Alviva Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alviva Bundle

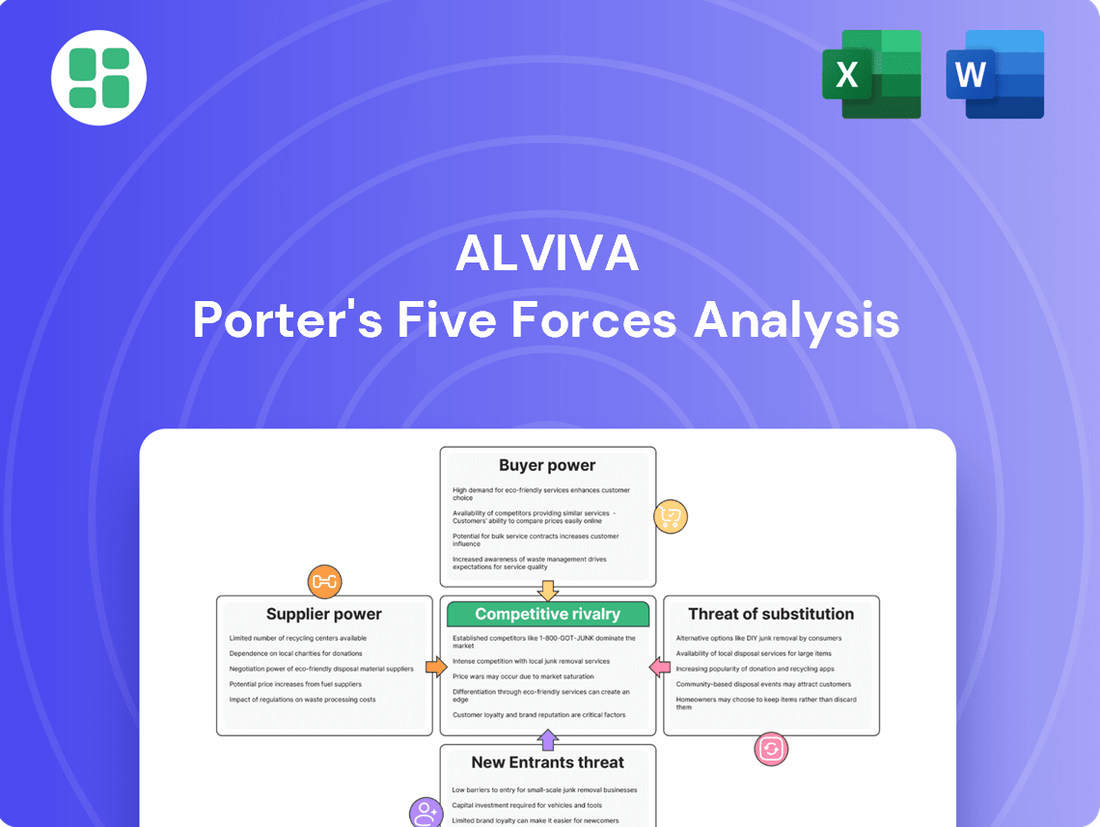

Understanding Alviva's competitive landscape is crucial for strategic success, and our Porter's Five Forces analysis provides that clarity. We've dissected the industry's core dynamics, revealing the true power of suppliers, the intensity of rivalry, and the ever-present threat of new entrants.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Alviva’s competitive dynamics, market pressures, and strategic advantages in detail, empowering you with the knowledge to navigate its market effectively.

Suppliers Bargaining Power

Alviva's reliance on a concentrated group of global hardware and software vendors is a significant factor in its bargaining power with suppliers. These key vendors, often multinational corporations with strong brand recognition and proprietary technology, hold considerable sway. For instance, major players in the semiconductor industry, which underpins much of ICT distribution, have historically demonstrated pricing power due to high R&D costs and limited competition in certain advanced chip segments. This concentration means Alviva has fewer alternatives for sourcing critical components, potentially leading to less favorable pricing and terms.

The specialized nature of certain ICT hardware and software, particularly high-end enterprise solutions, means Alviva may face significant switching costs if it were to change suppliers. For instance, in 2024, the average cost for businesses to migrate complex enterprise resource planning (ERP) systems, a common Alviva offering, can range from tens of thousands to millions of dollars, depending on the scale and customization involved.

The deep integration of these products into client systems, coupled with the necessity for certified expertise to manage and maintain them, further solidifies supplier power. This reliance can empower key vendors to influence pricing and contractual terms, potentially squeezing Alviva's profit margins.

Global supply chain disruptions, exemplified by the persistent semiconductor shortages that impacted numerous industries throughout 2022 and 2023, have demonstrably amplified the bargaining power of suppliers. When demand significantly outpaces available supply, as seen with critical components for electronics, vendors gain leverage to dictate terms, potentially prioritizing larger or more lucrative clients and increasing prices. This dynamic directly affects Alviva's capacity to procure necessary inventory and maintain competitive pricing for its reseller network and the ultimate end-users, underscoring the company's susceptibility to external forces influencing supplier leverage.

Forward Integration Threat

The threat of forward integration by suppliers represents a significant strategic consideration for Alviva. Major ICT vendors, particularly those with a substantial presence and interest in the African market, could opt to bolster their direct sales channels or enhance their own service delivery capabilities. This move would allow them to bypass intermediaries like Alviva, potentially diminishing the latter's market relevance and consequently weakening its bargaining power.

For instance, a large global technology firm might decide to invest more heavily in establishing its own regional support centers or direct-to-customer sales operations within Africa. This strategy could be driven by a desire for greater control over the customer experience and a larger share of the value chain. Such a shift would directly challenge Alviva's role as a primary distributor and service provider.

- Supplier Control: Vendors may seek to control the entire customer journey, from product sale to after-sales support, thereby reducing reliance on third-party distributors.

- Market Reach: Direct integration allows suppliers to leverage their global brand recognition and existing customer bases to penetrate African markets more effectively.

- Value Capture: By managing direct sales and services, suppliers can capture a larger portion of the profit margin previously shared with distributors.

Strategic Importance of Alviva's Network

Despite the inherent bargaining power of suppliers, Alviva's expansive distribution network and deep market penetration across Africa offer significant counter-leverage. For global technology vendors aiming to tap into the diverse and often challenging African markets, Alviva's established infrastructure and extensive reseller relationships are invaluable assets.

This strategic positioning transforms Alviva into a crucial channel partner for many suppliers, thereby affording it a degree of negotiation strength. For instance, Alviva's reach in regions like South Africa, where it holds significant market share in IT distribution, makes it a difficult partner for suppliers to bypass when targeting this continent.

- Network Reach: Alviva's presence in over 15 African countries provides suppliers with unparalleled access to a fragmented market.

- Market Penetration: The company's deep relationships with local resellers and end-users create a strong barrier to entry for competing distribution channels.

- Value Proposition: For vendors, Alviva offers a consolidated and efficient route to market, reducing complexity and cost associated with direct engagement across multiple African nations.

Suppliers hold considerable power over Alviva due to the concentrated nature of hardware and software vendors and the specialized, integrated products Alviva distributes. This means Alviva often has limited alternatives for sourcing critical components, potentially leading to less favorable pricing. For example, the high R&D costs and limited competition in advanced chip segments grant semiconductor vendors significant pricing power.

Switching costs for specialized ICT solutions are substantial; in 2024, migrating complex ERP systems could cost businesses millions. This deep integration and need for certified expertise further empower vendors, enabling them to dictate terms and potentially impact Alviva's profit margins.

Global supply chain disruptions, such as the semiconductor shortages of 2022-2023, have amplified supplier leverage. When demand outstrips supply, vendors can prioritize clients and increase prices, directly affecting Alviva's inventory procurement and pricing competitiveness.

The threat of forward integration by suppliers, where they might establish direct sales or service channels in Africa, could diminish Alviva's market relevance. This would allow vendors to bypass intermediaries and capture more of the value chain, directly challenging Alviva's role.

| Factor | Impact on Alviva | Example/Data Point |

|---|---|---|

| Supplier Concentration | Reduced negotiation leverage for Alviva | Reliance on a few key global hardware/software vendors |

| Switching Costs | Increased dependence on existing suppliers | 2024 ERP migration costs can reach millions |

| Product Specialization & Integration | Empowers suppliers to dictate terms | Need for certified expertise to manage complex systems |

| Supply Chain Disruptions | Amplifies supplier pricing power | Semiconductor shortages (2022-2023) led to increased vendor leverage |

| Forward Integration Threat | Potential for suppliers to bypass Alviva | Global tech firms enhancing direct sales/support in Africa |

What is included in the product

Examines the intensity of rivalry, buyer and supplier power, threat of new entrants, and substitute products to assess Alviva's competitive environment.

Visualize competitive intensity with a dynamic, interactive dashboard that highlights key threats and opportunities.

Customers Bargaining Power

Alviva's customer base is largely fragmented, with many small resellers distributing its products. This diffusion of customers generally limits the bargaining power of any single buyer. For instance, in the IT distribution sector, smaller resellers typically lack the scale to negotiate significant price concessions.

However, Alviva also serves large enterprise clients and public sector organizations. These major buyers, by virtue of their substantial procurement volumes and complex project needs, can wield considerable bargaining power. For example, a large government tender for IT hardware can involve millions of units, allowing the procuring entity to demand aggressive pricing and tailored service agreements, directly impacting Alviva's margins.

Customers and resellers in the African ICT market benefit from a wide array of choices. They can source products and services from numerous distributors, and increasingly, they have direct access to vendors or can opt for cloud-based solutions. This abundance of alternatives significantly strengthens their bargaining power.

The ability to easily switch providers if Alviva's pricing or service quality falls short of expectations is a direct consequence of this market dynamic. For example, the burgeoning adoption of cloud services presents a compelling alternative to traditional methods of acquiring hardware and software, further empowering customers.

Customers' bargaining power is significantly influenced by their price sensitivity and the ease with which they can switch providers. In the Information and Communications Technology (ICT) sector, particularly for standardized hardware and software, customers often exhibit a high degree of price sensitivity. They can readily compare offerings from various distributors, putting pressure on Alviva to maintain competitive pricing. For instance, in 2024, the average ICT hardware price saw a slight dip of 1.5% due to increased competition and oversupply in certain segments, making price a critical factor for buyers.

While switching costs can be substantial for complex, integrated ICT solutions or long-term IT service contracts, they are considerably lower for more commoditized products. This means that for many of Alviva's offerings, customers have the flexibility to move to a competitor if they find a better deal. However, Alviva's strategic inclusion of financial services is designed to mitigate this by bundling solutions and offering integrated financing, thereby increasing customer stickiness and effectively lowering perceived switching costs for their clientele.

Customer Information and Transparency

Customers today are significantly more informed, thanks to digital platforms that readily offer pricing comparisons and detailed product specifications. This increased transparency, a trend amplified in 2024, allows them to easily benchmark Alviva against its competitors. Armed with this market intelligence, customers can effectively negotiate for better value, reducing the traditional information gap.

This heightened customer awareness directly impacts Alviva's bargaining power. For instance, in the competitive electronics retail sector, where Alviva operates, price comparison websites and online reviews are prevalent. A 2024 report indicated that over 70% of consumers research products extensively online before making a purchase, often comparing prices across multiple retailers.

- Informed Price Comparisons: Digital tools allow customers to instantly compare Alviva's offerings with competitors, leading to greater price sensitivity.

- Access to Reviews and Ratings: Online feedback empowers customers to assess product quality and service, influencing their purchasing decisions and negotiation leverage.

- Industry Benchmarking: Customers can easily identify industry standards for pricing and features, expecting similar or better value from Alviva.

- Reduced Information Asymmetry: The widespread availability of data diminishes the advantage Alviva might have previously held through proprietary information.

Demand for End-to-End Solutions and Value-Added Services

Customers are increasingly demanding comprehensive, end-to-end solutions in the ICT sector, moving beyond simple product purchases. This shift means they are looking for integrated offerings that cover everything from initial setup to ongoing support and financing.

Alviva's strategic pivot to become an end-to-end provider, incorporating IT services and financial solutions, directly addresses this customer need. By offering a holistic package, Alviva aims to foster greater customer loyalty and reduce the likelihood of customers switching to competitors. For instance, in 2024, the demand for managed IT services, a key component of end-to-end solutions, saw significant growth, with the global market projected to reach over $300 billion.

This integrated approach can effectively diminish the bargaining power of customers. When a customer relies on Alviva for a complete suite of services, including financing, their ability to negotiate lower prices or seek alternative suppliers for individual components is reduced. They become more dependent on Alviva's comprehensive offering, enhancing Alviva's position in the market.

- Growing Demand for Integrated ICT Solutions: Customers prefer single-vendor relationships for seamless service delivery.

- Alviva's End-to-End Strategy: The company offers IT services and financial solutions to capture more customer value.

- Increased Customer Stickiness: Integrated offerings make it harder for customers to switch providers.

- Reduced Customer Bargaining Power: Reliance on a comprehensive provider limits customers' negotiation leverage.

Alviva's customers, particularly smaller resellers, have limited individual bargaining power due to the fragmented nature of the market. However, large enterprise clients and public sector organizations can exert significant influence through high-volume purchases and complex requirements, demanding competitive pricing and tailored service agreements. The African ICT market's abundance of choices, including direct vendor access and cloud alternatives, further empowers customers, making price sensitivity and ease of switching key determinants of their leverage.

| Factor | Impact on Customer Bargaining Power | Alviva's Response |

|---|---|---|

| Market Fragmentation | Low for individual small resellers | Focus on enterprise clients |

| Availability of Alternatives | High due to numerous distributors and cloud options | Strategic bundling and integrated solutions |

| Price Sensitivity | High for commoditized products; exacerbated by 2024 price dips | Competitive pricing strategies, value-added services |

| Switching Costs | Low for commoditized products, high for integrated solutions | Financial services to increase customer stickiness |

What You See Is What You Get

Alviva Porter's Five Forces Analysis

This preview showcases the complete Alviva Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate usability. You can confidently expect this professionally formatted analysis to be ready for your strategic planning needs without any alterations or missing sections.

Rivalry Among Competitors

The African ICT market is a dynamic arena with a substantial number of competitors vying for market share. This includes formidable global technology corporations, established regional distributors, and a multitude of local IT service providers.

Alviva navigates this landscape, encountering rivalry from both highly specialized firms focusing on niche segments and broadly diversified companies offering a wide array of solutions. This diversity in competitor offerings makes the competitive environment particularly intricate.

The sheer volume of active participants, many of whom possess significant financial resources, amplifies the intensity of competition. For instance, in 2024, the African digital transformation market alone was projected to reach over $100 billion, indicating a highly attractive yet fiercely contested sector.

The African ICT market is booming, with the South African sector expected to grow at a 7.90% compound annual growth rate. This robust expansion, alongside a projected 9.77% CAGR for the broader GCC and Africa ICT market through 2030, offers significant opportunities that can ease competitive pressures by creating space for many companies.

However, this attractive growth also acts as a magnet for new investment, inevitably intensifying the competition as more players vie for a larger slice of the expanding market. The digital transformation wave is a key driver, fueling this growth and reshaping how businesses operate across the continent.

While the core distribution of IT hardware and software can easily become a race to the bottom on price, Alviva carves out its competitive edge through a more sophisticated approach. Its vast distribution network, coupled with a commitment to providing end-to-end IT solutions, sets it apart. This includes crucial value-added services such as tailored financial support for its clients, a significant differentiator in a market where upfront costs can be a barrier.

The capacity to deliver holistic IT services, encompassing everything from cloud migration and management to specialized technical support, is paramount for Alviva's success in a crowded marketplace. In 2024, the IT services market saw continued growth, with companies increasingly prioritizing service quality and innovative solutions over mere product resale. For instance, the global IT services market was projected to reach over $1.3 trillion in 2024, highlighting the significant revenue potential for providers who can offer more than just basic distribution.

High Exit Barriers

The ICT distribution and services sector is characterized by substantial sunk costs. These include investments in specialized infrastructure, extensive logistics networks, and the development of a highly skilled workforce. These significant upfront investments create high exit barriers.

Because of these high exit barriers, companies often feel compelled to stay in the market even when profitability is low. This persistence fuels ongoing competitive intensity among existing players. Consolidation is a frequent response to this dynamic, as demonstrated by Alviva's strategic acquisition activities.

- High Sunk Costs: Significant capital is tied up in infrastructure and logistics.

- Skilled Personnel Investment: Training and retaining specialized talent represents a substantial cost.

- Persistence in Low Profitability: Competitors remain active despite unfavorable market conditions.

- Consolidation Trend: Acquisitions are a common strategy to navigate market pressures.

Technological Advancements and Innovation Pace

The competitive rivalry within Alviva's sector is significantly intensified by the swift evolution of technology. Innovations in areas such as artificial intelligence, 5G networks, and cloud computing demand constant adaptation from companies to stay competitive. For instance, the global AI market was projected to reach over $500 billion in 2024, highlighting the rapid investment and development in this space.

Alviva's success hinges on its capacity to embrace and integrate these emerging technologies. Companies that fail to innovate risk obsolescence as customer expectations shift towards digitally enhanced products and services. This technological race means that continuous investment in research and development is not optional, but a fundamental requirement for survival and growth.

Alviva's strategic advantage in Africa is particularly tied to its ability to leverage digital transformation trends. By adopting new technologies, Alviva can create more efficient operations and offer superior customer experiences, thereby outmaneuvering less agile competitors. For example, the increasing mobile penetration across Africa, with smartphone subscriptions expected to surpass 600 million by 2025, provides a fertile ground for digital service delivery.

- Technological Disruption: AI, 5G, and cloud computing are reshaping the competitive landscape, forcing rapid innovation.

- Adaptation Imperative: Companies must continuously update their offerings and strategies to remain relevant in a fast-evolving market.

- Digital Transformation in Africa: Alviva's ability to harness digital trends across the continent is crucial for maintaining its competitive edge and market position.

- Investment in R&D: The pace of technological change necessitates significant and ongoing investment in research and development to foster innovation and stay ahead.

Competitive rivalry in Alviva's African ICT market is intense due to a large number of global, regional, and local players. This rivalry is further fueled by significant growth opportunities, such as the African digital transformation market projected to exceed $100 billion in 2024, attracting substantial investment and competition.

Despite the fierce competition, Alviva differentiates itself by offering end-to-end IT solutions and value-added services like tailored financial support, moving beyond basic product distribution. The IT services market, valued at over $1.3 trillion globally in 2024, emphasizes the importance of service quality and innovation in this crowded space.

High sunk costs in infrastructure and skilled personnel create high exit barriers, forcing existing players to remain competitive even in low-profitability periods, leading to market consolidation. The rapid pace of technological change, with AI market growth projected over $500 billion in 2024, necessitates continuous innovation and R&D investment for companies like Alviva to maintain their edge.

| Factor | Description | Impact on Alviva |

| Number of Competitors | Numerous global, regional, and local IT firms. | High pressure on pricing and market share. |

| Market Growth | African digital transformation market > $100B (2024 est.); South Africa ICT CAGR 7.90%. | Attracts new entrants, intensifying competition. |

| Differentiation | End-to-end solutions, financial support, service quality. | Key to carving out market share and customer loyalty. |

| Technological Advancement | Rapid evolution (AI, 5G, Cloud); AI market > $500B (2024 est.). | Requires continuous R&D investment and adaptation. |

SSubstitutes Threaten

The threat of substitutes is particularly potent for Alviva due to customers increasingly sourcing ICT products directly from vendors. This trend, amplified by vendors expanding their direct sales and e-commerce platforms, directly challenges the traditional distribution model. For instance, major tech vendors have seen significant growth in their direct-to-customer sales channels, with some reporting double-digit percentage increases in online revenue in 2024.

This disintermediation pressures Alviva to clearly articulate its value proposition beyond mere product availability. To counter this, Alviva must focus on its value-added services, such as expert consultation, tailored solutions, and robust post-sales support, alongside cultivating strong, enduring relationships with its partners. These differentiators are crucial for justifying Alviva's continued relevance and profitability within the ICT supply chain.

The rise of cloud computing and Software-as-a-Service (SaaS) presents a significant threat of substitutes for traditional IT hardware and software sales. These cloud-based models diminish the necessity for customers to invest in on-premise infrastructure and perpetual software licenses, offering a more flexible and often cost-effective alternative. The strong market penetration of cloud services in South Africa, reaching 69.3% of the ICT market in 2024, underscores this shift, compelling companies like Alviva to pivot towards offering cloud-based solutions and managed services to remain competitive.

The rise of open-source software and hardware presents a significant threat of substitutes for Alviva. For instance, in 2024, the global open-source software market was valued at approximately $36.5 billion and is projected to grow, demonstrating the increasing adoption of these cost-effective alternatives by businesses and individuals alike.

These freely available or low-cost solutions can directly compete with Alviva's proprietary offerings, particularly for customers prioritizing budget over brand name or specialized support. Customers can leverage open-source operating systems, productivity suites, and even hardware designs, reducing their reliance on Alviva's traditional product lines and potentially impacting Alviva's market share and pricing power.

Internal IT Capabilities of Large Enterprises

Large enterprises and public sector organizations increasingly possess significant internal IT capabilities. This allows them to manage their own hardware procurement, software development, and IT services, directly substituting the need for external ICT solutions like those Alviva offers. For instance, a 2024 report indicated that 70% of Fortune 500 companies have dedicated cybersecurity teams, demonstrating a substantial in-house capacity for critical IT functions.

This internal strength means Alviva faces a threat from these organizations choosing to build rather than buy. When these entities develop robust in-house IT departments, their reliance on external providers diminishes, presenting a direct substitute for outsourced ICT solutions. This trend is amplified as technology becomes more accessible and specialized talent pools grow.

To counter this, Alviva must consistently showcase superior expertise, innovation, and cost-effectiveness in its offerings.

- Internal IT Development: Organizations can build custom solutions in-house, bypassing external vendors.

- Talent Acquisition: Large enterprises can hire specialized IT talent, reducing the need for outsourced expertise.

- Cost Efficiency: In-house IT can sometimes be perceived as more cost-effective for predictable, long-term needs.

- Control and Customization: Internal IT provides greater control over data, security, and customization.

Emerging Technologies and Service Models

New technological paradigms and service delivery models represent a significant threat of substitutes for Alviva. For instance, the rise of edge computing could offer alternatives to centralized cloud solutions that Alviva currently provides, potentially reducing demand for some of its core services. Similarly, highly specialized niche solutions, developed by smaller, agile competitors, might cater to specific customer needs more effectively than Alviva's broader offerings.

Alviva's strategy to counter this threat centers on its positioning as an end-to-end ICT solutions provider. By actively integrating emerging technologies and continuously adapting its service portfolio, Alviva aims to stay ahead of disruptive innovations. This proactive approach is crucial, especially as the ICT market evolves rapidly. For example, the global edge computing market was valued at approximately $10.5 billion in 2023 and is projected to grow significantly, highlighting the potential for substitute solutions to gain traction.

- Technological Disruption: Emerging technologies like edge computing and AI-driven platforms can offer alternative ways to achieve similar outcomes as Alviva's current services.

- Niche Specialization: Smaller, focused companies can develop highly specialized solutions that may be more attractive to specific customer segments than Alviva's comprehensive offerings.

- Adaptability is Key: Alviva's success in mitigating this threat relies on its ability to quickly adopt and integrate new technologies into its service portfolio.

- Market Value of Substitutes: The growing market for edge computing, estimated to reach over $100 billion by 2030, underscores the tangible threat posed by alternative technological approaches.

The threat of substitutes for Alviva is significant as customers increasingly bypass traditional distributors to purchase ICT products directly from vendors. This trend is fueled by vendors expanding their direct sales and e-commerce channels, with many reporting substantial growth in these areas during 2024. Alviva must therefore emphasize its value-added services like expert consultation and tailored solutions to remain competitive.

Cloud computing and SaaS models also pose a direct threat by reducing the need for on-premise hardware and perpetual software licenses, offering more flexible alternatives. The widespread adoption of cloud services in South Africa, which captured 69.3% of the ICT market in 2024, highlights this shift, pushing Alviva to adapt by offering cloud-based solutions.

Furthermore, the proliferation of open-source software and hardware provides cost-effective substitutes for Alviva's proprietary offerings. The global open-source software market, valued at approximately $36.5 billion in 2024, demonstrates the growing appeal of these alternatives for budget-conscious customers.

Large enterprises and public sector organizations are also a growing source of substitution by developing robust internal IT capabilities. With 70% of Fortune 500 companies having dedicated cybersecurity teams in 2024, many can now manage their own IT needs, reducing reliance on external providers like Alviva.

| Threat of Substitute | Description | Impact on Alviva | 2024 Data/Trend | Mitigation Strategy |

|---|---|---|---|---|

| Direct Vendor Sales | Customers buying directly from ICT product manufacturers. | Reduces Alviva's sales volume and margin. | Significant growth in vendor e-commerce channels reported in 2024. | Focus on value-added services, partner relationships. |

| Cloud Computing & SaaS | Subscription-based access to software and IT infrastructure. | Decreases demand for traditional hardware and software licenses. | South African cloud market share at 69.3% in 2024. | Offer cloud-based solutions and managed services. |

| Open-Source Alternatives | Free or low-cost software and hardware solutions. | Competes with Alviva's proprietary product lines. | Global open-source software market valued at ~$36.5 billion in 2024. | Highlight unique benefits of Alviva's offerings. |

| In-house IT Capabilities | Organizations managing their IT internally. | Reduces need for outsourced ICT solutions. | 70% of Fortune 500 companies have dedicated cybersecurity teams (2024). | Demonstrate superior expertise and cost-effectiveness. |

Entrants Threaten

Entering the ICT distribution and services sector, particularly across Africa, demands significant upfront capital. New players must invest heavily in warehousing, sophisticated logistics, robust IT systems, and skilled personnel. For instance, establishing a continental distribution network similar to Alviva's requires billions in infrastructure development.

Alviva's established physical presence and expansive operational network create substantial hurdles for newcomers. Replicating this 'end-to-end' capability from the ground up is an extremely capital-intensive undertaking, making it difficult for smaller or less-funded entities to compete effectively.

Alviva's established distribution networks and long-standing relationships with global ICT vendors present a significant hurdle for new entrants. Replicating this extensive network and securing the trust of major international brands would require substantial time and investment, making it difficult for newcomers to gain traction.

Vendor exclusivity agreements and preferred partner programs further fortify these channels, creating a competitive moat. For instance, in 2024, Alviva continued to leverage its strategic partnerships with leading technology providers, ensuring preferred access to new product releases and favorable terms, a benefit that is hard for nascent competitors to match.

Alviva's strong brand recognition as a leading ICT provider in Africa presents a significant barrier to new entrants. Established customer loyalty, especially within its core public and private sector markets, means newcomers face a steep climb to gain trust and market share.

Building comparable brand awareness and customer relationships would necessitate substantial investment in marketing and sales, a hurdle many potential new competitors might find prohibitive.

Regulatory Hurdles and Local Market Knowledge

Operating across diverse African markets presents significant regulatory hurdles. New entrants must contend with varying import duties, compliance requirements, and intricate local business practices that differ from country to country. For instance, navigating the specific tax laws and licensing procedures in South Africa versus Nigeria can be a complex undertaking.

Alviva's established presence and deep understanding of these local nuances offer a substantial competitive advantage. This ingrained market knowledge allows Alviva to operate more efficiently and with fewer compliance-related setbacks than a newcomer. A new entrant would face a steep learning curve, potentially incurring substantial costs and facing delays due to unforeseen regulatory challenges.

- Regulatory Complexity: African nations exhibit diverse regulatory frameworks impacting business operations.

- Local Market Expertise: Alviva's long-standing presence provides critical insights into local practices and compliance.

- Entry Barriers: Newcomers face significant costs and time investment to understand and adhere to varied regulations.

- Compliance Costs: Navigating different import duties and licensing requirements can be prohibitively expensive for new entrants.

Digital Skills Gap and Talent Acquisition

The burgeoning African ICT market, while promising, grapples with a significant digital skills gap. For new entrants, securing and keeping qualified IT talent, especially for advanced services and new technologies, presents a substantial hurdle to expanding their operations efficiently. This scarcity of specialized skills can slow down innovation and service delivery for those just entering the market.

This talent deficit acts as a considerable barrier to entry. For instance, a report from the African Development Bank in 2024 highlighted that over 60% of African businesses struggle to find employees with the necessary digital competencies. This makes it difficult for new companies to build robust teams capable of competing with established players like Alviva, which has a more established track record in talent development and acquisition.

- Digital Skills Shortage: A significant portion of the African workforce lacks advanced digital skills, impacting the ability of new companies to hire qualified personnel.

- Talent Acquisition Challenges: Attracting and retaining skilled IT professionals is difficult and costly for new market entrants.

- Scaling Barriers: The lack of readily available talent hinders the ability of new companies to scale their complex service offerings and adopt emerging technologies.

- Competitive Disadvantage: Established firms like Alviva often possess an inherent advantage in talent sourcing due to their existing infrastructure and brand recognition.

The threat of new entrants into Alviva's market is considerably low due to substantial capital requirements for infrastructure, logistics, and IT systems, making it difficult for smaller players to compete. For example, establishing a pan-African distribution network requires billions in investment. Vendor agreements and brand loyalty further solidify Alviva's position, creating significant barriers to entry for nascent competitors seeking to replicate its established network and vendor relationships.

Navigating the complex and varied regulatory landscapes across different African countries poses a significant challenge for newcomers, demanding extensive local market knowledge and compliance expertise. Furthermore, a pronounced digital skills gap in Africa hinders new entrants from acquiring and retaining qualified IT talent, a crucial element for scaling operations and delivering advanced services. This talent scarcity provides established firms like Alviva with a distinct advantage in talent acquisition and development.

| Barrier Type | Description | Impact on New Entrants | Alviva's Advantage |

|---|---|---|---|

| Capital Requirements | High investment needed for infrastructure, logistics, and IT systems. | Prohibitive for many potential entrants. | Established operational infrastructure. |

| Distribution Networks & Vendor Relationships | Extensive, long-standing relationships with ICT vendors. | Difficult to replicate, limiting access to products and favorable terms. | Preferred access and favorable terms secured through partnerships. |

| Brand Recognition & Customer Loyalty | Strong brand awareness and established customer trust. | New entrants face a steep climb to gain market share. | Existing customer base, particularly in public and private sectors. |

| Regulatory Complexity | Diverse and intricate regulations across African markets. | Requires significant investment in understanding and compliance. | Deep local market knowledge and established compliance processes. |

| Digital Skills Gap | Scarcity of qualified IT talent. | Hinders talent acquisition and operational scaling. | Established talent development and acquisition capabilities. |

Porter's Five Forces Analysis Data Sources

Our Alviva Porter's Five Forces analysis is built upon a robust foundation of data, including Alviva's annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific market research reports and competitor analysis from reputable sources to provide a comprehensive view of the competitive landscape.