Amazon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amazon Bundle

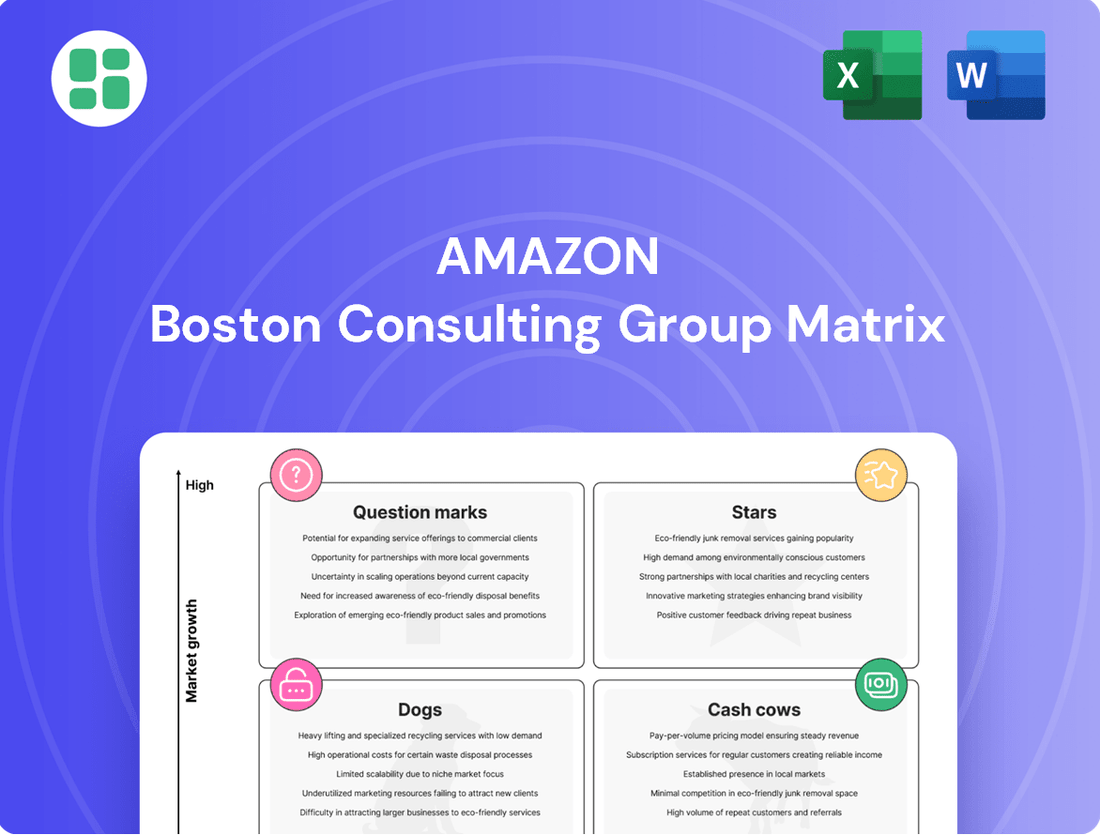

Uncover how Amazon's diverse product portfolio aligns with the BCG Matrix—identifying Stars, Cash Cows, Dogs, and Question Marks. This snapshot offers a glimpse into their strategic positioning, but for a comprehensive understanding and actionable insights to drive your own business forward, dive into the full report.

Stars

Amazon Web Services (AWS) stands as Amazon's star performer, consistently driving growth and profitability. In the first quarter of 2025, AWS saw a robust 17% revenue increase, building on a strong 19% growth in the second quarter of 2024.

AWS continues to dominate the cloud infrastructure market, holding a significant share of approximately 30-37.7% throughout 2024 and into 2025. This leadership position is maintained even as competition intensifies.

The company is making substantial investments, planning to allocate over $100 billion in 2025 to bolster its AI infrastructure. This strategic focus positions AWS to capitalize on the burgeoning AI market and maintain its competitive edge.

Amazon Advertising is a clear star in the BCG matrix, exhibiting robust growth and high profitability. In Q2 2025, its revenue climbed an impressive 22% to $15.7 billion, following an 18% increase in Q4 2024.

This expansion is driven by Amazon's effective use of customer data and its integration across its e-commerce empire and Prime Video, pushing its annual run rate towards $69 billion.

Amazon is heavily investing in AI, with CEO Andy Jassy highlighting its transformative power across customer experiences and business operations. This includes advancements like Alexa+, enhanced shopping agents, and AI for operational efficiency. While precise market share for its AI services is still developing, Amazon's substantial capital allocation towards AI infrastructure signals a strong commitment to leadership in this rapidly expanding technological domain.

Prime Video (with Ads)

Prime Video, now featuring an ad-supported tier, is a significant player in the streaming landscape. This strategy has proven effective in boosting Amazon's advertising income.

In the second quarter of 2024, Prime Video led the US SVOD market in new subscriber acquisition. This growth highlights the success of their approach in a crowded market.

- Subscriber Growth: Prime Video saw substantial new subscriber additions in Q2 2024, leading the US SVOD market.

- Advertising Revenue: The introduction of ads has directly contributed to increased advertising revenue for Amazon.

- Market Share: Prime Video continues to expand its market share within the competitive streaming sector.

- Ecosystem Engagement: The ad-supported plan helps maintain user engagement within the broader Amazon Prime ecosystem.

Amazon's Third-Party Seller Services

Amazon's third-party seller services, including its marketplace and Fulfillment by Amazon (FBA), are a cornerstone of its e-commerce empire. These services are not just growing; they are a significant revenue driver for the company. In fact, during Prime Day 2024, independent sellers moved more than 200 million products, a clear testament to the strength of Amazon's platform and its substantial market share in enabling these sales.

These third-party services are vital to Amazon's overall financial health and its ability to maintain its leading position in online retail. They represent a high-growth area within Amazon's business portfolio, contributing significantly to its profitability.

- Marketplace Dominance: Amazon's platform facilitates a vast number of transactions for external sellers.

- Fulfillment by Amazon (FBA): This service handles storage, packing, and shipping for sellers, boosting efficiency and customer satisfaction.

- Revenue Generation: Third-party seller services consistently contribute a substantial portion of Amazon's total revenue.

- Prime Day Success: Over 200 million items sold by third-party sellers on Prime Day 2024 highlights the ecosystem's scale and impact.

Amazon Web Services (AWS) and Amazon Advertising are prime examples of Amazon's Stars in the BCG matrix. AWS consistently shows strong revenue growth, projected at 17% for Q1 2025, and maintains a dominant cloud market share between 30-37.7% in 2024-2025. Amazon Advertising also demonstrates robust expansion, with Q2 2025 revenue reaching $15.7 billion, a 22% increase, driven by data integration and ecosystem reach.

| Business Unit | BCG Category | Key Financial Metric (2024-2025) | Market Position |

| AWS | Star | 17% Revenue Growth (Q1 2025) | 30-37.7% Cloud Market Share |

| Amazon Advertising | Star | $15.7 Billion Revenue (Q2 2025) | High Growth, Strong Profitability |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

Visualize your Amazon business units' market share and growth to strategically allocate resources and address underperforming areas.

Cash Cows

Amazon's core e-commerce retail operation remains a formidable Cash Cow. It commands a significant portion of the US online market, estimated between 37.6% and 40.9% of total sales in 2024-2025.

Although its growth rate has stabilized, this segment is a revenue powerhouse, with projections indicating US e-commerce sales could reach $540.29 billion by 2025. This consistent revenue generation is crucial for funding Amazon's other, faster-growing business units.

Amazon Prime subscriptions are a classic Cash Cow for Amazon. With over 200 million global subscribers and a remarkable 197 million US members as of March 2025, the service commands a dominant market share, reaching an impressive 82% of US households.

This massive subscriber base translates into substantial and consistent recurring revenue. The high retention rate, standing at 93% after one year, underscores the strong customer loyalty and the perceived value of Prime's benefits, particularly the allure of free shipping, which consistently encourages member spending.

Fulfillment by Amazon (FBA) is a prime example of a Cash Cow for Amazon, holding a substantial share in the e-commerce fulfillment market. This service allows third-party sellers to tap into Amazon's vast logistics, driving significant revenue and profitability. In 2024, FBA continued to be a dominant force, with millions of sellers relying on its infrastructure, underscoring its mature status and consistent income generation for Amazon.

Amazon Devices (Echo, Kindle, Fire TV)

Amazon's consumer electronics, like Echo, Kindle, and Fire TV, have become staples, boasting significant market reach and strong brand loyalty. These devices are key players in largely established markets, ensuring steady sales and strengthening Amazon's overall ecosystem.

The core of these device categories consistently generates reliable revenue. This is due to optimized production and marketing, even as new versions are introduced.

- Market Penetration: Amazon's devices have achieved substantial adoption, with millions of Echo devices sold globally and Kindle remaining a dominant force in e-reading.

- Revenue Stability: These products contribute significantly to Amazon's advertising and services revenue, with the Prime ecosystem further driving consistent purchasing behavior.

- Ecosystem Reinforcement: The devices act as gateways to Amazon's broader services, such as Prime Video, Music, and shopping, creating a sticky customer base.

Whole Foods Market

Whole Foods Market, acquired by Amazon in 2017, represents a strategic move into the physical grocery space. Despite operating in a mature market, it holds a substantial share within the niche of organic and natural foods, generating consistent revenue for Amazon.

The integration of Whole Foods allows Amazon to leverage its established physical footprint for expanded grocery delivery services, enhancing its overall e-commerce strategy. This acquisition positions Whole Foods as a key component in Amazon's diversified business model, contributing to stable cash flow.

- Market Position: High market share in the organic and natural food segment.

- Revenue Contribution: Provides stable, predictable revenue streams.

- Strategic Importance: Expands Amazon's physical retail presence and delivery capabilities.

- Operational Focus: Emphasis on efficiency and integration with Amazon's broader grocery ecosystem.

Amazon's core e-commerce retail operation is a significant Cash Cow. In 2024, it captured between 37.6% and 40.9% of US online sales, projected to reach $540.29 billion by 2025. This segment provides consistent revenue to fund other growth areas.

Amazon Prime subscriptions, with over 200 million global members and 197 million in the US as of March 2025, represent another strong Cash Cow. Its 93% one-year retention rate highlights customer loyalty and the value of benefits like free shipping.

Fulfillment by Amazon (FBA) is a mature Cash Cow, serving millions of sellers and driving substantial revenue through its logistics infrastructure. Consumer electronics like Echo and Kindle also contribute reliably to Amazon's ecosystem and advertising revenue.

| Business Segment | BCG Category | Key Characteristics | 2024/2025 Data Points |

| E-commerce Retail | Cash Cow | High market share, stable growth, significant revenue generation | 37.6%-40.9% US online sales share; US e-commerce sales ~$540.29B by 2025 |

| Amazon Prime | Cash Cow | Massive subscriber base, recurring revenue, high retention | >200M global subscribers; 197M US members (Mar 2025); 93% 1-year retention |

| Fulfillment by Amazon (FBA) | Cash Cow | Dominant in fulfillment market, consistent income | Millions of sellers rely on FBA infrastructure |

| Consumer Electronics (Echo, Kindle) | Cash Cow | Strong brand loyalty, ecosystem gateway, steady sales | Millions of Echo devices sold globally; Kindle dominant in e-reading |

Preview = Final Product

Amazon BCG Matrix

The Amazon BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means you'll get a comprehensive strategic analysis tool, ready for immediate application in your business planning, without any watermarks or demo content. The preview accurately represents the professional-grade BCG Matrix report, ensuring you know exactly what you're acquiring for your decision-making processes. You can confidently expect the same detailed insights and structure that will be directly delivered to you, enabling effective market positioning and resource allocation for Amazon's diverse product portfolio.

Dogs

Amazon's physical bookstores are a prime example of a potential 'Dog' in the BCG matrix. Despite initial forays, the company has significantly reduced its footprint, closing numerous locations. This move signals a struggle to capture meaningful market share in the traditional brick-and-mortar book retail space.

Operating within a market that has seen a decline in physical book sales, Amazon's physical bookstore strategy hasn't yielded the expected widespread expansion. The closures in recent years, including several in 2023 and early 2024, indicate these ventures likely failed to meet profitability targets or broader strategic objectives.

The Amazon Glow, a product designed for interactive video calls with children, met an untimely end. Launched with a focus on family connection, its market performance fell short of expectations.

Discontinuation was confirmed in late 2024, following its initial release. This move, occurring less than two years after its debut, signals Amazon's decisive approach to products that don't capture significant market share.

While specific sales figures for the Glow are not publicly disclosed, its rapid discontinuation suggests a low market share within its specialized segment, placing it in the 'Dog' category of the BCG matrix.

Amazon Explore, a platform for virtual experiences, was discontinued in 2022. This service targeted a niche market, and its closure suggests it held a low market share and limited growth prospects for Amazon. The discontinuation highlights a lack of substantial customer engagement and a poor strategic alignment with Amazon's broader objectives.

Standalone Amazon Go Stores

Standalone Amazon Go stores, while innovative, have encountered significant hurdles in the competitive convenience store market. Despite the appeal of 'Just Walk Out' technology, these smaller-format locations struggled to gain substantial market share and achieve consistent profitability when measured against established players. This has led Amazon to reassess its physical retail footprint.

Amazon's strategic shift involves re-evaluating the standalone Go store model, with several locations being closed. The company is exploring how to best leverage its advanced technology, with a particular focus on integrating it into larger formats like Amazon Fresh stores. This indicates a move away from niche, standalone convenience concepts towards broader grocery retail integration.

- Market Challenges: Standalone Amazon Go stores faced difficulties in competing with established convenience store chains on factors like price and accessibility, impacting their ability to capture widespread market share.

- Profitability Concerns: The operational costs and revenue generation of these smaller, tech-heavy stores did not consistently translate into the profitability required for sustained expansion compared to traditional models.

- Strategic Reorientation: Amazon is now prioritizing the integration of its 'Just Walk Out' technology into larger retail formats, such as Amazon Fresh supermarkets, signaling a change in its physical retail strategy.

- Technology Licensing: While the 'Just Walk Out' technology itself is still under development and being offered for licensing, its application within Amazon's own physical retail presence is being refined for broader impact.

Amazon Kids+ (Standalone)

Amazon Kids+ as a standalone service faces a crowded digital landscape. While it benefits from Amazon's brand, its independent market traction is likely modest when compared to established players in children's entertainment and education.

The service operates in a segment where competitors like Netflix Kids, Disney+, and various educational apps command significant user bases.

- Market Position: Likely a niche player in the standalone children's digital content market.

- Growth Potential: Limited on its own, heavily reliant on Amazon's broader ecosystem for visibility.

- Competitive Landscape: Faces strong competition from dedicated streaming services and educational platforms.

Amazon's physical bookstores, while an interesting experiment, have largely been categorized as 'Dogs' in the BCG matrix. Despite initial launches, the company has significantly scaled back its presence, closing numerous locations. This strategic retreat suggests these ventures struggled to gain substantial market share and profitability in the competitive brick-and-mortar book retail sector.

Similarly, products like the Amazon Glow, designed for interactive family calls, and Amazon Explore, a virtual experience platform, were discontinued. Their short lifespans and eventual removal from the market indicate a failure to capture significant market share or meet Amazon's growth expectations, placing them firmly in the 'Dog' quadrant.

Standalone Amazon Go stores also faced challenges. While the 'Just Walk Out' technology was innovative, these convenience stores struggled against established chains, leading to closures and a pivot to integrating the technology into larger formats like Amazon Fresh. This reassessment highlights their inability to achieve significant market penetration independently.

Amazon Kids+ as a standalone service likely occupies a niche. Facing intense competition from established streaming giants and educational platforms, its independent market traction appears modest, suggesting limited growth potential without leveraging Amazon's broader ecosystem.

| Product/Service | BCG Category | Reasoning |

|---|---|---|

| Amazon Physical Bookstores | Dog | Reduced footprint, struggle for market share in declining physical book sales. |

| Amazon Glow | Dog | Discontinued less than two years after launch, indicating low market share. |

| Amazon Explore | Dog | Discontinued in 2022, suggesting low market share and limited growth prospects. |

| Standalone Amazon Go Stores | Dog | Struggled for market share and profitability against competitors, leading to closures and integration into other formats. |

| Amazon Kids+ (Standalone) | Dog (Potential) | Faces intense competition, likely modest independent market traction and limited growth potential. |

Question Marks

Project Kuiper, Amazon's satellite internet venture, is positioned as a potential 'Star' in the BCG Matrix. It aims to tap into the rapidly expanding global broadband market, a sector ripe for disruption and growth.

With over $10 billion committed to launch contracts and initial deployments beginning in early 2025, Kuiper represents a significant investment. However, its current market share is negligible, as it remains in beta testing and early rollout stages, reflecting its status as a nascent but promising endeavor.

Amazon's foray into healthcare with Amazon Pharmacy and the One Medical acquisition positions these ventures as potential Stars or Question Marks within the BCG Matrix. The healthcare sector is experiencing robust growth, with the global digital health market projected to reach $660 billion by 2025, indicating significant opportunity.

Despite this potential, Amazon's current market share in healthcare services and pharmacy remains nascent when contrasted with established giants. This low share in a high-growth market is characteristic of a Question Mark, requiring substantial investment to build presence and capture market share.

These initiatives demand considerable capital investment as Amazon navigates a complex, regulated landscape and aims to disrupt existing healthcare models. For instance, Amazon reported over $1 billion in operating losses for its U.S. healthcare segment in 2023, underscoring the significant investment required.

Amazon Fresh stores represent a significant investment in the physical grocery sector, with Amazon actively expanding its footprint to capture a larger share of this high-growth market. Despite this expansion, Amazon's presence in brick-and-mortar grocery remains relatively small compared to established players, highlighting a key challenge.

The company experienced a pause in expansion in 2023, indicating potential hurdles in scaling these operations. This makes Amazon Fresh a question mark within the BCG matrix, requiring continued strategic investment to achieve greater market penetration and solidify its position.

Amazon Games

Amazon Games, within the context of the BCG Matrix, likely falls into the 'Question Mark' category. The video game industry is experiencing robust growth, with global gaming revenue projected to reach over $200 billion in 2024. However, Amazon's internal game development efforts have yet to yield significant market share, despite ongoing investment in new titles and live services.

The company's presence in the competitive gaming content space is currently limited, necessitating substantial capital infusion to achieve greater penetration. This strategic positioning highlights the need for careful evaluation of future investments and potential divestment if market traction remains elusive.

- High-Growth Industry: The global video game market is a significant growth sector, demonstrating consistent revenue expansion year over year.

- Low Market Share: Despite industry growth, Amazon Games has struggled to establish a dominant position in terms of popular game releases and player base.

- Significant Investment Required: To compete effectively and gain substantial market share, Amazon Games needs continued, substantial financial commitment.

- Uncertain Future Success: The success of Amazon's current and future game development projects remains uncertain, making it a classic 'Question Mark' in strategic analysis.

Amazon Style (Physical Fashion Stores)

Amazon Style represents Amazon's ambitious move into physical fashion retail, a sector experiencing robust growth. The company's current physical presence in fashion is minimal, translating to a low market share in this segment.

Significant capital will be necessary for store expansion, sophisticated inventory systems, and enhancing the in-store customer journey. This investment is crucial to assess Amazon Style's potential as a future revenue driver.

- Market Entry: Amazon's physical fashion stores are a new venture, targeting the expanding apparel market.

- Market Share: As a nascent player, Amazon Style holds a very small share of the overall fashion retail landscape.

- Investment Needs: Substantial funding is anticipated for store build-outs, inventory logistics, and customer experience development.

- Growth Potential: The success of Amazon Style hinges on its ability to scale effectively and compete within the established fashion industry.

Amazon Luna, Amazon's cloud gaming service, is positioned as a Question Mark within the BCG Matrix. The cloud gaming market is projected to grow significantly, with estimates suggesting it could reach over $20 billion by 2027, indicating a high-growth industry.

However, Luna faces intense competition from established players like Xbox Cloud Gaming and PlayStation Now, resulting in a relatively low market share for Amazon. This necessitates substantial ongoing investment to differentiate its offering and attract a broader user base.

The service requires continued capital for content acquisition, infrastructure development, and marketing to build brand awareness and user adoption in this dynamic market.

| Business Unit | Industry Growth | Market Share | Investment Needs | BCG Category |

|---|---|---|---|---|

| Amazon Luna | High (Cloud Gaming Market projected >$20B by 2027) | Low | High (Content, Infrastructure, Marketing) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.