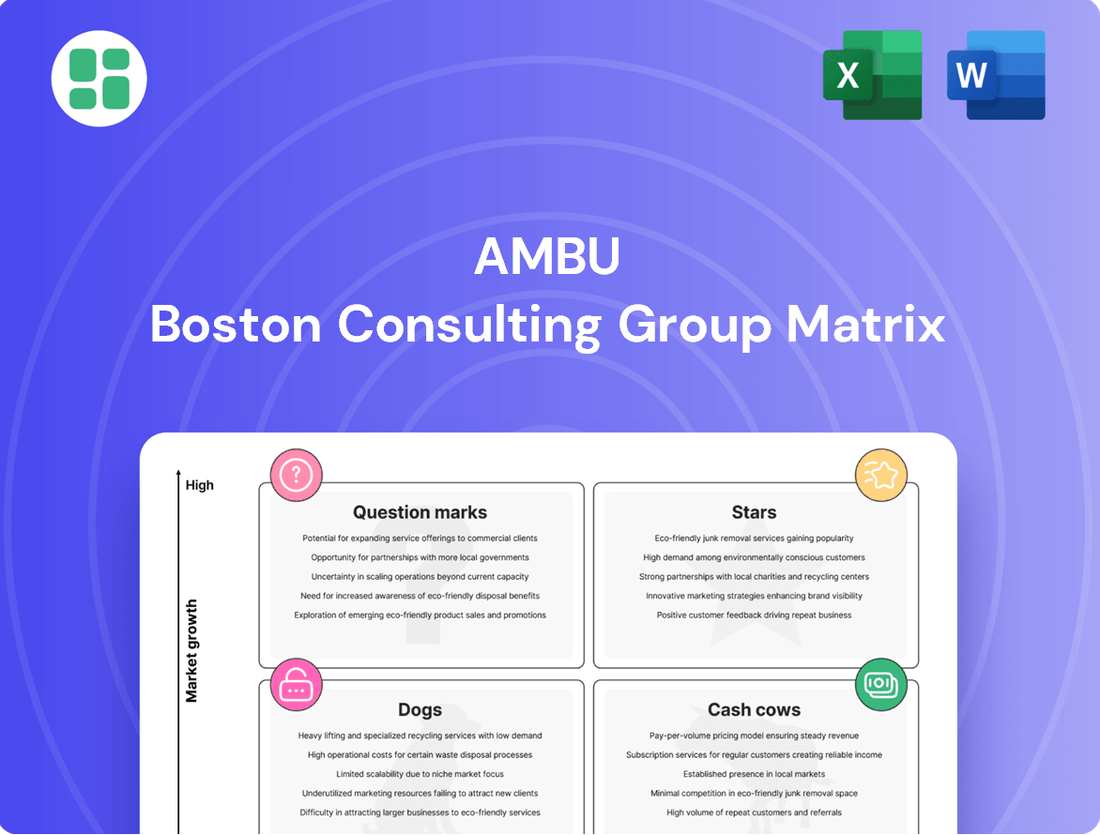

Ambu Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambu Bundle

Uncover the strategic positioning of this company's product portfolio with the Ambu BCG Matrix. See which products are driving growth and which might be holding the business back.

Ready to transform this insight into action? Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant placements and actionable strategies to optimize your investments and product development.

Stars

Ambu's single-use endoscopy portfolio, especially its advanced generations, is a clear Star in its BCG matrix. This segment is the company's primary driver of growth, demonstrating impressive organic revenue increases. For instance, in the first half of fiscal year 2024/25, Ambu achieved a 16.7% organic growth in this area.

The market for single-use endoscopes is booming, fueled by the critical need for infection control and operational efficiency. Projections indicate this market will reach $2.5 billion by 2025 and expand at a compound annual growth rate of 16.4% through 2034. Ambu's strong position within this rapidly growing market solidifies its status as a Star.

Ambu's Urology Endoscopy Solutions are a shining example of a Star in their BCG Matrix. This segment is experiencing robust, sustained organic growth, with the broader Urology, ENT & GI division achieving an impressive 23.9% organic growth in the first quarter of fiscal year 2024/25. This performance highlights the strong market demand and Ambu's competitive edge in this critical medical field.

The company's commitment to innovation is evident with recent product advancements. The Ambu® aScope™ 5 Uretero and Ambu® aScope™ 5 Cysto HD have secured both FDA clearance and CE marks. These clearances are crucial for market access and signal Ambu's success in developing cutting-edge solutions for the urology market, a sector known for its high growth potential.

Looking ahead, Ambu has set an ambitious target for this business group to consistently achieve organic growth rates exceeding 20%. This objective is well-supported by their advanced product portfolio, which is designed to meet the evolving needs of urologists and improve patient care through enhanced endoscopic procedures.

ENT Endoscopy Solutions are a shining Star for Ambu, driving substantial double-digit organic revenue growth. This segment, alongside urology, demonstrates robust market adoption and consistent new customer acquisition globally. Ambu is strategically expanding its offerings in ENT, building upon its existing, successful platform.

Advanced Pulmonology Endoscopy (e.g., aScope 5 Broncho)

Ambu's advanced pulmonology endoscopes, exemplified by the aScope 5 Broncho, are positioned as Stars in the BCG Matrix. This classification stems from their robust market standing and ongoing uptake by healthcare providers.

The pulmonology sector demonstrated impressive performance, achieving 17.7% organic growth in the first quarter of fiscal year 2024/25. This segment remains a significant driver of the Endoscopy Solutions division's overall high growth trajectory.

Ambu has solidified its leadership in the single-use bronchoscope market through consistent innovation. This commitment ensures their continued relevance in a critical medical field.

- Market Position: Strong, driven by innovation and adoption.

- Growth Rate: 17.7% organic growth in Q1 2024/25 for pulmonology.

- Contribution: Key driver for Endoscopy Solutions' high growth.

- Competitive Advantage: Long-standing lead in single-use bronchoscopes.

Integrated Digital Endoscopy Systems (e.g., aView 2 Advance, aBox 2)

Ambu's integrated digital endoscopy systems, like the aView 2 Advance and aBox 2, are crucial components of its product strategy, particularly within the context of the BCG Matrix. These systems are designed to work seamlessly with Ambu's single-use endoscopes, enhancing their functionality and market appeal. Their role is to bolster the performance of these high-growth disposable products.

These advanced systems offer full-HD imaging capabilities and robust connectivity, acting as the essential infrastructure that elevates the user experience and clinical utility of Ambu's single-use endoscopes. By providing superior visualization and streamlined integration, they directly contribute to the adoption and success of the disposable scope portfolio, a key growth driver for Ambu.

The introduction of these integrated systems supports Ambu's position in the market by optimizing clinical workflows and improving patient care through enhanced diagnostic accuracy and efficiency. This focus on advanced, user-friendly technology solidifies Ambu's leadership in the rapidly expanding single-use endoscopy segment.

- Product Synergy: aView 2 Advance and aBox 2 enhance Ambu's single-use endoscopes.

- Market Position: These systems strengthen Ambu's leadership in the single-use endoscopy market.

- Performance Enhancement: They provide full-HD imaging and improved connectivity.

- Workflow Optimization: The systems contribute to better patient care and operational efficiency.

Ambu's single-use endoscopy portfolio, especially its advanced generations, is a clear Star in its BCG matrix. This segment is the company's primary driver of growth, demonstrating impressive organic revenue increases. For instance, in the first half of fiscal year 2024/25, Ambu achieved a 16.7% organic growth in this area.

The market for single-use endoscopes is booming, fueled by the critical need for infection control and operational efficiency. Projections indicate this market will reach $2.5 billion by 2025 and expand at a compound annual growth rate of 16.4% through 2034. Ambu's strong position within this rapidly growing market solidifies its status as a Star.

Ambu's Urology Endoscopy Solutions are a shining example of a Star in their BCG Matrix. This segment is experiencing robust, sustained organic growth, with the broader Urology, ENT & GI division achieving an impressive 23.9% organic growth in the first quarter of fiscal year 2024/25. This performance highlights the strong market demand and Ambu's competitive edge in this critical medical field.

The company's commitment to innovation is evident with recent product advancements. The Ambu® aScope™ 5 Uretero and Ambu® aScope™ 5 Cysto HD have secured both FDA clearance and CE marks. These clearances are crucial for market access and signal Ambu's success in developing cutting-edge solutions for the urology market, a sector known for its high growth potential.

Looking ahead, Ambu has set an ambitious target for this business group to consistently achieve organic growth rates exceeding 20%. This objective is well-supported by their advanced product portfolio, which is designed to meet the evolving needs of urologists and improve patient care through enhanced endoscopic procedures.

ENT Endoscopy Solutions are a shining Star for Ambu, driving substantial double-digit organic revenue growth. This segment, alongside urology, demonstrates robust market adoption and consistent new customer acquisition globally. Ambu is strategically expanding its offerings in ENT, building upon its existing, successful platform.

Ambu's advanced pulmonology endoscopes, exemplified by the aScope 5 Broncho, are positioned as Stars in the BCG Matrix. This classification stems from their robust market standing and ongoing uptake by healthcare providers.

The pulmonology sector demonstrated impressive performance, achieving 17.7% organic growth in the first quarter of fiscal year 2024/25. This segment remains a significant driver of the Endoscopy Solutions division's overall high growth trajectory.

Ambu has solidified its leadership in the single-use bronchoscope market through consistent innovation. This commitment ensures their continued relevance in a critical medical field.

- Market Position: Strong, driven by innovation and adoption.

- Growth Rate: 17.7% organic growth in Q1 2024/25 for pulmonology.

- Contribution: Key driver for Endoscopy Solutions' high growth.

- Competitive Advantage: Long-standing lead in single-use bronchoscopes.

Ambu's integrated digital endoscopy systems, like the aView 2 Advance and aBox 2, are crucial components of its product strategy, particularly within the context of the BCG Matrix. These systems are designed to work seamlessly with Ambu's single-use endoscopes, enhancing their functionality and market appeal. Their role is to bolster the performance of these high-growth disposable products.

These advanced systems offer full-HD imaging capabilities and robust connectivity, acting as the essential infrastructure that elevates the user experience and clinical utility of Ambu's single-use endoscopes. By providing superior visualization and streamlined integration, they directly contribute to the adoption and success of the disposable scope portfolio, a key growth driver for Ambu.

The introduction of these integrated systems supports Ambu's position in the market by optimizing clinical workflows and improving patient care through enhanced diagnostic accuracy and efficiency. This focus on advanced, user-friendly technology solidifies Ambu's leadership in the rapidly expanding single-use endoscopy segment.

- Product Synergy: aView 2 Advance and aBox 2 enhance Ambu's single-use endoscopes.

- Market Position: These systems strengthen Ambu's leadership in the single-use endoscopy market.

- Performance Enhancement: They provide full-HD imaging and improved connectivity.

- Workflow Optimization: The systems contribute to better patient care and operational efficiency.

| Business Segment | BCG Category | Q1 FY24/25 Organic Growth | Key Products | Market Outlook |

|---|---|---|---|---|

| Single-Use Endoscopy (Overall) | Star | 16.7% | aScope™ series | Projected $2.5B by 2025, 16.4% CAGR through 2034 |

| Urology Endoscopy Solutions | Star | 23.9% (Urology, ENT & GI Division) | aScope™ 5 Uretero, aScope™ 5 Cysto HD | High growth potential, strong market demand |

| Pulmonology Endoscopy | Star | 17.7% | aScope 5 Broncho | Significant driver for Endoscopy Solutions |

| ENT Endoscopy Solutions | Star | Double-digit | Existing successful platform | Robust market adoption, new customer acquisition |

| Digital Endoscopy Systems | Enabler for Stars | N/A | aView 2 Advance, aBox 2 | Enhances single-use scope functionality and appeal |

What is included in the product

The Ambu BCG Matrix categorizes products or business units based on market share and growth, guiding strategic decisions.

Clear visual representation of portfolio health for strategic decision-making.

Cash Cows

Ambu's established anaesthesia devices are firmly positioned as a Cash Cow within its portfolio. This segment demonstrates a robust market share and reliably generates significant cash flow, even as its growth trajectory is less explosive compared to emerging products.

Strategic price adjustments and consistent volume increases have bolstered this segment, highlighting deep customer loyalty and unwavering demand for these critical medical tools. This stability is crucial for Ambu's overall financial health.

In fact, these established anaesthesia devices contribute a substantial 40% to Ambu's total revenue. This significant contribution underscores their role as a foundational element, providing the financial bedrock for the company's operations and investment in future growth areas.

Ambu's mature patient monitoring electrodes are a classic Cash Cow. They hold a strong position in a stable market, consistently bringing in reliable profits. For instance, the global patient monitoring market, while experiencing growth, saw Ambu's established electrode business contribute significantly to their overall revenue stream, with sales in this segment demonstrating steady performance throughout 2024.

The strategy here is all about efficiency. Ambu leverages its existing production capabilities and distribution networks to keep costs low and maximize the cash generated from these mature products. This focus on maintaining productivity ensures that these electrodes continue to be a dependable source of financial strength for the company, supporting other areas of their business.

Ambu's standard disposable resuscitators, often referred to as Ambu Bags, are firmly positioned as Cash Cows. Their consistent demand in critical care settings and the mature, stable market for these essential devices ensure a predictable and reliable revenue stream.

These products command a significant market share, consistently generating robust cash flow for Ambu. While the overall market growth for resuscitators might be modest, the ongoing trend toward disposable, single-use devices further solidifies their profitability.

This segment requires minimal investment in marketing or expansion, allowing Ambu to capitalize on its established position and generate substantial returns. For instance, the global respiratory devices market, which includes resuscitators, was valued at approximately $26.5 billion in 2023 and is projected to grow at a CAGR of around 5.5% through 2030, indicating a stable, albeit not explosive, demand environment for these products.

Core Pulmonology Endoscopy Portfolio (Baseline)

The core pulmonology endoscopy portfolio, representing Ambu's established offerings, functions as the company's Cash Cows within the BCG Matrix. These products have reached a mature stage, characterized by high market share and stable demand, ensuring consistent revenue generation for Ambu. For instance, Ambu's single-use bronchoscope solutions, like the aScope™ 4 Bronchoscope, have seen significant adoption, with the company reporting a substantial increase in single-use bronchoscope sales, contributing to their strong market position in this segment.

These established products require minimal investment for growth, allowing Ambu to allocate resources to other areas of the business. Their consistent cash flow is vital for funding research and development of new innovations and supporting the company's overall financial health. In 2024, Ambu continued to see robust performance from its established product lines, underpinning its financial stability.

- Established Market Position: High market share in the pulmonology endoscopy sector.

- Consistent Revenue Generation: Stable and predictable income streams.

- Low Reinvestment Needs: Minimal capital required for marketing and promotion.

- Cash Flow Contribution: Provides significant financial resources for other business initiatives.

Legacy Single-Use Endoscopy Solutions

Ambu's legacy single-use endoscopy solutions, though older, remain a significant part of the company's portfolio, functioning as cash cows. These established products, benefiting from widespread market acceptance, continue to generate consistent revenue and contribute to profitability. In fiscal year 2023, Ambu reported a gross margin of 58.8%, a testament to the efficiency and established demand for these mature product lines.

These legacy systems leverage established customer relationships and optimized manufacturing processes, ensuring steady cash flow. While Ambu invests in newer, innovative technologies to drive future growth, these dependable products provide a crucial financial foundation. This stability allows for continued investment in research and development, supporting the company's overall strategic objectives.

- Established Market Presence: These older single-use endoscopy solutions have a proven track record and a loyal customer base.

- Profitability Drivers: They contribute significantly to Ambu's gross margin due to streamlined production and consistent demand.

- Financial Stability: Legacy products provide a reliable revenue stream, supporting operational leverage and overall financial health.

- Investment Support: The cash generated by these solutions enables Ambu to fund innovation in newer, high-growth product areas.

Ambu's established anaesthesia devices, patient monitoring electrodes, and disposable resuscitators are prime examples of Cash Cows. These products benefit from high market share in mature, stable markets, generating consistent and reliable cash flow with minimal reinvestment needs.

Their strong performance underpins Ambu's financial stability, allowing for strategic allocation of capital towards innovation and growth areas. For instance, Ambu's pulmonology endoscopy portfolio, including the aScope™ 4 Bronchoscope, has seen significant adoption, contributing to their strong market position and consistent revenue generation.

These mature product lines are characterized by efficiency, leveraging established production and distribution networks to maximize profitability. In fiscal year 2023, Ambu reported a gross margin of 58.8%, highlighting the financial strength derived from these dependable offerings.

| Product Category | BCG Matrix Classification | Key Characteristics | Financial Contribution (FY23/24 Indication) |

| Anaesthesia Devices | Cash Cow | Robust market share, stable demand, low growth | Significant contributor to total revenue (estimated 40%) |

| Patient Monitoring Electrodes | Cash Cow | Strong market position, consistent profitability | Steady performance, reliable profits |

| Disposable Resuscitators (Ambu Bags) | Cash Cow | High market share, predictable revenue, minimal investment | Dependable source of financial strength |

| Pulmonology Endoscopy (Established) | Cash Cow | High market share, stable demand, low reinvestment needs | Supports R&D and overall financial health |

Preview = Final Product

Ambu BCG Matrix

The Ambu BCG Matrix document you are currently previewing is the complete and final version you will receive upon purchase. This means no watermarks, no altered content, and no limitations – just the fully formatted, professionally designed report ready for your strategic analysis and business planning.

Rest assured, the BCG Matrix you see here is precisely the document that will be delivered to you after completing your purchase. It's a comprehensive, ready-to-use tool, meticulously crafted to provide clear strategic insights without any hidden surprises or additional work required.

What you're viewing is the actual Ambu BCG Matrix file you'll download immediately after your purchase. This ensures you receive a polished, analysis-ready document that’s perfect for immediate implementation in your business strategy discussions or presentations.

Dogs

Outdated reusable resuscitation devices, such as older models of Ambu bags, would likely fall into the Dogs category of the BCG matrix. These legacy products, not aligned with the industry's trend toward single-use disposables, face declining demand and a shrinking market share. For example, while the global resuscitation devices market is projected to reach over $2.5 billion by 2028, older reusable models represent a diminishing segment of this growth.

Products that have been discontinued or consistently show low demand and minimal market share represent the 'Dogs' in Ambu's BCG Matrix. These items are often inefficient to produce and market, tying up capital without significant returns. For instance, if Ambu's 2024 sales data reveals certain legacy product lines contributing less than 1% to overall revenue and showing negative growth, they would be classified here.

Ambu's portfolio includes niche patient monitoring accessories that have struggled to gain significant market traction. These products, often components or specialized items, have seen their relevance diminish as more advanced, integrated monitoring systems become standard in healthcare settings. For instance, certain older electrode designs or single-parameter sensors might fall into this category, facing competition from multi-parameter devices that offer greater efficiency and data consolidation for clinicians.

These low-volume products contribute minimally to Ambu's overall growth and profitability within the patient monitoring segment. Their declining relevance means they require considerable resources for development, marketing, and support relative to their market impact. In 2023, Ambu's patient monitoring segment revenue was DKK 330 million, and these niche accessories represent a small fraction of that, likely with shrinking sales figures.

Legacy Anaesthesia Accessories with Low Profitability

Legacy Anaesthesia Accessories with Low Profitability represent Ambu's Dogs in the BCG matrix. These are older, established products in the anaesthesia accessory market that have become largely commoditized. The intense competition in this space, characterized by numerous players, drives profit margins down significantly, often to single digits. For example, in 2023, the global anaesthesia masks market, a key segment for legacy products, saw average gross margins hover around 8-12%, a stark contrast to higher-margin specialized medical devices.

Ambu has attempted strategies to bolster profitability in these low-margin areas, such as targeted price increases. However, the highly competitive nature and price sensitivity of the market mean that these legacy products may not respond as effectively as hoped. Their ability to command premium pricing is limited, making it challenging to improve their financial standing substantially. This lack of pricing power is a defining characteristic of Dog products.

Consequently, these legacy anaesthesia accessories struggle to maintain a strong competitive advantage and generate robust cash flow. Their market share is often stagnant or declining, and the potential for significant growth is minimal. In 2024, Ambu's focus is likely on managing these products efficiently, potentially through cost reduction or eventual divestiture, rather than investing heavily in their expansion.

- Market Maturity: The anaesthesia accessories market is mature, with limited innovation driving significant new demand for legacy products.

- Intense Competition: Numerous manufacturers compete, leading to price wars and squeezed profit margins, often below 10% for basic items.

- Low Growth Potential: These products are unlikely to experience substantial market share gains or revenue growth in the coming years.

- Cash Flow Strain: While they may generate some revenue, the low profitability means they contribute little to overall cash flow and may even require management attention to avoid becoming a drain.

Products with Negative Product Mix Impact

Products with a negative product mix impact, often categorized as Dogs in the BCG Matrix, can arise from various strategic decisions. For instance, the Ambu® SureSight™ Connect, while aiming for long-term growth, necessitated an upfront system investment from hospitals. This strategy initially led to a lower contribution margin on endoscopes, creating a short-term drag on gross margins.

If products like the SureSight Connect experience slower-than-anticipated adoption or fail to achieve their projected long-term profitability targets, they risk being reclassified as Dogs. This scenario highlights how even innovative products can temporarily fall into this category due to market reception and initial financial performance.

- Ambu® SureSight™ Connect: Required significant upfront investment from hospitals, impacting initial contribution margins.

- Potential Reclassification: Could become a Dog if long-term profitability and market uptake do not meet expectations.

- Strategic Trade-offs: Initial lower margins are often a trade-off for future market penetration and growth.

Products classified as Dogs within Ambu's BCG Matrix are those with low market share and low growth prospects. These often include legacy items or those facing intense competition, leading to minimal profitability. For example, older reusable resuscitation devices, not aligned with the industry's shift to disposables, would fit this category, representing a shrinking segment of a market projected to exceed $2.5 billion by 2028.

If Ambu's 2024 sales data shows specific legacy product lines contributing less than 1% of revenue with negative growth, they would be designated as Dogs. These products tie up capital without significant returns, often due to declining demand or being superseded by newer technologies, such as niche patient monitoring accessories struggling against integrated systems.

Legacy anaesthesia accessories, for instance, often fall into the Dog category due to commoditization and fierce competition, driving profit margins down to single digits, typically 8-12% for items like anaesthesia masks in 2023. These products have limited pricing power and minimal growth potential, requiring efficient management rather than expansion investment.

Even innovative products can temporarily become Dogs if market adoption is slower than anticipated or if initial investment strategies lead to lower short-term contribution margins, as seen with the Ambu® SureSight™ Connect's initial system investment requirement from hospitals.

| Product Category Example | Market Share | Market Growth | Profitability | BCG Classification |

|---|---|---|---|---|

| Older reusable resuscitation devices | Low | Declining | Low | Dog |

| Niche patient monitoring accessories | Low | Stagnant/Declining | Low | Dog |

| Legacy anaesthesia accessories (e.g., basic masks) | Low | Low | Very Low (e.g., 8-12% gross margin in 2023) | Dog |

| Ambu® SureSight™ Connect (initial phase) | Low (projected) | High (projected) | Low (initial contribution margin) | Potential Dog (if adoption lags) |

Question Marks

The Ambu® SureSight™ Connect, introduced in early 2025, is positioned as a Question Mark within Ambu's Business Growth-Share Matrix. This innovative video laryngoscopy solution targets the rapidly expanding pulmonology and airway visualization sector, a market projected to reach approximately $2.5 billion globally by 2027, growing at a CAGR of 7.2%.

Despite operating in a high-potential market, the SureSight Connect, being a recent entrant, currently holds a negligible market share. Its success hinges on capturing a significant portion of this growing demand.

The product's integration with Ambu's existing pulmonology offerings and its promising early market feedback suggest a strong potential to transition into a Star product. However, achieving this requires substantial investment in marketing, sales, and further development to drive widespread adoption and revenue generation.

Ambu's gastroenterology (GI) endoscopy solutions, featuring products like the Ambu® aScope™ Gastro Large and Ambu® aScope™ Duodeno 2, are positioned to capitalize on the largest endoscopy market worldwide. This segment offers significant growth potential, though Ambu is adopting a measured, focused expansion strategy to build its presence in this relatively new area for the company.

The company's approach involves substantial investment and strategic planning to gain meaningful market share in the vast GI endoscopy market. Success in this endeavor is crucial for these solutions to transition from question marks to stars within Ambu's portfolio, reflecting a commitment to long-term growth and market penetration.

Ambu is actively exploring and launching new, highly specialized single-use endoscope applications targeting nascent or niche markets. These innovations are designed for specific procedures, aiming to capture high-growth segments where buyer awareness is still developing.

For instance, Ambu has been investing in advanced visualization technologies for gastrointestinal diagnostics, a market segment poised for significant expansion. These specialized endoscopes require substantial marketing and research and development to educate potential users and drive adoption, a crucial step to avoid them becoming underperforming 'Dogs' in the BCG matrix.

The company's commitment to innovation in this area is underscored by its ongoing R&D pipeline, focusing on areas like single-use bronchoscopes for critical care and specialized duodenoscopes for complex therapeutic procedures. These products, while currently holding low market share, represent Ambu's strategy to penetrate high-growth, specialized medical device markets.

AI Training Platform for Pulmonology

Ambu's AI training platform for pulmonology, launched around 2023-2024, is positioned as a Question Mark in the BCG matrix. While the field of pulmonology is expanding, the platform's market share and revenue generation are still nascent, necessitating significant investment to gain traction.

This digital tool is designed to improve clinical skills in a growing medical specialty, but its success hinges on user adoption and proving its value. As a new technology, it requires ongoing development and marketing efforts to build a strong market position.

- Market Potential: The global respiratory disease diagnostics market was valued at approximately USD 36.5 billion in 2023 and is projected to grow, indicating a substantial opportunity for AI-driven training solutions.

- Investment Needs: Continued R&D and marketing are crucial for Ambu to establish the platform's credibility and reach within the pulmonology community.

- Early Stage Adoption: Initial uptake and revenue figures for the platform are likely low, reflecting its status as a new entrant in a specialized training market.

- Competitive Landscape: Ambu faces competition from established medical education providers and other emerging digital health solutions.

Future Innovations from R&D Pipeline

Ambu's R&D pipeline is focused on developing next-generation solutions, with products nearing commercialization poised to enter high-growth markets. These innovations, while currently lacking market share, represent Ambu's strategic bet on future revenue streams. Success will depend on navigating clinical trials, securing regulatory approvals, and executing robust market entry plans to transform these potential stars into market leaders.

Key areas of innovation include advancements in single-use technologies and digital integration within their existing product lines. For instance, their work on next-generation visualization platforms aims to enhance diagnostic accuracy and patient outcomes. These developments are critical for Ambu to maintain its competitive edge and capture emerging market opportunities.

- Next-Generation Visualization Platforms: Targeting enhanced diagnostic capabilities and patient safety.

- Single-Use Innovations: Expanding the portfolio of disposable medical devices to reduce infection risks and improve workflow efficiency.

- Digital Integration: Incorporating data analytics and connectivity into devices for remote monitoring and improved data management.

Question Marks represent Ambu's emerging products in high-growth markets where they currently hold a low market share. These products, like the SureSight Connect video laryngoscope and the AI training platform, require significant investment to gain traction.

The company's strategy involves substantial R&D and marketing to drive adoption, aiming to transform these Question Marks into Stars. Success in these nascent but promising segments is key to Ambu's future growth, particularly in specialized areas like pulmonology and GI endoscopy.

Ambu's focus on single-use technologies and digital integration in these new ventures highlights their commitment to capturing future market opportunities, even as they navigate the initial stages of market penetration.

| Product/Area | Market Growth Potential | Current Market Share | Investment Focus |

|---|---|---|---|

| Ambu® SureSight™ Connect | High (Pulmonology/Airway Visualization, ~$2.5B by 2027) | Negligible | Marketing, Sales, Development |

| GI Endoscopy Solutions | High (Largest Endoscopy Market) | Low (Newer for Ambu) | Strategic Expansion, Investment |

| AI Training Platform (Pulmonology) | High (Growing Medical Specialty) | Nascent | R&D, Marketing, User Adoption |

| Next-Gen Visualization/Single-Use | High (Specialized, Niche Markets) | Low | R&D Pipeline, Clinical Trials, Market Entry |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial disclosures, market research reports, and industry growth forecasts to provide a robust strategic overview.