Altria Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altria Group Bundle

Altria Group navigates a complex landscape shaped by intense rivalry and significant buyer power, particularly as consumer preferences shift. The threat of substitutes looms large, demanding constant innovation and adaptation. Understanding these forces is crucial for any strategic move.

The complete report reveals the real forces shaping Altria Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Altria Group's commanding presence in the U.S. tobacco market, a sector where it holds substantial sway, often leaves individual suppliers, like tobacco leaf farmers, with diminished leverage. This is primarily due to their reliance on a major purchaser like Altria.

Although Altria actively cultivates robust, long-term relationships with its suppliers, the sheer scale of its raw material procurement means that no single supplier can exert significant bargaining power. For instance, in 2023, Altria's net revenue was $20.1 billion, underscoring the massive volume of goods it requires.

Altria Group benefits significantly from the availability of diverse inputs, meaning they source raw materials and components from numerous vendors across different geographic locations. This broad supplier base inherently limits the bargaining power of any single supplier, as Altria can readily shift its business elsewhere if prices become unreasonable or supply is threatened. For instance, in 2024, Altria's extensive network of tobacco leaf suppliers across various continents provided a buffer against regional crop issues or localized supplier disputes.

The cost of switching suppliers for Altria Group can vary. For traditional tobacco products, where specific agricultural inputs and unique blends are crucial, switching costs might be moderate. For instance, if a particular type of flue-cured tobacco becomes scarce or its price escalates significantly, Altria would need to find a comparable substitute, which could involve higher sourcing costs or adjustments to product formulation.

However, Altria's strategic pivot towards smoke-free alternatives, such as heated tobacco products and oral nicotine pouches, introduces a different supplier landscape. These newer product categories may rely on specialized manufacturing components or novel chemical compounds, potentially leading to higher switching costs if a supplier for these unique elements is difficult to replace. For example, securing reliable suppliers for advanced battery technology in heated tobacco devices or specialized flavorants for oral nicotine pouches could present challenges if only a few vendors offer these critical inputs.

Supplier Integration Threat

The threat of suppliers integrating forward into Altria's manufacturing or distribution is quite low. This is largely due to the significant barriers to entry in the tobacco sector, including stringent regulations and the immense capital required to establish operations. For instance, in 2024, the U.S. tobacco market is dominated by a few major players, making it incredibly difficult for new entrants, including suppliers, to gain traction.

Most suppliers in this industry, while crucial for raw materials like tobacco leaves or packaging, typically lack the necessary scale, established brand equity, and specialized regulatory knowledge to challenge established giants like Altria. They generally focus on their core competencies rather than attempting to replicate Altria's complex, multi-faceted business model.

Consider the specialized nature of tobacco processing and distribution networks. These require extensive investment in infrastructure and deep understanding of compliance. Altria, with its decades of experience and established supply chain, presents a formidable competitive hurdle for any supplier contemplating such a move.

- Low Threat of Forward Integration: Suppliers typically lack the capital, regulatory expertise, and brand recognition to compete with Altria.

- Industry Barriers: The highly regulated and capital-intensive nature of the tobacco industry creates significant obstacles for supplier integration.

- Focus on Core Competencies: Suppliers generally concentrate on providing raw materials and components rather than entering manufacturing or distribution.

- Altria's Established Infrastructure: Altria's extensive and compliant operational infrastructure makes direct competition by suppliers unfeasible.

Raw Material Volatility and Tariffs

The bargaining power of suppliers for Altria Group is significantly influenced by raw material volatility and tariffs, particularly concerning agricultural inputs. Suppliers of tobacco, a core component, face environmental risks and inherent price fluctuations that can directly affect Altria's cost of goods sold. For example, adverse weather events in key growing regions can reduce yields and drive up prices for raw tobacco.

Tariffs also present a considerable challenge, especially for newer product categories. The potential imposition of tariffs on imported specialized tobacco blends could lead to increased input costs for heated tobacco products. While Altria's predominantly U.S.-based supply chain offers some insulation, global trade policies remain a critical factor. In 2023, the agricultural sector experienced notable price swings for various commodities, underscoring the ongoing vulnerability of input costs.

- Agricultural Price Volatility: Suppliers of tobacco and other agricultural inputs are subject to market forces and environmental conditions that can cause significant price fluctuations, impacting Altria's raw material costs.

- Tariff Impact on New Products: Tariffs on specialized imported tobacco blends could increase the cost of producing heated tobacco products, a key growth area for Altria.

- Supply Chain Resilience: Altria's largely domestic supply chain helps mitigate some of the risks associated with international trade disputes and tariffs, though not entirely.

- 2023 Input Cost Environment: The broader agricultural market in 2023 saw varied price movements for key commodities, highlighting the dynamic nature of supplier pricing power.

Altria Group generally faces low bargaining power from its suppliers. This is largely because Altria is a dominant buyer in its core markets, and many suppliers, particularly for traditional tobacco, are fragmented and lack significant scale. For example, Altria's 2023 net revenue of $20.1 billion highlights its purchasing power.

The company's ability to source from a diverse global network of tobacco leaf farmers and component manufacturers further diminishes individual supplier leverage. In 2024, Altria's broad supplier base across continents provides a crucial buffer against localized supply disruptions or price demands.

While switching costs for traditional tobacco inputs can be moderate, the specialized nature of components for newer products like heated tobacco devices could present higher switching costs if unique suppliers are hard to replace. However, the threat of suppliers integrating forward into Altria's business is minimal due to high industry barriers and regulatory complexities.

| Factor | Assessment for Altria | Supporting Data/Reasoning |

|---|---|---|

| Supplier Concentration | Low | Altria is a dominant buyer; many suppliers are fragmented. |

| Supplier Dependence on Altria | High | Many suppliers rely on Altria's large order volumes. |

| Switching Costs (Traditional) | Moderate | Sourcing specific tobacco blends can have some costs. |

| Switching Costs (New Products) | Potentially Higher | Specialized components for smoke-free alternatives may have fewer suppliers. |

| Threat of Forward Integration | Very Low | High capital requirements and regulatory hurdles deter suppliers. |

What is included in the product

This analysis unpacks the competitive forces shaping Altria Group's industry, revealing the intensity of rivalry, buyer and supplier power, and the threat of new entrants and substitutes.

Instantly gauge the impact of each force on Altria's profitability, allowing for targeted strategies to mitigate competitive threats.

Customers Bargaining Power

Altria's formidable brand loyalty, especially with Marlboro, significantly reduces customer bargaining power. Marlboro’s enduring appeal, evidenced by its consistent market leadership, allows Altria to implement price increases without triggering substantial customer attrition.

While Altria Group benefits from strong brand loyalty in many areas, the declining overall cigarette market, with U.S. cigarette volumes falling by approximately 4-5% annually in recent years, highlights a growing price sensitivity among consumers. The increasing availability and popularity of discount brands put pressure on established players to consider pricing strategies that balance revenue with maintaining market share.

The growing availability of reduced-risk products (RRPs) such as e-cigarettes, heated tobacco, and nicotine pouches significantly enhances consumer choice. This expansion directly translates to increased bargaining power for customers, as they can more easily switch between brands and product types if they are dissatisfied with pricing or product offerings.

Altria's strategic investments and acquisitions, including its stake in `on!` nicotine pouches and the acquisition of NJOY, demonstrate a clear response to this trend. By diversifying its portfolio into these RRPs, Altria aims to cater to evolving consumer preferences and maintain its market position amidst rising competition and consumer demand for alternatives to traditional combustible cigarettes.

Regulatory Impact on Consumer Behavior

Regulatory pressures, such as potential flavor bans and rising excise taxes, significantly impact consumer behavior for companies like Altria. These changes can steer consumers toward illicit markets or alternative products, thereby increasing the bargaining power of customers who can more easily switch to readily available, albeit potentially unregulated, options. For instance, in 2024, several U.S. states continued to explore or implement flavor restrictions on tobacco products, forcing consumers to re-evaluate their purchasing decisions.

Altria's strategic response to these evolving regulations is crucial. The company must adapt its product portfolio and marketing strategies to navigate these shifts. Consumers, empowered by the availability of diverse alternatives, can exert greater pressure on Altria to offer products that align with new regulatory landscapes or cater to changing preferences, directly influencing demand and pricing power.

- Regulatory Shifts: In 2024, discussions around menthol bans and increased federal excise taxes on tobacco products continued, directly affecting consumer choices.

- Consumer Adaptation: Consumers demonstrated a willingness to explore alternative nicotine products or even the illicit market in response to regulatory changes, enhancing their bargaining power.

- Altria's Challenge: Altria's ability to maintain market share and pricing power depends on its agility in adapting to these consumer shifts driven by regulatory pressures.

Information Availability and Health Awareness

Growing awareness of tobacco's health impacts, fueled by accessible information, significantly strengthens consumer bargaining power. This heightened awareness empowers individuals to make more informed choices, potentially shifting demand away from traditional products.

Consumers are increasingly seeking out perceived less harmful alternatives or choosing to quit entirely. This trend directly pressures companies like Altria to innovate and adapt their product offerings to meet evolving consumer preferences.

- Consumer Demand Shift: Public health campaigns and readily available research data empower consumers to scrutinize product risks, leading to a greater demand for harm-reduction options.

- Market Influence: By 2024, a significant portion of the adult smoking population expressed interest in or had already transitioned to reduced-risk products, demonstrating a tangible market shift.

- Company Adaptation: Companies investing in and effectively marketing products perceived as less harmful gain a competitive edge, as consumers actively seek these options.

While Altria’s Marlboro brand enjoys strong loyalty, the overall decline in cigarette consumption, estimated at 4-5% annually, means consumers are more price-sensitive. The increasing availability of diverse nicotine products, from e-cigarettes to pouches, further empowers consumers to switch if pricing or offerings are unsatisfactory.

Regulatory changes, such as potential flavor bans and tax increases in 2024, push consumers towards alternatives, including illicit markets, amplifying their bargaining power. This shift necessitates Altria's adaptation to new product categories and evolving consumer demands.

Heightened awareness of tobacco's health risks also strengthens consumer leverage, driving demand for reduced-risk products. By 2024, a notable segment of smokers showed interest in or had already adopted these alternatives, compelling companies to innovate.

| Factor | Impact on Customer Bargaining Power | Altria's Position/Response |

| Brand Loyalty (Marlboro) | Reduces power | Strong, but facing market shifts |

| Market Decline & Price Sensitivity | Increases power | Requires careful pricing and product mix |

| Product Alternatives (RRPs) | Significantly increases power | Diversifying into `on!` and NJOY |

| Regulatory Pressures (2024) | Increases power | Adapting to flavor restrictions and taxes |

| Health Awareness | Increases power | Focus on harm-reduction innovation |

Preview Before You Purchase

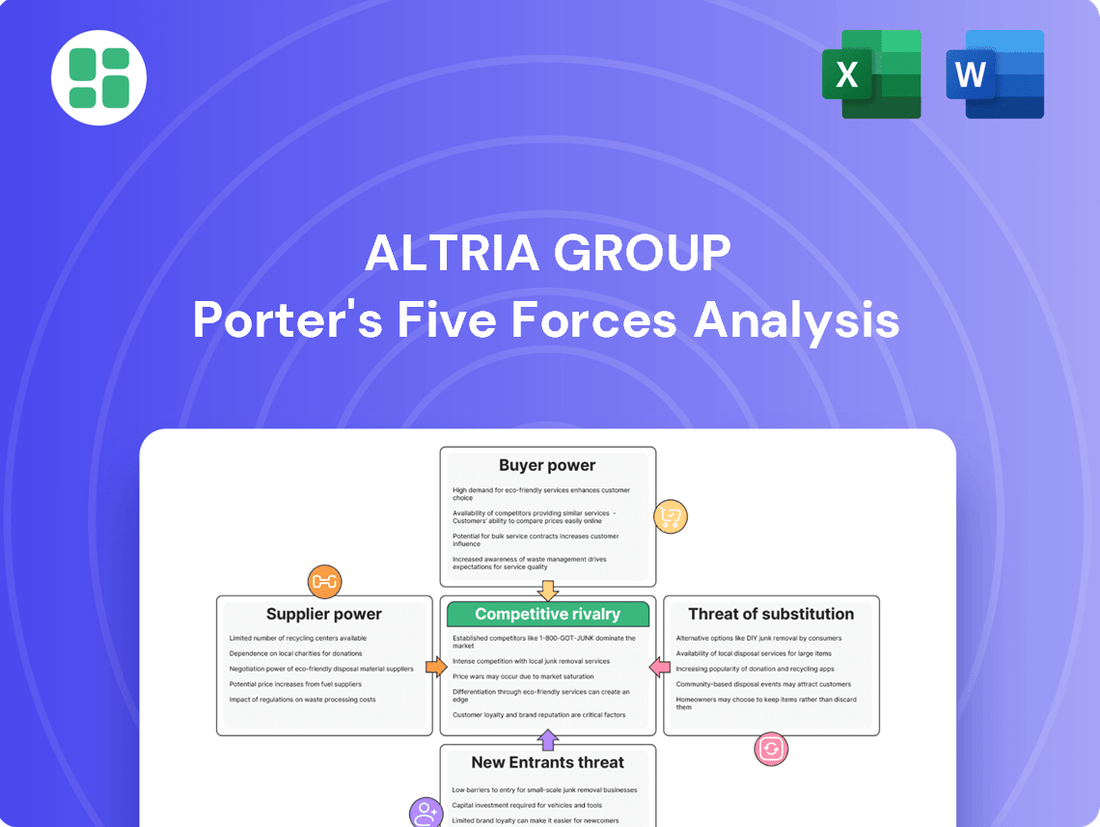

Altria Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis of the Altria Group, detailing the competitive landscape and strategic implications. You're looking at the actual document; once your purchase is complete, you’ll gain instant access to this exact, professionally formatted file, ready for your immediate use.

Rivalry Among Competitors

Altria Group faces a fiercely competitive U.S. tobacco and nicotine market. Major rivals like Philip Morris International, British American Tobacco, Imperial Brands, and Japan Tobacco Inc. are all vying for market share.

The competitive environment is particularly dynamic due to the rapid growth and innovation in smoke-free product categories. This evolving landscape means companies must constantly adapt their strategies to stay ahead.

The competitive landscape within reduced-risk products (RRPs) is heating up, with companies pouring resources into innovation and marketing. This segment, encompassing e-cigarettes, heated tobacco, and oral nicotine pouches, is experiencing substantial growth and attracting significant investment as firms vie for market dominance.

Altria's 2023 financial results highlight this shift, with its smoke-free segment, which includes RRPs, showing continued progress. For instance, the company's oral nicotine pouch product, *on!*, has been a key driver of growth, demonstrating the increasing consumer preference for these alternatives and the intense competition to capture this evolving market.

The traditional tobacco market, while still substantial, is undeniably shrinking. Altria's Marlboro, a titan in this space, still commands a significant market share, but the overall volume of traditional cigarette sales continues to fall. This decline intensifies competition, as rivals fight harder for a smaller customer base, often resorting to aggressive pricing and enhanced loyalty initiatives to retain and attract smokers.

Strategic Investments and Diversification

Altria's strategic investments, like its significant stake in Cronos Group, a Canadian cannabis company, and its acquisition of Ste. Michelle Wine Estates, fundamentally alter the competitive landscape. These moves pull Altria into direct competition with players in the burgeoning cannabis and established alcohol industries, intensifying rivalry beyond its historical tobacco focus.

By diversifying, Altria is not just hedging against declining tobacco volumes but also actively engaging with new market dynamics. For instance, in 2023, Cronos Group reported net revenue of $700 million CAD, showcasing the scale of the sector Altria is now involved in. This diversification strategy directly impacts the competitive rivalry by introducing new competitors and changing the basis of competition.

- Diversification into New Markets: Altria's expansion into cannabis (Cronos Group) and alcohol (Ste. Michelle Wine Estates) brings it into direct competition with established and emerging players in these sectors.

- Increased Competitive Intensity: These investments broaden the competitive arena, forcing Altria to contend with different sets of rivals and market strategies than those found solely within the tobacco industry.

- Strategic Capital Allocation: Altria's substantial investments, such as its initial $1.8 billion USD investment in Cronos Group in 2018, highlight a commitment to growth in non-traditional areas, signaling a long-term strategic shift that intensifies competition across its diversified portfolio.

Regulatory and Illicit Market Challenges

Altria faces significant headwinds from intense competition, exacerbated by strict regulatory frameworks and the pervasive issue of illicit market products. The company must meticulously adhere to evolving Food and Drug Administration (FDA) regulations, which significantly impact product development and marketing strategies.

The presence of unregulated, often lower-priced illicit e-vapor products directly siphons market share from legitimate offerings. For instance, in 2024, reports indicated a substantial portion of the e-vapor market operating outside of FDA’s Premarket Tobacco Product Application (PMTA) review process, creating an uneven playing field.

- Regulatory Hurdles: Navigating FDA's evolving PMTA requirements and marketing restrictions.

- Illicit Market Impact: Unregulated products undercut pricing and consumer trust in legal channels.

- Market Share Erosion: Illicit sales directly reduce revenue for compliant manufacturers like Altria.

- Compliance Costs: Significant investment is required to meet and maintain regulatory standards.

Altria's competitive rivalry is intense, particularly in the evolving U.S. tobacco and nicotine market. The company competes fiercely with major players like Philip Morris International and British American Tobacco, especially in the rapidly growing smoke-free product categories such as oral nicotine pouches. This dynamic environment necessitates continuous innovation and strategic adaptation to maintain market position amidst declining traditional cigarette volumes and the rise of new product segments.

| Competitor | 2023 Net Revenue (USD Billions) | Primary Focus Areas |

|---|---|---|

| Philip Morris International | 35.6 | Heated tobacco, e-cigarettes, traditional tobacco |

| British American Tobacco | 36.4 | New categories (vaping, oral), traditional tobacco |

| Imperial Brands | 8.1 | Next-generation products, traditional tobacco |

| Japan Tobacco Inc. | 17.9 | Heated tobacco, e-cigarettes, traditional tobacco |

SSubstitutes Threaten

The most significant threat of substitution for Altria Group stems from the burgeoning market of next-generation nicotine products. These include e-cigarettes, heated tobacco products, and oral nicotine pouches, all of which are experiencing rapid growth as consumers actively seek alternatives to traditional combustible cigarettes, often driven by perceptions of reduced harm.

For instance, the U.S. e-vapor market saw significant growth, with sales reaching approximately $8.1 billion in 2023, indicating a strong consumer shift. Similarly, oral nicotine pouches, a relatively newer category, have captured substantial market share, with some brands reporting triple-digit growth in recent years, demonstrating a clear substitution trend away from traditional tobacco products.

Altria is proactively mitigating the threat of substitutes by investing in and developing its own smoke-free product lines. This includes significant expansion of its `on!` nicotine pouches and NJOY e-vapor offerings, aiming to capture consumers shifting away from traditional cigarettes.

By internalizing this substitution threat, Altria aims to transition adult smokers to its reduced-harm alternatives, thereby retaining market share. For instance, in the first quarter of 2024, Altria reported that `on!` achieved a retail market share of 6.6%, demonstrating early traction in this evolving category.

The increasing acceptance and legalization of cannabis products represent a significant threat of substitutes for traditional nicotine products. Altria's strategic investment in Cronos Group, a global cannabis company, highlights this evolving landscape. As more jurisdictions permit cannabis use, consumers seeking recreational or relaxation alternatives may increasingly turn to these products instead of cigarettes or other tobacco offerings. This trend diversifies the competitive set beyond just other nicotine delivery systems.

Consumer Health Awareness and Lifestyle Changes

Growing consumer health awareness is a significant force, pushing individuals away from traditional tobacco products. This shift means more people are exploring alternatives or quitting altogether, directly impacting Altria's core business. For instance, in 2024, reports indicated a continued decline in traditional cigarette smoking rates, with many consumers seeking products they perceive as having lower health risks.

This trend amplifies the threat of substitutes. Consumers are increasingly turning to nicotine pouches, e-cigarettes, and even nicotine-free options as they prioritize their well-being. The market for these alternative products has seen substantial growth. For example, the global nicotine pouch market alone was projected to reach billions of dollars by 2024, demonstrating a clear migration of consumer spending away from combustible cigarettes.

- Declining Cigarette Consumption: In 2024, U.S. adult smoking prevalence continued its downward trend, impacting traditional product demand.

- Rise of Reduced-Risk Products: Consumers are increasingly adopting alternatives like nicotine pouches and e-cigarettes, perceived as less harmful.

- Growth in Nicotine Replacement Therapies (NRTs): The market for NRTs, including patches and gum, also saw continued expansion as consumers sought to quit smoking.

- Impact on Altria's Market Share: The increasing viability and popularity of these substitutes directly challenge Altria's dominance in the traditional tobacco sector.

Impact of Illicit and Unregulated Products

The rise of illicit and unregulated e-vapor products presents a substantial threat of substitutes for Altria. These products often sidestep costly regulatory compliance and taxation, allowing them to be offered at lower price points. This creates an unfair market dynamic, drawing consumers away from Altria's legitimate and taxed offerings.

For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued its efforts to address the widespread availability of unauthorized e-cigarettes. While specific figures on the market share of illicit products are difficult to pinpoint, their prevalence directly impacts the sales volume of regulated alternatives.

- Illicit products bypass regulatory approval processes.

- Lower pricing of unregulated alternatives attracts price-sensitive consumers.

- This diversion impacts the sales and market share of compliant products.

The threat of substitutes for Altria Group is substantial, driven by evolving consumer preferences and technological advancements in nicotine delivery. The increasing adoption of next-generation products like e-cigarettes and oral nicotine pouches directly challenges Altria's traditional combustible cigarette business. For example, the U.S. e-vapor market reached approximately $8.1 billion in 2023, highlighting a significant consumer shift.

| Substitute Category | 2023/2024 Market Insight | Altria's Response/Impact |

|---|---|---|

| E-cigarettes/Vaping | U.S. e-vapor market ~ $8.1 billion (2023) | Altria's NJOY acquisition aims to capture this segment. |

| Oral Nicotine Pouches | Rapid growth, some brands reporting triple-digit growth. | Altria's `on!` brand achieved 6.6% retail market share (Q1 2024). |

| Cannabis Products | Increasing legalization and consumer interest. | Altria's investment in Cronos Group addresses this diversifying threat. |

| Nicotine Replacement Therapies (NRTs) | Continued market expansion for patches, gum, etc. | Reflects broader consumer move away from traditional tobacco. |

Entrants Threaten

The tobacco and nicotine industry faces substantial hurdles due to rigorous government oversight. For instance, the U.S. Food and Drug Administration (FDA) mandates complex and expensive Premarket Tobacco Product Applications (PMTAs) for any new tobacco or nicotine products. These demanding approval processes effectively deter potential new competitors from entering the market.

Establishing a significant presence in the tobacco sector, particularly for national distribution and robust brand development, demands considerable financial outlay. This includes substantial investments in advanced manufacturing facilities, extensive marketing campaigns, and ongoing research and development for product innovation.

The sheer scale of capital required acts as a formidable barrier, effectively discouraging many potential new players from entering the market. For instance, the cost of building a new, compliant manufacturing plant and securing shelf space in major retail chains can easily run into hundreds of millions of dollars, a figure that is prohibitive for most startups.

Altria’s own capital expenditures in 2023 were $481 million, illustrating the ongoing investment needed to maintain and grow operations within the industry. This level of spending underscores the financial muscle required to compete effectively against established giants.

Established brand loyalty, exemplified by Altria's Marlboro, presents a significant barrier. For instance, Marlboro has consistently held a dominant market share in the U.S. combustible cigarette market, often exceeding 30% in recent years, demonstrating deep consumer allegiance built over decades.

Furthermore, Altria commands an extensive and deeply entrenched distribution network across the United States. This network provides unparalleled access to retail points of sale, making it incredibly difficult for new entrants to secure comparable shelf space and reach consumers effectively.

Lobbying and Legal Power of Incumbents

The threat of new entrants into the tobacco industry, particularly for a company like Altria, is significantly mitigated by the immense lobbying and legal power wielded by established players. Major tobacco companies, including Altria, actively engage in extensive lobbying to shape regulations, often creating a more challenging landscape for potential newcomers. For instance, in 2023, the tobacco industry spent millions on lobbying efforts, influencing discussions around product standards and marketing restrictions.

These substantial investments in lobbying not only affect current regulations but also serve to erect further barriers. New companies must navigate a complex and often costly regulatory environment that incumbents have helped to mold. Furthermore, the industry possesses considerable legal resources, enabling them to defend their market positions through litigation. This legal might can be a significant deterrent, as new entrants may face costly legal battles if they are perceived to infringe upon existing patents or market rights.

- Lobbying Expenditures: Major tobacco firms consistently rank among the top spenders on lobbying in the United States, influencing legislation related to taxation, marketing, and product regulations.

- Legal Defenses: The industry's history includes extensive use of legal challenges to defend against public health initiatives and to protect intellectual property, creating a high legal hurdle for new market participants.

- Regulatory Capture: Incumbents' deep involvement in policy discussions can lead to a form of regulatory capture, where rules are shaped in ways that favor existing, well-resourced companies over emerging competitors.

Difficulty in Achieving Scale and Profitability

The threat of new entrants for Altria Group is relatively low, primarily due to the immense difficulty in achieving necessary scale and profitability. While niche players might surface in specific segments, such as small e-liquid manufacturers, replicating the widespread distribution and brand recognition of a diversified giant like Altria is a formidable hurdle.

The tobacco and nicotine industry is heavily consolidated, with a few dominant players controlling a substantial market share. This makes it exceptionally challenging for newcomers to carve out significant market presence. For instance, in 2023, Altria’s total net revenue reached $20.6 billion, a testament to its established market position and scale. New entrants would face substantial capital requirements for manufacturing, marketing, and navigating complex regulatory landscapes, further deterring entry.

- High Capital Requirements: New entrants need significant investment for production facilities, extensive distribution networks, and aggressive marketing campaigns to compete with established players.

- Brand Loyalty and Recognition: Altria brands like Marlboro boast decades of consumer loyalty, creating a strong barrier for new brands to penetrate the market.

- Regulatory Hurdles: Stringent government regulations regarding product manufacturing, marketing, and sales, including flavor bans and advertising restrictions, add complexity and cost for new entrants.

- Economies of Scale: Existing large players benefit from lower per-unit costs due to high production volumes, making it difficult for smaller new entrants to match their pricing and profitability.

The threat of new entrants for Altria is notably low due to the substantial capital investment required for manufacturing, distribution, and marketing. For example, building a compliant manufacturing facility alone can cost hundreds of millions. Furthermore, established brand loyalty, like that of Marlboro which held over 30% market share in 2023, and extensive distribution networks create significant barriers that deter new companies from entering the market.

The tobacco industry also faces stringent regulatory hurdles, such as the FDA's PMTA process, which demands costly and complex applications for new products. This regulatory environment, coupled with significant lobbying efforts by established players, effectively raises the cost and complexity of market entry. For instance, tobacco companies consistently invest millions in lobbying to shape favorable regulations, making it harder for newcomers to navigate the landscape.

| Barrier Type | Description | Example for Altria |

|---|---|---|

| Capital Requirements | High initial investment needed for production, R&D, and marketing. | Altria's 2023 capital expenditures were $481 million, highlighting ongoing investment needs. |

| Brand Loyalty | Established brands have deep consumer allegiance built over time. | Marlboro's consistent market share exceeding 30% in the U.S. combustible cigarette market. |

| Distribution Networks | Extensive reach into retail points of sale is crucial for market access. | Altria's deeply entrenched national distribution network provides unparalleled retail access. |

| Regulatory Hurdles | Complex and costly government approvals and compliance requirements. | FDA's PMTA process for new tobacco and nicotine products. |

| Lobbying and Legal Power | Influence on regulations and ability to defend market position through legal means. | Millions spent annually on lobbying to shape industry regulations and standards. |

Porter's Five Forces Analysis Data Sources

Our analysis of Altria Group's competitive landscape leverages data from Altria's annual reports and SEC filings, alongside industry-specific market research from firms like Euromonitor and Nielsen. We also incorporate insights from financial news outlets and economic databases to provide a comprehensive view of the forces shaping the tobacco industry.