Altria Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altria Group Bundle

Altria Group faces a complex landscape, balancing its established strength in traditional tobacco with the growing opportunities and threats in reduced-risk products. Understanding these dynamics is crucial for any stakeholder looking to navigate the future of this industry giant.

Want the full story behind Altria's market position, including its formidable brand loyalty, the challenges of declining smoking rates, and its strategic investments in new product categories? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Altria Group's strength lies in its robust brand portfolio, anchored by Marlboro, which commanded an impressive 42% share of the U.S. cigarette market in 2024. This enduring market leadership, coupled with strong performance in smokeless tobacco, translates into substantial pricing power and a reliable revenue base, even within a challenging industry landscape.

Altria Group demonstrates exceptional financial strength, consistently generating substantial cash flow and maintaining healthy revenue and profit margins. This robust financial performance underpins its ability to reward investors.

The company boasts an impressive track record of shareholder value creation, highlighted by 55 consecutive years of dividend increases. As of early 2024, Altria’s dividend yield remains attractive, providing a reliable income stream for its investors, further complemented by ongoing share repurchase initiatives.

Altria is strategically broadening its offerings beyond traditional cigarettes, focusing on the growing reduced-risk product category. Products like on! oral nicotine pouches and NJOY e-vapor are key components of this diversification, aiming to capture market share in evolving consumer preferences. This pivot is crucial for long-term sustainability as adult smokers increasingly seek alternatives.

Strategic Investments in Emerging Industries

Altria Group's strategic investments, particularly its stake in Cronos Group, position it to benefit from the expanding U.S. legal cannabis market. This diversification into emerging industries offers a pathway to new revenue streams beyond its traditional tobacco products.

These ventures are crucial for long-term growth, aiming to offset potential declines in cigarette volumes. For instance, as of the first quarter of 2024, Altria's investment in Cronos Group, valued at approximately $1.7 billion, represents a significant bet on the future of cannabis. The company is actively exploring opportunities within this sector, anticipating substantial market expansion in the coming years.

- Investment in Cronos Group: Altria holds a substantial stake, aiming to leverage the growth of the legal cannabis market.

- Revenue Diversification: These strategic moves provide avenues for new income streams outside of tobacco.

- Market Potential: The U.S. legal cannabis market is projected for significant growth, offering substantial upside.

Commitment to Harm Reduction Vision

Altria's core strength lies in its unwavering commitment to its 'Moving Beyond Smoking' vision. This strategic pivot focuses on the responsible transition of adult smokers to smoke-free alternatives, a significant undertaking in a rapidly evolving market. The company is actively accelerating its investments in innovation, scientific research, and regulatory advocacy for these new product platforms.

This commitment is backed by substantial financial backing. For instance, in 2023, Altria reported $20.4 billion in net revenue, with a significant portion of its strategy now geared towards these next-generation products. The company's dedicated R&D spending, though not always broken out separately for smoke-free initiatives, is a critical component of this vision, reflecting a long-term investment in scientific validation and product development. This proactive approach aligns with shifting consumer preferences and the ongoing public health dialogue surrounding reduced-risk tobacco products.

- Strategic Vision: Altria's 'Moving Beyond Smoking' vision is a clear commitment to a future less reliant on traditional combustible cigarettes.

- Investment in Innovation: The company is channeling significant resources into developing and promoting smoke-free alternatives, including heated tobacco products and oral nicotine pouches.

- Scientific Rigor: Altria emphasizes a science-based approach to product development and regulatory engagement, aiming to build credibility for its reduced-risk offerings.

- Market Adaptation: This strategy positions Altria to adapt to changing consumer demands and the evolving regulatory landscape, a crucial strength in the tobacco industry.

Altria's formidable strength is its dominant position in the U.S. cigarette market, with Marlboro holding a commanding 42% share in 2024. This market leadership, combined with a robust presence in smokeless tobacco, translates into significant pricing power and a stable revenue foundation.

The company consistently demonstrates exceptional financial health, generating substantial cash flow and maintaining healthy profit margins. This financial resilience allows Altria to effectively reward shareholders through dividends and share repurchases.

Altria's commitment to shareholder returns is evident in its 55-year streak of consecutive dividend increases, with an attractive yield as of early 2024. This consistent income stream, coupled with share buybacks, underscores its financial discipline and focus on investor value.

Altria is actively diversifying its product portfolio, prioritizing growth in reduced-risk products like on! oral nicotine pouches and NJOY e-vapor. This strategic shift aims to capture evolving consumer preferences and secure long-term market relevance.

| Brand | 2024 U.S. Market Share (Cigarettes) | Key Growth Area |

|---|---|---|

| Marlboro | 42% | Core Cigarette Business |

| on! | N/A (Growing) | Oral Nicotine Pouches |

| NJOY | N/A (Re-launching) | E-vapor |

What is included in the product

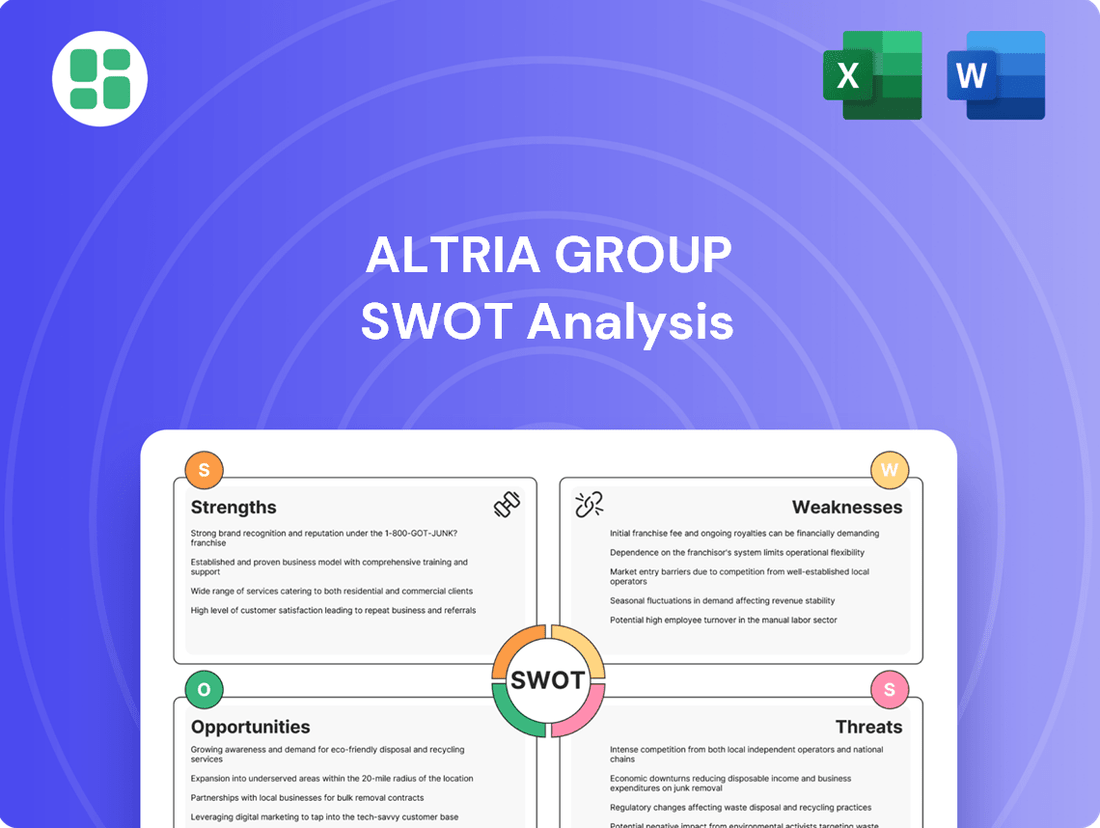

Analyzes Altria Group’s competitive position through key internal and external factors, highlighting its strong brand portfolio and distribution network while acknowledging regulatory pressures and evolving consumer preferences.

Offers a clear breakdown of Altria's challenges and opportunities, simplifying complex market dynamics for strategic decision-making.

Weaknesses

Altria's continued substantial reliance on traditional combustible products, primarily Marlboro cigarettes, presents a significant weakness. Despite strategic investments in reduced-risk products, cigarettes still generated approximately $5.4 billion in adjusted operating income for Altria in 2023, underscoring their dominance in the company's revenue streams.

This deep dependence on a declining product category makes Altria vulnerable to shifting consumer preferences and regulatory pressures. The ongoing secular decline in cigarette volumes, which fell by roughly 8% in the U.S. during 2023, directly impacts Altria's core profitability and growth prospects.

Altria operates within a heavily regulated sector, constantly navigating a complex web of legal disputes and strict government policies designed to curb tobacco use. These challenges, such as potential bans on menthol and flavored products, mandated graphic warning labels, and future nicotine reduction requirements, significantly increase operating expenses and introduce considerable business uncertainty.

Altria's revenue is heavily concentrated in the United States, with a very limited international footprint. This domestic reliance makes it vulnerable to shifts in U.S. regulations and consumer preferences. For instance, in 2023, Altria's net revenues were primarily driven by its U.S. tobacco operations, highlighting the significant gap compared to global players who benefit from diverse international markets.

Competition and Challenges in Smoke-Free Categories

Altria faces intense competition in the burgeoning smoke-free product market. Its on! nicotine pouch brand, while growing, contends with established players like ZYN, which has captured significant market share. This competitive landscape necessitates continuous innovation and aggressive marketing to gain and maintain traction.

The e-vapor category presents a particularly formidable challenge, largely due to the widespread availability of illicit disposable e-vapor products. These unregulated products directly compete with Altria's NJOY brand, often at lower price points, thereby hindering the growth and profitability of legitimate, regulated offerings. For instance, the U.S. Food and Drug Administration (FDA) has issued numerous warning letters to companies distributing unauthorized e-vapor products.

- Intense competition in nicotine pouches: Altria's on! brand faces strong rivalry from market leader ZYN.

- E-vapor market disruption: Illicit disposable e-vapor products undermine the growth of legal brands like NJOY.

- Regulatory hurdles: Navigating the evolving regulatory environment for new product categories adds complexity.

Negative Public Perception and Health Trends

Public perception increasingly views traditional tobacco products negatively due to well-documented health risks. This trend is amplified by a broader societal movement towards healthier living, directly challenging Altria's core business. For instance, in the US, smoking rates among adults continued their decline, with the Centers for Disease Control and Prevention (CDC) reporting that approximately 11.5% of adults were current smokers in 2022, a figure that has been steadily decreasing.

Altria must constantly adapt its strategy to resonate with evolving consumer preferences that prioritize well-being. This shift necessitates a proactive approach to product development and marketing that acknowledges and addresses these health-conscious trends. The company's reliance on combustible cigarettes, while still significant, faces headwinds from this growing demand for healthier alternatives.

Key challenges include:

- Declining Smoking Rates: Continued reduction in adult smoking prevalence directly impacts sales volumes of traditional products.

- Negative Health Associations: Persistent public awareness of the severe health consequences of smoking creates an ongoing reputational challenge.

- Societal Shift to Wellness: A growing cultural emphasis on healthy lifestyles makes products like cigarettes less socially acceptable and desirable.

- Regulatory Scrutiny: Increased government regulation and public health campaigns further pressure traditional tobacco sales.

Altria's substantial dependence on combustible cigarettes, particularly Marlboro, remains a core weakness. Despite efforts in reduced-risk products, cigarettes accounted for a significant portion of its 2023 adjusted operating income, approximately $5.4 billion. This reliance on a declining product category makes the company susceptible to evolving consumer tastes and stricter regulations.

The secular decline in cigarette volumes, which saw an approximate 8% drop in the U.S. during 2023, directly impacts Altria's profitability and future growth. Furthermore, the company's limited international presence magnifies its vulnerability to U.S.-specific regulatory changes and consumer behavior shifts, unlike global competitors who benefit from diversified markets.

Intense competition in the smoke-free market, especially in nicotine pouches where its on! brand faces a strong challenge from ZYN, requires continuous innovation. The e-vapor sector is particularly disrupted by illicit disposable products that undercut regulated brands like NJOY, hindering their market penetration and profitability.

Altria faces significant regulatory challenges, including potential menthol bans and nicotine reduction mandates, which increase operational costs and introduce uncertainty. The negative public perception of traditional tobacco, coupled with a societal shift towards wellness, further pressures its core business, as evidenced by the continued decline in U.S. adult smoking rates, which stood at about 11.5% in 2022.

Same Document Delivered

Altria Group SWOT Analysis

This is the actual Altria Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You'll gain a comprehensive understanding of their Strengths, Weaknesses, Opportunities, and Threats. This detailed report is ready for your strategic planning needs.

Opportunities

The expanding global market for reduced-risk nicotine products, including e-cigarettes and oral nicotine pouches, offers a substantial avenue for growth. Altria's strategic investments in brands like NJOY and on! are designed to capitalize on this trend, aiming to attract adult smokers to these potentially less harmful alternatives and secure a significant market share.

Altria's existing investment in Cronos Group positions it to capitalize on the rapidly expanding U.S. legal cannabis market. Projections indicate significant growth in this sector, with the U.S. legal cannabis market expected to reach approximately $70 billion by 2030. This strategic foothold allows Altria to leverage its extensive experience in navigating complex regulatory environments for consumer products, facilitating entry into a new, high-potential industry.

Advancements in product technology, like sophisticated heated tobacco systems and next-generation vaping devices, present a significant opportunity for Altria to attract new consumers and retain existing ones who are seeking modern alternatives to traditional cigarettes. For instance, the company's investment in companies developing these technologies, such as its prior stake in Juul, highlights its strategic focus on this evolving market.

Continuous innovation in these areas is crucial for Altria to differentiate its product portfolio in the rapidly changing nicotine landscape. This differentiation can lead to increased market share and revenue growth as consumers shift towards potentially reduced-risk products.

Potential for Strategic Acquisitions and Partnerships

Altria could strategically acquire or partner with companies in the harm-reduced product space, potentially leveraging its significant cash flow. For instance, further integration of its investment in NJOY, a leading e-vapor company, could solidify its market share. As of late 2024, Altria has demonstrated a commitment to this strategy, having invested billions in the category.

Expanding beyond nicotine presents another avenue for growth. This might involve exploring opportunities in adjacent consumer sectors where Altria's distribution and marketing expertise can be applied. Such diversification could mitigate risks associated with the declining traditional tobacco market.

- Acquire or fully integrate existing harm-reduced product investments like NJOY.

- Explore partnerships in emerging consumer categories beyond nicotine.

- Leverage strong cash flow to fund strategic M&A activities.

Advocacy for Harm Reduction Policies

Altria has a significant opportunity to proactively engage with regulatory bodies, particularly the Food and Drug Administration (FDA), to champion the adoption of harm reduction policies within the tobacco industry. This strategic advocacy could pave the way for regulations that foster the expansion of authorized smoke-free alternatives, thereby creating a more equitable competitive landscape against unregulated, illicit market offerings.

By actively participating in policy discussions, Altria can influence the development of a regulatory environment that acknowledges and supports the transition to reduced-risk products. This proactive approach is crucial as the market for smoke-free alternatives continues to evolve, with projections indicating continued growth in this segment. For instance, the U.S. market for e-cigarettes and heated tobacco products was valued at approximately $15 billion in 2024 and is expected to see further expansion.

- Advocate for FDA guidance on smoke-free product categories.

- Influence the regulatory framework to support product innovation and market access.

- Promote policies that differentiate authorized reduced-risk products from illicit alternatives.

- Engage with policymakers to ensure a balanced approach to tobacco regulation.

The expanding global market for reduced-risk nicotine products, including e-cigarettes and oral nicotine pouches, offers a substantial avenue for growth. Altria's strategic investments in brands like NJOY and on! are designed to capitalize on this trend, aiming to attract adult smokers to these potentially less harmful alternatives and secure a significant market share. The U.S. market for e-cigarettes and heated tobacco products was valued at approximately $15 billion in 2024 and is expected to see further expansion.

Altria's existing investment in Cronos Group positions it to capitalize on the rapidly expanding U.S. legal cannabis market. Projections indicate significant growth in this sector, with the U.S. legal cannabis market expected to reach approximately $70 billion by 2030. This strategic foothold allows Altria to leverage its extensive experience in navigating complex regulatory environments for consumer products, facilitating entry into a new, high-potential industry.

Advancements in product technology, like sophisticated heated tobacco systems and next-generation vaping devices, present a significant opportunity for Altria to attract new consumers and retain existing ones who are seeking modern alternatives to traditional cigarettes. Continuous innovation in these areas is crucial for Altria to differentiate its product portfolio in the rapidly changing nicotine landscape, leading to increased market share and revenue growth.

Altria has a significant opportunity to proactively engage with regulatory bodies, particularly the Food and Drug Administration (FDA), to champion the adoption of harm reduction policies within the tobacco industry. This strategic advocacy could pave the way for regulations that foster the expansion of authorized smoke-free alternatives, thereby creating a more equitable competitive landscape against unregulated, illicit market offerings.

| Opportunity Area | Market Potential (Est. 2024/2025) | Altria's Position/Action |

|---|---|---|

| Reduced-Risk Nicotine Products | U.S. E-cigarettes/Heated Tobacco: ~$15 Billion (2024) | Investments in NJOY, on! |

| Legal Cannabis Market | U.S. Market: ~$70 Billion by 2030 | Investment in Cronos Group |

| Product Innovation | Evolving consumer preferences for advanced devices | Focus on next-gen vaping and heated tobacco |

| Regulatory Advocacy | Shaping harm reduction policies | Engaging with FDA for smoke-free product categories |

Threats

The tobacco industry is under increasing pressure from regulators, with potential federal bans on menthol cigarettes and other flavored products posing a significant threat. Altria, heavily reliant on its combustible tobacco segment, could see substantial revenue and market share erosion if such regulations are enacted.

The long-standing trend of falling cigarette consumption in the U.S. remains a substantial threat to Altria's core business. This persistent volume reduction, a trend observed for years, forces the company to rely on price increases to try and compensate, a strategy that may not always fully offset the declining number of cigarettes sold.

In 2023, Altria reported a 7.3% decline in cigarette shipment volume, highlighting the ongoing challenge. While pricing actions helped offset some of this volume loss, the fundamental shift away from traditional cigarettes continues to exert pressure on revenue streams.

The surge in illicit, unregulated disposable e-vapor products poses a significant threat, directly impacting Altria's NJOY brand and the broader legal e-vapor market. This illegal trade creates a difficult operating landscape for compliant companies, hindering their progress toward smoke-free growth objectives.

Estimates suggest the illicit e-vapor market could represent a substantial portion of the total market, potentially billions of dollars in lost revenue for legitimate businesses. For instance, reports from late 2023 and early 2024 indicated a sharp increase in the seizure of counterfeit and unregulated vaping products, highlighting the scale of the problem.

Aggressive Competition in Next-Generation Products

Altria is encountering intense rivalry in the developing reduced-risk product (RRP) market. Global competitors, often further along in their smoke-free transitions, are launching innovative products that directly challenge Altria's established position. This aggressive competition poses a significant threat to Altria's future growth and market share in these crucial emerging segments.

Competitors like Philip Morris International have seen considerable success with their RRP offerings. For instance, IQOS, a heated tobacco product, has gained substantial traction globally. Similarly, ZYN, a nicotine pouch product, has experienced rapid growth in the U.S. market, directly competing with Altria's own oral nicotine offerings like on!. These successful launches by rivals could potentially siphon off market share that Altria aims to capture in the transition away from traditional combustible cigarettes.

- Market Share Erosion: Competitors' strong RRP portfolios, exemplified by Philip Morris International's IQOS and ZYN, directly threaten Altria's ability to gain significant market share in the rapidly evolving smoke-free category.

- Innovation Lag: Some analysts suggest Altria may be perceived as playing catch-up in certain next-generation product categories compared to competitors who have been aggressively investing and innovating in this space for longer periods.

- Pricing Pressures: Increased competition in RRPs could lead to pricing pressures, impacting Altria's profit margins as it seeks to attract consumers to its smoke-free alternatives.

Ongoing Litigation and Public Health Campaigns

Altria faces ongoing litigation risks stemming from health claims and smoking-related diseases. These legal battles can result in significant financial penalties, impacting profitability and cash flow. For instance, while specific recent litigation figures are proprietary, historical settlements, like the Master Settlement Agreement of 1998, have amounted to billions of dollars over time, setting a precedent for future liabilities.

Furthermore, persistent public health campaigns actively discourage tobacco consumption. These initiatives, often supported by government bodies and health organizations, contribute to a shrinking customer base for traditional tobacco products. This trend directly affects Altria's core business, potentially reducing sales volume and revenue. In 2023, U.S. adult smoking rates continued their long-term decline, hovering around 11.5%, a testament to the effectiveness of these campaigns.

- Litigation Exposure: Altria remains susceptible to lawsuits related to the health impacts of its products, potentially leading to substantial financial judgments.

- Shrinking Market: Public health efforts and changing consumer preferences are contributing to a gradual reduction in the overall demand for combustible tobacco.

- Reputational Challenges: Negative public perception, fueled by health concerns and regulatory scrutiny, can damage brand image and consumer loyalty.

The persistent decline in U.S. cigarette consumption, with volumes down 7.3% in 2023, remains a core threat, forcing reliance on price increases to offset falling sales. Regulatory actions, like potential federal bans on menthol cigarettes, could significantly impact Altria's revenue, as combustible tobacco still forms the bulk of its business. The growing illicit e-vapor market, estimated in the billions, directly undermines legal products like Altria's NJOY, while intense competition in reduced-risk products from global players like Philip Morris International, with successful offerings like IQOS and ZYN, challenges Altria's transition strategy.

| Threat Category | Specific Threat | Impact on Altria | Supporting Data/Trend |

|---|---|---|---|

| Regulatory Environment | Potential Federal Ban on Menthol Cigarettes | Significant revenue and market share erosion | Ongoing regulatory discussions and industry analysis |

| Market Trends | Declining Cigarette Consumption | Reduced core business revenue, reliance on price increases | 7.3% cigarette shipment volume decline in 2023 |

| Competition | Growth of Illicit E-Vapor Market | Undermines NJOY brand and legal e-vapor market | Billions estimated in illicit market value, increased seizures |

| Competition | Strong RRP Offerings from Competitors | Challenges market share in smoke-free transition | Success of IQOS (heated tobacco) and ZYN (nicotine pouches) |

SWOT Analysis Data Sources

This analysis draws from a comprehensive range of data, including Altria's official financial filings, extensive market research reports, and expert industry commentary to provide a robust and informed strategic overview.