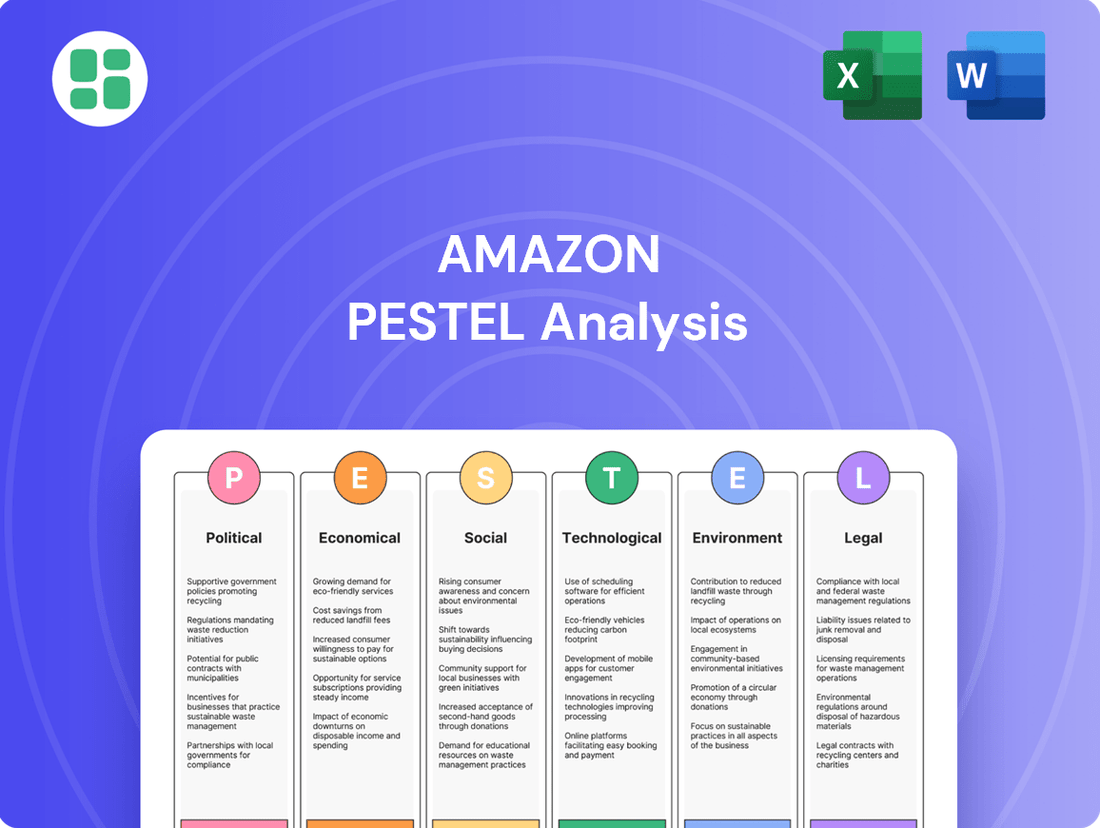

Amazon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amazon Bundle

Amazon operates in a dynamic global environment, constantly influenced by political shifts, economic fluctuations, and evolving social trends. Understanding these external forces is crucial for any stakeholder looking to grasp Amazon's strategic positioning and future trajectory. Don't get left behind; gain a competitive edge by unlocking the full PESTLE analysis, packed with actionable intelligence.

Political factors

Amazon is navigating a complex web of government regulation and antitrust scrutiny worldwide. The European Union is poised to initiate a probe in 2025 under the Digital Markets Act (DMA), specifically examining whether Amazon unfairly promotes its own products on its vast marketplace. Should violations be found, the company could face penalties reaching up to 10% of its global annual revenue.

In the United States, the Federal Trade Commission (FTC), alongside numerous state attorneys general, initiated a significant lawsuit in September 2023. This legal action alleges that Amazon engages in anti-competitive practices, including price inflation, excessive charges to sellers, and the suppression of market competition. A trial for this case is currently scheduled for October 2026, indicating a prolonged period of legal challenge.

Amazon faces a growing web of data privacy and consumer protection laws globally, including Europe's GDPR and California's CCPA. These regulations demand stringent data handling practices, impacting how Amazon collects, uses, and stores customer information.

The Federal Trade Commission (FTC) has been actively scrutinizing Amazon's practices, particularly concerning its Prime subscription service. Allegations of deceptive enrollment and difficult cancellation procedures have led to ongoing legal actions, with significant implications expected through 2025.

Failure to comply with these evolving legal frameworks can result in substantial financial penalties. For instance, GDPR fines can reach up to 4% of annual global revenue. Maintaining consumer trust through robust data protection is therefore paramount for Amazon's continued success and reputation.

Amazon's vast global e-commerce network is significantly influenced by international trade policies and tariffs. Changes in these regulations, such as those seen with ongoing trade discussions between major economic blocs, can directly affect the cost of goods Amazon imports and exports, impacting its pricing and profitability. For instance, a shift towards more protectionist policies in key markets could necessitate adjustments to Amazon's sourcing strategies and supply chain infrastructure.

Geopolitical tensions and evolving trade agreements, like the potential renegotiation of existing pacts or the imposition of new sanctions, pose a direct risk to Amazon's market access and operational efficiency. These factors can disrupt established logistics routes and increase shipping costs, as demonstrated by the supply chain challenges experienced globally in recent years, which saw shipping rates surge significantly. Such disruptions require Amazon to maintain flexibility in its expansion plans and to continually assess the economic and political stability of the regions where it operates.

Political Lobbying and Influence

Amazon's significant investment in political lobbying aims to shape legislation impacting its vast operations, from e-commerce rules to cloud computing regulations. In 2023 alone, Amazon reportedly spent over $20 million on lobbying efforts in the United States, reflecting its commitment to influencing policy decisions that affect its bottom line.

Concerns have been raised regarding Amazon's governance structure and the 'revolving door' phenomenon, where former government officials move into lobbying roles for the company. This practice can potentially lead to undue influence on policy-making, creating an uneven playing field for competitors.

- Lobbying Spend: Amazon's lobbying expenditures in the US exceeded $20 million in 2023.

- Regulatory Focus: Key areas of lobbying include antitrust, data privacy, and labor laws.

- Influence Concerns: The 'revolving door' practice between government and Amazon lobbying roles raises questions about potential policy bias.

Labor Laws and Worker Rights

Amazon continues to navigate a complex landscape of labor laws and worker rights, facing persistent scrutiny over its employment practices. Unionization drives, particularly within its vast network of fulfillment centers, remain a significant concern, with ongoing efforts by workers seeking better conditions and wages. For instance, in 2024, the National Labor Relations Board (NLRB) continued to oversee numerous cases related to Amazon's labor relations, highlighting the persistent tension between the company and its workforce.

These labor challenges directly impact operational costs and potential disruptions. Stricter enforcement of existing labor regulations or the introduction of new legislation mandating higher wages, improved safety standards, or enhanced benefits could increase Amazon's expenses significantly. For example, potential increases in minimum wage requirements in various operating regions, a trend observed in several US states and cities throughout 2024 and projected into 2025, directly affect Amazon's substantial hourly workforce.

- Increased Labor Costs: Potential for higher wages and benefits mandated by new or enforced labor laws.

- Unionization Impact: Collective bargaining agreements could lead to changes in work rules and compensation structures.

- Regulatory Fines: Non-compliance with labor laws can result in substantial penalties and legal fees.

- Reputational Risk: Negative publicity surrounding labor disputes can affect consumer perception and brand loyalty.

Amazon faces significant regulatory challenges globally, with antitrust probes in the EU under the Digital Markets Act potentially leading to fines up to 10% of global revenue in 2025. The US FTC and state attorneys general filed a major lawsuit in September 2023 alleging anti-competitive practices, with a trial set for October 2026.

Data privacy laws like GDPR and CCPA are forcing Amazon to adopt stringent data handling, impacting its operations. The FTC is also scrutinizing Amazon's Prime service for deceptive practices, with legal actions expected to continue through 2025.

International trade policies and geopolitical tensions directly affect Amazon's supply chain and market access, with recent years seeing significant shipping rate surges. Amazon's lobbying efforts in the US exceeded $20 million in 2023, focusing on e-commerce, cloud computing, and antitrust regulations.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting Amazon, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by highlighting how these global trends create both challenges and opportunities for Amazon's diverse operations.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting Amazon's operations.

Economic factors

Amazon's foundational e-commerce segment continues its upward trajectory, though its growth rate is sensitive to broader consumer spending patterns and the intensifying rivalry from both online and traditional brick-and-mortar competitors. For instance, in the first quarter of 2024, Amazon reported online stores sales of $58.3 billion, a 7% increase year-over-year, demonstrating sustained momentum.

To solidify its market leadership, Amazon has strategically emphasized broadening its product selection, implementing competitive pricing strategies, and enhancing delivery efficiency, especially for its loyal Prime membership base. This focus is crucial as global e-commerce sales are projected to reach $7.5 trillion by 2026, according to Statista, highlighting the significant market opportunity and the need for continuous innovation.

Amazon Web Services (AWS) continues to dominate the cloud infrastructure market, though its share saw a slight dip in 2024 due to intensified competition from rivals like Microsoft Azure and Google Cloud. This segment is crucial for Amazon's financial health, serving as a major engine for both revenue and profit generation.

To maintain its leading position, AWS is making significant capital expenditures, with investments in artificial intelligence infrastructure alone projected to surpass $100 billion by 2025. This strategic investment is aimed at solidifying AWS's competitive advantage in the rapidly evolving cloud landscape.

Inflation significantly impacts Amazon's operational expenses. In the US, the Consumer Price Index (CPI) saw a notable increase, with core inflation remaining elevated throughout 2024. This rise in the CPI directly translates to higher costs for shipping, warehousing, and employee wages, squeezing Amazon's profit margins.

Consumer purchasing power is directly tied to inflation. As prices rise, consumers have less discretionary income, potentially reducing spending on non-essential items sold on Amazon's platform. For instance, if inflation outpaces wage growth, consumers might cut back on electronics or apparel, impacting Amazon's sales volume.

Global Economic Stability and Recession Risks

Amazon's vast global footprint means it's highly attuned to the ebb and flow of worldwide economic health. When economies are stable, consumers and businesses tend to spend more freely, benefiting Amazon's e-commerce and AWS segments. However, a shaky global economy or the looming threat of recession can significantly dampen this spending, directly impacting Amazon's revenue streams.

The risk of a global recession in 2024-2025 presents a notable challenge. Factors like persistent inflation, high interest rates, and geopolitical tensions continue to weigh on consumer confidence and corporate investment. This could translate into slower growth for Amazon's retail operations as discretionary spending tightens, and potentially reduced demand for AWS as businesses look to cut costs.

- Reduced Consumer Spending: Global economic slowdowns typically lead to consumers cutting back on non-essential purchases, directly impacting Amazon's retail sales.

- Business Cost-Cutting: During economic uncertainty, businesses often reduce IT budgets, which could affect the growth rate of Amazon Web Services (AWS) as companies optimize cloud spending.

- Supply Chain Disruptions: Economic instability can exacerbate existing supply chain issues, leading to higher operational costs and potential stock shortages for Amazon.

- Currency Fluctuations: A volatile global economic landscape can result in significant currency exchange rate shifts, impacting the reported earnings of Amazon's international operations.

Labor Market Dynamics and Wage Pressures

Amazon faces significant challenges from a tight labor market, with rising wage pressures impacting its vast logistics operations. This is particularly acute for warehouse and delivery staff, essential for fulfilling customer orders and maintaining Amazon's rapid delivery promises.

Managing these escalating labor costs while ensuring sufficient staffing to meet peak demand and uphold service quality is a delicate balancing act. The company's profitability can be directly affected by its ability to navigate these dynamics effectively.

As of early 2024, the US unemployment rate remained historically low, hovering around 3.7%. This scarcity of available workers, coupled with increased demand for logistics roles, has driven up average hourly wages in the sector. For instance, Amazon has been investing heavily in its workforce, with reported average starting wages for fulfillment and logistics employees in the US reaching over $20 per hour in 2023, a figure likely to see continued upward pressure in 2024 and 2025.

- Tight Labor Market: Historically low unemployment rates create a competitive environment for attracting and retaining workers.

- Wage Inflation: Increased competition and cost of living contribute to upward pressure on wages for logistics and warehouse roles.

- Operational Costs: Higher labor expenses directly impact Amazon's operational expenditures and potential profit margins.

- Service Level Maintenance: The need to maintain adequate staffing levels to meet delivery expectations adds complexity to cost management.

Amazon's profitability is significantly influenced by macroeconomic trends, particularly inflation and consumer spending power. Elevated inflation in 2024, as seen in the US CPI, directly increases Amazon's operational costs for shipping, warehousing, and wages. This, in turn, can reduce consumer discretionary income, potentially leading to lower sales volumes for non-essential goods on its platform.

The company's global operations make it sensitive to worldwide economic health; a slowdown or recessionary pressures in 2024-2025 could dampen both consumer and business spending, impacting e-commerce and AWS revenue. For instance, persistent inflation and high interest rates are already weighing on consumer confidence.

Labor market dynamics, including historically low unemployment rates in the US as of early 2024, contribute to wage inflation. Amazon's extensive logistics network faces upward pressure on wages for warehouse and delivery staff, with average starting wages exceeding $20 per hour in 2023, a trend likely to continue into 2024-2025, impacting operational costs.

| Economic Factor | Impact on Amazon | Supporting Data/Trend (2024-2025 Focus) |

|---|---|---|

| Inflation | Increased operational costs (shipping, wages), reduced consumer spending power | US Core CPI elevated throughout 2024; potential for continued pressure on discretionary spending. |

| Economic Growth/Recession Risk | Potential slowdown in e-commerce and AWS growth due to reduced consumer and business spending | Global recessionary concerns persist due to inflation and geopolitical tensions, impacting confidence. |

| Labor Market Conditions | Upward pressure on wages, challenges in recruitment and retention for logistics staff | US unemployment rate around 3.7% in early 2024; average starting wages for fulfillment staff over $20/hour in 2023, with ongoing increases expected. |

Preview the Actual Deliverable

Amazon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Amazon PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the e-commerce giant. Gain strategic insights into market dynamics and competitive landscapes.

Sociological factors

Consumer tastes are shifting, with a pronounced desire for convenience, tailored experiences, and sustainable practices. Amazon is responding by broadening its vast product catalog and enhancing delivery speed, offering same-day and next-day options in many areas. In 2024, Amazon's focus on personalization, driven by AI, aims to meet these evolving demands, with the company investing heavily in technologies that predict and cater to individual shopper needs.

Amazon faces significant societal pressure to foster diversity, equity, and inclusion (DEI) across its extensive global workforce. This commitment is crucial for its brand image and talent acquisition, especially as public and advocacy group scrutiny intensifies.

In 2023, Amazon reported that women held 28.7% of its leadership positions, a slight increase from previous years, signaling ongoing efforts. However, the company continues to be evaluated on its progress in areas like racial and ethnic representation, with many expecting further demonstrable improvements in 2024 and beyond.

Amazon's public image is significantly shaped by its social responsibility efforts. Consumers and stakeholders are paying closer attention to how the company treats its employees, its tax contributions, and its involvement in local communities. For instance, in 2023, Amazon continued to face scrutiny over warehouse working conditions, with ongoing reports and unionization efforts highlighting these concerns.

The company's dedication to ethical practices directly influences its brand reputation and customer trust. Positive actions, such as investments in renewable energy or community support programs, can bolster loyalty. Conversely, negative perceptions regarding labor practices or tax avoidance can lead to boycotts or reputational damage, impacting sales and market position.

Impact on Traditional Retail and Local Economies

Amazon's massive e-commerce footprint profoundly alters traditional retail, with implications for local economies. As online sales continue to grow, brick-and-mortar stores face increasing pressure. For instance, in the US, e-commerce sales reached an estimated $1.14 trillion in 2023, a significant portion of total retail sales, directly impacting physical store revenues.

This transformation sparks ongoing societal debates. Concerns about job displacement in traditional retail sectors are prominent, alongside discussions on urban planning as retail spaces evolve or close. The concentration of economic power in large online platforms like Amazon also fuels public and political sentiment, influencing regulatory discussions and consumer choices.

- Retail Landscape Shift: E-commerce growth, projected to capture an increasing share of global retail, directly challenges traditional brick-and-mortar establishments.

- Employment Concerns: The shift raises questions about job losses in physical retail versus new job creation in logistics and warehousing, a dynamic that continues to evolve.

- Economic Concentration: Amazon's market dominance prompts discussions about wealth distribution and the impact on smaller, local businesses and their communities.

- Urban Planning Impact: Changes in retail footprints affect commercial real estate, urban development, and the vibrancy of local town centers.

Gig Economy and Flexible Work Arrangements

The increasing prevalence of the gig economy and the strong demand for flexible work arrangements significantly impact Amazon's vast delivery and logistics network, notably through its Amazon Flex program. This model allows individuals to use their own vehicles to deliver packages, offering a flexible income stream that appeals to a growing segment of the workforce. As of early 2024, millions of individuals globally participate in gig work, and this trend shows no signs of slowing down, directly influencing Amazon's ability to scale its delivery capabilities efficiently.

Amazon faces the ongoing sociological challenge of balancing the advantages of this flexible labor pool with critical considerations regarding worker benefits, job security, and overall stability. This dynamic requires continuous adaptation in how Amazon structures its relationships with delivery partners, ensuring compliance with evolving labor regulations and meeting societal expectations for fair treatment of workers. For instance, discussions around worker classification and benefits for gig workers remain prominent in many markets where Amazon operates, impacting operational costs and public perception.

- Gig Economy Growth: Projections indicate the global gig economy could reach over $455 billion by 2023, with continued expansion anticipated through 2025, directly feeding into Amazon's Flex driver pool.

- Worker Preferences: Surveys consistently show a significant portion of the workforce, particularly younger demographics, prioritize flexibility and autonomy in their work arrangements.

- Regulatory Scrutiny: Governments worldwide are increasingly examining the legal and ethical implications of gig work, potentially leading to new mandates for companies like Amazon regarding worker protections.

Societal expectations for corporate responsibility are escalating, pushing Amazon to demonstrate tangible progress in areas like sustainability and ethical labor practices. Consumers increasingly favor brands that align with their values, making Amazon's commitment to environmental, social, and governance (ESG) initiatives a critical component of its brand image and long-term viability.

In 2024, Amazon's investments in renewable energy projects, such as wind and solar farms, are key to meeting its Climate Pledge goals. The company aims to power its operations with 100% renewable energy by 2025, a target that garners significant public attention and influences consumer perception.

Amazon's impact on the retail landscape continues to reshape consumer habits and expectations. The convenience and vast selection offered by e-commerce platforms like Amazon have led to a decline in foot traffic for many brick-and-mortar stores, with e-commerce sales in the US projected to grow by approximately 8-10% in 2024.

| Societal Factor | Amazon's Response/Impact | 2024/2025 Data/Trend |

|---|---|---|

| Consumer Demand for Convenience | Enhanced delivery speeds, one-click ordering, personalized recommendations | Continued growth in same-day/next-day delivery services; AI-driven personalization investments |

| Diversity, Equity, and Inclusion (DEI) | Focus on increasing representation in leadership and workforce | Ongoing evaluation of leadership diversity metrics; 2023 data showed 28.7% women in leadership |

| Social Responsibility & Ethics | Scrutiny on labor conditions, tax contributions, and community impact | Continued focus on warehouse conditions and unionization efforts; investment in renewable energy |

| Gig Economy Integration | Leveraging flexible work for delivery services (Amazon Flex) | Millions globally participating in gig work; ongoing discussions on worker benefits and classification |

Technological factors

Amazon's commitment to Artificial Intelligence is substantial, with plans to invest over $100 billion by 2025, primarily channeled through Amazon Web Services (AWS). This significant capital allocation is designed to propel AI advancements across the company.

These investments are strategically focused on bolstering cloud computing infrastructure, enhancing customer interactions with advanced generative AI chatbots, and pioneering new AI models like Amazon Nova. These developments are set to permeate various aspects of Amazon's operations and service offerings.

Amazon Web Services (AWS) remains at the forefront of cloud infrastructure, consistently introducing novel services and technologies. This innovation is crucial for supporting a wide array of business requirements, from startups to large enterprises.

AWS's strategic expansion of its global data center footprint, coupled with a strong emphasis on energy efficiency, directly addresses the escalating demand for cloud services. This is particularly evident with the significant uptake in artificial intelligence (AI) workloads, which require substantial computing power.

In 2024, AWS continued its aggressive build-out, with capital expenditures expected to remain robust to support this growing infrastructure need. The company's commitment to sustainability in its data center operations is a key technological factor, ensuring scalability while managing environmental impact.

Amazon's extensive use of automation and robotics in its fulfillment centers is a cornerstone of its operational strategy, driving significant improvements in efficiency and delivery speed. For instance, by 2023, Amazon had deployed over 1 million robotic drive units across its global network, a testament to its commitment to this technological factor.

These investments are crucial for managing Amazon's immense inventory and keeping operational costs in check, particularly as the company continues to expand its reach and product offerings. The company reported a 2023 operating income of $36.9 billion, partly attributed to these efficiency gains.

However, the increasing reliance on robotics also sparks ongoing discussions about the evolving role of human workers within Amazon's logistics operations, presenting a complex challenge for workforce management and societal impact.

Drone Delivery Advancements (Prime Air)

Amazon's Prime Air drone delivery service is making significant strides, with its latest MK30 drones designed to carry packages up to 5 pounds and operate even in light rain. This technological leap is crucial for expanding the service's reach and reliability.

While regulatory approvals and technological advancements are paving the way, widespread adoption of drone delivery still encounters hurdles. These include the substantial operational costs associated with such a novel system, gaining public trust and acceptance, and navigating complex, evolving regulatory frameworks. Amazon's ambitious target of achieving 500 million annual drone deliveries by 2029 underscores their commitment to overcoming these challenges.

- MK30 Drone Capabilities: Carries up to 5 pounds, operates in light rain.

- Delivery Target: Aiming for 500 million annual drone deliveries by 2029.

- Implementation Challenges: Operational costs, public acceptance, regulatory restrictions.

Cybersecurity and Data Protection Technologies

Amazon's reliance on vast amounts of customer and business data necessitates advanced cybersecurity. In 2024, the company continued to invest heavily in protecting its digital infrastructure, a critical factor given the increasing sophistication of cyber threats. This ongoing commitment is vital for maintaining customer trust and ensuring compliance with global data privacy laws.

The technological landscape demands continuous innovation in data protection. Amazon's strategy involves implementing cutting-edge data encryption, sophisticated threat detection systems, and privacy-enhancing technologies. These efforts are crucial for mitigating risks associated with data breaches and adapting to evolving regulatory requirements, such as GDPR and CCPA.

- Cybersecurity Investment: Amazon's annual spending on cybersecurity is substantial, reflecting the critical nature of data protection in its operations.

- Data Encryption: Advanced encryption protocols are employed across all data storage and transmission points to safeguard sensitive customer information.

- Threat Detection: Machine learning and AI-powered systems are utilized to proactively identify and neutralize potential cyber threats in real-time.

- Regulatory Compliance: Adherence to stringent data protection regulations is a key driver for technological advancements in cybersecurity.

Amazon's technological prowess is evident in its aggressive AI investment, with over $100 billion earmarked for AI development by 2025, primarily through AWS. This fuels advancements in cloud computing, generative AI chatbots, and new AI models like Amazon Nova, impacting all operational facets.

AWS continues to lead in cloud infrastructure innovation, essential for supporting diverse business needs, from startups to large enterprises. Its global data center expansion, with a focus on energy efficiency, directly addresses the surge in AI workloads requiring substantial computing power.

The company's extensive use of robotics in fulfillment centers, deploying over 1 million robotic drive units by 2023, significantly boosts efficiency and delivery speed, contributing to a 2023 operating income of $36.9 billion.

Amazon's Prime Air drone delivery service, featuring MK30 drones capable of carrying up to 5 pounds and operating in light rain, aims for 500 million annual deliveries by 2029, despite challenges in cost, public acceptance, and regulation.

| Technological Factor | Description | Key Data/Statistics |

|---|---|---|

| Artificial Intelligence (AI) | Investment in AI development and integration across services. | Over $100 billion planned investment by 2025. |

| Cloud Computing (AWS) | Expansion and innovation in cloud infrastructure. | Robust capital expenditures in 2024 for infrastructure build-out. |

| Automation & Robotics | Deployment of robots in fulfillment centers for efficiency. | Over 1 million robotic drive units deployed globally by 2023. |

| Drone Delivery (Prime Air) | Advancement of drone technology for package delivery. | MK30 drones carry up to 5 lbs; target of 500 million annual deliveries by 2029. |

| Cybersecurity | Investment in protecting digital infrastructure and data. | Continuous substantial investment in advanced encryption and threat detection. |

Legal factors

Amazon faces intense scrutiny regarding antitrust and competition law, particularly in the US and the EU. These regions have ongoing lawsuits alleging monopolistic behavior, such as prioritizing Amazon's own products and penalizing third-party sellers who offer better prices on competing platforms. For example, in late 2023, the EU continued its investigation into Amazon's use of third-party seller data, a key aspect of its market dominance concerns.

The potential repercussions of these legal challenges are significant. Fines could amount to billions of dollars, impacting Amazon's profitability. More critically, these lawsuits could mandate substantial alterations to Amazon's core business model, potentially affecting how it operates its marketplace and manages its vast logistics network.

Amazon faces significant legal hurdles related to data privacy and security. Compliance with stringent global regulations like the EU's General Data Protection Regulation (GDPR) and evolving US state laws, such as California's Consumer Privacy Act (CCPA), requires constant vigilance and investment in robust data protection measures. Failure to comply can result in substantial fines, impacting profitability and brand reputation.

The Federal Trade Commission's (FTC) ongoing lawsuit against Amazon concerning its Prime subscription and cancellation processes underscores the increasing regulatory focus on consumer protection and transparency. This action specifically targets alleged use of 'dark patterns' – user interface designs that trick users into making unintended decisions – highlighting the legal risks associated with subscription models and user consent mechanisms in the digital marketplace.

Amazon faces a continuous stream of intellectual property infringement allegations, covering trademarks, copyrights, and patents, primarily from third-party sellers and brands operating on its vast marketplace. These claims often involve unauthorized use of brand names, logos, or patented product designs.

To address these issues, Amazon has implemented robust programs such as APEX (Amazon Patent Evaluation Express) and actively collaborates with intellectual property owners. This partnership aims to identify and remove counterfeit goods and enforce existing IP rights, contributing to a more secure marketplace.

In 2023, Amazon reported seizing over 1.5 million counterfeit products through its Brand Protection efforts, a testament to the scale of the infringement challenge. The company's ongoing investment in these protective measures underscores the critical legal and reputational risks associated with IP violations.

Labor and Employment Regulations

Amazon consistently navigates a complex web of labor and employment regulations globally. The company has faced numerous allegations concerning unfair labor practices, particularly in its warehouse operations, alongside scrutiny over workplace safety standards. For instance, in 2023, OSHA issued citations and proposed penalties totaling over $1.7 million for alleged safety violations at several Amazon facilities across the United States.

Compliance with varying national and international labor laws, including minimum wage requirements and working condition standards, presents an ongoing legal and operational challenge. These regulations impact everything from employee benefits and scheduling to the right to organize. Amazon's significant workforce, estimated to be over 1.5 million globally as of early 2024, amplifies the complexity and potential impact of these legal frameworks.

- Unionization Efforts: Amazon faces continued challenges from organized labor, with ongoing campaigns and legal disputes related to unionization drives at its fulfillment centers.

- Workplace Safety Compliance: The company must adhere to stringent occupational safety and health regulations, with agencies like OSHA actively monitoring and enforcing workplace safety standards.

- Wage and Hour Laws: Adherence to diverse minimum wage laws and overtime regulations across different jurisdictions is critical, impacting operational costs and employee compensation structures.

- Worker Classification: Ensuring correct classification of workers, particularly in relation to independent contractor versus employee status, remains a legal consideration in certain operational models.

Consumer Protection and Product Liability Laws

Amazon operates under stringent consumer protection laws, necessitating a focus on product safety, transparent advertising, and equitable return policies. These regulations are critical for maintaining customer trust in its vast marketplace and its own branded products. Failure to comply can result in significant penalties and reputational damage.

Product liability laws hold Amazon accountable for defective or unsafe products sold through its platform, whether manufactured by Amazon or third-party sellers. This includes addressing issues such as product defects, misrepresentation, and fraudulent sales. For instance, in 2024, regulatory bodies continued to scrutinize online marketplaces for the sale of counterfeit or unsafe goods, with fines escalating for non-compliance.

- Consumer Protection: Laws like the Consumer Rights Act (UK) and FTC regulations (US) mandate fair practices.

- Product Safety: Compliance with standards set by agencies like the CPSC (US) and CE marking (EU) is essential.

- Liability: Amazon can be held liable for damages caused by faulty products sold on its site.

- Fraud Prevention: Measures to combat counterfeit goods and deceptive seller practices are ongoing.

Amazon navigates a complex legal landscape, facing significant antitrust scrutiny in both the US and EU for alleged monopolistic practices, as seen in ongoing investigations into its use of third-party seller data. The company must also comply with stringent global data privacy regulations like GDPR and CCPA, with non-compliance risking substantial fines and reputational damage. Furthermore, Amazon is actively addressing intellectual property infringement claims, having seized over 1.5 million counterfeit products in 2023 through its Brand Protection efforts, highlighting the ongoing legal and reputational risks associated with IP violations.

| Legal Area | Key Issues | 2023/2024 Data/Developments |

| Antitrust & Competition | Monopolistic behavior, data usage, marketplace practices | Ongoing EU investigation into third-party seller data; US lawsuits alleging anti-competitive practices. |

| Data Privacy & Security | GDPR, CCPA compliance, data protection | Continuous investment in robust data protection measures to avoid fines and reputational damage. |

| Intellectual Property | Counterfeit goods, trademark/patent infringement | Seized over 1.5 million counterfeit products in 2023; ongoing collaboration with IP owners via programs like APEX. |

| Labor & Employment | Workplace safety, unionization, wage laws | OSHA proposed over $1.7 million in penalties in 2023 for safety violations; global workforce exceeding 1.5 million (early 2024). |

| Consumer Protection | Product safety, advertising transparency, Prime cancellations | FTC lawsuit concerning Prime subscription and cancellation processes; continued scrutiny of online marketplaces for unsafe goods in 2024. |

Environmental factors

Amazon's commitment to net-zero carbon emissions by 2040, as outlined in The Climate Pledge, faces ongoing challenges. Despite a reported decrease in carbon intensity in 2024, the company saw a 6% rise in absolute emissions, largely driven by its expanding operations and data centers.

Amazon achieved its goal of matching 100% of its electricity use with renewable energy sources in 2023, a milestone it sustained through 2024, surpassing its initial 2025 target. This commitment is backed by significant investments in wind, solar, and other carbon-free energy projects worldwide.

These renewable energy initiatives are crucial for powering Amazon's vast operational footprint, including its Amazon Web Services (AWS) data centers, which are energy-intensive by nature. By 2023, Amazon had invested in over 100 renewable energy projects globally, totaling more than 15 gigawatts of capacity.

Amazon's commitment to sustainable packaging saw the global elimination of plastic air pillows in 2024, replaced by recyclable paper fillers. This initiative significantly cut down on single-use plastic in deliveries.

By the end of 2024, Amazon achieved an 85% landfill diversion rate, a testament to its ongoing efforts in waste reduction and the adoption of more environmentally friendly packaging solutions.

Electric Vehicle (EV) Fleet Deployment

Amazon's commitment to electric vehicle (EV) fleet deployment is a significant environmental factor. The company aims to have 100,000 electric delivery vans by 2030, a substantial undertaking that will reduce its carbon footprint.

In 2024, Amazon's EV fleet grew from 19,000 to over 31,000 vehicles, demonstrating accelerated progress. Furthermore, Amazon achieved its 2025 target of 10,000 EVs in India ahead of schedule, highlighting a global push towards sustainable logistics.

- Fleet Expansion: Amazon's EV fleet grew from 19,000 to over 31,000 in 2024.

- 2030 Goal: The company plans to deploy 100,000 electric delivery vans by 2030.

- India Milestone: Amazon met its 2025 target of 10,000 EVs in India ahead of schedule.

Water Stewardship and Biodiversity

Amazon is making significant strides in water stewardship, with a clear goal to be water positive globally by 2030. By the close of 2024, the company had achieved 53% of this ambitious target. This commitment extends to tangible actions, as demonstrated by the 4.3 billion liters of water returned to communities in 2024.

Beyond water, Amazon is actively engaged in protecting and restoring land through nature-based solutions. This dual focus on water and biodiversity underscores a broader environmental strategy.

- Water Positive Goal: Aiming for global water positivity by 2030, with 53% completion by end of 2024.

- Water Replenishment: Returned 4.3 billion liters of water to communities in 2024.

- Biodiversity Commitment: Focused on protecting or restoring land via nature-based solutions.

Amazon's environmental efforts show progress in renewable energy and fleet electrification, but absolute emissions are still rising. The company achieved its 100% renewable energy goal for 2023 and maintained it through 2024, investing heavily in clean energy projects. Significant expansion of its electric vehicle fleet is underway, with over 31,000 EVs deployed by the end of 2024, pushing towards a 2030 goal of 100,000. Furthermore, Amazon is working towards water positivity by 2030, having returned 4.3 billion liters of water in 2024.

| Environmental Metric | 2023 Data | 2024 Data | Target/Goal |

|---|---|---|---|

| Renewable Energy Use | 100% | 100% | Sustained |

| Absolute Emissions | N/A | Increased 6% | Net-zero by 2040 |

| Electric Delivery Vans | 19,000 | 31,000+ | 100,000 by 2030 |

| Water Replenishment | N/A | 4.3 billion liters | Water positive by 2030 |

PESTLE Analysis Data Sources

Our Amazon PESTLE Analysis is meticulously crafted using data from official government publications, reputable market research firms, and leading economic institutions. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in credible and current information.