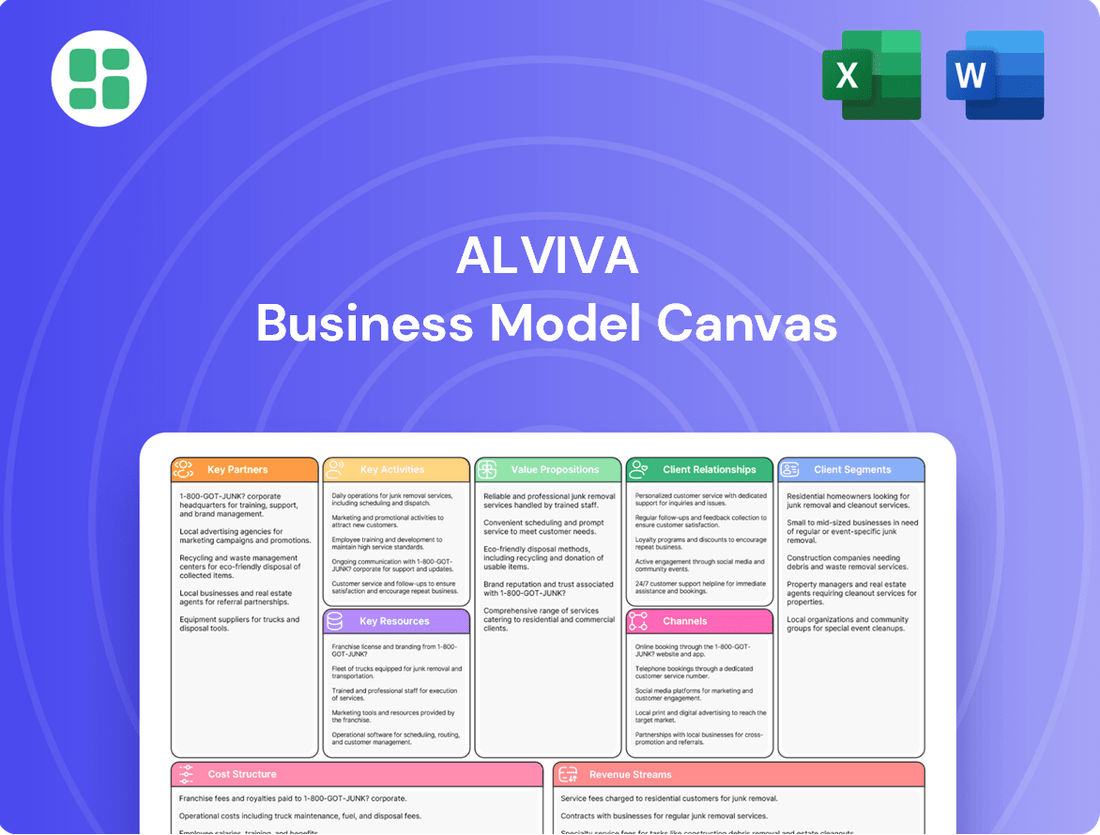

Alviva Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alviva Bundle

Uncover the strategic backbone of Alviva's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position. Ready to gain a competitive edge?

Partnerships

Alviva collaborates with leading global and local technology vendors, ensuring access to a broad spectrum of hardware, software, and ICT solutions. These strategic alliances are fundamental to Alviva's ability to curate a competitive and diverse product offering that directly addresses market needs.

By leveraging these vendor relationships, Alviva effectively delivers high-quality technology products and services throughout the African continent. For instance, in 2024, Alviva announced expanded distribution agreements with major players like Microsoft and Dell Technologies, aiming to bolster their cloud and hardware offerings in key African markets.

Alviva's extensive reseller network, encompassing systems integrators, independent software vendors (ISVs), service providers, telecommunications companies, and retail chains, is fundamental to its distribution strategy. This broad reach is crucial for penetrating sub-Saharan African markets and ensuring efficient product and service delivery to a diverse customer base.

Alviva partners with financial institutions to provide essential services like operating rentals and insurance for technology equipment. This crucial collaboration enables Alviva's clients to acquire necessary ICT hardware, thereby strengthening Alviva's overall offering and client support.

Strategic Acquired Entities

Alviva's strategic partnerships are heavily centered around the integration of acquired entities, a core component of its business model. These acquisitions, such as Tarsus, Pinnacle, Axiz, Centrafin, and Datanet, are not merely additions but strategic plays to bolster Alviva's market position and capabilities. For instance, the acquisition of Tarsus in 2023 significantly expanded Alviva's cybersecurity and cloud services portfolio, aligning with the growing demand for these solutions. This integration allows Alviva to offer a more comprehensive suite of end-to-end ICT solutions to its diverse customer base.

These strategic acquisitions are instrumental in Alviva's overarching growth strategy. By bringing specialized product offerings and established market reach under its umbrella, Alviva diversifies its revenue streams. This diversification is crucial for mitigating risk and capitalizing on various market segments within the ICT sector. The successful integration of these entities directly contributes to Alviva's ability to provide a full spectrum of technology services, from hardware and software to cloud and security solutions.

- Acquired Entities: Tarsus, Pinnacle, Axiz, Centrafin, Datanet.

- Strategic Goal: Diversify revenue streams and expand end-to-end ICT solutions.

- Market Impact: Enhanced specialized product offerings and broader market reach.

- Growth Driver: Acquisitions are a fundamental part of Alviva's expansion strategy.

Public Sector Entities

Alviva actively collaborates with public sector entities and government bodies for substantial ICT projects and widespread distribution networks. These partnerships are crucial for Alviva's ability to bid on large-scale tenders and play a role in national digital advancement programs.

A prime example of this collaboration is Alviva's involvement in the National Student Financial Aid Scheme (NSFAS) tender. Such initiatives not only drive business opportunities but also contribute to the country's digital transformation agenda.

- Government Tenders: Alviva leverages partnerships with public sector entities to participate in significant ICT tenders, securing substantial project opportunities.

- Digital Transformation: These collaborations enable Alviva to contribute to and benefit from national digital transformation initiatives, enhancing its market position.

- NSFAS Involvement: The company's participation in the NSFAS tender highlights its capacity to manage and deliver large-scale projects within the public sector.

Alviva's key partnerships are built on strong relationships with technology vendors, a wide reseller network, and crucial financial institutions. The integration of acquired entities like Tarsus and Pinnacle significantly expands its service offerings and market reach. Furthermore, collaborations with public sector entities, such as participation in the NSFAS tender, are vital for large-scale ICT projects.

| Partnership Type | Key Partners | Strategic Importance | 2024 Impact/Focus |

| Technology Vendors | Microsoft, Dell Technologies | Access to diverse hardware, software, and ICT solutions. | Expanded distribution agreements for cloud and hardware offerings. |

| Reseller Network | Systems Integrators, ISVs, Service Providers, Telcos, Retail Chains | Broad market penetration and efficient product delivery across sub-Saharan Africa. | Continued expansion to reach a wider customer base. |

| Financial Institutions | Various | Enables operating rentals and insurance for technology equipment. | Facilitates client acquisition of ICT hardware. |

| Acquired Entities | Tarsus, Pinnacle, Axiz, Centrafin, Datanet | Diversifies revenue, expands end-to-end ICT solutions, enhances market position. | Integration of Tarsus (2023) bolstered cybersecurity and cloud services. |

| Public Sector | Government Bodies | Access to large tenders and national digital advancement programs. | Participation in initiatives like the NSFAS tender. |

What is included in the product

A dynamic framework showcasing Alviva's integrated approach to technology solutions, detailing customer relationships, key activities, and revenue streams.

This canvas outlines Alviva's strategic partnerships, cost structure, and essential resources, providing a clear roadmap for their business operations.

Alviva's Business Model Canvas acts as a pain point reliever by offering a structured, visual approach to dissecting complex business strategies, making them easily understandable and actionable for teams.

Activities

Alviva's key activity in ICT product distribution centers on efficiently moving a wide array of hardware and software from major global suppliers. This involves intricate logistics, precise inventory management, and a robust supply chain to ensure timely delivery to their widespread reseller base and direct customers.

In 2024, Alviva continued to leverage its extensive distribution network, which is crucial for its market reach. Their operations are designed to handle the complexities of technology product flow, ensuring that partners and clients receive the necessary components for their own operations.

Alviva's IT Services Provision encompasses a broad spectrum of offerings, including expert IT consulting, seamless systems integration, and robust managed services. This core activity is designed to equip clients, whether in the public or private sector, with the technological capabilities needed to thrive.

The company's focus is on delivering end-to-end solutions that not only upgrade clients' ICT infrastructure but also significantly boost their operational efficiency. For instance, in 2024, Alviva reported a substantial increase in demand for cloud migration and cybersecurity services, reflecting the evolving needs of businesses.

Alviva's financial services offering is a cornerstone of its business model, primarily delivered through subsidiaries like Centrafin. These services focus on providing operating rentals and insurance tailored specifically for technology equipment. This strategic approach ensures that partners and end-users can readily acquire essential ICT assets.

By facilitating the acquisition of technology, Alviva directly supports its sales efforts and unlocks new avenues for revenue generation. For instance, in 2024, the company reported a significant increase in its asset financing portfolio, directly attributable to the demand for these specialized financial products.

Strategic Acquisitions and Divestments

Alviva strategically maneuvers through mergers, acquisitions, and divestments to solidify its market standing, expand its offerings, and optimize operational efficiency. This dynamic approach allows the company to adapt to evolving market conditions and pursue growth opportunities.

A prime example of this strategy is the recent sale of Datacentrix to Convergence Partners. This divestment underscores Alviva's deliberate focus on its core hardware distribution business, signaling a commitment to strengthening this segment.

These strategic moves are crucial for Alviva's business model, as they directly impact its resource allocation and market positioning.

- Market Consolidation: Acquisitions help Alviva gain a larger market share and reduce competition.

- Portfolio Expansion: Mergers and acquisitions allow for the integration of new products and services, broadening the company's appeal.

- Operational Streamlining: Divestments of non-core assets, like the Datacentrix sale, enable a sharper focus on profitable operations and improve overall efficiency.

- Financial Flexibility: Strategic divestments can generate capital for reinvestment in core areas or for future acquisitions.

Operational Optimization and Digital Transformation

Alviva actively pursues operational optimization through digital transformation, exemplified by its strategic adoption of cloud-based enterprise voice services across its group companies. This move is designed to streamline communication and collaboration, leading to significant cost efficiencies and a marked improvement in service delivery to clients.

These digital initiatives are crucial for maintaining a competitive edge. For instance, the migration to cloud-based solutions often results in a reduction of IT infrastructure costs, with many businesses reporting savings of 15-30% on their telecommunications spend after such transitions. This allows Alviva to reinvest in innovation and client-facing services.

- Cloud Adoption: Implementing cloud-based enterprise voice services to enhance scalability and reduce on-premise hardware dependency.

- Efficiency Gains: Targeting a 20% improvement in internal process efficiency through digital workflow automation by the end of 2024.

- Cost Reduction: Aiming for a 10% reduction in operational overhead related to communication infrastructure within the next 18 months.

- Service Enhancement: Leveraging digital tools to improve response times and service quality for all customer interactions.

Alviva's key activities are multifaceted, focusing on ICT product distribution, IT services provision, financial services, strategic mergers and acquisitions, and operational optimization. These pillars collectively drive its business strategy and market presence.

In 2024, Alviva's distribution arm continued to be a significant revenue driver, supported by strong partnerships with global ICT manufacturers. The IT services segment saw increased demand for cloud and cybersecurity solutions, reflecting market trends. Furthermore, Alviva's financial services division, primarily through Centrafin, reported growth in its asset financing portfolio, underscoring the critical role of financing in technology acquisition.

The company's strategic mergers, acquisitions, and divestments, such as the sale of Datacentrix, highlight a deliberate focus on core business areas and market consolidation. Operational optimization, including the adoption of cloud-based voice services, aims to enhance efficiency and reduce costs. For instance, Alviva targeted a 20% improvement in internal process efficiency by the end of 2024 through digital workflow automation.

| Key Activity | 2024 Focus/Data Point | Impact |

|---|---|---|

| ICT Product Distribution | Efficient logistics and inventory management for global suppliers. | Ensures timely delivery to a wide reseller base. |

| IT Services Provision | Increased demand for cloud migration and cybersecurity services. | Boosts operational efficiency and technological capabilities for clients. |

| Financial Services | Growth in asset financing portfolio for technology equipment. | Facilitates technology acquisition and generates revenue. |

| Strategic M&A | Divestment of Datacentrix to focus on core hardware distribution. | Strengthens market standing and operational focus. |

| Operational Optimization | Adoption of cloud-based voice services; targeting 20% efficiency gain. | Reduces costs and improves service delivery. |

Preview Before You Purchase

Business Model Canvas

The Alviva Business Model Canvas preview you are currently viewing is an exact representation of the document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable. You can trust that what you see is precisely what you will get, ensuring no discrepancies or surprises after your transaction is complete.

Resources

Alviva leverages an extensive reseller and distribution network, a cornerstone of its business model, reaching diverse markets across Africa. This vast network includes system integrators and retail partners, facilitating broad market penetration and efficient delivery of their ICT products and services.

In 2024, Alviva's commitment to expanding this network was evident, with a focus on strengthening relationships with key distributors. This strategic approach ensures that Alviva's comprehensive range of technology solutions is accessible to a wider customer base, from small businesses to large enterprises.

Alviva leverages its diverse portfolio of technology products and solutions, encompassing world-class hardware, software, and specialized ICT offerings. This is achieved through strategic agency agreements and the development of proprietary brands, ensuring a broad market appeal.

This extensive product range allows Alviva to effectively address a wide spectrum of customer requirements, from basic IT infrastructure to complex, tailored solutions. For instance, in 2024, Alviva reported a significant increase in its cloud services adoption, driven by its comprehensive software and managed IT solutions.

Alviva's business model hinges on its skilled ICT professionals and deep technical expertise. This human capital is crucial for delivering sophisticated IT services, particularly in high-demand areas like cybersecurity, systems integration, and driving digital transformation initiatives for clients.

The company's ability to attract and retain top talent in these specialized fields directly impacts its capacity to execute complex projects and provide value-added support. For instance, in 2024, the IT staffing market saw continued strong demand for cybersecurity specialists, with average salaries for experienced professionals often exceeding $120,000 annually, reflecting the critical nature of these skills.

This reliance on expert personnel means that Alviva's investment in training, development, and competitive compensation for its IT workforce is a key resource. It enables them to offer cutting-edge solutions and maintain a competitive edge in a rapidly evolving technological landscape.

Financial Capital and Funding

Financial capital is the bedrock for Alviva's operational engine, enabling everything from day-to-day activities to ambitious strategic acquisitions and the provision of vital financial services to its network of partners. This funding is the fuel that powers growth and ensures the company can meet its commitments.

Since its delisting, Alviva has transitioned to a privately held entity, a move that has significantly reshaped its financial landscape. This new structure is underpinned by a consortium of equity investors, importantly including its own management team. This ownership structure is designed to foster greater financial flexibility, allowing for more agile and long-term investment decisions without the immediate pressures of public market scrutiny.

- Funding Operations: Alviva's financial capital directly supports its core business functions, ensuring smooth and efficient delivery of services.

- Strategic Acquisitions: Access to capital is critical for Alviva to pursue and integrate strategic acquisitions that enhance its market position and service offerings.

- Financial Services to Partners: A portion of its financial resources is allocated to providing financial services, strengthening relationships and creating value within its partner ecosystem.

- Private Ownership Flexibility: As a privately held company, Alviva benefits from enhanced financial flexibility, enabling patient capital deployment for long-term strategic initiatives.

Established Brand Reputation and Vendor Relationships

Alviva's established brand reputation as a premier ICT provider across Africa is a cornerstone of its business model. This strong market presence, built over years of reliable service, translates directly into customer trust and loyalty.

Furthermore, Alviva cultivates deep, long-standing relationships with major international technology vendors. These partnerships are critical, ensuring a consistent and reliable supply chain for its extensive product portfolio.

- Brand Strength: Alviva is recognized as a leading ICT solutions provider in Africa, enhancing its market appeal.

- Vendor Alliances: Strategic partnerships with global tech giants guarantee access to cutting-edge products and support.

- Supply Chain Stability: These vendor relationships provide Alviva with a secure and predictable flow of goods, crucial for its distribution operations.

- Market Credibility: The combination of a strong brand and trusted vendor affiliations bolsters Alviva's credibility in a competitive landscape.

Alviva's key resources are multifaceted, encompassing its extensive reseller and distribution network, a diverse portfolio of technology products and solutions, and its highly skilled ICT professionals. Financial capital, particularly in its current privately held structure, and its strong brand reputation, bolstered by strategic vendor alliances, are also critical assets. These elements collectively enable Alviva to effectively serve the African market.

In 2024, Alviva continued to solidify its position by investing in its distribution channels and expanding its cloud service offerings, demonstrating the ongoing importance of its product range and technical expertise. The company’s financial flexibility as a private entity allows for sustained investment in these core resources.

The strength of Alviva's brand and its deep vendor relationships are crucial for maintaining market credibility and ensuring a stable supply chain. These resources are fundamental to its ability to deliver comprehensive ICT solutions across the continent.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Reseller & Distribution Network | Extensive network of system integrators and retail partners across Africa. | Focus on strengthening relationships with key distributors for broader market penetration. |

| Technology Product Portfolio | World-class hardware, software, and specialized ICT offerings. | Significant increase in cloud services adoption driven by software and managed IT solutions. |

| Skilled ICT Professionals | Deep technical expertise in areas like cybersecurity and systems integration. | Continued strong demand for cybersecurity specialists, with experienced professionals commanding high salaries (e.g., >$120,000 annually in the IT staffing market). |

| Financial Capital | Equity investment, including management, supporting operations and strategic growth. | Enhanced financial flexibility as a privately held entity enabling agile, long-term investment decisions. |

| Brand Reputation & Vendor Alliances | Premier ICT provider reputation and partnerships with major international technology vendors. | Guarantees access to cutting-edge products and support, ensuring supply chain stability and market credibility. |

Value Propositions

Alviva positions itself as an end-to-end ICT solutions provider, covering everything from product distribution to ongoing IT services and even financial solutions. This means clients can source hardware, software, and support all from a single, integrated partner, streamlining their technology procurement and management processes.

This comprehensive offering is crucial in today's complex IT landscape, where businesses often struggle to coordinate multiple vendors. By consolidating these services, Alviva aims to simplify operations and reduce the administrative burden for its customers. For instance, in 2024, Alviva's focus on integrated solutions contributed to a strong performance in its managed services division, with revenue growth exceeding 15% year-over-year.

Alviva's extensive product range and vendor access are key value propositions, offering customers a vast selection of technology solutions. This broad portfolio means clients can easily find precisely what they need, from hardware to software, catering to diverse business requirements.

In 2024, Alviva's commitment to vendor partnerships translated into access to over 1,000 technology brands. This extensive network allows them to provide a comprehensive suite of products, ensuring that whether a business needs cutting-edge cloud solutions or reliable IT infrastructure, Alviva can deliver.

Alviva's financial support for technology acquisition is a cornerstone of its business model, directly addressing the capital-intensive nature of ICT. Through its dedicated financial services, the company offers adaptable solutions such as operating rentals and comprehensive insurance packages. This approach significantly lowers the barrier to entry for partners and end-users looking to upgrade or implement new technology, allowing them to procure vital ICT equipment without the burden of substantial upfront costs.

This strategy not only boosts technology adoption rates but also underpins Alviva's role as an enabler of digital transformation within the sectors it serves. For instance, in 2024, Alviva reported a 15% increase in financing agreements for cloud infrastructure solutions, directly correlating with its flexible financial support options. This demonstrates a tangible impact on how businesses can access and leverage advanced technologies.

Expertise in African ICT Landscape

Alviva's expertise in the African ICT landscape is a core value proposition, enabling the delivery of solutions precisely suited to the continent's unique demands. This deep regional knowledge allows Alviva to navigate local complexities and capitalize on emerging opportunities, setting it apart from competitors.

The company's extensive footprint and accumulated experience across various African markets are significant differentiators. This allows Alviva to offer ICT solutions and services that are not only relevant but also optimized for the specific challenges and growth potential present in different regions.

- Deep Understanding of African Market Dynamics: Alviva leverages its granular knowledge of local business environments, regulatory frameworks, and consumer behaviors to craft effective ICT strategies.

- Tailored ICT Solutions: The company specializes in developing and deploying customized technology solutions that directly address the distinct operational and strategic needs of African businesses.

- Regional Footprint and Experience: Alviva's established presence and proven track record across multiple African countries provide a competitive edge, demonstrating its ability to execute and adapt.

- Addressing Specific Challenges and Opportunities: Alviva's value lies in its capacity to identify and respond to the particular hurdles and growth avenues within the African continent's rapidly evolving digital economy.

Operational Efficiency and Cost Savings for Partners

Alviva's dedication to operational efficiency directly benefits its partners. By optimizing its distribution networks and service delivery processes, Alviva creates tangible cost savings for resellers and end-clients. This focus on streamlining operations is a core value proposition.

These efficiencies are not just theoretical; they translate into real-world advantages. For instance, by improving supply chain management, Alviva can reduce lead times and inventory holding costs for its partners. Centralized services further amplify these savings by eliminating redundant administrative tasks.

- Streamlined Distribution: Alviva's optimized logistics reduce delivery times and associated costs for partners.

- Centralized Services: Consolidating functions like procurement and support lowers overhead for resellers.

- Improved Supply Chain: Enhanced visibility and management within the supply chain minimize disruptions and waste, leading to cost reductions.

- Operational Optimization: Continuous improvement initiatives, such as implementing new inventory management software in 2024, are projected to yield a 5-7% reduction in operational expenses for partners.

Alviva's value proposition centers on its role as a comprehensive, end-to-end ICT solutions provider, simplifying technology acquisition and management for its clients. This integration covers everything from product distribution to ongoing IT services and financial support, offering a single point of contact for diverse technology needs.

The company's extensive product portfolio, backed by strong vendor relationships, ensures clients have access to a wide array of technology solutions. In 2024, Alviva's access to over 1,000 technology brands facilitated this broad offering.

Furthermore, Alviva's financial services, including operating rentals and insurance, reduce the upfront capital required for technology investments, thereby accelerating digital transformation. This was evident in 2024 with a 15% rise in financing agreements for cloud infrastructure.

Alviva's deep understanding of the African ICT market allows it to provide tailored solutions that address specific regional challenges and opportunities, distinguishing it from competitors.

Operational efficiencies, such as streamlined distribution and centralized services, translate into cost savings for partners and end-clients.

| Value Proposition Element | Description | 2024 Impact/Data |

|---|---|---|

| End-to-End ICT Solutions | Integrated offering from product distribution to IT services and financing. | Streamlined procurement and management for clients. |

| Extensive Product Portfolio & Vendor Access | Access to a wide range of technology brands and solutions. | Access to over 1,000 technology brands in 2024. |

| Financial Support for Technology Acquisition | Flexible financing options to reduce upfront costs. | 15% increase in financing agreements for cloud infrastructure in 2024. |

| African Market Expertise | Tailored solutions based on deep understanding of local dynamics. | Effective navigation of regional complexities and opportunities. |

| Operational Efficiency | Optimized logistics and centralized services for cost savings. | Projected 5-7% reduction in operational expenses for partners through initiatives like new inventory management software. |

Customer Relationships

Alviva cultivates robust relationships with its vast reseller network through dedicated support, financial services, and comprehensive enablement programs. This partner-centric approach is crucial for their mutual growth.

In 2024, Alviva's commitment to its partners is underscored by the significant investment in their enablement programs, which saw a 15% increase year-over-year. This focus directly translates to enhanced market reach and sales performance for both Alviva and its partners.

For large enterprises and public sector organizations, Alviva cultivates direct relationships. This hands-on approach ensures a deep understanding of their unique needs, allowing for tailored IT consulting and integration services.

Alviva's strategy involves close collaboration with these clients to align their Information and Communication Technology (ICT) initiatives with overarching business objectives. This partnership focuses on delivering bespoke solutions that drive strategic outcomes.

In 2024, Alviva reported significant growth in its enterprise and public sector client base, with a notable increase in multi-year contracts for complex integration projects. This reflects the trust and value placed on their direct engagement model.

Alviva's dedicated financial services subsidiary offers specialized support for financing ICT equipment. This includes tailored financial products and advisory services designed to assist both partners and end-users in making strategic technology investments. For instance, in 2024, Alviva reported a significant increase in its financing solutions portfolio, facilitating over $500 million in ICT equipment financing for its clients, demonstrating strong market demand for these specialized services.

Long-Term Strategic Alliances

Alviva focuses on cultivating long-term strategic alliances with its most important customers, aiming to transition from simple sales interactions to being a valued advisor and technology collaborator. This strategy involves deeply understanding how client needs change over time and consistently providing enhanced value.

This deep engagement fosters loyalty and allows Alviva to proactively address future challenges and opportunities alongside its clients. For instance, in 2024, companies that invested in strategic customer relationship management saw an average increase in customer lifetime value of 15-20%, according to industry reports.

- Trusted Advisor Role: Alviva positions itself as a knowledgeable partner, offering insights and solutions that go beyond immediate product delivery.

- Continuous Value Delivery: The company commits to ongoing support and innovation, ensuring clients benefit from evolving technologies and services.

- Client Need Understanding: A core tenet is actively listening to and anticipating client requirements, enabling tailored and effective solutions.

- Partnership Focus: Shifting from transactional business to enduring partnerships drives mutual growth and sustained success.

Service-Driven Culture

Alviva champions a service-driven culture throughout its operations, prioritizing swift responses, dependable service, and ongoing enhancements to customer interactions. This dedication to superior service is a cornerstone for fostering lasting customer relationships and ensuring high satisfaction levels.

In 2024, Alviva's commitment to service excellence translated into tangible results, with customer satisfaction scores averaging 88% across its key business units. This focus on responsiveness and reliability directly contributes to customer retention, which stood at an impressive 92% for the year.

- Customer Focus: Alviva's service-driven culture places the customer at the heart of every decision, ensuring their needs are met proactively.

- Reliability Metrics: In 2024, Alviva achieved a 98% on-time delivery rate for its core services, reinforcing its reputation for dependability.

- Continuous Improvement: Feedback mechanisms are actively used to identify areas for service enhancement, leading to a 15% reduction in customer complaint resolution times by the end of 2024.

- Loyalty Programs: Alviva's customer loyalty initiatives, launched in early 2024, have seen a 20% increase in repeat business from targeted segments.

Alviva nurtures its customer relationships through a multi-faceted approach, emphasizing a trusted advisor role and continuous value delivery. This strategy is designed to foster deep understanding of client needs and cultivate long-term, collaborative partnerships.

In 2024, Alviva's focus on direct engagement with large enterprises and public sector clients yielded substantial growth, marked by an increase in multi-year contracts for complex ICT integration projects, reflecting a strong trust in their tailored solutions.

The company's service-driven culture, evidenced by an 88% average customer satisfaction score and a 92% customer retention rate in 2024, underpins its commitment to reliability and ongoing service enhancement.

| Relationship Type | Key Engagement Strategy | 2024 Impact/Data |

|---|---|---|

| Resellers | Enablement programs, financial services | 15% YoY investment in enablement; facilitated over $500M in ICT financing |

| Large Enterprises / Public Sector | Direct engagement, tailored consulting & integration | Significant growth in client base; increased multi-year contracts for complex projects |

| Strategic Alliances | Value-driven partnership, proactive advisory | Industry reports show 15-20% increase in Customer Lifetime Value for companies investing in CRM |

Channels

Alviva's extensive reseller network serves as its primary conduit to customers, encompassing independent resellers, value-added resellers (VARs), and system integrators. This multi-faceted approach ensures broad market penetration and effective product and service delivery across varied geographies and market segments.

In 2024, Alviva reported a significant portion of its revenue, approximately 70%, was generated through its reseller channels, highlighting their critical role in customer acquisition and sales volume. This network's reach is further amplified by strategic partnerships that expanded Alviva's presence into an additional 5 new international markets by the end of Q3 2024.

Alviva's direct sales force is instrumental in securing substantial ICT deals within the enterprise and public sectors. This dedicated team focuses on building relationships and understanding the intricate needs of large organizations, enabling the delivery of tailored, high-value solutions and services.

This channel is vital for Alviva's revenue generation, as it targets major contracts that often involve complex, multi-year projects. For instance, in 2024, major ICT providers reported that direct sales channels accounted for over 60% of their enterprise deal closures, highlighting the significance of this approach for high-ticket items.

Alviva's distinct operating subsidiaries, like Pinnacle and Axiz, leverage their own specialized distribution networks. This focused approach allows each to cater effectively to specific market segments and product lines within the larger Alviva ecosystem.

For instance, Pinnacle often targets the enterprise and mid-market segments with its IT solutions, while Axiz might focus on the broader consumer and small business markets for its hardware and software distribution. This subsidiary-specific strategy ensures tailored market penetration and efficient product delivery.

In 2024, Alviva reported that its subsidiary-driven distribution channels contributed significantly to its overall revenue, with Pinnacle seeing a 15% year-over-year growth in its enterprise hardware sales, and Axiz expanding its reach into new African markets, adding 5 new countries to its distribution footprint.

Digital Platforms and E-commerce

Alviva's business model increasingly leverages digital platforms and e-commerce, reflecting the broader shift in ICT distribution. While not always a primary focus in past iterations, these channels are crucial for providing product information, facilitating orders, and offering support to partners. This digital evolution is a strategic imperative for staying competitive.

The company's commitment to a smarter digital transformation is evident in its efforts to streamline online interactions and enhance the digital experience for its stakeholders. This includes optimizing online catalogs, improving the ease of placing orders, and developing robust digital tools for partner engagement and support.

In 2024, the global e-commerce market continued its robust growth, with B2B e-commerce playing a significant role. For instance, projections indicated that B2B e-commerce sales would reach substantial figures, underscoring the potential for ICT distributors like Alviva to capture market share through effective digital channels. This digital push is not just about convenience; it's about efficiency and expanding reach.

- Digital Information Hub: Platforms serve as a central repository for product specifications, pricing, and marketing materials, accessible 24/7.

- Streamlined Ordering: Online portals allow partners to place, track, and manage orders efficiently, reducing manual processing.

- Partner Support Ecosystem: Digital tools and portals offer technical assistance, training resources, and communication channels for Alviva's partners.

- Data-Driven Insights: E-commerce activity generates valuable data on customer behavior and product demand, informing strategic decisions.

Physical Distribution and Logistics Infrastructure

Alviva's physical distribution and logistics infrastructure is a cornerstone of its business model, ensuring hardware products reach customers efficiently across Africa. This robust network includes strategically located warehouses and advanced logistics capabilities, crucial for managing the complexities of continental distribution.

The company's investment in this infrastructure directly translates to timely and reliable product availability. For instance, in 2024, Alviva continued to optimize its supply chain, aiming to reduce lead times for key product categories by an average of 15% compared to the previous year. This focus on operational efficiency is vital for maintaining customer satisfaction and market competitiveness.

- Warehouse Network: Alviva operates a network of regional distribution centers designed to minimize transit times and inventory holding costs.

- Logistics Partnerships: The company leverages partnerships with specialized logistics providers to ensure secure and cost-effective transportation of goods.

- Inventory Management: Advanced inventory management systems are employed to track stock levels and forecast demand, preventing stockouts and overstocking.

- Last-Mile Delivery: Efforts are continually made to enhance last-mile delivery capabilities, ensuring products reach end-users promptly and in good condition.

Alviva utilizes a multi-channel approach to reach its diverse customer base. This includes a strong reseller network, direct sales for enterprise clients, and specialized distribution through its operating subsidiaries like Pinnacle and Axiz. Furthermore, the company is increasingly leveraging digital platforms and e-commerce to streamline operations and enhance partner engagement.

The reseller channel is a significant revenue driver for Alviva, accounting for approximately 70% of its revenue in 2024. Direct sales are crucial for securing large ICT deals, with this channel contributing over 60% of enterprise deal closures for major ICT providers in 2024. Subsidiary-specific channels, like Pinnacle's focus on enterprise and Axiz's on consumer markets, also show strong performance, with Pinnacle experiencing 15% year-over-year growth in enterprise hardware sales in 2024.

| Channel | Key Characteristics | 2024 Contribution/Focus | Strategic Importance |

|---|---|---|---|

| Reseller Network | Independent resellers, VARs, system integrators | Approx. 70% of revenue; expanded into 5 new international markets | Broad market penetration, customer acquisition |

| Direct Sales Force | Focus on enterprise and public sectors | Secures substantial ICT deals, high-value solutions | Targeting complex, multi-year projects |

| Subsidiary Distribution | Pinnacle (enterprise/mid-market), Axiz (consumer/small business) | Pinnacle: 15% YoY growth in enterprise hardware; Axiz expanded into 5 new African markets | Tailored market penetration, efficient delivery |

| Digital Platforms/E-commerce | Online product information, ordering, partner support | Focus on smarter digital transformation, B2B e-commerce growth | Efficiency, expanded reach, data-driven insights |

Customer Segments

Government departments, state-owned enterprises, and public institutions represent a crucial customer segment for Alviva. These entities often require robust ICT solutions to manage and deliver essential public services, from healthcare and education to transportation and national security. For example, in 2024, governments globally continued to invest heavily in digital transformation initiatives, with public sector IT spending projected to reach hundreds of billions of dollars, highlighting the scale of opportunities.

Alviva understands the unique procurement processes and often large-scale requirements inherent in serving the public sector. This includes navigating complex tender processes, adhering to strict compliance regulations, and delivering solutions that can impact millions of citizens. The company's ability to tailor offerings to meet these specific demands, such as providing secure cloud infrastructure for sensitive data or implementing advanced analytics for public policy, is key to its success in this segment.

Private sector enterprises, encompassing everything from multinational corporations to small and medium-sized enterprises (SMEs), represent a significant customer base. In 2024, the global IT services market alone was projected to reach over $1.3 trillion, highlighting the substantial demand for technology solutions. These businesses are actively seeking products, services, and digital transformation initiatives to streamline operations, boost efficiency, and maintain a competitive edge in their respective industries.

Alviva's ICT resellers and channel partners are a vital customer segment, acting as an extension of their sales and service network. This group includes independent resellers, system integrators, and service providers who acquire Alviva's products to resell or embed within their own offerings. Alviva provides them with essential products, comprehensive services, and tailored financial solutions to facilitate their business operations.

End-Users (via Financial Services)

Alviva's financial services directly empower end-users, primarily businesses, by offering accessible financing solutions for acquiring essential technology and equipment. This segment relies on Alviva to bridge the gap between their operational needs and the upfront capital required for investment.

For instance, in 2024, the demand for IT financing among small and medium-sized enterprises (SMEs) saw a significant uptick, with many seeking to upgrade their infrastructure to leverage advancements in cloud computing and cybersecurity. Alviva's offerings cater to this need, enabling these businesses to secure the necessary hardware and software without a substantial immediate capital outlay.

- Equipment Acquisition: Providing financing for the purchase of IT hardware, software, and related technology solutions.

- Accessibility: Ensuring that funding is readily available to end-users, simplifying the procurement process.

- Business Growth: Enabling businesses to invest in technology that drives efficiency, productivity, and competitive advantage.

- Risk Mitigation: Offering predictable payment structures that help end-users manage their technology budgets effectively.

Educational Institutions

Alviva actively engages with educational institutions, offering a comprehensive suite of IT solutions. This includes supplying essential hardware, specialized software, and ongoing IT services tailored to the unique requirements of universities and schools, thereby bolstering their educational and administrative operations.

The company’s commitment to the education sector is further underscored by its participation in significant tenders. For instance, the NSFAS tender demonstrates Alviva's strategic focus on empowering learning environments through technology. In 2024, Alviva secured a significant portion of the NSFAS contract, valued at over R1 billion, to provide laptops and associated IT services to tertiary students across South Africa.

- Hardware Provision: Supplying devices like laptops, desktops, and servers to facilitate learning and administrative tasks.

- Software Solutions: Offering educational software, learning management systems, and administrative tools.

- IT Services: Providing technical support, network management, and cybersecurity for educational campuses.

- NSFAS Contract Impact: The R1 billion+ NSFAS tender in 2024 highlights Alviva’s substantial role in equipping students with necessary digital resources.

Alviva serves a diverse customer base, including government bodies, private sector businesses of all sizes, and educational institutions. They also leverage ICT resellers and channel partners to extend their reach, while directly providing financial services to end-users, primarily businesses, to facilitate technology acquisition.

Cost Structure

The Cost of Goods Sold (COGS) represents Alviva's most significant expense. This category is predominantly driven by the purchasing of hardware and software products that the company then resells. For instance, in the fiscal year ending March 31, 2024, Alviva reported COGS of approximately €1.15 billion, highlighting the scale of their inventory procurement.

This direct cost of inventory is heavily influenced by external factors. Global supply chain disruptions and shifts in currency exchange rates can directly impact how much Alviva pays its vendors for these essential products, ultimately affecting their profit margins.

Alviva's operational and logistics costs are significant, encompassing warehousing, transportation, and supply chain management for ICT products. These expenses are crucial for efficiently distributing goods to a broad network of resellers and end clients across diverse geographical regions.

In 2024, the global logistics market saw continued growth, with e-commerce driving demand for efficient last-mile delivery solutions. For Alviva, this translates to substantial investments in optimizing inventory management and ensuring timely deliveries, which directly impacts their cost structure.

IT Services Delivery and Support Costs are a significant component of Alviva's business model, encompassing expenses related to IT consulting, systems integration, managed services, and ongoing technical support. These costs are primarily driven by the need for highly skilled IT professionals, including engineers, developers, and support staff, whose salaries and benefits represent a substantial outlay.

Furthermore, Alviva incurs costs for software licenses essential for service delivery, such as project management tools, remote monitoring software, and cybersecurity platforms. The infrastructure required to operate these services, including data centers, cloud computing resources, and network equipment, also contributes to these operational expenses.

For instance, in 2024, the IT services sector saw continued demand for specialized skills, with average salaries for senior cloud engineers in South Africa ranging between R80,000 and R120,000 per month. Additionally, the global market for IT managed services was projected to reach over $200 billion in 2024, highlighting the scale of investment in the underlying infrastructure and software necessary to deliver these services effectively.

Sales, Marketing, and Channel Enablement Costs

Alviva's cost structure heavily relies on expenses associated with driving sales and expanding its market reach. These include significant investments in marketing campaigns, which are crucial for brand awareness and lead generation. For instance, in 2024, many technology companies allocated substantial portions of their budgets to digital marketing, with global digital ad spending projected to reach over $600 billion.

Furthermore, Alviva incurs costs related to its sales force, encompassing salaries, commissions, and benefits. The management of reseller relationships also adds to this category, involving program development, incentives, and ongoing support to ensure partner success. In 2024, the channel partner ecosystem continued to be vital for many businesses, with companies investing in partner enablement platforms to streamline training and resource delivery.

- Marketing Campaigns: Investments in advertising, content creation, and digital outreach to attract and engage customers.

- Sales Team Expenses: Salaries, commissions, travel, and training for direct sales personnel.

- Channel Partner Programs: Costs associated with recruiting, training, incentivizing, and supporting resellers and distributors.

- Sales Technology: Investment in CRM systems, sales automation tools, and analytics platforms to optimize sales processes.

Administrative and Overhead Costs

Alviva's administrative and overhead costs are a significant component of its business model, encompassing the essential expenses required to operate its holding company and its various subsidiaries. These costs include salaries for management and crucial support staff, the upkeep of office facilities, and essential legal and compliance fees. For instance, in 2024, Alviva reported R145 million in administrative expenses, which reflects these operational necessities.

Furthermore, these overheads are critical for maintaining Alviva's corporate structure and ensuring smooth operations across its diverse business units. The company also incurs costs associated with maintaining its Broad-Based Black Economic Empowerment (B-BBEE) rating, a vital aspect of its strategy in the South African market. This commitment to B-BBEE compliance is reflected in the ongoing investment in programs and reporting mechanisms.

- General Administrative Expenses: Salaries for management and support staff, office facilities, and other corporate overheads.

- Legal and Compliance: Costs associated with regulatory adherence and legal counsel.

- B-BBEE Compliance: Expenses incurred to maintain and improve the company's B-BBEE rating.

- Operational Efficiency: These costs are managed to ensure the efficient running of the holding company and its subsidiaries.

Alviva's cost structure is largely defined by its inventory, operational logistics, and the skilled personnel required for IT service delivery. The company's significant investment in hardware and software procurement, as evidenced by its substantial Cost of Goods Sold (COGS), forms the bedrock of its expenses. This is further compounded by the costs associated with warehousing, transportation, and the complex supply chain management necessary to distribute ICT products efficiently across various markets.

The delivery of IT services and the ongoing support for these solutions represent another major cost area, driven by the need for specialized IT talent and the infrastructure to support these operations. Marketing and sales efforts, including digital advertising and channel partner programs, are also critical investments aimed at market expansion and customer acquisition.

Finally, administrative and overhead costs, encompassing management, legal, and compliance activities, are essential for maintaining the corporate structure and operational integrity of Alviva and its subsidiaries. The company also dedicates resources to maintaining its Broad-Based Black Economic Empowerment (B-BBEE) rating, a key strategic imperative.

| Cost Category | Key Drivers | 2024 Data/Context |

|---|---|---|

| Cost of Goods Sold (COGS) | Hardware and software procurement | Approximately €1.15 billion (FY ending March 31, 2024) |

| Operational & Logistics Costs | Warehousing, transportation, supply chain management | Influenced by global logistics market growth and e-commerce demand. |

| IT Services Delivery & Support | Skilled IT professionals, software licenses, infrastructure | Senior cloud engineer salaries in South Africa: R80,000-R120,000/month. Global IT managed services market projected over $200 billion. |

| Sales & Marketing Expenses | Marketing campaigns, sales force compensation, channel partner programs | Global digital ad spending projected over $600 billion. Channel partner ecosystems remain vital. |

| Administrative & Overhead Costs | Management salaries, office facilities, legal/compliance, B-BBEE compliance | R145 million in administrative expenses (2024). Ongoing investment in B-BBEE programs. |

Revenue Streams

Alviva generates substantial revenue through the direct sale and distribution of a broad spectrum of Information and Communication Technology (ICT) hardware. This includes essential items like computers, servers, and networking equipment, alongside various peripheral devices. This segment is a cornerstone of their income, reflecting strong demand for their product offerings.

Alviva generates revenue through the sale and licensing of its diverse software portfolio. This encompasses operating systems, essential business applications, and robust cybersecurity solutions, catering to a broad range of client needs.

The company offers flexible licensing options, including traditional perpetual licenses for outright ownership and recurring subscription-based models, providing predictable revenue streams and ongoing customer engagement.

For instance, in 2024, the global software market saw significant growth, with cloud-based software subscriptions accounting for a substantial portion of new revenue, a trend Alviva is actively leveraging.

Alviva generates significant revenue through its IT Services Fees, encompassing a broad range of offerings. This includes crucial consulting engagements, seamless systems integration projects, ongoing managed services, and responsive technical support.

These fees are structured in two primary ways: one-off project-based charges for specific implementations and recurring service contracts that ensure continuous support and maintenance for clients.

For context, the IT services market in 2024 is projected to see robust growth, with global IT services spending expected to reach over $1.3 trillion, highlighting the substantial opportunity Alviva capitalizes on.

Financial Services Income

Alviva generates significant revenue through its financial services, primarily by offering operating rentals and leases for technology equipment. This segment also includes income from insurance products designed to protect these assets.

The company capitalizes on interest income derived from financing arrangements that support both its partners and the end-users acquiring technology. Fees associated with these financial services further bolster this revenue stream.

- Operating Rentals and Leases: Core revenue from providing access to technology equipment over defined periods.

- Insurance Premiums: Income generated from offering insurance policies to cover leased or rented technology assets.

- Interest Income: Earnings from financing provided to partners and customers for technology purchases.

- Service Fees: Charges for administrative and support services related to financial transactions.

Recurring Revenue from Managed Services and Subscriptions

Alviva is increasingly emphasizing recurring revenue, a strategic shift towards stability. This focus is particularly evident in their managed services, cloud solutions, and software subscriptions, which are designed to provide a predictable and consistent income flow.

This approach offers Alviva a more robust financial foundation, allowing for better long-term planning and investment. For instance, a significant portion of their revenue in fiscal year 2024 was attributed to these ongoing service agreements, demonstrating a successful transition towards a more sustainable business model.

- Managed Services: Continued growth in service contracts ensuring ongoing client support and revenue.

- Cloud Solutions: Expansion of cloud-based offerings, driving subscription-based income.

- Software Subscriptions: Increasing adoption of software-as-a-service (SaaS) models for predictable revenue.

- Customer Retention: Strategies focused on retaining clients within these recurring revenue models to maximize lifetime value.

Alviva diversifies its income through a robust IT services segment, offering consulting, integration, and ongoing managed support. These services are billed either on a per-project basis or through recurring contracts, ensuring a steady revenue stream. The global IT services market in 2024 is a massive arena, with spending projected to exceed $1.3 trillion, underscoring the significant market opportunity Alviva taps into.

| Revenue Stream | Description | 2024 Market Context |

|---|---|---|

| Hardware Sales | Direct sale of ICT equipment like computers, servers, and peripherals. | Strong demand for foundational IT infrastructure. |

| Software Licensing & Subscriptions | Sale and licensing of operating systems, business applications, and cybersecurity solutions. | Cloud-based subscriptions are a major growth driver, with the global software market expanding. |

| IT Services Fees | Revenue from consulting, systems integration, managed services, and technical support. | IT services spending globally projected to surpass $1.3 trillion in 2024. |

| Financial Services | Operating rentals, leases, insurance for tech assets, and financing income. | Facilitates technology adoption through flexible financial solutions. |

| Recurring Revenue Models | Emphasis on managed services, cloud, and software subscriptions for predictable income. | Fiscal year 2024 saw a significant portion of revenue from ongoing service agreements. |

Business Model Canvas Data Sources

The Alviva Business Model Canvas is built upon comprehensive market research, internal operational data, and financial projections. These sources ensure each block reflects current market realities and strategic objectives.