Ambu Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambu Bundle

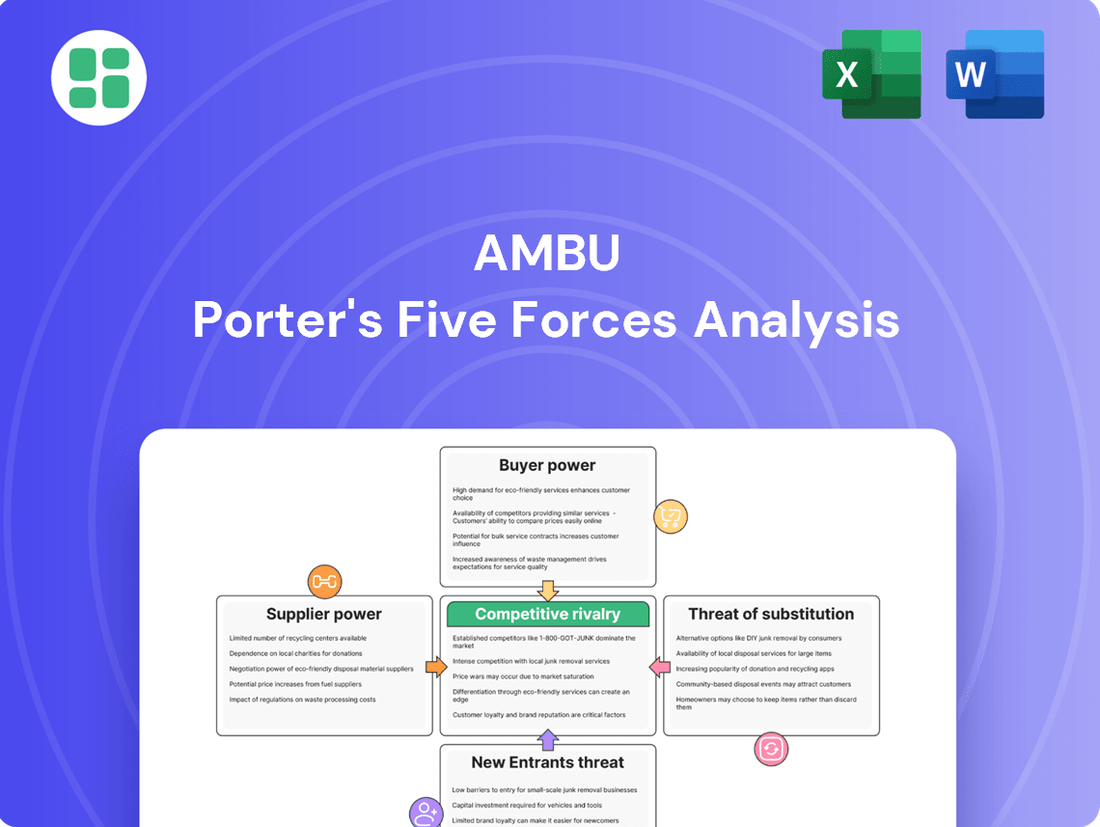

Ambu's competitive landscape is shaped by the interplay of five key forces, from the bargaining power of buyers to the intensity of rivalry. Understanding these dynamics is crucial for navigating the healthcare device market.

The complete report reveals the real forces shaping Ambu’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers to Ambu is significantly shaped by the concentration and specialization within the medical device component and raw material markets. When a limited number of suppliers can provide the critical, high-quality inputs essential for Ambu's product lines, such as their single-use endoscopes and patient monitoring systems, these suppliers gain considerable leverage. For instance, the stringent requirements for medical-grade materials, coupled with necessary certifications, often restrict the pool of potential suppliers, thereby amplifying their negotiating strength.

Switching costs for Ambu, a medical device company, are a significant factor influencing supplier bargaining power. These costs encompass the financial outlays and operational disruptions Ambu would face if it decided to change its suppliers for critical components or raw materials.

In the highly regulated medical device sector, these switching costs can be substantial. For instance, Ambu might need to undergo extensive re-qualification processes for new components, which often involves rigorous testing to ensure they meet stringent quality and performance standards. Furthermore, any change in materials or design necessitates obtaining new regulatory approvals, a process that can be time-consuming and expensive, potentially delaying product launches or impacting existing supply chains.

The presence of high switching costs for Ambu directly strengthens the bargaining power of its current suppliers. When it is difficult and costly for Ambu to find and onboard alternative suppliers, existing suppliers can leverage this situation to negotiate more favorable terms, potentially including higher prices or less flexible contract conditions. This dynamic can limit Ambu's ability to seek out more competitive sourcing options, thereby impacting its cost structure and profitability.

Suppliers might leverage their position by threatening to move into Ambu's space, perhaps by creating their own medical devices. While it's not typical for suppliers of basic components to jump into the intricate medical device manufacturing, this potential leverage can strengthen their hand during price discussions.

This particular threat becomes more significant if a supplier holds exclusive or critical technology that Ambu relies on heavily for its product offerings. For instance, if a supplier controls a unique material or a patented manufacturing process essential for Ambu's key products, they gain considerable bargaining power.

Impact of Raw Material Volatility and Tariffs

Geopolitical uncertainty and a volatile macroeconomic climate in 2024 are fueling inflationary pressures on raw materials, energy, and logistics. This directly translates to increased costs for suppliers, who can then leverage this situation to demand higher prices from companies like Ambu.

Tariffs, particularly those impacting components sourced from major manufacturing hubs such as China, are a significant factor. For instance, in 2024, ongoing trade tensions have led to increased import duties on various goods, including those essential for medical device production, thereby amplifying supplier pricing power.

- Increased Input Costs: Suppliers face higher expenses for raw materials and energy, forcing them to pass these onto buyers.

- Tariff Impact: Import duties on critical components from regions like China directly inflate the cost of goods for manufacturers.

- Supplier Leverage: These rising costs empower suppliers to negotiate more favorable terms, increasing their bargaining power over Ambu.

Supplier Diversification and Resilience Efforts

Medical device manufacturers like Ambu are actively working to spread out their production and sourcing. This strategy is designed to make them less vulnerable to disruptions in the supply chain. For example, by reshoring or nearshoring production, companies aim to shorten lead times and reduce reliance on distant suppliers.

Partnerships with regional manufacturing services are also becoming more common. These collaborations can provide alternative production capabilities, further enhancing flexibility. By diversifying, Ambu can potentially lessen the bargaining power of individual suppliers over the long term.

This shift towards greater supplier diversification is a significant trend. For instance, a 2024 survey indicated that over 60% of medical device companies were increasing their efforts to diversify their supplier base. This proactive approach aims to build more resilient operations.

- Diversification of Production Sites: Companies are establishing manufacturing facilities in multiple geographic locations to avoid over-reliance on any single region.

- Nearshoring and Reshoring Initiatives: Bringing production closer to home markets reduces transportation costs and lead times, and can offer greater control over the manufacturing process.

- Strategic Supplier Partnerships: Developing deeper relationships with a broader range of suppliers, including smaller, regional players, can create more options and reduce dependency.

- Increased Inventory Management Flexibility: While not directly supplier diversification, enhanced inventory strategies can buffer against short-term supplier disruptions, indirectly impacting supplier leverage.

The bargaining power of suppliers to Ambu is influenced by several key factors, including the concentration of suppliers, the uniqueness of their offerings, and the costs Ambu incurs when switching to a different supplier. In 2024, global economic conditions, such as inflation and tariffs, have further amplified this power, leading to increased input costs for manufacturers.

Suppliers can leverage their position by threatening to enter Ambu's market or by controlling proprietary technology. The rise in raw material and energy prices in 2024, coupled with tariffs on components, has given suppliers more leverage to demand higher prices. For instance, tariffs on goods from China have directly impacted the cost of essential medical device components.

In response, companies like Ambu are diversifying their production and sourcing strategies, including nearshoring and partnering with regional manufacturers. This diversification aims to reduce reliance on single suppliers and build more resilient operations, with a significant percentage of medical device companies increasing their supplier diversification efforts in 2024.

| Factor | Impact on Ambu | 2024 Trend/Data |

|---|---|---|

| Supplier Concentration & Specialization | Limited suppliers for critical medical-grade materials increase their leverage. | High, due to stringent regulatory requirements for medical components. |

| Switching Costs | Significant costs for re-qualification, testing, and regulatory approvals for new components. | Substantial, impacting Ambu's flexibility in sourcing. |

| Threat of Forward Integration | Suppliers controlling critical technology could potentially develop their own devices. | Low for basic components, but higher for suppliers with unique patented processes. |

| Input Cost Inflation & Tariffs | Increased raw material, energy, and logistics costs empower suppliers to raise prices. | Significant inflationary pressures and tariffs on components from China in 2024. |

What is included in the product

This analysis dissects the competitive forces impacting Ambu, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly visualize competitive intensity with a dynamic, interactive dashboard that simplifies complex market dynamics.

Gain actionable insights into industry forces, allowing for proactive strategy adjustments and risk mitigation.

Customers Bargaining Power

Ambu's customer base, primarily hospitals and rescue services, often represents concentrated demand. These entities, especially larger healthcare systems and Group Purchasing Organizations (GPOs), frequently place substantial volume orders. For instance, in fiscal year 2023, Ambu reported a significant portion of its revenue derived from its top customers, highlighting the impact of large-scale purchasing.

This concentration of purchasing power grants these customers considerable leverage. They can effectively negotiate for more favorable pricing, extended payment terms, and specific product customizations. The ability to purchase in bulk empowers them to exert strong pressure on Ambu's profit margins, as they can readily compare offers and switch suppliers if terms are not met.

Healthcare providers are facing significant financial strain, driving a strong demand for cost-effective solutions without compromising patient care. This financial pressure directly translates into heightened price sensitivity for medical devices and services.

Ambu's core business strategy revolves around offering cost-effective products, a clear indicator that its customer base, primarily hospitals, is highly attuned to pricing. For instance, in fiscal year 2023, Ambu reported a revenue of DKK 5.2 billion (approximately $750 million USD), underscoring the scale of their operations and the importance of price in their market.

Hospitals are actively re-evaluating their procurement processes. This means medical device companies like Ambu must rigorously demonstrate both the clinical efficacy and the economic advantages of their offerings to justify expenditures, especially as budgets tighten.

While switching medical device suppliers can incur some training and integration expenses for healthcare facilities, the advantages of single-use devices, like improved infection prevention and streamlined workflows, often make these costs worthwhile. Ambu's focus on innovative single-use endoscopes aims to set them apart, yet customers retain the flexibility to select from multiple manufacturers. The persistent need for sterile, disposable instruments, driven by concerns over hospital-acquired infections, significantly shapes customer purchasing decisions, impacting the bargaining power they hold.

Threat of Backward Integration by Customers

The threat of backward integration by customers, meaning they might start making their own medical devices, is typically low. This is because developing and manufacturing medical devices requires significant investment in research and development, along with navigating complex regulatory approvals. For instance, the average R&D spending for a Class III medical device can run into tens of millions of dollars.

However, customers can exert pressure through alternative means. Large hospital networks or group purchasing organizations (GPOs) might opt for private label or generic medical supplies. This strategy allows them to secure components or finished goods at reduced prices, effectively mimicking the cost-saving benefits of backward integration without the substantial upfront investment.

- Low Direct Backward Integration: The high capital expenditure and specialized expertise needed for medical device manufacturing limit direct backward integration by most customers.

- Indirect Pressure via Private Labeling: Customers increasingly utilize private label or generic alternatives, which can reduce the average selling price of comparable branded products by 10-20%.

- Regulatory Hurdles: The stringent FDA approval process for new medical devices, which can take years and cost millions, acts as a significant barrier to entry for potential customer manufacturers.

- Focus on Core Competencies: Healthcare providers generally prefer to focus on patient care rather than diverting resources to complex manufacturing operations.

Customer Demand for Value-Based Solutions

Hospitals are increasingly prioritizing value-based solutions that enhance patient safety, streamline workflows, and improve their financial standing. Ambu's commitment to infection prevention and cost-saving measures directly aligns with these critical customer demands.

This trend signifies a significant shift in healthcare procurement, where manufacturers are now expected to proactively collaborate with buyers and present comprehensive clinical and economic evidence to validate their product offerings. This move towards outcomes-based purchasing is a defining characteristic of the current market landscape.

- Value-Based Healthcare: A 2024 report indicated that 65% of healthcare providers are actively seeking solutions that demonstrate a clear return on investment, focusing on improved patient outcomes and reduced long-term costs.

- Ambu's Alignment: Ambu's single-use endoscopes, for example, directly address infection control concerns, a major driver for value-based purchasing in procedural departments.

- Data-Driven Procurement: Buyers are demanding robust clinical trial data and health economic analyses, with an estimated 70% of purchasing decisions in 2024 being influenced by demonstrable economic benefits and improved patient safety metrics.

Ambu's customer bargaining power is significant due to concentrated demand from large healthcare systems and GPOs. These entities can negotiate favorable pricing and terms, impacting Ambu's profitability. For instance, in fiscal year 2023, Ambu's revenue was DKK 5.2 billion, with a notable portion coming from key accounts, emphasizing the leverage these large buyers hold.

Customers are highly price-sensitive, driven by financial pressures in the healthcare sector, and actively seek cost-effective solutions. A 2024 report shows 65% of healthcare providers prioritize ROI, directly influencing purchasing decisions for medical devices like Ambu's. This necessitates Ambu demonstrating clear economic advantages.

While switching costs for medical devices exist, the benefits of single-use products, like infection prevention, often outweigh them. Customers can also exert indirect pressure through private labeling, potentially reducing comparable product prices by 10-20%, a strategy that bypasses the high R&D and regulatory hurdles of direct backward integration, which can cost tens of millions for Class III devices.

| Factor | Impact on Ambu | Supporting Data (2023-2024) |

|---|---|---|

| Customer Concentration | High leverage for pricing and terms negotiation | Significant revenue from top customers in FY23 |

| Price Sensitivity | Demand for cost-effective solutions | 65% of providers seek ROI (2024 report) |

| Switching Costs | Mitigated by benefits of single-use devices | Focus on infection prevention drives value |

| Indirect Backward Integration | Pressure via private labeling | Potential 10-20% price reduction on generics |

Preview the Actual Deliverable

Ambu Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This comprehensive Porter's Five Forces analysis for Ambu details the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the medical device industry. Understanding these forces is crucial for Ambu's strategic decision-making and market positioning.

Rivalry Among Competitors

The medical device sector, especially for products like endoscopes and patient monitoring systems, is intensely competitive. Ambu contends with a significant number of global and regional companies vying for market share.

Key rivals for Ambu in the disposable endoscope market include industry giants such as Olympus Corporation, Boston Scientific Corporation, Karl Storz SE & Co. KG, and Fujifilm Holdings Corporation. These established players possess considerable resources and brand recognition, intensifying the competitive pressure on Ambu.

This varied and robust competitive environment demands that Ambu consistently prioritizes innovation and maintains agility in its market strategies to stay ahead. For instance, in 2023, the global medical device market was valued at approximately $520 billion, highlighting the scale of competition Ambu operates within.

The disposable endoscopes market is booming, forecast to hit $2.26 billion by 2025, up from $1.91 billion in 2024. This expansion, fueled by a focus on infection control and the rise of minimally invasive surgery, is a double-edged sword for competitive rivalry.

While market growth typically tempers intense competition, the disposable endoscope sector is seeing increased investment and more aggressive strategies from established players. Ambu’s Endoscopy Solutions, a major contributor to this growth, is anticipated to achieve over 15% organic growth in 2024/25, indicating strong performance within this dynamic environment.

Ambu stands out by focusing on single-use endoscopes, a strategy that boosts patient safety and cuts healthcare expenses by minimizing hospital-acquired infections. This specialization is a key differentiator in a market where infection control is paramount.

The company’s commitment to rapid innovation, exemplified by new product introductions like video laryngoscopy and ureteroscopy, is crucial for staying ahead. In 2024, Ambu continued to invest in its product pipeline, aiming to address unmet clinical needs and expand its market reach.

Competitors are actively engaged in their own R&D efforts, pouring significant resources into product differentiation and the integration of cutting-edge technologies such as artificial intelligence. For instance, Boston Scientific reported a 10% increase in R&D spending for its Endoscopy division in its Q1 2024 earnings, signaling a strong focus on innovation to counter Ambu's advancements.

Switching Costs for Customers

For customers, the decision to switch between medical device providers like Ambu involves more than just the initial purchase price. There are often significant hidden costs associated with adopting new technology. These can include the expense of training clinical staff on new equipment, the logistical challenge of integrating new devices into existing hospital systems, and the administrative burden of updating established clinical protocols and procedures. These factors create a form of customer inertia, making them less likely to switch unless the benefits are substantial.

Despite these barriers, a compelling value proposition from a competitor can indeed sway customer loyalty. If a rival medical device company introduces a single-use solution that is demonstrably more affordable or offers superior clinical outcomes, the perceived switching costs might be outweighed by the potential long-term savings and patient benefits. For instance, a new device offering a 15% reduction in procedure time could significantly offset training expenses.

Ambu's strategy to counter this competitive pressure hinges on reinforcing customer relationships through tangible benefits. By continuously emphasizing workflow efficiencies and robust infection control measures in their product development, Ambu aims to make their offerings indispensable. This focus on operational improvements and patient safety helps to embed their products deeper into hospital routines, thereby increasing the perceived cost and difficulty of switching away.

- Training and Integration Costs: Hospitals may spend thousands of dollars on training staff and integrating new medical equipment into their IT and supply chain systems.

- Protocol Updates: Revising and approving new clinical protocols can take months and involve significant administrative resources.

- Competitor Value Proposition: A competitor offering a 20% cost saving on consumables or a 10% improvement in diagnostic accuracy could challenge existing loyalty.

- Ambu's Loyalty Strategy: Focus on ease of use and infection prevention aims to reduce the total cost of ownership for healthcare providers.

Strategic Acquisitions and Partnerships

The MedTech industry is a hotbed of strategic consolidation, where mergers and acquisitions (M&A) constantly redefine the competitive arena. Companies frequently snap up smaller, innovative firms to bolster their product offerings or gain access to cutting-edge technology, thereby heightening the rivalry among established players.

Ambu itself actively pursues a strategy of portfolio expansion and deepening customer relationships, which inherently involves navigating this M&A-driven landscape. For instance, in 2023, the MedTech sector saw a notable increase in M&A activity, with several significant deals announced, indicating a trend towards larger, more integrated companies.

- Industry Consolidation: Strategic M&A is a key driver of competitive intensity in MedTech.

- Portfolio Expansion: Competitors acquire smaller firms to broaden product lines and technological reach.

- Ambu's Strategy: Ambu focuses on growth through portfolio enhancement and customer engagement.

- Market Dynamics: The sector's consolidation directly influences Ambu's competitive position and strategic choices.

Competitive rivalry in the medical device sector, particularly for disposable endoscopes, is fierce, with Ambu facing established giants like Olympus and Boston Scientific. These competitors leverage significant resources and brand equity, intensifying market pressure.

The disposable endoscope market, projected to reach $2.26 billion by 2025, is attracting substantial investment and aggressive strategies from major players, including Ambu's own Endoscopy Solutions which is targeting over 15% organic growth in 2024/25.

Competitors are also heavily investing in R&D, with Boston Scientific increasing its Endoscopy division's R&D spending by 10% in Q1 2024, aiming to counter Ambu's innovation in areas like video laryngoscopy and ureteroscopy.

Customer switching costs, including training and integration, create inertia, but a strong competitor value proposition, such as a 15% reduction in procedure time, can overcome these barriers.

| Competitor | Focus Area | Recent R&D Investment Indication |

| Olympus Corporation | Endoscopy, Medical Imaging | Significant market share and established product lines |

| Boston Scientific Corporation | Minimally Invasive Surgery, Endoscopy | 10% increase in Endoscopy R&D spending (Q1 2024) |

| Fujifilm Holdings Corporation | Medical Imaging, Endoscopy | Continued investment in advanced imaging technologies |

| Karl Storz SE & Co. KG | Endoscopy, Surgical Instruments | Focus on high-quality visualization and integrated systems |

SSubstitutes Threaten

Reusable medical devices represent a significant threat to Ambu's single-use offerings. While Ambu champions disposability for infection control, the historical prevalence of reusable endoscopes means a substantial installed base and established infrastructure exist for their maintenance and use.

The persistent challenge of ensuring complete sterilization for reusable devices remains a key driver for Ambu's market. Studies have shown that even with rigorous reprocessing protocols, contamination rates on reusable duodenoscopes can reach as high as 15.2%, highlighting the inherent risks that disposable alternatives aim to mitigate.

Advances in non-invasive diagnostic imaging, such as enhanced MRI and CT scan capabilities, alongside the growing sophistication of remote patient monitoring, present a potential threat by reducing reliance on certain invasive endoscopic procedures. While often complementary, the increasing precision of these technologies could, over time, diminish the demand for some of Ambu's current product offerings.

The threat of substitutes for Ambu's single-use medical devices is largely influenced by the cost-benefit analysis healthcare providers undertake when choosing between disposable and reusable options. This analysis extends beyond initial purchase price to encompass reprocessing costs, sterilization, potential for cross-contamination, and overall operational efficiency.

Ambu's core strategy directly counters this threat by highlighting the economic and safety benefits of their single-use products, particularly in infection control. For instance, the cost of reprocessing reusable endoscopes can range from $100 to $500 per procedure, including labor and supplies, while also carrying the inherent risk of inadequate sterilization. Ambu's devices eliminate these reprocessing costs and risks, offering a more predictable and safer patient care pathway.

Evolution of Medical Procedures and Techniques

The relentless advancement in medical procedures, particularly the surge in minimally invasive techniques, directly impacts the demand for specialized medical devices like those Ambu offers. For instance, the global market for minimally invasive surgery devices was projected to reach over $30 billion in 2024, highlighting a significant shift in healthcare practices.

While current trends often favor single-use instruments, a future where entirely novel treatment modalities emerge could potentially render existing endoscopic tools obsolete. Imagine a scenario where advanced nanotechnology or bio-regenerative therapies bypass the need for traditional scopes altogether. This represents a potent, albeit longer-term, threat of substitution.

- Minimally Invasive Surgery Market Growth: Expected to exceed $30 billion in 2024, indicating a strong preference for less invasive procedures.

- Technological Disruption: Emerging fields like nanomedicine or regenerative therapies could offer alternative treatment pathways.

- Device Obsolescence Risk: New procedural paradigms might reduce reliance on current endoscopic technologies.

Regulatory and Clinical Guidelines

Increasingly stringent regulatory frameworks and clinical guidelines are a significant factor pushing the market toward single-use medical devices. For instance, the European Union's Medical Device Regulation (MDR) and the U.S. Food and Drug Administration's (FDA) focus on device reprocessing and sterilization protocols directly impact the attractiveness of reusable alternatives. These evolving standards, which prioritize infection prevention and patient safety, inherently make reusable substitutes less appealing due to the inherent risks associated with their cleaning and sterilization processes.

These regulations actively diminish the viability and attractiveness of reusable substitutes that carry higher infection risks. For example, studies have shown that inadequate reprocessing of reusable medical devices can lead to healthcare-associated infections (HAIs), a growing concern for healthcare providers globally. In 2023, HAIs were estimated to affect millions of patients annually, leading to increased morbidity, mortality, and substantial healthcare costs.

Consequently, the push for enhanced patient safety through stricter oversight strengthens the market for companies like Ambu, which specialize in single-use solutions. The perceived and actual reduction in infection transmission risks associated with single-use products, compared to reusable counterparts that require meticulous reprocessing, directly addresses these regulatory and clinical imperatives. This trend is likely to continue as healthcare systems globally aim to minimize patient harm and comply with evolving safety standards.

The threat of substitutes for Ambu's single-use medical devices is multifaceted, encompassing both existing reusable alternatives and emerging technological advancements. While reusable devices have an established infrastructure, concerns over sterilization efficacy and associated costs, estimated between $100-$500 per procedure, favor disposables. Furthermore, advancements in non-invasive imaging and remote monitoring could reduce reliance on certain endoscopic procedures, though these often remain complementary.

The global market for minimally invasive surgery devices was projected to exceed $30 billion in 2024, underscoring a shift towards less invasive techniques that may influence the demand for specific endoscopic tools. Longer-term, novel treatment modalities like advanced nanotechnology or regenerative therapies could potentially render current endoscopic solutions obsolete, representing a significant, albeit future, substitution threat.

| Substitute Type | Key Considerations | Ambu's Counter-Strategy |

|---|---|---|

| Reusable Medical Devices | Established infrastructure, but sterilization concerns and reprocessing costs ($100-$500 per procedure). | Highlighting cost savings and infection control benefits of single-use. |

| Non-invasive Imaging/Remote Monitoring | Potential to reduce demand for some invasive procedures. | Focus on complementary nature and specific procedural advantages. |

| Novel Therapies (e.g., Nanomedicine) | Long-term threat of rendering existing technologies obsolete. | Continuous innovation and adaptation to evolving medical practices. |

Entrants Threaten

Entering the medical device sector, particularly for critical diagnostic and life-support equipment, demands significant upfront capital. This includes substantial outlays for research and development, establishing sophisticated manufacturing plants, and acquiring specialized machinery. For instance, the global medical device market was valued at approximately $520 billion in 2023, with a considerable portion dedicated to R&D for new technologies.

The medical device industry presents a formidable barrier to new entrants due to stringent regulatory requirements. Companies must navigate complex approval processes, including extensive clinical trials and rigorous documentation, to gain clearance from bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) for the CE Mark.

These regulatory landscapes are constantly evolving, with an increasing emphasis on risk-based approaches and robust post-market surveillance. For instance, the FDA's premarket approval (PMA) pathway for high-risk devices can take years and cost millions, a significant deterrent for startups.

Compliance costs are substantial, impacting the financial viability of new ventures. In 2024, the average cost to bring a new medical device to market, factoring in regulatory submissions and testing, continued to be in the millions of dollars, with some complex devices exceeding tens of millions.

Ambu's strong intellectual property, particularly its patent portfolio for single-use endoscopy, acts as a formidable barrier against new entrants. For instance, Ambu's investment in R&D, exceeding DKK 300 million in fiscal year 2023/24, directly fuels the creation of these protective patents.

These patents effectively prevent competitors from easily copying Ambu's successful products, forcing potential entrants to either develop entirely novel technologies or face costly legal battles and licensing agreements. This IP protection is a critical component in maintaining Ambu's market position and deterring new companies from entering the specialized medical device sector.

Economies of Scale and Distribution Channels

New entrants into the medical technology market, particularly those looking to compete with established players like Ambu, face significant hurdles related to economies of scale. Ambu's extensive manufacturing capabilities and optimized distribution networks, developed over years of operation, provide cost advantages that are difficult for newcomers to replicate quickly. For instance, Ambu's strategic investment in a new manufacturing facility in Mexico, operational by late 2023, enhances its production capacity and logistical efficiency, allowing for better cost management and faster delivery times.

The sheer cost and time required to build comparable distribution channels present a substantial barrier. Ambu has actively expanded its direct commercial organization, ensuring broad market reach and strong customer relationships. Establishing such an intricate and efficient supply chain and sales infrastructure from scratch is a daunting and capital-intensive undertaking for any nascent competitor.

- Economies of Scale: New entrants struggle to match Ambu's cost efficiencies derived from high-volume production and established supply chains.

- Distribution Network Costs: Building a direct commercial organization and robust distribution channels comparable to Ambu's is prohibitively expensive and time-consuming for startups.

- Manufacturing Capacity: Ambu's recent expansion, including its Mexico plant, increases its production volume and reduces per-unit manufacturing costs, a scale advantage difficult for new entrants to overcome.

Brand Reputation and Customer Relationships

In the healthcare sector, particularly for medical devices like those Ambu produces, brand reputation and deeply ingrained customer relationships act as significant barriers to new entrants. Building trust with hospitals and emergency services takes considerable time and effort, as these entities prioritize reliability and proven performance. Ambu has cultivated these relationships over decades, fostering a reputation centered on patient safety and product quality. This customer-centric approach, combined with their established name, makes it challenging for newcomers to gain a foothold.

New entrants face the daunting task of establishing clinical credibility and brand recognition from the ground up. This process is inherently lengthy and resource-intensive. For instance, gaining regulatory approvals and demonstrating superior clinical outcomes requires extensive testing and validation, often taking years. Ambu's consistent investment in research and development, and its focus on customer feedback, has solidified its market position.

- Brand Loyalty: Ambu's long-standing presence has fostered significant brand loyalty among healthcare providers.

- Clinical Validation: New entrants must invest heavily in clinical trials and studies to match Ambu's established credibility.

- Customer Relationships: Ambu's customer-centric approach, including dedicated support and training, strengthens ties with existing clients.

- Market Perception: In 2024, Ambu continued to be perceived as a leader in patient safety, a critical factor for healthcare purchasing decisions.

The threat of new entrants into the medical device market, especially for specialized areas like Ambu's single-use endoscopy, is significantly mitigated by high capital requirements. New companies need substantial funding for R&D, manufacturing infrastructure, and regulatory compliance. For instance, the global medical device market's growth, projected to reach over $600 billion by 2024, underscores the investment needed to capture even a small share.

Stringent regulatory hurdles, such as FDA approvals and EMA certifications, create a substantial barrier. The lengthy and costly process of clinical trials and documentation deters many potential new players. In 2024, the average time and expense to bring a new medical device to market remained in the millions, with complex devices potentially costing tens of millions.

Ambu's robust patent portfolio and significant R&D investment, exceeding DKK 300 million in fiscal year 2023/24, protect its innovations. This intellectual property prevents easy replication, forcing competitors to either innovate independently or face legal challenges, thereby limiting new entrants.

Economies of scale, driven by Ambu's high-volume production and optimized supply chains, offer cost advantages that are difficult for newcomers to match. Ambu's expanded manufacturing capacity, including its Mexico plant, further solidifies this cost leadership.

Established brand reputation and strong customer relationships, built over decades, are critical deterrents. Healthcare providers prioritize reliability and proven performance, making it challenging for new entrants to gain trust and market share against Ambu's established credibility and customer-centric approach.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the Ambu porter industry is built upon a robust foundation of data, including industry-specific market research reports, company financial statements, and trade association publications. We also incorporate data from government labor statistics and relevant academic studies to capture a comprehensive view of the competitive landscape.