioning during planning sessions, enabling AMCON Distributing to proactively address potential challenges and capitalize on opportunities.

Economic factors

Consumer disposable income is a critical driver for AMCON Distributing, impacting sales of both essential groceries and discretionary items like candy. As of late 2024, personal disposable income in the U.S. has shown resilience, though inflation continues to pressure household budgets, potentially shifting spending towards value-oriented options.

Economic downturns directly affect AMCON's revenue. For instance, a projected slowdown in consumer spending in 2025, driven by persistent inflation and higher interest rates, could lead to decreased demand across AMCON's retail and wholesale segments. Monitoring consumer confidence surveys will be crucial for anticipating these shifts.

Rising inflation in 2024 and projected into 2025 poses a significant challenge for AMCON Distributing, directly impacting its cost of goods sold. Increased procurement prices for key products like tobacco and food items are inevitable, squeezing initial margins.

AMCON's profitability hinges on its capacity to effectively transfer these escalating costs to retailers and, subsequently, to the end consumer. Without successful price adjustments, the company faces reduced profit margins, a trend observed across the distribution sector as input costs climbed throughout 2024.

Strategic inventory management and dynamic pricing are paramount for AMCON to navigate this inflationary landscape. For instance, the Consumer Price Index (CPI) in the US saw a notable increase in 2024, underscoring the need for agile business practices to maintain financial health.

For AMCON Distributing, with its vast distribution network, fuel prices are a major operational expense. For instance, the average price of regular gasoline in the U.S. hovered around $3.50 per gallon in early 2024, a figure that directly impacts the cost of running AMCON's delivery fleet.

When fuel prices rise, AMCON's transportation expenses increase, potentially squeezing profit margins. The company might need to implement fuel surcharges or find ways to make its delivery routes more efficient to offset these higher costs.

Keeping a close eye on global energy markets is crucial for AMCON's logistical planning. For example, geopolitical events in major oil-producing regions can cause sudden spikes in crude oil prices, which then translate to higher diesel costs for AMCON's trucks.

Interest Rates and Access to Capital

Changes in interest rates directly influence AMCON Distributing's borrowing expenses for everything from daily operations to significant expansions or acquisitions. For instance, if the Federal Reserve raises its benchmark interest rate, AMCON's cost of capital for new loans or existing variable-rate debt will likely increase, potentially squeezing profit margins.

Higher interest rates can also make future investments, such as new equipment or market entry, considerably more expensive. This could force AMCON to re-evaluate its growth plans, possibly delaying or scaling back strategic initiatives that rely on debt financing to maintain financial flexibility.

Maintaining access to favorable credit terms is crucial for AMCON's financial health. It ensures the company has the necessary liquidity to manage its day-to-day business and to seize opportunities for strategic growth, like acquiring new product lines or expanding its distribution network.

- Federal Reserve Rate Hikes: The Federal Reserve has demonstrated a commitment to controlling inflation, with the federal funds rate target range reaching 5.25%-5.50% as of mid-2024. This higher rate environment directly increases the cost of borrowing for companies like AMCON.

- Impact on Investment Decisions: A higher cost of capital means that projects requiring debt financing must offer a greater potential return to be considered viable, potentially slowing down capital expenditure and expansion plans.

- Credit Market Conditions: Tightening credit markets, often accompanying rising interest rates, can make it more challenging for businesses to secure loans or refinance existing debt on favorable terms, impacting liquidity and strategic funding.

Competitive Landscape and Pricing Strategies

The economic climate significantly shapes the competitive arena for distributors like AMCON, directly impacting how they set prices. In a robust economy, there's more room for varied pricing, but during downturns, intense competition can trigger price wars, severely compressing profit margins for all players.

AMCON faces the challenge of navigating this dynamic. For instance, the consumer electronics distribution sector, a key area for many distributors, saw intense promotional activity in late 2023 and early 2024 due to cautious consumer spending. This often forces distributors to accept lower margins to move inventory.

To remain profitable, AMCON must strategically balance its pricing. This involves understanding the price elasticity of demand for its diverse product lines and tailoring strategies for different customer segments.

- Price Wars: Economic slowdowns can intensify competition, leading to price wars that erode distributor profit margins.

- Margin Squeeze: Distributors like AMCON must carefully manage pricing to maintain profitability amidst competitive pressures.

- Strategic Balancing: Success hinges on balancing competitive pricing with the need to sustain healthy margins across product categories.

- Consumer Spending Impact: Fluctuations in consumer spending directly influence the pricing strategies distributors can effectively employ.

Economic factors significantly influence AMCON Distributing's operational costs and revenue streams. Rising inflation in 2024 and into 2025 directly increases the cost of goods sold, impacting margins on products like tobacco and food. Fluctuations in consumer disposable income, influenced by inflation and interest rates, dictate demand for both essential and discretionary items, with a potential shift towards value options noted in late 2024.

Fuel prices remain a critical expense for AMCON's extensive logistics network. For instance, average U.S. gasoline prices around $3.50 per gallon in early 2024 directly affect transportation costs, necessitating efficient route planning and potential fuel surcharges. Geopolitical events impacting crude oil prices can cause sudden spikes in diesel costs.

Interest rate hikes, such as the Federal Reserve's target range of 5.25%-5.50% in mid-2024, increase AMCON's borrowing expenses and the cost of capital for investments, potentially slowing expansion plans. Tightening credit markets can also hinder access to favorable loan terms, impacting liquidity.

| Economic Factor | Impact on AMCON Distributing | 2024/2025 Data Point |

|---|---|---|

| Consumer Disposable Income | Drives sales volume, particularly for discretionary items. Inflationary pressures may shift spending to value-oriented options. | U.S. personal disposable income showed resilience in late 2024, but inflation remains a concern. |

| Inflation Rate | Increases cost of goods sold and operational expenses, potentially squeezing profit margins if costs cannot be passed on. | Consumer Price Index (CPI) saw notable increases in 2024. |

| Fuel Prices | Directly impacts transportation and logistics costs, a major operational expense. | Average U.S. regular gasoline prices were around $3.50/gallon in early 2024. |

| Interest Rates | Affects borrowing costs, investment viability, and overall cost of capital. | Federal funds rate target range was 5.25%-5.50% as of mid-2024. |

What You See Is What You Get

AMCON Distributing PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of AMCON Distributing provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It's designed to offer actionable insights for strategic decision-making.

Sociological factors

Consumers are increasingly prioritizing health and wellness, which directly affects demand for products like tobacco. This growing awareness is fueling a shift towards healthier food options and lifestyle choices.

For AMCON, this means a potential decline in traditional tobacco sales. However, it also presents an opportunity to capitalize on the rising demand for healthier snacks, organic foods, and other wellness-focused items, necessitating a strategic adaptation of their product offerings.

In 2024, the global wellness market was valued at over $5.6 trillion, with significant growth projected in segments like healthy eating and preventative health. This trend underscores the importance for AMCON to explore diversification into health-related product categories to align with evolving consumer preferences.

Demographic shifts significantly impact AMCON's customer base. For instance, the aging population in many developed nations, projected to grow substantially by 2030, means a greater demand for convenient access to essential goods and potentially a need for specialized products. AMCON's strategy must consider how to best serve this growing segment.

Urbanization trends, with more people moving to cities, concentrate demand and create opportunities for optimized distribution. However, it also intensifies competition. AMCON needs to analyze urban growth patterns to ensure its retail locations and delivery networks are strategically positioned to capture these evolving urban markets, adapting product assortments to local tastes.

Migration patterns can also reshape local demand. As new communities form, AMCON must be agile in understanding their unique needs, whether it's specific product preferences or the demand for culturally relevant goods. This adaptability is key to maintaining market share and relevance in diverse, shifting community landscapes.

Societal attitudes toward tobacco use are undergoing a significant transformation, marked by a noticeable decline in social acceptance and a robust increase in anti-smoking initiatives. This evolving landscape directly impacts AMCON's core tobacco distribution operations, signaling a potential long-term decrease in sales volumes.

For instance, in the United States, the Centers for Disease Control and Prevention (CDC) reported that in 2022, approximately 11.5% of adults (28.3 million people) were current cigarette smokers. This figure represents a continued downward trend from previous years, underscoring the societal shift away from tobacco consumption. AMCON must proactively explore diversification avenues and develop strategies to effectively manage this shrinking market segment to ensure future resilience.

Convenience Culture and On-the-Go Consumption

The pervasive convenience culture significantly boosts sales for businesses like AMCON, particularly in convenience stores and quick-service food. Consumers increasingly prioritize speed and ease, driving demand for ready-to-eat meals and rapid shopping experiences. For instance, the global convenience store market was valued at approximately $2.7 trillion in 2023 and is projected to grow, reflecting this trend. AMCON's success hinges on its ability to align its product assortment and distribution networks with this demand for immediate gratification.

This shift impacts AMCON's product strategy and operational efficiency. The expectation of instant availability means AMCON must ensure its supply chain is robust and responsive.

- Convenience Store Growth: The U.S. convenience store industry reported over $800 billion in sales in 2023, with a significant portion attributed to food and beverages.

- On-the-Go Food Market: The market for ready-to-eat meals and grab-and-go options continues to expand, driven by busy lifestyles.

- Digital Integration: Consumers expect seamless online ordering and quick pickup or delivery options, further emphasizing the need for convenience.

Workforce Diversity and Employment Expectations

Societal expectations for diversity and inclusion significantly impact AMCON Distributing's talent acquisition and retention. In 2024, a significant majority of job seekers, particularly millennials and Gen Z, prioritize companies with strong diversity initiatives. Failure to demonstrate commitment to these values can hinder AMCON's ability to staff its distribution centers and retail locations effectively.

A company culture that champions fair labor practices and robust employee well-being programs is increasingly crucial for attracting and keeping skilled workers. This focus on employee support can directly translate into enhanced recruitment success and improved productivity within AMCON's operations. For instance, companies with high employee satisfaction often report lower turnover rates, a key factor for operational stability.

AMCON Distributing's ability to align with contemporary values around employee support and fair labor practices directly influences its operational stability. A positive workplace environment, demonstrably valuing diversity, can lead to a more engaged and productive workforce, mitigating risks associated with labor shortages and employee dissatisfaction. This is particularly relevant in the distribution sector, which often faces high demand and a competitive labor market.

Societal attitudes towards health and wellness are profoundly influencing consumer choices, leading to a decreased demand for traditional tobacco products. This shift, evidenced by the global wellness market exceeding $5.6 trillion in 2024, presents AMCON with a clear imperative to diversify its offerings into healthier alternatives like organic foods and wellness-focused items.

Demographic shifts, particularly the growing aging population and increasing urbanization, are reshaping AMCON's customer base and distribution strategies. By 2030, the aging demographic will demand more convenient access to goods, while urban concentration necessitates optimized logistics and localized product assortments to navigate intensified competition.

The increasing societal emphasis on diversity, inclusion, and fair labor practices directly impacts AMCON's talent acquisition and retention efforts. Companies prioritizing these values, as a majority of job seekers in 2024 do, are better positioned to attract and retain a skilled workforce, ensuring operational stability and mitigating risks in a competitive labor market.

Technological factors

The escalating adoption of e-commerce, particularly in grocery, significantly reshapes the retail landscape for AMCON. By the end of 2024, global e-commerce sales are projected to reach $7.0 trillion, a substantial portion of which includes consumer goods AMCON distributes.

This digital shift presents a dual challenge and opportunity. While intensifying competition for brick-and-mortar partners, it also creates avenues for AMCON to offer its distribution expertise to online retailers or assist its existing clients in bolstering their digital sales channels, a move critical for sustained relevance in 2025.

Advances in logistics technology are transforming how companies like AMCON Distributing operate. Think about warehouse automation, which uses robots to move goods, and sophisticated route optimization software that finds the quickest delivery paths. Real-time inventory tracking is also a game-changer, giving a clear, up-to-the-minute view of stock levels across the entire supply chain.

Implementing these technologies can dramatically boost AMCON's efficiency. For instance, improved route planning can cut fuel costs and delivery times. A report from McKinsey in 2024 highlighted that companies adopting advanced logistics tech saw an average of 10-15% reduction in transportation costs. This translates directly to better operational performance and a stronger bottom line.

By improving delivery speed and accuracy, AMCON can enhance customer satisfaction and reduce costly errors. Optimizing inventory levels means less capital tied up in stock and fewer instances of stockouts or overstocking. For example, companies leveraging AI-powered inventory management systems reported a 5-10% decrease in inventory holding costs in 2024, according to Supply Chain Dive.

Investing in these technological advancements isn't just about efficiency; it's about gaining a significant competitive edge. As of early 2025, the logistics technology market is projected to grow at a CAGR of over 12%, indicating a strong industry trend toward automation and data-driven optimization. AMCON's strategic adoption of these tools positions it to lead in a rapidly evolving marketplace.

Leveraging big data analytics is crucial for AMCON Distributing to gain deeper insights into consumer purchasing patterns and sales trends. For instance, in 2024, companies across retail sectors saw an average 15% increase in sales efficiency by implementing advanced analytics for demand forecasting.

This technology directly enables more informed decision-making for AMCON regarding product assortment, pricing, and inventory management. By analyzing vast datasets, AMCON can optimize stock levels, reducing carrying costs and minimizing stockouts, ultimately improving both profitability and customer satisfaction.

The adoption of data-driven strategies is paramount. In 2025, it's projected that businesses utilizing sophisticated business intelligence tools will outperform competitors by an estimated 10-12% in market share growth due to superior operational efficiency.

Point-of-Sale (POS) and Payment Technologies

Innovations in point-of-sale (POS) systems and payment technologies are significantly reshaping the retail landscape for AMCON Distributing's clients, including health product stores and convenience stores. The adoption of mobile payment options and contactless transactions, like Apple Pay and Google Pay, is becoming standard, with global contactless payment transaction volume projected to reach over $15 trillion by 2027. Staying abreast of these advancements is crucial for enhancing customer experience, speeding up checkout processes, and gathering valuable sales data.

These technological shifts directly influence AMCON's distribution strategy by requiring a focus on products compatible with modern payment infrastructures. For instance, the increasing prevalence of QR code payments in many Asian markets, exceeding 1.5 billion users in 2024, highlights the need for retailers to offer diverse payment methods to capture a wider customer base. Secure and efficient payment systems are no longer a luxury but a necessity for maintaining competitiveness and customer satisfaction in today's retail environment.

- Increased adoption of contactless payments: Global contactless payment transactions saw a significant surge, with estimates suggesting continued double-digit growth through 2025.

- Mobile payment integration: Mobile wallets are becoming a primary payment method for many consumers, driving demand for POS systems that seamlessly integrate these options.

- Data analytics from POS: Modern POS systems offer advanced analytics, providing retailers with insights into customer behavior and sales trends, which AMCON can leverage to better tailor its product offerings.

- Security and fraud prevention: Robust security features in payment technologies are paramount to protect both retailers and consumers from financial fraud.

Cybersecurity and Data Protection

AMCON Distributing's reliance on digital systems for inventory management, sales, and customer data makes cybersecurity a critical technological factor. Cyber threats, including ransomware and data breaches, present a substantial risk, potentially leading to significant financial losses and operational paralysis. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report.

Protecting sensitive customer and operational data is not just about preventing financial loss; it's fundamental to maintaining customer trust and brand reputation. Regulatory compliance, such as GDPR or CCPA, also mandates stringent data protection, with substantial fines for non-compliance. Failure to safeguard data can result in severe penalties and a loss of competitive advantage.

Robust cybersecurity measures are therefore essential for AMCON's business continuity and long-term viability. This includes investing in advanced threat detection, data encryption, regular security audits, and employee training. The increasing sophistication of cyberattacks in 2024 and projected into 2025 necessitates a proactive and adaptive approach to cybersecurity.

- Cybersecurity Threats: Ransomware attacks and data breaches are significant risks to AMCON's operations.

- Cost of Breaches: The global average cost of a data breach was $4.45 million in 2024, highlighting the financial impact.

- Customer Trust: Protecting sensitive information is crucial for maintaining customer confidence and brand integrity.

- Regulatory Compliance: Adherence to data protection laws is mandatory, with severe penalties for violations.

Technological advancements are fundamentally altering AMCON Distributing's operational landscape, particularly with the rapid growth of e-commerce and the sophisticated tools now available for logistics and data analysis. The increasing reliance on digital platforms for sales and inventory management also elevates the importance of robust cybersecurity measures to protect sensitive data and maintain operational integrity.

The integration of advanced logistics technologies, such as warehouse automation and route optimization, offers significant potential for efficiency gains, with companies adopting these tools seeing notable reductions in transportation costs. Furthermore, the proliferation of modern POS systems and diverse payment technologies necessitates AMCON's adaptation to ensure its clients can meet evolving consumer expectations for seamless transactions.

Leveraging big data analytics is crucial for AMCON to derive actionable insights into consumer behavior, enabling more precise demand forecasting and inventory optimization. This data-driven approach is projected to enhance market share growth for businesses that effectively utilize business intelligence tools.

| Technology Area | Key Trend | Impact on AMCON | 2024/2025 Data Point |

|---|---|---|---|

| E-commerce Adoption | Growth in online grocery sales | Expands distribution opportunities and competition | Global e-commerce sales projected to reach $7.0 trillion by end of 2024 |

| Logistics Technology | Automation and route optimization | Boosts operational efficiency, reduces costs | Companies adopting advanced logistics tech saw 10-15% reduction in transportation costs (McKinsey, 2024) |

| Data Analytics | Consumer purchasing pattern analysis | Informs product assortment, pricing, and inventory management | 15% average increase in sales efficiency via advanced analytics for demand forecasting (2024) |

| Payment Technologies | Contactless and mobile payments | Enhances customer experience, requires POS system integration | Global contactless payment transaction volume projected to exceed $15 trillion by 2027 |

| Cybersecurity | Data breaches and ransomware | Threatens operational continuity and customer trust | Global average cost of a data breach reached $4.45 million in 2024 (IBM) |

Legal factors

AMCON Distributing's deep engagement in tobacco distribution means it navigates a complex web of regulations and faces significant litigation risks tied to public health and marketing. Compliance with federal mandates, like those from the FDA, and state-level master settlement agreements is absolutely essential to avoid hefty fines and legal entanglements.

The legal landscape for tobacco is constantly evolving, with ongoing scrutiny of marketing tactics and product safety. For instance, in 2024, continued focus on reducing youth access to tobacco products could lead to new compliance burdens and potential legal challenges for distributors if oversight falters.

AMCON Distributing's operations, particularly in food, beverages, and health products, are heavily shaped by the Food and Drug Administration (FDA). The FDA mandates strict adherence to regulations covering product safety, accurate labeling, manufacturing processes, and distribution practices. For instance, the FDA's Food Safety Modernization Act (FSMA) continues to evolve, impacting supply chain oversight and preventive controls for food distributors.

Failure to comply with these FDA standards can result in severe repercussions. These include costly product recalls, substantial financial penalties, and significant damage to AMCON's brand reputation. In 2023, the FDA reported over $1.5 billion in recalls across various consumer product categories, highlighting the financial exposure for distributors.

To mitigate these risks, AMCON must maintain robust quality control systems and comprehensive compliance programs. This involves continuous monitoring of regulatory updates and ensuring all distribution partners uphold the highest standards. Proactive management of FDA compliance is critical for sustained business operations and consumer trust.

AMCON Distributing, as a significant employer, must navigate a complex web of federal and state labor laws. These regulations cover everything from minimum wage requirements, such as the federal minimum wage of $7.25 per hour which many states have exceeded, to workplace safety mandates enforced by OSHA. Failure to comply can lead to costly lawsuits and penalties, impacting operational continuity and potentially inviting unionization drives.

Ensuring adherence to anti-discrimination statutes and providing legally mandated employee benefits are also critical. For instance, the Affordable Care Act (ACA) requires employers with 50 or more full-time equivalent employees to offer health coverage. Maintaining fair and legally sound employment practices is therefore paramount for AMCON's stable operations and fostering positive employee relations.

Antitrust and Competition Law

AMCON Distributing, as a significant player in its distribution markets, must meticulously adhere to antitrust and competition laws. These regulations are designed to foster a level playing field, preventing any single entity from dominating through unfair practices like price fixing or market division. Failure to comply can lead to severe repercussions.

The company’s operations, particularly concerning pricing strategies and potential mergers or acquisitions, are scrutinized under these legal frameworks. For instance, in 2024, the Federal Trade Commission (FTC) continued its robust enforcement of antitrust laws, issuing numerous fines and blocking several large mergers across various sectors, signaling a heightened regulatory environment for major distributors.

- Fair Competition: AMCON must ensure its distribution practices do not stifle competition or create monopolies.

- Pricing Regulations: Adherence to laws preventing predatory pricing or price collusion is paramount.

- Merger Scrutiny: Any proposed acquisitions by AMCON will face rigorous review to assess their impact on market competition.

- Regulatory Penalties: Non-compliance can result in substantial fines and legal challenges, as demonstrated by ongoing FTC actions in 2024.

Data Privacy and Consumer Protection Laws

AMCON Distributing must navigate a complex landscape of data privacy and consumer protection laws. Compliance with regulations like the California Consumer Privacy Act (CCPA) and similar state-level legislation is paramount, given the company's collection of customer and operational data. Failure to adhere to these laws can result in significant penalties; for instance, CCPA violations can lead to fines of up to $7,500 per intentional violation as of 2024.

Maintaining robust data security protocols, transparent privacy policies, and clear consent mechanisms are essential not only to avoid these financial repercussions but also to foster and maintain consumer trust. The increasing emphasis on data governance underscores its critical role in AMCON's operations.

- CCPA Fines: Up to $7,500 per intentional violation in 2024.

- Consumer Trust: Directly impacted by data handling practices.

- Data Governance: Growing importance for regulatory compliance and operational integrity.

- State-Specific Laws: AMCON must monitor and comply with diverse privacy regulations across operating states.

AMCON Distributing faces significant legal challenges stemming from its tobacco distribution activities, requiring strict adherence to federal and state regulations, including Master Settlement Agreements. The evolving legal environment, particularly concerning youth access and marketing practices, presents ongoing compliance demands and potential litigation risks, as seen with increased scrutiny in 2024.

Furthermore, the company's operations in food, beverages, and health products are governed by FDA regulations, impacting product safety, labeling, and supply chain management, with the Food Safety Modernization Act (FSMA) continuously shaping compliance requirements. Non-compliance with these mandates can lead to costly recalls and penalties, with the FDA reporting over $1.5 billion in recalls in 2023, underscoring the financial exposure.

AMCON must also navigate labor laws, ensuring compliance with wage, safety, and benefits mandates like the Affordable Care Act, to avoid lawsuits and maintain stable operations. Additionally, the company is subject to antitrust laws, with the FTC actively enforcing these regulations in 2024, scrutinizing pricing and potential mergers to ensure fair competition.

Data privacy laws, such as the CCPA, impose strict requirements on data handling, with potential fines of up to $7,500 per intentional violation in 2024, making robust data governance and consumer trust paramount.

Environmental factors

AMCON Distributing's operations, spanning distribution and retail, inevitably produce substantial waste, from packaging and unsaleable inventory to everyday refuse. Navigating the complex web of local and federal waste disposal and recycling mandates is a critical operational requirement for the company.

For instance, in 2024, the U.S. Environmental Protection Agency reported that commercial and institutional sources accounted for approximately 47% of the total municipal solid waste generated. AMCON must adhere to regulations that govern how this waste is handled and processed, impacting logistics and operational costs.

By proactively adopting sustainable waste management strategies, such as optimizing packaging to reduce material usage and enhancing recycling programs, AMCON can achieve cost savings and bolster its environmental credentials. This commitment can also significantly improve its public perception, a valuable asset in today's environmentally conscious market.

AMCON Distributing's operations, from its warehouses and distribution centers to its vehicle fleet, directly contribute to its energy consumption and carbon footprint. For instance, in 2024, the logistics sector globally saw a significant increase in discussions around Scope 1 and Scope 2 emissions, with companies like AMCON facing scrutiny. This means the electricity used in facilities and fuel burned by trucks are key areas of environmental impact.

As environmental regulations tighten and stakeholder expectations rise, AMCON may need to invest in greener solutions. This could involve adopting energy-efficient technologies in its warehouses, exploring renewable energy sources for its facilities, and optimizing its vehicle fleet to reduce fuel use and emissions. For example, many distributors are now evaluating electric vehicle (EV) options for their last-mile deliveries, a trend expected to accelerate through 2025.

Ultimately, measuring and actively reducing its environmental impact is evolving from a voluntary initiative to a core business necessity for AMCON. Companies that proactively address their carbon footprint often find benefits in cost savings through efficiency and enhanced brand reputation among increasingly eco-conscious consumers and business partners.

AMCON Distributing faces increasing pressure from consumers and regulators to ensure its supply chain operates sustainably. This means AMCON will likely need to verify that its suppliers are committed to ethical labor and environmentally sound practices. For instance, a growing number of consumers, particularly millennials and Gen Z, are willing to pay more for products from companies with transparent and sustainable supply chains. A 2024 survey indicated that over 60% of consumers consider sustainability when making purchasing decisions.

To meet these demands, AMCON may need to implement stricter supplier vetting processes, focusing on environmental impact assessments and ethical certifications. Promoting eco-friendly products and actively working to reduce the carbon footprint across its distribution network, from manufacturing partners to last-mile delivery, will become crucial. The company could explore options like using recycled packaging materials, optimizing logistics to reduce fuel consumption, and partnering with suppliers who utilize renewable energy sources. The global sustainable packaging market, for example, was valued at over $250 billion in 2023 and is projected to grow significantly, presenting both challenges and opportunities for AMCON.

Traceability and transparency are paramount in this evolving landscape. AMCON will likely need to invest in technologies that allow for clear tracking of products and materials from origin to consumer. This could involve blockchain solutions or robust data management systems to provide verifiable proof of sustainable sourcing. Companies that can demonstrate this level of transparency are often rewarded with greater customer loyalty and a stronger brand reputation. In 2025, reports suggest that supply chain visibility is a top priority for over 70% of businesses aiming to improve their sustainability efforts.

Climate Change and Extreme Weather Impacts

Climate change poses significant physical risks to AMCON Distributing. More frequent extreme weather events, such as hurricanes and floods, can severely disrupt supply chains, damage critical infrastructure like warehouses, and impede transportation networks. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate weather and climate disasters each with losses exceeding $1 billion, totaling over $170 billion in damages. This highlights the tangible threat to operations.

To counter these threats, AMCON must prioritize developing resilient supply chain strategies and robust contingency plans. This includes diversifying suppliers, exploring alternative transportation routes, and investing in weather-resilient infrastructure. Proactive adaptation is not just a defensive measure but a strategic imperative for ensuring business continuity and minimizing financial losses in the face of escalating climate volatility.

- Supply Chain Disruption: Extreme weather can halt the movement of goods, leading to stockouts and increased costs.

- Infrastructure Damage: Facilities are vulnerable to damage from severe storms, requiring costly repairs or rebuilding.

- Transportation Delays: Flooded roads, damaged bridges, and extreme heat impacting road surfaces can significantly slow down deliveries.

- Increased Operational Costs: Businesses may face higher insurance premiums, increased energy costs for climate control, and expenses related to disaster recovery.

Water Usage and Conservation

AMCON Distributing's facilities, like many businesses, consume water for operations and cleaning, which can attract regulatory attention, especially in areas facing water scarcity. For instance, in 2024, several Western U.S. states continued to implement stricter water usage guidelines for commercial entities, impacting operational planning.

Adopting water conservation strategies presents a dual benefit for AMCON. Not only can it lead to reduced utility expenses, potentially lowering overhead costs, but it also bolsters the company's image as an environmentally conscious organization. This is increasingly important as consumers and business partners prioritize sustainability in their choices.

Efficiently managing water resources aligns with broader corporate sustainability objectives. By implementing measures such as low-flow fixtures or water recycling systems, AMCON can demonstrate a commitment to responsible resource utilization, a key component of modern environmental, social, and governance (ESG) frameworks.

- Regulatory Scrutiny: Water usage in commercial facilities is increasingly subject to local and regional regulations, particularly in drought-prone areas.

- Cost Reduction: Implementing water-saving technologies can directly reduce operational expenses related to water consumption and wastewater treatment.

- Enhanced Reputation: Demonstrating water conservation efforts can improve brand image and appeal to environmentally conscious customers and investors.

- Sustainability Alignment: Water management is a critical aspect of a comprehensive corporate sustainability strategy, contributing to overall ESG performance.

AMCON Distributing's environmental impact is multifaceted, encompassing waste generation, energy consumption, supply chain sustainability, and water usage.

The company faces increasing regulatory scrutiny and consumer demand for greener practices, necessitating proactive strategies in waste management, emissions reduction, and responsible sourcing.

Climate change also presents tangible risks, requiring AMCON to build resilience into its operations and supply chains to mitigate disruptions and financial losses.

| Environmental Factor | 2024/2025 Data/Trend | Impact on AMCON |

|---|---|---|

| Waste Management | Commercial waste accounts for ~47% of municipal solid waste (US EPA 2024). | Compliance with disposal/recycling mandates, operational costs. |

| Energy Consumption & Emissions | Logistics sector facing scrutiny over Scope 1 & 2 emissions (2024). EV adoption for last-mile delivery accelerating (through 2025). | Need for energy-efficient tech, renewable sources, fleet optimization (e.g., EVs). |

| Supply Chain Sustainability | >60% of consumers consider sustainability in purchasing (2024). Supply chain visibility a top priority for >70% of businesses (2025). Global sustainable packaging market >$250B (2023). | Supplier vetting for ethical/environmental practices, promoting eco-friendly products, transparency. |

| Climate Change Risks | 28 US weather/climate disasters >$1B in 2023 (NOAA), totaling >$170B. | Supply chain disruption, infrastructure damage, transportation delays, increased operational costs. |

| Water Usage | Stricter water usage guidelines for commercial entities in some US regions (2024). | Potential for reduced utility expenses, enhanced brand reputation, alignment with ESG. |

PESTLE Analysis Data Sources

Our AMCON Distributing PESTLE Analysis is meticulously crafted using data from reputable sources including government economic reports, industry-specific market research, and analyses of current technological advancements. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting AMCON.