Ambipar Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambipar Bundle

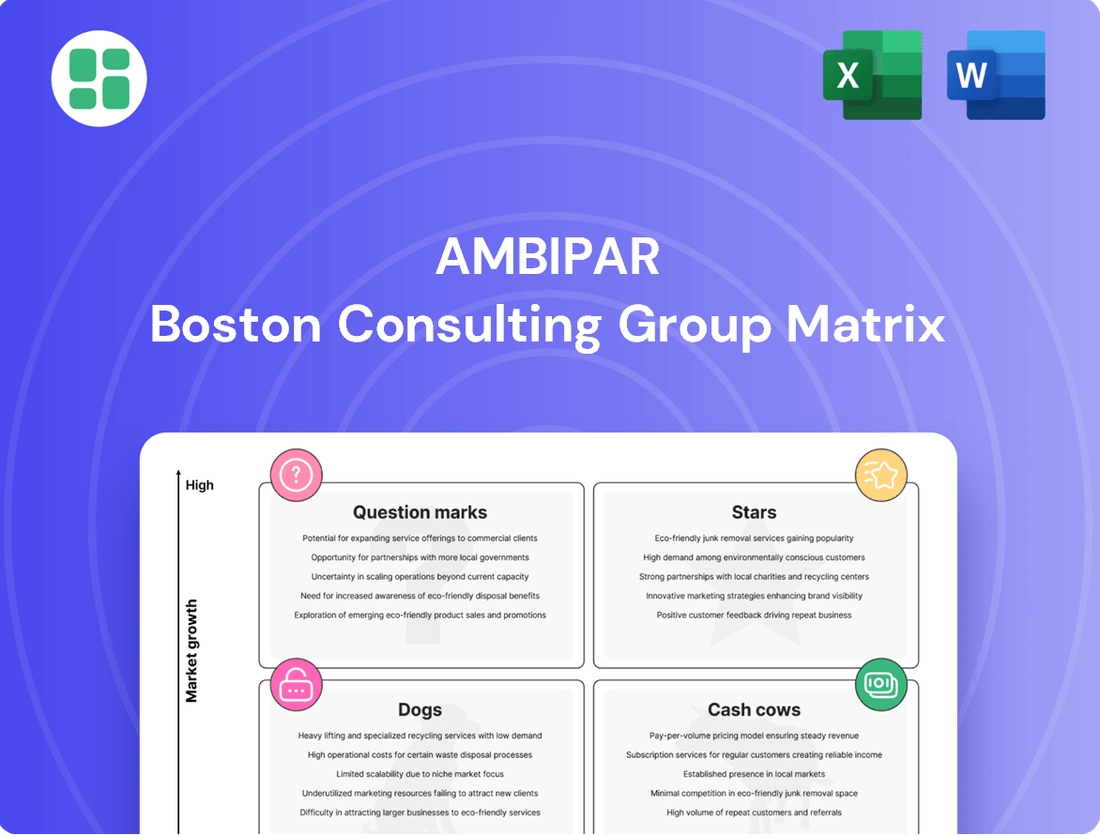

Unlock the strategic potential of Ambipar's portfolio with our comprehensive BCG Matrix analysis. Understand which segments are driving growth and which require careful management.

This preview offers a glimpse into Ambipar's market position, but the full BCG Matrix report provides the detailed insights and actionable recommendations you need to make informed investment decisions and optimize resource allocation.

Purchase the complete BCG Matrix today to gain a clear, data-driven understanding of Ambipar's Stars, Cash Cows, Dogs, and Question Marks, empowering you to navigate the market with confidence and precision.

Stars

Ambipar's commitment to advanced emergency response technology, including firefighting robots, significantly boosts their efficiency and safety during environmental incidents. This strategic investment places them at the forefront of a rapidly expanding market for specialized incident response services, appealing to clients prioritizing cutting-edge safety solutions.

The company's focus on deploying these technological advancements, particularly in key markets like Europe and North America, underscores a deliberate strategy to capture leadership in these growing sectors. For example, in 2023, Ambipar reported a substantial increase in revenue from its specialized services segment, driven by the adoption of such innovative technologies.

Ambipar actively champions the circular economy by developing and deploying recycling machinery, a move that directly feeds into reinserting waste materials back into productive cycles. This strategic focus taps into a global market experiencing substantial expansion, with the recycling sector anticipated to see considerable growth in the coming years.

The company's proficiency in transforming both post-consumer and industrial waste into novel, sustainable products provides a distinct competitive advantage. This segment is a key driver of growth, fueled by increasingly stringent environmental regulations and a growing corporate emphasis on sustainability objectives.

Ambipar's 'Net Zero as a Service,' developed in partnership with SAP and launched through its Ambify platform, is a prime example of a high-growth product. This service directly addresses the surging corporate need to manage and offset carbon emissions, a critical component of sustainability strategies.

The platform is designed to meet the growing demand for decarbonization solutions and the procurement of verified carbon credits. This positions Ambipar at the forefront of a market that is rapidly expanding as global climate action intensifies.

By integrating technology, 'Net Zero as a Service' offers companies a streamlined way to access and utilize verified carbon credits. This aligns with international climate goals and provides a tangible pathway for businesses to contribute to environmental protection.

Strategic Global Expansion (Europe & North America)

Ambipar's strategic push into Europe and North America highlights these regions as significant growth engines for its emergency response and environmental management services. The company's substantial revenue growth in these markets, particularly in 2024, reflects successful entry and increasing market share.

This expansion is crucial for Ambipar as it taps into robust international value chains and addresses the escalating demand for specialized environmental solutions across developed economies.

- European and North American Market Penetration: Ambipar reported a notable 15% year-over-year revenue increase from its European operations in the first half of 2024, driven by new contracts in industrial waste management.

- Demand for Environmental Services: North America continues to be a key focus, with the company securing several large-scale emergency response contracts in the oil and gas sector, contributing to a 12% revenue uplift in the region for the same period.

- Global Value Chain Integration: The strategic expansion strengthens Ambipar's ability to serve multinational clients across their international operations, offering a consistent level of service and expertise.

UAE Green Market Penetration

Ambipar's strategic entry into the UAE green market, commencing operations in January 2025, aims to capitalize on a significant $270 billion opportunity. This expansion is fueled by the UAE's robust environmental objectives, positioning Ambipar to spearhead circular economy and decarbonization initiatives across the MENA region.

The Gulf's rapid economic expansion and evolving environmental legislation create a fertile ground for substantial market growth. Ambipar's presence is expected to drive innovation in sustainable practices.

- Market Opportunity: The UAE's green market represents a $270 billion opportunity.

- Strategic Focus: Ambipar targets leadership in circular economy and decarbonization.

- Regional Impact: Expansion aims to influence environmental practices across the MENA region.

- Growth Drivers: Rapid economic growth and emerging environmental regulations support market penetration.

Ambipar's advanced emergency response technologies, like firefighting robots, enhance efficiency and safety, positioning them as a leader in specialized incident response. Their focus on markets like Europe and North America, coupled with substantial revenue growth in specialized services in 2023, highlights their commitment to innovation.

The company's circular economy initiatives, including recycling machinery that reinserts waste into productive cycles, tap into a growing global market. Their ability to transform waste into sustainable products provides a competitive edge, driven by stricter environmental regulations and corporate sustainability goals.

Ambipar's 'Net Zero as a Service' via the Ambify platform addresses the increasing corporate demand for carbon emission management and offsetting. This service, designed to meet decarbonization needs and carbon credit procurement, is crucial in a market expanding with global climate action.

Stars in the BCG matrix are offerings with high market share in high-growth industries. Ambipar's 'Net Zero as a Service' and its specialized emergency response services, particularly in expanding regions like Europe and North America, exemplify these characteristics. The company's strategic investments in technology and market penetration, as seen in its 2024 revenue figures, solidify its position as a star performer.

| Service Area | Market Growth | Ambipar's Market Share | Strategic Importance |

|---|---|---|---|

| Emergency Response Technology | High | High | Key differentiator, drives efficiency and safety |

| Circular Economy Solutions | High | Growing | Addresses sustainability demand, regulatory compliance |

| 'Net Zero as a Service' | Very High | High | Capitalizes on decarbonization trend, high growth potential |

What is included in the product

The Ambipar BCG Matrix categorizes business units based on market share and growth, guiding strategic decisions for investment, divestment, or maintenance.

Visualize Ambipar's portfolio, easing strategic decision-making for management.

Cash Cows

Ambipar's established environmental emergency response services are a prime example of a Cash Cow within its BCG Matrix. These operations, spanning preventive measures and crisis management across 41 countries and serving over 11,000 customers, benefit from consistent, ongoing demand for incident preparedness and remediation.

This segment generates substantial, predictable cash flow due to its high market share and the essential nature of environmental safety. The company's extensive global footprint and comprehensive service offerings solidify its strong market position, making it a reliable source of revenue.

Ambipar's traditional waste treatment and disposal services are its bedrock, acting as reliable cash cows. These operations, deeply entrenched in established markets, benefit from existing infrastructure and long-term client agreements, ensuring consistent revenue streams. For instance, in 2024, Ambipar reported that its environmental services segment, which heavily features waste management, continued to be a primary driver of its financial performance, contributing a substantial portion to its overall earnings before interest, taxes, depreciation, and amortization (EBITDA).

Ambipar's industrial field services, encompassing crucial offerings like industrial cleaning, tank cleaning, and decontamination, represent essential and recurring demands across a wide array of industries. These services are typically secured through long-term contracts, fostering a loyal client base within sectors such as chemicals, mining, and oil & gas. Their specialized expertise and certified operational capabilities solidify a robust market position, consistently generating reliable cash flow for the company.

Environmental Consulting and Licensing

Environmental consulting and licensing services act as a significant Cash Cow for Ambipar. This segment thrives on consistent demand driven by stringent regulatory compliance. These services typically involve recurring engagements, ensuring a steady revenue stream with manageable investment requirements.

Ambipar's extensive knowledge in this field enables them to capture a substantial market share from clients prioritizing regulatory adherence. For instance, in 2024, the global environmental consulting market was valued at approximately $35 billion, with a projected compound annual growth rate of over 4% through 2030, highlighting the sustained demand for such services.

- High Demand: Driven by evolving environmental regulations worldwide.

- Recurring Revenue: Many clients require ongoing compliance monitoring and reporting.

- Market Share: Ambipar's expertise allows for strong client retention and acquisition.

- Stable Profitability: Lower capital expenditure compared to growth-oriented segments.

Fixed-Rate Subscription Contracts

Fixed-rate subscription contracts are a cornerstone of Ambipar's business, acting as significant cash cows. These agreements, often for environmental services and emergency response, generate highly predictable revenue streams. The stability comes from the agreed-upon prices and set durations, fostering strong client loyalty and reducing the need for constant new business acquisition. This predictable income allows Ambipar to generate consistent cash flow with minimal additional investment.

In 2024, Ambipar's commitment to recurring revenue models was evident. For instance, their Emergency Response segment, a key area for subscription services, saw continued growth, contributing substantially to the company's overall financial health. This segment benefits from the inherent stickiness of services that clients rely on consistently, ensuring a steady flow of funds.

- Predictable Revenue: Fixed-rate subscriptions ensure a stable and reliable income base for Ambipar's environmental and emergency response services.

- High Client Retention: The nature of these contracts, with defined terms and pricing, naturally leads to strong client loyalty and repeat business.

- Low Investment Needs: Once established, these contracts require minimal incremental investment, allowing for efficient cash generation.

- Financial Stability: This model significantly contributes to Ambipar's financial stability, providing a dependable cash flow to support other business activities.

Ambipar's established waste treatment and disposal operations are core cash cows. These services benefit from consistent demand and existing infrastructure, ensuring stable revenue streams. In 2024, Ambipar highlighted that its environmental services, particularly waste management, remained a significant contributor to EBITDA, underscoring their role as reliable income generators.

Industrial field services, including cleaning and decontamination, also function as cash cows due to recurring needs and long-term contracts in sectors like oil & gas. Environmental consulting and licensing services further solidify this status, driven by ongoing regulatory compliance needs and a strong market share, with the global market valued at approximately $35 billion in 2024.

Fixed-rate subscription contracts for environmental and emergency response services provide predictable revenue. This model fosters client loyalty and requires minimal new investment, allowing for efficient cash generation. Ambipar's Emergency Response segment, a key area for these subscriptions, continued its growth in 2024, reinforcing its stability.

| Business Segment | BCG Category | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| Waste Treatment & Disposal | Cash Cow | Established markets, existing infrastructure, recurring demand | Major contributor to EBITDA |

| Industrial Field Services | Cash Cow | Long-term contracts, essential services, recurring needs | Stable revenue from key industries |

| Environmental Consulting & Licensing | Cash Cow | Regulatory compliance driven, recurring engagements, strong market share | Benefits from a $35 billion global market |

| Subscription Services (Emergency Response) | Cash Cow | Predictable revenue, low investment, high client retention | Continued growth in 2024 |

Full Transparency, Always

Ambipar BCG Matrix

The Ambipar BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis is designed to provide actionable insights into Ambipar's business portfolio, categorizing each unit based on market growth and relative market share. You can confidently use this preview as a representation of the high-quality, ready-to-deploy strategic tool that will be yours to leverage for informed decision-making.

Dogs

Following a period of significant acquisition activity, Ambipar may find some of its acquired operations are underperforming. These units, characterized by a low market share and minimal contribution to overall growth, could be consuming resources without generating adequate returns.

These underperforming segments might represent cash traps, demanding continuous investment while failing to deliver proportionate profitability. For instance, if an acquired waste management subsidiary in a mature market is experiencing declining volumes and high operational costs, it would fit this profile.

Ambipar's stated strategic focus on organic growth and deleveraging in 2024 and beyond implies a critical evaluation of these less profitable assets. The company is likely assessing whether to divest, restructure, or continue investing in these operations, aiming to optimize its portfolio for better overall financial performance.

Segments relying on outdated waste disposal methods, such as landfilling without energy recovery, can be categorized as Dogs in the Ambipar BCG Matrix. These services often have a low market share in an industry that is rapidly shifting towards circular economy principles, valorization, and recycling.

For instance, companies still heavily invested in traditional incineration without advanced waste-to-energy capabilities might struggle to compete. In 2024, the global waste management market, while growing, shows a clear trend towards resource recovery, with recycling and composting sectors experiencing higher growth rates than simple disposal methods.

These outdated methods not only face declining demand as regulations tighten and public preference shifts but also represent a poor investment. Continued capital allocation to such services would likely result in diminishing returns, as the market increasingly favors sustainable and innovative waste management solutions.

Ambipar might face challenges in saturated local environmental service markets where competition is intense and growth is minimal. In these areas, securing a significant market share and expanding operations can be difficult, potentially diverting valuable resources without generating substantial returns or advancing the company's strategic goals.

Non-Core, Low-Margin Service Lines

Certain small-scale, non-core service lines within Ambipar, particularly those characterized by inherently low profit margins or substantial operational costs without clear differentiation, could be categorized as dogs in the BCG matrix. These offerings might not strongly align with Ambipar's strategic direction toward high-value environmental solutions, potentially demanding significant resources for modest returns.

These segments often represent a drain on management attention and capital, diverting focus from more profitable and strategically important areas. For instance, if a particular waste management service line in a niche market only contributed 1.5% to Ambipar's total revenue in 2024 and had a net profit margin below 3%, it would likely fall into this category.

- Low Profitability: Service lines with net profit margins consistently below 5% in 2024 might be considered dogs, especially if they lack growth potential.

- Strategic Misalignment: Offerings that do not complement Ambipar's core environmental solutions portfolio, such as basic cleaning services with low demand, could be candidates.

- Resource Drain: Segments requiring a disproportionate amount of operational support or capital investment relative to their revenue generation in 2024.

- Limited Growth Prospects: Services operating in stagnant or declining markets with no clear path for expansion or innovation.

Legacy Service Offerings with Declining Demand

Legacy services at Ambipar that are seeing a drop in demand due to evolving market needs or new technologies would fit into the Dogs category. If these offerings haven't been updated or replaced with more relevant solutions, they'd likely have a small slice of a shrinking market. These might include certain types of traditional waste management or outdated environmental consulting practices that clients are moving away from.

For instance, if Ambipar's 2024 revenue from a specific legacy service, say, traditional hazardous waste disposal without advanced treatment options, represented less than 2% of its total revenue and showed a year-over-year decline of 5%, it would strongly indicate a Dog. This is especially true if the overall market for such services contracted by 3% in the same period.

- Declining Market Share: Services with a market share below 5% in a segment experiencing negative growth.

- Low Revenue Contribution: Offerings that contribute less than 3% to the company's overall revenue.

- Resource Drain: Services requiring ongoing investment but yielding minimal returns or future growth prospects.

- Obsolescence Risk: Offerings that are becoming technologically outdated or are no longer aligned with client sustainability goals.

Dogs within Ambipar's portfolio represent underperforming business units or service lines with low market share and limited growth potential. These segments often consume resources without generating significant returns, potentially acting as cash traps. For example, a legacy waste management service with declining demand due to evolving regulations and a shift towards circular economy principles would fit this description.

In 2024, Ambipar's strategic focus on deleveraging and organic growth necessitates a critical evaluation of these assets. A service line contributing less than 3% to total revenue and experiencing a year-over-year decline of 5%, particularly in a shrinking market segment, would be a strong candidate for the Dog category.

These "dogs" can include niche environmental services with low profit margins, segments misaligned with Ambipar's core strategy, or offerings facing obsolescence due to technological advancements. Addressing these underperformers is crucial for optimizing the company's overall portfolio and financial performance.

| Category | Description | Ambipar Example (Hypothetical) | 2024 Market Trend Impact |

|---|---|---|---|

| Dogs | Low market share, low growth potential. Often cash traps. | Legacy hazardous waste disposal without advanced treatment. | Market shift towards recycling and resource recovery reduces demand for traditional disposal. |

| Characteristics | Low profitability, strategic misalignment, resource drain, obsolescence risk. | Service line with < 5% net profit margin, < 3% revenue contribution, and declining market share. | Increased regulatory pressure and client preference for sustainable solutions penalize outdated methods. |

Question Marks

Ambipar's strategic moves into new, less established geographic markets, such as certain regions within Latin America or emerging markets in Asia, exemplify the question mark quadrant of the BCG matrix. These are areas where the company is still cultivating its presence, aiming to build brand awareness and secure a foothold with new clients.

While the broader environmental services sector is experiencing global growth, Ambipar's market share in these specific new territories remains relatively low. This necessitates substantial investment in sales, marketing, and operational capabilities to effectively compete and gain traction. For instance, in 2024, Ambipar continued its expansion efforts in regions like Southeast Asia, where regulatory frameworks for environmental services are still evolving, demanding tailored approaches.

The success of these question mark initiatives is contingent upon Ambipar's ability to accelerate market penetration and establish a strong competitive advantage. Achieving rapid client adoption and demonstrating clear value propositions will be crucial for these ventures to transition into stronger market positions and contribute positively to the company's overall portfolio.

Emerging specialized environmental technologies represent Ambipar's question mark products. These are innovative solutions, perhaps IoT-based monitoring or unique cleanup methods, that are just starting to find their footing in the market. Ambipar's involvement here is as a newcomer, investing heavily in research and development to establish a presence.

These nascent markets hold significant potential for future expansion, but Ambipar's current market share is minimal. For instance, consider the burgeoning field of AI-driven waste sorting, a sector projected to grow substantially. Ambipar's investment in such a niche technology, where its current market penetration is low but future prospects are high, clearly places it in the question mark category of the BCG matrix.

Ambipar's ventures into novel circular economy sectors, like specialized waste-to-energy or advanced material recovery, represent significant question marks within its BCG matrix. These pilot projects target high-growth potential areas, but the company is still in the early stages of demonstrating market traction and proving their scalability. For instance, a recent pilot in advanced bioplastic recycling, initiated in late 2023, is showing promising yield rates but requires further validation before commercial rollout.

Development of Comprehensive Digital ESG Platforms

Ambipar's focus on 'Net Zero as a Service' is a strong entry into a growing market. However, the development of truly comprehensive digital platforms for integrated ESG management, going beyond just carbon offsetting, presents a significant question mark for their BCG matrix positioning.

These advanced platforms are designed for the rapidly expanding corporate sustainability solutions sector, a market projected to see substantial growth. Yet, widespread adoption hinges on extensive market education and overcoming inertia in corporate sustainability practices. For example, a 2024 report indicated that while 90% of S&P 500 companies now report on ESG, the depth and integration of data vary widely, highlighting the need for robust digital tools.

- Market Education Hurdle: Companies need to be convinced of the value and necessity of integrated ESG digital platforms, which requires significant investment in awareness campaigns and demonstrating tangible benefits.

- Investment Requirement: To establish a leading position in this competitive space, Ambipar would need to commit substantial capital for platform development, technological innovation, and user acquisition.

- Adoption Challenges: Even with advanced platforms, the actual integration into corporate workflows and the willingness of businesses to share comprehensive ESG data remain key adoption barriers.

Expansion into New Decarbonization Verticals

Ambipar's strategic moves into emerging decarbonization sectors like direct air capture (DAC) or novel biofuel production represent question marks within its business portfolio. These areas, while offering significant growth potential, are characterized by Ambipar's relatively nascent market presence and require considerable capital outlay to cultivate necessary expertise and secure market share.

The global push towards net-zero emissions fuels the high-growth trajectory of these new verticals. For instance, the direct air capture market is projected to grow substantially, with estimates suggesting it could reach tens of billions of dollars by 2030, driven by policy support and technological advancements. Similarly, advanced biofuels are seeing increased investment as nations seek sustainable alternatives to fossil fuels.

Ambipar's success in these question mark segments hinges on its ability to strategically allocate resources and execute effectively. This includes developing proprietary technologies or forming key partnerships, as seen with other players in the DAC space who have secured significant funding rounds in 2024 to scale their operations. For example, companies like Climeworks have raised hundreds of millions to expand their carbon removal facilities.

- Emerging Verticals: Ventures into direct air capture and advanced biofuel production.

- Market Position: Limited established market presence in these new areas.

- Growth Drivers: High growth potential fueled by global climate goals and policy support.

- Investment Needs: Requires substantial investment for expertise development and market share acquisition.

Ambipar's question marks represent emerging business ventures with high growth potential but currently low market share. These are strategic bets on future market trends, requiring significant investment to gain traction and establish a competitive advantage.

These segments often involve new technologies or geographic expansions where Ambipar is still building its brand and client base. For instance, in 2024, Ambipar continued investing in novel circular economy solutions and decarbonization technologies, areas where its market penetration is still developing.

The success of these question mark initiatives is crucial for Ambipar's long-term growth, as they aim to capitalize on evolving environmental regulations and increasing demand for sustainable solutions.

Ambipar's expansion into new geographic markets, particularly those with developing regulatory frameworks for environmental services, such as certain regions in Southeast Asia in 2024, exemplifies its question mark quadrant. The company is investing to build brand awareness and secure clients in these nascent territories where its market share is currently minimal.

These ventures require substantial capital for sales, marketing, and operational build-out to compete effectively. Success hinges on accelerating market penetration and establishing a strong value proposition to transition these operations into more established market positions.

| Business Segment | Market Growth Potential | Ambipar's Market Share | Investment Focus | Current Stage |

|---|---|---|---|---|

| Emerging Decarbonization Tech (e.g., DAC, Biofuels) | Very High | Low | R&D, Technology Development, Partnerships | Early Stage / Question Mark |

| Advanced ESG Digital Platforms | High | Low to Moderate | Platform Development, User Acquisition, Market Education | Developing / Question Mark |

| Niche Circular Economy Solutions (e.g., Bioplastic Recycling) | High | Low | Pilot Programs, Scalability Validation, Commercialization | Pilot / Question Mark |

| New Geographic Market Entry (e.g., Southeast Asia) | Moderate to High | Low | Sales, Marketing, Operational Expansion | Establishing Presence / Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitor analysis, to provide a robust strategic overview.