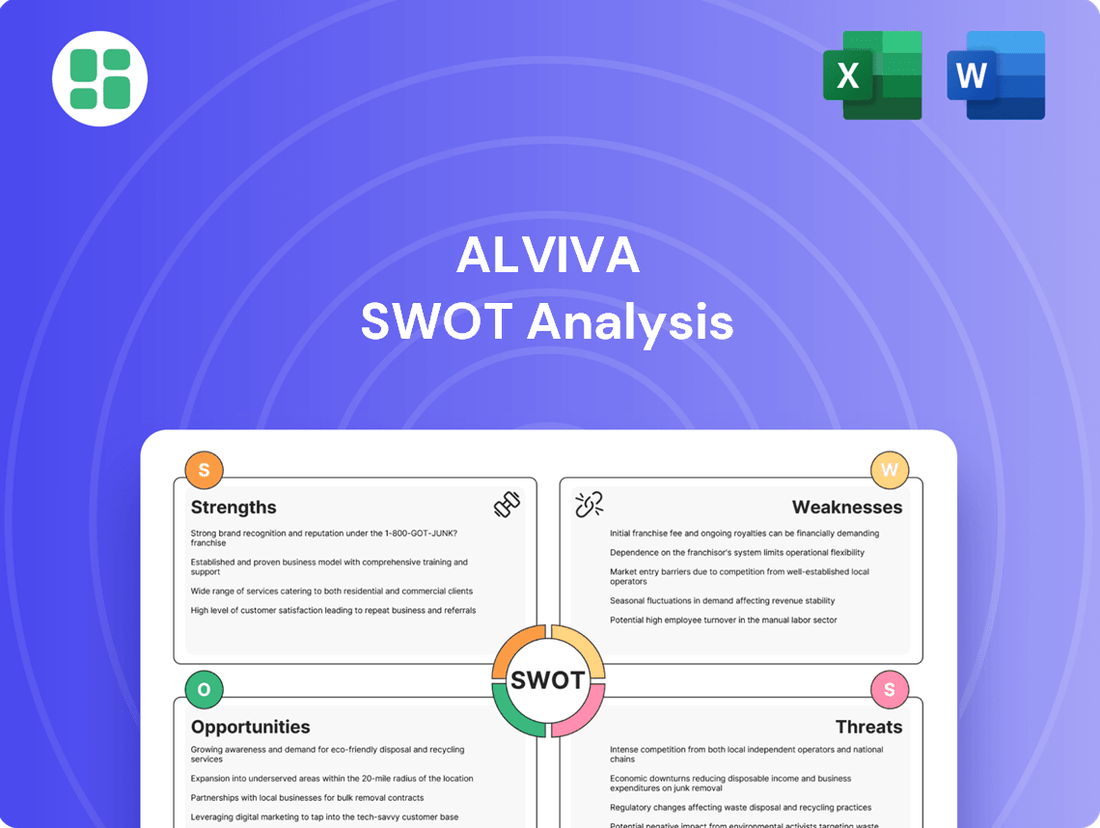

Alviva SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alviva Bundle

Alviva's SWOT analysis reveals a company poised for growth, leveraging its strong brand recognition and established market presence. However, understanding the full scope of its competitive landscape and potential challenges is crucial for informed decision-making.

Want the full story behind Alviva's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Alviva Holdings boasts an extensive ICT product and service portfolio, spanning hardware, software, and a comprehensive range of IT services. This broad spectrum allows Alviva to function as an end-to-end solutions provider, effectively catering to the diverse requirements of both public and private sector clients.

This diversified approach significantly reduces the company's dependence on any single product or service category, thereby enhancing its resilience against market fluctuations. For instance, during the 2024 fiscal year, Alviva's ICT services segment demonstrated robust growth, contributing significantly to the group's overall revenue.

Alviva leverages a robust distribution network, reaching customers across sub-Saharan Africa through its extensive reseller channels and national retail chains. This deep market penetration is a significant advantage, allowing the company to effectively serve a broad customer base with its diverse technology solutions.

The company's strategic focus on building commercial and technological ecosystems empowers partners to deliver top-tier solutions, further solidifying its market presence. For instance, in 2023, Alviva reported a 15% year-over-year increase in revenue, partly attributed to the expansion of its distribution reach into new African markets.

Alviva has a strong history of strategic acquisitions, notably the acquisition of Tarsus Technology Group, which significantly bolstered its IT distribution and cloud service offerings. This proactive approach to expanding its capabilities demonstrates a commitment to growth and market penetration.

The recent divestment of Datacentrix, while a reduction in scope, highlights Alviva's strategic focus on optimizing its portfolio and aligning with its core hardware distribution business. This move is designed to streamline operations and enhance efficiency.

Looking ahead, Alviva is committed to increasing shareholder returns through continued diversification of its product and service portfolio. This strategy aims to capture new market opportunities and build a more resilient business model.

Commitment to Digital Transformation and Innovation

Alviva's commitment to digital transformation is a significant strength, with substantial investments being made across its group entities. The company is prioritizing cutting-edge technologies, including cybersecurity and artificial intelligence, to bolster its operations.

This strategic focus on innovation is designed to streamline processes, cut expenses, and elevate the quality of services provided to customers. For instance, the recent introduction of enterprise voice services has already demonstrated tangible benefits, leading to notable cost reductions and enhanced operational efficiency.

- Digital Investment: Alviva is actively channeling resources into digital transformation initiatives.

- Technology Focus: Emphasis on advanced technologies like AI and cybersecurity.

- Efficiency Gains: Initiatives like enterprise voice services have shown proven cost savings and efficiency improvements.

Established Presence in a Growing African Market

Alviva stands out as a major player in Africa's burgeoning information and communication technology (ICT) sector, recognized as one of the continent's largest providers of ICT products and services. This established presence is a significant advantage in a market experiencing rapid expansion.

The African continent offers substantial growth potential, fueled by increasing mobile phone penetration, expanding broadband access, and a surge in digital infrastructure investments. For instance, mobile subscriptions in Africa were projected to reach over 1.5 billion by the end of 2024, highlighting the vast user base.

Alviva is strategically positioned to leverage these growth drivers, benefiting from the continent's accelerating digital transformation. The company's extensive network and understanding of local markets allow it to effectively tap into this dynamic environment.

Key factors supporting Alviva's strength in this area include:

- Market Leadership: Alviva is a recognized leader in a sector poised for significant future growth across Africa.

- Growth Tailwinds: The company benefits from macro trends like increasing digital adoption and infrastructure development across the continent.

- Scalability: Its established operations provide a foundation for scaling services to meet the growing demand in African markets.

Alviva's extensive ICT product and service portfolio, coupled with a robust distribution network across sub-Saharan Africa, positions it as an end-to-end solutions provider. This diversification reduces reliance on single product lines, enhancing resilience. For example, Alviva’s ICT services saw strong growth in FY2024, contributing significantly to overall revenue.

What is included in the product

Delivers a strategic overview of Alviva’s internal capabilities and external market dynamics.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential roadblocks into opportunities for growth.

Weaknesses

Alviva Holdings' delisting from the Johannesburg Stock Exchange in March 2023 marked a significant shift to private ownership. This transition, while intended to foster future growth, inherently curtails the public transparency and detailed financial disclosures previously available to investors and analysts.

The move away from public markets limits Alviva's access to capital raising through equity issuance, potentially hindering ambitious expansion plans that might require substantial public funding. This reduced financial visibility could also impact external stakeholder confidence and valuation assessments.

Alviva's significant presence in South Africa makes it vulnerable to the nation's economic instability. For instance, the South African rand experienced significant depreciation against the US dollar throughout 2023 and into early 2024, impacting Alviva's costs for imported technology components. This currency volatility directly affects the profitability of hardware sales and necessitates careful adjustments to pricing strategies to maintain competitiveness.

Furthermore, a slowdown in the South African economy, a recurring concern, can lead to reduced discretionary spending by both consumers and businesses on ICT solutions. In 2023, South Africa's GDP growth was projected to be modest, around 0.7%, highlighting the challenging economic environment that could dampen demand for Alviva's products and services.

Alviva's reliance on reseller channels and key vendor relationships presents a significant weakness. For instance, in the 2023 fiscal year, a substantial portion of Alviva's revenue was generated through its established reseller network, highlighting the critical nature of these partnerships. Any strain on these relationships, perhaps due to increased competition among resellers or changes in vendor terms, could directly impede Alviva's ability to reach its target markets and maintain its competitive edge.

Intense Competition in the ICT Sector

The information and communication technology (ICT) sector is intensely competitive, featuring numerous local and international entities all striving for market dominance. Alviva contends with other significant distributors and IT service providers, a dynamic that inherently pressures pricing strategies and profit margins. For instance, in 2024, the global ICT market was valued at approximately USD 5.5 trillion, with a significant portion attributed to distribution and services, highlighting the scale of competition Alviva navigates.

Maintaining a competitive advantage necessitates a commitment to continuous innovation and effective differentiation. Players in this space must constantly adapt to technological advancements and evolving customer demands to stand out. In 2025, the emphasis on cloud services, cybersecurity, and artificial intelligence solutions continues to intensify, requiring substantial investment in R&D and strategic partnerships to remain relevant.

- Intense Market Saturation: The ICT landscape is crowded with established players and emerging disruptors, making it challenging to capture and retain market share.

- Price Sensitivity: Competitors often engage in aggressive pricing to attract customers, potentially eroding Alviva's margins.

- Rapid Technological Obsolescence: The fast pace of technological change requires constant investment in new products and services to avoid falling behind.

- Global and Local Competitors: Alviva faces pressure from both large multinational corporations and agile local businesses, each with unique strengths.

Potential for Infrastructure Misuse or Association

Recent reports have flagged an Autonomous System Number (ASN) linked to Alviva Holding Limited as being associated with bulletproof hosting services. These services are often utilized by ransomware operations, creating a potential reputational risk for Alviva. While this association doesn't directly implicate the company in illegal activities, it could lead to increased scrutiny and operational hurdles if not proactively managed.

The implication of Alviva's ASN with illicit hosting providers, even indirectly, could damage its brand image and trustworthiness among clients and partners. This association might also attract unwanted attention from cybersecurity agencies and regulatory bodies, potentially leading to investigations or compliance challenges. For instance, in 2023, several hosting providers with similar associations faced significant sanctions and de-platforming, impacting their business operations.

- Reputational Damage: Association with bulletproof hosting can tarnish Alviva's brand, impacting customer trust and market perception.

- Regulatory Scrutiny: Such links may trigger investigations by cybersecurity authorities, potentially leading to compliance issues.

- Operational Disruptions: Increased scrutiny could result in difficulties securing partnerships or facing restrictions on certain services.

Alviva's delisting from the JSE in March 2023 limits public financial transparency and access to capital markets, potentially hindering growth. Its significant reliance on the South African market exposes it to economic instability and currency volatility, as seen with the rand's depreciation against the USD in 2023-2024, impacting import costs and hardware profitability. The company also faces intense competition in the ICT sector, with aggressive pricing strategies from global and local players pressuring margins, a challenge amplified by the rapid pace of technological change requiring continuous investment in innovation to avoid obsolescence.

Preview Before You Purchase

Alviva SWOT Analysis

The preview you see is the actual Alviva SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This ensures you know exactly what you're getting before you commit.

This is a real excerpt from the complete Alviva SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to implement the insights effectively.

You’re viewing a live preview of the actual Alviva SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive strategic overview.

Opportunities

The African ICT market is projected for substantial expansion, fueled by the ongoing integration of Artificial Intelligence (AI) and the rollout of 5G networks. This presents a prime opportunity for Alviva, given its expertise in systems integration and AI solutions, to pioneer and deliver cutting-edge offerings that meet the escalating demand for these transformative technologies.

Alviva can capitalize on this by enhancing its investment in AI-powered tools for data analytics and customer service. Such advancements are expected to optimize internal processes and unlock novel avenues for revenue generation, aligning with the projected 15% compound annual growth rate for AI adoption in African enterprises through 2025.

The digital economy in South Africa is experiencing robust growth, with projections indicating continued expansion driven by e-commerce and digital services. For instance, Statista reported that the South African e-commerce market was valued at approximately $3.2 billion in 2023 and is expected to grow to $5.7 billion by 2027, demonstrating a clear upward trend.

Alviva is well-positioned to capitalize on this trend by leveraging its established distribution networks and service expertise to assist businesses in their digital transformation journeys. This includes supporting their move to online platforms and the adoption of hybrid cloud solutions, which are becoming increasingly prevalent.

This increasing reliance on digital infrastructure and cloud adoption creates significant opportunities for Alviva to broaden its service portfolio and reach a wider customer base. The demand for integrated IT solutions and support services in this evolving landscape is substantial.

The digital transformation sweeping across Africa, particularly in 2024 and projected into 2025, is fueling an unprecedented demand for cybersecurity. As businesses and governments increasingly rely on digital infrastructure, the threat landscape expands, making robust protection essential. This trend presents a prime opportunity for Alviva to enhance its cybersecurity services, meeting a critical market need.

Alviva's existing presence in cybersecurity solutions positions it advantageously to leverage this growth. By deepening its expertise and expanding its service portfolio, the company can capture a larger share of this expanding market. This strategic focus is anticipated to drive significant revenue growth and profitability in the coming years, as cybersecurity spending in Africa is expected to rise substantially.

Untapped Markets and Digital Divide Bridging in Africa

Africa presents a significant opportunity for Alviva to address the digital divide. Despite advancements, many regions still grapple with limited digital infrastructure and connectivity. For instance, in 2024, mobile internet penetration across sub-Saharan Africa hovered around 40%, leaving vast populations offline.

Alviva can capitalize on this by expanding its services into these underserved remote areas. The rollout of 5G technology, projected to cover over 50% of the African population by 2029 according to recent industry forecasts, offers a powerful tool to deliver high-speed mobile broadband access. This expansion not only fosters economic development but also unlocks entirely new customer segments for Alviva.

- Bridging the Digital Divide: Significant portions of Africa remain underserved by digital infrastructure, presenting a prime opportunity for expansion.

- Leveraging 5G: The increasing adoption of 5G technology by 2029 offers a pathway to deliver enhanced mobile broadband services to remote areas.

- Economic Impact: Expanding connectivity contributes to local economic growth and creates new markets for Alviva's offerings.

- New Customer Segments: Reaching previously unconnected populations opens up substantial new revenue streams.

Increased Investment in Digital Infrastructure

Governments and private sectors across Africa are channeling significant capital into digital infrastructure, a trend that directly benefits Alviva. For instance, initiatives like the African Continental Free Trade Area (AfCFTA) are spurring investment in cross-border connectivity and data centers. This heightened focus on broadband expansion and mobile network upgrades creates substantial opportunities for Alviva to engage in large-scale projects, supplying essential ICT hardware, software, and services.

Alviva is well-positioned to capitalize on this digital transformation wave. The company's expertise in providing comprehensive ICT solutions aligns perfectly with the growing demand driven by these infrastructure investments. This presents a clear pathway for Alviva to secure new contracts and forge strategic partnerships, thereby expanding its market reach and revenue streams within the burgeoning African digital economy.

- Growing Digitalization: African governments are prioritizing digital transformation, with significant public and private sector investments in broadband and mobile infrastructure.

- AfCFTA Impact: The African Continental Free Trade Area is a key driver for improved digital connectivity and data center development across the continent.

- Alviva's Role: As a leading ICT provider, Alviva can leverage its expertise to supply hardware, software, and services for these critical infrastructure projects.

- Market Expansion: These investments create direct opportunities for Alviva to secure new contracts and partnerships, enhancing its market presence and revenue.

The increasing demand for AI and 5G in Africa presents a significant growth avenue for Alviva, especially with projected enterprise AI adoption rates reaching 15% compound annual growth by 2025.

Alviva's established distribution networks and digital transformation expertise allow it to capitalize on South Africa's expanding e-commerce market, which was valued at approximately $3.2 billion in 2023 and is expected to reach $5.7 billion by 2027.

The growing need for cybersecurity, driven by increased digital reliance across Africa, offers Alviva a chance to expand its services and capture a larger market share, as cybersecurity spending in Africa is anticipated to rise substantially.

Addressing the digital divide in underserved African regions by expanding services, particularly with the rollout of 5G technology projected to cover over 50% of the African population by 2029, opens up new customer segments and revenue streams for Alviva.

Threats

Heightened geopolitical tensions, particularly between major technology-producing nations, pose a significant threat to the ICT sector. These tensions directly translate into supply chain vulnerabilities, impacting the availability and pricing of essential hardware and components crucial for Alviva's distribution operations.

For instance, the ongoing trade disputes and export controls enacted in recent years have already demonstrated the potential for widespread disruption. These events can lead to shortages and increased costs for semiconductors and other critical IT infrastructure, directly affecting Alviva's ability to procure and deliver products efficiently to its customer base.

Such supply chain interruptions can significantly hinder Alviva's capacity to meet escalating customer demand, potentially leading to lost sales and a negative impact on overall profitability. The company must navigate these volatile global dynamics to maintain its competitive edge and ensure consistent service delivery.

The relentless pace of technological change poses a significant threat, as ICT products and solutions can become outdated rapidly. Alviva must maintain substantial investments in research and development to ensure its offerings remain current and competitive in the market.

Failure to adapt to emerging technologies, such as the latest advancements in artificial intelligence or new computing architectures, could result in a decline in Alviva's market share. For instance, the global IT spending is projected to reach $5 trillion in 2024, highlighting the immense pressure to innovate and capture a piece of this expanding market.

As a significant player in the ICT sector, Alviva faces substantial cybersecurity risks. The increasing sophistication of cyberattacks, such as ransomware and data breaches, poses a direct threat to its operational continuity and the sensitive data it handles for clients. In 2024, the average cost of a data breach globally reached $4.45 million, a figure Alviva must actively mitigate.

A successful cyberattack could severely disrupt Alviva's services, leading to significant financial losses through downtime, recovery costs, and potential regulatory fines. Furthermore, a breach would undoubtedly damage customer trust and Alviva's hard-earned reputation, potentially impacting future business opportunities and market share.

Regulatory and Compliance Challenges in Diverse African Markets

Operating across multiple sub-Saharan African markets means Alviva must contend with a patchwork of evolving regulations. For instance, data privacy laws vary significantly, with countries like South Africa having the Protection of Personal Information Act (POPIA), while others are still developing their frameworks. Navigating these diverse requirements, alongside differing import/export rules and local content mandates, presents a substantial compliance burden.

The potential for non-compliance carries significant risks. Fines, operational disruptions, and damage to Alviva's reputation are real possibilities if regulatory obligations are not met. In 2024, for example, several multinational corporations faced substantial penalties in various African nations for failing to adhere to local content regulations in their supply chains.

- Diverse Regulatory Landscape: Sub-Saharan Africa presents a complex web of data privacy, import/export, and local content laws.

- Compliance Costs: Adhering to these varied regulations can be both time-consuming and financially demanding for Alviva.

- Risk of Penalties: Non-compliance can lead to significant fines, operational restrictions, and reputational damage.

- Evolving Legal Frameworks: The dynamic nature of regulations across these markets necessitates continuous monitoring and adaptation.

Economic Slowdown and Reduced Corporate/Public Spending

An economic slowdown, both globally and within Alviva's key African markets, poses a significant threat. This downturn could translate to decreased spending on ICT products and services from both corporate and public sectors, directly impacting Alviva's revenue, especially in distribution and IT services. For instance, as of early 2024, many African economies are grappling with persistent inflation and the lingering effects of global supply chain disruptions, which are likely to dampen consumer and business confidence and spending power.

Furthermore, inflationary pressures and potential interest rate hikes by central banks in 2024 and 2025 are expected to further constrain customer budgets. This economic tightening makes it harder for businesses and governments to invest in new technology or upgrade existing infrastructure. The ongoing challenge of load shedding in South Africa also adds a layer of operational complexity and cost, potentially impacting the demand for and profitability of ICT solutions.

- Economic Slowdown: Global GDP growth forecasts for 2024 and 2025 suggest a more subdued economic environment compared to previous years, potentially leading to reduced IT spending.

- Inflationary Pressures: Elevated inflation rates in key African markets continue to erode purchasing power, making ICT investments a lower priority for many businesses and consumers.

- Load Shedding Impact: South Africa's persistent energy crisis (load shedding) increases operational costs for businesses and can hinder the adoption of energy-intensive ICT solutions.

- Reduced Public Spending: Governments facing fiscal constraints may cut back on public sector IT projects, a significant revenue source for many ICT distributors and service providers.

Intensified competition from both established global players and emerging local vendors presents a significant threat. This increased market saturation can lead to price wars and reduced profit margins for Alviva, particularly in its distribution segments.

The rapid evolution of cloud computing and as-a-service models challenges traditional hardware sales. Companies increasingly opt for subscription-based IT solutions, potentially diminishing Alviva's reliance on upfront hardware procurement and distribution.

The threat of counterfeit products entering the market is also a concern for distributors like Alviva. Dealing with uncertified or imitation goods can damage brand reputation and lead to customer dissatisfaction.

| Threat Category | Description | Impact on Alviva | Example/Data (2024-2025) |

|---|---|---|---|

| Intensified Competition | Increased market saturation from global and local players. | Price wars, reduced profit margins, market share erosion. | Global IT market competition is fierce, with IDC projecting worldwide IT spending to reach $5.1 trillion in 2024. |

| Technological Disruption | Shift towards cloud and as-a-service models. | Reduced demand for traditional hardware distribution, need for service model adaptation. | Gartner predicts cloud services will grow by 20.4% in 2024, impacting traditional IT infrastructure sales. |

| Counterfeit Products | Infiltration of fake or uncertified ICT goods. | Reputational damage, customer dissatisfaction, potential legal issues. | The global market for counterfeit goods is substantial, impacting various sectors including electronics. |

SWOT Analysis Data Sources

This Alviva SWOT analysis is built upon a robust foundation of data, including Alviva's official financial filings, comprehensive market research reports, and insights from industry experts. These sources ensure the analysis is grounded in factual evidence and current market dynamics.