Amazon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amazon Bundle

Amazon's dominance is shaped by intense rivalry and significant buyer power, but what about the threats from new entrants and substitutes? Understanding these forces is crucial for any business operating in or adjacent to e-commerce.

The complete report reveals the real forces shaping Amazon’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Amazon's vast marketplace, featuring millions of third-party sellers worldwide, effectively fragments the supplier base. This sheer volume means no single seller holds significant sway, allowing Amazon to set favorable terms. For instance, new Fulfillment by Amazon (FBA) fees implemented in 2024 and adjusted in February 2025 demonstrate Amazon's ability to unilaterally alter pricing structures, a testament to the limited bargaining power of individual sellers.

Amazon's considerable investment in its own logistics and fulfillment network significantly curtails its reliance on third-party shipping companies. For instance, the company's projected capital expenditures of $100 billion for 2025, largely allocated to AI and infrastructure, underscore this commitment to internal capabilities.

This robust internal infrastructure grants Amazon substantial bargaining power when negotiating rates with external logistics providers such as UPS, FedEx, and USPS. The ability to handle a significant portion of its own shipping allows Amazon to demand more favorable terms and pricing, directly contributing to cost efficiencies.

Amazon's immense scale as a buyer of technology components, particularly for its vast AWS infrastructure and consumer electronics like Kindle and Echo devices, gives it significant bargaining power. This allows Amazon to negotiate favorable terms and pricing from its suppliers due to the sheer volume of its orders, often benefiting from economies of scale that smaller buyers cannot achieve. For instance, in 2023, Amazon's capital expenditures alone reached over $50 billion, a substantial portion of which was directed towards technology and infrastructure, underscoring its purchasing might.

Influence on Content Creators

Amazon's bargaining power with content creators is substantial. While Amazon needs compelling content for Prime Video and Music to keep subscribers engaged, its vast reach and subscriber numbers make it an attractive partner for creators. This leverage allows Amazon to negotiate favorable licensing terms, often dictating the conditions of these agreements.

This dynamic is evident in how Amazon secures exclusive content. For instance, in 2023, Amazon reportedly spent billions on content acquisition, including significant investments in sports rights and original series, demonstrating their commitment to content that drives subscriptions. This spending power gives them an edge when negotiating with studios and independent creators alike.

- Amazon's extensive subscriber base (over 200 million Prime members globally as of early 2024)

- The platform's massive distribution capabilities

- Amazon's willingness to invest heavily in exclusive content

- The need for creators to access a wide audience

Increasing Scrutiny on Supply Chain Compliance

Amazon's increasing scrutiny on supply chain compliance, particularly evident with policy updates in 2024, significantly bolsters its bargaining power over suppliers. By demanding direct sourcing from brands or authorized distributors, Amazon effectively reduces the number of intermediaries and ensures greater control over product authenticity and availability.

This heightened focus on documentation and authorized sourcing places a greater burden on suppliers to prove their legitimacy and adherence to Amazon's standards. For instance, the introduction of stricter verification processes in 2024 means suppliers must invest more in compliance, potentially increasing their costs and making them more amenable to Amazon's terms.

- Enhanced Control: Amazon gains more direct oversight of its product catalog, minimizing risks associated with counterfeit or unauthorized goods.

- Supplier Responsibility: Suppliers are now primarily responsible for providing robust compliance documentation, shifting the onus away from Amazon.

- Marketplace Integrity: This move aims to protect consumers and maintain the integrity of the Amazon marketplace, indirectly strengthening Amazon's position.

- Reduced Supplier Options: By enforcing direct sourcing, Amazon can limit the pool of available suppliers, giving it leverage in negotiations.

Amazon's immense scale as a buyer across diverse categories, from technology components to consumer goods, significantly diminishes supplier bargaining power. This is amplified by its ability to source directly or leverage its vast marketplace, forcing suppliers to accept Amazon's terms. For example, Amazon's 2024 policy updates requiring direct sourcing from brands or authorized distributors in certain categories reduced the number of intermediaries, consolidating Amazon's leverage.

The company's substantial investments in its own logistics and fulfillment infrastructure, with projected capital expenditures of $100 billion for 2025, further reduce reliance on external suppliers and strengthen its negotiating position with shipping partners. This internal capacity allows Amazon to dictate terms to logistics providers.

Amazon's ability to unilaterally adjust terms, such as new Fulfillment by Amazon (FBA) fees introduced in 2024 and adjusted in February 2025, clearly illustrates the limited bargaining power of its vast third-party seller base. The sheer volume of sellers on its platform means no single entity can exert significant influence.

Amazon's bargaining power with content creators is substantial due to its extensive reach and over 200 million Prime members globally as of early 2024. This leverage allows for favorable licensing terms, as seen in its billions spent on content acquisition in 2023.

| Factor | Amazon's Position | Supplier Bargaining Power |

|---|---|---|

| Scale of Purchases | Vast, across multiple categories | Low |

| Logistics Control | High, significant internal infrastructure | Low |

| Marketplace Fragmentation | Millions of third-party sellers | Low |

| Content Acquisition | Large subscriber base, significant investment | Low |

What is included in the product

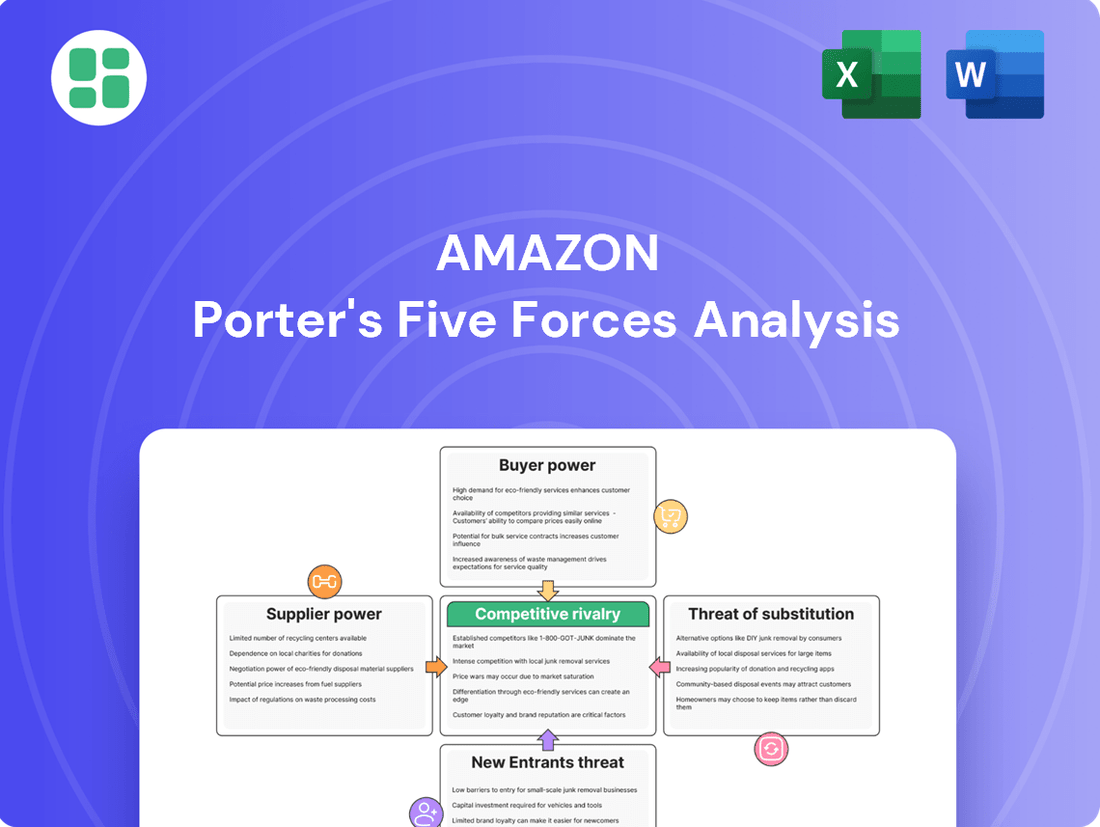

Analyzes the intensity of competition, buyer and supplier power, threat of new entrants, and the availability of substitutes that shape Amazon's market environment.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Individual consumers on Amazon's e-commerce platform experience very low switching costs. They can effortlessly compare prices and products across a vast array of online and offline retailers, making it simple to find better deals or alternative options. This accessibility to information and choices significantly amplifies their bargaining power in the marketplace.

The sheer availability of substitutes for almost every product sold on Amazon further bolsters customer leverage. For instance, in 2024, the global e-commerce market is projected to reach over $6.3 trillion, with a significant portion of this growth fueled by consumers actively seeking the best value across multiple platforms. This intense competition among sellers, driven by informed consumers, directly translates to greater power for the buyer.

While alternatives like Microsoft Azure and Google Cloud Platform are available, businesses deeply embedded with Amazon Web Services (AWS) often encounter substantial switching costs. This is primarily due to the intricate integration of their existing cloud infrastructure, applications, and data, making a migration a complex and resource-intensive undertaking.

Despite these integration challenges, the intensifying competition within the cloud computing market does grant larger enterprises a degree of negotiation leverage. As of early 2024, the global cloud computing market is projected to reach over $1 trillion, with AWS holding a significant market share, yet the aggressive pricing strategies and feature enhancements from competitors like Azure and GCP are compelling AWS to offer more competitive terms to retain its enterprise clients.

Amazon Prime members, while enjoying benefits like fast delivery and digital streaming, possess bargaining power through their ability to cancel subscriptions if the perceived value diminishes. In 2024, Amazon continued to focus on value, with Prime membership fees remaining stable, signaling an effort to retain this crucial customer base.

Amazon continuously enhances Prime benefits, such as extended Prime Day deals in 2025, to maintain its high retention rate. This strategy aims to counter customer bargaining power by increasing the perceived value proposition, thereby reducing churn.

Third-Party Sellers as Customers

Third-party sellers on Amazon, numbering over two million as of early 2024, are significant customers for the platform's marketplace services. These sellers leverage Amazon's vast customer base, which includes over 310 million active customer accounts globally, to reach a wide audience. However, they face increasing scrutiny and potential shifts in Amazon's fee structures and operational policies, which can directly impact their profitability and business models.

The bargaining power of these third-party sellers is influenced by their ability to seek alternative sales channels. Many are exploring or have already diversified their operations to other e-commerce marketplaces or are developing their own direct-to-consumer (DTC) websites. This diversification strategy aims to reduce their dependence on Amazon and provides them with leverage in negotiations or a fallback should Amazon's terms become unfavorable.

- Seller Dependence: Over 2 million third-party sellers rely on Amazon's marketplace, accessing over 310 million global users.

- Fee Structure Impact: Sellers are sensitive to Amazon's evolving fee structures, which directly affect their margins.

- Diversification Strategy: Sellers are increasingly diversifying to other platforms and DTC models to mitigate reliance on Amazon.

- Marketplace Growth: Third-party sales accounted for approximately 60% of Amazon's total retail sales in 2023, highlighting their importance but also their potential leverage.

Advertisers' Diverse Options

Advertisers have a wealth of choices beyond Amazon’s platform, a key factor in their bargaining power. For instance, in 2024, the global digital advertising market is projected to reach over $700 billion, with Google and Meta holding significant shares, offering advertisers vast reach and sophisticated targeting capabilities. This competitive landscape forces Amazon to continually demonstrate the superior value and return on investment (ROI) of its advertising solutions to retain and attract businesses.

Amazon's advertising platform does offer unique advantages, such as access to rich consumer data and direct insights into purchasing intent. However, the sheer volume of alternative digital advertising channels available means advertisers can easily shift budgets if Amazon's offerings do not meet their performance expectations. This dynamic compels Amazon to innovate and optimize its ad products to maintain its competitive edge.

- Diverse Digital Advertising Market: The global digital ad spend is substantial, with Google and Meta representing major competitors to Amazon's advertising services.

- Advertiser Leverage: The availability of numerous alternative platforms grants advertisers significant bargaining power, allowing them to demand competitive pricing and demonstrable results.

- Amazon's Value Proposition: Amazon must consistently prove the effectiveness and ROI of its advertising solutions to retain advertisers in a competitive marketplace.

Individual consumers on Amazon possess considerable bargaining power due to low switching costs and the abundance of substitute products available in the vast e-commerce landscape. In 2024, with the global e-commerce market exceeding $6.3 trillion, consumers can easily compare prices and features across numerous retailers, compelling sellers on Amazon to offer competitive pricing and value to retain their business.

Preview Before You Purchase

Amazon Porter's Five Forces Analysis

This preview showcases the complete Amazon Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape that shapes Amazon's strategic decisions. What you see here is the exact, professionally formatted document you will receive instantly after purchase, providing actionable insights without any surprises or placeholders. This comprehensive analysis delves into the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors, all ready for your immediate use.

Rivalry Among Competitors

Amazon faces intense rivalry in the e-commerce space. Competitors like Walmart are rapidly expanding their online presence, notably outperforming Amazon in certain areas such as digital grocery sales growth in 2024. Emerging platforms such as Temu and Shein are also capturing market share with aggressive pricing strategies.

Despite this pressure, Amazon continues to dominate the U.S. e-commerce market. Projections indicate Amazon will hold approximately 40.9% of the U.S. e-commerce market share by 2025, underscoring its enduring strength amidst fierce competition.

Amazon Web Services (AWS) operates in a fiercely competitive cloud computing market. Despite holding a leading market share of approximately 30-31% in late 2024 and early 2025, AWS faces significant challenges from rivals like Microsoft Azure, which commands around 20-21% of the market, and Google Cloud Platform, holding 12-13%.

These competitors are not standing still; they are actively expanding their capabilities and investing heavily in growth areas. Microsoft Azure and Google Cloud Platform are particularly focused on developing and promoting hybrid cloud solutions and advanced artificial intelligence services. This strategic push aims to capture market share and directly contest AWS's established leadership in the cloud infrastructure space.

The digital streaming arena is intensely competitive, with Amazon Prime Video facing off against giants like Netflix, Disney+, and Max. This fragmentation means Amazon must constantly invest in exclusive content and refine its pricing. For instance, Netflix reported 270 million paid subscribers globally as of Q1 2024, highlighting the scale of competition Amazon is up against.

Growing Competition in Digital Advertising

Amazon's advertising business faces intense rivalry from established players like Google and Meta, alongside a growing number of specialized digital ad platforms. This heightened competition is driving up costs for sellers utilizing Amazon's platform, particularly Pay-Per-Click (PPC) advertising. For instance, average PPC costs on Amazon have seen a steady increase, impacting seller profitability.

To counter this, Amazon is heavily investing in its advertising technology. Key initiatives include the development of advanced AI-driven advertising tools and the expansion of its Demand-Side Platform (DSP). These investments aim to offer more sophisticated targeting and performance optimization, thereby attracting and retaining ad spend in a competitive landscape.

- Increased Rivalry: Google and Meta continue to dominate the digital ad market, offering robust solutions that compete directly with Amazon's advertising services.

- Rising PPC Costs: Sellers on Amazon are experiencing escalating Pay-Per-Click expenses, a direct consequence of increased advertiser demand and competition on the platform.

- Amazon's Strategic Response: Amazon is bolstering its advertising capabilities through AI integration and enhancements to its Demand-Side Platform (DSP) to maintain its competitive standing.

Innovation-Driven Rivalry Across Segments

Amazon's competitive rivalry is characterized by a relentless pursuit of innovation across its diverse business segments. This is particularly evident in areas like artificial intelligence, where the company is a major player, and in the continuous improvement of its vast logistics and supply chain networks.

The company's commitment to staying ahead is underscored by its significant financial outlays. For instance, Amazon's research and development (R&D) expenditure was a substantial $85 billion in 2024. This massive investment fuels its ability to introduce new technologies and services, thereby maintaining a distinct competitive edge.

- AI Development: Amazon is heavily invested in AI, driving innovation in areas like its Alexa voice assistant and cloud computing services.

- Logistics and Supply Chain: Continuous upgrades to its fulfillment centers and delivery networks are key to its competitive advantage.

- R&D Spending: The $85 billion invested in R&D in 2024 highlights a strategic focus on technological leadership.

- Technological Differentiation: Innovation serves as a primary tool for differentiating Amazon's offerings in a crowded marketplace.

Amazon operates in highly competitive markets, facing intense rivalry from established giants and agile newcomers. In e-commerce, Walmart's digital growth and platforms like Temu and Shein challenge Amazon's dominance, even as Amazon is projected to hold 40.9% of the U.S. e-commerce market by 2025.

The cloud computing sector sees AWS, with a 30-31% market share in late 2024/early 2025, contending with Microsoft Azure (20-21%) and Google Cloud Platform (12-13%), both aggressively investing in AI and hybrid solutions.

| Market Segment | Key Competitors | Amazon's Position/Strategy |

|---|---|---|

| E-commerce | Walmart, Temu, Shein | Projected 40.9% U.S. market share by 2025; focus on logistics and customer experience. |

| Cloud Computing (AWS) | Microsoft Azure, Google Cloud Platform | Leading market share (30-31%); investing in AI and specialized services to counter competition. |

| Digital Advertising | Google, Meta | Facing rising PPC costs; investing in AI-driven tools and DSP enhancements. |

SSubstitutes Threaten

Traditional brick-and-mortar stores and direct-to-consumer (DTC) brands represent significant substitutes for Amazon's core e-commerce business. Consumers might choose physical retail for immediate product acquisition or the sensory experience of touching and trying items, a factor that remains relevant despite online convenience. For instance, in 2024, while e-commerce continued its growth, physical retail still accounted for a substantial portion of total retail sales, demonstrating its enduring appeal.

DTC brands offer an alternative by providing unique product assortments and often more personalized customer engagement, bypassing Amazon's marketplace. This direct relationship can foster brand loyalty and provide a curated experience that some consumers prefer over Amazon's vast, often overwhelming, selection. The rise of DTC, particularly in categories like apparel and beauty, highlights a clear threat as these brands build direct customer relationships and control their brand narrative.

For Amazon Web Services (AWS), the threat of substitutes is significant. These include rival public cloud providers like Microsoft Azure and Google Cloud Platform, as well as hybrid cloud approaches that blend on-premise and cloud resources. Businesses might opt for these alternatives due to specific security requirements, a desire for greater control over their infrastructure, or for cost management on particular workloads.

Furthermore, companies continuing to invest in and maintain their own on-premise data centers represent a direct substitute. While the trend favors cloud migration, a notable portion of the market, especially those with legacy systems or highly sensitive data, still relies on private infrastructure. For instance, in 2024, while global public cloud spending continued to grow, many enterprises still allocated substantial budgets to modernize and maintain their on-premise IT environments, reflecting the persistent appeal of direct control and perceived security benefits for certain use cases.

The threat of substitutes for Amazon's entertainment offerings is substantial, extending far beyond direct competitors in the streaming space. Consumers can opt for traditional cable television, movie theaters, video games, or even engage in offline activities like reading or attending live events. In 2024, the global video game market alone was projected to reach over $200 billion, illustrating a significant portion of entertainment spending that could divert from streaming services.

The ease with which consumers can switch between these entertainment options further amplifies this threat. With minimal effort and often no long-term commitment, a user can cancel a Prime Video subscription and turn to Netflix, YouTube, or even simply watch broadcast television. This low switching cost means Amazon must constantly innovate and provide compelling content to retain its audience amidst a sea of readily available alternatives.

Specialized Online Retailers and Marketplaces

Specialized online retailers and niche marketplaces present a significant threat of substitutes to Amazon. These platforms, focusing on curated selections and expert advice, cater to customers seeking unique or specific products, directly challenging Amazon's broad appeal. For instance, sites like Etsy offer handmade and vintage goods, while dedicated electronics retailers provide in-depth product comparisons and specialized support that Amazon's generalist approach may not match.

This specialization allows these substitutes to capture customer loyalty by offering a more personalized and informed shopping experience. In 2023, the global e-commerce market continued to see growth in niche segments, with specialized online retail segments outperforming generalist platforms in certain categories, indicating a sustained threat. For example, the online apparel market, a significant segment for Amazon, saw strong performance from specialized fashion retailers that emphasize sustainability or unique design.

- Niche Marketplaces: Platforms like Etsy and Reverb (for musical instruments) attract buyers looking for unique, artisanal, or specialized items not easily found on Amazon.

- Specialized Retailers: Online stores focusing on specific categories, such as outdoor gear (e.g., REI online) or electronics (e.g., B&H Photo), offer deeper product knowledge and tailored customer service.

- Direct-to-Consumer (DTC) Brands: Many brands now sell directly to consumers online, bypassing marketplaces like Amazon and building their own customer relationships and brand loyalty.

- Subscription Boxes: Curated subscription services in areas like beauty, food, or books offer a recurring substitute for general online shopping by providing a convenient, discovery-oriented experience.

Alternative Fulfillment and Logistics Services

The threat of substitutes for Amazon's fulfillment services is moderate but growing. While Amazon's vast fulfillment network is a significant competitive advantage, third-party logistics (3PL) providers and the in-house fulfillment capabilities of other major retailers represent viable alternatives for many sellers and businesses.

These substitutes offer businesses the potential for greater control over their inventory and shipping processes, cost efficiencies, or the ability to meet highly specific logistical requirements that Amazon's standardized services might not accommodate. For instance, companies requiring specialized handling or temperature-controlled shipping might find 3PLs more suitable.

- Third-Party Logistics (3PL) Providers: Companies like FedEx Logistics, UPS Supply Chain Solutions, and DHL offer comprehensive warehousing, transportation, and last-mile delivery services, directly competing with Amazon's FBA (Fulfillment by Amazon).

- In-house Fulfillment: Larger retailers, such as Walmart and Target, continue to invest heavily in their own logistics and distribution networks, providing a direct alternative for sellers who prefer to manage their entire supply chain internally.

- Specialized Fulfillment Services: Niche providers cater to specific industries, offering tailored solutions that Amazon may not replicate, thereby reducing the substitutability for those particular market segments.

For Amazon's core e-commerce business, traditional brick-and-mortar stores and direct-to-consumer (DTC) brands are key substitutes. Consumers still value the immediate gratification and tactile experience of physical retail, a segment that remained robust in 2024, holding a significant share of total retail sales. DTC brands further challenge Amazon by offering curated selections and personalized customer relationships, bypassing Amazon's marketplace and fostering direct brand loyalty.

Entrants Threaten

The threat of new entrants for Amazon's core e-commerce and cloud computing businesses is significantly low. Establishing a comparable e-commerce platform requires massive upfront capital for inventory, warehousing, and sophisticated logistics networks. For instance, Amazon's global fulfillment network involves hundreds of facilities, a testament to the scale of investment needed.

Furthermore, Amazon leverages substantial economies of scale, which are difficult for newcomers to replicate. This scale allows Amazon to negotiate better terms with suppliers and achieve lower per-unit operating costs. In 2024, Amazon's continued investment in automation and last-mile delivery further solidifies these advantages, creating a formidable barrier to entry.

Amazon's formidable brand loyalty, fueled by its customer-first ethos and the ubiquitous Prime membership, presents a significant hurdle for newcomers. In 2024, Prime boasts over 200 million members globally, a testament to its sticky ecosystem.

Furthermore, the powerful network effects inherent in Amazon's marketplace, where a vast customer base attracts a multitude of sellers, and vice versa, create a self-reinforcing cycle. This makes it exceptionally difficult for any new entrant to achieve critical mass and replicate the scale and convenience Amazon offers.

The threat of new entrants into Amazon's core e-commerce and cloud computing markets is significantly mitigated by the advanced technological and operational complexity required to compete. Building a platform that rivals Amazon's scale and efficiency demands immense capital investment, not just for infrastructure but for cutting-edge capabilities in artificial intelligence, machine learning, and sophisticated data analytics. For instance, Amazon's AWS cloud services require substantial ongoing investment in data centers and network infrastructure, a barrier that few can surmount.

Furthermore, Amazon's relentless pursuit of innovation, backed by substantial research and development expenditures, continually elevates the industry standard. In 2023 alone, Amazon reported $87.7 billion in R&D spending, a figure that underscores its commitment to technological advancement and operational excellence, making it exceedingly difficult for newcomers to establish a comparable foothold.

Regulatory Hurdles and Market Dominance Scrutiny

New entrants attempting to challenge Amazon's established market positions often encounter significant regulatory hurdles. These can include complex compliance requirements related to data privacy, consumer protection, and environmental standards, which are particularly stringent in sectors where Amazon operates at scale, such as e-commerce and cloud computing. For instance, the European Union's Digital Markets Act (DMA) and Digital Services Act (DSA) impose new obligations on large online platforms, potentially increasing compliance costs for any new player aiming to compete directly with Amazon's integrated services.

Furthermore, in markets where Amazon already holds a dominant position, new entrants face intense scrutiny from antitrust authorities. This heightened attention, driven by concerns over market concentration and potential anti-competitive practices, can act as a significant deterrent. For example, ongoing investigations into Amazon's market power in various regions globally signal a cautious regulatory environment that new competitors must navigate, often requiring substantial legal and lobbying resources to overcome.

- Regulatory Compliance Costs: New entrants must factor in the substantial costs associated with adhering to diverse and evolving regulations in markets where Amazon is dominant.

- Antitrust Scrutiny: The presence of a dominant player like Amazon invites increased regulatory oversight, making it harder for new businesses to establish themselves without facing antitrust challenges.

- Market Saturation: In already saturated markets, regulatory barriers and the sheer scale of incumbent operations like Amazon's create a high threshold for new entrants to achieve viability.

Established Distribution Channels and Seller Base

Amazon's formidable distribution network, including its extensive fulfillment centers and last-mile delivery infrastructure, acts as a substantial barrier to new entrants. In 2024, Amazon's operations spanned over 1,100 fulfillment and sorting centers globally, enabling rapid delivery that competitors struggle to match.

Furthermore, Amazon has cultivated relationships with millions of third-party sellers, creating a vast marketplace that attracts consumers. For a new competitor to gain traction, it would need to replicate this massive seller base and invest heavily in comparable logistics capabilities, a task that requires immense capital and time.

Consider these points regarding established distribution channels and seller base:

- Vast Fulfillment Network: Amazon's global network of over 1,100 fulfillment and sorting centers in 2024 is a critical competitive advantage, enabling efficient and fast delivery.

- Large Seller Base: Millions of third-party sellers actively use Amazon's platform, providing a wide selection of products and driving significant customer traffic.

- High Entry Costs: Replicating Amazon's distribution and seller ecosystem requires substantial investment in infrastructure, technology, and seller acquisition, making it difficult for new players to compete effectively.

The threat of new entrants for Amazon is significantly low due to immense capital requirements for infrastructure and technology, coupled with strong brand loyalty and network effects. Amazon's vast fulfillment network, boasting over 1,100 centers globally in 2024, and its Prime membership, with over 200 million members worldwide, create formidable barriers.

New entrants also face substantial regulatory hurdles and antitrust scrutiny, particularly in markets where Amazon holds a dominant position. Amazon's significant investments in R&D, reaching $87.7 billion in 2023, further cement its competitive advantage by continuously raising industry standards.

| Barrier Type | Description | Example Data (2024/2023) |

|---|---|---|

| Capital Requirements | Massive investment needed for logistics, inventory, and technology. | Hundreds of global fulfillment facilities. |

| Brand Loyalty & Ecosystem | Strong customer retention through services like Prime. | Over 200 million global Prime members. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | Negotiating power with millions of suppliers. |

| Network Effects | More sellers attract more buyers, and vice versa. | Vast marketplace with millions of third-party sellers. |

| R&D Investment | Continuous innovation to stay ahead. | $87.7 billion in R&D spending in 2023. |

| Regulatory & Antitrust | Compliance costs and potential legal challenges. | Navigating EU's Digital Markets Act (DMA). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Amazon leverages data from Amazon's own investor relations reports, SEC filings, and public earnings calls. We also incorporate insights from reputable market research firms, industry analyst reports, and news articles covering the e-commerce and cloud computing sectors.