Altria Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altria Group Bundle

Navigating the complex landscape of the tobacco industry requires a keen understanding of external forces. Altria Group's PESTLE analysis reveals significant political pressures from evolving regulations, economic shifts impacting consumer spending, and social trends pushing for healthier alternatives. Technological advancements also present both challenges and opportunities for product innovation and distribution.

Gain a strategic advantage by delving into the full PESTLE analysis of Altria Group. Understand how these critical external factors are shaping its operations and future trajectory. Download the complete report now to unlock actionable insights and refine your market approach.

Political factors

The political environment for Altria Group is shaped by a dynamic regulatory framework impacting both traditional and next-generation tobacco products. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued its review of e-cigarette products, with potential marketing denial orders for certain flavored products directly affecting Altria's investments like its stake in JUUL. Flavor bans, implemented at various state and local levels throughout 2023 and continuing into 2024, have significantly curtailed market access for menthol and other flavored e-cigarettes, a key area for harm-reduction strategies.

Altria's profitability is heavily influenced by excise taxes on tobacco and nicotine products. For instance, in 2024, federal excise taxes on cigarettes remain at $1.01 per pack, a rate that has been in place since 2009. State-level excise taxes, however, vary significantly, with some states like New York imposing rates as high as $5.35 per pack, directly impacting consumer pricing and demand.

Public health organizations and anti-tobacco advocacy groups exert considerable political pressure on Altria, directly influencing its operating landscape. These entities are vocal in their lobbying efforts for increased tobacco taxes and more rigorous regulations, aiming to curb smoking rates. For instance, in 2024, continued advocacy efforts have pushed for expanded smoke-free environments and stricter marketing rules for traditional tobacco products.

The political arena often responds to this advocacy by considering or implementing stricter oversight. This pressure compels companies like Altria to accelerate their investment in and promotion of reduced-harm alternatives, such as e-cigarettes and heated tobacco products, as a strategic response to evolving public health priorities and potential legislative actions.

Cannabis Legalization and Regulation

Altria's significant investment in the cannabis sector, primarily through its stake in Cronos Group, makes federal and state-level legalization and regulation of cannabis a paramount political factor. The trajectory of cannabis reform, encompassing aspects like taxation, product safety standards, and the potential for interstate commerce, directly influences the growth prospects and operational challenges for Altria's cannabis-related businesses. Political decisions on cannabis legalization can either open up substantial market opportunities or impose stringent operational constraints.

The evolving legal landscape for cannabis presents a dual-edged sword for Altria's diversified business interests. For instance, as of early 2024, several US states continued to expand their medical and adult-use cannabis programs, signaling a growing acceptance. However, the patchwork of state laws and the continued federal prohibition in the United States create complexities for companies like Cronos Group, impacting supply chain management and market access. The potential for federal reform, such as the SAFE Banking Act, could significantly ease financial operations for cannabis businesses, a development Altria will closely monitor.

- Federal vs. State Legalization: The ongoing divergence between federal prohibition and state-level legalization creates regulatory uncertainty for cannabis businesses, impacting Altria's Cronos Group investment.

- Taxation Policies: State excise taxes on cannabis products can vary significantly, influencing consumer pricing and the profitability of ventures like Cronos Group. For example, some states have implemented high excise taxes that can stifle market growth.

- Product Standards and Safety: Regulations concerning product testing, labeling, and potency are critical for consumer safety and market acceptance, directly affecting the operational requirements for cannabis producers.

- Interstate Commerce: The prohibition of interstate commerce for cannabis products under federal law limits the scalability of cannabis businesses, hindering the realization of economies of scale for companies like Cronos Group.

International Trade Relations and Sanctions

While Altria's core tobacco business is heavily concentrated in the United States, shifts in international trade relations and the imposition of sanctions can still cast a shadow. These global political currents can indirectly affect Altria by disrupting supply chains for essential ingredients or manufacturing components sourced from abroad. For instance, changes in trade tariffs or export restrictions could increase the cost of raw materials, impacting overall profitability.

Geopolitical stability and the nature of international trade agreements play a crucial role in the smooth global movement of goods and capital. For a large multinational investor like Altria, these dynamics can influence the cost and availability of necessary inputs, as well as shape potential future expansion avenues. The global political landscape, therefore, introduces complexities that require careful monitoring, even if the direct impact isn't immediately apparent.

- Supply Chain Vulnerability: Altria's reliance on imported agricultural inputs or manufacturing equipment can be exposed to international trade disputes and sanctions.

- Global Economic Impact: Broader sanctions against certain countries could affect currency exchange rates and the overall cost of international business operations.

- Investment Diversification: Altria's significant investments in companies like Anheuser-Busch InBev, which has global operations, mean that international political factors can influence the valuation of these holdings.

- Regulatory Uncertainty: Evolving international trade policies can create uncertainty for companies with global supply chains, necessitating adaptive strategies.

Government regulations significantly shape Altria's operating environment, particularly concerning tobacco and nicotine products. For example, the FDA's ongoing review of e-cigarettes in 2024, including potential marketing denial orders for flavored products, directly impacts Altria's investments and product strategies. State-level flavor bans, prevalent in 2023 and continuing into 2024, have restricted market access for key product categories.

Taxation policies remain a critical political factor, with federal excise taxes on cigarettes holding steady at $1.01 per pack since 2009, while state excise taxes vary widely, impacting consumer pricing and demand. For instance, New York's rate of $5.35 per pack highlights this disparity.

Public health advocacy groups continue to exert considerable political pressure, lobbying for increased tobacco taxes and stricter regulations, influencing Altria's strategic shift towards reduced-harm alternatives.

The evolving political landscape for cannabis legalization and regulation, particularly concerning Altria's investment in Cronos Group, presents both opportunities and challenges. The patchwork of state laws and continued federal prohibition in the U.S. create operational complexities, though potential federal reforms like the SAFE Banking Act could ease financial operations.

What is included in the product

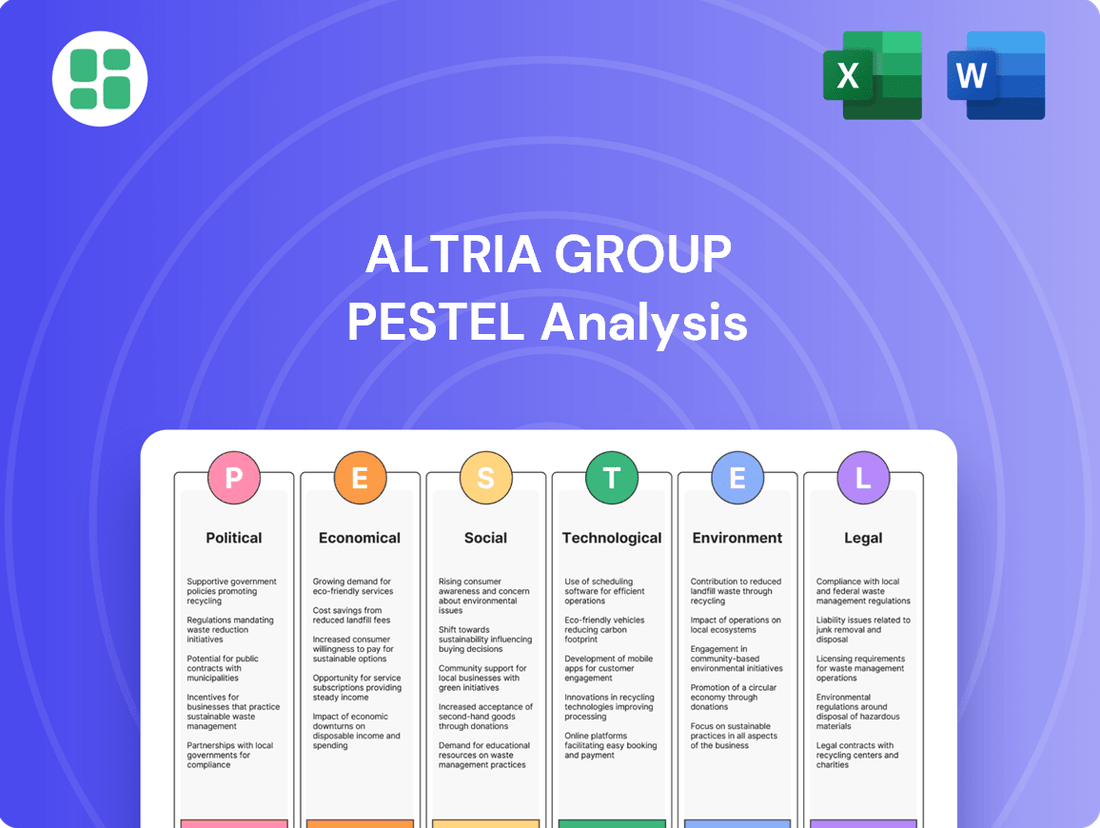

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces influencing Altria Group's operations and strategic planning.

It provides a comprehensive overview of the external macro-environmental landscape, highlighting key trends and their potential impact on the company's future growth and challenges.

A concise PESTLE analysis for Altria Group that cuts through complexity, enabling quick identification of external factors impacting their business and facilitating more informed strategic decisions.

Economic factors

Consumer purchasing power, heavily influenced by inflation and wage growth, directly affects discretionary spending on products like those offered by Altria. For instance, the U.S. inflation rate hovered around 3.4% in early 2024, impacting how much consumers can afford for non-essential items. When incomes don't keep pace with rising prices, consumers may cut back on premium tobacco or alcohol, opting for cheaper alternatives.

Economic downturns or sustained high inflation can shift consumer behavior significantly. If unemployment rises, as it did to 3.9% in April 2024, disposable income shrinks, leading to reduced spending on higher-margin products. This necessitates Altria to potentially adjust its pricing strategies or product offerings to remain competitive and cater to budget-conscious consumers.

While tobacco has historically shown inelastic demand, meaning price changes don't drastically alter consumption, severe economic pressures can test this. A substantial economic shock could make even these habits more sensitive to price, forcing Altria to consider product mix adjustments or promotions to maintain sales volumes amidst changing consumer financial realities.

Excise taxes on tobacco and nicotine products, like those Altria Group sells, directly inflate retail prices. For instance, federal excise taxes on cigarettes, as of early 2024, remain at $1.01 per pack, a figure that has been stable but can be compounded by state and local taxes, pushing average pack prices well over $8 in many areas. This economic burden is largely shifted to consumers, impacting affordability.

While these taxes boost government coffers, higher prices can dampen consumer demand for Altria's products, potentially leading to a decline in unit sales. Furthermore, significant price disparities created by excise taxes can foster a black market for untaxed or lower-taxed products, diverting sales from legitimate channels and impacting Altria's market share and profitability.

Altria must strategically navigate these tax-driven price increases to preserve its market position. Understanding how sensitive consumers are to these price hikes is vital for accurate revenue projections and effective sales strategies. For example, a 10% increase in cigarette prices due to taxes might lead to a 5% drop in consumption, a key metric for forecasting.

The alternative nicotine product market, encompassing e-vapor and heated tobacco, is a crucial economic driver for Altria's future. For instance, the U.S. e-vapor market alone was projected to reach approximately $10 billion in 2024, with continued growth expected. Altria's significant investments in brands like NJOY underscore their strategic pivot towards these categories as traditional combustible tobacco volumes contract.

Consumer adoption of these newer products is heavily influenced by economic factors, including the price point relative to traditional cigarettes and the perceived value proposition of harm reduction. The affordability and accessibility of e-vapor devices and e-liquids, as well as heated tobacco units, directly impact sales volumes and revenue generation for Altria's diversification efforts.

The overall market size and projected growth rates within the alternative nicotine segments are vital economic indicators for Altria's long-term strategy. Analysts anticipate the global heated tobacco market to expand significantly, potentially reaching over $40 billion by 2027, presenting a substantial economic opportunity for companies like Altria that are positioned to capitalize on this shift.

Interest Rates and Cost of Capital

Changes in interest rates directly impact Altria Group's cost of borrowing. For instance, if the Federal Reserve raises its benchmark interest rate, the cost for Altria to secure new loans or refinance existing debt will likely increase. This can strain profitability by raising debt servicing expenses, a crucial factor given Altria's substantial capital expenditures and ongoing investments.

Higher interest rates can also affect shareholder returns by increasing the cost of capital, making new projects less attractive. Conversely, a favorable interest rate environment, such as the period of historically low rates seen in recent years, allows companies like Altria to finance growth initiatives more efficiently.

For example, Altria's long-term debt stood at approximately $25.4 billion as of the end of 2023. Fluctuations in interest rates, even by a percentage point, can translate to hundreds of millions of dollars in annual interest payments.

- Cost of Debt: Rising interest rates increase the expense of servicing Altria's significant debt obligations.

- Investment Decisions: Higher borrowing costs can make new capital projects and acquisitions less financially viable.

- Profitability Impact: Increased interest expenses directly reduce net income and can pressure earnings per share.

- Capital Allocation: Favorable rates enable more efficient funding of strategic growth and share repurchases.

Global Economic Stability and Exchange Rates

While Altria's primary focus remains the U.S. market, its international investments, such as its stake in Cronos Group, mean it's not entirely insulated from global economic shifts. Fluctuations in foreign exchange rates directly influence the U.S. dollar value of earnings generated abroad. For instance, a stronger U.S. dollar can diminish the reported profits from international operations when translated back.

Economic instability worldwide can also dampen consumer spending in markets where Altria has international exposure. A global economic slowdown in 2024 or 2025 could therefore negatively impact demand for products associated with its diversified holdings. Conversely, a stable global economic landscape generally supports the performance of its broader investment portfolio.

- Exchange Rate Impact: For example, if Cronos Group generates significant revenue in Canadian dollars, a strengthening USD against the CAD would reduce the USD-denominated value of those earnings for Altria.

- Global Demand Sensitivity: Economic downturns in key international markets could reduce consumer purchasing power for discretionary items, affecting Altria's indirect revenue streams.

- Investment Portfolio Performance: A stable global economic environment, characterized by steady growth and predictable inflation, is crucial for the overall health and valuation of Altria's international investments.

Consumer purchasing power, heavily influenced by inflation and wage growth, directly affects discretionary spending on products like those offered by Altria. For instance, the U.S. inflation rate hovered around 3.4% in early 2024, impacting how much consumers can afford for non-essential items. When incomes don't keep pace with rising prices, consumers may cut back on premium tobacco or alcohol, opting for cheaper alternatives.

Economic downturns or sustained high inflation can shift consumer behavior significantly. If unemployment rises, as it did to 3.9% in April 2024, disposable income shrinks, leading to reduced spending on higher-margin products. This necessitates Altria to potentially adjust its pricing strategies or product offerings to remain competitive and cater to budget-conscious consumers.

While tobacco has historically shown inelastic demand, meaning price changes don't drastically alter consumption, severe economic pressures can test this. A substantial economic shock could make even these habits more sensitive to price, forcing Altria to consider product mix adjustments or promotions to maintain sales volumes amidst changing consumer financial realities.

Excise taxes on tobacco and nicotine products, like those Altria Group sells, directly inflate retail prices. For instance, federal excise taxes on cigarettes, as of early 2024, remain at $1.01 per pack, a figure that has been stable but can be compounded by state and local taxes, pushing average pack prices well over $8 in many areas. This economic burden is largely shifted to consumers, impacting affordability.

While these taxes boost government coffers, higher prices can dampen consumer demand for Altria's products, potentially leading to a decline in unit sales. Furthermore, significant price disparities created by excise taxes can foster a black market for untaxed or lower-taxed products, diverting sales from legitimate channels and impacting Altria's market share and profitability.

Altria must strategically navigate these tax-driven price increases to preserve its market position. Understanding how sensitive consumers are to these price hikes is vital for accurate revenue projections and effective sales strategies. For example, a 10% increase in cigarette prices due to taxes might lead to a 5% drop in consumption, a key metric for forecasting.

The alternative nicotine product market, encompassing e-vapor and heated tobacco, is a crucial economic driver for Altria's future. For instance, the U.S. e-vapor market alone was projected to reach approximately $10 billion in 2024, with continued growth expected. Altria's significant investments in brands like NJOY underscore their strategic pivot towards these categories as traditional combustible tobacco volumes contract.

Consumer adoption of these newer products is heavily influenced by economic factors, including the price point relative to traditional cigarettes and the perceived value proposition of harm reduction. The affordability and accessibility of e-vapor devices and e-liquids, as well as heated tobacco units, directly impact sales volumes and revenue generation for Altria's diversification efforts.

The overall market size and projected growth rates within the alternative nicotine segments are vital economic indicators for Altria's long-term strategy. Analysts anticipate the global heated tobacco market to expand significantly, potentially reaching over $40 billion by 2027, presenting a substantial economic opportunity for companies like Altria that are positioned to capitalize on this shift.

Changes in interest rates directly impact Altria Group's cost of borrowing. For instance, if the Federal Reserve raises its benchmark interest rate, the cost for Altria to secure new loans or refinance existing debt will likely increase. This can strain profitability by raising debt servicing expenses, a crucial factor given Altria's substantial capital expenditures and ongoing investments.

Higher interest rates can also affect shareholder returns by increasing the cost of capital, making new projects less attractive. Conversely, a favorable interest rate environment, such as the period of historically low rates seen in recent years, allows companies like Altria to finance growth initiatives more efficiently.

For example, Altria's long-term debt stood at approximately $25.4 billion as of the end of 2023. Fluctuations in interest rates, even by a percentage point, can translate to hundreds of millions of dollars in annual interest payments.

- Cost of Debt: Rising interest rates increase the expense of servicing Altria's significant debt obligations.

- Investment Decisions: Higher borrowing costs can make new capital projects and acquisitions less financially viable.

- Profitability Impact: Increased interest expenses directly reduce net income and can pressure earnings per share.

- Capital Allocation: Favorable rates enable more efficient funding of strategic growth and share repurchases.

While Altria's primary focus remains the U.S. market, its international investments, such as its stake in Cronos Group, mean it's not entirely insulated from global economic shifts. Fluctuations in foreign exchange rates directly influence the U.S. dollar value of earnings generated abroad. For instance, a stronger U.S. dollar can diminish the reported profits from international operations when translated back.

Economic instability worldwide can also dampen consumer spending in markets where Altria has international exposure. A global economic slowdown in 2024 or 2025 could therefore negatively impact demand for products associated with its diversified holdings. Conversely, a stable global economic landscape generally supports the performance of its broader investment portfolio.

- Exchange Rate Impact: For example, if Cronos Group generates significant revenue in Canadian dollars, a strengthening USD against the CAD would reduce the USD-denominated value of those earnings for Altria.

- Global Demand Sensitivity: Economic downturns in key international markets could reduce consumer purchasing power for discretionary items, affecting Altria's indirect revenue streams.

- Investment Portfolio Performance: A stable global economic environment, characterized by steady growth and predictable inflation, is crucial for the overall health and valuation of Altria's international investments.

| Economic Factor | Description | Impact on Altria | 2024/2025 Data Point/Trend |

|---|---|---|---|

| Consumer Spending Power | Ability of consumers to spend on goods and services. | Directly affects demand for Altria's products. | U.S. inflation around 3.4% in early 2024; unemployment at 3.9% in April 2024. |

| Excise Taxes | Taxes levied on specific goods, like tobacco. | Increases product prices, potentially reducing demand and encouraging illicit trade. | Federal cigarette excise tax at $1.01/pack (early 2024); average pack prices exceeding $8 in many areas. |

| Alternative Nicotine Market Growth | Expansion of e-vapor and heated tobacco sectors. | Represents a key growth area for diversification. | U.S. e-vapor market projected at ~$10 billion in 2024; global heated tobacco market projected over $40 billion by 2027. |

| Interest Rates | Cost of borrowing money. | Impacts debt servicing costs and investment viability. | Altria's long-term debt ~$25.4 billion (end of 2023). |

| Foreign Exchange Rates | Value of one currency relative to another. | Affects the USD value of international earnings and investment performance. | USD strength against CAD can reduce reported earnings from Canadian operations (e.g., Cronos Group). |

Preview Before You Purchase

Altria Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Altria Group details key political, economic, social, technological, legal, and environmental factors impacting the company. Understand the strategic landscape and potential challenges facing Altria.

Sociological factors

Societal trends reveal a persistent decline in traditional cigarette smoking, especially in developed countries. This is largely due to heightened health awareness and widespread public health initiatives. For instance, in the US, the smoking rate among adults dropped to an estimated 11.5% in 2023, a significant decrease from previous decades.

This shift in consumer behavior compels companies like Altria to strategically invest in and promote harm-reduced alternatives to remain competitive and align with evolving societal expectations regarding health and wellness.

The growing perception of tobacco as harmful has unfortunately led to the stigmatization of smoking, encouraging consumers to seek out or quit altogether, impacting traditional product sales.

A significant sociological trend is the growing acceptance of harm-reduced tobacco and nicotine products, like e-cigarettes and heated tobacco. Consumers, especially adult smokers, are actively seeking alternatives they believe are less harmful than traditional cigarettes. For instance, in 2024, a significant portion of adult smokers in key markets expressed interest in switching to reduced-risk products.

Altria's strategy is deeply intertwined with this societal shift, focusing on offering a diverse portfolio of these products and educating consumers about their potential benefits. The social normalization and increasing acceptance of these newer product categories are absolutely critical for their market penetration and, consequently, for Altria's future growth trajectory.

The escalating prevalence of youth vaping presents a significant sociological challenge, sparking widespread public criticism and demands for more stringent regulations. This trend casts a shadow over the entire nicotine sector, including Altria's harm-reduced alternatives aimed at adult smokers.

Societal pressure to restrict youth access to and use of nicotine products directly impacts public policy and erodes consumer trust. For instance, the 2023 National Youth Tobacco Survey indicated that 7.1% of middle and high school students used e-cigarettes in the past 30 days, a figure that remains a key concern for regulators and public health advocates.

Altria must actively address these societal anxieties by emphasizing responsible marketing and backing initiatives designed to prevent underage vaping. This includes robust age-verification systems and educational campaigns, crucial for maintaining brand reputation and long-term market viability in a scrutinized industry.

Changing Social Norms Around Cannabis Use

Societal views on cannabis are undergoing a significant transformation, moving away from prohibition towards acceptance and normalization. This shift is directly impacting the growth potential of the cannabis industry, an area where Altria Group has made strategic investments, notably in Cronos Group. As of early 2024, projections indicate continued expansion in the legal cannabis market, driven by this evolving social acceptance.

The increasing acceptance of cannabis for both medicinal and recreational use is creating new consumer segments and expanding market opportunities. This sociological trend influences public policy decisions regarding legalization and regulation, further shaping the industry landscape. For instance, by mid-2024, several US states were considering or had recently enacted new cannabis-related legislation, reflecting these changing norms.

- Destigmatization: The ongoing destigmatization of cannabis use is a primary catalyst for its future market expansion.

- Market Growth: Projections for the global legal cannabis market anticipate substantial growth through 2025, fueled by changing social attitudes.

- Policy Influence: Evolving social norms are directly linked to shifts in public policy, leading to broader legalization efforts.

- Consumer Demand: Increased social acceptance translates into higher consumer demand for cannabis products across various categories.

Influence of Social Media and Digital Culture

The pervasive influence of social media and digital culture profoundly shapes consumer perceptions and product trends for Altria. Platforms like TikTok and Instagram are critical for understanding evolving consumer preferences, particularly among younger demographics, impacting marketing strategies for products such as heated tobacco and oral nicotine pouches. For instance, by May 2024, over 60% of US adults reported using social media daily, highlighting its reach.

Social media can amplify public health messages and shape opinions on nicotine products, creating both opportunities and challenges for Altria's harm reduction initiatives. While platforms can facilitate discussions about reduced-risk products, they also present a risk of misinformation. In 2023, the US Food and Drug Administration (FDA) continued its efforts to regulate marketing of these products online, underscoring the sensitive digital environment.

The rapid dissemination of information online necessitates agility in Altria's communication and brand management. Negative sentiment or regulatory news can spread quickly, requiring swift and transparent responses. Altria's digital engagement strategies must navigate this dynamic landscape, focusing on responsible communication and brand stewardship to maintain trust.

Understanding digital consumer behavior and leveraging online channels responsibly are crucial for engaging with target audiences. Altria's approach to digital marketing, including its investments in e-commerce and direct-to-consumer channels, must align with evolving privacy regulations and consumer expectations for ethical online interactions.

Societal shifts continue to drive a decline in traditional cigarette smoking, with health consciousness and public health campaigns playing a significant role. This trend is evident in the US, where adult smoking rates have seen a marked decrease, falling to approximately 11.5% in 2023.

Consequently, companies like Altria are compelled to pivot, investing in and promoting harm-reduced alternatives to align with evolving consumer expectations around health and wellness and to maintain market relevance.

The growing acceptance of harm-reduced tobacco and nicotine products, such as e-cigarettes and heated tobacco, presents a key opportunity. Adult smokers are increasingly seeking alternatives perceived as less harmful, with significant interest noted in key markets during 2024.

Altria's strategy is thus heavily influenced by this societal evolution, focusing on a diverse product portfolio and consumer education regarding these newer categories, which are critical for future growth.

Technological factors

Technological advancements are the engine behind Altria's focus on reduced-risk nicotine products (RRPs), including e-vapor and heated tobacco. Innovations in battery life, precise heating elements, and sophisticated e-liquid compositions are key to enhancing product performance and safety. These improvements are vital for transitioning adult smokers to alternatives. For instance, by Q1 2024, Altria reported a significant increase in RRP net revenue, driven by these technological enhancements.

Technological advancements in manufacturing, particularly automation and data analytics, are key to boosting Altria's operational efficiency and lowering production expenses. For instance, the company has invested in sophisticated manufacturing technologies to ensure consistent product quality and streamline operations.

Implementing smart factory concepts and optimizing supply chains with technology can result in substantial cost reductions and quicker launches for new products, a critical factor for competitiveness. Altria's focus on these efficiencies helps maintain competitive pricing and profitability within the heavily regulated tobacco industry.

Continuous investment in manufacturing technology is essential for Altria to scale its production effectively and maintain high standards of consistency across its product lines, supporting long-term growth and market presence.

Altria is increasingly using advanced data analytics and AI to understand its consumers better. This allows for more precise marketing, tailored product development, and efficient distribution, especially as they focus on harm-reduced alternatives.

By analyzing vast amounts of data, Altria can identify emerging market trends and specific consumer preferences. For instance, their investment in companies developing reduced-risk products is informed by data showing shifts in consumer demand away from traditional combustible cigarettes.

This technological edge helps Altria pinpoint unmet needs and customize offerings, a crucial strategy for acquiring and retaining customers in a rapidly evolving market. In 2024, the company continued to invest in digital capabilities to enhance these consumer insights.

Digital Marketing and E-commerce Platforms

The ongoing migration to digital marketing and e-commerce platforms presents a critical technological shift for Altria, particularly as traditional advertising avenues for tobacco products face increasing limitations. Leveraging online channels allows for targeted communication regarding product information and consumer engagement, and where regulations permit, direct-to-consumer sales. This digital transformation is essential for Altria to effectively convey its harm reduction initiatives and manage its product distribution in a rapidly changing consumer landscape.

Altria's investment in digital capabilities is directly linked to evolving consumer behavior and regulatory environments. For instance, in 2023, e-commerce sales continued to grow across various consumer goods sectors, highlighting the importance of online presence. Altria’s strategic focus on its reduced-risk products, such as those offered by its subsidiary JUUL, necessitates strong digital platforms for education and accessibility. The company's 2024 strategy emphasizes adapting to these digital trends to maintain market relevance and reach adult smokers seeking alternatives.

- Digital Engagement: Altria is enhancing its digital marketing strategies to reach adult consumers, focusing on platforms that allow for compliant communication about its product portfolio, including reduced-risk alternatives.

- E-commerce Expansion: The company is exploring and developing e-commerce capabilities to improve accessibility and convenience for consumers, in line with broader retail trends and regulatory frameworks.

- Harm Reduction Communication: Digital channels are vital for Altria to effectively communicate its commitment to harm reduction and educate consumers about its evolving product offerings.

- Adaptation to Online Retail: Building robust and compliant digital infrastructures is key for Altria to navigate the changing retail environment and maintain a competitive edge in the digital marketplace.

Biotechnology and Cannabis Product Development

Altria's strategic investment in the cannabis sector, notably through its significant stake in Cronos Group, places biotechnology at the forefront of product innovation. Advancements in cannabinoid research are crucial for developing products with specific therapeutic or recreational profiles, directly impacting market appeal and regulatory compliance. For instance, the 2024 market for cannabinoid-based products is seeing increased demand for precisely dosed edibles and beverages, driven by consumer preference for controlled experiences.

Innovations in cultivation techniques, such as vertical farming and controlled environment agriculture, are enhancing the efficiency and sustainability of cannabinoid production. These methods allow for optimized growth conditions, leading to higher yields and consistent quality of active compounds. Cronos Group, for example, is leveraging advanced cultivation technologies to improve its production of CBD and THC, aiming for cost efficiencies and scalability to meet projected 2025 demand increases.

Extraction methods are also evolving, with a focus on more efficient and environmentally friendly processes. Supercritical CO2 extraction and advanced chromatography are enabling the isolation of specific cannabinoids and terpenes with greater purity, which is vital for creating differentiated product formats. This technological capability is essential for Cronos Group to innovate in areas like cannabis-infused beverages and advanced topical formulations, catering to a sophisticated consumer base by mid-2025.

- Cannabinoid Research: Focus on isolating and synthesizing specific cannabinoids beyond THC and CBD to unlock new product functionalities.

- Cultivation Advancements: Implementation of AI-driven environmental controls and genetic selection for optimized cannabinoid yield and plant resilience.

- Extraction Technologies: Development of cleaner, more efficient extraction methods to produce high-purity cannabinoid isolates and distillates.

- Product Formulation: Innovations in delivery systems for precise dosing in edibles, beverages, and inhalation products, enhancing consumer experience and safety.

Technological advancements are central to Altria's strategy in developing reduced-risk nicotine products (RRPs), improving battery life, heating elements, and e-liquid compositions for better performance and safety. By Q1 2024, RRP net revenue saw a significant boost, directly linked to these technological upgrades.

Legal factors

The U.S. Food and Drug Administration (FDA) significantly shapes Altria's operating landscape through its oversight of tobacco and nicotine products. This includes requirements for Premarket Tobacco Product Applications (PMTAs) for new offerings, alongside restrictions on marketing and specific product standards. For instance, in 2023, the FDA continued its review of numerous PMTAs, impacting the potential market entry of next-generation products.

Compliance with these FDA regulations is non-negotiable for Altria to legally sell its diverse product portfolio, especially its reduced-harm alternatives. Changes in FDA policy, such as potential menthol ban discussions or stricter nicotine level regulations, can create substantial legal and operational hurdles, necessitating significant investment in compliance and potentially altering product availability for consumers.

Beyond federal regulations, Altria navigates a complex web of state and local laws, particularly concerning flavor bans for e-cigarettes and other tobacco products. These vary significantly, impacting how Altria can market and sell its products across different regions.

For instance, as of early 2024, numerous states and hundreds of municipalities have implemented flavor restrictions, impacting products like Altria's NJOY e-vapor. This necessitates customized distribution and marketing approaches for each jurisdiction to ensure compliance.

Failure to adhere to these localized regulations can lead to substantial financial penalties, seizure of inventory, and significant damage to Altria's brand reputation, making compliance a constant operational challenge.

Altria Group faces ongoing exposure to product liability litigation stemming from the health impacts of its tobacco products and past marketing strategies. These legal challenges, frequently structured as class actions, can lead to significant expenses for legal defense and substantial settlement payments, directly affecting the company's financial results. For instance, while specific recent settlement figures are often confidential, historical large-scale tobacco litigation has resulted in multi-billion dollar payouts over decades, underscoring the magnitude of this risk.

Beyond traditional litigation, Altria must also consider the potential for future legal actions related to its reduced-harm products or its ventures into the cannabis market. Proactively managing legal defense, including robust risk mitigation strategies, remains a crucial and continuous legal concern for the company as it navigates evolving product landscapes and regulatory environments.

Cannabis Legalization and Regulatory Frameworks

The legal landscape for cannabis in the United States presents a significant challenge for Altria's investment in Cronos Group. While numerous states have moved to legalize cannabis for medical and recreational use, it remains a Schedule I controlled substance at the federal level. This dichotomy creates a complex operating environment, impacting everything from banking access to interstate commerce for cannabis businesses.

This federal prohibition creates a unique set of hurdles for companies like Cronos Group, which operates within this bifurcated legal system. The ongoing debate around federal legalization is a critical factor that will ultimately shape the future growth trajectory and operational stability of Altria's cannabis-related ventures.

- Federal Illegality: Cannabis remains illegal under federal law in the U.S., creating significant compliance and operational challenges.

- State-Level Variations: Over 20 states have legalized recreational cannabis, while nearly 40 permit medical use, leading to a patchwork of regulations.

- Banking Restrictions: The federal illegality complicates banking and financial services for cannabis businesses, even in legal states.

- Future Legalization Impact: Potential federal reform could unlock significant growth opportunities and streamline operations for Cronos Group.

Intellectual Property Protection and Patents

Protecting Altria's intellectual property (IP), encompassing patents for innovative harm-reduced products, trademarks for established brands like Marlboro, and trade secrets for proprietary manufacturing, is a crucial legal consideration. This robust IP framework is indispensable for sustaining a competitive edge and deterring infringement from rivals.

Legal recourse to enforce these IP rights is frequently required to safeguard substantial investments in research and development. The capacity to secure and defend patents for emerging technologies, particularly within the rapidly evolving reduced-risk products (RRP) and cannabis sectors, directly correlates with Altria's long-term business viability and market leadership.

- Patent Portfolio Strength: Altria's ongoing investment in R&D for next-generation products necessitates a strong patent portfolio to protect its innovations.

- Brand Protection: Safeguarding iconic trademarks like Marlboro is paramount for maintaining brand equity and market share against counterfeit or imitative products.

- Trade Secret Defense: Protecting proprietary manufacturing processes and formulations through trade secret law is vital for operational efficiency and competitive differentiation.

- Litigation Strategy: Proactive legal strategies to address IP infringement are essential to recover damages and prevent unauthorized use of Altria's patented technologies.

Altria operates under stringent FDA regulations, including premarket tobacco product applications (PMTAs) for new products, impacting market entry for innovations like those from NJOY. The company also faces a complex patchwork of state and local laws, with over 20 states having legalized recreational cannabis, creating operational challenges for its Cronos Group investment due to federal prohibition.

Legal challenges, particularly product liability litigation, remain a significant concern, with historical tobacco litigation resulting in substantial payouts. Protecting intellectual property, including patents for reduced-harm products and trademarks like Marlboro, is crucial for maintaining market leadership and requires ongoing legal defense strategies.

| Regulatory Body | Key Regulations/Actions | Impact on Altria |

|---|---|---|

| FDA | Premarket Tobacco Product Applications (PMTAs) | Market entry for new products (e.g., NJOY) |

| State/Local Governments | Flavor bans, sales restrictions | Varied market access for e-vapor and tobacco products |

| U.S. Federal Government | Cannabis Schedule I Controlled Substance | Operational complexities for Cronos Group |

Environmental factors

Investors, regulators, and the public are increasingly focused on Altria's environmental, social, and governance (ESG) performance, pushing for transparent reporting on carbon emissions, water usage, and waste. For instance, in 2023, Altria reported a reduction in Scope 1 and 2 greenhouse gas emissions intensity by 20.5% compared to its 2019 baseline, demonstrating progress in its environmental stewardship.

Meeting these evolving ESG reporting standards and actively implementing sustainable practices are vital for retaining investor trust and fulfilling corporate responsibility mandates. Failure to do so can result in significant reputational harm and hinder access to crucial capital markets, impacting overall financial health.

Altria's dedication to sustainability is emerging as a significant competitive advantage, differentiating it in a market where environmental consciousness is paramount. This commitment is not just about compliance but about building long-term value and resilience.

The environmental impact of tobacco product waste, especially cigarette butts, is a major issue, with billions littered annually and their non-biodegradable nature contributing to pollution. Altria is under increasing scrutiny to manage the end-of-life phase of its offerings, from traditional cigarettes to newer e-vapor products, posing a significant environmental challenge.

Developing eco-friendly packaging and encouraging responsible disposal are key environmental hurdles for Altria. Furthermore, exploring recycling solutions for the components of e-vapor devices is crucial for minimizing the company's ecological footprint and addressing public concerns about plastic and electronic waste.

Altria's manufacturing and operational processes, particularly those involving tobacco product production, are inherently resource-intensive, demanding substantial quantities of water and energy. This consumption directly contributes to the company's environmental footprint, a factor under increasing scrutiny by regulators and the public alike. For instance, in 2023, Altria reported its Scope 1 and 2 greenhouse gas emissions, a key indicator of energy consumption, totaling 2.7 million metric tons of CO2 equivalent, reflecting the energy demands of its facilities.

The growing global emphasis on resource conservation and climate change mitigation translates into mounting pressure on companies like Altria to optimize their water and energy usage. Regulatory bodies are increasingly implementing stricter standards and potential penalties for excessive consumption, pushing for more sustainable operational models. This regulatory environment necessitates proactive strategies for efficiency and responsible resource management.

To address these environmental factors, Altria is exploring and implementing strategies such as adopting energy-efficient technologies within its manufacturing plants and investigating opportunities for sourcing renewable energy. Furthermore, responsible water resource management, including efforts to reduce water withdrawal and improve water use efficiency, is a critical component of its environmental strategy. These initiatives are not only driven by environmental stewardship but also by the potential for significant operational cost savings by reducing resource intensity.

Supply Chain Environmental Impact (Tobacco Cultivation)

Altria Group's supply chain, particularly tobacco cultivation, presents significant environmental challenges. These include deforestation for new tobacco fields, extensive pesticide and herbicide use, and soil degradation from monoculture farming practices. For instance, tobacco farming is known to be water-intensive, and the curing process often requires burning wood, contributing to deforestation in some regions.

While Altria does not directly cultivate tobacco, its substantial influence over its suppliers makes sustainable sourcing a critical environmental consideration. The company's commitment to responsible agricultural practices among its growers is paramount in mitigating these impacts. By encouraging and enforcing environmentally sound methods, Altria can reduce its indirect footprint.

Ensuring that tobacco suppliers adopt greener farming techniques is vital for managing supply chain risks and upholding corporate social responsibility. This includes promoting integrated pest management, water conservation, and soil health initiatives. For example, in 2024, many agricultural sectors are seeing increased investment in precision agriculture technologies to reduce chemical inputs and optimize resource use.

Promoting sustainable farming contributes not only to long-term environmental well-being but also to the resilience of Altria's supply chain. This approach helps ensure a stable supply of raw materials while minimizing negative ecological consequences. By 2025, there's a growing expectation for companies to demonstrate tangible progress in reducing their Scope 3 emissions, which heavily involve supply chain activities.

- Deforestation: Tobacco farming has historically been linked to deforestation, especially in developing countries where land is cleared for cultivation and wood is used for curing.

- Pesticide and Herbicide Use: The tobacco industry relies on significant inputs of agrochemicals, raising concerns about water contamination and biodiversity loss.

- Soil Degradation: Continuous tobacco cultivation can deplete soil nutrients and lead to erosion, impacting land productivity over time.

- Water Consumption: Tobacco plants require substantial amounts of water, placing a strain on local water resources in cultivation areas.

Climate Change Risks and Adaptation

Climate change poses significant environmental risks to Altria, particularly impacting its reliance on agricultural inputs like tobacco. Extreme weather events, such as droughts and floods, can disrupt crop yields and quality, leading to increased raw material costs. For instance, the 2023 growing season saw varied weather patterns across key tobacco-producing regions, affecting supply availability.

Adapting to these climate-related challenges is crucial for Altria's operational resilience and long-term sustainability. This involves investing in more resilient supply chains, implementing robust water conservation strategies in agricultural practices, and diversifying energy sources to mitigate the impact of energy price volatility. These measures are becoming increasingly vital as global temperatures continue to rise.

Altria's commitment to understanding and mitigating climate risks is paramount for business continuity. The company is increasingly focused on assessing and disclosing its exposure to both physical risks, like extreme weather, and transitional risks, such as policy changes related to carbon emissions. This proactive approach is essential for maintaining stakeholder confidence and ensuring a sustainable business model in the face of evolving environmental conditions.

- Agricultural Disruption: Extreme weather events directly threaten tobacco crop yields and quality, impacting raw material availability and cost.

- Operational Cost Volatility: Fluctuations in energy prices, often linked to climate-related policies and events, can increase operating expenses.

- Supply Chain Resilience: Building more robust and adaptable supply chains is key to navigating climate-induced disruptions.

- Disclosure and Risk Assessment: Transparently assessing and disclosing exposure to physical and transitional climate risks is a growing expectation for investors and regulators.

Altria's environmental performance, including a 20.5% reduction in Scope 1 and 2 greenhouse gas emissions intensity by 2023 against a 2019 baseline, reflects a commitment to sustainability. However, challenges remain with product waste, particularly cigarette butts, and the resource-intensive nature of manufacturing, which consumed 2.7 million metric tons of CO2 equivalent in 2023.

Supply chain impacts, such as deforestation and agrochemical use in tobacco cultivation, are significant indirect environmental concerns. Climate change also poses risks through agricultural disruptions and operational cost volatility, necessitating resilient supply chains and proactive risk assessment.

| Environmental Factor | 2023/2024 Data/Trend | Impact on Altria |

|---|---|---|

| Greenhouse Gas Emissions | 20.5% reduction in Scope 1 & 2 intensity (vs. 2019); 2.7 million metric tons CO2e (Scope 1 & 2) | Operational efficiency, regulatory compliance, investor perception |

| Product Waste | Billions of littered cigarette butts annually; scrutiny on e-vapor device disposal | Reputational risk, potential regulatory action, R&D for eco-friendly solutions |

| Supply Chain (Tobacco Cultivation) | Concerns over deforestation, pesticide/herbicide use, water consumption | Supply chain resilience, ethical sourcing, Scope 3 emissions management |

| Climate Change Impact | Increased risk of extreme weather affecting crop yields; energy price volatility | Raw material cost fluctuations, operational continuity, need for adaptation strategies |

PESTLE Analysis Data Sources

Our Altria Group PESTLE Analysis is built on a robust foundation of data from official government publications, leading financial news outlets, and reputable industry analysis firms. We draw insights from economic indicators, legislative updates, and technological advancements to provide a comprehensive view.