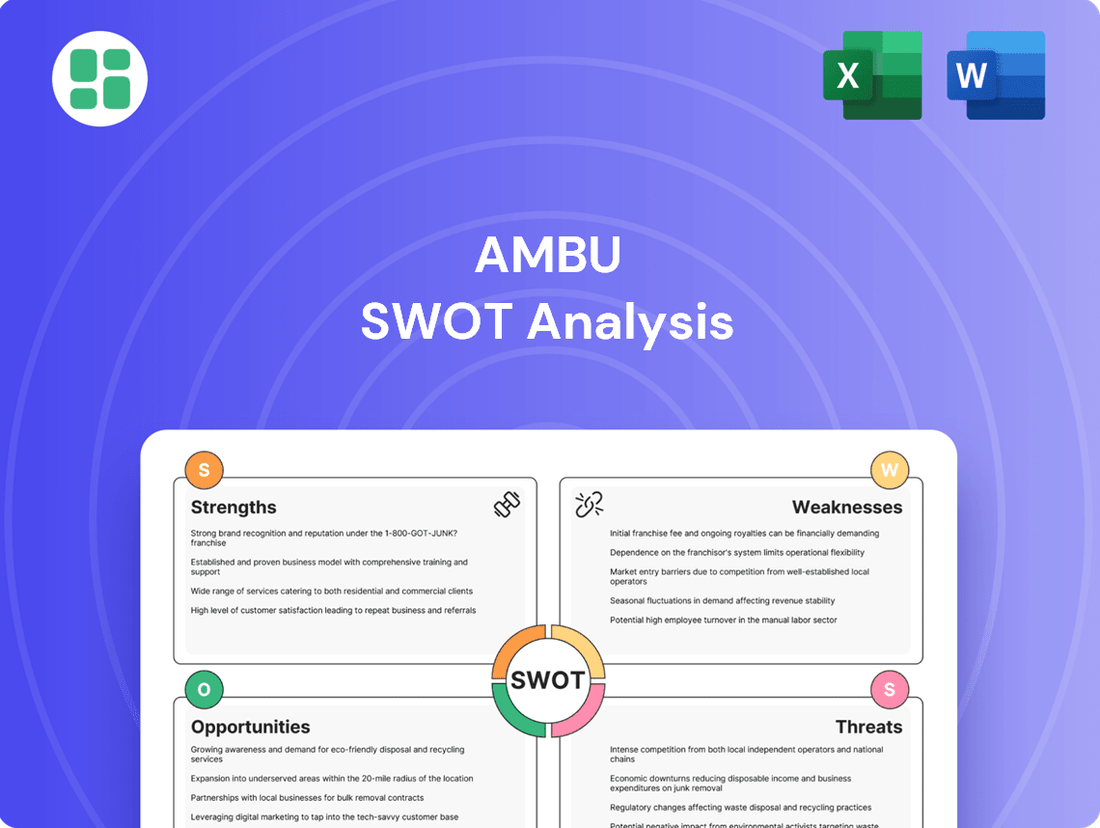

Ambu SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambu Bundle

Ambu's innovative product pipeline and strong brand reputation are key strengths, but they also face intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for any strategic decision-maker.

Want the full story behind Ambu's market position, potential threats, and opportunities for expansion? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning and investment strategies.

Strengths

Ambu's established market leadership in single-use endoscopy, a segment it pioneered in 2009, is a significant strength. This position is underscored by impressive sales figures, with over 1.5 million patients treated with Ambu's single-use endoscopes in the past year. This volume surpasses the combined total of all other single-use endoscopy competitors, highlighting Ambu's dominant market share.

The company's strategic focus on eliminating cross-contamination risks and reducing hospital-acquired infections (HAIs) directly addresses critical healthcare concerns. This commitment resonates in a market that is increasingly prioritizing patient safety and infection control, providing Ambu with a strong competitive advantage and growth potential.

Ambu has showcased impressive financial strength, achieving 11.7% organic revenue growth and a 14.4% EBIT margin before special items in the second quarter of fiscal year 2024/25. This performance highlights the company's ability to generate substantial revenue and maintain healthy profitability.

The company's financial outlook for 2024/25 has been consistently revised upwards, indicating strong confidence in its ongoing growth trajectory. Ambu now anticipates organic revenue growth to fall between 11% and 14%, with an EBIT margin before special items projected at 13% to 15%.

This upward revision in guidance is a testament to Ambu's solid operational execution and market positioning. The positive financial momentum is being propelled by robust growth across its key business segments, specifically Endoscopy Solutions and Anaesthesia & Patient Monitoring.

Ambu's commitment to innovation is a significant strength, demonstrated by a robust pipeline and ongoing product launches. The company is investing heavily in research and development to bring cutting-edge solutions to market. This focus ensures Ambu remains at the forefront of medical technology.

Recent advancements highlight this strategy, with the introduction of the Ambu® SureSight™ Connect video laryngoscopy solution in 2024. Furthermore, Ambu expanded its urology offerings with products like the Ambu® aScope™ 5 Uretero, showcasing a dedication to broadening its impact across critical medical fields.

These continuous introductions of advanced solutions across pulmonology, ENT, urology, and GI segments underscore Ambu's dedication to improving patient care and streamlining clinical workflows. This proactive approach to product development is a key differentiator.

Focus on Patient Safety and Infection Control

Ambu's core business model is built around improving patient safety and lowering healthcare expenses by offering single-use medical devices. This focus directly addresses the increasing global emphasis on infection control, particularly concerning healthcare-associated infections (HAIs). The company's disposable products bypass the need for expensive and time-consuming reprocessing, thereby substantially minimizing the risk of cross-contamination, a critical factor in modern healthcare settings.

The demand for effective infection prevention strategies is a significant tailwind for Ambu. For instance, the World Health Organization (WHO) highlights that HAIs affect millions of patients annually, leading to increased morbidity, mortality, and substantial economic burdens. Ambu's single-use solutions offer a direct response to this challenge.

- Reduced HAI Risk: Ambu's single-use devices eliminate the risk of pathogen transmission associated with reusable equipment reprocessing.

- Cost Efficiency: By removing reprocessing steps, Ambu's products can lead to lower overall operational costs for hospitals.

- Market Demand: Growing awareness of infection control benefits Ambu's product portfolio, aligning with global healthcare priorities.

Diversified Product Portfolio Across Key Medical Segments

Ambu's strength lies in its broad range of diagnostic and life-supporting medical devices spanning critical areas like pulmonology, gastroenterology, urology, ENT, anesthesia, and patient monitoring. This extensive product diversification acts as a natural risk buffer, reducing dependence on any single product category and opening up various growth avenues.

The Endoscopy Solutions business is a significant driver of Ambu's expansion, with all four of its endoscopy segments showing positive contributions. For instance, in the first half of fiscal year 2024, Ambu reported a 10% growth in its Endoscopy Solutions, reaching DKK 1.1 billion. This segment's consistent performance underscores the company's strategic advantage in offering a comprehensive suite of endoscopic solutions.

- Broad Medical Segment Coverage: Ambu addresses multiple high-demand medical fields, reducing market-specific risks.

- Endoscopy Growth Engine: The Endoscopy Solutions business, a key contributor, saw a 10% revenue increase in H1 FY24.

- Diversified Revenue Streams: The company benefits from multiple product lines, enhancing financial stability.

- Mitigated Product Line Risk: Reliance on a single product is minimized, allowing for resilience against market shifts.

Ambu's market leadership in single-use endoscopy, a segment it pioneered, is a clear strength, treating over 1.5 million patients with its endoscopes in the past year. This dominance is further bolstered by strong financial performance, including 11.7% organic revenue growth and a 14.4% EBIT margin before special items in Q2 FY24/25, with upwardly revised guidance for the full fiscal year.

The company's commitment to innovation is evident in its robust product pipeline and recent launches, such as the Ambu® SureSight™ Connect video laryngoscopy solution in 2024 and the Ambu® aScope™ 5 Uretero, expanding its reach across critical medical fields like pulmonology, ENT, urology, and GI.

Ambu's business model, centered on single-use medical devices, directly addresses the critical healthcare need for infection prevention, particularly against healthcare-associated infections (HAIs). This focus aligns with global priorities, offering cost efficiencies and reduced cross-contamination risks.

The company benefits from a diversified product portfolio across multiple medical segments, including pulmonology, gastroenterology, urology, ENT, anesthesia, and patient monitoring. The Endoscopy Solutions business, a key growth driver, saw a 10% revenue increase in H1 FY24, contributing significantly to financial stability.

| Metric | Value (Q2 FY24/25) | Outlook (FY24/25) |

|---|---|---|

| Organic Revenue Growth | 11.7% | 11% - 14% |

| EBIT Margin (before special items) | 14.4% | 13% - 15% |

| Patients Treated with Single-Use Endoscopes (Past Year) | >1.5 Million | N/A |

| Endoscopy Solutions Revenue Growth (H1 FY24) | 10% | N/A |

What is included in the product

Delivers a strategic overview of Ambu’s internal and external business factors, highlighting its strengths in product innovation and market leadership, while also addressing weaknesses in production capacity and opportunities for expansion into new markets, alongside threats from competitor pricing and regulatory changes.

Offers a clear, actionable framework to identify and address Ambu's core challenges and opportunities.

Weaknesses

Ambu faces significant headwinds from ongoing geopolitical instability and broader financial uncertainties. For instance, persistent inflationary pressures, particularly on raw materials, energy, and logistics, directly impact Ambu's cost of goods sold and overall profitability. These external forces, which have been a consistent theme throughout 2024 and are projected to continue into 2025, necessitate robust risk management strategies.

The company's reliance on a global supply chain makes it particularly susceptible to disruptions arising from international conflicts or trade policy shifts. These external factors can lead to unexpected increases in operating expenses, potentially squeezing Ambu's profit margins if not effectively mitigated. While Ambu has implemented measures to manage these challenges, their persistent nature remains a key weakness.

Ambu has faced challenges with rising inventory levels, as highlighted in its Q1 and Q2 2024/25 interim reports. While some of this increase stems from strategic stocking for upcoming product introductions, elevated inventory inherently ties up significant capital.

This capital immobilization can strain free cash flow in the immediate term and introduces potential risks. Higher holding costs are a direct consequence, and there's also the possibility of inventory becoming obsolete if market demand doesn't align with projections, leading to potential write-downs.

While the endoscopy market generally shows robust growth, Ambu experienced a noticeable slowdown in specific segments during the second quarter of fiscal year 2024/2025. Pulmonology, for instance, saw slower organic growth, partly attributed to the timing of customer orders.

Furthermore, key areas such as urology, ear, nose, and throat (ENT), and gastroenterology (GI) also reflected a deceleration compared to preceding quarters. This temporary dip in certain crucial segments, even with Ambu's confidence in their eventual return to stronger growth trajectories, could potentially affect the company's overall segment performance and how market analysts perceive its progress.

Reliance on Price Increases for Growth in Anaesthesia & Patient Monitoring

Ambu's Anaesthesia & Patient Monitoring segment has seen its growth bolstered by price increases. For instance, in the first half of fiscal year 2024, this segment reported a 10% revenue growth, with price adjustments contributing significantly to this figure.

However, relying heavily on price hikes for sustained growth presents a risk. Such a strategy could encounter market pushback or intensified competition if not matched by substantial volume increases or clear product innovation. The current visibility on strong volume growth drivers for this segment remains limited, making this reliance a potential weakness.

- Price-driven growth: Anaesthesia & Patient Monitoring revenue in H1 FY24 saw a 10% increase, partly due to price adjustments.

- Market resistance risk: Continued reliance on price increases could alienate customers or attract more aggressive competitors.

- Volume growth uncertainty: The segment's ability to achieve significant volume growth to offset potential price sensitivity is not yet clearly demonstrated.

Initial Revenue Contributions from New Launches are Gradual

Ambu's new product launches, while promising, often experience a gradual ramp-up in revenue. For instance, the video laryngoscopy and ureteroscopy solutions are currently in their early stages of market introduction. This means their immediate financial impact is limited, requiring time to gain market traction and achieve significant sales volumes.

This lag between significant R&D investment and substantial revenue generation can create pressure on short-term financial performance metrics. Investors and stakeholders often look for quicker returns, making this gradual revenue build-up a notable weakness.

- Gradual Revenue Ramp-Up: New products like video laryngoscopy and ureteroscopy are in initial launch phases, leading to slow initial revenue contributions.

- Time to Market Impact: It takes time for new solutions to penetrate markets and generate substantial sales, impacting short-term financial results.

- R&D Investment Lag: The delay between investing in innovation and seeing significant revenue can pose a challenge for Ambu's financial reporting.

Ambu's financial performance is susceptible to external economic pressures, with inflation impacting raw material costs and supply chain disruptions adding to operational expenses. For example, the company noted in its Q1 2024/25 update that persistent inflation was a key factor affecting its cost of goods sold. This vulnerability to global economic volatility remains a significant concern, potentially eroding profit margins if not effectively managed.

The company's inventory levels have also presented a challenge, with a notable increase observed in the first half of fiscal year 2024/2025. While some of this is strategic for new product introductions, elevated inventory ties up capital and incurs higher holding costs, creating potential risks of obsolescence and impacting free cash flow.

Ambu's revenue growth in certain key segments, such as pulmonology, urology, ENT, and GI, experienced a deceleration in Q2 FY2024/2025 compared to previous periods. This slowdown, even if temporary, can affect overall segment performance and investor perception of the company's growth trajectory.

The Anaesthesia & Patient Monitoring segment's reliance on price increases for growth, which contributed significantly to its 10% revenue growth in H1 FY24, poses a risk. Without strong accompanying volume growth, this strategy could face market resistance or increased competition.

| Segment | H1 FY24 Revenue Growth | Key Driver | Potential Weakness |

|---|---|---|---|

| Anaesthesia & Patient Monitoring | 10% | Price Increases | Market resistance, limited volume growth visibility |

| Pulmonology | Slowdown in Q2 FY24/25 | Timing of customer orders | Potential impact on overall segment performance |

| Urology, ENT, GI | Deceleration in Q2 FY24/25 | Market dynamics | Affecting overall segment performance |

What You See Is What You Get

Ambu SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global market for disposable endoscopes is expanding rapidly, fueled by a heightened focus on preventing healthcare-associated infections and boosting patient safety. This trend presents a significant opportunity for companies like Ambu, as healthcare facilities are increasingly turning to single-use solutions to streamline operations and reduce infection risks.

The disposable endoscopes market is expected to grow substantially, projected to reach USD 5.74 billion by 2032, up from USD 2.65 billion in 2024. This robust growth indicates a strong market appetite for Ambu's single-use endoscope offerings.

Ambu can significantly boost its market penetration by targeting emerging economies within its existing geographic footprint, such as Southeast Asia and parts of Eastern Europe, where healthcare infrastructure is rapidly developing. This expansion could tap into a substantial, underserved patient population.

Further growth opportunities lie in diversifying Ambu's customer base beyond traditional hospital settings. Exploring direct-to-consumer channels for certain product lines or focusing on home healthcare providers could unlock new revenue streams. For instance, the increasing demand for remote patient monitoring solutions presents a fertile ground.

Within the core Ambu bag market, specializing in high-need niches like pediatric and neonatal resuscitation offers a strategic advantage. These specialized segments often require tailored product features and can command premium pricing, reflecting the critical nature of their application.

Ambu's commitment to research and development is a significant opportunity, enabling the company to broaden its product range and incorporate advanced technologies such as AI-driven diagnostics and enhanced imaging. This focus on innovation allows Ambu to stay ahead of clinical demands.

The successful development of new products, including video laryngoscopy and sophisticated ureteroscopy devices, further solidifies Ambu's market position. These advancements directly address unmet clinical needs and demonstrate the company's capacity for creating value.

By consistently bringing novel solutions to market, Ambu is well-positioned to secure a greater share of the global medical device market. For instance, Ambu's 2023 financial report highlighted a strong performance in its Visualization segment, driven by its single-use endoscope portfolio, indicating successful market penetration through technological advancement.

Leveraging Sustainability Initiatives

Ambu's dedication to sustainability offers a significant opportunity. Their 'Recircle' program, which focuses on collecting and recycling used endoscopes, directly addresses environmental concerns. This initiative not only bolsters Ambu's brand image but also aligns with the increasing demand from healthcare providers for eco-conscious solutions.

By developing and promoting innovative methods to reduce its carbon footprint, Ambu can carve out a distinct market position. This strategic alignment with customer sustainability goals is becoming a key differentiator in the healthcare sector. For instance, the integration of bioplastic materials into endoscope handles further underscores this commitment.

- Enhanced Brand Reputation: Ambu's 'Recircle' program and use of bioplastics appeal to environmentally conscious healthcare providers.

- Market Differentiation: Innovative sustainability practices set Ambu apart from competitors.

- Meeting Customer Demands: Aligning with healthcare providers' sustainability goals opens new market avenues.

- Reduced Environmental Impact: Initiatives like endoscope recycling contribute to a circular economy in healthcare.

Strategic Acquisitions and Partnerships

Ambu's improved financial health, evidenced by its recent fiscal performance, positions it advantageously for strategic growth. This includes actively seeking acquisitions or partnerships that align with its long-term vision, potentially enhancing its technological capabilities or expanding its global footprint.

The company's capacity to invest in external opportunities, possibly leveraging its strengthened balance sheet from 2024, allows for targeted M&A activities. These moves could integrate complementary technologies or provide access to new market segments, thereby accelerating Ambu's strategic objectives.

Strategic collaborations are key to bolstering Ambu's competitive standing. By partnering with other innovators or established players, Ambu can foster a more dynamic environment for product development and market penetration, ultimately driving innovation and creating synergistic value.

Ambu's strategic acquisition and partnership opportunities are amplified by its robust financial standing, with a focus on expanding its product portfolio and market reach. For instance, in the first half of fiscal year 2023-2024, Ambu reported a significant improvement in its operating profit, creating a stronger foundation for such strategic initiatives.

- Strategic Acquisitions: Pursuing companies with innovative technologies or established market presence to accelerate growth.

- Partnerships: Collaborating with other healthcare entities to co-develop solutions or expand distribution networks.

- Technology Expansion: Acquiring or partnering for advanced technologies that complement Ambu's existing product lines, such as AI-driven diagnostics or novel material science.

- Market Reach: Forming alliances or acquiring businesses to gain access to new geographical markets or customer segments, particularly in emerging economies.

Ambu's focus on innovation, particularly in single-use endoscopes, positions it to capitalize on the growing global market. The company's commitment to R&D, evidenced by new product launches like video laryngoscopy, directly addresses unmet clinical needs and strengthens its market position. Ambu's ability to introduce novel solutions consistently allows it to capture a larger share of the medical device market, as seen in its Visualization segment performance in FY23.

Threats

The disposable endoscope market, Ambu's core area, is exceptionally competitive. Established giants like Olympus and Boston Scientific are relentless innovators, constantly pushing the boundaries of what's possible. This means Ambu must continually invest in R&D to keep pace, which can strain resources.

Adding to this pressure, Ambu is encountering a growing challenge from Chinese manufacturers entering the U.S. market. These new entrants often compete aggressively on price, potentially eroding Ambu's market share and impacting its profitability. For instance, in 2023, the U.S. market saw a noticeable uptick in offerings from Chinese medical device companies, signaling a shift in the competitive dynamics.

Ongoing geopolitical tensions, such as the conflict in Ukraine and broader trade disputes, continue to disrupt global supply chains. This instability directly fuels cost inflation, impacting Ambu's procurement of essential raw materials and components. For instance, the global inflation rate averaged 7.1% in 2023, a significant increase from prior years, directly affecting input costs for medical device manufacturers like Ambu.

The volatile macroenvironment translates into unpredictable energy prices and elevated logistics expenses. These rising operational costs can put pressure on Ambu's bottom line, potentially squeezing profit margins. Companies like Ambu must therefore implement robust pricing strategies and maintain strict cost discipline to mitigate these external economic headwinds and preserve profitability in the face of persistent inflation.

Ambu operates in a highly regulated sector, facing stringent and continually changing medical device regulations globally. For instance, the European Union's Medical Device Regulation (MDR) has significantly increased scrutiny and compliance burdens since its full application in May 2021, impacting market access and product lifecycle management for all device manufacturers, including Ambu.

Adapting to new requirements, such as those concerning cybersecurity for connected devices or the emerging regulatory landscape for artificial intelligence in healthcare, poses a substantial challenge. These shifts can directly affect Ambu's product development timelines and necessitate costly updates to existing products to ensure ongoing market compliance.

Failure to adhere to these evolving standards can result in severe consequences. In 2023, regulatory bodies worldwide issued numerous fines and recalls for non-compliant medical devices, underscoring the financial and reputational risks associated with regulatory missteps. For Ambu, such non-compliance could lead to delayed product launches or even market withdrawal, impacting revenue and growth prospects.

Supply Chain Disruptions

Supply chain disruptions, encompassing raw material shortages, shipping delays, and manufacturing issues, present a considerable threat to medical device manufacturers like Ambu. These disruptions can hinder Ambu's operational continuity, potentially leading to delayed sales and shipments to clients, which in turn impacts revenue and customer satisfaction.

For instance, the global supply chain faced significant strain in 2023 and early 2024, with many industries, including medical devices, experiencing extended lead times for critical components. Ambu's reliance on a global network for its single-use endoscopes and other products makes it particularly vulnerable to these widespread logistical challenges.

- Raw Material Volatility: Fluctuations in the availability and cost of essential materials like plastics and specialized metals can directly affect production efficiency and Ambu's cost of goods sold.

- Logistical Bottlenecks: Port congestion and reduced air freight capacity, which persisted through much of 2023, can delay the delivery of finished goods to Ambu's international customer base.

- Manufacturing Dependencies: Reliance on specific manufacturing partners or regions for key components means that localized production issues can have a ripple effect across Ambu's entire product portfolio.

Cybersecurity Risks

Ambu faces significant cybersecurity risks due to the increasing interconnectedness of its medical devices and reliance on sophisticated IT infrastructure. A successful cyberattack could severely disrupt Ambu's operations, impacting product delivery and its market position. Furthermore, breaches could compromise sensitive patient data, leading to severe regulatory penalties and reputational damage.

The threat landscape is evolving rapidly, with cybercriminals targeting healthcare organizations. For instance, the global cost of healthcare data breaches reached an average of $10.10 million in 2023, highlighting the financial implications. Ambu must invest heavily in robust cybersecurity measures to protect its systems and data from these escalating threats.

Regulatory scrutiny regarding medical device cybersecurity is intensifying. Agencies worldwide are implementing stricter guidelines, requiring manufacturers like Ambu to demonstrate comprehensive security protocols. Failure to comply can result in product recalls, fines, and market access restrictions, adding another layer of pressure.

Key cybersecurity threats for Ambu include:

- Ransomware attacks that could lock down critical operational systems.

- Data breaches compromising patient health information and proprietary company data.

- Denial-of-service attacks disrupting the availability of connected medical devices.

Ambu faces intense competition from established players like Olympus and Boston Scientific, requiring continuous R&D investment. Emerging Chinese manufacturers are also entering the U.S. market, often with lower prices, potentially impacting Ambu's market share and profitability.

Geopolitical instability and global inflation, which averaged 7.1% in 2023, increase raw material and logistics costs. This volatile macroenvironment, including unpredictable energy prices, puts pressure on Ambu's profit margins.

Ambu must navigate stringent and evolving medical device regulations, such as the EU's MDR, which increased compliance burdens. Adapting to new requirements for cybersecurity and AI in healthcare can delay product development and necessitate costly updates.

Supply chain disruptions, including component shortages and shipping delays, pose a significant threat. Extended lead times for critical components, a trend observed through 2023 and early 2024, can hinder Ambu's operations and impact revenue.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Ambu's official financial reports, comprehensive market research, and insights from industry experts to provide a well-rounded strategic perspective.