Ambipar SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambipar Bundle

Ambipar's current SWOT analysis reveals a company with significant market presence and a strong commitment to sustainability, but also highlights potential challenges in market saturation and regulatory shifts.

Want the full story behind Ambipar's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ambipar boasts an impressive global reach, operating in 40 countries across six continents with over 500 operational bases. This extensive network, as of early 2024, allows them to effectively serve a diverse international clientele and swiftly address environmental incidents on a global scale.

Their comprehensive service portfolio is a significant strength, integrating waste management solutions like valorization, treatment, and disposal with critical environmental emergency response capabilities. This holistic approach provides clients with a one-stop solution for a wide range of environmental challenges.

Ambipar's core business of waste valorization and resource recovery is a natural fit for the circular economy, a model gaining significant traction globally. This inherent alignment resonates strongly with growing investor and regulatory focus on sustainability. For instance, in 2023, Ambipar reported a significant increase in the volume of materials processed for recycling, contributing to a more resource-efficient economy.

The global market for environmental services, encompassing waste management and consulting, is on a strong upward trajectory. This growth is fueled by a heightened awareness of environmental issues, more stringent government regulations, and a global commitment to sustainability. For instance, the waste management market alone was valued at over $1.5 trillion globally in 2023 and is projected to reach nearly $2 trillion by 2030, indicating substantial expansion.

Ambipar is strategically positioned to benefit from this expanding market. The company’s comprehensive suite of services, including specialized hazardous waste management and critical emergency response solutions, directly addresses the increasing need for integrated environmental solutions. This alignment with market trends provides a significant advantage.

Proven Financial Performance and Strategic Acquisitions

Ambipar showcases a history of robust financial performance, with recent periods marked by record revenues and EBITDA. This consistent growth is evident across both its Environment and Response divisions, underscoring operational strength.

The company’s proactive approach to strategic acquisitions is a key driver of its expansion. By integrating new businesses, Ambipar effectively broadens its service offerings and enhances its market presence.

- Record Revenue Growth: Ambipar reported a significant increase in revenue, reaching R$7.3 billion in 2023, a 24.6% jump from the previous year.

- EBITDA Expansion: The company’s EBITDA also saw substantial growth, climbing 30.5% to R$2.4 billion in 2023, reflecting improved profitability.

- Strategic M&A: In 2023 alone, Ambipar completed 15 acquisitions, integrating diverse capabilities and expanding its geographical footprint.

This dual strategy of fostering organic growth alongside opportunistic mergers and acquisitions solidifies Ambipar's competitive standing and market leadership.

Expertise in Hazardous Materials and Emergency Response

Ambipar's deep specialization in hazardous materials and emergency response is a significant strength. They offer comprehensive preparedness and response services, a critical need for industries facing environmental risks. This niche expertise is highly valued, especially given the increasing focus on environmental protection and regulatory compliance.

The market for emergency spill response is experiencing robust growth. For instance, the global oil spill response market was valued at approximately USD 10.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2030. This expansion directly benefits companies like Ambipar with specialized capabilities.

- Specialized Niche: Expertise in handling hazardous materials and environmental incidents.

- Critical Service: Essential for minimizing damage and regulatory fines in high-risk sectors.

- Market Growth: Benefiting from a growing global market for spill response services, projected to expand significantly in the coming years.

Ambipar's extensive global presence across 40 countries and over 500 operational bases provides a significant competitive advantage in responding to environmental needs worldwide. Their integrated service model, combining waste management with emergency response, offers clients a comprehensive and efficient solution. This broad operational scope and service integration are key differentiators in the environmental services sector.

The company's alignment with the circular economy principles, particularly in waste valorization and resource recovery, positions it favorably for sustainable growth. This focus is further amplified by strong financial performance, as evidenced by record revenues and EBITDA in recent periods. Strategic acquisitions also play a crucial role, consistently expanding Ambipar's capabilities and market reach.

| Metric | 2023 Value | Year-over-Year Change |

| Revenue | R$7.3 billion | +24.6% |

| EBITDA | R$2.4 billion | +30.5% |

| Acquisitions Completed | 15 | N/A |

What is included in the product

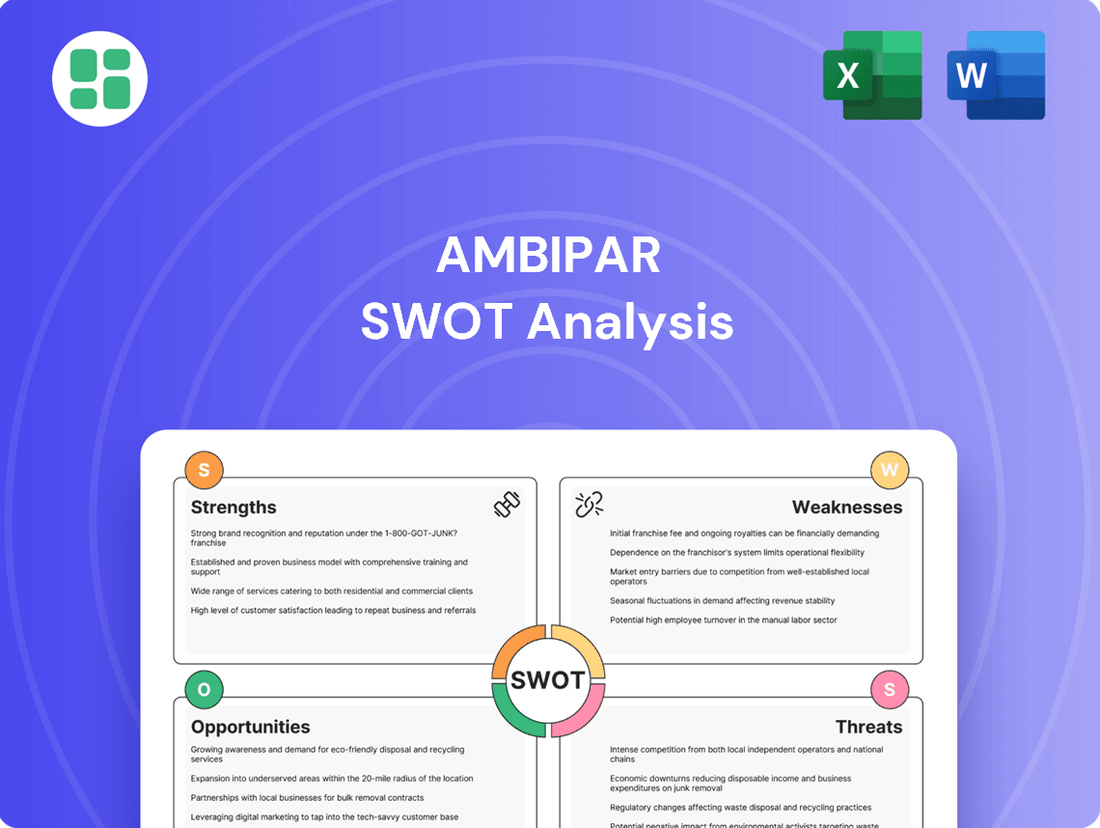

Delivers a strategic overview of Ambipar’s internal and external business factors, highlighting its strengths in environmental management and emergency response, alongside opportunities for expansion in sustainability services and potential threats from regulatory changes.

Offers a clear, actionable SWOT analysis for Ambipar, pinpointing areas for growth and mitigating potential risks.

Weaknesses

Ambipar's specialized environmental management and emergency response services, especially those involving hazardous materials, inherently lead to significant operational expenses. These costs are driven by the necessity of acquiring and maintaining sophisticated equipment, providing ongoing, specialized training for a highly skilled workforce, and rigorously adhering to demanding safety regulations. For instance, in 2023, Ambipar reported that its operational expenditures, influenced by these specialized needs, represented a substantial portion of its revenue, impacting its net profit margins.

Ambipar faces a significant challenge in managing the complex and constantly changing environmental regulations across the many countries it operates in. This regulatory web requires constant vigilance and substantial resources to ensure compliance.

The evolving nature of rules, such as those concerning hazardous waste disposal, emerging PFAS standards, and e-waste management, necessitates continuous adaptation. For instance, the anticipated tightening of PFAS regulations globally in 2025 will likely demand new investment in treatment technologies and updated operational protocols, adding to administrative and financial overhead.

While Ambipar specializes in environmental emergency response, the company itself is not immune to reputational damage from environmental incidents. Should Ambipar be involved in or perceived as mishandling an environmental event, its brand image could suffer considerably. This could lead to increased public scrutiny and potential legal and financial penalties.

Dependence on Industrial and Corporate Clients

Ambipar's revenue generation is significantly tied to its industrial and corporate client base, especially within the oil & gas, chemical, and manufacturing sectors. This concentration exposes the company to the volatility of these specific industries.

A slowdown or disruption in these key sectors, such as a downturn in oil prices or reduced industrial production, directly impacts the demand for Ambipar's waste management and emergency response services. For instance, in the first quarter of 2024, revenue from its Environmental business segment, which heavily serves industrial clients, showed a year-on-year increase but remained susceptible to the cyclical nature of its customer base.

- Client Concentration: Reliance on a few large industrial sectors makes Ambipar vulnerable to sector-specific economic shocks.

- Economic Sensitivity: Downturns in oil & gas, chemicals, or manufacturing can directly reduce demand for services.

- Revenue Volatility: Shifts in industrial activity can lead to fluctuations in Ambipar's overall revenue streams.

Intense Competition in Specific Market Segments

Ambipar operates in a market with significant competition, particularly in specialized areas like hazardous waste treatment and industrial cleaning. Established global players and numerous regional providers often compete fiercely for contracts, potentially impacting Ambipar's pricing power and ability to expand market share. For instance, in 2024, the global environmental services market, while robust, saw increased consolidation and aggressive bidding in key segments, as reported by industry analysts.

This intense rivalry necessitates continuous investment in advanced technologies and service offerings to maintain a competitive edge. Without ongoing innovation and a clear value proposition, Ambipar could face challenges in differentiating itself and securing profitable contracts. The need to constantly adapt to evolving regulatory landscapes and client demands further amplifies the pressure from competitors.

- Intensified Rivalry: Specific environmental service niches, such as specialized waste disposal and environmental remediation, are crowded with both large multinational corporations and agile local businesses.

- Pricing Pressure: High competition can lead to downward pressure on service fees, potentially squeezing profit margins if operational efficiencies are not maintained.

- Market Share Erosion: Competitors with strong existing client relationships or lower cost structures may capture market share, requiring Ambipar to actively defend its position through superior service and innovation.

Ambipar's reliance on a concentrated client base, primarily within volatile sectors like oil & gas and chemicals, exposes it to significant revenue fluctuations. A downturn in these industries, as observed in early 2024 with some industrial clients scaling back operations, directly impacts demand for Ambipar's environmental services. This economic sensitivity means that shifts in industrial activity can lead to unpredictable revenue streams, making financial forecasting more challenging.

Full Version Awaits

Ambipar SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Ambipar SWOT analysis, providing a clear understanding of its strengths, weaknesses, opportunities, and threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain comprehensive insights into Ambipar's strategic position.

Opportunities

The escalating global push for stricter environmental regulations and the increasing demand for Environmental, Social, and Governance (ESG) compliance represent a prime opportunity for Ambipar. Governments are enacting more robust policies concerning waste management, emissions control, and circular economy principles. For instance, the European Union's Green Deal aims for climate neutrality by 2050, driving demand for specialized environmental services. This regulatory landscape directly benefits companies like Ambipar that offer solutions for sustainable waste management and pollution control.

Ambipar's strategic push into new geographies, especially Latin America and North America, presents a significant opportunity for expansion. This internationalization strategy aims to capitalize on growing demand for specialized environmental and emergency response solutions.

The company's recent ventures, including key partnerships and project acquisitions in these regions, highlight the potential to penetrate markets with unmet needs. For instance, Ambipar's entry into the North American market in 2023, following acquisitions, signals a strong commitment to leveraging its expertise in new territories.

Expanding its footprint in emerging markets allows Ambipar to diversify revenue streams and gain a competitive edge by offering advanced services where environmental regulations and safety standards are increasingly stringent. This geographical diversification is crucial for long-term, sustainable growth.

Ambipar can significantly boost its services and efficiency by adopting cutting-edge technologies like AI and IoT for waste sorting and collection. These advancements, coupled with sophisticated recycling facilities and the use of bio-based materials, represent a major opportunity to improve operational processes and customer offerings.

The environmental consulting and emergency response sectors are increasingly driven by digital transformation and AI. For instance, the global AI in waste management market was projected to reach USD 1.2 billion by 2024, highlighting the growing adoption of these intelligent systems for more proactive and efficient solutions.

By integrating these technologies, Ambipar can develop more predictive models for waste generation and optimize collection routes, reducing costs and environmental impact. This strategic move aligns with the industry's shift towards data-driven, smarter environmental management.

Growth of Circular Economy Initiatives and Waste-to-Resource Projects

The global push towards a circular economy presents a significant opportunity for Ambipar. This trend, where waste is seen as a valuable resource, opens doors for innovative waste-to-resource projects. For instance, the European Union aims to increase recycling rates to 65% by 2035, highlighting the growing market for companies like Ambipar that can facilitate this transition.

Ambipar can capitalize on this by developing new ventures in waste-to-energy, upcycling, and transforming waste into higher-value materials. These initiatives directly address the global imperative to reduce landfill dependency and enhance resource efficiency. The market for waste management and recycling services is projected to reach over $700 billion globally by 2027, indicating substantial growth potential.

- Expansion into waste-to-energy: Developing projects that convert waste into electricity or heat, tapping into the growing demand for renewable energy sources.

- Upcycling and material recovery: Creating new products from discarded materials, adding value and reducing the need for virgin resources.

- Circular economy consulting: Offering expertise to other businesses looking to adopt more sustainable, circular practices.

- Partnerships for resource innovation: Collaborating with industries to find novel uses for waste streams, fostering a more integrated circular system.

Strategic Partnerships and Acquisitions to Enhance Capabilities

Ambipar's proven track record of integrating acquired companies and forging strategic partnerships offers a significant opportunity for growth. This approach allows for rapid expansion of service portfolios, immediate access to new technologies, and entry into previously untapped markets. For instance, in 2023, Ambipar completed several acquisitions, bolstering its presence in waste management and emergency response sectors, which contributed to its reported revenue growth for the year.

Continuing this strategic M&A and partnership focus can accelerate Ambipar's ability to offer a more comprehensive suite of environmental solutions. By acquiring specialized expertise or technologies, the company can enhance its competitive edge and cater to a broader range of client needs. This strategy is particularly relevant as regulatory landscapes evolve, demanding integrated solutions for complex environmental challenges.

- Acquisition of specialized waste treatment technology: This could expand service offerings and capture higher-margin business.

- Partnerships with renewable energy firms: Integrating services for circular economy initiatives, aligning with sustainability trends.

- Expansion into new geographic markets: Acquiring established players to gain immediate market share and operational presence.

Ambipar is well-positioned to capitalize on the growing global demand for sustainable waste management and circular economy solutions. The increasing focus on ESG principles and stricter environmental regulations worldwide, such as the EU's Green Deal aiming for climate neutrality by 2050, creates a fertile ground for Ambipar's specialized services. For example, the global waste management market is projected to exceed $700 billion by 2027, demonstrating significant growth potential.

The company's strategic expansion into new markets, particularly in Latin America and North America, presents a substantial growth avenue. This internationalization strategy, bolstered by recent acquisitions and partnerships in 2023, aims to address the rising need for environmental and emergency response solutions in these regions. This geographical diversification is key to unlocking new revenue streams and strengthening its competitive standing.

Leveraging advanced technologies like AI and IoT for waste management offers another significant opportunity. The AI in waste management market was projected to reach $1.2 billion by 2024, indicating a clear trend towards data-driven efficiency. By integrating these technologies, Ambipar can optimize operations, reduce costs, and enhance its service offerings, aligning with the industry's move towards smarter, more proactive environmental solutions.

Ambipar's proven success in strategic acquisitions and partnerships allows for rapid portfolio expansion and market penetration. For instance, its 2023 acquisition activities strengthened its position in key sectors, contributing to revenue growth. This approach enables the company to quickly adapt to evolving regulatory landscapes and meet diverse client needs by integrating specialized expertise and technologies.

Threats

Economic downturns, particularly those impacting industrial sectors, pose a significant threat to Ambipar. A slowdown in global manufacturing or regional economic contraction can directly reduce the need for waste management and environmental remediation services as industrial clients scale back operations. For instance, a projected global GDP growth slowdown in 2024 could translate to lower industrial output, directly affecting Ambipar's contract volumes and revenue streams.

The environmental services sector faces significant pricing challenges, particularly from smaller, localized competitors and niche specialists. These players often undercut larger firms like Ambipar by focusing on specific service areas or operating with lower overheads, creating intense price pressure. For example, in Brazil, where Ambipar has a strong presence, the waste management sector has seen numerous smaller regional players emerge, offering competitive rates for basic collection and disposal services.

Competitors' rapid adoption of advanced technologies, such as AI-driven waste sorting or novel bioremediation techniques, could render Ambipar's current operational processes less competitive. For instance, a breakthrough in chemical recycling that significantly lowers costs could disrupt Ambipar's established waste management models. This necessitates ongoing, substantial investment in research and development to stay ahead of or at least keep pace with these technological advancements.

Changes in Environmental Policy or Enforcement

Sudden shifts in environmental policy, such as a loosening of regulations, could reduce demand for Ambipar's core services. Conversely, the introduction of new, stringent policies that favor specific, unproven technologies over established solutions could also pose a challenge, requiring significant adaptation and investment. For instance, if a major market were to suddenly relax waste management standards, Ambipar's specialized disposal services might see reduced uptake.

Inconsistent enforcement of environmental regulations across different operational regions presents another threat. This uneven playing field can create competitive disadvantages for Ambipar if competitors in certain areas are not held to the same standards. In 2024, for example, varying interpretations of waste traceability laws across South American countries impacted operational costs and compliance strategies for companies like Ambipar.

- Regulatory Uncertainty: Ambipar's business model is sensitive to changes in environmental legislation, which can impact service demand and operational costs.

- Uneven Enforcement: Inconsistent application of environmental laws across jurisdictions can create unfair competition and operational complexities.

- Policy Favoritism: New regulations might disproportionately benefit certain technologies, potentially disadvantaging Ambipar's existing service offerings.

Increased Public Scrutiny and Environmental Activism

Growing public awareness and environmental activism mean that companies in the waste management and emergency response sectors, like Ambipar, face heightened scrutiny. This trend intensified in 2024 and is projected to continue into 2025, as environmental, social, and governance (ESG) factors become increasingly critical for investors and consumers alike.

Negative publicity from even minor incidents or perceived failures in sustainability practices could lead to significant reputational damage. For instance, a spill or an inefficient waste processing incident, even if quickly contained, can trigger widespread public outcry and media attention. This can result in protests and pressure from various stakeholders, including investors demanding greater accountability and more robust environmental protocols.

- Heightened ESG Scrutiny: Investors increasingly favor companies with strong ESG performance, making environmental missteps a direct financial risk.

- Reputational Risk: Negative media coverage or social media campaigns can swiftly damage brand image and customer trust.

- Operational Disruptions: Protests or regulatory actions stemming from environmental concerns can disrupt operations and increase costs.

- Investor Pressure: Funds focused on sustainability may divest from companies perceived as environmentally irresponsible, impacting share price and access to capital.

Ambipar faces threats from economic slowdowns impacting industrial clients and intense pricing pressure from smaller competitors. Technological advancements by rivals could also diminish Ambipar's competitive edge, necessitating continuous innovation. Furthermore, shifts in environmental policy and inconsistent regulatory enforcement across regions present significant challenges, potentially creating an uneven playing field and increasing compliance complexities.

SWOT Analysis Data Sources

This Ambipar SWOT analysis is built upon comprehensive data from financial statements, market intelligence reports, and industry expert commentary to provide a robust and informed strategic overview.